WOW. This would be historic:

Both Elon Musk and Coinbase's CEO have now proposed putting ALL US spending on blockchain.

This means $6.9 TRILLION of US spending PER YEAR would be placed on a decentralized ledger.

What does this mean? Let us explain.

(a thread)

Both Elon Musk and Coinbase's CEO have now proposed putting ALL US spending on blockchain.

This means $6.9 TRILLION of US spending PER YEAR would be placed on a decentralized ledger.

What does this mean? Let us explain.

(a thread)

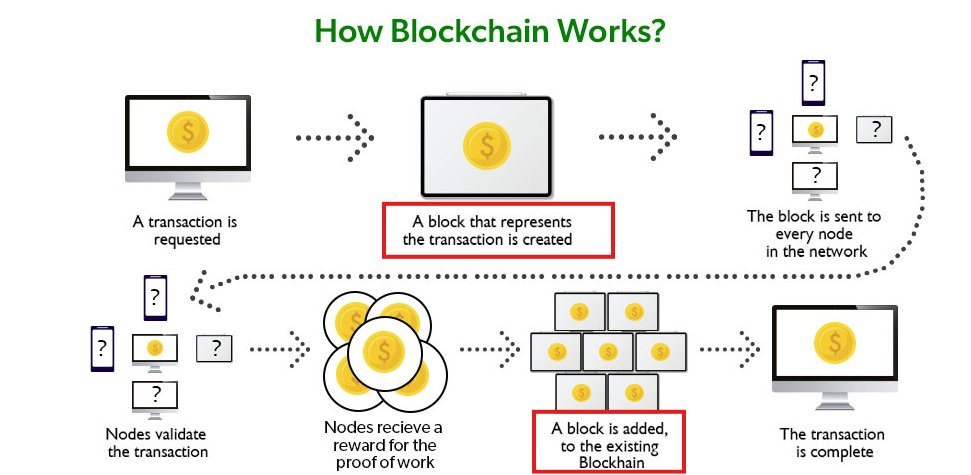

First, it's important to understand how blockchain works.

A blockchain functions as a decentralized digital ledger where data is stored in blocks that are linked together in a chain.

This means that US government spending would be FAR more secure if implemented properly.

A blockchain functions as a decentralized digital ledger where data is stored in blocks that are linked together in a chain.

This means that US government spending would be FAR more secure if implemented properly.

Why is it more secure?

Because, when data is stored in these "blocks," it becomes a part of an uneditable digital chain.

Ledgers can be permissioned to restrict viewership and fraudulent spending is almost INSTANTLY flagged.

It is also virtually un-hackable if done right.

Because, when data is stored in these "blocks," it becomes a part of an uneditable digital chain.

Ledgers can be permissioned to restrict viewership and fraudulent spending is almost INSTANTLY flagged.

It is also virtually un-hackable if done right.

Furthermore, the blockchain could be publicly accessible to increase transparency.

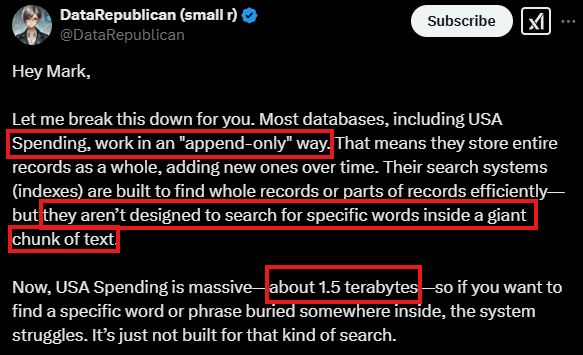

Currently, the US government's spending database is built in an "append-only" way.

This makes searching for specific words in the database virtually impossible.

It is NOT transparent.

Currently, the US government's spending database is built in an "append-only" way.

This makes searching for specific words in the database virtually impossible.

It is NOT transparent.

For example, after weeks of digging through data @DOGE found this:

62 contracts worth $182 million which were entirely for "administrative expenses."

This included a $168,000 contract for an Anthony Fauci exhibit at the NIH Museum.

This is only the tip of the iceberg.

62 contracts worth $182 million which were entirely for "administrative expenses."

