This is the only thing you need to read about tariffs to understand Bitcoin for 2025. This is undoubtedly my highest conviction macro trade for the year: Plaza Accord 2.0 is coming.

Bookmark this and revisit as the financial war unravels sending Bitcoin violently higher.

Bookmark this and revisit as the financial war unravels sending Bitcoin violently higher.

For my mobile readers:

To understand tariffs today, there are two contexts you have to frame the conversation in: 1) the curse of the Triffin dilemma, and 2) Trump’s personal goals. By analyzing both, the end game becomes clear: tariffs might be just a temporary tool, but the permanent conclusion is that Bitcoin is not only going higher—but faster.

First, the Triffin dilemma: The US dollar status as a reserve currency gives the US what is called “exorbitant privilege” in financial transactions/trade, and it has a few implications: 1) the dollar is structurally overvalued due to its need to be held as reserves by other countries in a price-inelastic manner, 2) the US has to run a persistent trade balance deficit to supply the world with those dollars, and 3) the US government therefore can borrow persistently cheaper than it should be able to. The US wants to keep #3, but rid #1 and #2–but how? Enter tariffs.

Recognize that tariffs are often a temporary negotiation tool to achieve a goal. The ultimate goal is to seek a multi-lateral agreement to weaken the dollar, essentially a Plaza Accord 2.0. One hypothetical way this could happen is that the US would explicitly specify that countries have to reduce their dollar reserves, while also requiring them to shift the duration of the UST holding further out. In other words, Trump is trying to find a way to implement a “YCC, not YCC” strategy within the realms of the executive branch. No doubt Bessent is on board, recognizing that he was left a bag of trash by Yellen, whose legacy will have been the near-permanent impairment of the Treasury’s ability to manage duration by doubling the proportion of debt financing to T-bills (adding fake liquidity), exposing the US to the mercy of the whims of refinancing– idiotically while interest rates were beginning to rise. The cost to US taxpayers here cannot be understated.

As a result, the US is charting a path to achieve the holy grail of fiat alchemy: lower dollar and lower yield.

This brings me to my second point: I have shared before that Trump’s #1 goal is to lower the 10y rate, the reason being that his own bags depend upon it: real estate. His obsession with Powell cutting short-term rates, then realizing it is not working, is the catalyst. Never doubt the uncomplicated incentives of the transparently profit-motivated, and align yourself next to him. Mark my words: the 10y is going to go down, whatever it takes.

The asset to own therefore is Bitcoin. In a world of weaker dollar and weaker US rates, something broken pundits will tell you is impossible (because they can’t model statecraft), risk assets in the US will fly through the roof beyond your wildest imagination, for it is likely a giant tax cut will have to accompany the higher costs borne by the loss of comparative advantage. The tariff costs, most likely through higher inflation, will be shared by both US and trade partners, but the relative impact will be much heavier on foreigners. These countries then will have to find a way to fend off their weak growth issues leading to stimulating the economy through monetary and fiscal policies that ultimately cause currency debasement. The outraged citizens of these countries will experience a mini-financial crisis and look for alternatives. And unlike the 1970s when the world was largely offline, today we are not only online–we are onchain. So while both sides of the trade imbalance equation will want Bitcoin for two different reasons, the end result is the same: higher, violently faster—for we are at war.

TLDR: You simply have not yet grasped how amazing a sustained tariff war is going to be for Bitcoin in the long run.

To understand tariffs today, there are two contexts you have to frame the conversation in: 1) the curse of the Triffin dilemma, and 2) Trump’s personal goals. By analyzing both, the end game becomes clear: tariffs might be just a temporary tool, but the permanent conclusion is that Bitcoin is not only going higher—but faster.

First, the Triffin dilemma: The US dollar status as a reserve currency gives the US what is called “exorbitant privilege” in financial transactions/trade, and it has a few implications: 1) the dollar is structurally overvalued due to its need to be held as reserves by other countries in a price-inelastic manner, 2) the US has to run a persistent trade balance deficit to supply the world with those dollars, and 3) the US government therefore can borrow persistently cheaper than it should be able to. The US wants to keep #3, but rid #1 and #2–but how? Enter tariffs.

