Budget 2025: When less is more.

Can someone earning ₹12.75 lakh take home more than someone earning ₹13 lakh?

Yes—at least to some extent.

Here’s a thread 🧵

Can someone earning ₹12.75 lakh take home more than someone earning ₹13 lakh?

Yes—at least to some extent.

Here’s a thread 🧵

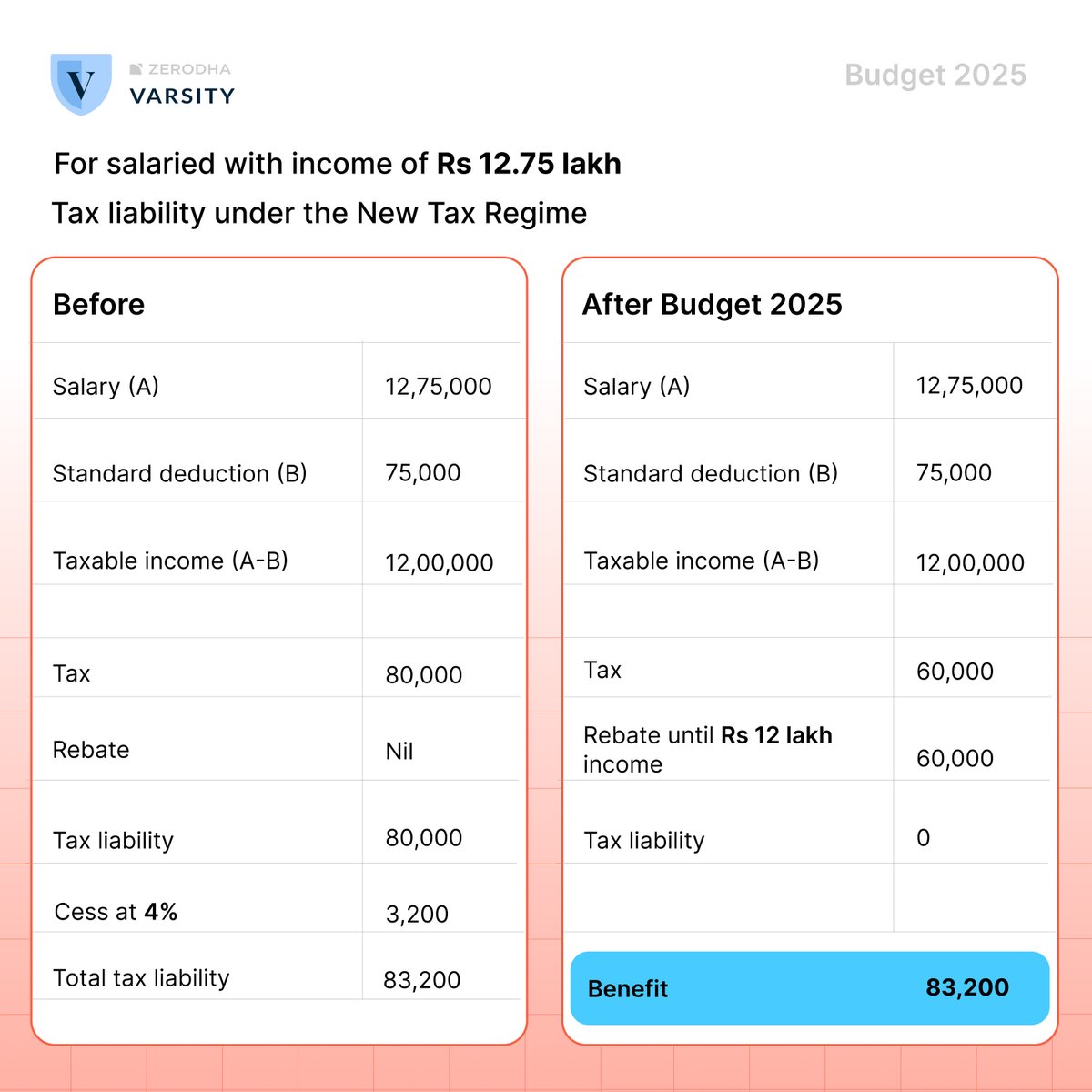

Take ‘A’, who earns an annual salary of 12.75 lakhs. ‘A’ gets a standard deduction (SD) of 75,000, making the taxable income Rs 12 lakh.

Tax liability after Budget 2025: Nil

Here, ‘A’ is getting a full rebate on tax liability as the income is 12 lakhs or less.

Tax liability after Budget 2025: Nil

Here, ‘A’ is getting a full rebate on tax liability as the income is 12 lakhs or less.

Now, here’s the tax liability of ‘B’ earning a salary of Rs 13 lakh.

After the standard deduction of Rs 75,000, the taxable income becomes Rs 12.25 lakh.

Tax liability as per revised slab rates would be Rs 63,750.

But here comes the benefit of ‘Marginal relief on rebate’.

After the standard deduction of Rs 75,000, the taxable income becomes Rs 12.25 lakh.

Tax liability as per revised slab rates would be Rs 63,750.

But here comes the benefit of ‘Marginal relief on rebate’.

If the tax amount is more than the income exceeding ₹12 lakh, then the tax will be limited to the extent of income exceeding Rs 12 lakh, said @canaveenwadhwa

In our e.g, the tax liability is Rs 63,750. But the income exceeding Rs 12 lk is only Rs 25,000 (12.25 lk - Rs 12lk)

In our e.g, the tax liability is Rs 63,750. But the income exceeding Rs 12 lk is only Rs 25,000 (12.25 lk - Rs 12lk)

Thus, the tax liability on a salary of Rs 13 lakh comes down to Rs 25,000.

Phew! The post-tax income of ‘B’ is now Rs 12.75 lk.

But it is not over. A cess of 4% is levied on B’s tax of Rs 25,000, which is equal to Rs 1,000.

B’s total tax payable=Rs 26,000 (Rs 25,000+Rs 1,000)

Phew! The post-tax income of ‘B’ is now Rs 12.75 lk.

But it is not over. A cess of 4% is levied on B’s tax of Rs 25,000, which is equal to Rs 1,000.

B’s total tax payable=Rs 26,000 (Rs 25,000+Rs 1,000)

A’s pre-tax income = Rs 12,75,000

A’s post-tax income = Rs 12,75,000

B’s pre-tax income = Rs 13,00,000

B’s post-tax income = Rs 12,74,000

When less is more, slightly 🙂

The cess made the difference & it won't be significant. Btw, marginal relief is not new with Budget 2025.

A’s post-tax income = Rs 12,75,000

B’s pre-tax income = Rs 13,00,000

B’s post-tax income = Rs 12,74,000

When less is more, slightly 🙂

The cess made the difference & it won't be significant. Btw, marginal relief is not new with Budget 2025.

• • •

Missing some Tweet in this thread? You can try to

force a refresh