India’s 64-year-old Income Tax law is getting a complete makeover.

A new Bill promises a simpler and more modern tax system.

There are 6 big changes. Let’s have a look. 🧵👇

A new Bill promises a simpler and more modern tax system.

There are 6 big changes. Let’s have a look. 🧵👇

Before discussing the changes, let’s first talk about what has NOT changed.

The old tax regime is NOT being abolished.

You can still choose between the old & new regimes.

And no new taxes are being introduced.

The bill is about simplification, not increasing your tax burden.

The old tax regime is NOT being abolished.

You can still choose between the old & new regimes.

And no new taxes are being introduced.

The bill is about simplification, not increasing your tax burden.

1. INTRODUCTION OF "TAX YEAR"

Currently, we have two separate terms—"Previous Year" and "Assessment Year."

The Previous Year (PY) is when you earn your income.

The Assessment Year (AY) is the year after that when you file taxes.

This often confuses people.

Currently, we have two separate terms—"Previous Year" and "Assessment Year."

The Previous Year (PY) is when you earn your income.

The Assessment Year (AY) is the year after that when you file taxes.

This often confuses people.

The new bill replaces both with a single "Tax Year."

It will cover April to March, aligning tax filing with the financial year.

No more unnecessary jargon. Just one simple term.

It will cover April to March, aligning tax filing with the financial year.

No more unnecessary jargon. Just one simple term.

2. SHORTER AND MORE STRUCTURED TAX LAW

The current Income Tax Act has 52 chapters, 1,647 pages and 298 sections.

The new bill? Just 23 chapters, 622 pages, and 536 sections.

Years of amendments made the law complex.

Cross-references between sections made it even harder to interpret.

The new bill restructures everything, making tax laws easier to read and understand.

The current Income Tax Act has 52 chapters, 1,647 pages and 298 sections.

The new bill? Just 23 chapters, 622 pages, and 536 sections.

Years of amendments made the law complex.

Cross-references between sections made it even harder to interpret.

The new bill restructures everything, making tax laws easier to read and understand.