This included a $168,000 contract for an Anthony Fauci exhibit at the NIH Museum.

This is only the tip of the iceberg.

Look at this:

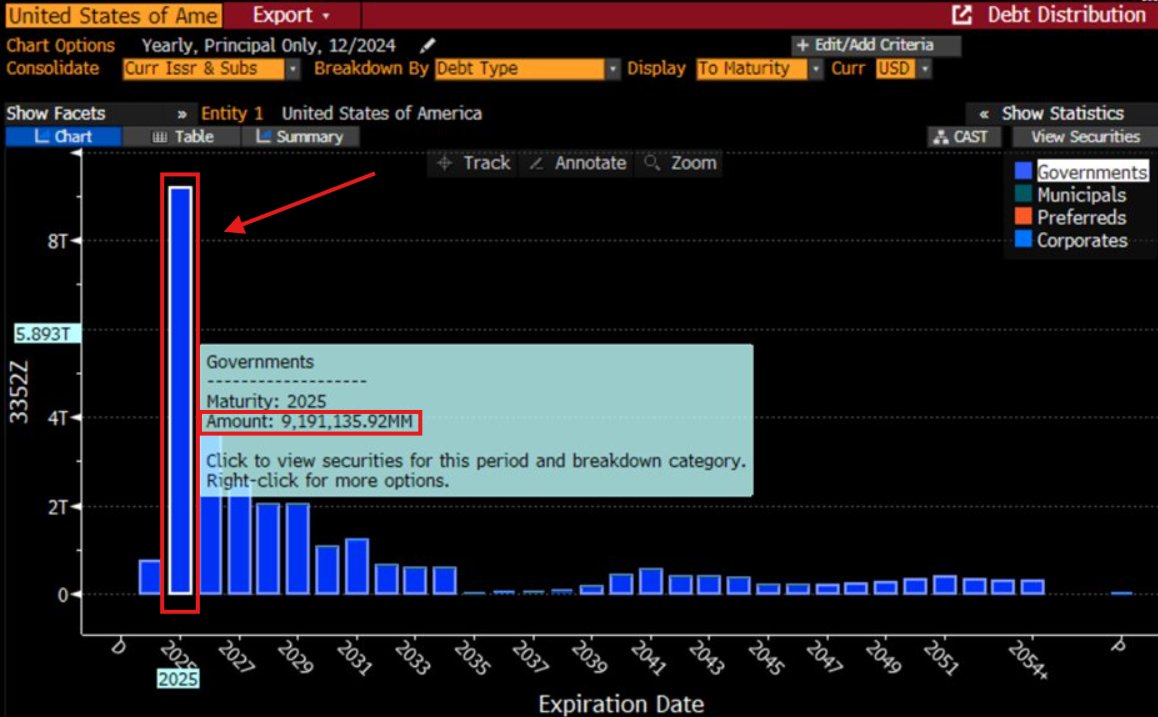

The US Pentagon couldn’t account 63% of its $3.8 TRILLION of assets in an audit.

It's hard to believe this 2023 press release is real.

The DoD says they have $3.8 trillion in assets and $4.0 trillion in liabilities.

The balance sheet doesn't even BALANCE.

The US Pentagon couldn’t account 63% of its $3.8 TRILLION of assets in an audit.

It's hard to believe this 2023 press release is real.

The DoD says they have $3.8 trillion in assets and $4.0 trillion in liabilities.

The balance sheet doesn't even BALANCE.

By using blockchain technology, payments would be easily tracked and audits could even be automated.

This is why many large banks are already utilizing blockchain.

56% of cross-border businesses have integrated blockchain technology into their operations as of 2024.

This is why many large banks are already utilizing blockchain.

56% of cross-border businesses have integrated blockchain technology into their operations as of 2024.

The US Pentagon spent $1 billion to audit JUST their 2018 financials, and failed the audit.

Their goal is to pass an audit by 2028.

That's $10+ billion in cost which could be cut from MULTIPLE government agencies if blockchain is utilized.

Blockchain removes inefficiencies.

Their goal is to pass an audit by 2028.

That's $10+ billion in cost which could be cut from MULTIPLE government agencies if blockchain is utilized.

