How to get URL link on X (Twitter) App

https://twitter.com/palantirtech/status/1910665112924439018I have long shared privately with my Stanford friends that I have this idea in my head that if I do my job correctly as a parent, my kids may have the elite option to not go to college. I got a lot of pushbacks on this, but I have a feeling overtime this won’t sound so crazy.

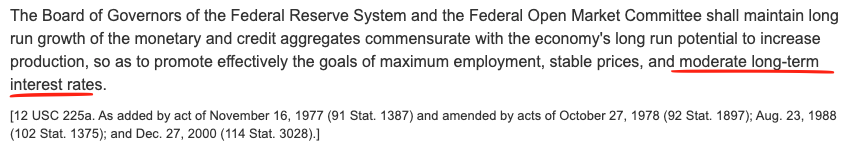

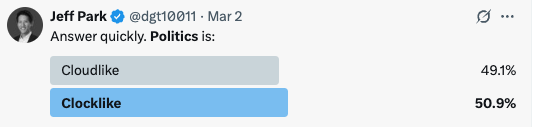

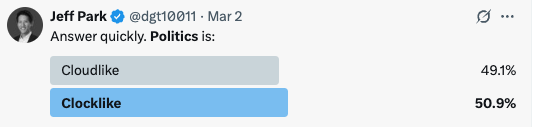

Karl Popper, an influential philosopher of science, uses the metaphor of clouds and clocks to explain the difference between natural sciences (like physics) and the social sciences (like economics).

Karl Popper, an influential philosopher of science, uses the metaphor of clouds and clocks to explain the difference between natural sciences (like physics) and the social sciences (like economics).

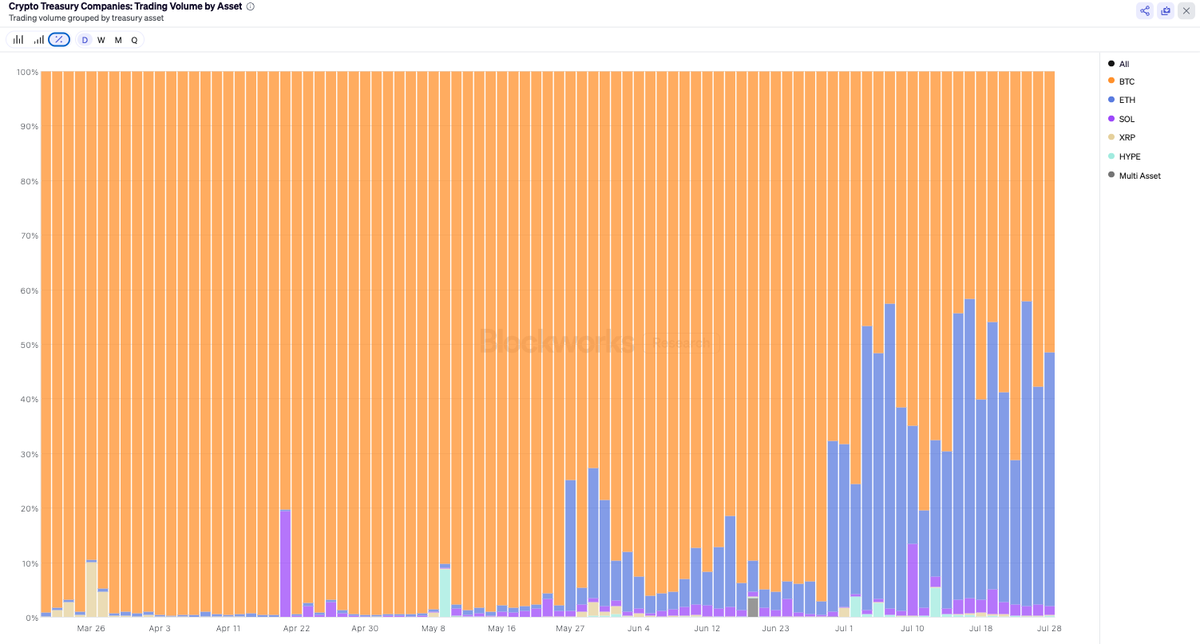

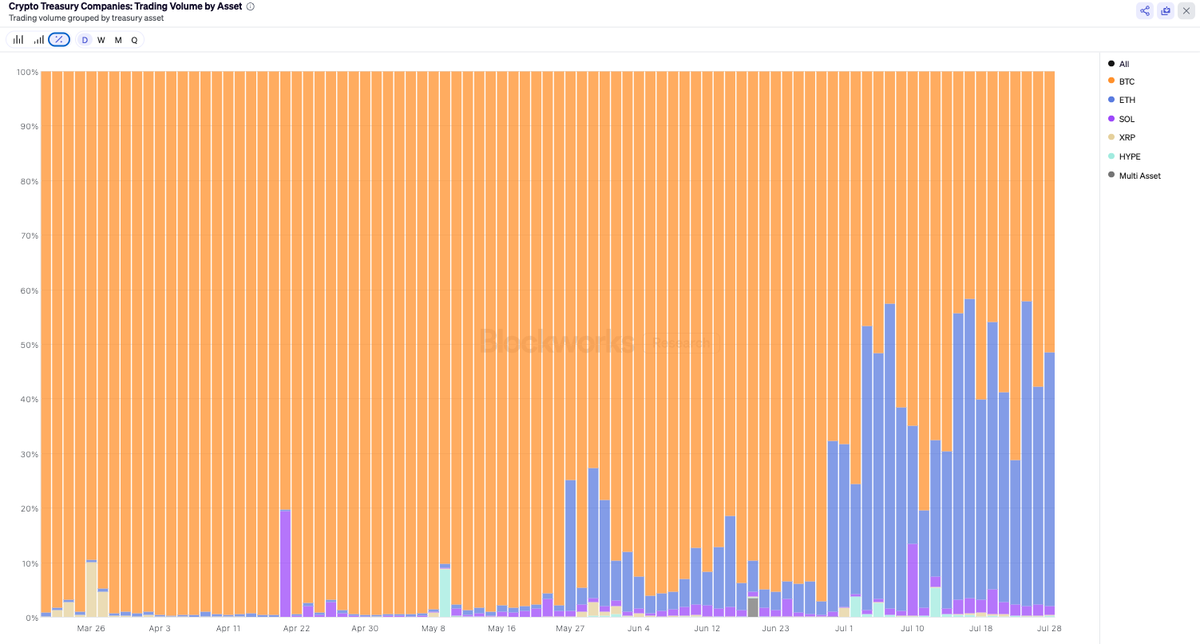

2/ Let me first break down the graph. It shows how globalization lowers the price of goods, requiring foreign producers to fill the supply gap since domestic producers can only supply Q1, while consumers demand Q4.

2/ Let me first break down the graph. It shows how globalization lowers the price of goods, requiring foreign producers to fill the supply gap since domestic producers can only supply Q1, while consumers demand Q4.

https://twitter.com/dgt10011/status/1549393616262598656

For my mobile readers:

For my mobile readers:

The global economy is a complex fluid system. It’s possible shock tariffs can reduce demand for dollars and lower trade deficit, weakening the global dollar supply-demand dynamics. It likely will drive inflation higher, but with the right Fed policies, can also weaken the dollar.

The global economy is a complex fluid system. It’s possible shock tariffs can reduce demand for dollars and lower trade deficit, weakening the global dollar supply-demand dynamics. It likely will drive inflation higher, but with the right Fed policies, can also weaken the dollar.

https://twitter.com/joshmandell6/status/1875972064969920795the danger zone is actually the Jan-10 expiry, not Jan-17

https://twitter.com/samcallah/status/18737591504944171262/ First, the reinsurance business can be extremely lucrative, even better than the regular non-life P&C insurance business. There are various factors but the two most important differentiators are 1) portfolio yield, and 2) tax as per below model.

2/ The key insight is that no major US trade ally can move first (e.g., India), no country with closed capital borders can move first due to capital flight risks (e.g., China), and no country without favorable demographics for political benefits will move first (e.g., Japan).

2/ The key insight is that no major US trade ally can move first (e.g., India), no country with closed capital borders can move first due to capital flight risks (e.g., China), and no country without favorable demographics for political benefits will move first (e.g., Japan).

2/Unlike ETF options, which involve physical delivery, these are cash-settled with European-style expiration.

2/Unlike ETF options, which involve physical delivery, these are cash-settled with European-style expiration.https://x.com/dgt10011/status/18582560939081896452/ we're going to walk through the live example now that i suggested and the post-mortem. the first trade i suggested on 11/22 was to sell 400 call. explanation below:

https://x.com/dgt10011/status/1858523620147933312