Trader | Investor | Scalper in stocks and Nifty sensex

SEBI Registered ❌

Paid Course ❌

All tweets are for educational purposes 💚

5 subscribers

How to get URL link on X (Twitter) App

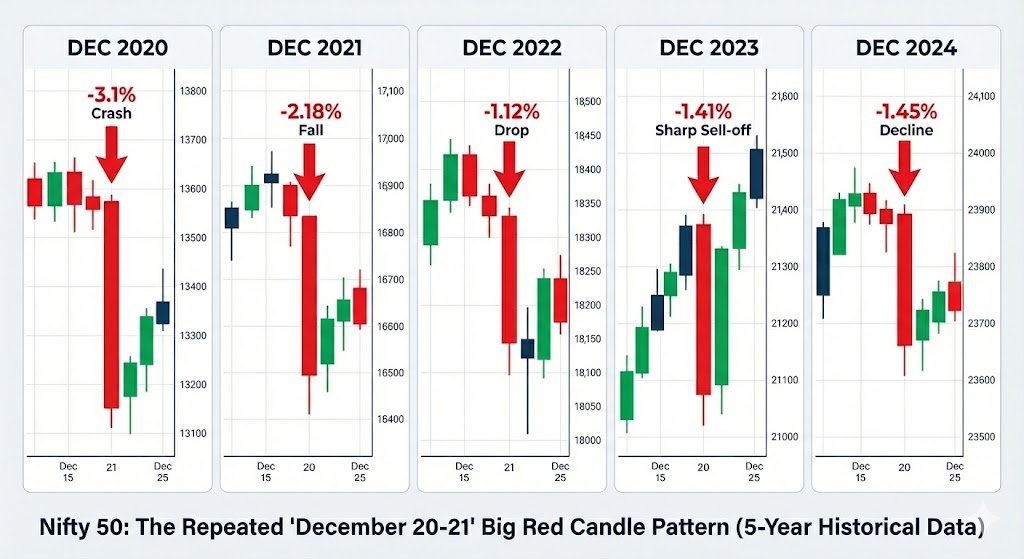

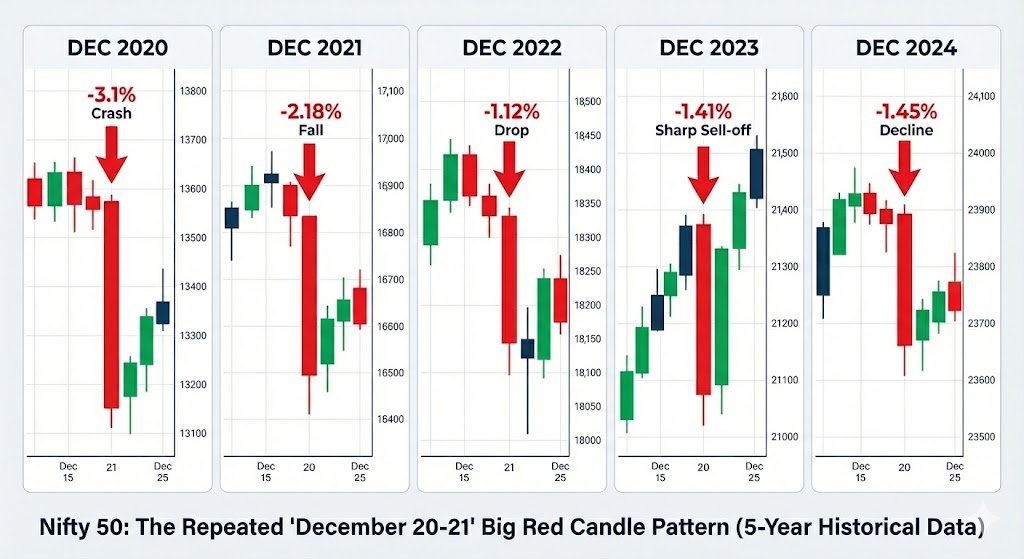

December 21, 2020:

December 21, 2020: