The Venture Capital Apocalypse is coming...it might even be here already.

The venture capital asset class is facing a watershed moment. Orphaned/Zombie VC software companies are everywhere.

I'm a 'DATA DRIVEN' guy so I'm going to show you 6 graphs that illustrate how dire the situation is.

The venture capital asset class is facing a watershed moment. Orphaned/Zombie VC software companies are everywhere.

I'm a 'DATA DRIVEN' guy so I'm going to show you 6 graphs that illustrate how dire the situation is.

The problems really start in 2020/2021. Massive amounts of dollars poured into every stage of Venture Capital. The number of unicorns exploded. This will come in later as a major issue.

There were simply too many dollars facing the same number of generational companies.

There were simply too many dollars facing the same number of generational companies.

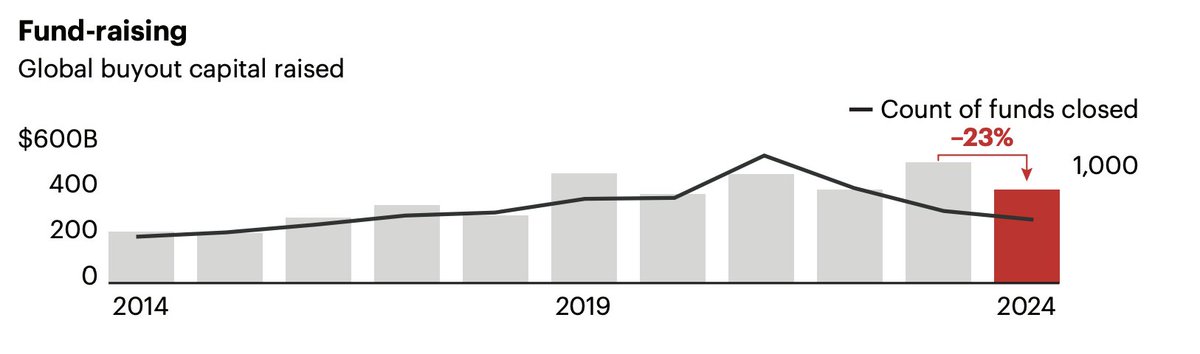

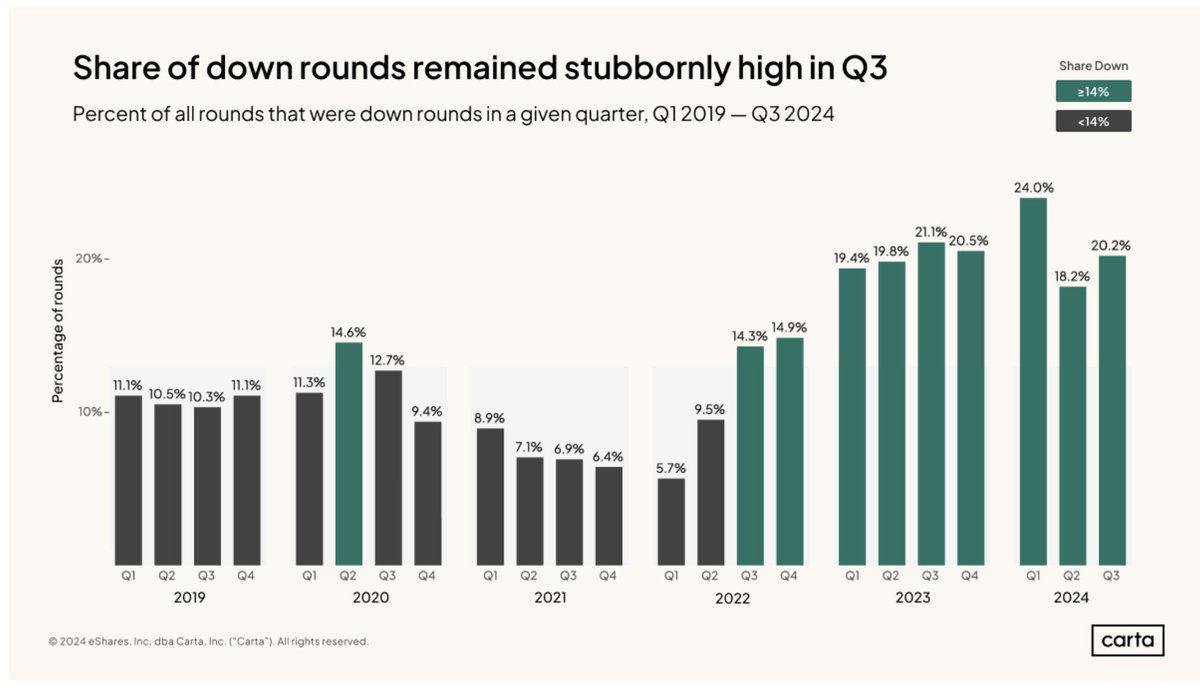

Eventually, interest rates got JACKED UP and a combination of public market valuations and private equity skepticism led to an early decline in M&A. The only way VCs make money is on long tail M&A outcomes. This eventually led to skyrocketing numbers of down rounds.

