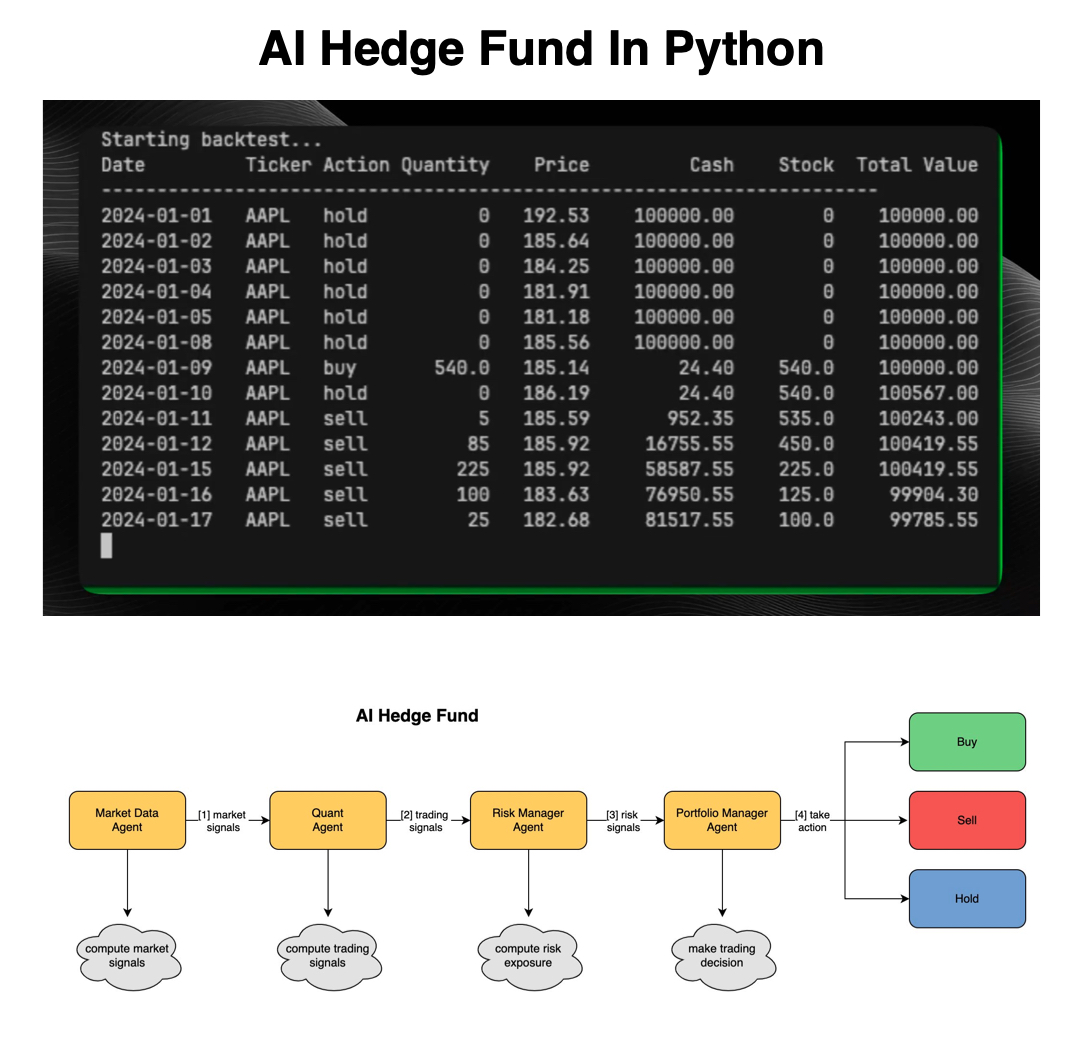

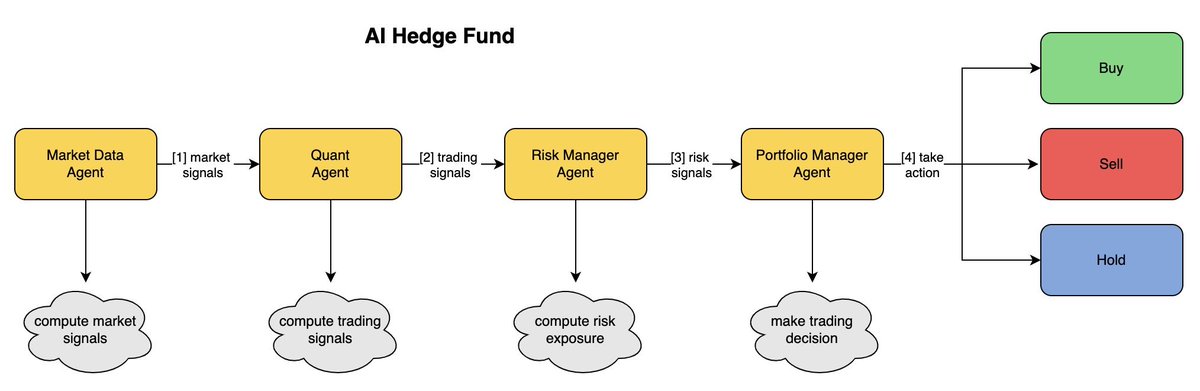

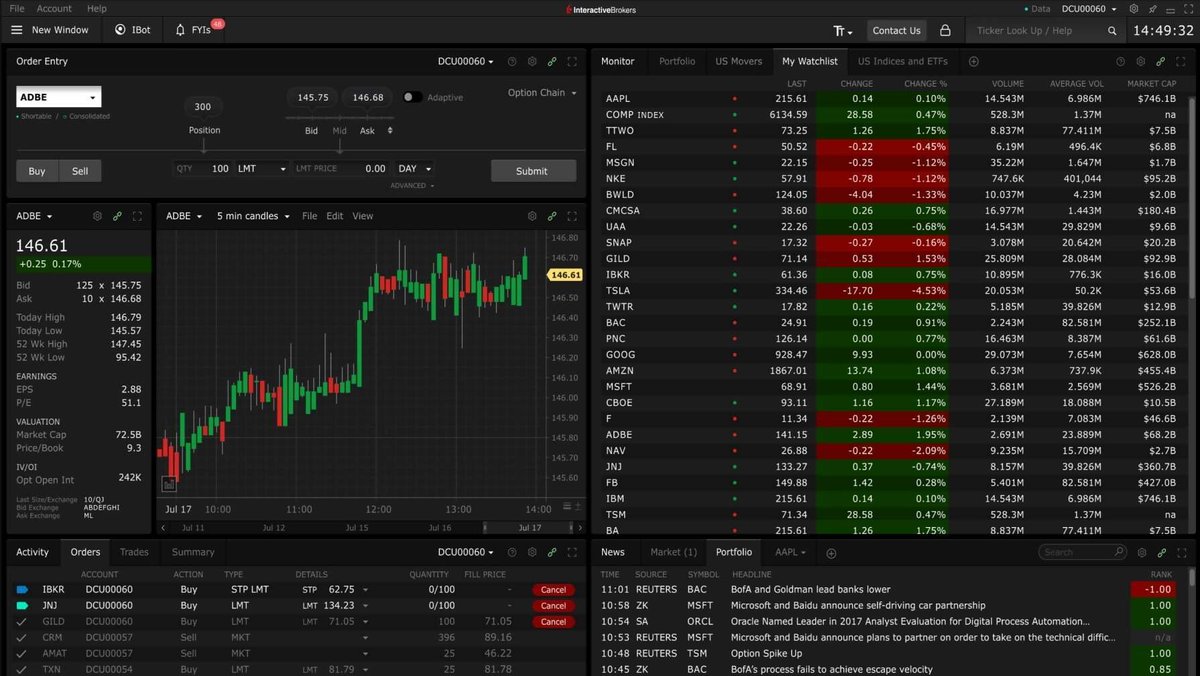

Algorithmic (“algo”) trading uses computer-driven rules to automate buys & sells (and take human emotion out of trading).

