Private Equity Investor skewing towards software.

Former Head of AI @ $1B+ PE fund.

Former Data Scientist using AI to source deals.

DMs Open

3 subscribers

How to get URL link on X (Twitter) App

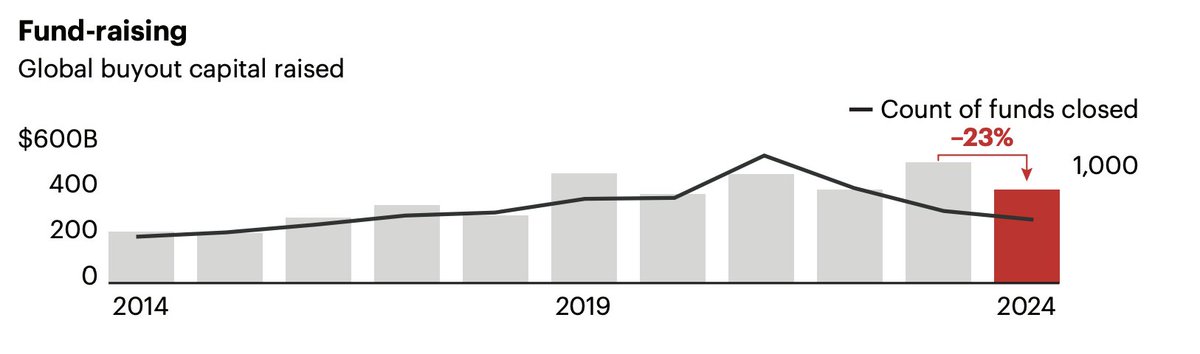

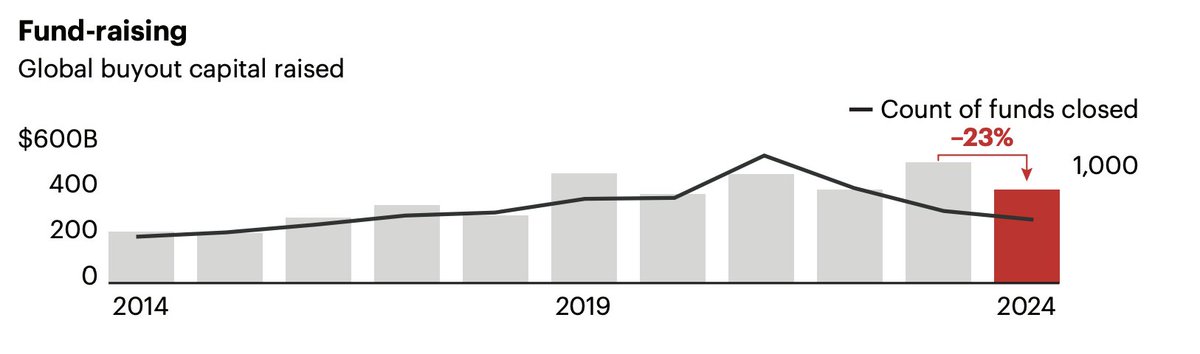

Bain PE released their yearly report on PE, and it was filled with some particularly damning statics.

Bain PE released their yearly report on PE, and it was filled with some particularly damning statics.

'Special Situations'...what the f*** does that mean? Well, it is really just majority investing in weird situations. Traditional Software PE was 'Buy a growing software company at premium valuation, grow it more, sell to a public OR IPO'. Sadly, this strategy is FLOPPING rn.

'Special Situations'...what the f*** does that mean? Well, it is really just majority investing in weird situations. Traditional Software PE was 'Buy a growing software company at premium valuation, grow it more, sell to a public OR IPO'. Sadly, this strategy is FLOPPING rn.

The problems really start in 2020/2021. Massive amounts of dollars poured into every stage of Venture Capital. The number of unicorns exploded. This will come in later as a major issue.

The problems really start in 2020/2021. Massive amounts of dollars poured into every stage of Venture Capital. The number of unicorns exploded. This will come in later as a major issue.