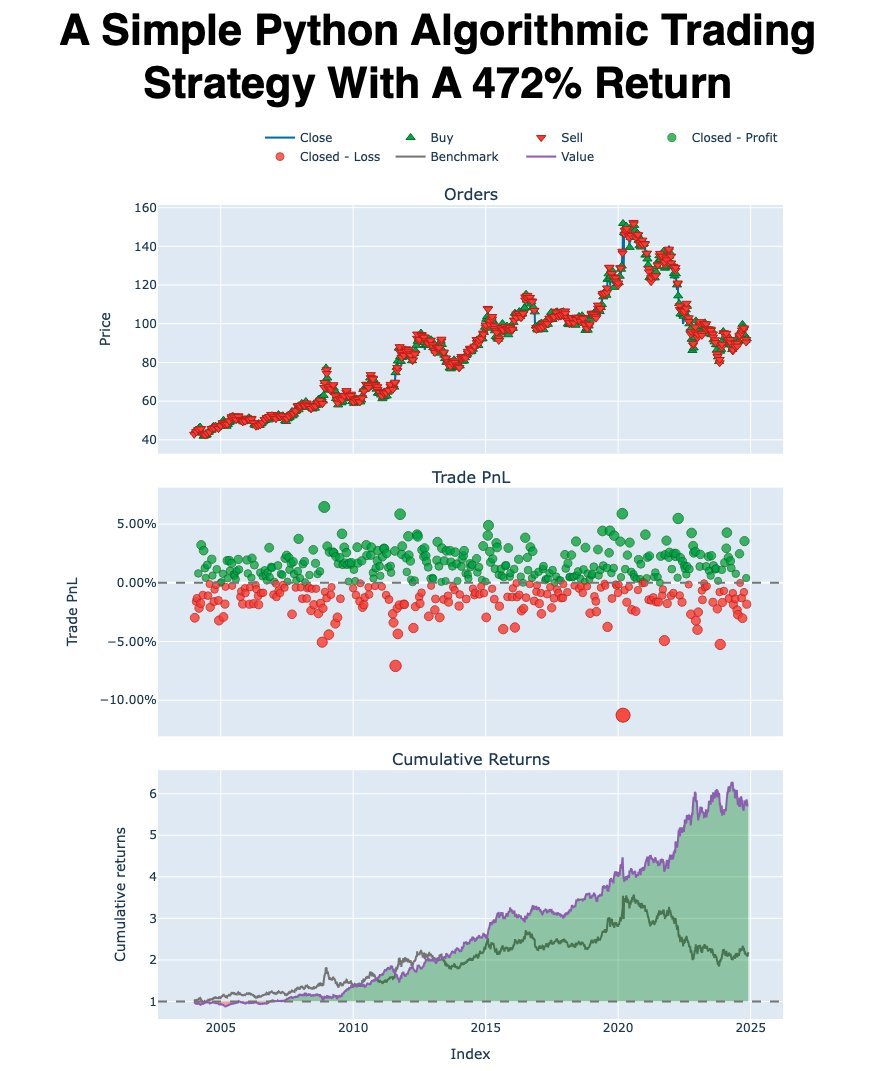

How to build an algorithmic trading system with Python

(based on 3 years of fixing mistakes and gaining confidence + results)

A thread:

(based on 3 years of fixing mistakes and gaining confidence + results)

A thread:

Today I want to share a little bit about what I've learned along my journey in algorithmic trading.

It took me 3 years to grow my confidence.

I made a ton of mistakes. But now my portfolio is $6,500,000.

I'm still learning. But here's what worked for me:

It took me 3 years to grow my confidence.

I made a ton of mistakes. But now my portfolio is $6,500,000.

I'm still learning. But here's what worked for me:

1) Data Sourcing & Quality

• Start with reliable financial data.

• Scrub for inconsistencies & fill missing values.

• Free data sources exist, but for serious work, consider paid APIs (e.g., from broker APIs or market data providers).

• Start with reliable financial data.

• Scrub for inconsistencies & fill missing values.

• Free data sources exist, but for serious work, consider paid APIs (e.g., from broker APIs or market data providers).

I use these 2 data sources (paid):

• Nasdaq DataLink (Bulk price data)

• Financial Modeling Prep (fundamental data)

To get started I recommend these free resources:

• yfinance

• openbb

• Nasdaq DataLink (Bulk price data)

• Financial Modeling Prep (fundamental data)

To get started I recommend these free resources:

• yfinance

• openbb

2) Alpha Model

• Core logic: generates buy/sell signals.

• Could be mean reversion, trend following, or ML-based.

In Python, I perform quant research with:

pandas,

NumPy,

scikit-learn

I use these to test different hypotheses quickly.

• Core logic: generates buy/sell signals.

• Could be mean reversion, trend following, or ML-based.

In Python, I perform quant research with:

pandas,

NumPy,

scikit-learn

I use these to test different hypotheses quickly.

3) Portfolio Construction

• Allocate positions based on signal confidence & risk tolerance.

• Use Python frameworks (e.g., Riskfolio for optimization).

• Equal-weight, risk-parity, or custom weighting—depends on your strategy & risk profile.

• Allocate positions based on signal confidence & risk tolerance.

• Use Python frameworks (e.g., Riskfolio for optimization).

• Equal-weight, risk-parity, or custom weighting—depends on your strategy & risk profile.

4) Transaction Costs & Execution

• Account for commissions, slippage, and order types in your backtests.

• Model these costs realistically (even if estimates).

• Python tip: incorporate slippage/commissions logic directly into your trade simulations

I use Zipline & VectorBT

• Account for commissions, slippage, and order types in your backtests.

• Model these costs realistically (even if estimates).

• Python tip: incorporate slippage/commissions logic directly into your trade simulations

I use Zipline & VectorBT

5) Risk Management

• Ongoing monitoring of drawdowns & exposure.

• Set stop losses, trailing stops, or volatility-based position sizing.

• Tools like pandas & plotly help visualize risk metrics & performance over time.

• Ongoing monitoring of drawdowns & exposure.

• Set stop losses, trailing stops, or volatility-based position sizing.

• Tools like pandas & plotly help visualize risk metrics & performance over time.

7) Putting It All Together

• The pipeline: Data → Alpha → Portfolio Construction → Execution → Risk Management.

• Write modular code to keep each component testable & maintainable.

• Start simple; refine iteratively as you gain insights.

• The pipeline: Data → Alpha → Portfolio Construction → Execution → Risk Management.

• Write modular code to keep each component testable & maintainable.

• Start simple; refine iteratively as you gain insights.

Want to learn how to get started with algorithmic trading with Python?

Then join us on February 12th for a live webinar, how to Build Algorithmic Trading Strategies (that actually get results)

Register here (500+ registered): learn.quantscience.io/qs-register

Then join us on February 12th for a live webinar, how to Build Algorithmic Trading Strategies (that actually get results)

Register here (500+ registered): learn.quantscience.io/qs-register

• • •

Missing some Tweet in this thread? You can try to

force a refresh