Recognize that tariffs are often a temporary negotiation tool to achieve a goal. The ultimate goal is to seek a multi-lateral agreement to weaken the dollar, essentially a Plaza Accord 2.0. One hypothetical way this could happen is that the US would explicitly specify that countries have to reduce their dollar reserves, while also requiring them to shift the duration of the UST holding further out. In other words, Trump is trying to find a way to implement a “YCC, not YCC” strategy within the realms of the executive branch. No doubt Bessent is on board, recognizing that he was left a bag of trash by Yellen, whose legacy will have been the near-permanent impairment of the Treasury’s ability to manage duration by doubling the proportion of debt financing to T-bills (adding fake liquidity), exposing the US to the mercy of the whims of refinancing– idiotically while interest rates were beginning to rise. The cost to US taxpayers here cannot be understated.

As a result, the US is charting a path to achieve the holy grail of fiat alchemy: lower dollar and lower yield.

This brings me to my second point: I have shared before that Trump’s #1 goal is to lower the 10y rate, the reason being that his own bags depend upon it: real estate. His obsession with Powell cutting short-term rates, then realizing it is not working, is the catalyst. Never doubt the uncomplicated incentives of the transparently profit-motivated, and align yourself next to him. Mark my words: the 10y is going to go down, whatever it takes.

The asset to own therefore is Bitcoin. In a world of weaker dollar and weaker US rates, something broken pundits will tell you is impossible (because they can’t model statecraft), risk assets in the US will fly through the roof beyond your wildest imagination, for it is likely a giant tax cut will have to accompany the higher costs borne by the loss of comparative advantage. The tariff costs, most likely through higher inflation, will be shared by both US and trade partners, but the relative impact will be much heavier on foreigners. These countries then will have to find a way to fend off their weak growth issues leading to stimulating the economy through monetary and fiscal policies that ultimately cause currency debasement. The outraged citizens of these countries will experience a mini-financial crisis and look for alternatives. And unlike the 1970s when the world was largely offline, today we are not only online–we are onchain. So while both sides of the trade imbalance equation will want Bitcoin for two different reasons, the end result is the same: higher, violently faster—for we are at war.

TLDR: You simply have not yet grasped how amazing a sustained tariff war is going to be for Bitcoin in the long run.

Here is a one-of-a-kind reference material from last summer, where I had the honor to host a lively conversation between @SalehaMohsin and @resistancemoney on this very topic:

https://x.com/dgt10011/status/1820818712943009976

I know the price action has been disappointing in the short term. But that's why I posted the best trade was actually "long vol" on Friday. IV went up from 40 to 60(!) in 2 days. Trading isn't always directional, there's many different ways to make money.

https://x.com/dgt10011/status/1885411535327048042

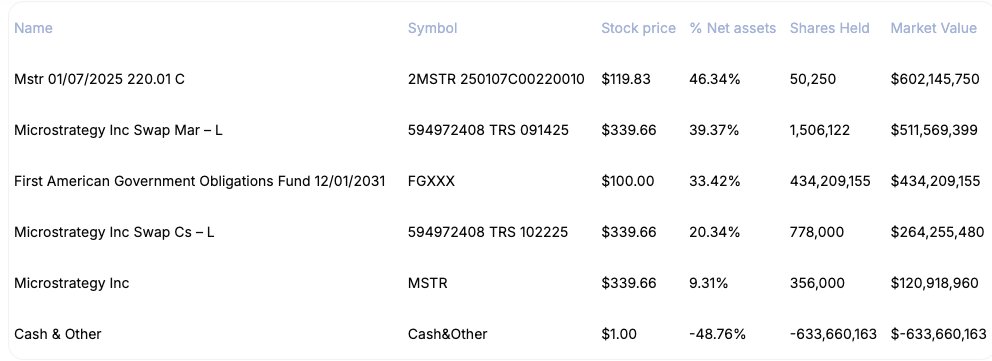

So here's my final post to end this thread. If there is one consistent advice I've been hammering into your brain, you should now be equipped with all the power and knowledge to intuit what the next perfect trade is. Leverage all the insights regarding the structural mispricing of long-dated very OTM calls👇

…

…

https://x.com/dgt10011/status/1837278352823972147

• • •

Missing some Tweet in this thread? You can try to

force a refresh