Our new report: the world's most convincing fake company - and how it tried to seize a gold mine in Ukraine

That leads to 60 fake companies, £300bn of fake gold & even a fake country. With backing from the Duke & Duchess of Cambridge, Nadhim Zahawi and Baroness Mone. All fake.

That leads to 60 fake companies, £300bn of fake gold & even a fake country. With backing from the Duke & Duchess of Cambridge, Nadhim Zahawi and Baroness Mone. All fake.

This will be a long thread. But if you want something more convenient, longer, or you just love footnotes, our full report is here: taxpolicy.org.uk/2025/02/08/who…

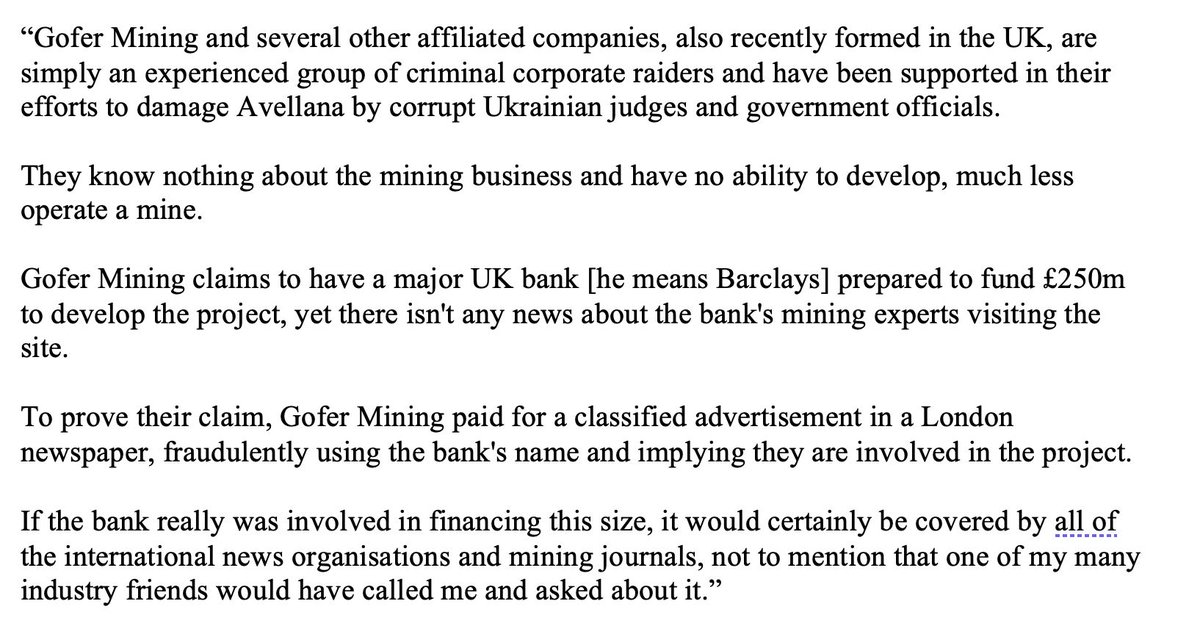

This is Brian Savage, CEO of the very real mining company Avellana Gold. He's furious, because a company he's never heard of called Gofer Mining plc is trying to steal a gold mine in Ukraine

Here's Gofer Mining plc's 2019 annual report. 128 pages.

It's really convincing. Lots of small oddities, but it really looks like a mining company's annual report and accounts. Their website convincing too.

taxpolicy.org.uk/wp-content/ass…

It's really convincing. Lots of small oddities, but it really looks like a mining company's annual report and accounts. Their website convincing too.

taxpolicy.org.uk/wp-content/ass…

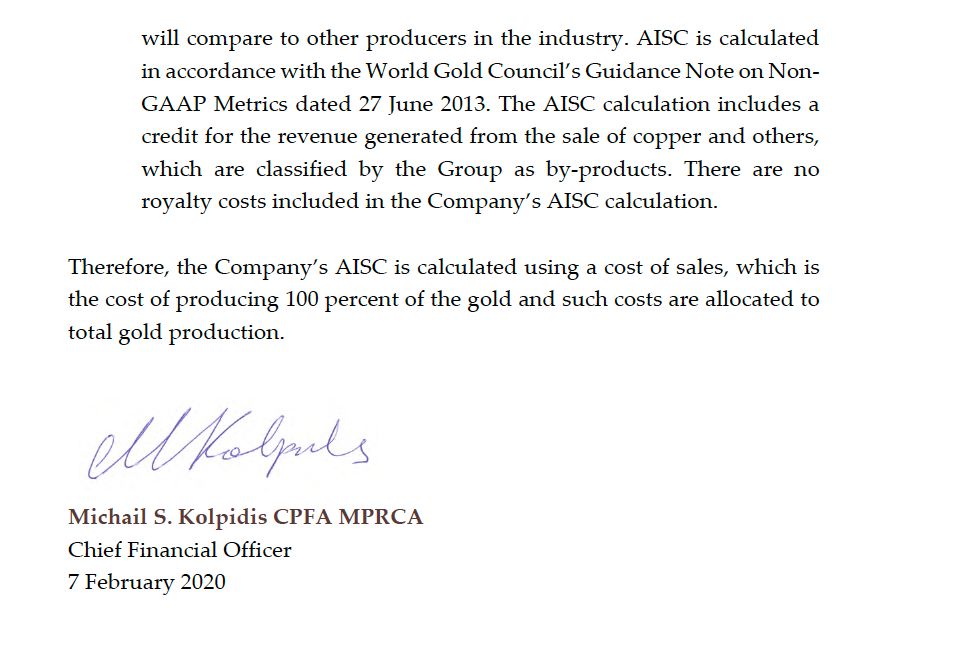

We had lots of experts look at the report, and they all have little niggles. But there weren't obvious red flags. Although nobody had heard of the company, its CEO Sergey Kolpidi or its CFO Michail Kolpidis.

Except...

Except...

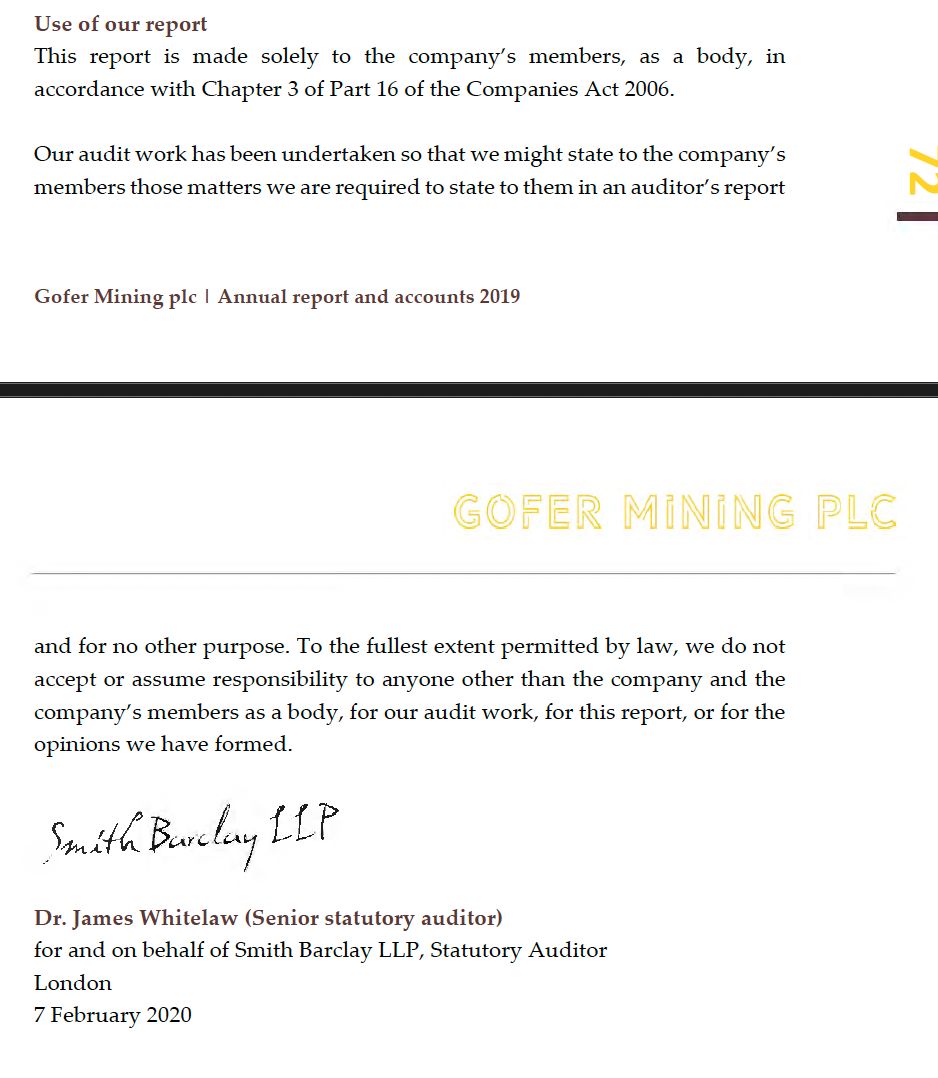

The accounts were audited by Dr James Whitelaw, of Smith Barclay LLP.

If you haven't heard of them, it's probably because they never had an audit licence. Neither did Whitelaw - if he even existed at all.

If you haven't heard of them, it's probably because they never had an audit licence. Neither did Whitelaw - if he even existed at all.

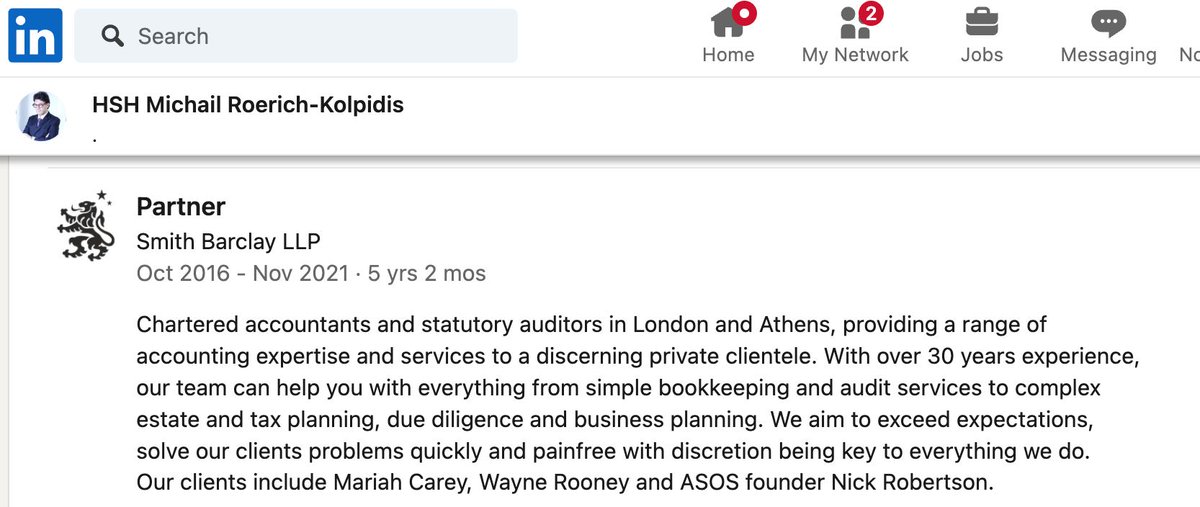

But on LinkedIn, right now, you can still see a former partner of Smith Barclay LLP bragging about his client list - including Mariah Carey.

The partner is Michail Roerich/Kolpidis. Also the CFO of Gofer Mining plc.

The CFO created a fake audit firm to audit his own company.

The partner is Michail Roerich/Kolpidis. Also the CFO of Gofer Mining plc.

The CFO created a fake audit firm to audit his own company.

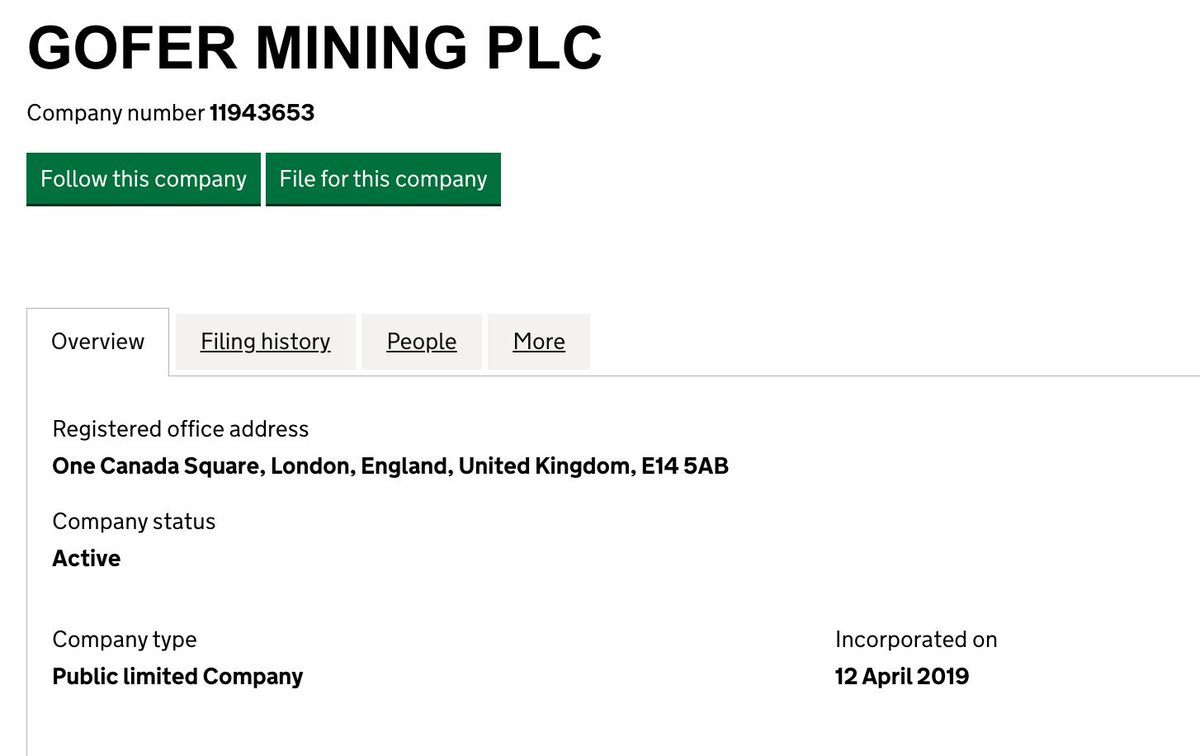

And there is almost no evidence that Gofer Mining plc existed at all, outside its Companies House filings.

No sign of their thousands of employees. No sign of their Canary Wharf HQ.

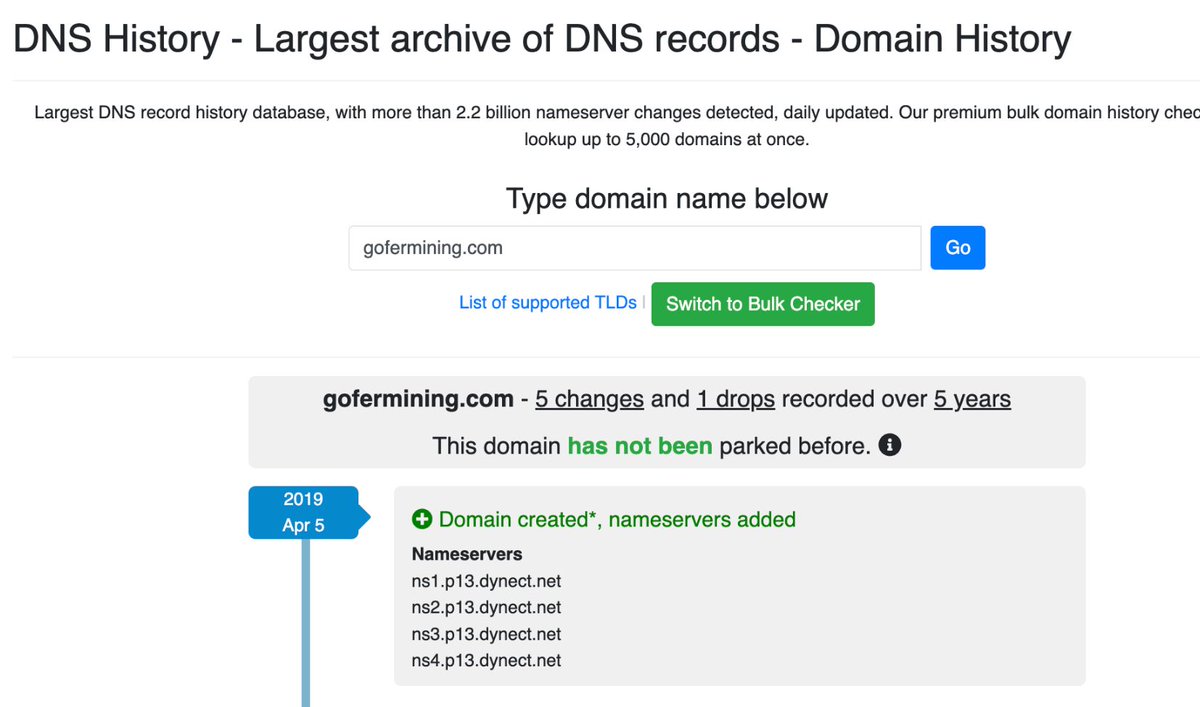

And those 2019 accounts? The company and website were only created in April 2019.

No sign of their thousands of employees. No sign of their Canary Wharf HQ.

And those 2019 accounts? The company and website were only created in April 2019.

Someone went to a great deal of effort to create the Gofer Mining plc report and accounts - they're easily the most impressive fake accounts we've seen.

We do not know who was responsible, but we can say two things for sure.

We do not know who was responsible, but we can say two things for sure.

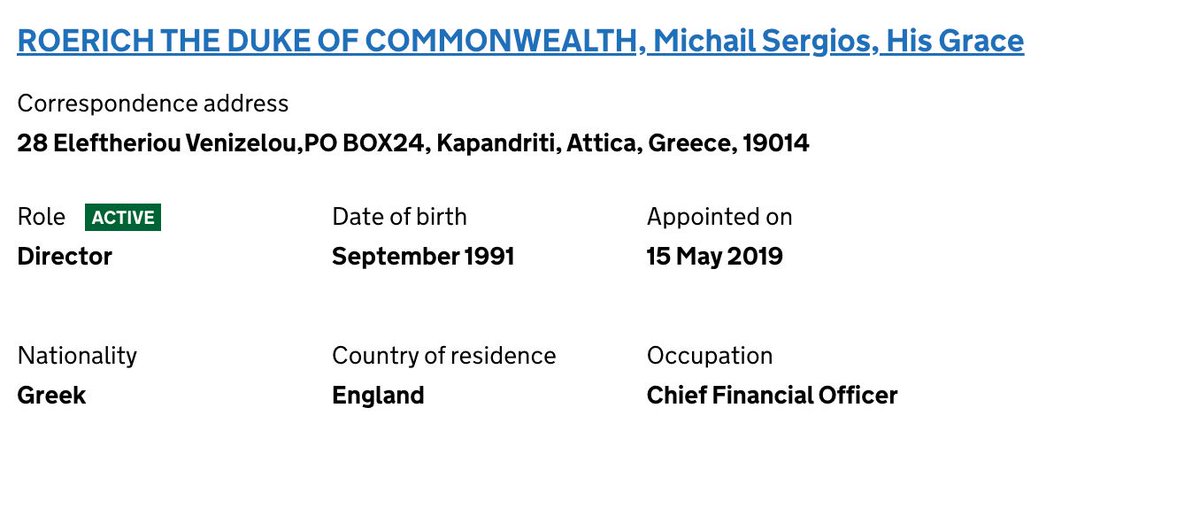

First: Michail Roerich is real - although he goes by several names. He's the central figure in our report.

Second: whilst Gofer Mining plc didn't exist in any real sense, that didn't prevent it from trying to control a very real Ukrainian gold mine.

Second: whilst Gofer Mining plc didn't exist in any real sense, that didn't prevent it from trying to control a very real Ukrainian gold mine.

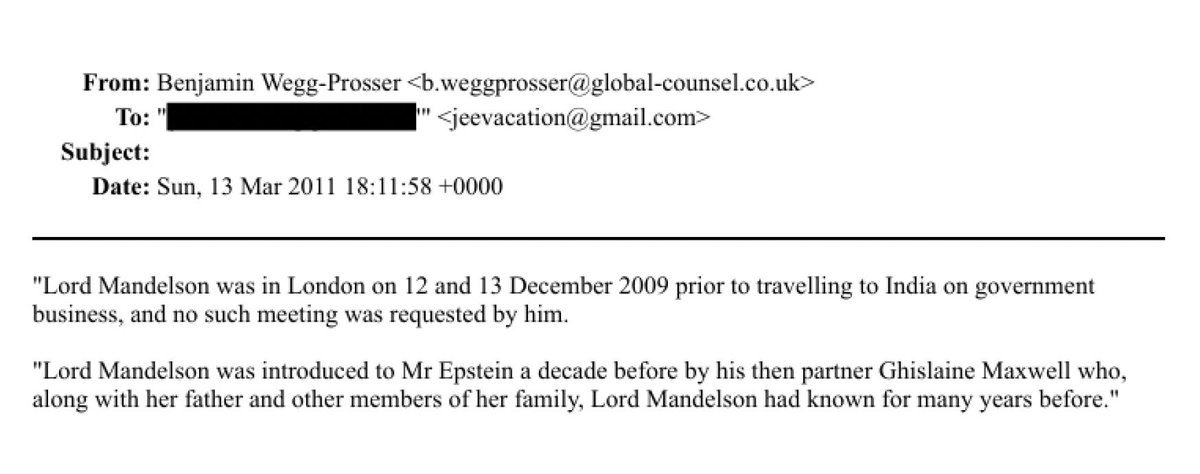

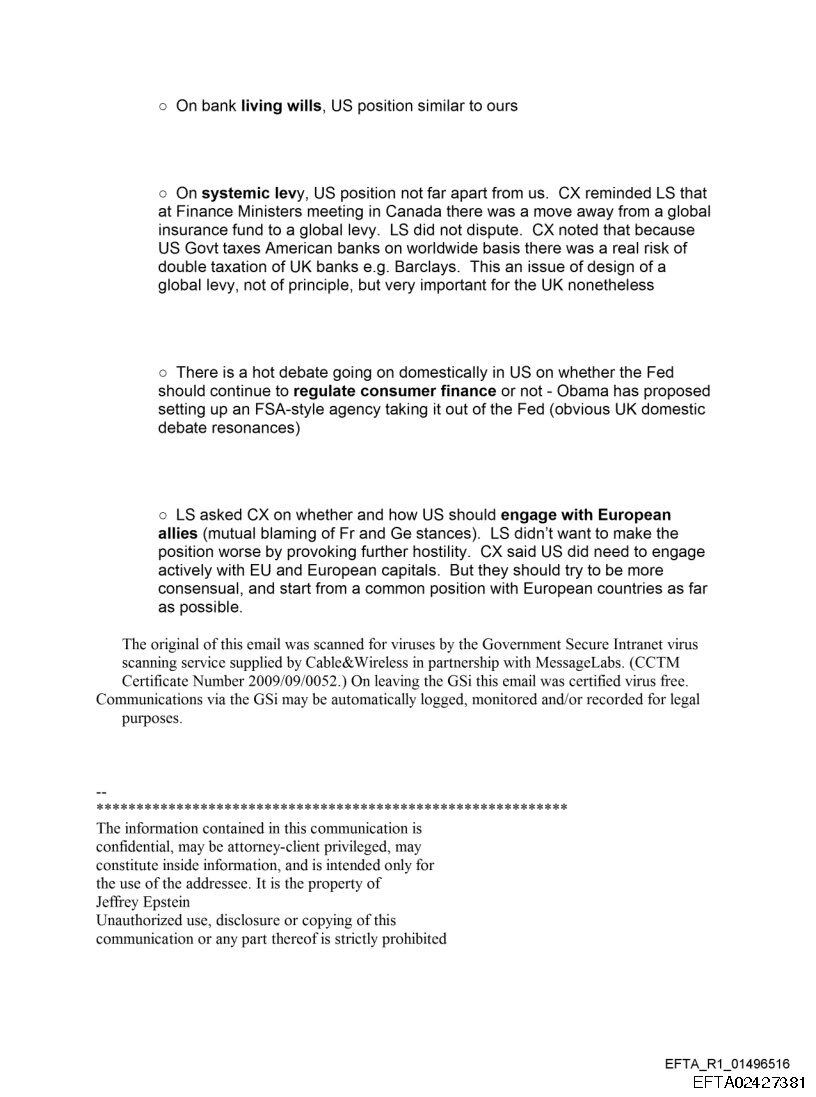

On 16 April 2019, a small advertisement was placed in The Times' "business to business" classified section. It claimed that Gofer Mining plc had been established by "Barclays PLC and its affiliated companies":

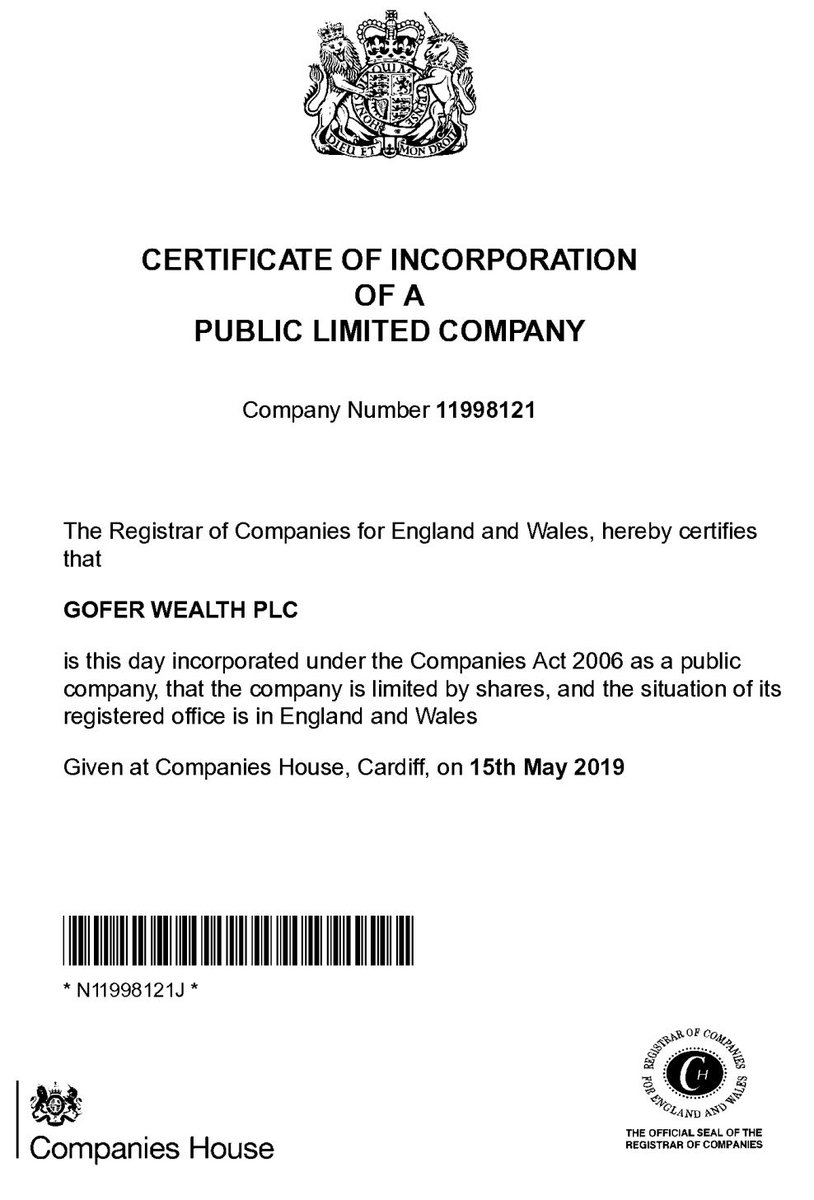

And, sure enough, Companies House records showed that Gofer Mining's parent, Gofer Wealth plc, was indeed owned by Barclays plc.

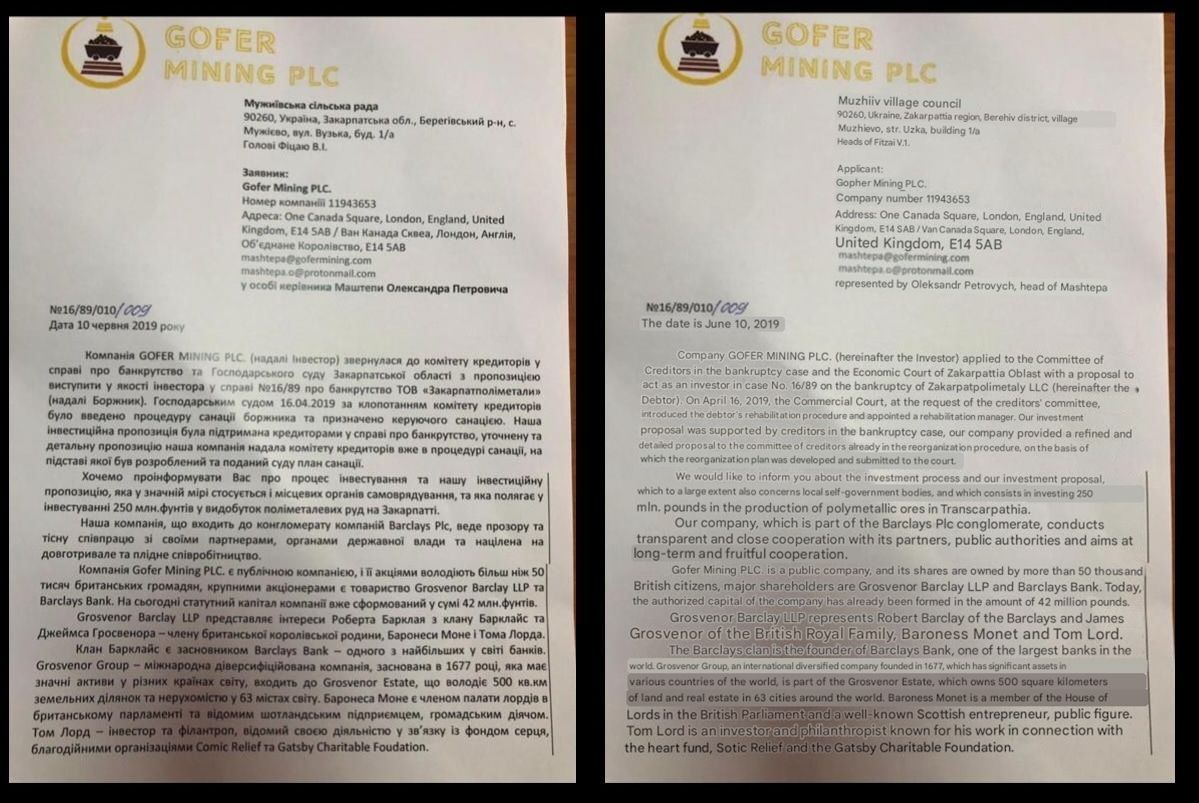

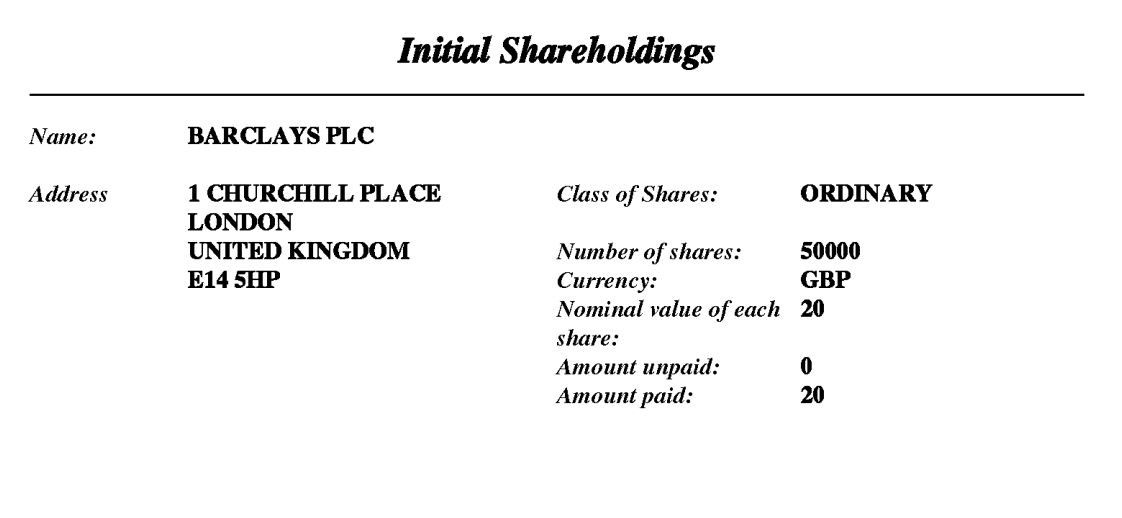

Two months later, this letter was sent by Gofer to a village council near a Ukrainian gold mine:

(with verified Google Translate to the right)

(with verified Google Translate to the right)

The letter says Gofer Mining is owned by more than 50,000 British citizens, plus Barclays Bank, the Grosvenor Estate and Baroness Mone.

All lies. But Gofer Mining plc obtained a court judgment, blocking the sale of the mine to Avellana.

All lies. But Gofer Mining plc obtained a court judgment, blocking the sale of the mine to Avellana.

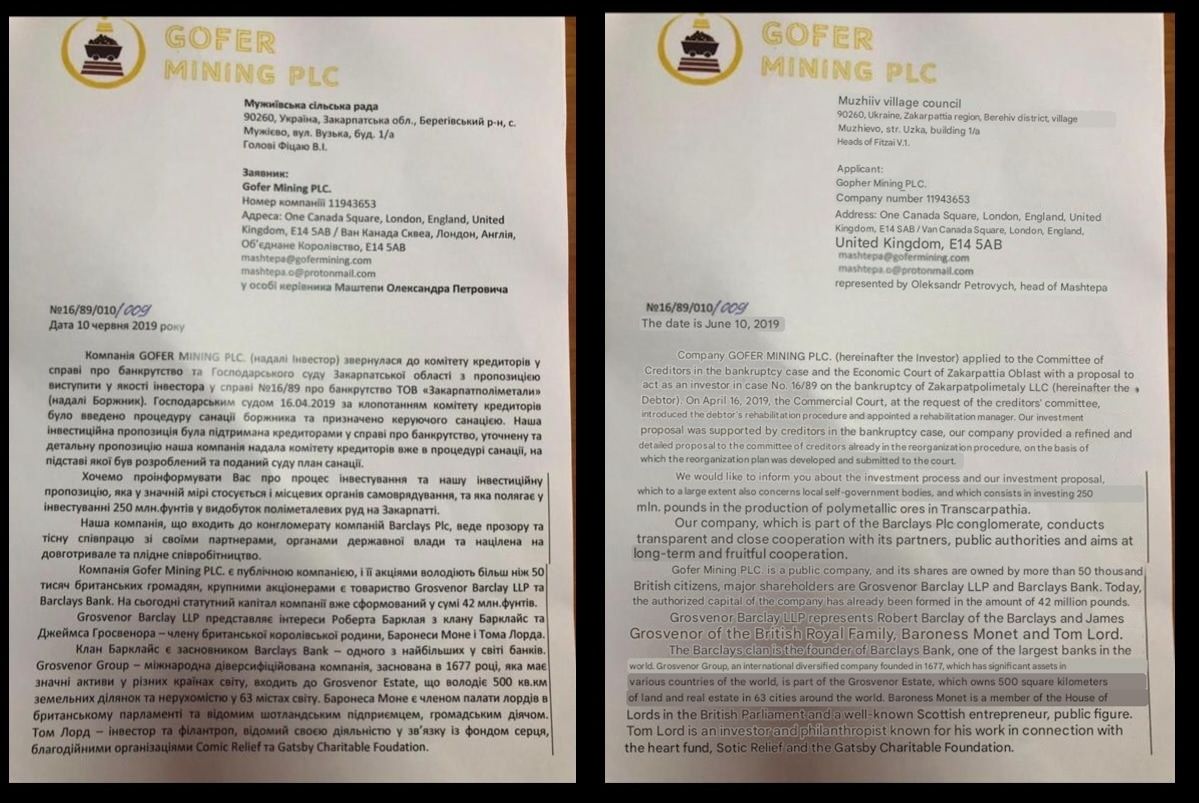

Avellana appealed, and the case went all the way to the Ukraine Supreme Court. Where Avellana won - the fictitious nature of Gofer was confirmed.

(see ) unian.ua/politics/10897…

(see ) unian.ua/politics/10897…

During the court battle, the British Ukraine Chamber of Commerce wrote to Companies House, begging them to do something.

They did nothing at all.

They did nothing at all.

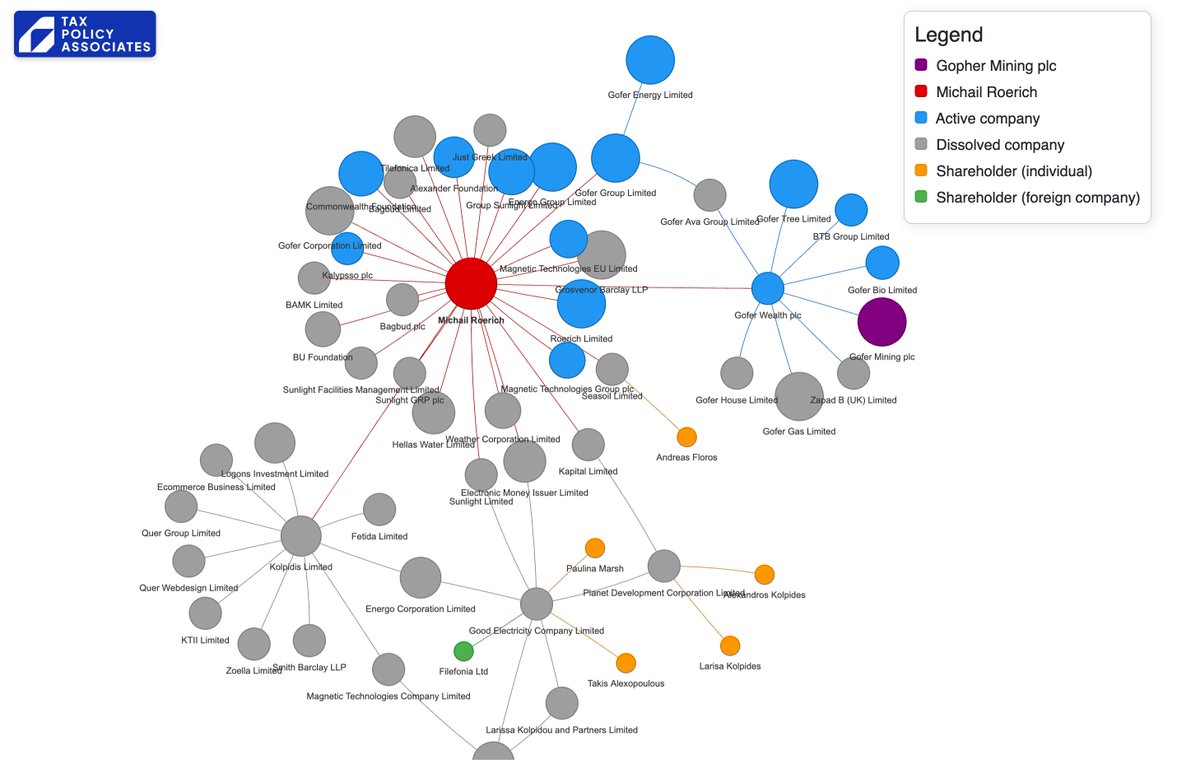

But that's not the end of the story. It's the start. Things get really weird once we start tracing through other Gofer companies.

We've an interactive diagram of the group here: taxpolicy.org.uk/wp-content/ass…

We've an interactive diagram of the group here: taxpolicy.org.uk/wp-content/ass…

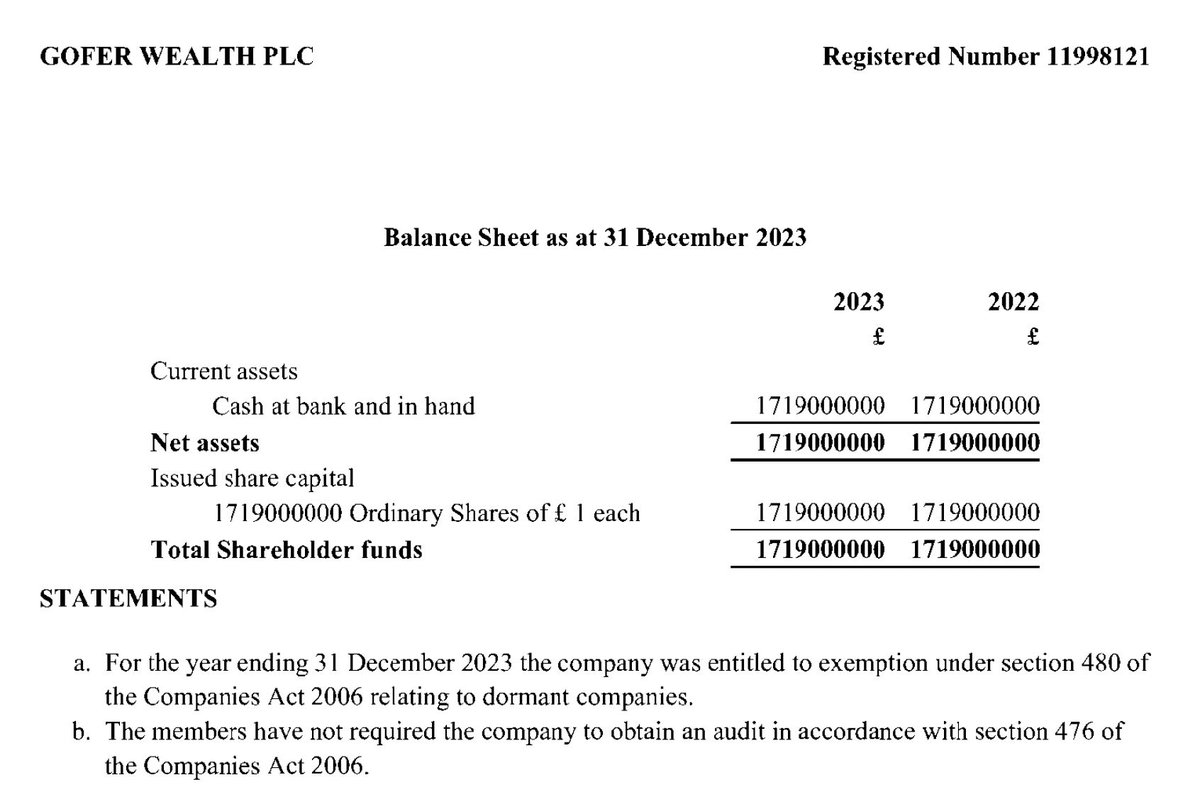

There's Gofer Wealth plc, the holding company.

Says it's listed - it isn't.

Says it's had £1.7bn of cash for five years straight (with not even £1 of interest). And is also a dormant small company. Jimmy Hill.

Says it's listed - it isn't.

Says it's had £1.7bn of cash for five years straight (with not even £1 of interest). And is also a dormant small company. Jimmy Hill.

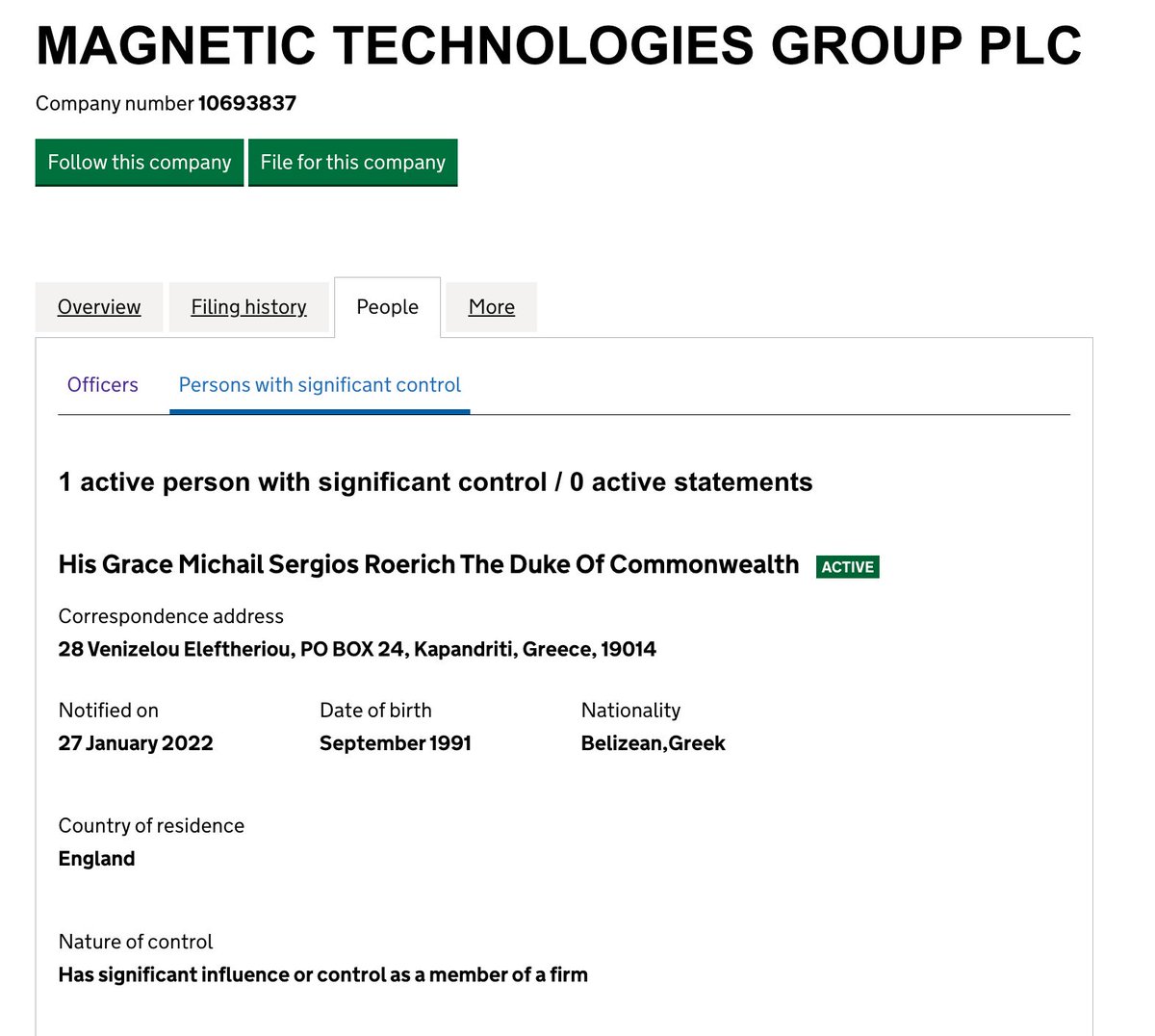

On the board of Gofer Wealth plc we again see Michail Roerich - but now he's calling himself "Michail Sergios Roerich, His Grace the Duke of Commonwealth"

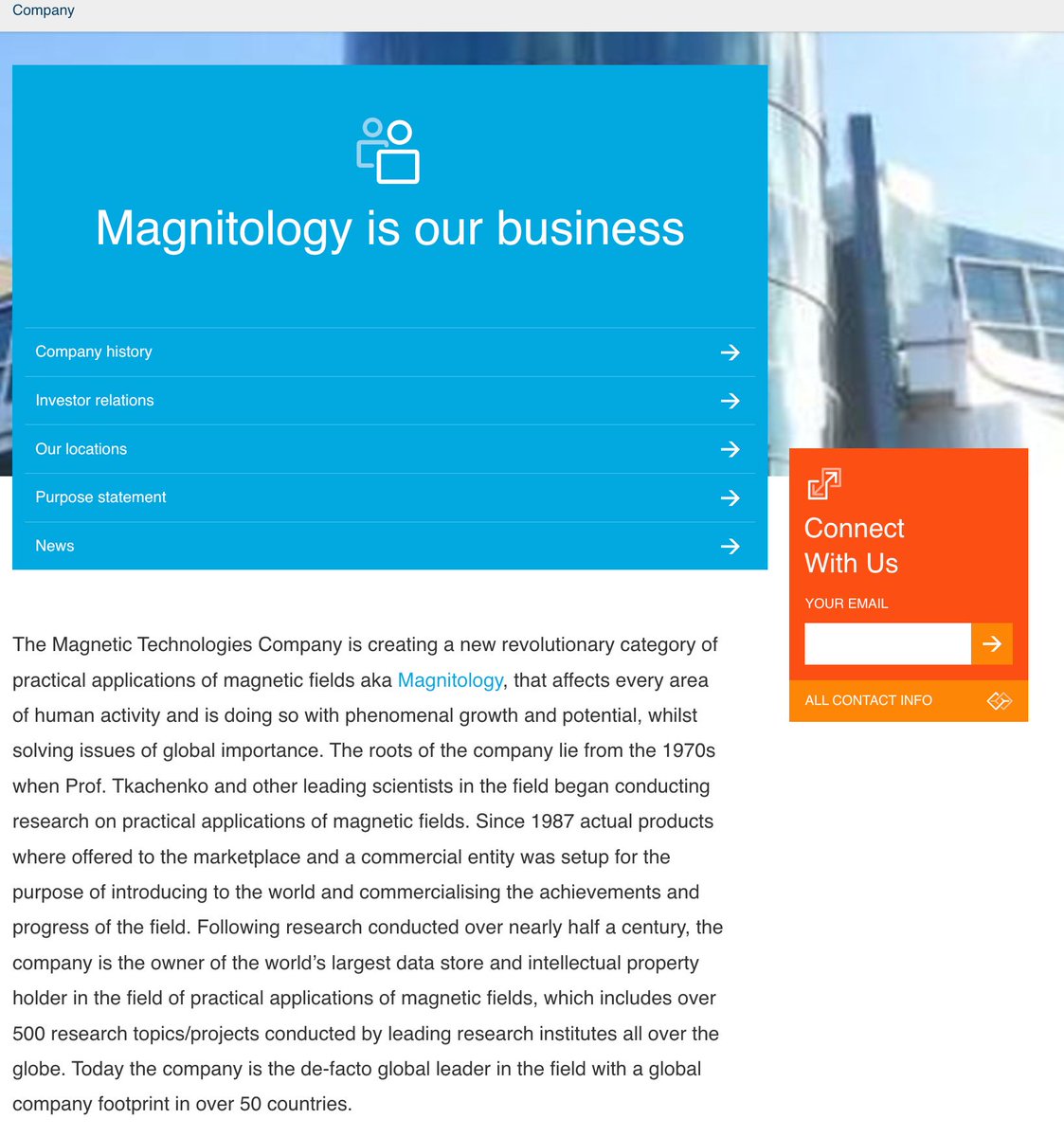

Or what about Magnetic Technologies Group plc? Global leader in the field of "magnitology", it's active in 50 countries, its shares are AIM listed, the auditor is Grant Thornton, and its European headquarters are in Slough.

