Javier Milei just DESTROYED the memecoin market:

Hours ago, Argentinian President Milei launched a memecoin, $LIBRA, for "the growth of their economy."

Within 5 hours, over -$4.4 BILLION of market cap was erased.

Is this the biggest rug pull in history?

(a thread)

Hours ago, Argentinian President Milei launched a memecoin, $LIBRA, for "the growth of their economy."

Within 5 hours, over -$4.4 BILLION of market cap was erased.

Is this the biggest rug pull in history?

(a thread)

It all began with this post at 5:01 PM ET from Javier Milei.

As seen during President Trump's memecoin launch, the first hour was full of speculation:

Was this a hack or a real launch?

It turned out to be real as multiple other Argentinian politicians posted the news.

As seen during President Trump's memecoin launch, the first hour was full of speculation:

Was this a hack or a real launch?

It turned out to be real as multiple other Argentinian politicians posted the news.

Right off the bat, something seemed off about this project.

The website says the purpose of this launch is "to boost the Argentine economy by funding small projects."

The icing on the cake?

The website literally links to a Google Form to "apply for funding." Strange.

The website says the purpose of this launch is "to boost the Argentine economy by funding small projects."

The icing on the cake?

The website literally links to a Google Form to "apply for funding." Strange.

But it gets worse.

The website was created hours before launch, as shown below.

The domain was registered for a 1-year registration period.

There is no public owner information and there are multiple restricted domain statuses.

Was this project literally created overnight?

The website was created hours before launch, as shown below.

The domain was registered for a 1-year registration period.

There is no public owner information and there are multiple restricted domain statuses.

Was this project literally created overnight?

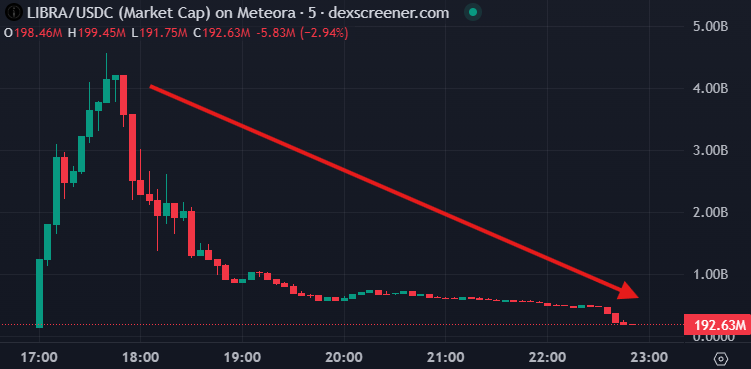

Within 3 hours of the launch, insiders in $LIBRA began cashing out.

According to Bubblemaps, $87.4 MILLION was cashed out within the first 3 hours.

Furthermore, 82% of $LIBRA was held in one cluster and no tokenomics were shared with the public.

But it gets even worse.

According to Bubblemaps, $87.4 MILLION was cashed out within the first 3 hours.

Furthermore, 82% of $LIBRA was held in one cluster and no tokenomics were shared with the public.

But it gets even worse.

As Bubblemaps notes below, insiders were adding one-sided liquidity pools on Meteora with only $LIBRA.

They were removing USD and SOL and used these liquidity pools instead of selling on the market.

$LIBRA fell 90%+ as the $87.4M in sales absorbed all buy pressure at the top.

They were removing USD and SOL and used these liquidity pools instead of selling on the market.

$LIBRA fell 90%+ as the $87.4M in sales absorbed all buy pressure at the top.

Within minutes of the launch, multiple large holders began liquidating MILLIONS of USD worth of $LIBRA.

This included gains of +$4 million or more as $LIBRA rose to $4.6 billion in market cap.

After the top was set at 5:40 PM ET, the coin fell in a literal straight-line.

This included gains of +$4 million or more as $LIBRA rose to $4.6 billion in market cap.

After the top was set at 5:40 PM ET, the coin fell in a literal straight-line.

In fact, these insiders controlled so much of the market that only ~27% of transactions were sales.

This means that LARGE sale transactions were filled by smaller buys, likely to retail traders.

For every seller, there were 2 buyers and over $1.1 BILLION of volume was traded.

This means that LARGE sale transactions were filled by smaller buys, likely to retail traders.

For every seller, there were 2 buyers and over $1.1 BILLION of volume was traded.

Now, Javier Milei has posted that he was "not aware of the details of the project."

He says that after becoming aware of the details, he decided to stop spreading the word and delete the post.

$LIBRA just fell to a new low of $200 million in market cap, erasing $4.4 BILLION.

He says that after becoming aware of the details, he decided to stop spreading the word and delete the post.

$LIBRA just fell to a new low of $200 million in market cap, erasing $4.4 BILLION.

The launch of this coin took so much liquidity out of the market that even $TRUMP coin fell sharply.

We saw over $500 MILLION in market cap erased from $TRUMP after the launch.

More than 50,000 wallets became holders of $LIBRA within the first 2 hours of launch.

We saw over $500 MILLION in market cap erased from $TRUMP after the launch.

More than 50,000 wallets became holders of $LIBRA within the first 2 hours of launch.

This entire event has completely destroyed the majority of liquidity in the memecoin market.

$6+ billion of market cap has been erased over the last 3 hours across the market.

Are memecoins officially dead?

Follow us @KobeissiLetter for real time analysis as this develops.

$6+ billion of market cap has been erased over the last 3 hours across the market.

Are memecoins officially dead?

Follow us @KobeissiLetter for real time analysis as this develops.

This is not the first and it won’t be the last mainstream memecoin launch to rug retail investors.

Early signs of these scams have become increasingly easy to spot.

Be sure to turn on @KobeissiLetter post notifications to stay ahead of the game.

Early signs of these scams have become increasingly easy to spot.

Be sure to turn on @KobeissiLetter post notifications to stay ahead of the game.

• • •

Missing some Tweet in this thread? You can try to

force a refresh