I have a new piece in @ForeignAffairs titled, "The Post-Neoliberal Delusion and the Tragedy of Bidenomics". They were generous about giving me a lot of words but were less generous with charts--so this long thread partially rectifies that. (And links to the piece at the end.)

@ForeignAffairs First let me say some good policy came out of the Biden administration, including on climate and microchips. And more good policy would have come out if it wasn't blocked by unified Republican opposition.

But...

But...

@ForeignAffairs Also some tragically misguided policy, not least the oversized stimulus. But also the first Democratic President in 100 years not to permanently expand the social safety net plus a reduction in inflation-adjusted infrastructure investment and support for children.

@ForeignAffairs Part of why I wrote this was the many people--even in retrospect--talking about how Biden was the transformational President since FDR. The massive disconnect between these claimed accomplishments & reality are important to avoid falling into the same policy traps in the future.

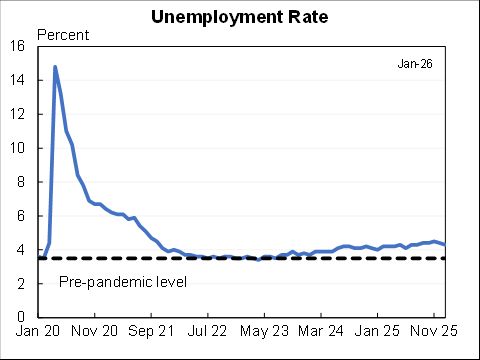

@ForeignAffairs Overall hard to say built back better successfully. Macroeconomy was better in 2019 than 2024 (lower unemployment rate, lower inflation, less debt, lower interest rates). Poverty was lower in 2019 and inflation-adjusted incomes higher. Safety net and min wage larger in 2019 too.

@ForeignAffairs In my piece I discuss some of the intellectual debate around so-called neoliberalism and "post neoliberalism". You can read it here, won't do much the framing in this thread. foreignaffairs.com/united-states/…

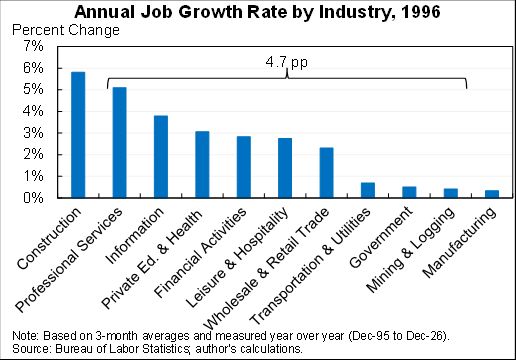

@ForeignAffairs In many ways the United States economy recovered quite strongly. Other advanced economies did too as soon as they reopened after COVID. In fact growth in 2021-Q1 was 5.8% annual rate in US before stimulus really went into effect.

@ForeignAffairs The United States did grow faster than peer countries. BUT this was widely expected even prior to COVID given our demography and productivity. Compared to pre-COVID forecasts or trends U.S. macro performance in the center of the pack.

@ForeignAffairs BTW, and cut from piece for space reasons, there should be more angst about why the United States had among the worst employment recoveries of the advanced economies. This is change in prime-age EPOP from pre-COVID to most recent. Worth more angsting.