The lack of M&A continued to compound. Public markets now started to care a LOT more about profit and real accretive acquisitions. You couldn't just buy a high growth start up and see a share price pop. Not only that, there was a ton of software M&A in 2021 and those acquisitions started to fail.

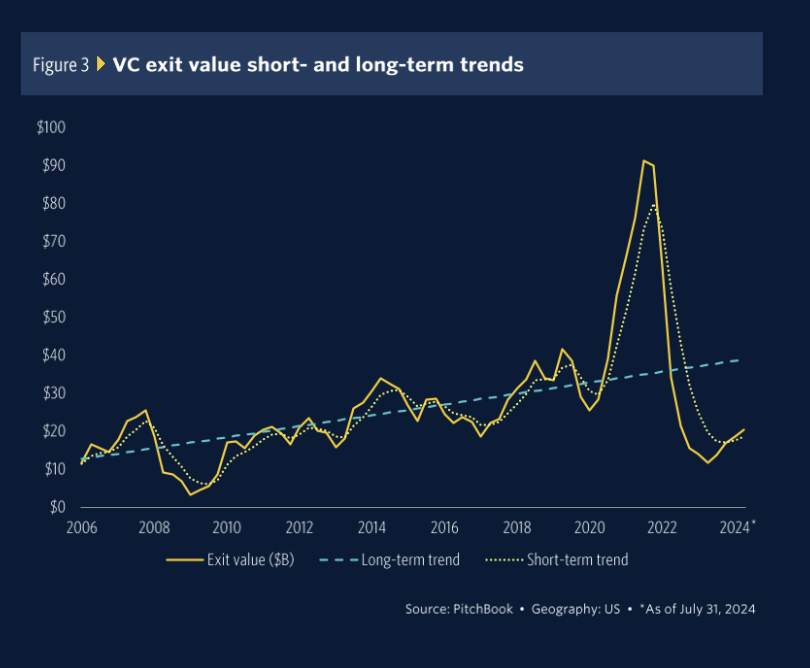

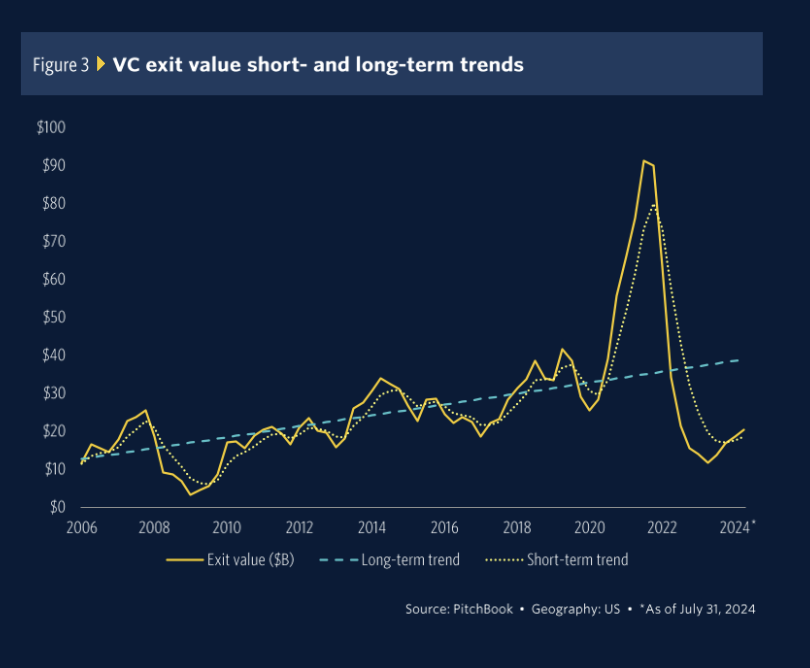

This chart is particularly damning. For the technical chart nerds among us, exit values generally followed a long term trend upward. This made the VC asset class viable. We have seen a massive gap form between the trend line for acquisition price and actuals in software.

