Top 5 inversion fair value gap setups of the week + explanations + letter rating

I take 2 hours out of my week to make these for you guys when I don't even need to but I want you guys to make money so please be grateful

1.27.25 - 1.31.25 🧵

I take 2 hours out of my week to make these for you guys when I don't even need to but I want you guys to make money so please be grateful

1.27.25 - 1.31.25 🧵

Monday

A+

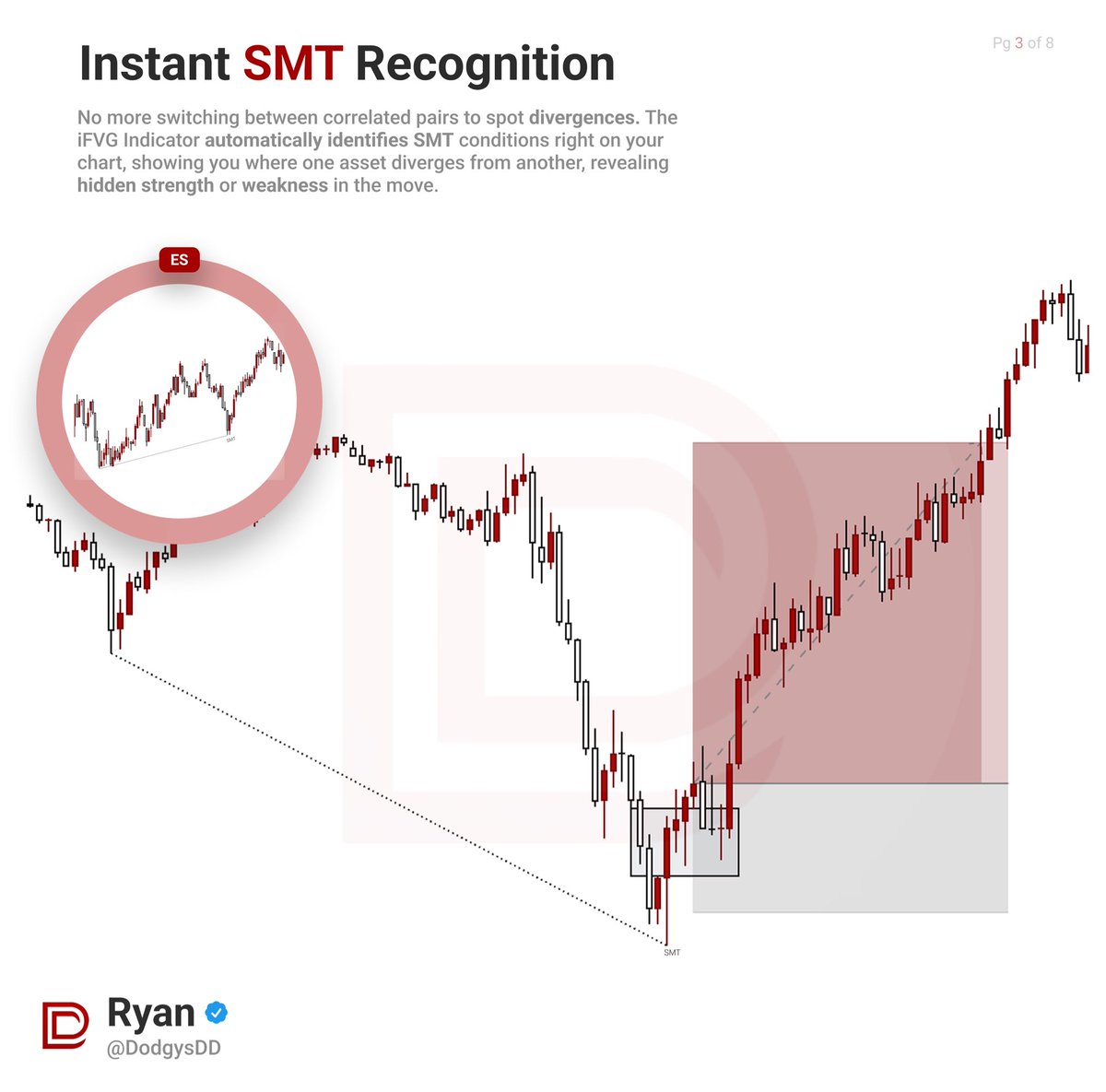

-SMT w / ES

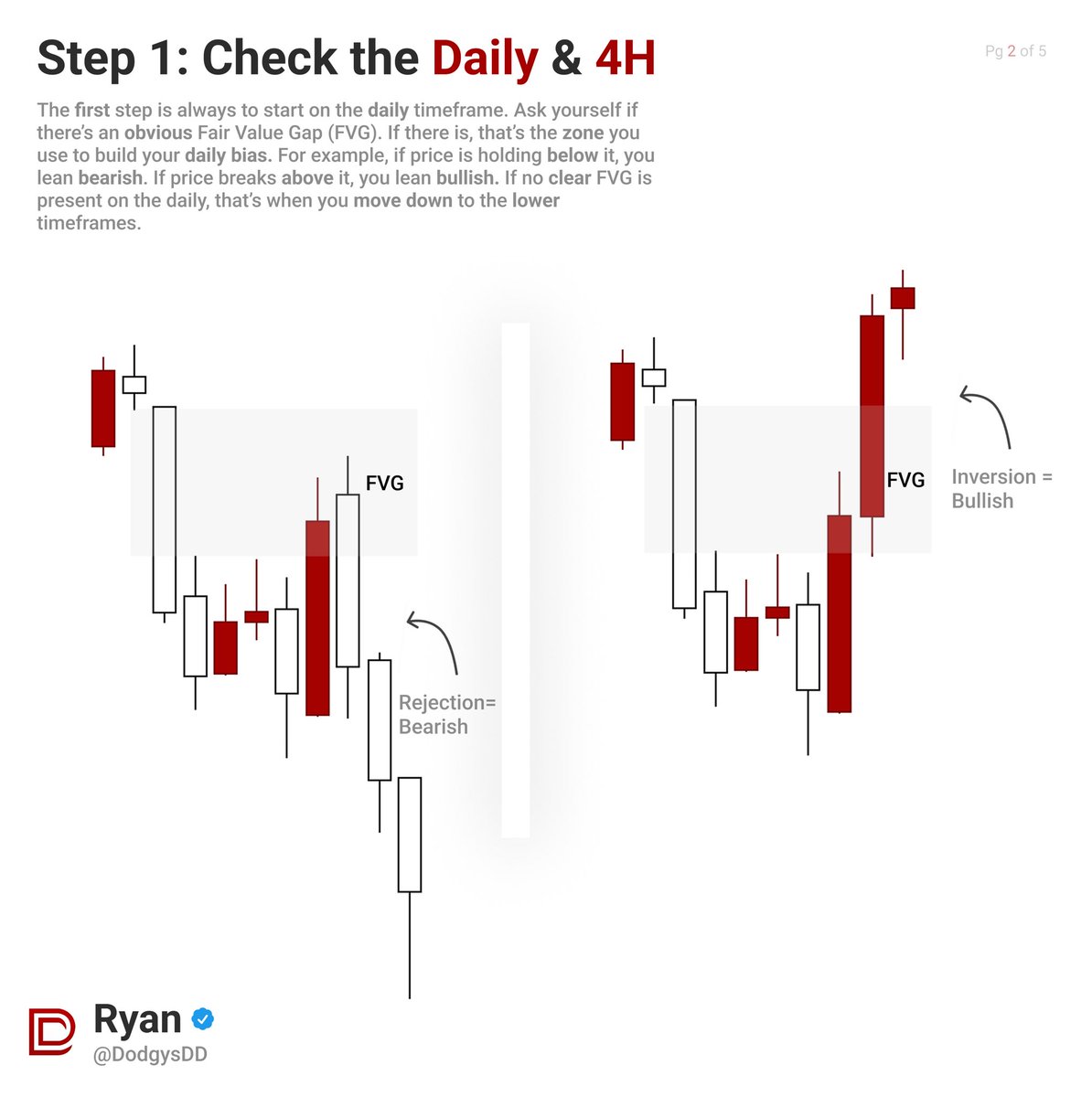

-Singular FVG

-HTF 15 min iFVG

-Good momentum/vshape

-ES hit discount

-Mini LRLR above

A+

-SMT w / ES

-Singular FVG

-HTF 15 min iFVG

-Good momentum/vshape

-ES hit discount

-Mini LRLR above

Tuesday

A+

-Delivery from M30 FVG

-Swept HTF liquidity

-OB + iFVG

-9:30 High (good liquidity pool)

-HTF coming off 15 min iFVG

-HTF in discount

A+

-Delivery from M30 FVG

-Swept HTF liquidity

-OB + iFVG

-9:30 High (good liquidity pool)

-HTF coming off 15 min iFVG

-HTF in discount

Wednesday (FOMC)