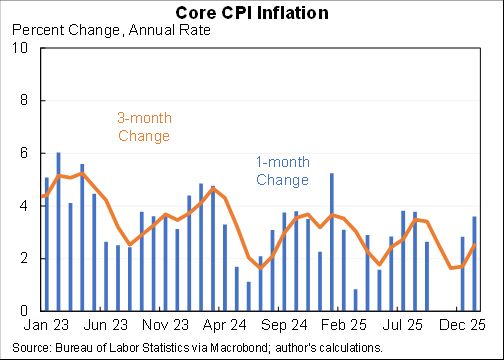

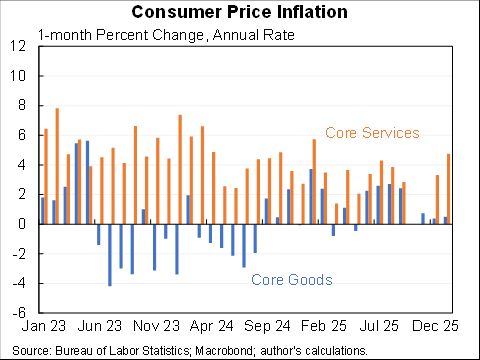

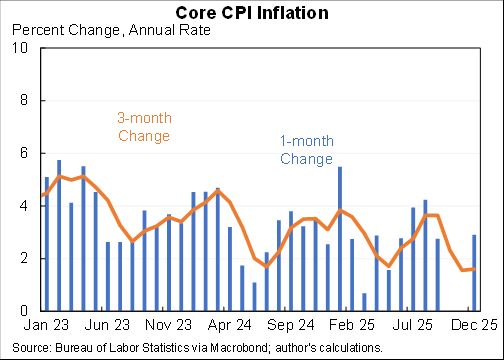

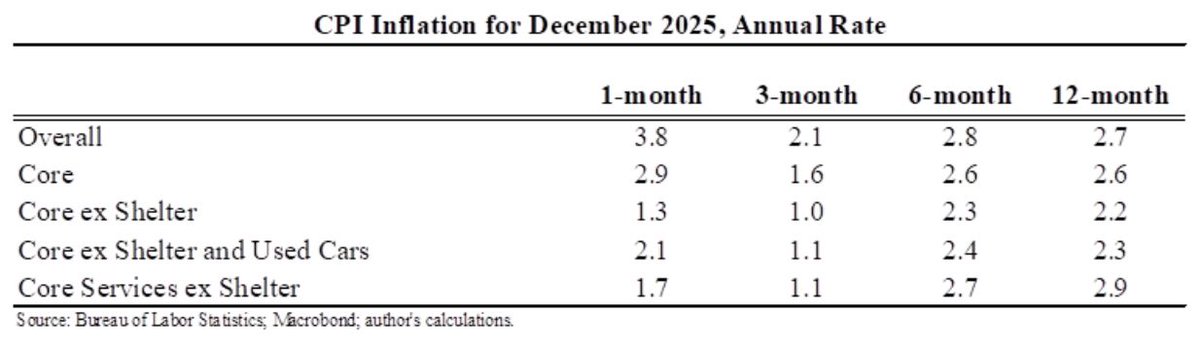

@ForeignAffairs The inflation was global but that doesn’t let U.S. policymakers off the hook any more does the global nature of the Great Depression or the financial crisis. Other countries also had a MUCH bigger energy shock, overstimulated too, and US exported inflation.

@ForeignAffairs Some of the excuses for inflation don’t stand up to scrutiny. We didn’t experience a huge supply shock—in fact we had incredibly impressive supply as real durables spending up 30% from pre-COVID. Supply couldn’t keep up with huge demand.

@ForeignAffairs The hot economy increased nominal wage growth. But it also increased price growth. The net effect was real wage growth only for the bottom half of workers—and even for them much slower than before. So way below trend.

@ForeignAffairs There was a huge increase in infrastructure spending but an even larger increase in the cost of building. So real highway spending worse in the best year of Biden than any year from 2003 through 2020.

@ForeignAffairs Note, the chart is for highway spending—which is where much of the money has gone so far. Visionary stuff like car chargers and broadband have barely spent out or done anything. But broader infrastructure measures tell the same story.

@ForeignAffairs Similarly, not only was there no permanent legislated expansion in the social safety net but programs that are not indexed to inflation—most importantly the child tax credit and minimum wage—were de facto scaled back quite a lot in real terms.

@ForeignAffairs The IRA will lower emissions by about 17% in 2050 and the benefits of that will exceed the costs. But we should be honest that a very small carbon tax (~$12/ton) could have done the same amount with compensation for households and no big corporate subsidies.

@ForeignAffairs To be clear, I don’t think Biden could have passed a carbon tax. But I don’t think enthusiasts for his approach should kid themselves into thinking they found a more ambitious, effective or progressive approach either. Corporate subsidies not scaleable nor are they progressive.

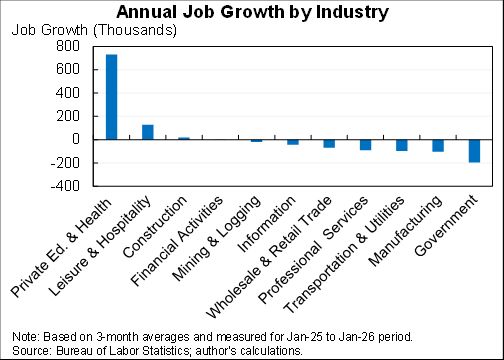

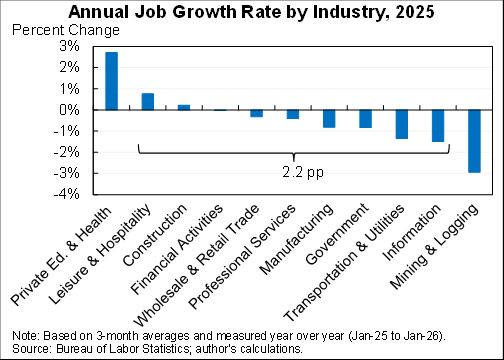

@ForeignAffairs Remember all the talk about restoring manufacturing? I never thought it was a worthwhile goal. Regardless, manufacturing employment continued to slide and industrial production was flat.

@ForeignAffairs (It is possible manufacturing will take off with a lag given the large increase in manufacturing structures. But we're not seeing any increase in other types of industrial investment, output or employment so I'm skeptical. Regardless would be a very small %age of the workforce.)

@ForeignAffairs Policy can increase favored sectors with subsidies (microchips are worth subsidizing, I’m more skeptical but uncertain about solar panels). But that process crowds out other manufacturing: higher borrowing costs, stronger dollar, higher construction costs.

@ForeignAffairs Finally, the Biden administration emphasized “predistribution”. In theory I support it too but need to recognize how little it has accomplished and not make a virtue of the failure to legislate any permanent changes to the social safety net--while unionization fell.

@ForeignAffairs This piece is more criticism than a sketch of an alternative approach. But here is a teaser for that and hope to do more on it over time.

@ForeignAffairs Here's a link to the full piece. A lot of nuance and detail I was unable to cover in the above. Comments welcome! foreignaffairs.com/united-states/…

@ForeignAffairs P.S. I've seen various substantive criticisms on social media, I'll try to address them in the coming days.

Errata, my tweet earlier shows change in employment rates. If you look at prime age (as my tweet said) the US is towards the bottom but slightly better relative position.

• • •

Missing some Tweet in this thread? You can try to

force a refresh