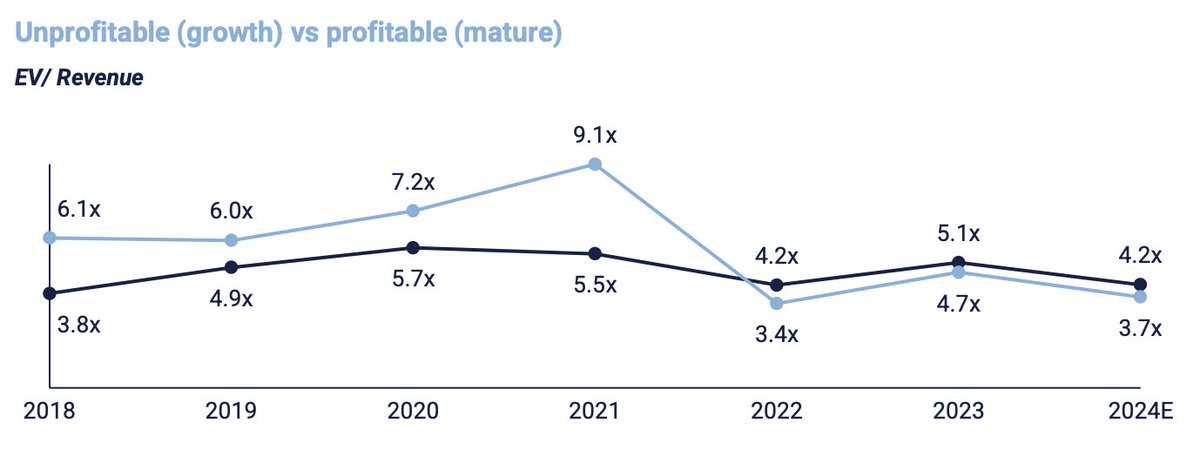

Finally, we are seeing exit multiples (acquisition prices) for both growth software companies and rule of 40 stay stubbornly low. I know on my side in software PE that I'm seeing some TOUGH valuation pills to swallow for founders. This is DIRE for the VC asset the class. All the ROI is in the long tail outcomes...and they aren't happening.