Blockchain removes inefficiencies.

Another benefit would be eliminating "Ghost Beneficiaries."

Blockchain can ensure that aid programs, pensions, and Social Security are received only by eligible individuals, reducing fraud.

In 2022 alone, there were $13.6 BILLION of "improper" Social Security payments.

Blockchain can ensure that aid programs, pensions, and Social Security are received only by eligible individuals, reducing fraud.

In 2022 alone, there were $13.6 BILLION of "improper" Social Security payments.

The biggest downside is that the plan will be met with UNPRECEDENTED resistance.

We will see legal barriers and resistance from bureaucracy like never before.

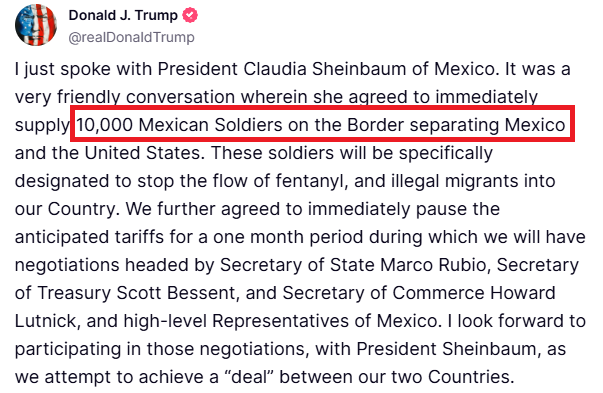

This has already started as federal judges have restricted @ElonMusk and @DOGE's access to payment systems.

We will see legal barriers and resistance from bureaucracy like never before.

This has already started as federal judges have restricted @ElonMusk and @DOGE's access to payment systems.

Resistance will come from the beneficiaries of these inefficiencies.

For example, over $322 BILLION of taxpayer dollars has gone to various 501(c)(3) organizations, per DataRepublican.

Most taxpayers have no idea this money has gone with $724 BILLION of total contributions.

For example, over $322 BILLION of taxpayer dollars has gone to various 501(c)(3) organizations, per DataRepublican.

Most taxpayers have no idea this money has gone with $724 BILLION of total contributions.

