Smart Money concept Full course FREE

Part 1 : Fair Value Gap (FVG) : A Detailed Thread 🧵

Open this thread 👇to learn topic FVG which is part of Smart money concept course

Part 1 : Fair Value Gap (FVG) : A Detailed Thread 🧵

Open this thread 👇to learn topic FVG which is part of Smart money concept course

1️⃣ What is a Fair Value Gap (FVG)?

🔹 Definition: A Fair Value Gap (FVG) is an imbalance in price caused by aggressive buying or selling, leaving a gap in liquidity.

🔹 Why does it happen?

When institutions place large orders, price moves fast without filling all orders in between.

The market later retraces to "fill" these gaps before continuing its trend.

📌 Key Insight:

✅ If price is bullish, FVGs act as support.

✅ If price is bearish, FVGs act as resistance.

🔹 Definition: A Fair Value Gap (FVG) is an imbalance in price caused by aggressive buying or selling, leaving a gap in liquidity.

🔹 Why does it happen?

When institutions place large orders, price moves fast without filling all orders in between.

The market later retraces to "fill" these gaps before continuing its trend.

📌 Key Insight:

✅ If price is bullish, FVGs act as support.

✅ If price is bearish, FVGs act as resistance.

2. How to Identify a Fair Value Gap

To identify an FVG, follow these steps:

Step 1: Look for a Strong Move

Identify a strong bullish or bearish candle (e.g., a large engulfing candle or a candle with a long body and small wicks).

This candle should be followed by another candle that does not fully overlap the wicks of the previous candle.

Step 2: Define the FVG Area

For a Bullish FVG:

The FVG is the area between the high of the previous candle and the low of the next candle.

This gap represents a buying imbalance.

For a Bearish FVG:

The FVG is the area between the low of the previous candle and the high of the next candle.

This gap represents a selling imbalance.

Step 3: Mark the FVG on the Chart

Use horizontal lines or a rectangle tool to mark the FVG area on your chart.

This area acts as a zone of interest for potential trades.

To identify an FVG, follow these steps:

Step 1: Look for a Strong Move

Identify a strong bullish or bearish candle (e.g., a large engulfing candle or a candle with a long body and small wicks).

This candle should be followed by another candle that does not fully overlap the wicks of the previous candle.

Step 2: Define the FVG Area

For a Bullish FVG:

The FVG is the area between the high of the previous candle and the low of the next candle.

This gap represents a buying imbalance.

For a Bearish FVG:

The FVG is the area between the low of the previous candle and the high of the next candle.

This gap represents a selling imbalance.

Step 3: Mark the FVG on the Chart

Use horizontal lines or a rectangle tool to mark the FVG area on your chart.

This area acts as a zone of interest for potential trades.

3. How to Trade FVGs

Trading FVGs involves waiting for price to return to the gap and then entering a trade with confirmation. Here’s how to do it:

Entry

Wait for Price to Return to the FVG:

Once you identify an FVG, wait for price to return to this area.

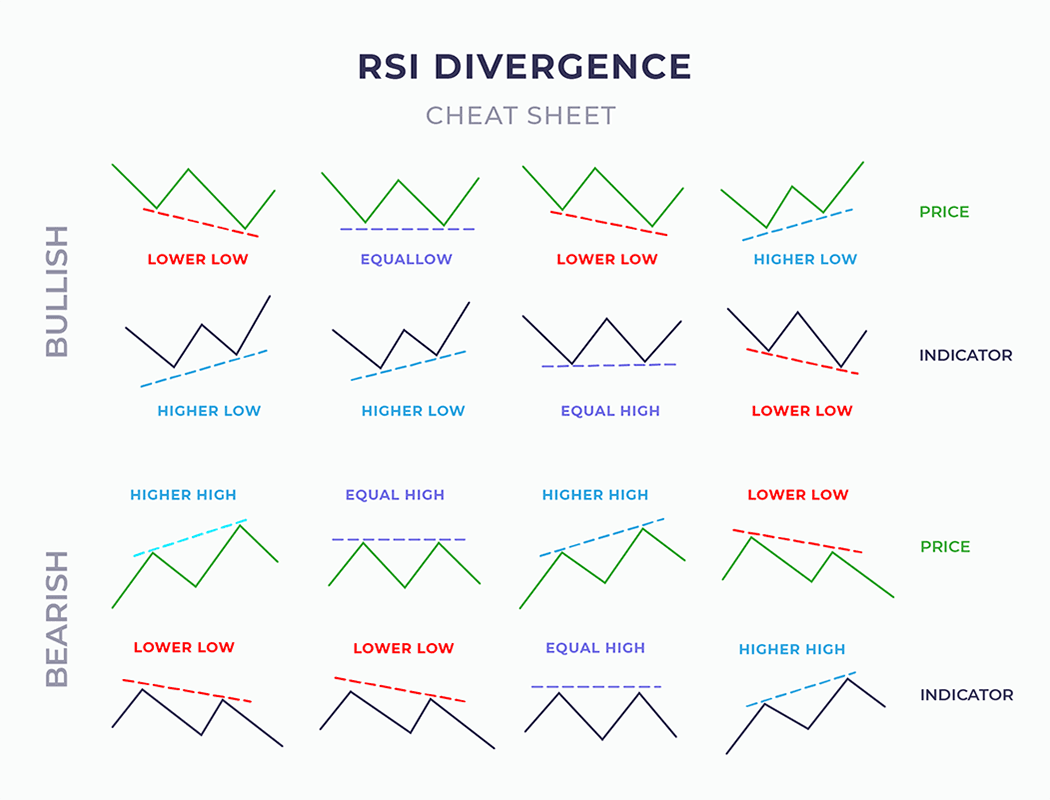

Look for Confirmation:

Use candlestick patterns (e.g., pin bars, engulfing candles) or other indicators (e.g., RSI, volume) to confirm the trade.