Doesn't exist. And again, controlled by Roerich.

Doesn't exist. And again, controlled by Roerich.

There are so many related companies that listing them here would take up pages and pages.

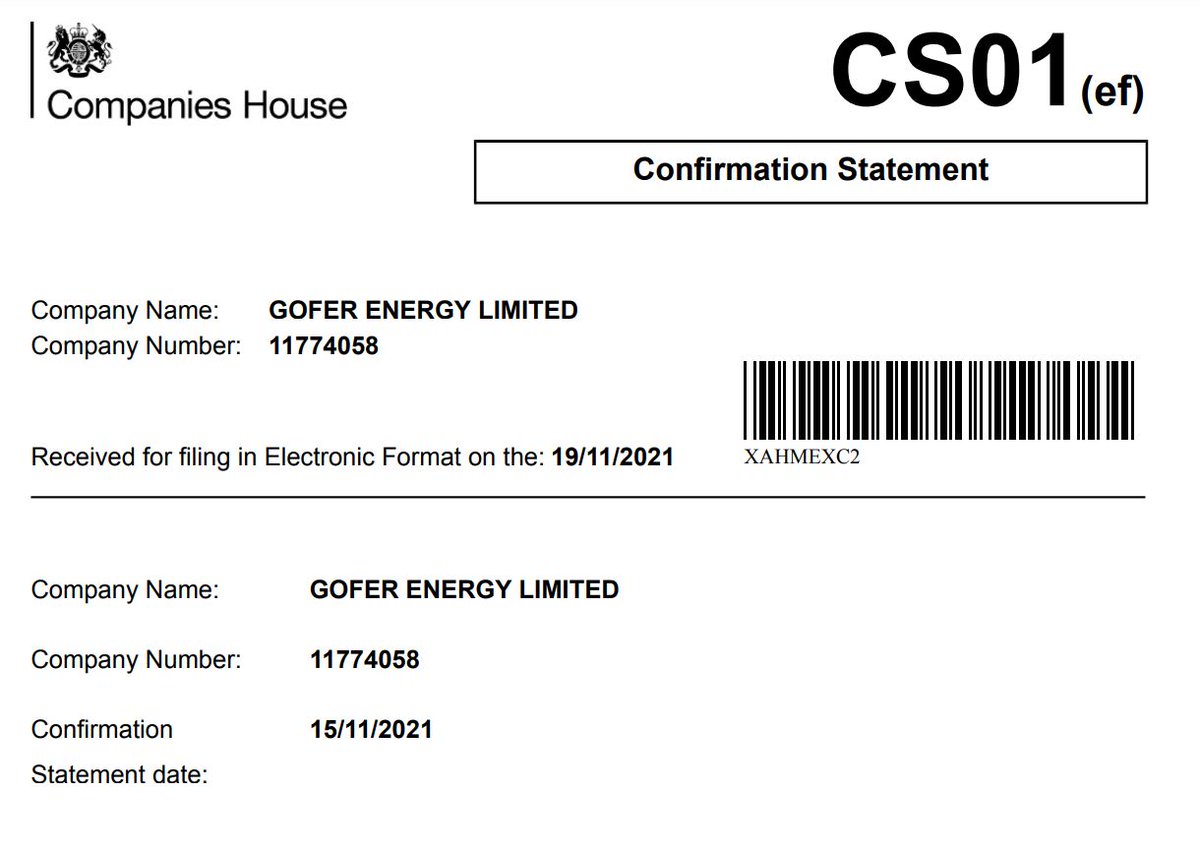

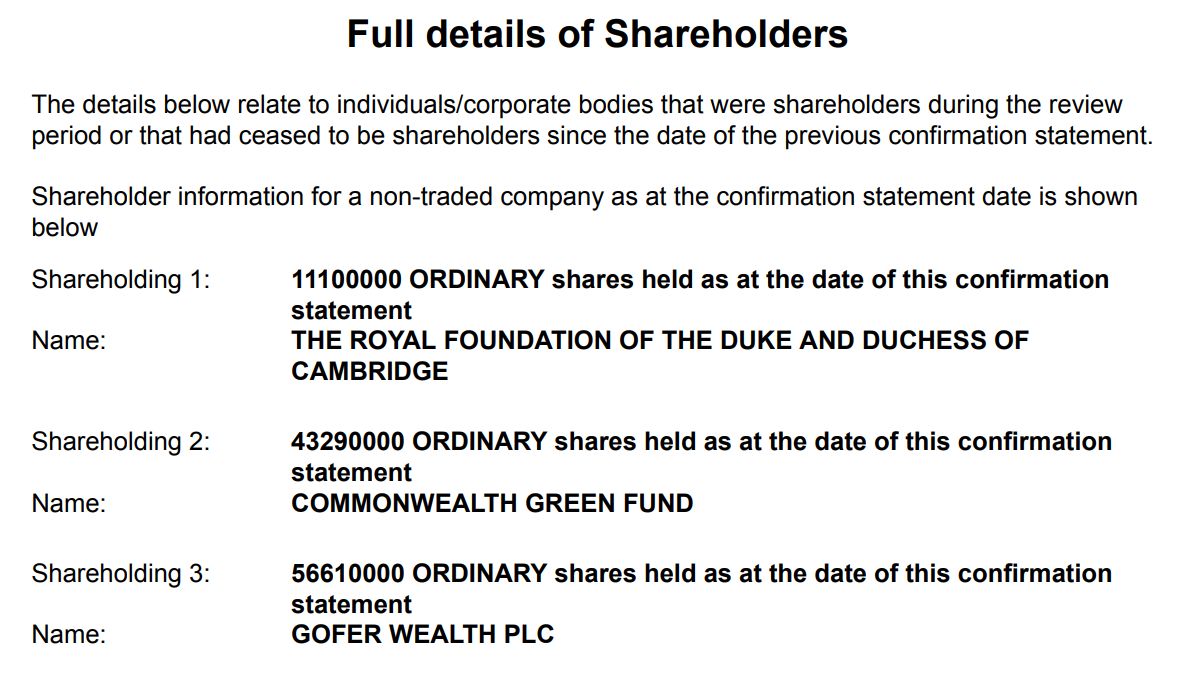

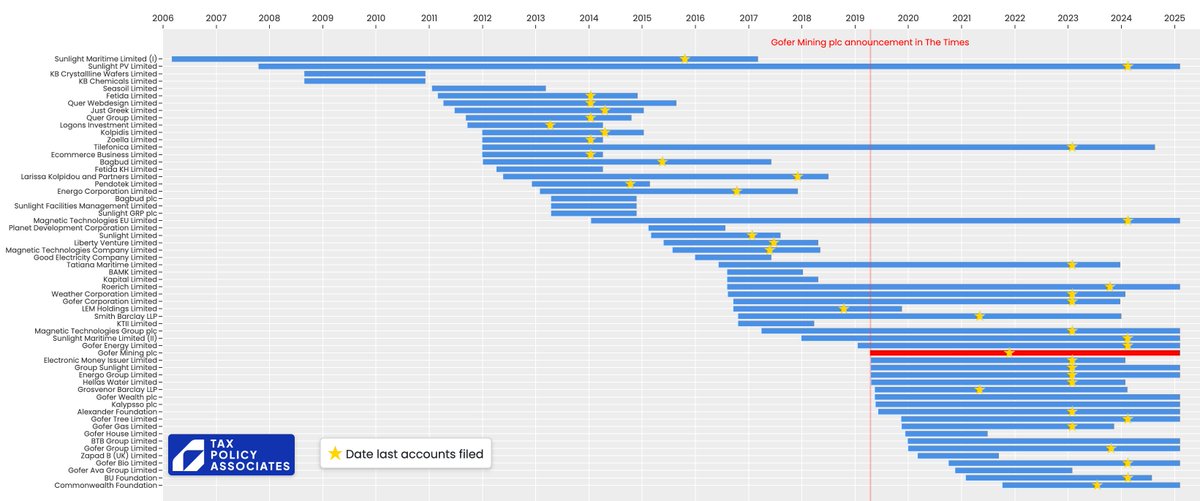

Perhaps the highlight is Gofer Energy Ltd, which was claimed to be part-owned by Barclays Bank plc, and part by the Royal Foundation of the Duke and Duchess of Cambridge.

Perhaps the highlight is Gofer Energy Ltd, which was claimed to be part-owned by Barclays Bank plc, and part by the Royal Foundation of the Duke and Duchess of Cambridge.

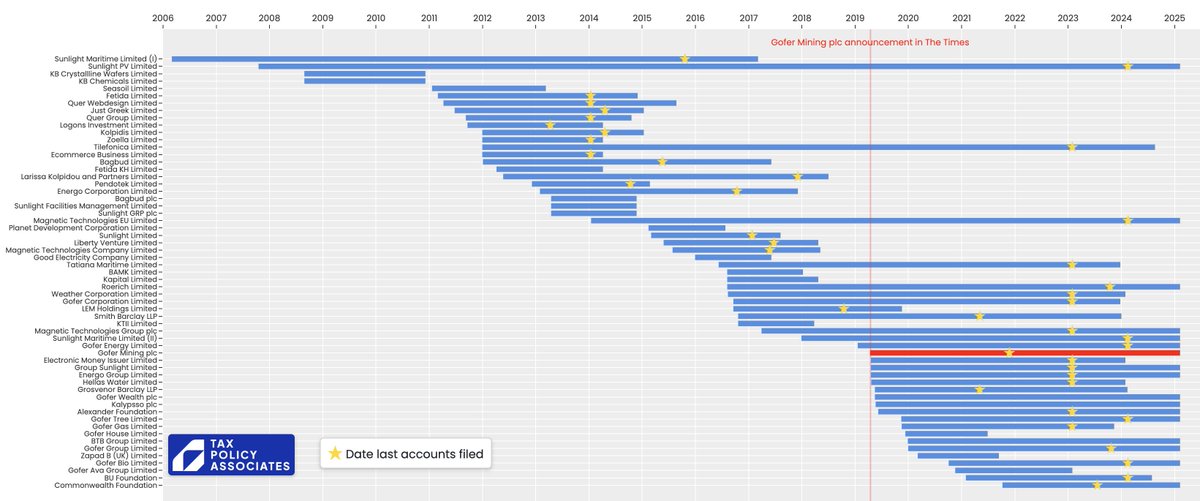

Here's how the group was created over time. Can't be the sole creation of Michail Roerich, given he was only 14 or 15 when the first company, Sunlight Maritime Limited (I), was formed.

(interactive chart: ) taxpolicy.org.uk/wp-content/ass…

(interactive chart: ) taxpolicy.org.uk/wp-content/ass…

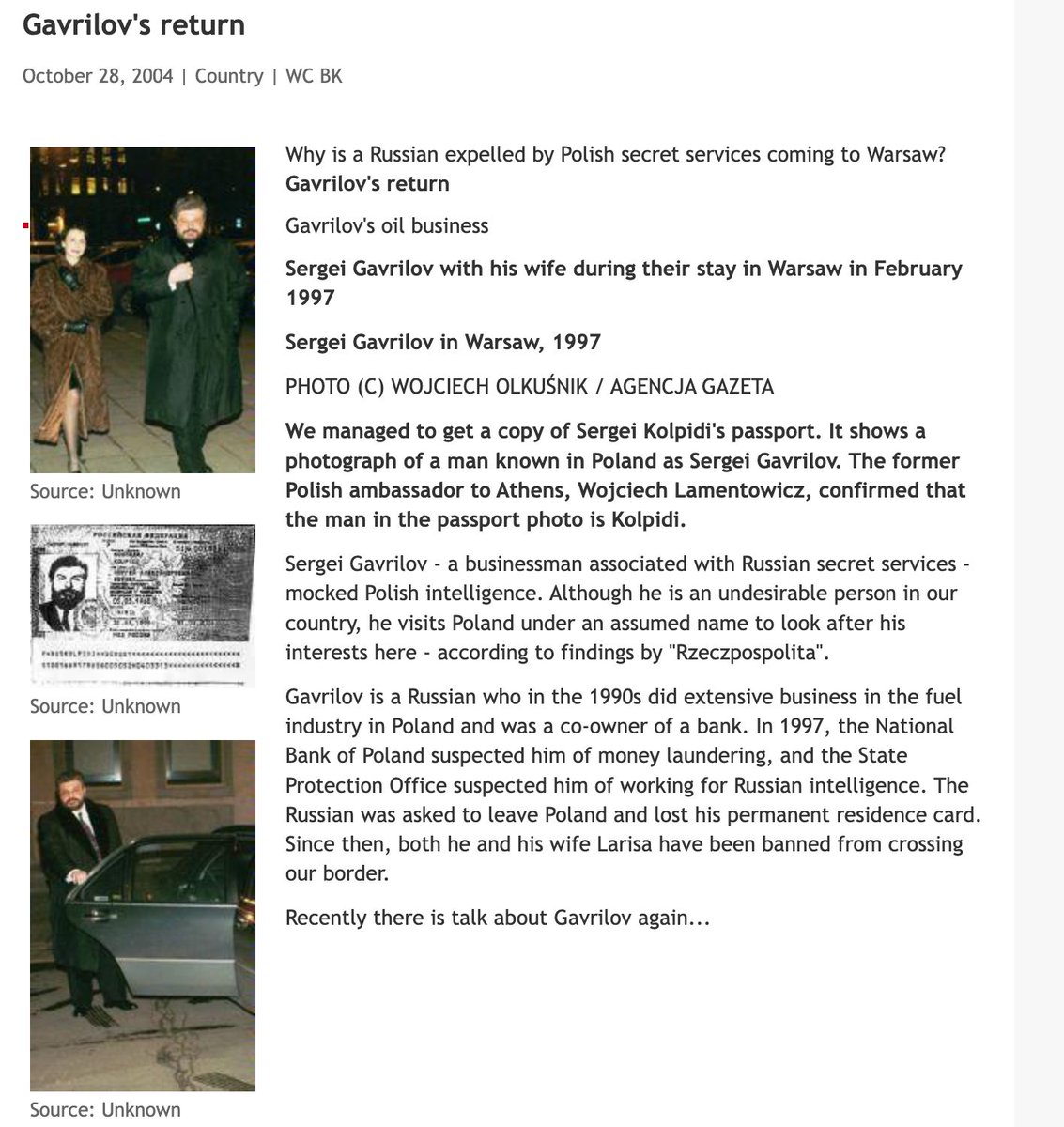

So who else was involved? Sergey Kolpidi is listed as a director of nine of the companies; Larisa Kolpidou as a director or secretary of no fewer than thirteen. We believe that Sergey and Larisa are Michail Roerich’s parents. And Sergey's background:

That chart suggests to me three bursts of activity: 2012, 2016 and 2019. We know the gold mine was 2019. What happened in the other two years?

We haven't been able to find out.

We haven't been able to find out.

But things now get more weird.

