There are companies worth £50bn* based in this terraced house in Bolton.

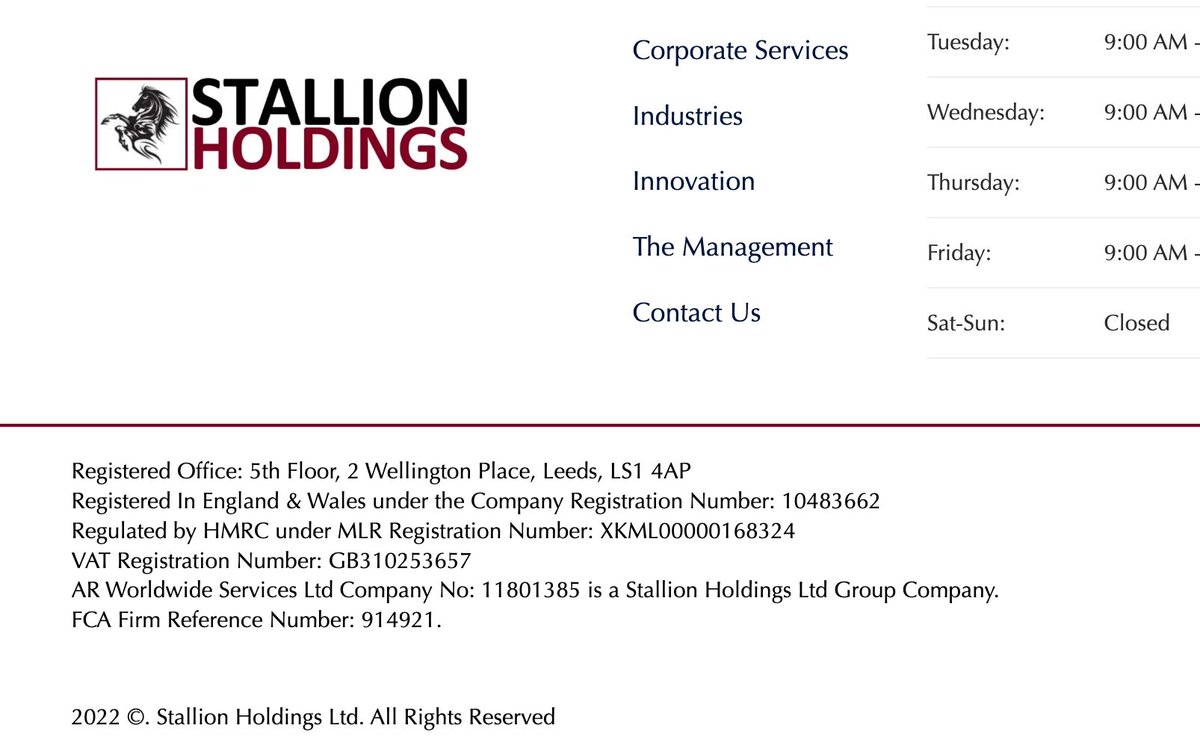

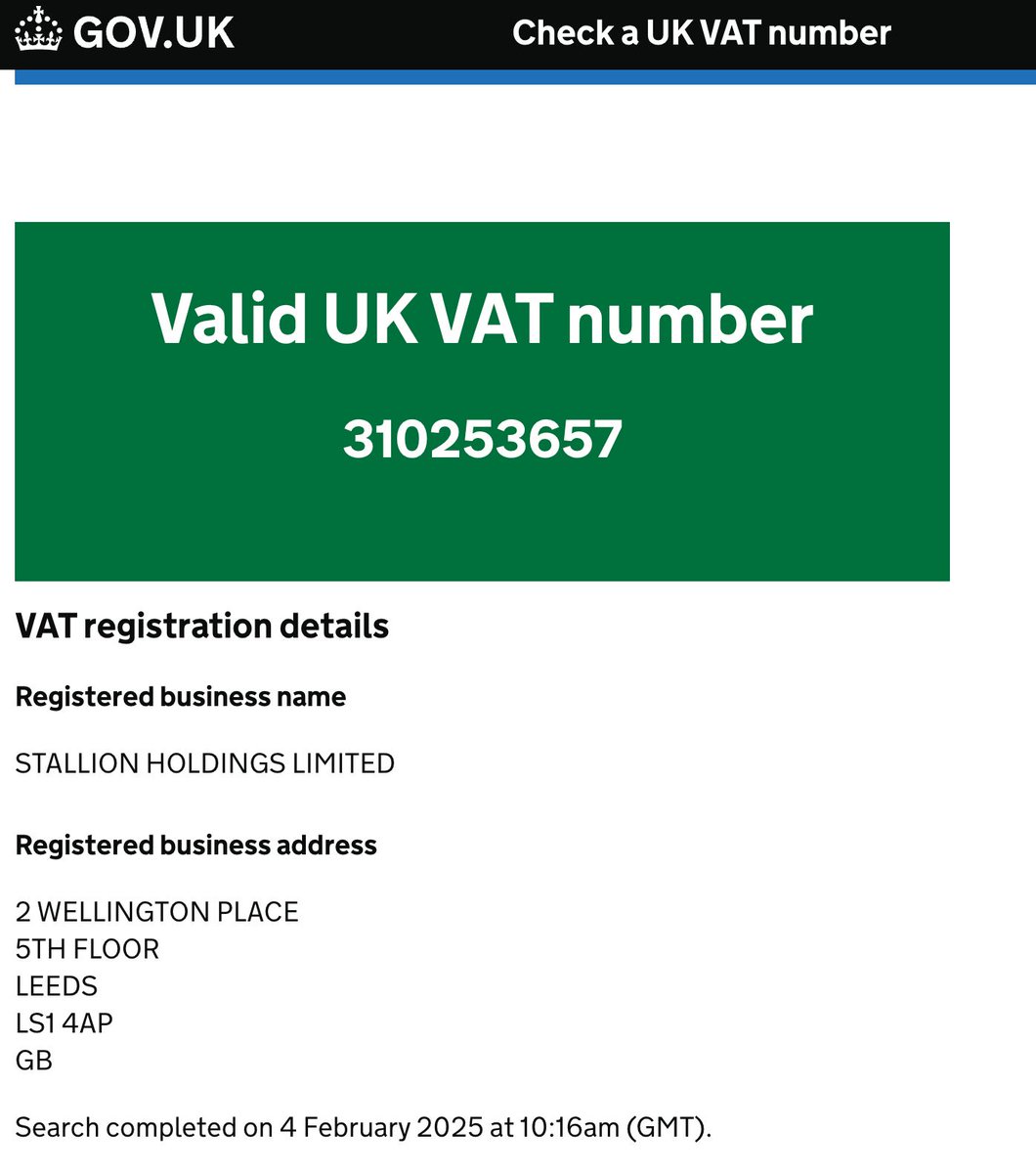