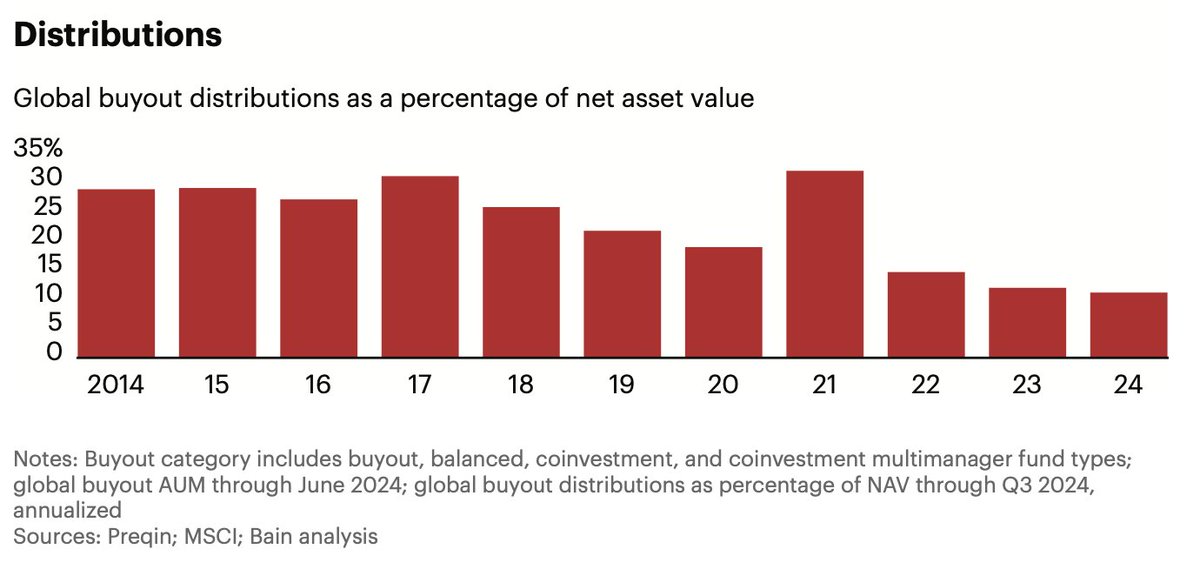

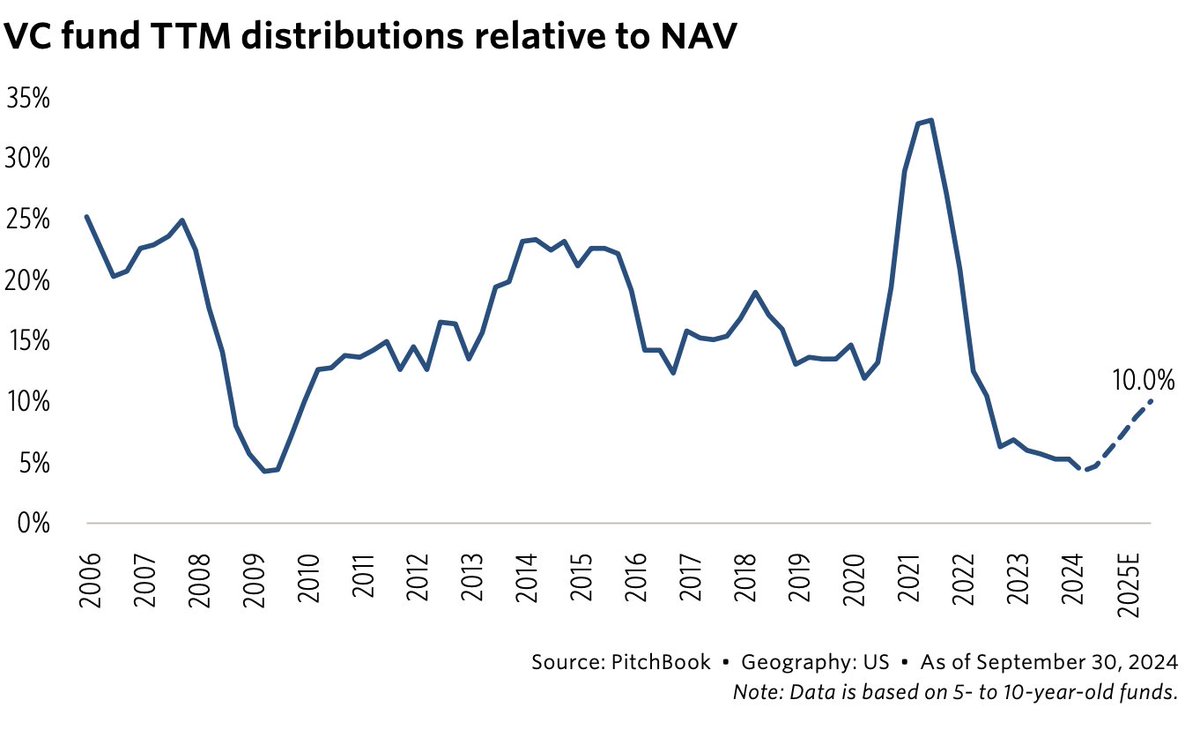

All of this has manifested in lows for distributions for most VC funds.

1) VCs invested in businesses at lofty valuations.

2) VC. backed software acquisitions are plummeting

3) Down rounds are sky rocketing

All of this results in VCs not distributing much to LPs.

1) VCs invested in businesses at lofty valuations.

2) VC. backed software acquisitions are plummeting

3) Down rounds are sky rocketing

All of this results in VCs not distributing much to LPs.

So, where do we go from here?

1) Many VCs will likely shut down. This sucks.

2) I think the top VC funds will be fine. There will always be generational businesses founded every year. Top VCs will get the pick of the litter. They will downsize AUM.

3) Overall LP allocation to VC will likely go down.

4) There will be many 'orphaned' VC backed software companies that don't have a path forward in the new environment.

IF you have >$10mm in ARR and want out, DM me. I'll help you find a solution. Don't work the rest of your life for an outcome that's unlikely.

1) Many VCs will likely shut down. This sucks.

2) I think the top VC funds will be fine. There will always be generational businesses founded every year. Top VCs will get the pick of the litter. They will downsize AUM.

3) Overall LP allocation to VC will likely go down.

4) There will be many 'orphaned' VC backed software companies that don't have a path forward in the new environment.

IF you have >$10mm in ARR and want out, DM me. I'll help you find a solution. Don't work the rest of your life for an outcome that's unlikely.

• • •

Missing some Tweet in this thread? You can try to

force a refresh