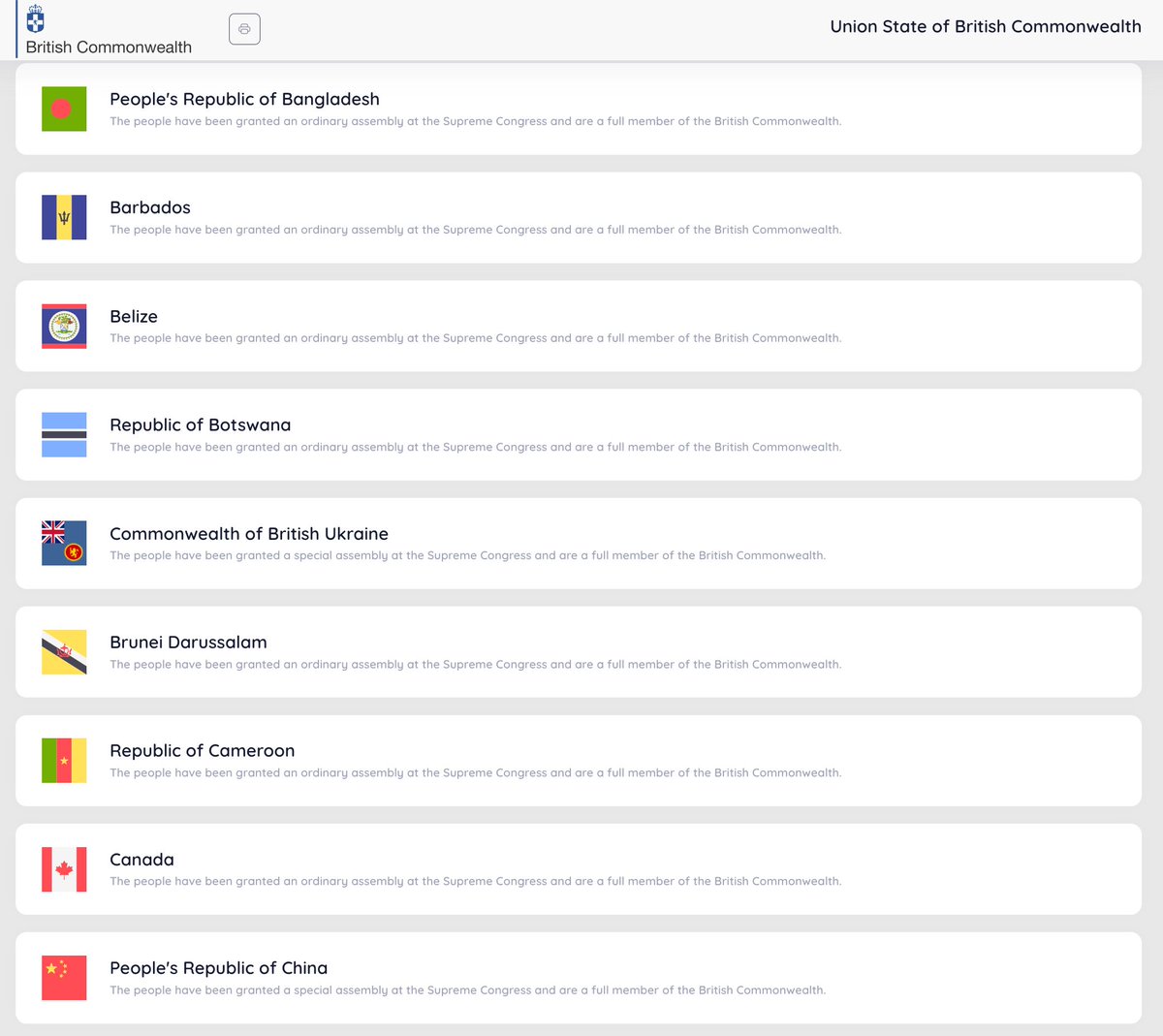

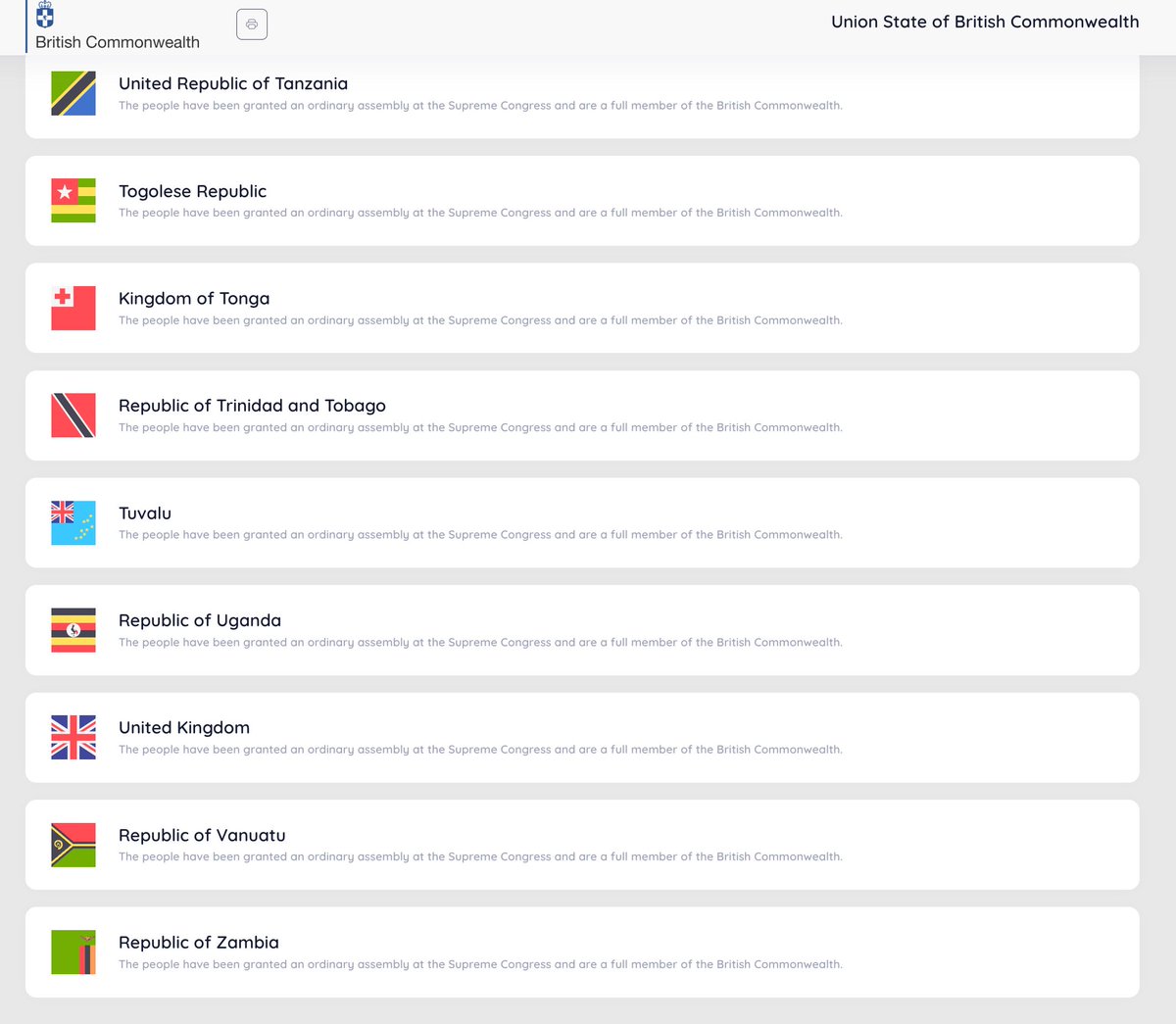

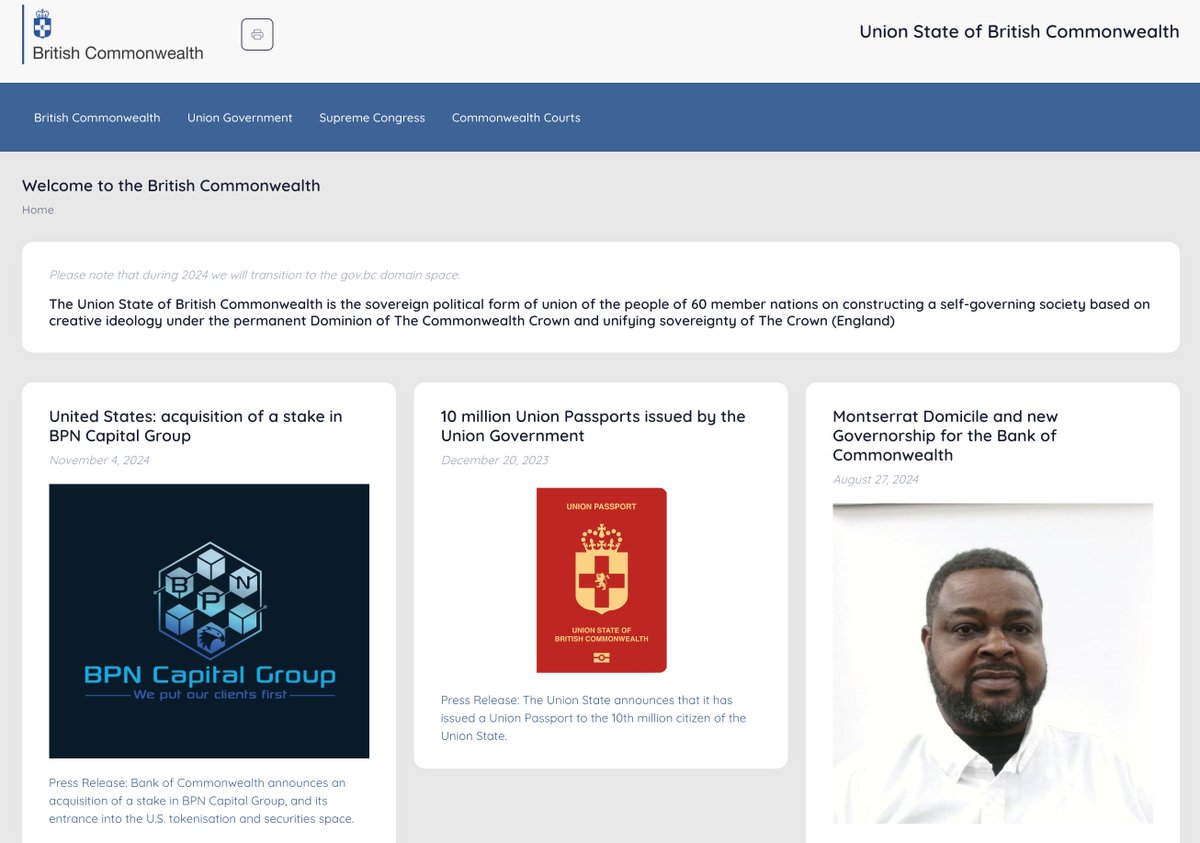

Mr Roerich has founded the Union State of British Commonwealth - the "sovereign political form of union and alliance of the people of 60 member nations".

Mr Roerich has founded the Union State of British Commonwealth - the "sovereign political form of union and alliance of the people of 60 member nations".

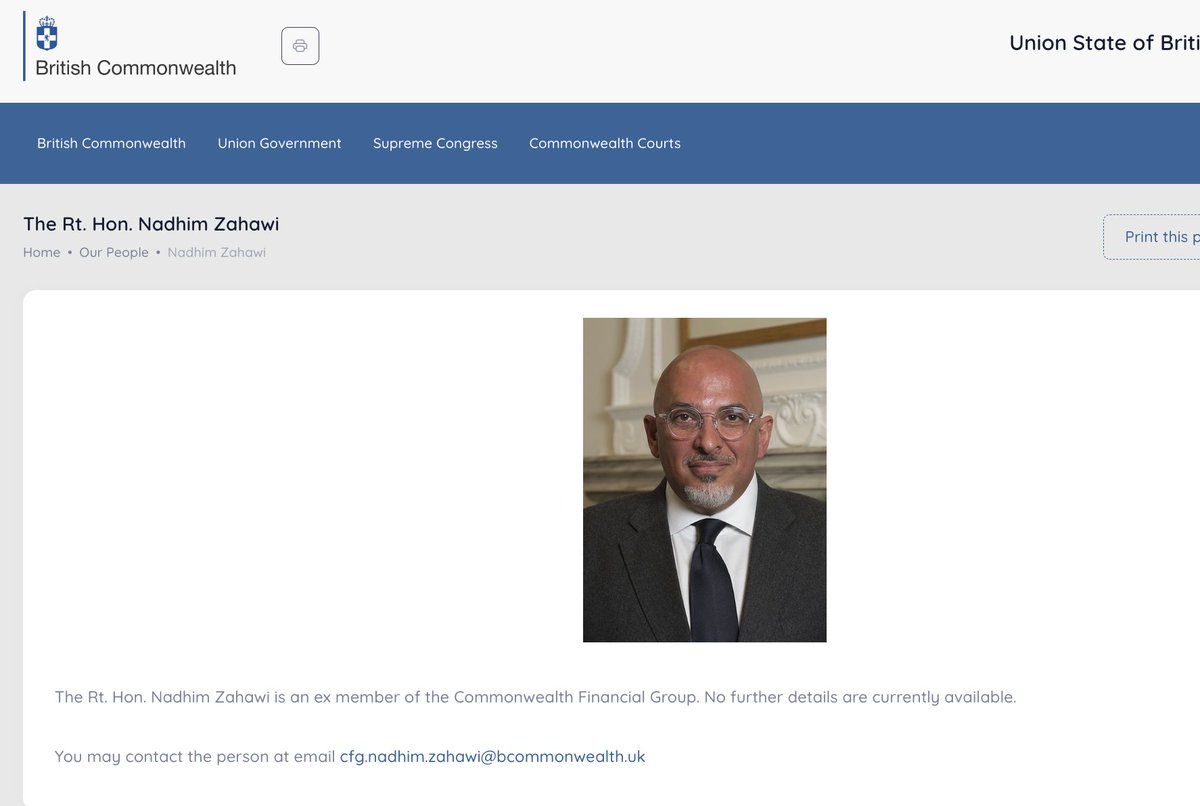

It is supported by a variety of luminaries, including Nadhim Zahawi, a former member of its Financial Group.

Obviously - no country recognises the Union State of British Commonwealth or (so far as we can tell) is even aware of it. Mr Zahawi has no involvement and had never heard of the Union State; likely the same is true for the other named individuals.

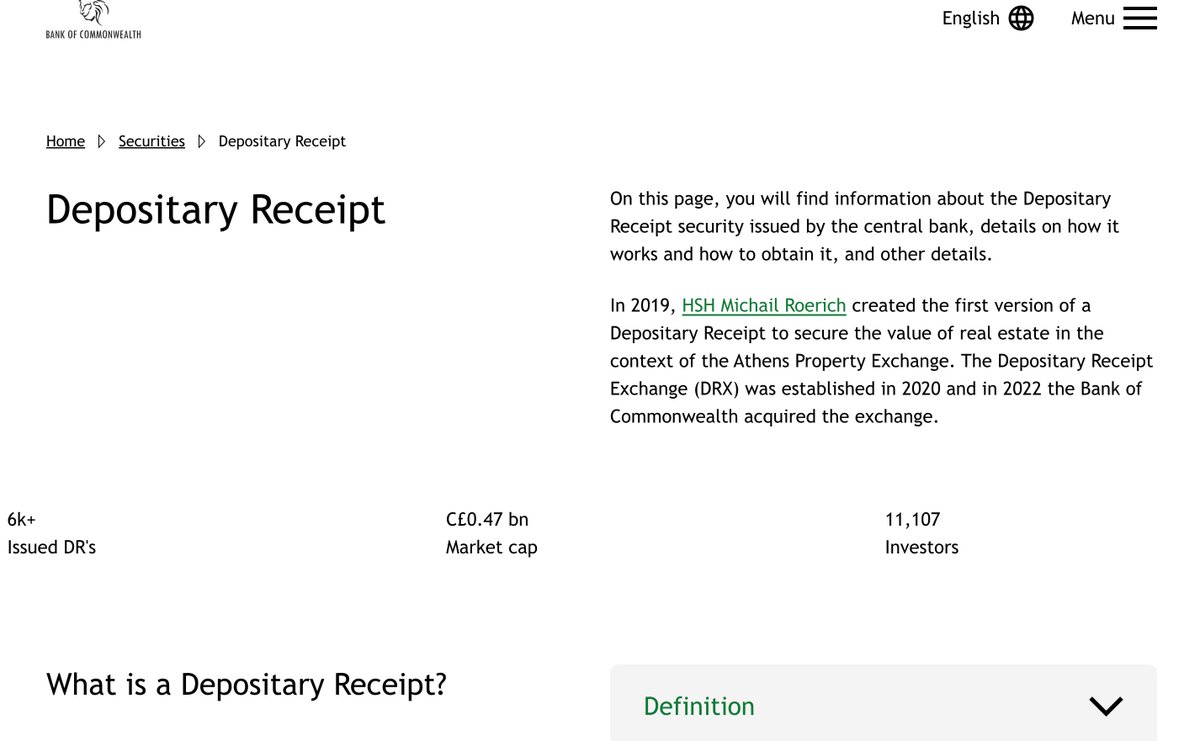

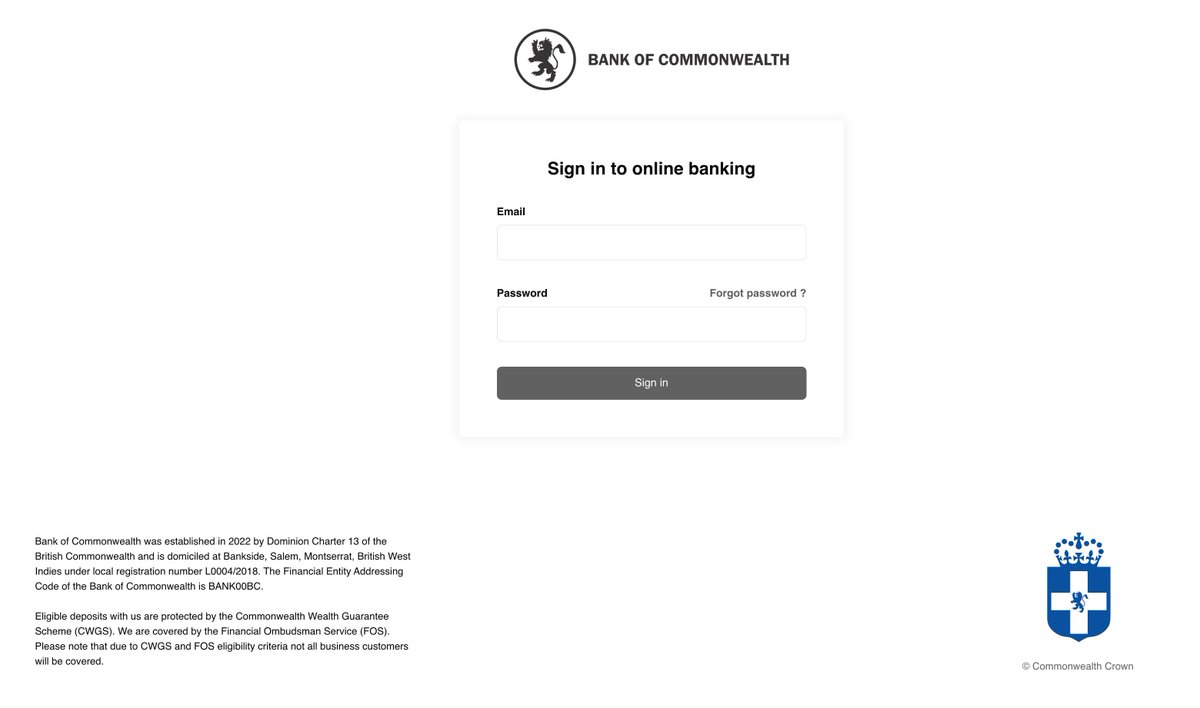

The Union State has a central bank - The Bank of Commonwealth, which claims it is based in Montserrat.