Below are 7 tested strategies on $SPY (S&P 500) & more—plus final pros/cons.

Not financial advice!

Below are 7 tested strategies on $SPY (S&P 500) & more—plus final pros/cons.

Not financial advice!

1) Scaling In (Averaging Down)

• Buy in portions as price drops

• E.g., allocate 50% at first RSI drop, another 50% if RSI falls an additional 5 pts

• Benefits: Lowers drawdowns, reduces time in market

• Best for mean-reverting assets

• Buy in portions as price drops

• E.g., allocate 50% at first RSI drop, another 50% if RSI falls an additional 5 pts

• Benefits: Lowers drawdowns, reduces time in market

• Best for mean-reverting assets

2) Sell the Rip

• Original RSI exit ⇒ large drawdowns

• “Q’s exit” rule: Sell if close > previous day’s high

• Outcome: Smoother equity curve, minimized prolonged dips

• Focus on timely exits vs. strict RSI signals

• Original RSI exit ⇒ large drawdowns

• “Q’s exit” rule: Sell if close > previous day’s high

• Outcome: Smoother equity curve, minimized prolonged dips

• Focus on timely exits vs. strict RSI signals

3) 1st Trading Day Strategy

• Buy at close on last trading day of the month, sell at close on the 1st trading day of next month

• Historically outperforms random day returns

• Variation: “Turn-of-the-month” (last 5 days + first 3 days) captures most market gains

• Buy at close on last trading day of the month, sell at close on the 1st trading day of next month

• Historically outperforms random day returns

• Variation: “Turn-of-the-month” (last 5 days + first 3 days) captures most market gains

4) 200-Day MA Pullback

• Trade only if $SPY > 200-day moving average (bullish filter)

• Buy on short-term price weakness (pullbacks)

• Typically invested ~30% of the time

• Less exposure vs. buy-and-hold, but still captures upside

• Trade only if $SPY > 200-day moving average (bullish filter)

• Buy on short-term price weakness (pullbacks)

• Typically invested ~30% of the time

• Less exposure vs. buy-and-hold, but still captures upside

5) Fabian Timing Model

• Weekly check: $SPX, $DJIA, & Utilities vs. 39-week MA

• If all 3 > 39-week MA ⇒ stay long $SPY

• If ≥ 2 < 39-week MA ⇒ exit

• Historically outperforms buy-and-hold with ~50% market exposure

• Weekly check: $SPX, $DJIA, & Utilities vs. 39-week MA

• If all 3 > 39-week MA ⇒ stay long $SPY

• If ≥ 2 < 39-week MA ⇒ exit

• Historically outperforms buy-and-hold with ~50% market exposure

6) Meb Faber Momentum

• Assets: $SPY (stocks), $TLT (bonds), $GLD (gold)

• If 3-month MA > 10-month MA ⇒ invest; else ⇒ stay out

• Historically ~13% annual returns w/ lower drawdowns

• Performance dipped post-2015 but still a classic momentum model

• Assets: $SPY (stocks), $TLT (bonds), $GLD (gold)