For a Bullish FVG, look for bullish reversal patterns.

For a Bearish FVG, look for bearish reversal patterns.

Stop Loss

Place your stop loss below the FVG for a buy trade or above the FVG for a sell trade.

This ensures you are protected if the trade goes against you.

Target

Take profit at the next key level or liquidity pool.

You can also use a risk-reward ratio (e.g., 1:2 or 1:3) to set your target.

Trading FVGs involves waiting for price to return to the gap and then entering a trade with confirmation. Here’s how to do it:

Entry

Wait for Price to Return to the FVG:

Once you identify an FVG, wait for price to return to this area.

Look for Confirmation:

Use candlestick patterns (e.g., pin bars, engulfing candles) or other indicators (e.g., RSI, volume) to confirm the trade.

For a Bullish FVG, look for bullish reversal patterns.

For a Bearish FVG, look for bearish reversal patterns.

Stop Loss

Place your stop loss below the FVG for a buy trade or above the FVG for a sell trade.

This ensures you are protected if the trade goes against you.

Target

Take profit at the next key level or liquidity pool.

You can also use a risk-reward ratio (e.g., 1:2 or 1:3) to set your target.

4️⃣ Stock Selection for FVG Trading

💡 How to Find the Best Stocks for FVG Trading?

📌 Criteria :

✅ High volume stocks (institutions trade here)

✅ Stocks with strong trend movements

✅ Look for FVGs on higher timeframes (1H, 4H, Daily) for accuracy

📊 Best Sectors for FVG Trading:

Banking Stocks (HDFC Bank, ICICI Bank, SBI)

Tech Stocks (TCS, Infosys, Wipro)

Energy Stocks (Reliance, Adani Green)

🚀 Use a stock screener to filter stocks with large momentum candles.

💡 How to Find the Best Stocks for FVG Trading?

📌 Criteria :

✅ High volume stocks (institutions trade here)

✅ Stocks with strong trend movements

✅ Look for FVGs on higher timeframes (1H, 4H, Daily) for accuracy

📊 Best Sectors for FVG Trading:

Banking Stocks (HDFC Bank, ICICI Bank, SBI)

Tech Stocks (TCS, Infosys, Wipro)

Energy Stocks (Reliance, Adani Green)

🚀 Use a stock screener to filter stocks with large momentum candles.

Example of Trading with FVG

Stock: Reliance Industries

FVG found on 1H chart at ₹2600 – ₹2620

Price later retraced into this zone

📌 Trade Setup:

1️⃣ Entry: Buy at ₹2610 when price enters the FVG and shows bullish confirmation.

2️⃣ Stop Loss (SL): Below the FVG at ₹2595 (Risk = ₹15).

3️⃣ Target: Previous high at ₹2650 (Reward = ₹40).

🛠 Risk-Reward Ratio :

RR=Risk/Reward=40/15=2.67

🎯 Potential Gain: 2.67x Risk!

Stock: Reliance Industries

FVG found on 1H chart at ₹2600 – ₹2620

Price later retraced into this zone

📌 Trade Setup:

1️⃣ Entry: Buy at ₹2610 when price enters the FVG and shows bullish confirmation.

2️⃣ Stop Loss (SL): Below the FVG at ₹2595 (Risk = ₹15).

3️⃣ Target: Previous high at ₹2650 (Reward = ₹40).

🛠 Risk-Reward Ratio :

RR=Risk/Reward=40/15=2.67

🎯 Potential Gain: 2.67x Risk!

6. Advanced Tips for Trading FVGs

Combine with Market Structure:

Use FVGs in conjunction with market structure (e.g., higher highs, lower lows) to increase accuracy.

Look for Confluences:

Combine FVGs with other key levels like support/resistance, trendlines, or Fibonacci retracements.

Timeframe Selection:

Use higher timeframes (e.g., 1H, 4H, Daily) for more reliable FVGs.

Avoid Overcrowded Gaps:

If multiple FVGs are clustered in one area, the market may not respect each gap individually.

Combine with Market Structure:

Use FVGs in conjunction with market structure (e.g., higher highs, lower lows) to increase accuracy.

Look for Confluences:

Combine FVGs with other key levels like support/resistance, trendlines, or Fibonacci retracements.

Timeframe Selection:

Use higher timeframes (e.g., 1H, 4H, Daily) for more reliable FVGs.

Avoid Overcrowded Gaps:

If multiple FVGs are clustered in one area, the market may not respect each gap individually.

7. Common Mistakes to Avoid

Trading Every FVG:

Not all FVGs are valid. Wait for confirmation before entering a trade.

Ignoring Market Context:

FVGs work best in trending markets. Avoid trading FVGs in choppy or sideways markets.

Poor Risk Management:

Always use stop losses and proper position sizing to protect your capital.

Trading Every FVG:

Not all FVGs are valid. Wait for confirmation before entering a trade.

Ignoring Market Context:

FVGs work best in trending markets. Avoid trading FVGs in choppy or sideways markets.

Poor Risk Management:

Always use stop losses and proper position sizing to protect your capital.

• • •

Missing some Tweet in this thread? You can try to

force a refresh