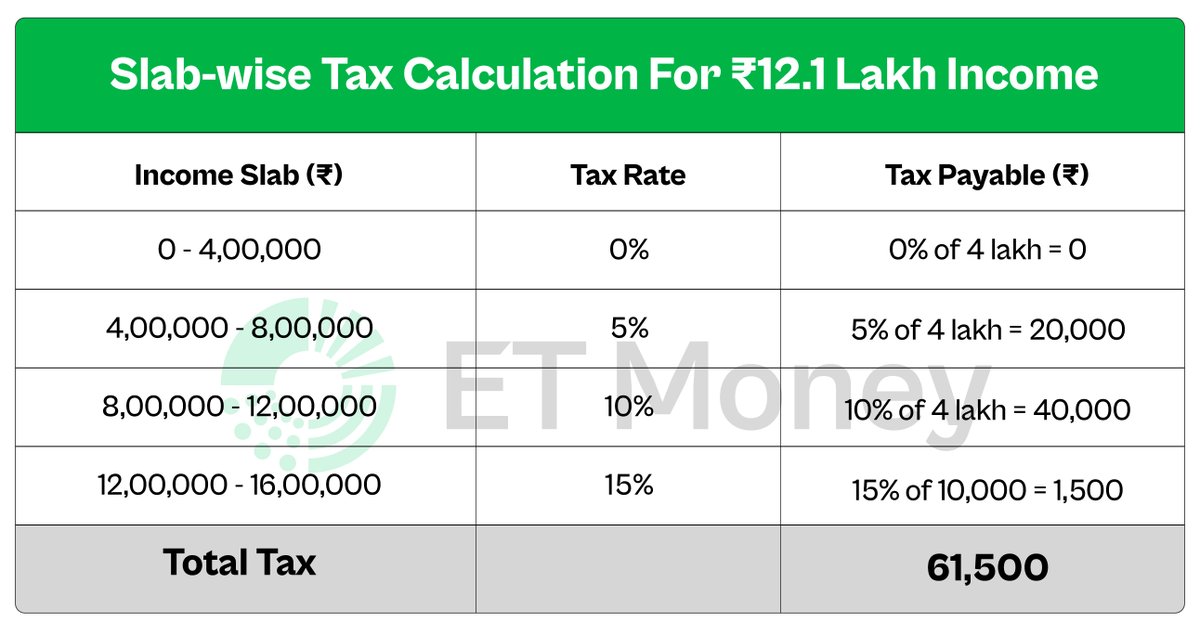

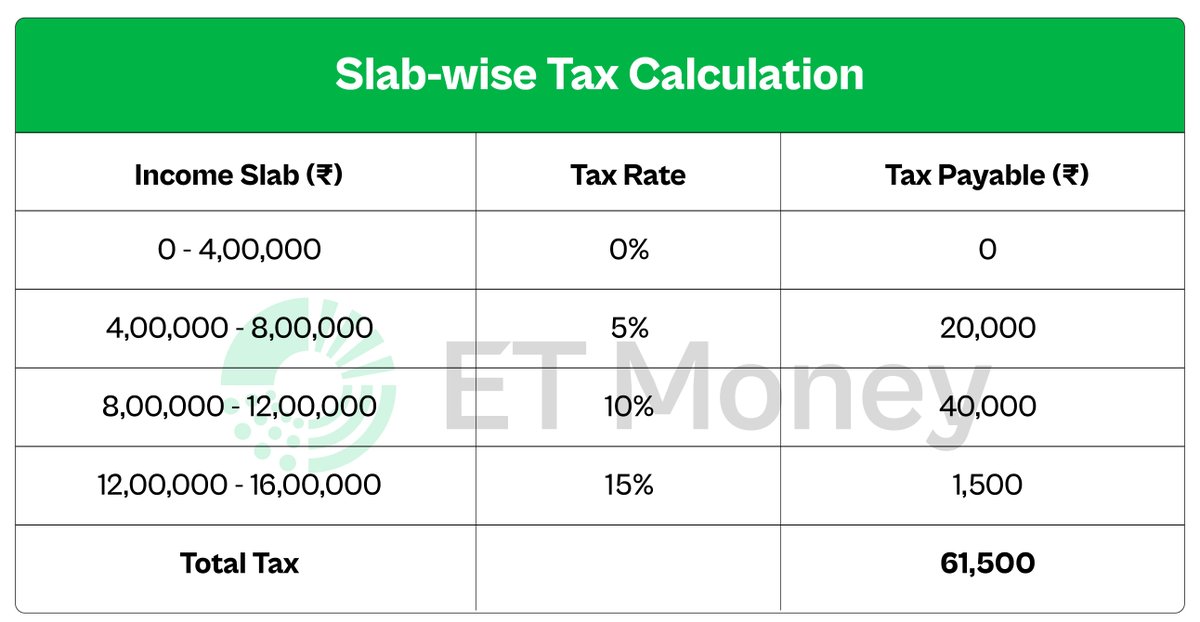

3. A DEDICATED CHAPTER FOR THE NEW TAX REGIME

Currently, updates to the new tax regime are scattered across different sections of the Act.

This makes comparing tax slabs and rates between the old and new regimes difficult.

Currently, updates to the new tax regime are scattered across different sections of the Act.

This makes comparing tax slabs and rates between the old and new regimes difficult.

The bill fixes that.

All details of the new regime will be in one place.

If you’re deciding between the two systems, it just got much easier.

All details of the new regime will be in one place.

If you’re deciding between the two systems, it just got much easier.

4. REMOVAL OF OUTDATED EXEMPTIONS AND DEDUCTIONS

Over the years, many provisions became irrelevant but remained in the law.

The bill cleans up these sections.

For example, Section 54E.

It gave capital gains exemptions for asset transfers before April 1, 1992.

This is no longer needed and has been removed.

Over the years, many provisions became irrelevant but remained in the law.

The bill cleans up these sections.

For example, Section 54E.

It gave capital gains exemptions for asset transfers before April 1, 1992.

This is no longer needed and has been removed.

5. CRYPTO AND DIGITAL TRANSACTIONS

The bill modernises tax laws to reflect today’s economy.

Digital transactions and crypto assets are now explicitly covered.

Before this, they existed in a legal grey area.

The new bill provides more clarity on how they will be taxed.

The bill modernises tax laws to reflect today’s economy.

Digital transactions and crypto assets are now explicitly covered.

Before this, they existed in a legal grey area.

The new bill provides more clarity on how they will be taxed.

6. CBDT GETS MORE POWER

Earlier, the I-T Department had to approach Parliament for procedural changes, new tax schemes, and compliance frameworks.

This caused delays and bureaucratic roadblocks.

Not anymore.

Earlier, the I-T Department had to approach Parliament for procedural changes, new tax schemes, and compliance frameworks.

This caused delays and bureaucratic roadblocks.

Not anymore.

Under Clause 533, the CBDT can introduce tax administration rules, compliance measures, and digital tax monitoring systems on its own.

This means faster tax policy changes and a more adaptive tax system.

Moreover, the new bill replaces dense text with tables for key details, making it easier to understand.

This means faster tax policy changes and a more adaptive tax system.

Moreover, the new bill replaces dense text with tables for key details, making it easier to understand.

If passed, the new I-T bill 2025 will replace the existing Income Tax Act, 1961.

It will come into effect from April 1, 2026.

That gives taxpayers plenty of time to adapt.

It will come into effect from April 1, 2026.

That gives taxpayers plenty of time to adapt.

Which change do you think will help taxpayers the most?

If you found this useful, show some love.❤️

Please like, share, and retweet the first tweet. 👇

Please like, share, and retweet the first tweet. 👇

https://x.com/ETMONEY/status/1889967988847386701

• • •

Missing some Tweet in this thread? You can try to

force a refresh