The Montserrat authorities say there is no such bank in Montserrat.

The Montserrat authorities say there is no such bank in Montserrat.

The Bank of Commonwealth has a client login page, but it is a fake - a successful login (if one is even possible) just prints the word "success".

(tech nerds: our report includes an analysis of the javascript)

(tech nerds: our report includes an analysis of the javascript)

Roerich makes a variety of eccentric claims linked to the Union State, including:

- He controls a trust holding gold bullion that was owned by the Russian Imperial Romanov family in 1916, of which he's given £320bn worth away.

- He controls a trust holding gold bullion that was owned by the Russian Imperial Romanov family in 1916, of which he's given £320bn worth away.

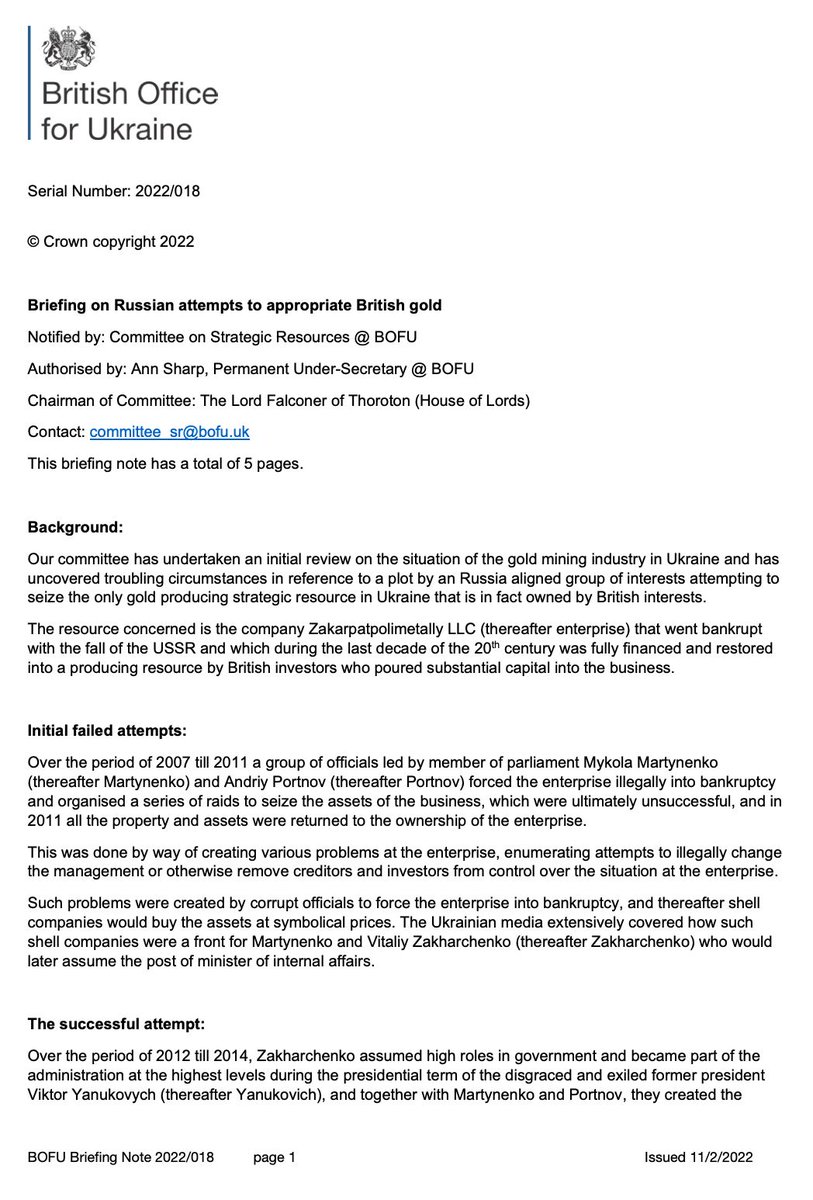

- He is involved with a "British Office for Ukraine", an "independent non-ministerial" department of the British Government. It has a press secretary and a permanent under-secretary for development, publishing stuff like this:

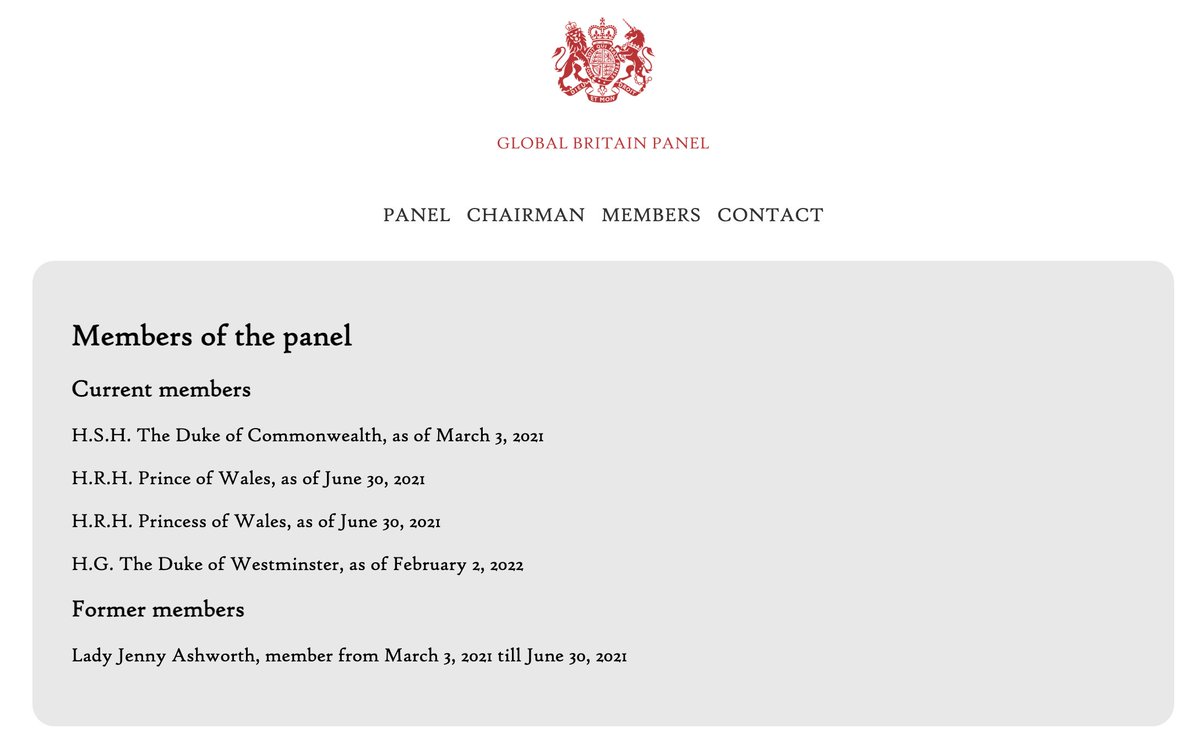

- He chairs the "Global Britain Panel" which included (in 2021) the Prince and Princess of Wales and the Duke of Westminster.

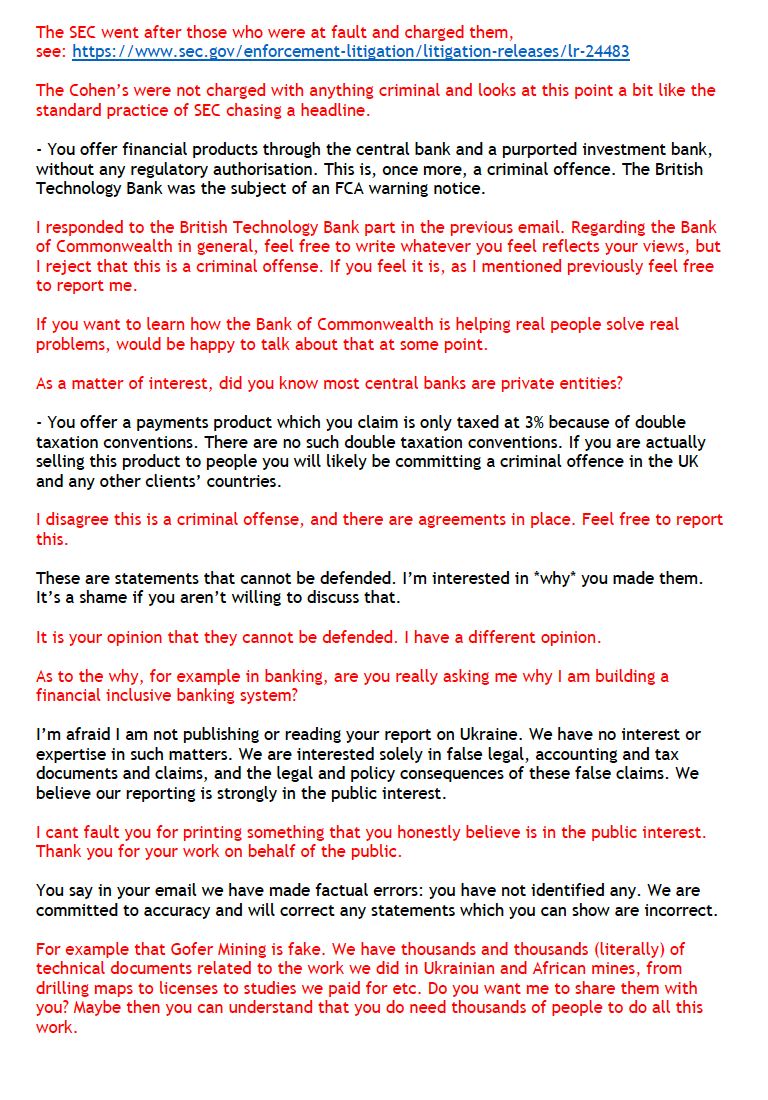

These are all very tall tales, but essentially harmless. However the activities of the "central bank" appear rather less innocent.

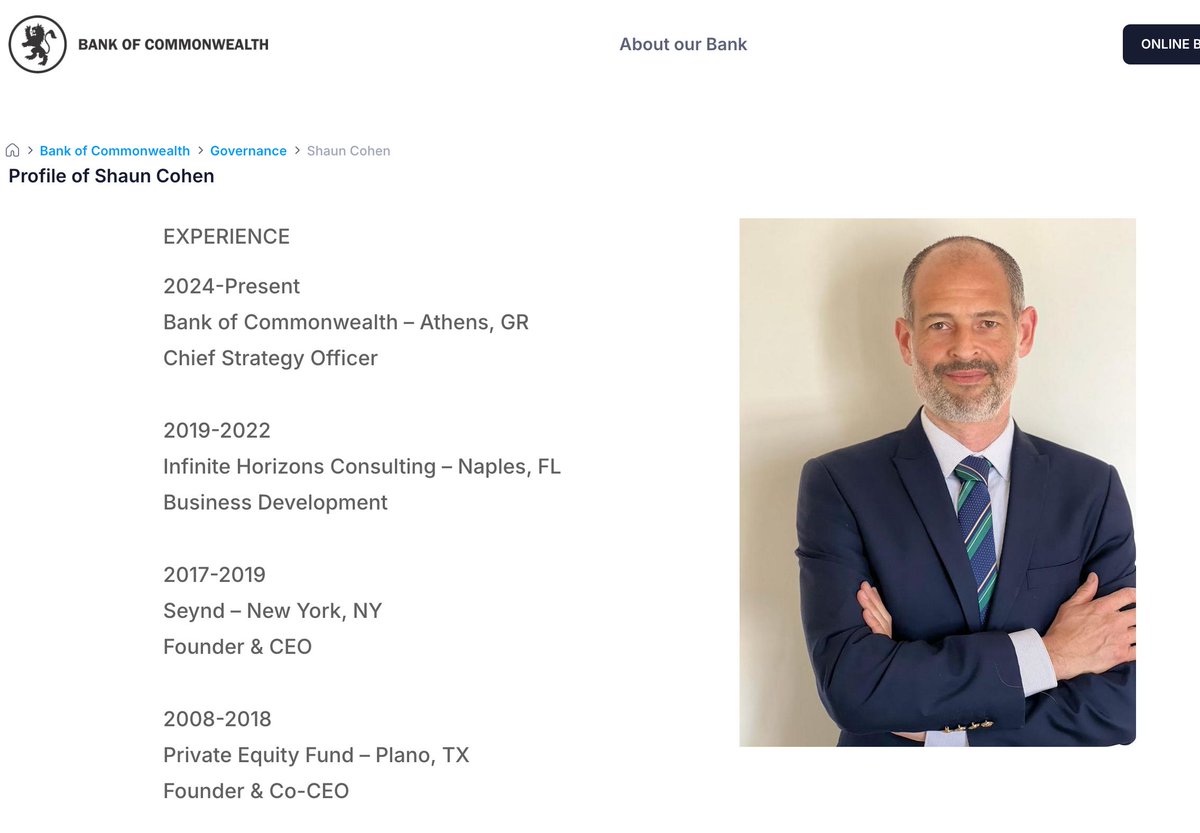

This is the Bank of Commonwealth's Chief Strategy Officer: Shaun Cohen.

Shaun Cohen ran a Ponzi scheme in Texas which defrauded investors out of $135m

Shaun Cohen ran a Ponzi scheme in Texas which defrauded investors out of $135m

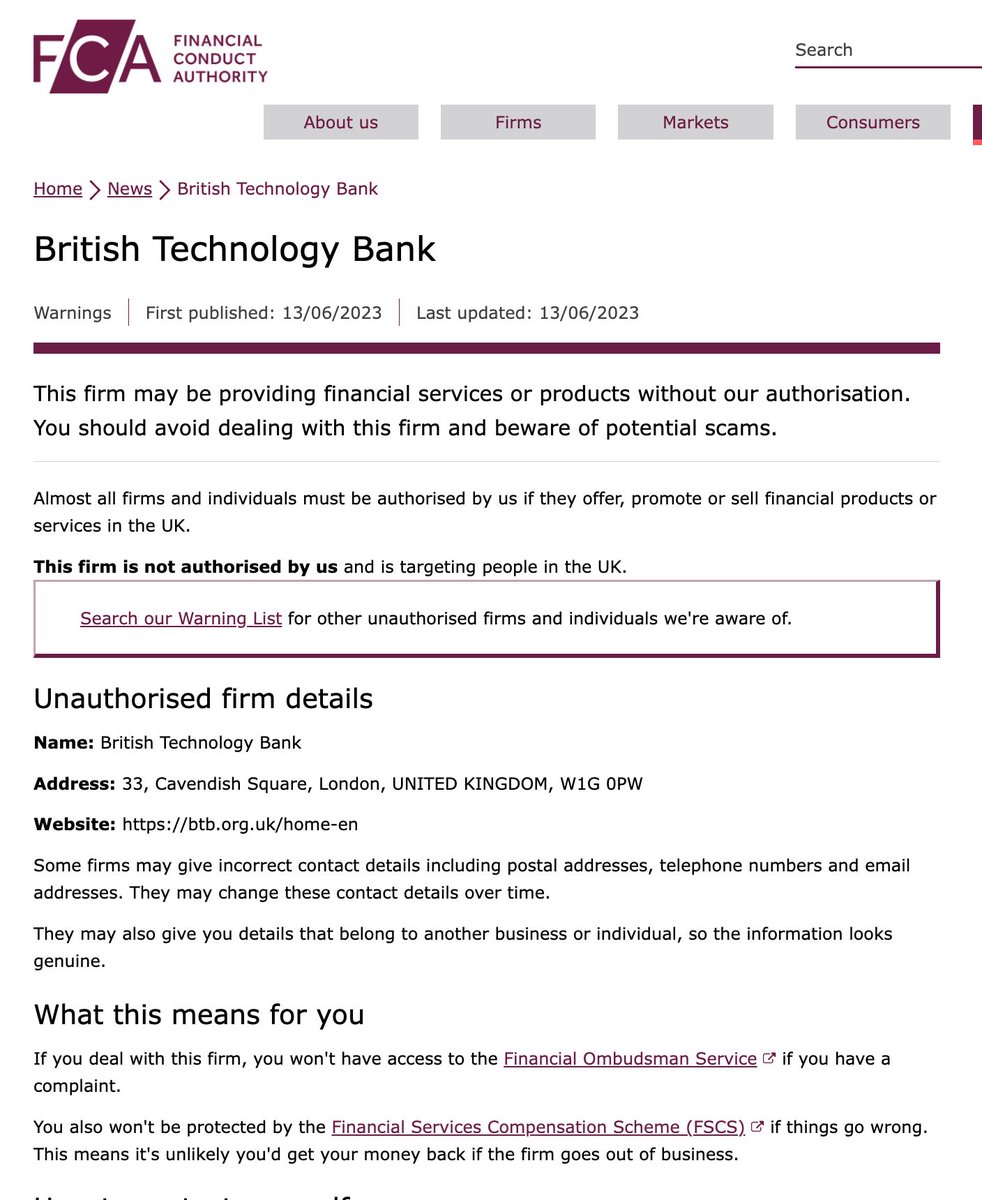

So it's concerning that the Bank of Commonwealth's "British Technology Bank" was the subject of an FCA warning that it was targeting UK consumers.