• If 3-month MA > 10-month MA ⇒ invest; else ⇒ stay out

• Historically ~13% annual returns w/ lower drawdowns

• Performance dipped post-2015 but still a classic momentum model

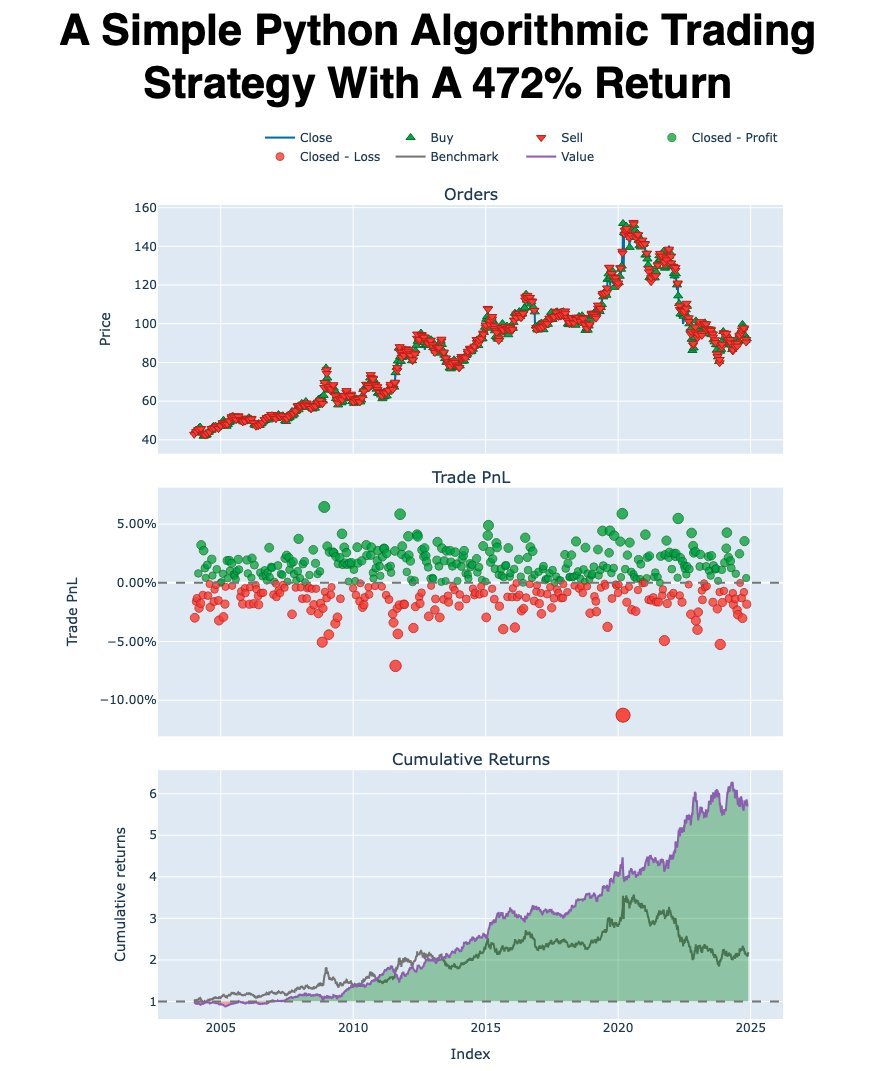

7) Simple Mean Reversion

• Just 1 buy variable + 1 sell variable (S&P 500)

• ~15% annual return since ’93, only ~35% time in market

• Sharply lower drawdowns vs. buy-and-hold

• Shows power of straightforward rule sets

• Just 1 buy variable + 1 sell variable (S&P 500)

• ~15% annual return since ’93, only ~35% time in market

• Sharply lower drawdowns vs. buy-and-hold

• Shows power of straightforward rule sets

Conclusions:

• AlgoTrading can be simple yet effective

• Key: rigorous backtesting, clear rules, consistent execution

• Pros: Automation, scalability, fewer emotional errors

• Cons: Coding learning curve

• Keep it systematic & disciplined!

You can do this!

• AlgoTrading can be simple yet effective

• Key: rigorous backtesting, clear rules, consistent execution

• Pros: Automation, scalability, fewer emotional errors

• Cons: Coding learning curve

• Keep it systematic & disciplined!

You can do this!

Want to learn how to get started with algorithmic trading with Python?

Then join us on February 12th for a live webinar, how to Build Algorithmic Trading Strategies (that actually get results)

Register here (500+ registered): learn.quantscience.io/qs-register

Then join us on February 12th for a live webinar, how to Build Algorithmic Trading Strategies (that actually get results)

Register here (500+ registered): learn.quantscience.io/qs-register

• • •

Missing some Tweet in this thread? You can try to

force a refresh