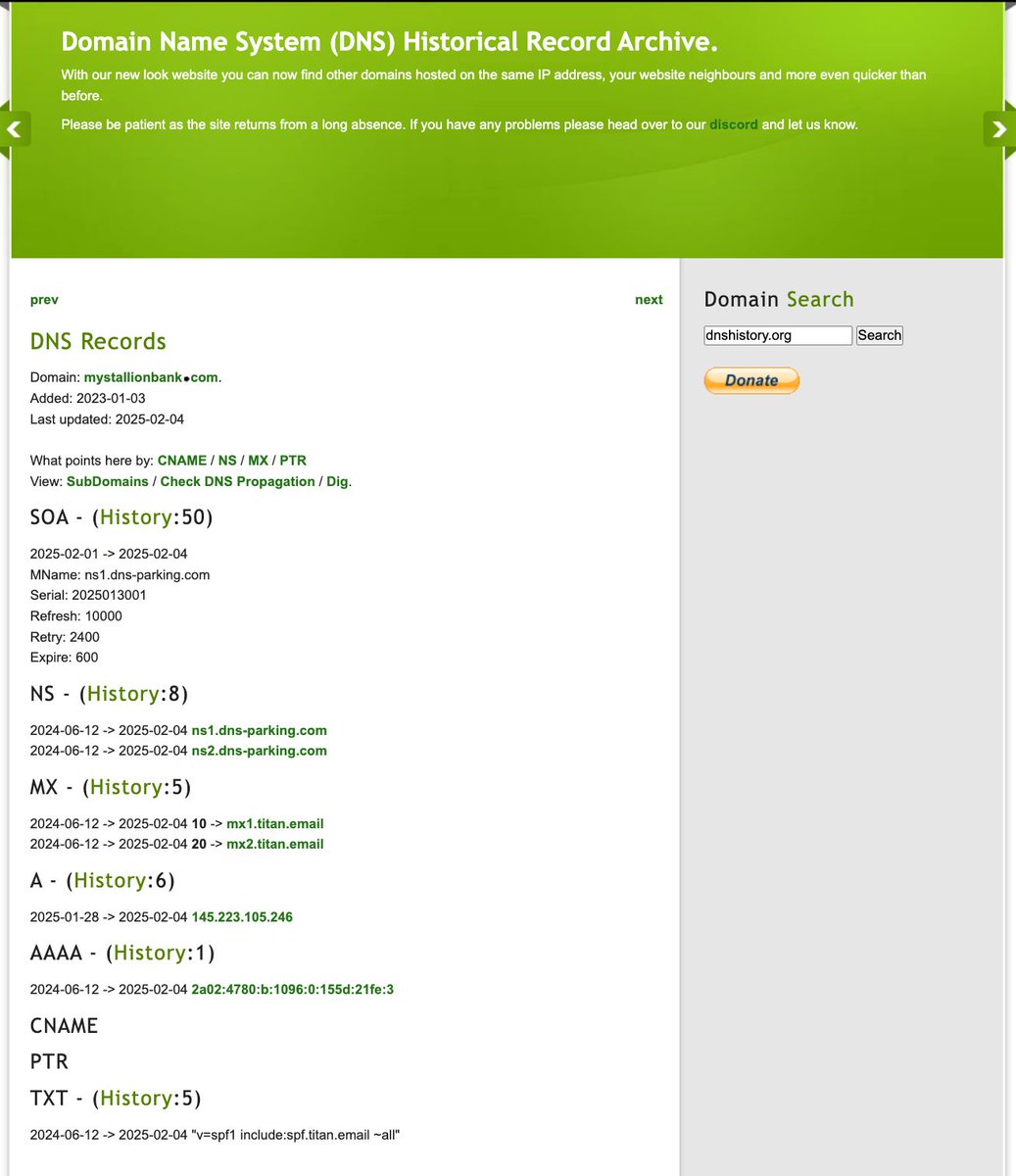

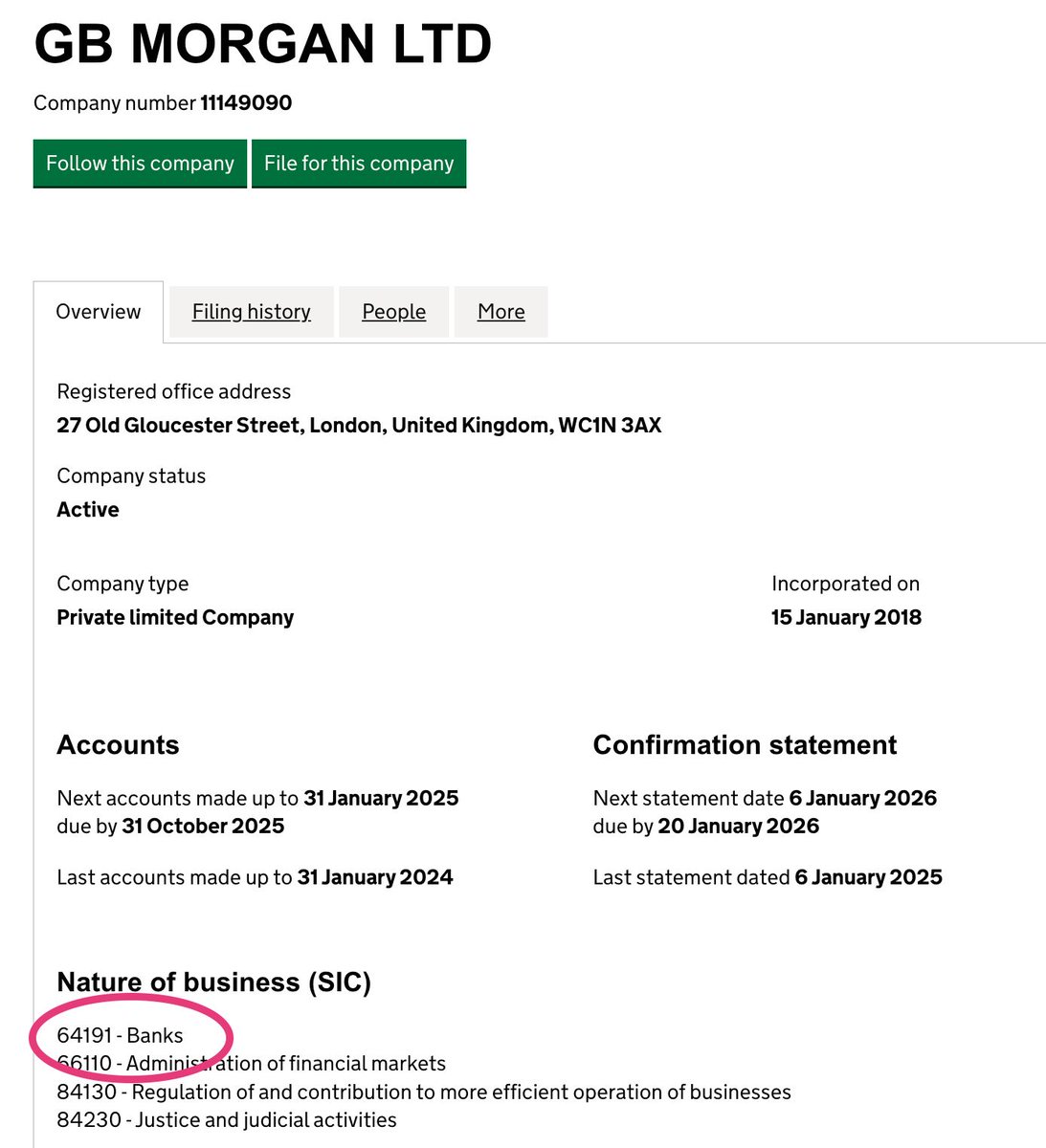

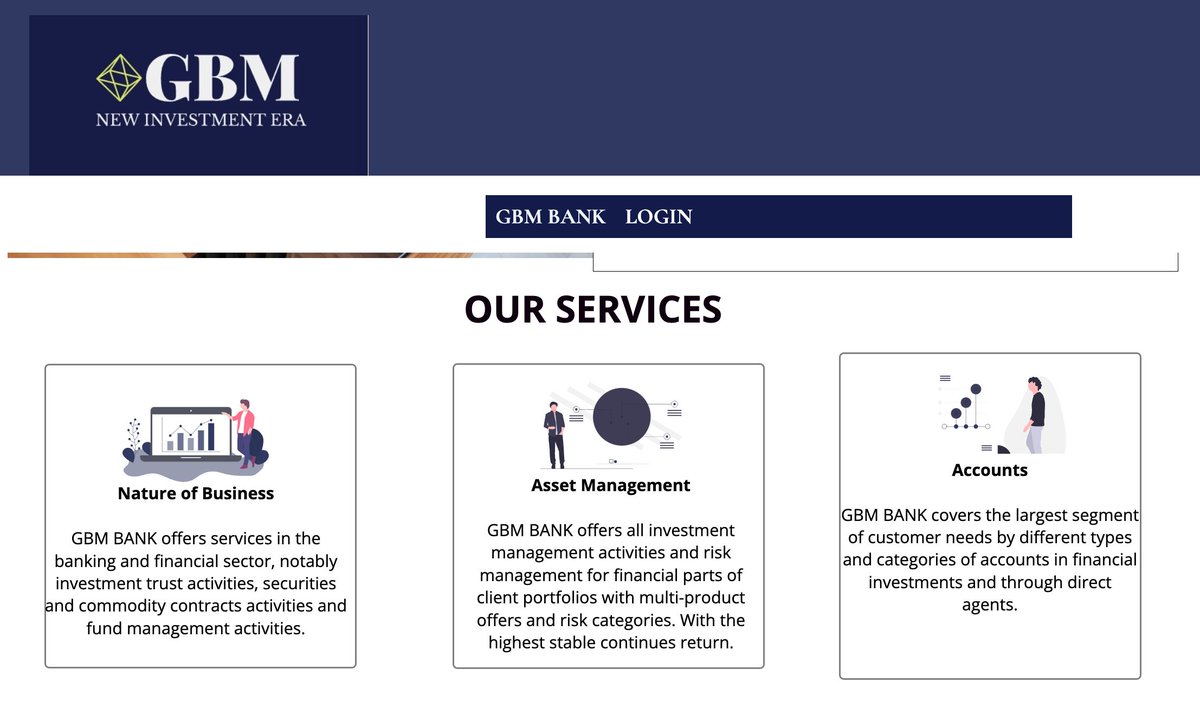

Turns out they also have a bank. With a valid VAT registration number.

(*on paper)

Turns out they also have a bank. With a valid VAT registration number.

(*on paper)

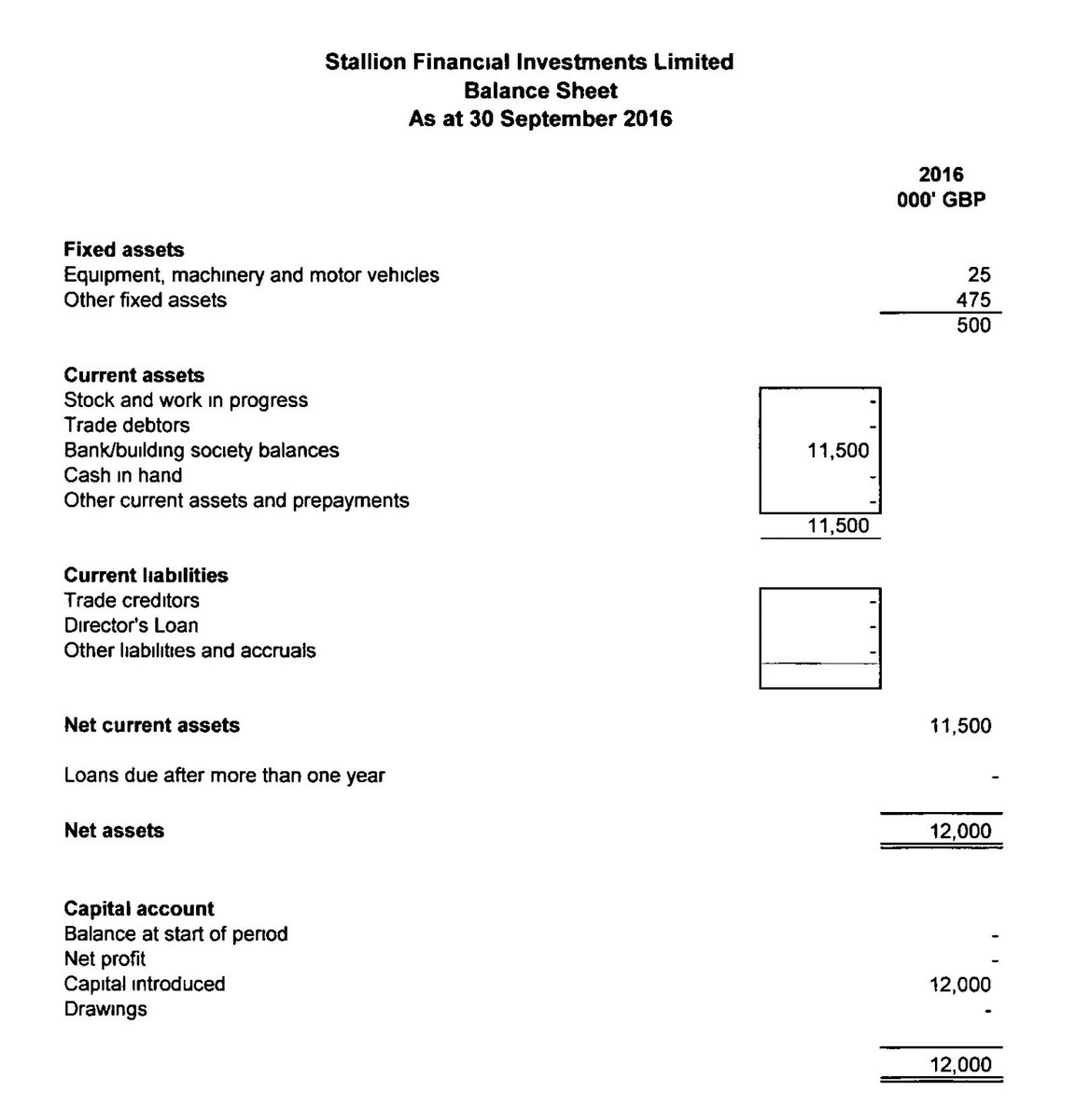

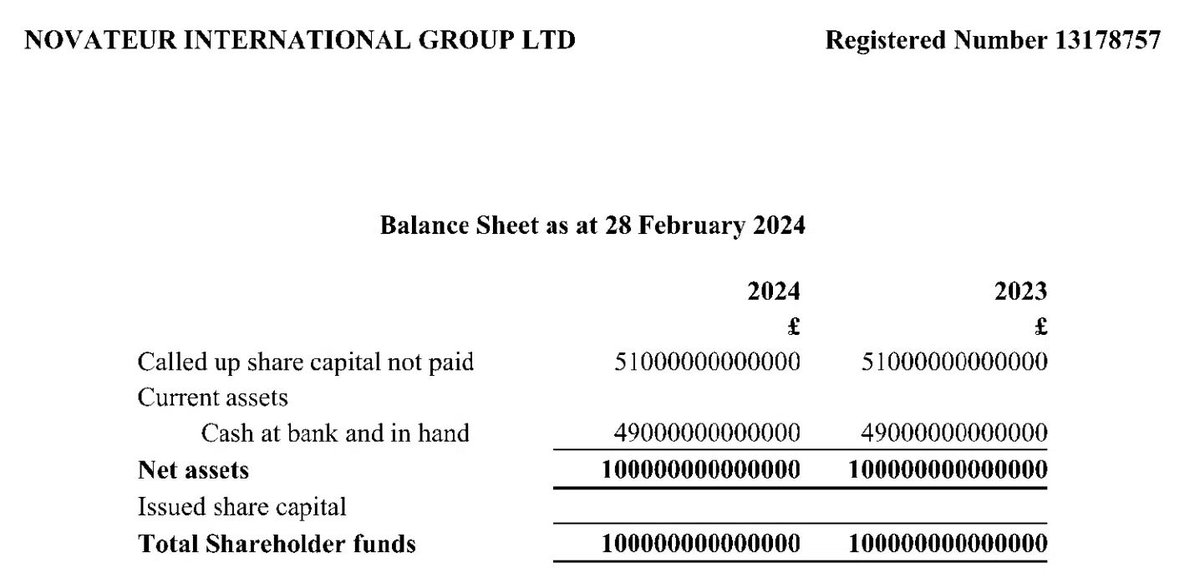

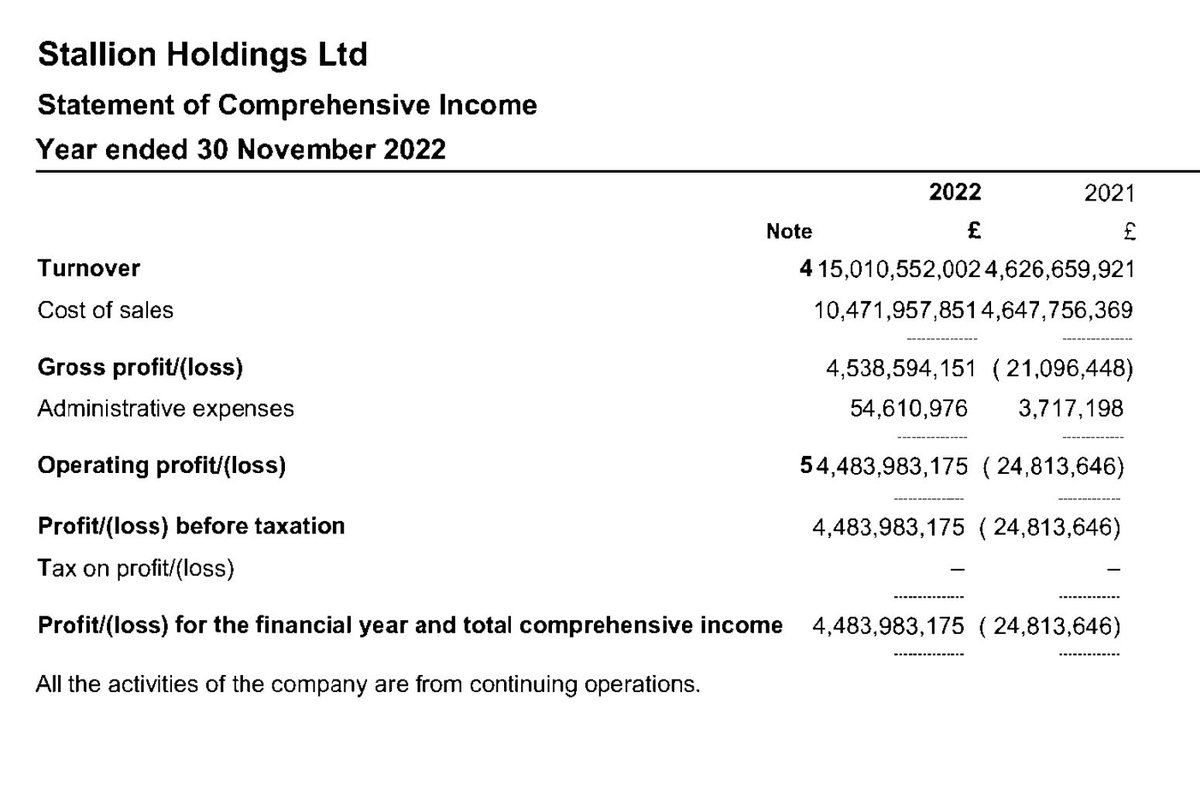

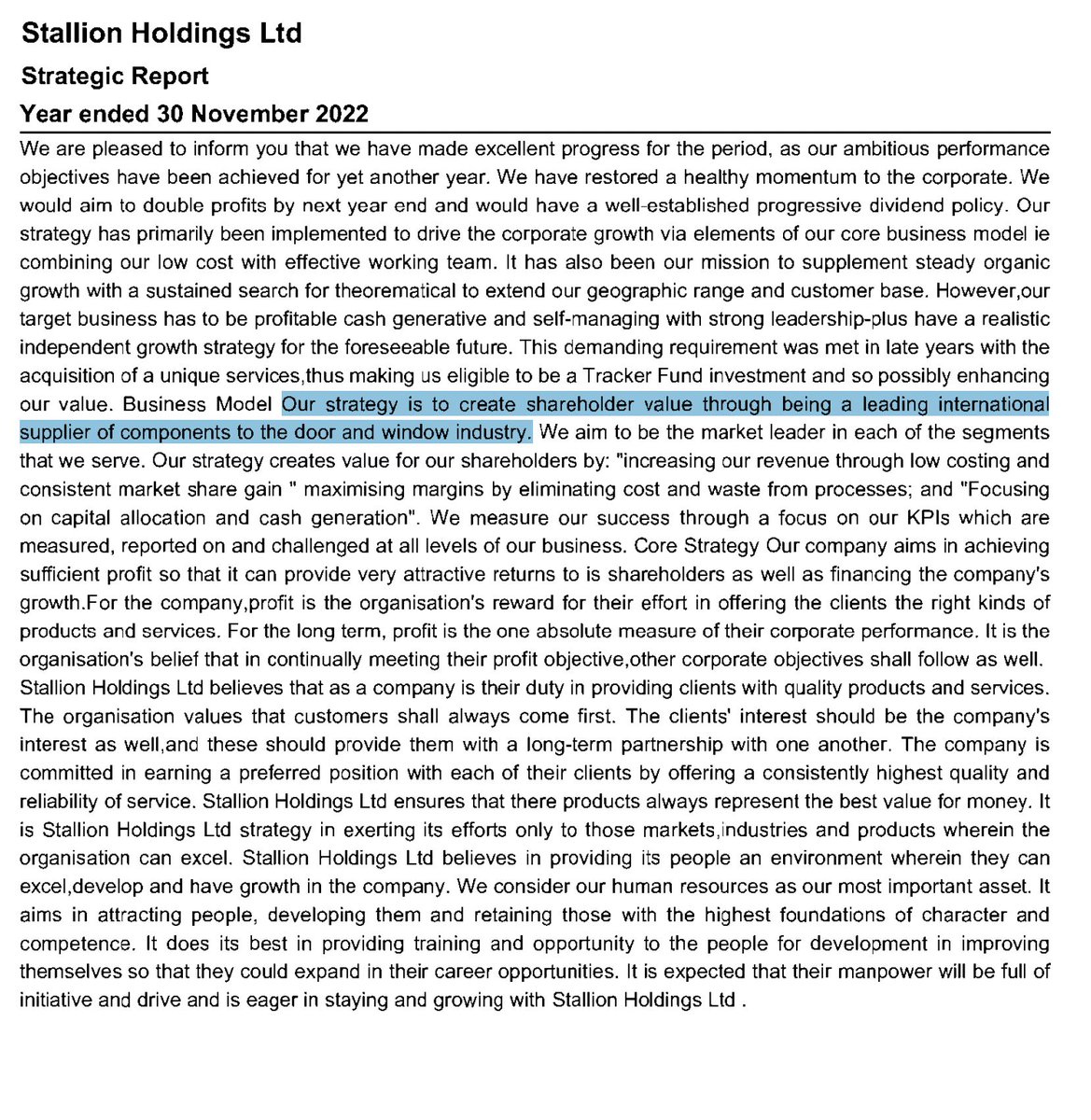

And audited accounts that are superficially plausible, if you ignore the £15bn turnover for an unknown company. And tiny tiny clues the accounts were plagiarised from elsewhere. Like a sentence saying they're a "leading supplier of components to the door and window industry".

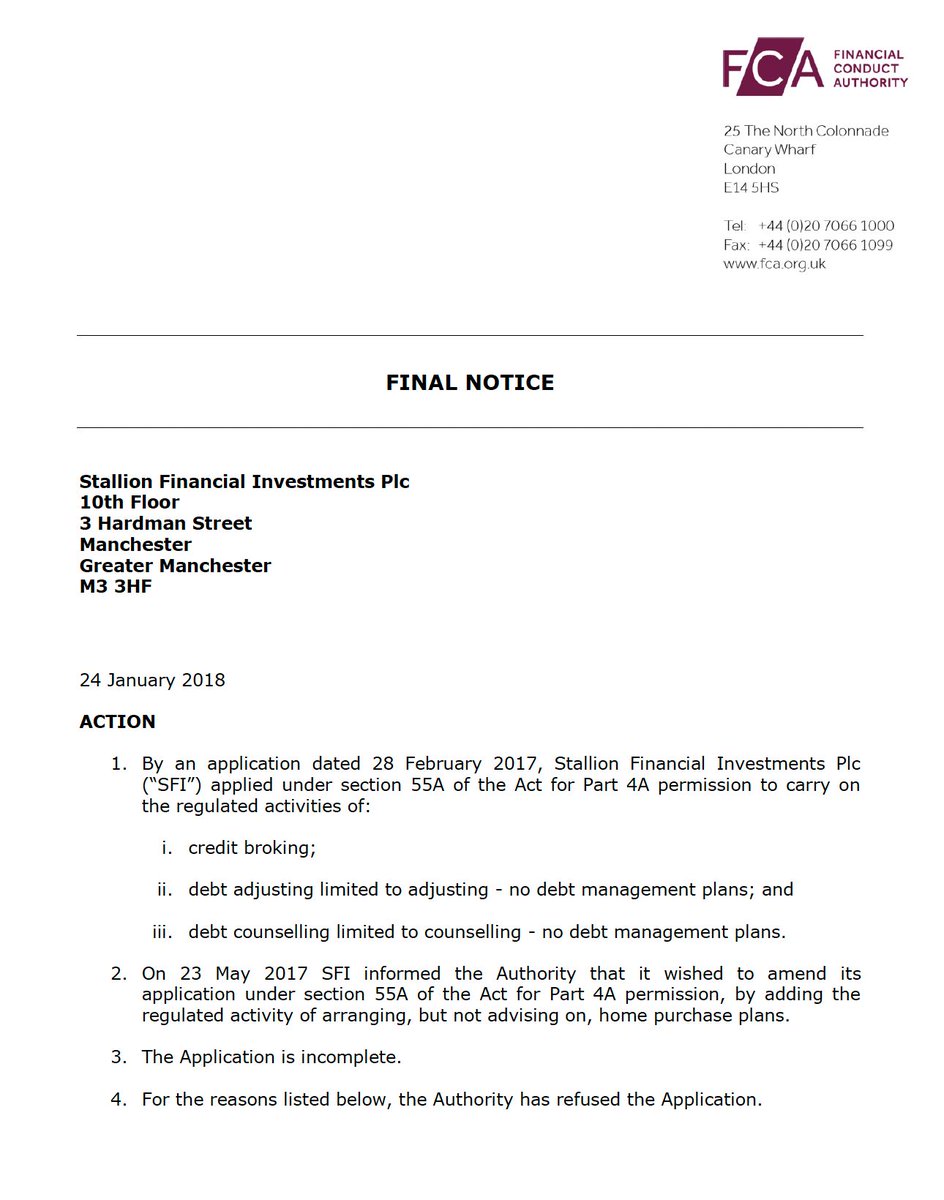

The audit certificate is a forgery. I've spoken to the audit firm and individual auditor named in these accounts and I'm convinced they have nothing to do with this. They don't even know each other.

We called their phone number; it gives the option of "sales" or "customer services", but both just go through to a maillbox.

The first draft of our report said we didn't know if these companies were created for fraud or as the product of someone's fantasy...

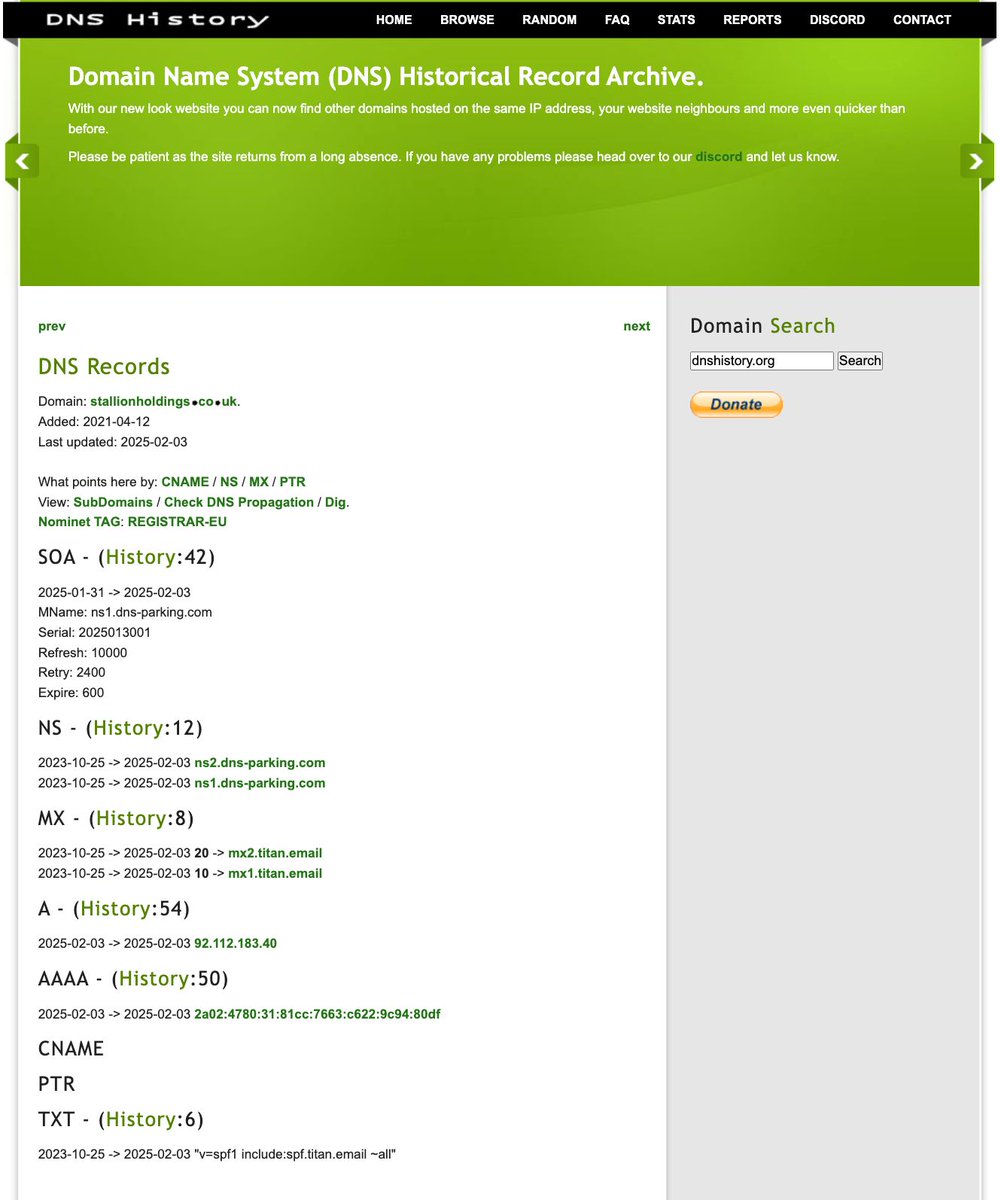

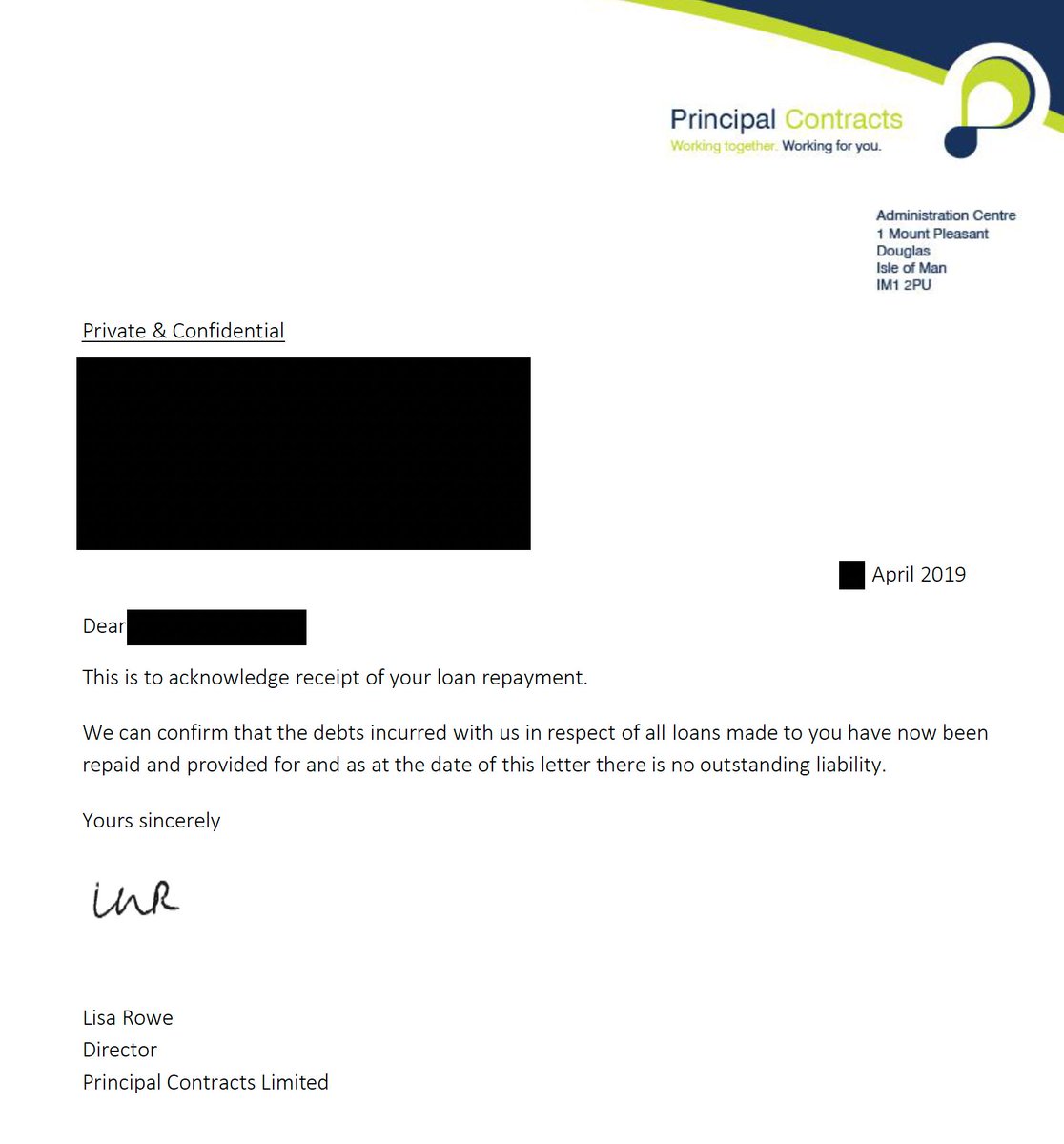

However the additional information we've received (the bank website, VAT registration, and the attempt to win business for Avantulo SA Ltd) makes reasonably clear this is a fraud.

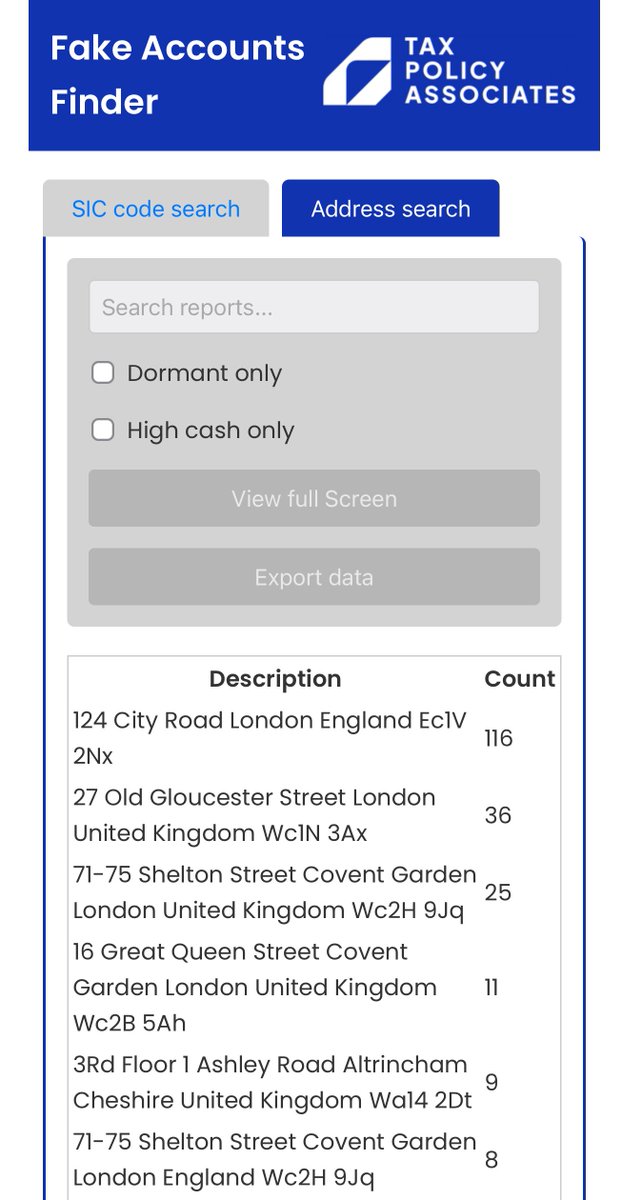

Our report on fake banks is here, including simple steps Companies House could take to end the fraudulent use of UK companies with fake accounts. taxpolicy.org.uk/2025/02/01/fin…

And a report from @MarpleLeaf at The Business Desk here: thebusinessdesk.com/northwest/news…

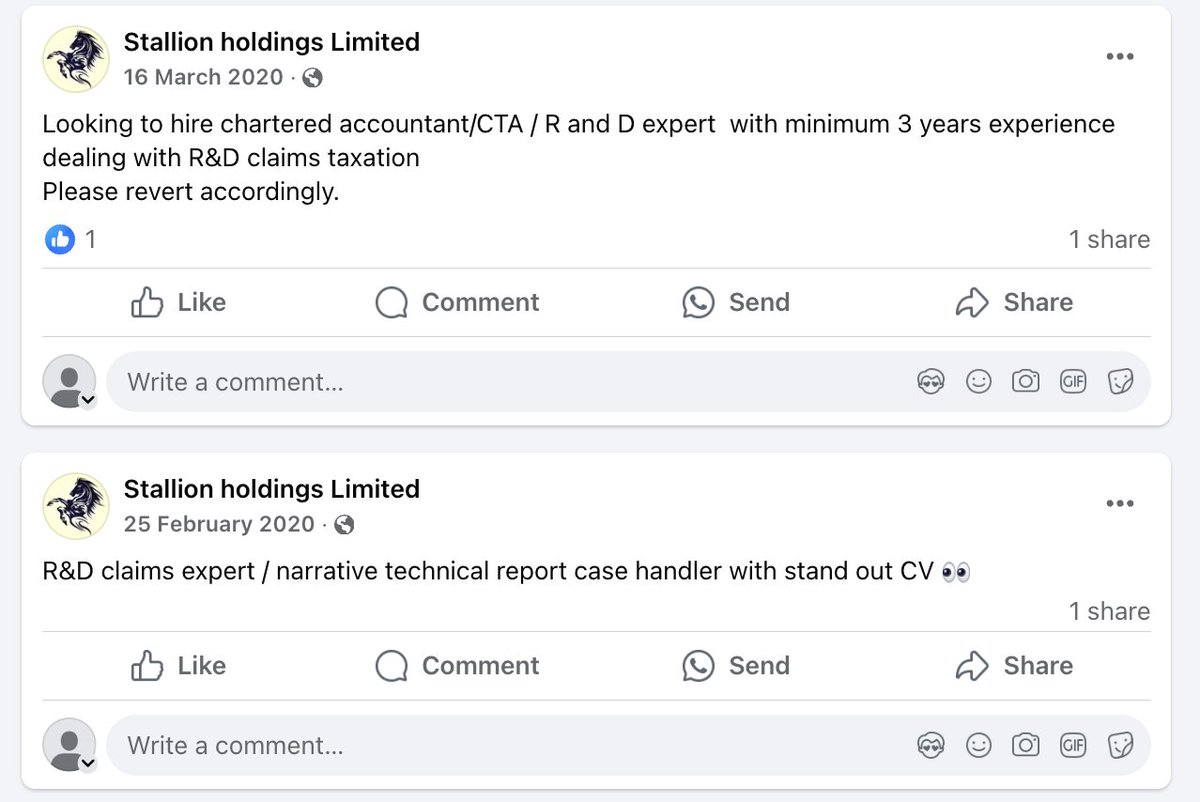

Just to add: the Stallion Facebook pages suggests the fraud is aimed at Muslims: facebook.com/stallionholidi…

• • •

Missing some Tweet in this thread? You can try to

force a refresh