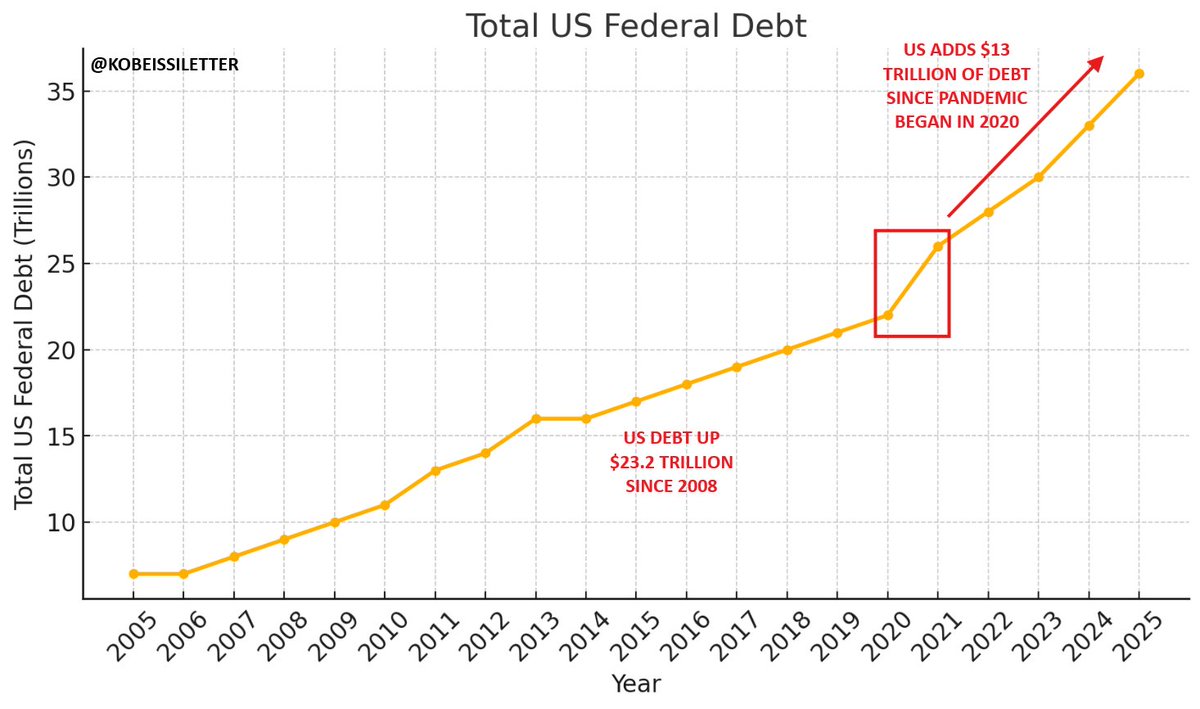

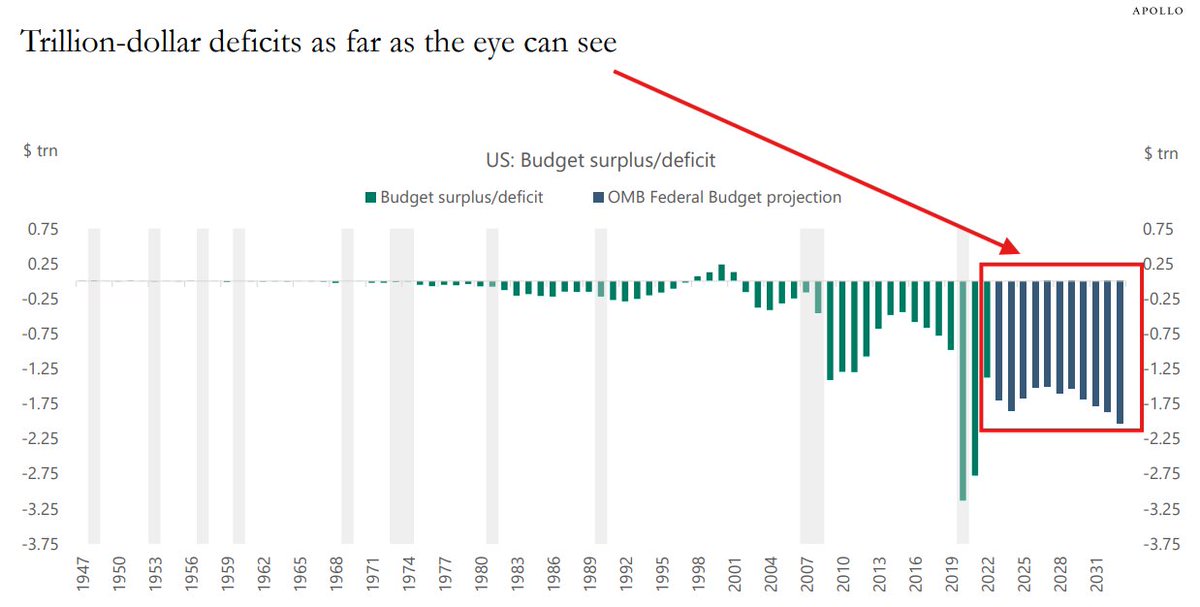

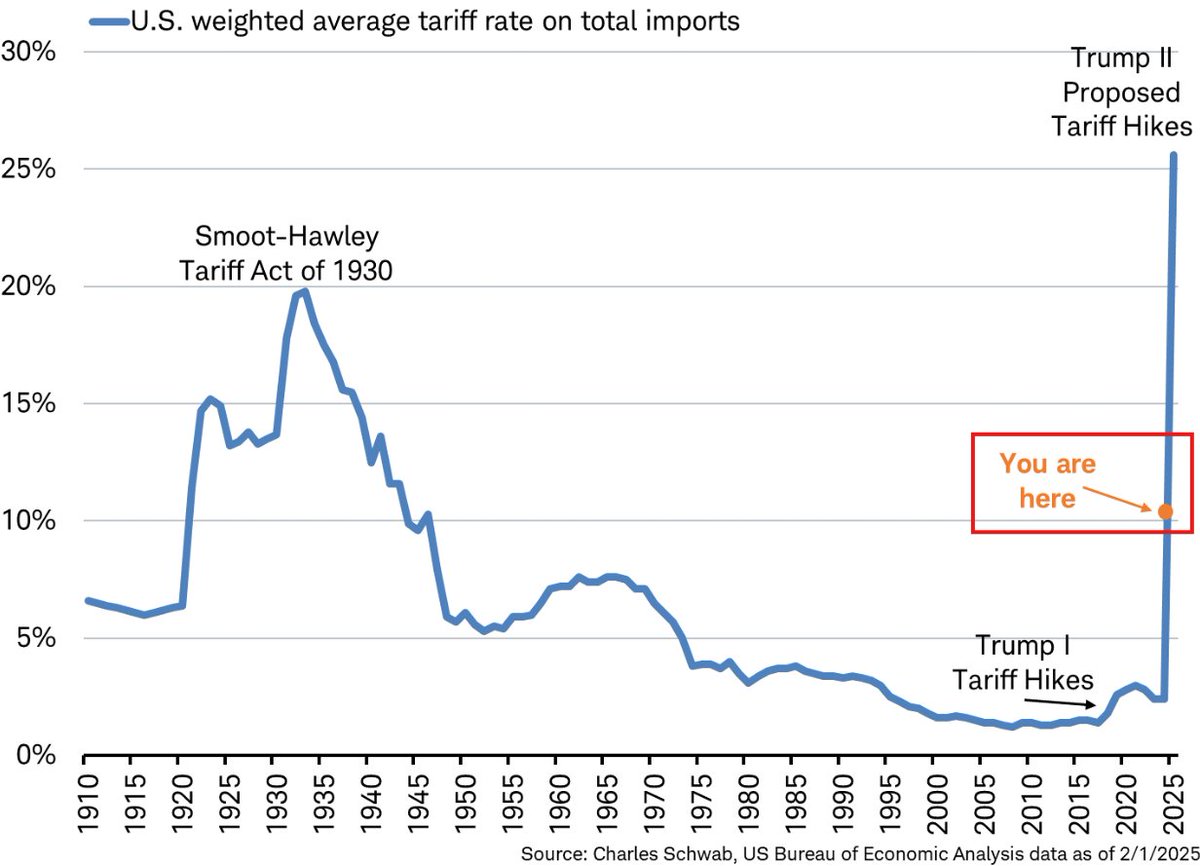

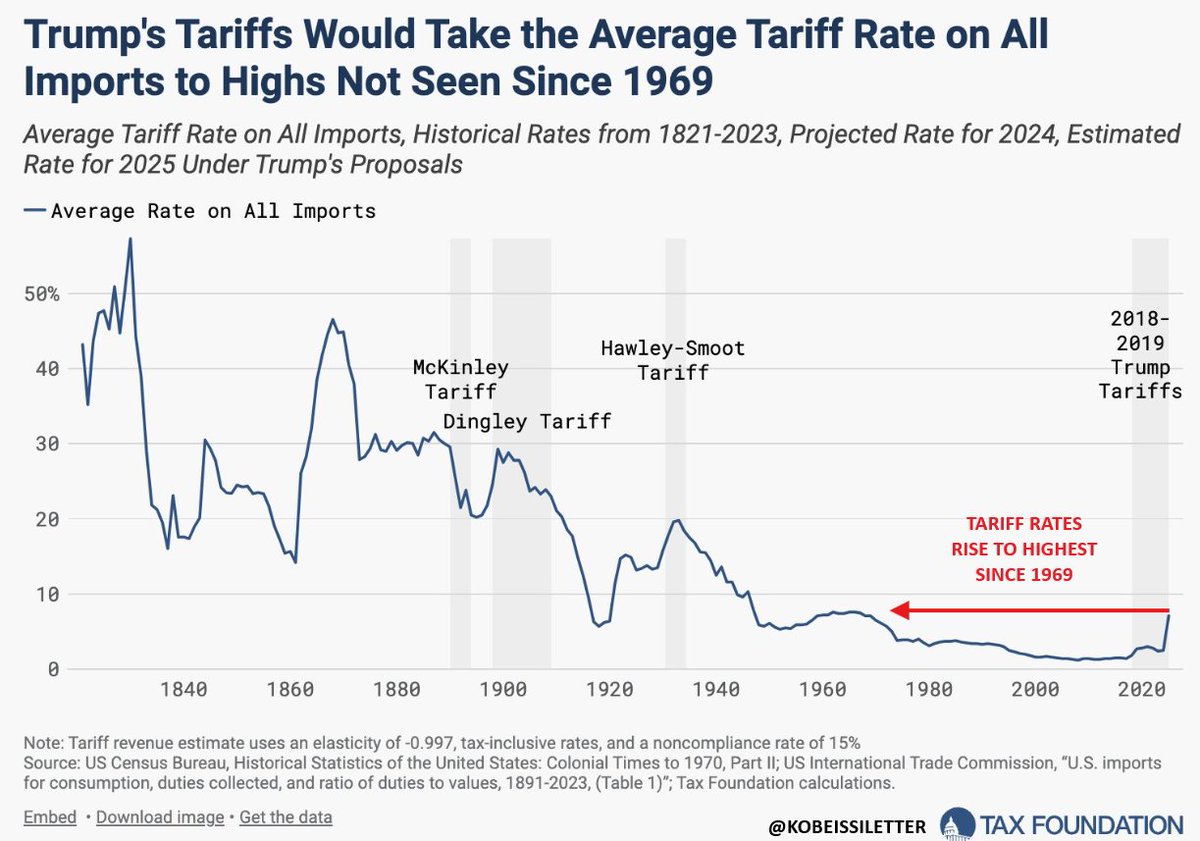

If the US government wants to eliminate deficit spending, we need to cut $5 billion of spending PER DAY.

The US is now spending 44% of GDP per year, the same levels as World War 2.

Most will be surprised how many "problems" will be fixed if deficit spending is eliminated.

The US is now spending 44% of GDP per year, the same levels as World War 2.

Most will be surprised how many "problems" will be fixed if deficit spending is eliminated.

