This is absolutely insane:

Since DOGE began discussing mass layoffs, the median home price in Washington DC has FALLEN by -$139,000.

In 30 days, nearly 4,000 homes have been listed for sale in and around Washington DC.

What is happening? Let us explain.

(a thread)

Since DOGE began discussing mass layoffs, the median home price in Washington DC has FALLEN by -$139,000.

In 30 days, nearly 4,000 homes have been listed for sale in and around Washington DC.

What is happening? Let us explain.

(a thread)

Here's a chart showing median home price in the Washington, DC area.

In November 2024, the median home in Washington, DC was worth ~$699,000, according to Redfin.

Today, the median home is worth $560,000, marking a -20% drop in ~3 months.

Mass selling is an understatement.

In November 2024, the median home in Washington, DC was worth ~$699,000, according to Redfin.

Today, the median home is worth $560,000, marking a -20% drop in ~3 months.

Mass selling is an understatement.

There are now nearly 8,000 homes for sale in the Washington, DC metro area.

Nearly HALF of these homes have been listed for sale over the last 30 days.

Since November 2024, nearly 5,000 homes have been listed for sale, well above average.

So, what exactly is happening here?

Nearly HALF of these homes have been listed for sale over the last 30 days.

Since November 2024, nearly 5,000 homes have been listed for sale, well above average.

So, what exactly is happening here?

Year-over-year, home listings in the Washington DC metro area are up ~23%.

Parts of Virginia are seeing 60%-70%+ jumps in year-over-year listings.

Keep in mind, this is during the winter months in a housing market that has been historically LOW on supply.

Truly insane.

Parts of Virginia are seeing 60%-70%+ jumps in year-over-year listings.

Keep in mind, this is during the winter months in a housing market that has been historically LOW on supply.

Truly insane.

Listings accelerated after DOGE's federal employee buyout offer was announced.

The offer pays employees through September 2025 if they quit, with 5%-10% of employees expected agree.

As of this week, 65,000 federal employees have accepted the buyout offer, per WSJ.

The offer pays employees through September 2025 if they quit, with 5%-10% of employees expected agree.

As of this week, 65,000 federal employees have accepted the buyout offer, per WSJ.

Today, Fox News reported that 3,600 probationary Health and Human Services employees were laid off by DOGE.

This is expected to save $600 MILLION in taxpayer dollars annually.

The 65,000 DOGE cuts so far are now saving an estimated ~$38 billion in annual taxpayer dollars.

This is expected to save $600 MILLION in taxpayer dollars annually.

The 65,000 DOGE cuts so far are now saving an estimated ~$38 billion in annual taxpayer dollars.

On day 8 of the formation of @DOGE, the below announcement was made.

DOGE is reportedly saving the US Government $1 billion PER DAY.

This means DOGE could reduce US deficit spending by 20% in YEAR 1.

More layoffs are coming as workforce reduction has been a primary DOGE goal.

DOGE is reportedly saving the US Government $1 billion PER DAY.

This means DOGE could reduce US deficit spending by 20% in YEAR 1.

More layoffs are coming as workforce reduction has been a primary DOGE goal.

Here's where it gets even more interesting:

There has been a SURGE in new listings in Washington, DC with a listing price of $1,000,000+.

There are now 525 listings of $1+ million and 44 listings worth $5+ million.

This suggests high-profile job exits are rising.

There has been a SURGE in new listings in Washington, DC with a listing price of $1,000,000+.

There are now 525 listings of $1+ million and 44 listings worth $5+ million.

This suggests high-profile job exits are rising.

Just wait until we see the effects on commercial real estate in Washington, DC.

DOGE announced plans to eliminate up to TWO-THIRDS of US government office buildings, per WSJ.

Not a single major US government agency is currently occupying even 50% of their office space.

DOGE announced plans to eliminate up to TWO-THIRDS of US government office buildings, per WSJ.

Not a single major US government agency is currently occupying even 50% of their office space.

DOGE has specifically noted that Washington, DC federal government buildings are particularly empty.

On average, they are just 12% occupied.

The Department of Agriculture saw just ~456 of 7,400 employees use their office.

The DC real estate market is just getting started.

On average, they are just 12% occupied.

The Department of Agriculture saw just ~456 of 7,400 employees use their office.

The DC real estate market is just getting started.

If you zoom out further, there are ~15 THOUSAND homes for sale around Washington, DC.

In fact, there are so many homes for sale in the downtown area that Zillow is grouping 280 homes together.

This is an unprecedented level of selling in a generally "strong" housing market.

In fact, there are so many homes for sale in the downtown area that Zillow is grouping 280 homes together.

This is an unprecedented level of selling in a generally "strong" housing market.

Are layoffs and rising inventory in DC a coincidence?

Time will tell. But, we see more layoffs ahead as DOGE looks to cut $4 billion/day.

With US debt up $13 TRILLION since 2020, spending cuts are needed.

Follow us @KobeissiLetter for real time analysis as this develops.

Time will tell. But, we see more layoffs ahead as DOGE looks to cut $4 billion/day.

With US debt up $13 TRILLION since 2020, spending cuts are needed.

Follow us @KobeissiLetter for real time analysis as this develops.

DOGE's goal of rapidly reducing the $1.8 trillion US deficit will impact MULTIPLE markets.

The 10-year note yield has fallen ~40 bps from its high and gold is nearing $3000, even as inflation rebounded.

Subscribe below to see how we are trading it:

thekobeissiletter.com/subscribe

The 10-year note yield has fallen ~40 bps from its high and gold is nearing $3000, even as inflation rebounded.

Subscribe below to see how we are trading it:

thekobeissiletter.com/subscribe

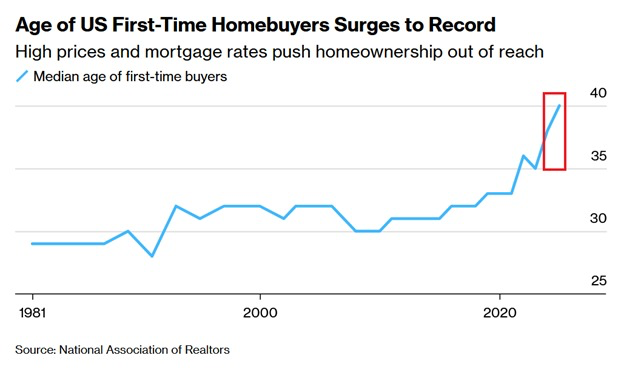

With mortgage demand at 30-year lows, stocks at all time highs, and DOGE disrupting government spending, tons of change is coming.

As investors, we must evolve with this change.

Be sure to turn on @Kobeissiletter post notifications to receive our real-time analysis.

As investors, we must evolve with this change.

Be sure to turn on @Kobeissiletter post notifications to receive our real-time analysis.

• • •

Missing some Tweet in this thread? You can try to

force a refresh