A+

-SMT w/ ES

-Lunch high buyside

-Vshape recovery

-HTF bullish

-In discount

-LRLR above

A+

-SMT w/ ES

-Lunch high buyside

-Vshape recovery

-HTF bullish

-In discount

-LRLR above

Thursday

A+

-In discount

-Manipulation leg

-Mini LRLR

-4 hour BPR

-Singular iFVG

-Inversed with momentum

-Big LRLR above

-ITH above

A+

-In discount

-Manipulation leg

-Mini LRLR

-4 hour BPR

-Singular iFVG

-Inversed with momentum

-Big LRLR above

-ITH above

Friday

A+

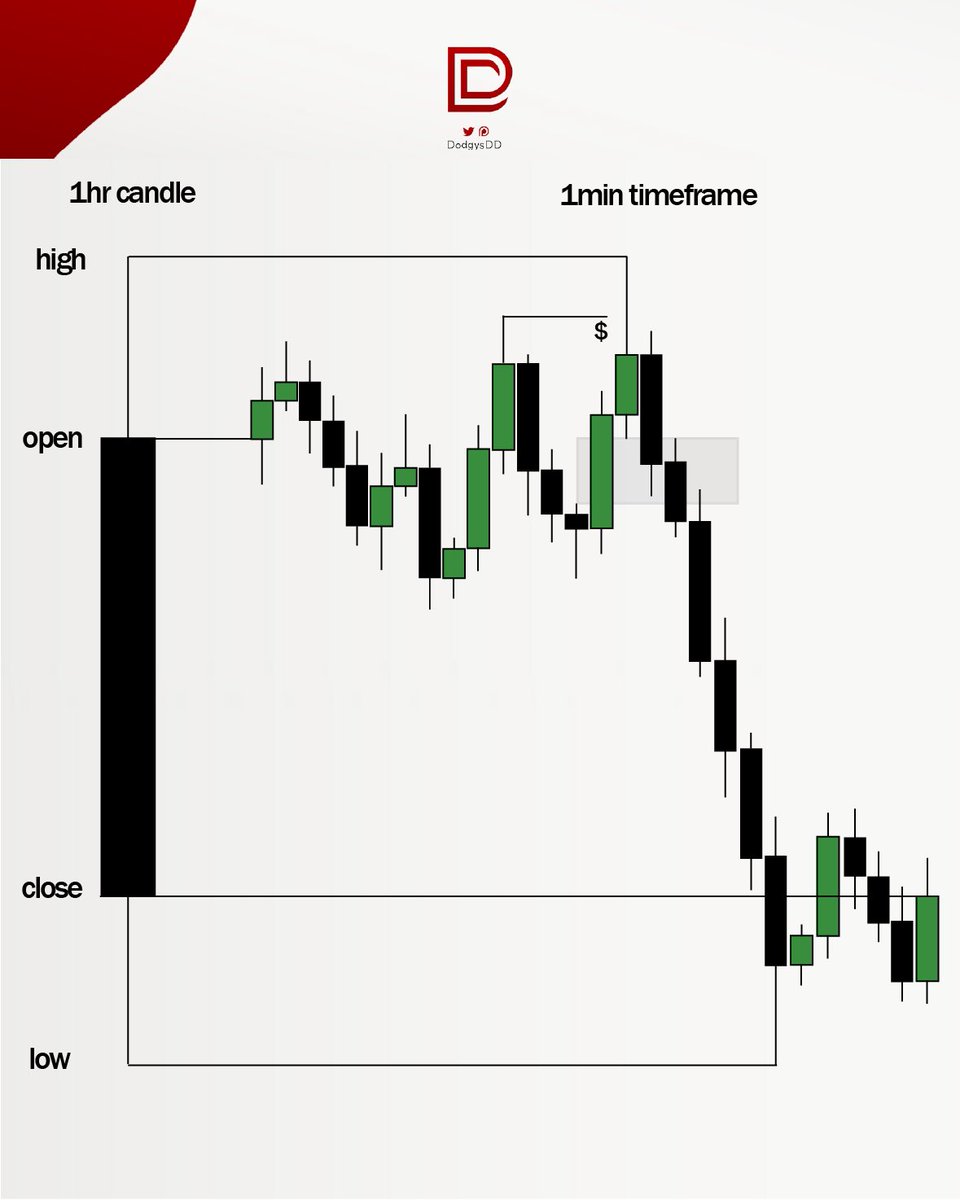

-One Setup for Life

-Delivery off 5 min FVG

-Swept HTF Liquidity

-Good momentum back up

-Data Highs

-In discount

A+

-One Setup for Life

-Delivery off 5 min FVG

-Swept HTF Liquidity

-Good momentum back up

-Data Highs

-In discount

If you have any questions, make sure to check out my discord (link in description)

Follow my other socials for more ICT tips

-Instagram @ dodgysddofficial

-tik tok @ dodgysdd

Follow my other socials for more ICT tips

-Instagram @ dodgysddofficial

-tik tok @ dodgysdd

• • •

Missing some Tweet in this thread? You can try to

force a refresh