More disruption means more opportunity for investors.

Investors who can adapt to change will find the market to be HIGHLY profitable.

Want to see how we are positioned in the market?

Subscribe below to access our premium analysis and alerts:

thekobeissiletter.com/subscribe

Investors who can adapt to change will find the market to be HIGHLY profitable.

Want to see how we are positioned in the market?

Subscribe below to access our premium analysis and alerts:

thekobeissiletter.com/subscribe

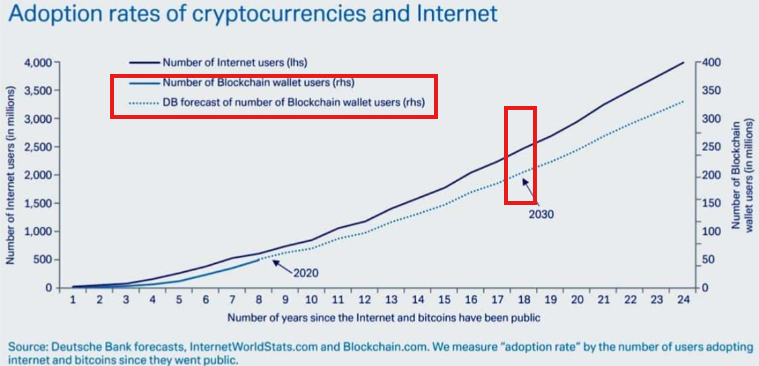

Moving US spending to blockchain helps build efficiency, security, and transparency.

By 2030, Deutsche Bank estimates there will be over 250 MILLION blockchain wallet users.

It's time for more efficiency.

Follow us @KobeissiLetter for real time analysis as this develops.

By 2030, Deutsche Bank estimates there will be over 250 MILLION blockchain wallet users.

It's time for more efficiency.

Follow us @KobeissiLetter for real time analysis as this develops.

This would have massive implications for crypto as well.

Should we make a thread on the implications for crypto if this happens?

Should we make a thread on the implications for crypto if this happens?

• • •

Missing some Tweet in this thread? You can try to

force a refresh