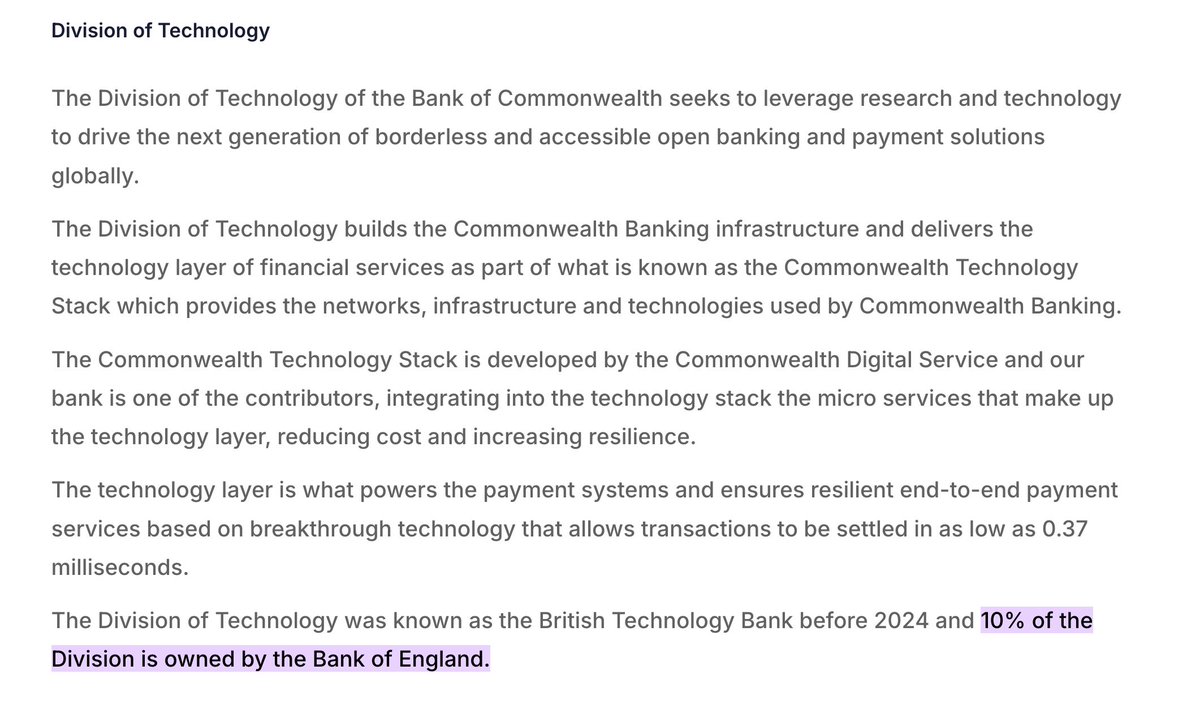

Roerich claims the BTB is 10% owned by the Bank of England (spoiler: it isn't)

Roerich claims the BTB is 10% owned by the Bank of England (spoiler: it isn't)

And Roerich's website promotes "Commonwealth Pay" which lets you escape all taxes (except 3% to him).

(Spoiler: it doesn't)

(Spoiler: it doesn't)

And a related "investment bank" with a very plausible-looking website offering a variety of financial products.

Is this all fantasy, or real?

If real, it looks (to use a technical legal term) extremely fraudy.

If real, it looks (to use a technical legal term) extremely fraudy.

Very little described in this report has real existence, with one exception: a person calling himself Michail Roerich certainly exists.

Here he was, three months ago, promoting registration on the "ROERICH marketplace". It has 29 views:

Here he was, three months ago, promoting registration on the "ROERICH marketplace". It has 29 views:

And one month before that, promoting the "ROERICH Youth Programme for Ukraine" (56 views):

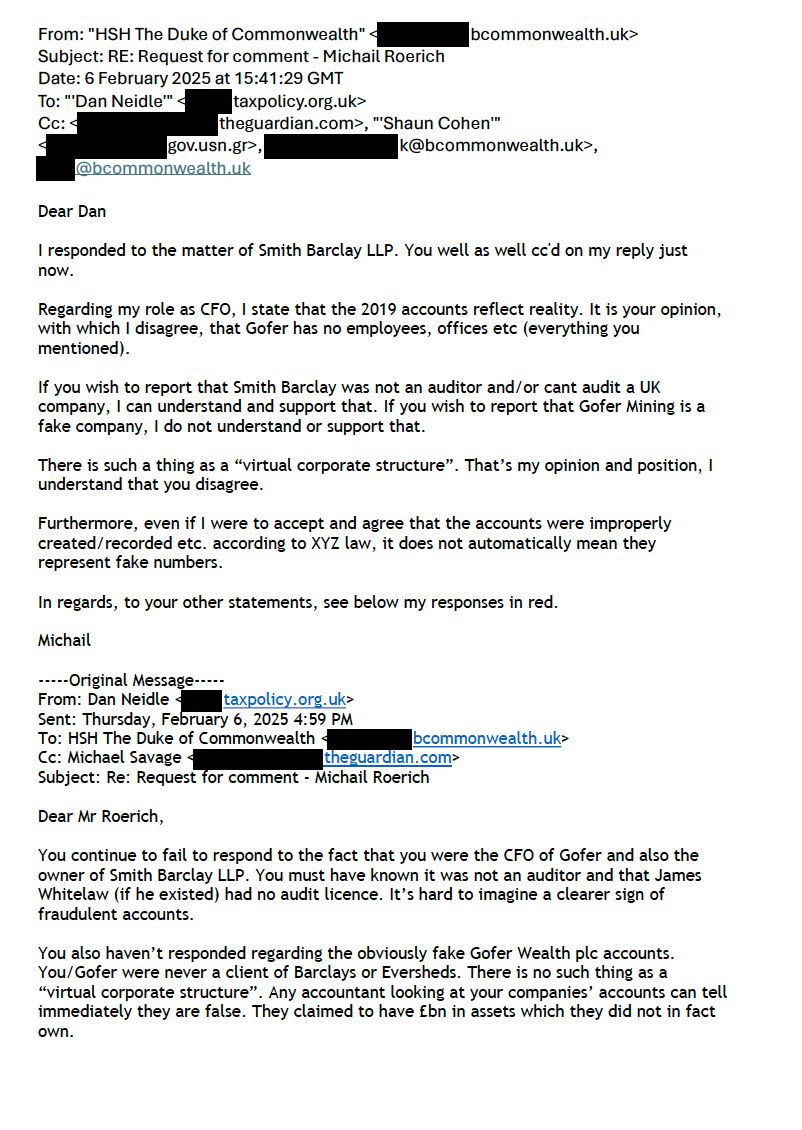

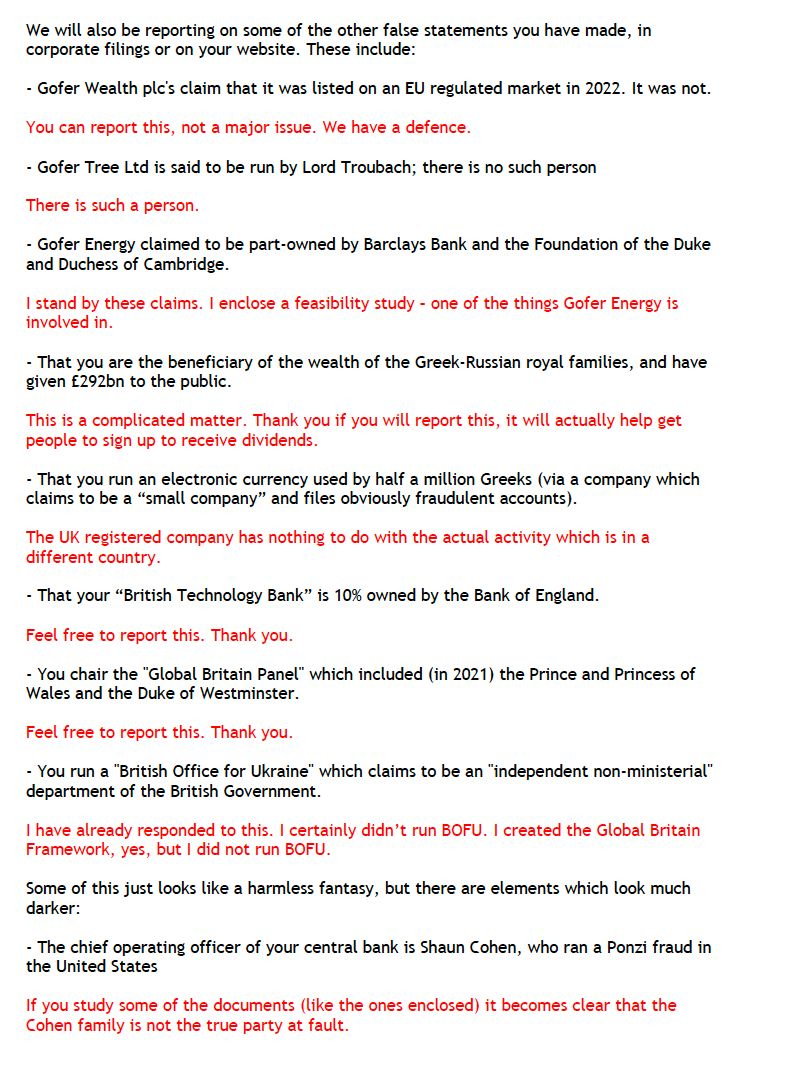

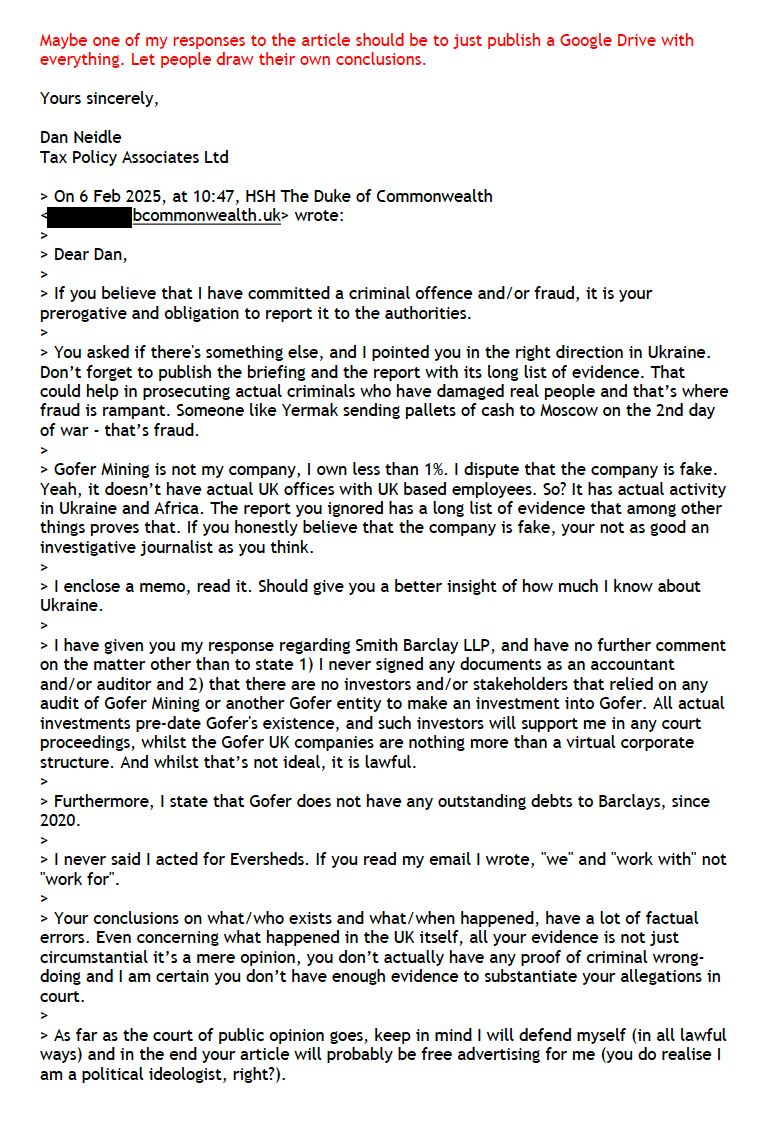

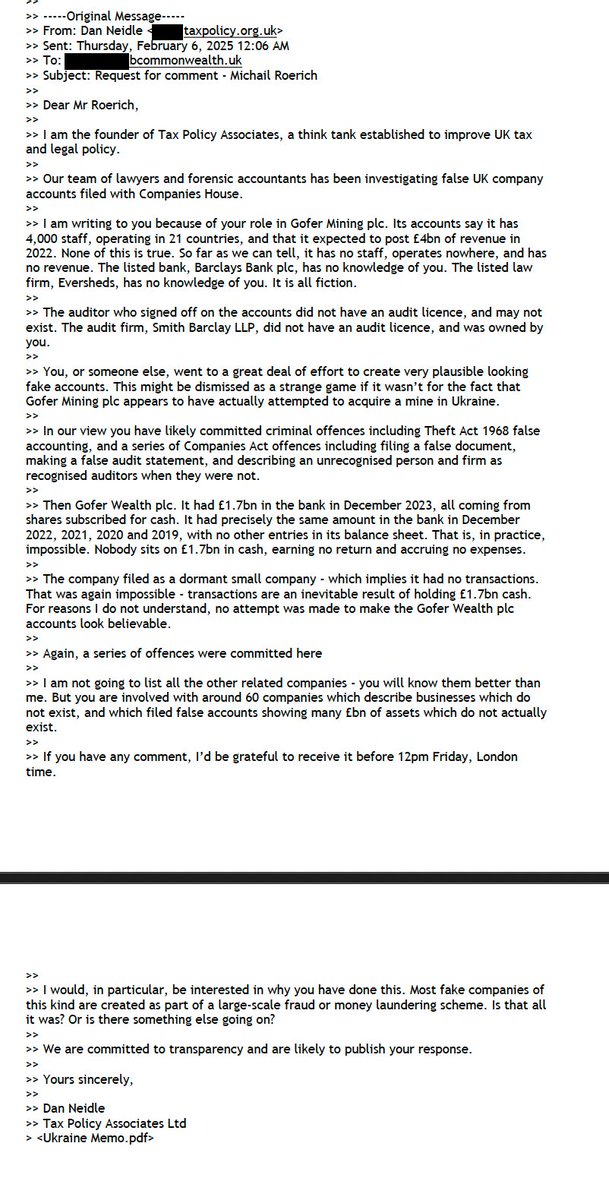

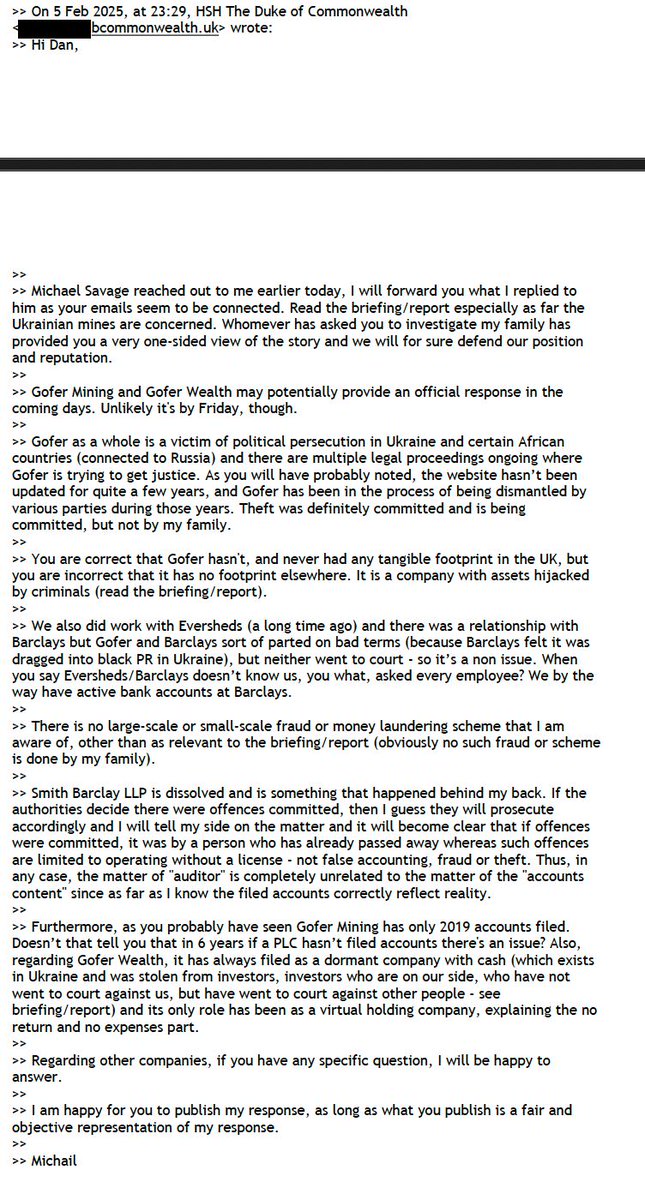

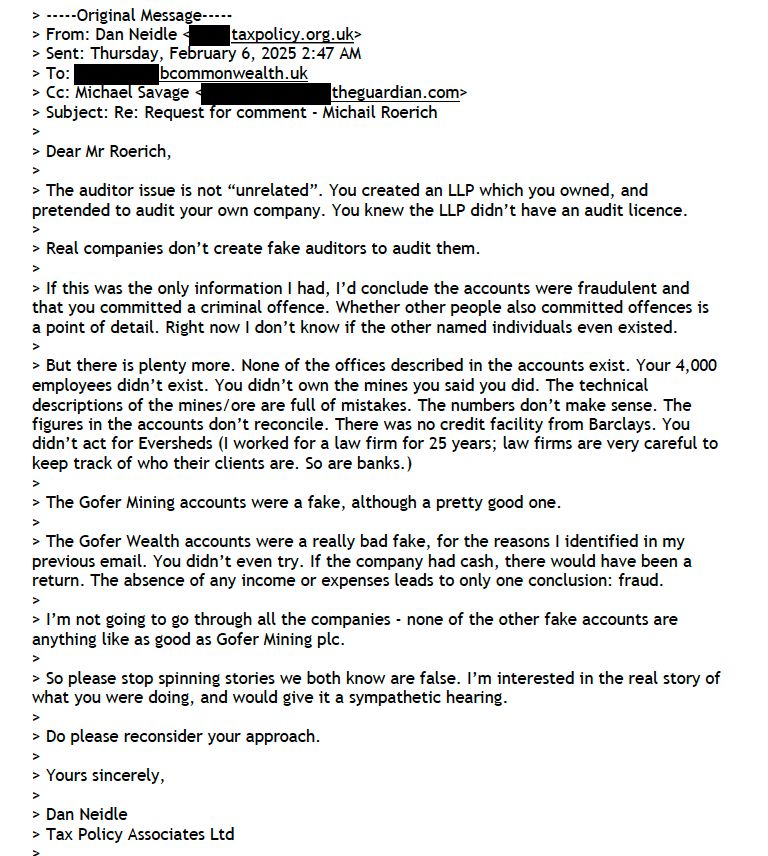

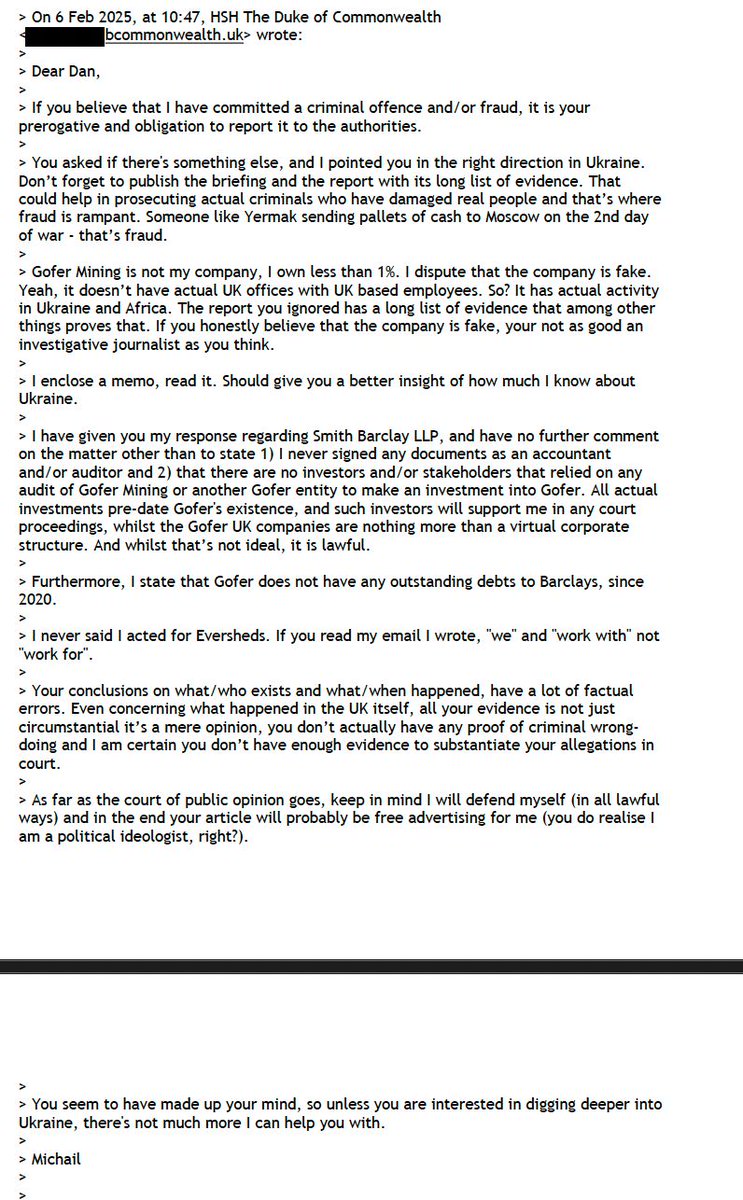

We corresponded with Mr Roerich earlier this week, and asked him why he was involved with so many fake companies. He is adamant that Gofer Mining plc and the other companies are real. He says that the Gofer group was a victim of political persecution and theft.

The tl;dr:

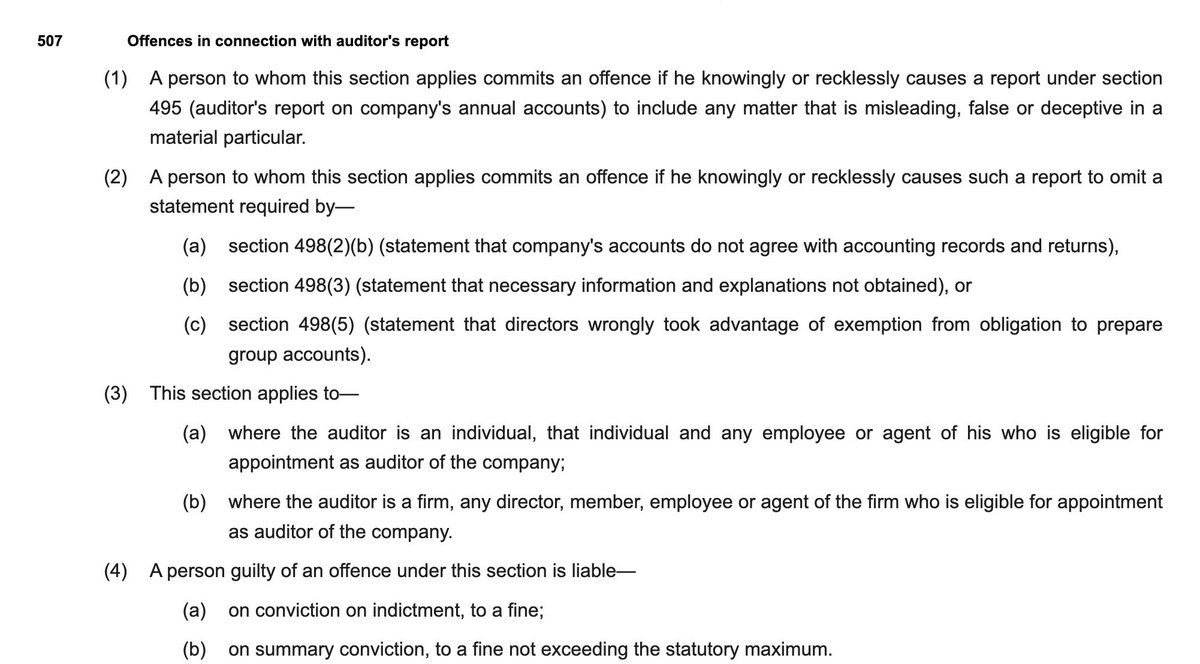

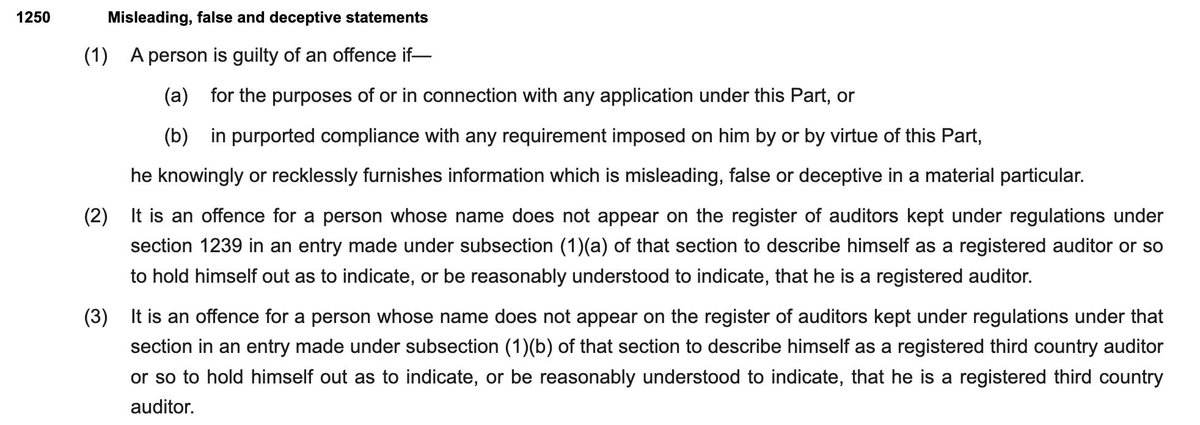

- Roerich admits that he knew Gofer Mining plc's auditor, Smith Barclay LLP didn't have an audit licence and was owned by him. This is an admission of two criminal offences.

- Roerich admits that he knew Gofer Mining plc's auditor, Smith Barclay LLP didn't have an audit licence and was owned by him. This is an admission of two criminal offences.

- Roerich knows Shaun Cohen was accused of running a Ponzi scheme, but seems to believe he was hard done by.

- He insists that his many other claims are true, but without providing any extrinsic evidence, or indeed anything beyond vague assertions.

We're almost at the end of this shaggy dog story.

You may be wondering: what on earth is going on?

You may be wondering: what on earth is going on?

It seems reasonably clear that Gofer Mining plc had a real purpose. It attempted to steal a Ukrainian gold mine. We're also aware of one other attempted mining project.

To some extent this fits in with the pattern of transactions and attempted transactions we've seen from other entities with fraudulent accounts. But they usually look to take the money and run - not engaged in protracted court battles.

The difference between those cases and this one is the high quality of the documents created for Gofer Mining plc. A small team was involved, and it took significant time and resources.

Who were they? And why?

Who were they? And why?

The supposed financial offerings of Mr Roerich's "central bank" and "investment bank" could be frauds - we don't know. The involvement of Shaun Cohen is hard to explain if they are just fantasy, and concerning if they are not.

We have, however, no explanation for the sprawling conglomerate that the Gofer group became - at least 60 companies. We certainly can't explain the Union State of Commonwealth.

The only person who knows is Michail Roerich, and he isn't telling.

Why does it matter?

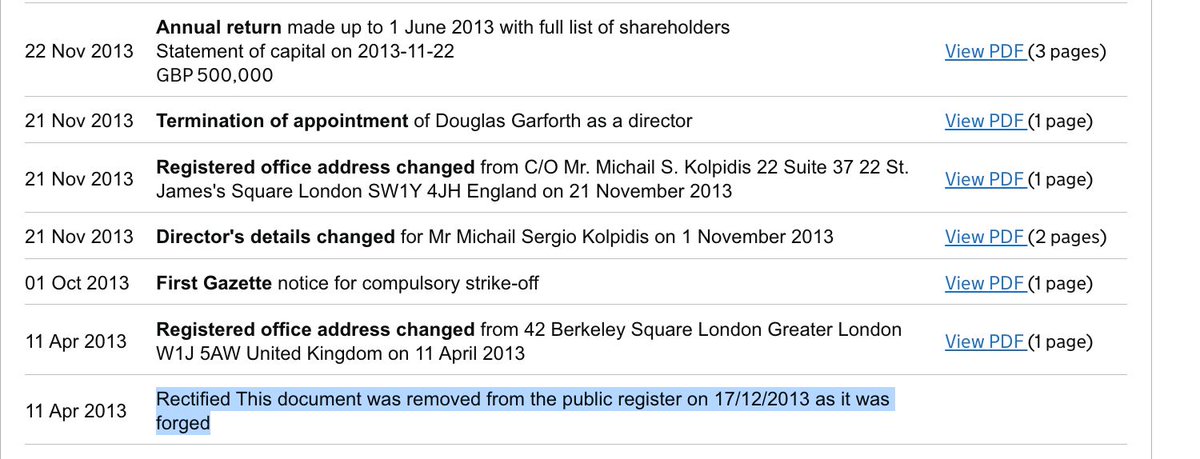

The Gofer network of fraudulent companies has continued for two decades because of well-known failings by Companies House:

The Gofer network of fraudulent companies has continued for two decades because of well-known failings by Companies House:

Gofer Mining plc and others failed to file accounts for years. Every company on our list made multiple breaches of company law, but they were treated no more seriously than the late return of a library book.

In one case, a document was removed from the registry because of forgery; but the company was permitted to just continue as if nothing had happened. No action was taken against the directors.

Gofer Wealth plc and others in the group filed impossible accounts claiming huge amounts of cash in the bank, whilst still being dormant and small companies. Companies House could easily create systems to identify false accounts of this type. It doesn't.

And most seriously - the British Ukraine Chamber of Commerce begged Companies House begging to be done about an obviously fraudulent company - but no action was taken.

The Gofer Mining plc accounts, on the other hand, present a new and much more difficult challenge to the integrity of Companies House.

Companies House can't be expected to identify that kind of sophisticated fraud. And it's now a million times easier than it was in 2019, thanks to ChatGPT.

Assurance should be provided by the audit; but it is trivially easy to forge an audit report. This is a problem - and in a ChatGPT world it's a problem that has to be solved.

It wouldn't be hard to create a system where audited accounts have to be submitted by a licensed auditor. Otherwise we are going to see more fake companies like Gofer plc committing fraud, using the credibility that Companies House has given them.

Companies House should act to give the world assurance that "audited accounts" are actually audited accounts.

And I'd love to see others pick up this investigation and try to find out what, precisely, Roerich and the unknown team working with him have been up to.

If you have thoughts or theories, drop me a line: dan ATSYMBOL taxpolicy.org.uk

If you have thoughts or theories, drop me a line: dan ATSYMBOL taxpolicy.org.uk

Thank you so much if you made it this far. Our full report:

Thank you to the many people who contributed to it - lawyers, accountants, mining experts, white hat hackers. I'm very grateful.taxpolicy.org.uk/2025/02/08/who…

Thank you to the many people who contributed to it - lawyers, accountants, mining experts, white hat hackers. I'm very grateful.taxpolicy.org.uk/2025/02/08/who…

You can subscribe for updates from us here. All subscribers receive a free trust interest in £330bn of Tsarist gold. taxpolicy.org.uk/subscribe?gold…

And the Observer’s story is here

@michaelsavage made a huge contribution to this investigationtheguardian.com/business/2025/…

@michaelsavage made a huge contribution to this investigationtheguardian.com/business/2025/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh