🚨🚨 $ASTS WEEK IN REVIEW🚨🚨

T-Mobile blows its Super Bowl ad on $ASTS, FCC approvals, Anduril CEO is an investor, and more…

T-Mobile blows its Super Bowl ad on $ASTS, FCC approvals, Anduril CEO is an investor, and more…

🤯T-Mobile Advertises…$ASTS?

Wait, what the? Who had this on their bingo card? A T-Mobile advertisement for Starlink causes $ASTS to nearly double? Lol. Stocks are crazy. What's even funnier is that it flushed out that one of the great tech titans revealed he owned $ASTS. We are not alone.

x.com/elonmusk/statu…

x.com/PalmerLuckey/s…

x.com/PCMag/status/1…

Wait, what the? Who had this on their bingo card? A T-Mobile advertisement for Starlink causes $ASTS to nearly double? Lol. Stocks are crazy. What's even funnier is that it flushed out that one of the great tech titans revealed he owned $ASTS. We are not alone.

x.com/elonmusk/statu…

x.com/PalmerLuckey/s…

x.com/PCMag/status/1…

😡T-Mobile Blow Back

T-Mobile also advertised to the US that they are an Elon company. Crazy to see the reaction, but here it is:

T-Mobile also advertised to the US that they are an Elon company. Crazy to see the reaction, but here it is:

https://x.com/KthankS24/status/1888760903727772077

🆙And we had a big change in pattern

Tut summarizes the prior trends, but now the trend broke. Something is afoot.

Tut summarizes the prior trends, but now the trend broke. Something is afoot.

https://x.com/kingtutcap/status/1888801616310288396

🧠What Did We Learn?

We learned a lot. For one, we learned the price floor for D2D and it was WAY higher than the market was assuming. It was cool to see Palmer Luckey talk about what a huge opportunity this was. He would know. His business is built on things that are connected. The Spacemob saw the implications of this immediately.

x.com/KevinLMak/stat…

x.com/Reformed_Trade…

We learned a lot. For one, we learned the price floor for D2D and it was WAY higher than the market was assuming. It was cool to see Palmer Luckey talk about what a huge opportunity this was. He would know. His business is built on things that are connected. The Spacemob saw the implications of this immediately.

x.com/KevinLMak/stat…

x.com/Reformed_Trade…

🎈ARPU Attach Rates Come Into View

Rest assured Wall Street will start to dial this in, and the stock price will follow

Rest assured Wall Street will start to dial this in, and the stock price will follow

https://x.com/mikeddano/status/1889397744873443402

™️He Knows What He Owns

So this happened. The CEO of Anduril. You can do your work, and then randomly someone who reached the same conclusion truly 'influences' the opinion of others, leading to a rapid readjustment of perception. Stunning when it happens.

So this happened. The CEO of Anduril. You can do your work, and then randomly someone who reached the same conclusion truly 'influences' the opinion of others, leading to a rapid readjustment of perception. Stunning when it happens.

https://x.com/PalmerLuckey/status/1888846639877837033

⚓️Why Does Anduril Know?

Jagaloon is on the hunt about ASTS Navy work. More pieces fall into place.

Jagaloon is on the hunt about ASTS Navy work. More pieces fall into place.

https://x.com/Jagaloon6/status/1890770716401786996

💡ASTS is an Exciting Story!

Don't forget the power of captured imaginations

Don't forget the power of captured imaginations

https://x.com/peterlindmark/status/1889080785967161648

🪙Everything, All At Once

It’s September 2025, and people look back and go, “it was right there”

It’s September 2025, and people look back and go, “it was right there”

https://x.com/pk_fund/status/1890332152849400124?s=61

⏩And Faster

I’ve said it each week, but I think we are going to get a shock & awe update

I’ve said it each week, but I think we are going to get a shock & awe update

https://x.com/endless_frank/status/1889707260496269737?s=61

🐬Resulting In…The Free Cash Flow Flippening

Think of ice skating on sand and then skating on ice. One is hard. The other…magical. We are close to detaching from our funding-based anchor and once the business model is humming, all bets are off on where the stock can go.

Think of ice skating on sand and then skating on ice. One is hard. The other…magical. We are close to detaching from our funding-based anchor and once the business model is humming, all bets are off on where the stock can go.

https://x.com/redrum_2001/status/1889786715877032037?s=61

🛰️or🛰️🛰️We keep seeing the ISRO launch as plural

We’ll find out soon enough.

We’ll find out soon enough.

https://x.com/catse___apex___/status/1889749384499282053?s=61

🚦Testing Commencing

US Testing Can Start. Light 'em up.

US Testing Can Start. Light 'em up.

https://x.com/CatSE___ApeX___/status/1890774020947153080

📺Future Advertising Reach

As Tut shows, the future media opportunities where ASTS's MNO partners will highlight the service are astounding

As Tut shows, the future media opportunities where ASTS's MNO partners will highlight the service are astounding

https://x.com/kingtutcap/status/1890815650567778568

💨It’s Too Late, Baby

At first they ignore you. Then they say it’s already over. Then they say, “buy at any price”

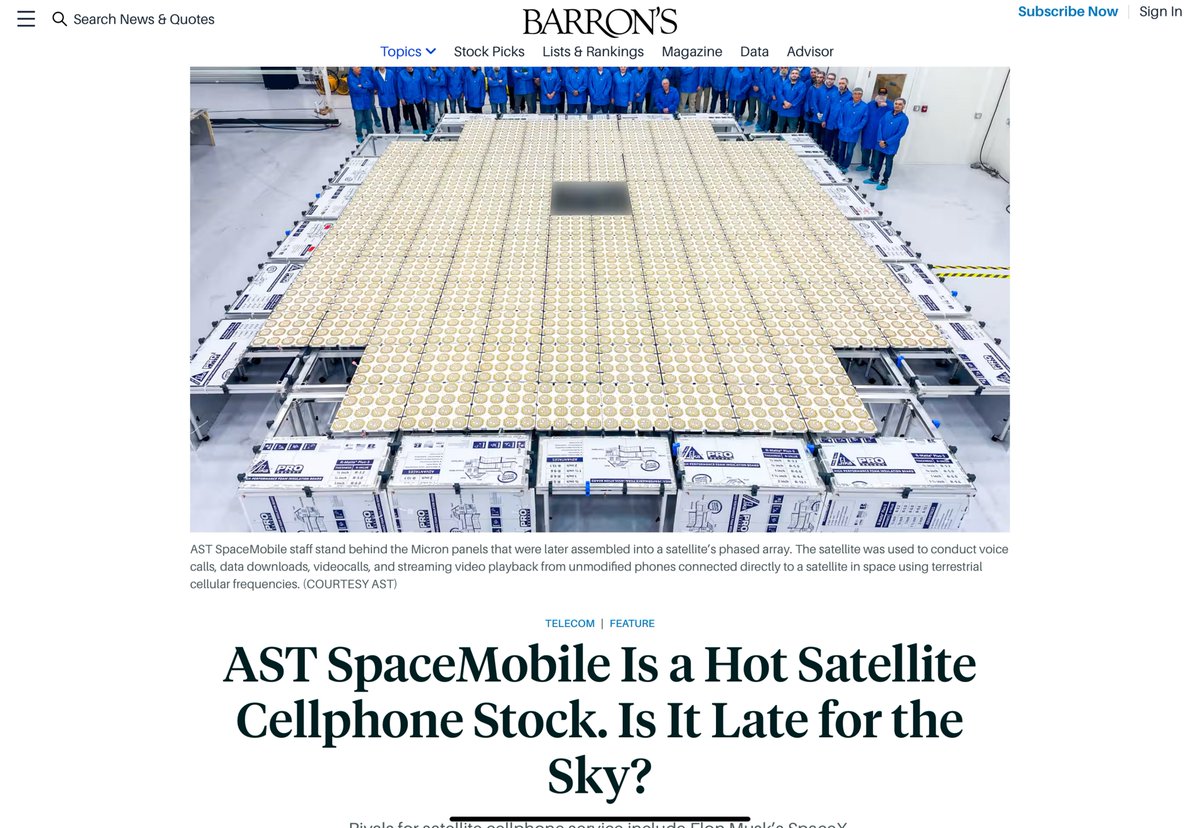

By Adam Clark and Bill Alpert

(Barron's) -- A heavenly battle is brawling for your cellphone.

Overhead, competing rings of satellites are readying cell towers in space that will eliminate dead zones down here. The rivals include Elon Musk's SpaceX, Apple, Amazon.com, and an upstart named AST SpaceMobile.

Since its 2021 initial offering, AST SpaceMobile has lured investors with its aim of delivering 5G-quality voice, data, and video coverage worldwide. It is the only pure stock play on direct-to-cell service.

AST stock rose more than sixfold after announcing partnerships last year with Verizon Communications and AT&T. It has deals with 45 other mobile network operators around the globe. Fans say that gives AST a shot at 2.8 billion wireless subscribers.

Its prospects are dicier than the stock price suggests. The bankruptcies of previous satellite phone ventures cast a shadow on its goal of finding millions of customers who would pay an extra $10 a month for satellite coverage, when it will come cheaper -- or free -- from rivals.

Foremost among those rivals is SpaceX, with over 6,000 Starlink satellites already orbiting and a thriving home internet service to subsidize its cell service. Those watching Sunday's Super Bowl saw an ad in which Starlink cell partner T-Mobile US announced that its own direct-to-cell messaging service is now open for anyone in the U.S. to try, including customers of Verizon and AT&T.

The first satellite phone networks were high-profile flops. Motorola's Iridium sought bankruptcy protection barely a year after its 1998 debut. Globalstar avoided bankruptcy for just a few years more. Their bulky, dedicated phones, and cost of two bucks a minute, found only a couple of hundred thousand subscribers.

The new satellite services will link to everyday cellphones. The idea was already in the air when Musk's SpaceX launched its first 60 satellites in 2019. The next year, space station astronauts helped the start-up Lynk send a text message to an Android phone in the Falklands.

Investors became desperate to follow privately held SpaceX into orbit. More than half a dozen space ventures came public through mergers with special purpose acquisition corporations, or SPACs, in 2021. One of them, AST SpaceMobile, was founded by veteran satellite entrepreneur Abel Avellan. AST promised more than text: the first global satellite broadband for off-the-shelf cellphones.

At an August trade show in 2022, Musk joined T-Mobile to announce that a new generation of Starlink satellites would offer cellular coverage across the U.S., in addition to Starlink's home internet service. Then Apple surprised everyone the next month with the cellphone industry's first satellite service: Each iPhone 14 had free emergency messaging that used Globalstar's satellites and frequencies.

Eager to keep America in the lead of the new direct-to-cell technologies, the Federal Communications Commission proposed regulations in 2023 to let satellite firms use the frequencies reserved for cellphones, if they made a deal with the cell carrier licensed for the frequency. Once approved, T-Mobile customers' unmodified phones will work with SpaceX's Starlink, while AST satellites will service the phones of partners Verizon and AT&T.

"The new rules were written with us in mind," AST President Scott Wisniewski tells Barron's. After the FCC created a dedicated Space Bureau, then completed its regulations for Supplemental Coverage from Space last year, AST moved its satellite licenses from Papua New Guinea to the U.S.

AST didn't launch its first five commercial satellites until September 2024, seven years after the company's formation. In November, the company announced agreements to launch as many as 60 satellites to cover key markets such as the U.S., Europe, and Japan.

The 2025 and 2026 launch program will use rockets from SpaceX, the Jeff Bezos rocket company Blue Origin, and the Indian Space Research Organization. With a 700-square-foot antenna, AST's satellites will be among the largest commercial communications arrays in low Earth orbit. The company bets that its fewer, but bigger, satellites can reach cellphones better than the legions of smaller satellites flown by SpaceX.

AST's big satellites cost a lot: from $19 million to $21 million each.

Wisniewski says the company's five orbiting satellites could provide a total of 30 minutes of coverage a day for any particular location. For half-time coverage of the U.S. and Europe, AST will require 20 more satellites. A total of 40 to 50 satellites will be needed to deliver coverage around the clock.

At $20 million apiece, building and launching 50 satellites would use up the $1 billion in cash that AST now has on its balance sheet; the company must also fund $100 million or more in annual operating losses. The full constellation of nearly 250 satellites, for which AST has sought FCC approval, could cost about $4.9 billion, not counting operating expenses.

For a company with a $7.2 billion enterprise value, raising the money for a satellite fleet will dilute shareholders materially, at today's $28 stock price. The stock showed its sensitivity to dilutive capital raises when it dropped 18% a few weeks ago on AST's announcement of a $460 million convertible note offering that could convert to 3% of its shares outstanding.

Wisniewski said an initial fleet of 20 satellites providing half a day's service should be enough to get AST to break-even cash flow. "With 40 to 50 satellites, we feel we will be very much on our front foot and positioned to win," says Wisniewski. "We'll add more, but it will be demand based."

To make a case for the billions that AST must raise for its satellites, bulls say that it will find millions of users. Deutsche Bank's Bryan Kraft is the biggest optimist, justifying his Street-high $53 target price for the stock with a projection for nearly $5 billion in yearly revenue by 2030.

He predicts that 12 million people will subscribe for supplemental satellite cell service at $10 a month, with another 300 million paying $5 a day for occasional day passes. Some 125 million others in the developing nations will pay $1 a month to use AST satellites as their primary broadband connection, Kraft believes.

AST hasn't yet said exactly how much it intends to charge for its supplemental service, although executives have spoken of monthly subscription fees in the $10 to $15 range, with revenue split equally between the company and its carrier partners.

"We think there is a ton of demand," says Wisniewski.

But those forecasts for AST's subscribers and pricing might not be easy to achieve, given the extent of terrestrial coverage and the competition from Starlink and others.

Dead zones exist, but nearly 97% of U.S. households now have access to terrestrial 5G broadband service, according to the FCC's year-end 2024 report on the communications marketplace. Household access to 5G in the United Kingdom is only about 80%, but close to 100% in most of Europe's affluent countries. The prior-generation broadband service called 4G LTE has even wider coverage.

The question for satellite phone subscriptions is: How much time do those households spend beyond cell tower reach? Studying that question globally, the wireless researchers at Opensignal found that subscribers in the U.S. and the U.K. spend 1% of their time in places with no tower signal.

As for price levels, the FCC report shows that mobile broadband prices in Germany match those in the U.S. but are cheaper in France and Italy, and far cheaper in the U.K. and Spain. A $10 add-on subscription might be hard to sell abroad.

However large the total market proves for satellite phone service, AST's pricing power will also face competition.

Apple's free iPhone satellite service, available since 2022, can send only terse SOS messages and the phone's location to friends and emergency responders. But Apple thinks enough of the feature to have supplied $1.7 billion in financing to Globalstar. That gives Apple 20% ownership of Globalstar's direct-to-cell service, and covers most of the cost of upgrading satellites and ground stations to allow expanded services in the next couple of years.

Musk's SpaceX is ready to roll. T-Mobile says Starlink service will be included free in its best wireless plans, once beta tests end in July. Lower-tier plans can add satellite coverage for $15 a month, or $10 for those who take part in the beta trial. Even Verizon and AT&T customers will be able to have the service for $20 a month.

T-Mobile Starlink will be text-messaging at first, said T-Mobile CEO Mike Sievert in the company's Super Bowl announcement. Picture messages, data, and voice calls will follow.

Starlink's coverage will be hard for other satellite networks to match. It has launched more than 350 satellites equipped for direct-to-cellphone service, and plans to double that number by mid-2025. SpaceX rockets can carry 60 of the birds per launch, and the FCC has given permission for up to 7,500 of the new-generation satellites. Ultimately, Starlink sees its constellation growing to 40,000.

After several years of delay, Amazon is also entering the internet space race, with FCC approval to launch over 3,200 satellites for its Project Kuiper. It has committed over $10 billion. Amazon has told regulators it is exploring options for direct-to-cell services.

"[AST executives] have to say they're going to offer something orders of magnitude better than those services if they're going to try and charge for it. Because if [another service] is free, they're screwed," says Tim Farrar, a telecom industry analyst and consultant in satellite communications.

AST's Wisniewski is confident that the company's broadband service will prove more valuable than the lower-grade service of rivals. Amazon said it wasn't yet ready to talk about its Kuiper plans. SpaceX didn't respond to requests for comment.

AST is progressing. In January, its British partner, Vodafone, demonstrated what it claimed was a "world's first" video satellite call though AST satellites to a standard smartphone on a Welsh hilltop with no terrestrial coverage. In late January, the FCC authorized AT&T and Verizon to start testing AST's service on a few thousand phones each.

Providing voice service and some video to a demonstration phone is one thing. Serving up 5G-quality broadband concurrently to thousands of moving phones is a technical challenge.

"A modern cellphone is essentially an underpowered, poorly located satellite antenna for a cell tower in space," said Sara Spangelo, the co-leader of SpaceX's direct-to-cell program, at a conference a few years back. To better reach cellphones, SpaceX has asked the FCC to let Starlink satellites transmit at higher power and with narrower safeguards protecting neighboring frequencies from interference.

In common with other stocks that came to the market via SPAC deals, AST has a strong retail investor following. Some institutional fans recognize there is a degree of risk. AST is the single biggest holding in the Hennessy Focus fund, a high-conviction concentrated portfolio run by California-based Hennessy Funds. It recently removed a warning about the potential for a "complete capital loss" on the investment, but still classifies it as a "special situation."

Others remain skeptical. Some 27% of AST's free-trading shares have been sold short by those betting the stock will drop.

So far, AST SpaceMobile's celestial broadband quest has defied skeptics. Some of the world's biggest carriers have bought in, and five functioning satellites now fly overhead. For its numbers to work -- not to mention its stock -- it will have to find millions of callers willing to pay a premium above what rivals like SpaceX charge.

Write to Adam Clark at adam.clark@barrons.com and Bill Alpert at william.alpert@barrons.com

This content was created by Barron's, which is operated by Dow Jones & Co. Barron's is published independently from Dow Jones Newswires and The Wall Street Journal.

At first they ignore you. Then they say it’s already over. Then they say, “buy at any price”

By Adam Clark and Bill Alpert

(Barron's) -- A heavenly battle is brawling for your cellphone.

Overhead, competing rings of satellites are readying cell towers in space that will eliminate dead zones down here. The rivals include Elon Musk's SpaceX, Apple, Amazon.com, and an upstart named AST SpaceMobile.

Since its 2021 initial offering, AST SpaceMobile has lured investors with its aim of delivering 5G-quality voice, data, and video coverage worldwide. It is the only pure stock play on direct-to-cell service.

AST stock rose more than sixfold after announcing partnerships last year with Verizon Communications and AT&T. It has deals with 45 other mobile network operators around the globe. Fans say that gives AST a shot at 2.8 billion wireless subscribers.

Its prospects are dicier than the stock price suggests. The bankruptcies of previous satellite phone ventures cast a shadow on its goal of finding millions of customers who would pay an extra $10 a month for satellite coverage, when it will come cheaper -- or free -- from rivals.

Foremost among those rivals is SpaceX, with over 6,000 Starlink satellites already orbiting and a thriving home internet service to subsidize its cell service. Those watching Sunday's Super Bowl saw an ad in which Starlink cell partner T-Mobile US announced that its own direct-to-cell messaging service is now open for anyone in the U.S. to try, including customers of Verizon and AT&T.

The first satellite phone networks were high-profile flops. Motorola's Iridium sought bankruptcy protection barely a year after its 1998 debut. Globalstar avoided bankruptcy for just a few years more. Their bulky, dedicated phones, and cost of two bucks a minute, found only a couple of hundred thousand subscribers.

The new satellite services will link to everyday cellphones. The idea was already in the air when Musk's SpaceX launched its first 60 satellites in 2019. The next year, space station astronauts helped the start-up Lynk send a text message to an Android phone in the Falklands.

Investors became desperate to follow privately held SpaceX into orbit. More than half a dozen space ventures came public through mergers with special purpose acquisition corporations, or SPACs, in 2021. One of them, AST SpaceMobile, was founded by veteran satellite entrepreneur Abel Avellan. AST promised more than text: the first global satellite broadband for off-the-shelf cellphones.

At an August trade show in 2022, Musk joined T-Mobile to announce that a new generation of Starlink satellites would offer cellular coverage across the U.S., in addition to Starlink's home internet service. Then Apple surprised everyone the next month with the cellphone industry's first satellite service: Each iPhone 14 had free emergency messaging that used Globalstar's satellites and frequencies.

Eager to keep America in the lead of the new direct-to-cell technologies, the Federal Communications Commission proposed regulations in 2023 to let satellite firms use the frequencies reserved for cellphones, if they made a deal with the cell carrier licensed for the frequency. Once approved, T-Mobile customers' unmodified phones will work with SpaceX's Starlink, while AST satellites will service the phones of partners Verizon and AT&T.

"The new rules were written with us in mind," AST President Scott Wisniewski tells Barron's. After the FCC created a dedicated Space Bureau, then completed its regulations for Supplemental Coverage from Space last year, AST moved its satellite licenses from Papua New Guinea to the U.S.

AST didn't launch its first five commercial satellites until September 2024, seven years after the company's formation. In November, the company announced agreements to launch as many as 60 satellites to cover key markets such as the U.S., Europe, and Japan.

The 2025 and 2026 launch program will use rockets from SpaceX, the Jeff Bezos rocket company Blue Origin, and the Indian Space Research Organization. With a 700-square-foot antenna, AST's satellites will be among the largest commercial communications arrays in low Earth orbit. The company bets that its fewer, but bigger, satellites can reach cellphones better than the legions of smaller satellites flown by SpaceX.

AST's big satellites cost a lot: from $19 million to $21 million each.

Wisniewski says the company's five orbiting satellites could provide a total of 30 minutes of coverage a day for any particular location. For half-time coverage of the U.S. and Europe, AST will require 20 more satellites. A total of 40 to 50 satellites will be needed to deliver coverage around the clock.

At $20 million apiece, building and launching 50 satellites would use up the $1 billion in cash that AST now has on its balance sheet; the company must also fund $100 million or more in annual operating losses. The full constellation of nearly 250 satellites, for which AST has sought FCC approval, could cost about $4.9 billion, not counting operating expenses.

For a company with a $7.2 billion enterprise value, raising the money for a satellite fleet will dilute shareholders materially, at today's $28 stock price. The stock showed its sensitivity to dilutive capital raises when it dropped 18% a few weeks ago on AST's announcement of a $460 million convertible note offering that could convert to 3% of its shares outstanding.

Wisniewski said an initial fleet of 20 satellites providing half a day's service should be enough to get AST to break-even cash flow. "With 40 to 50 satellites, we feel we will be very much on our front foot and positioned to win," says Wisniewski. "We'll add more, but it will be demand based."

To make a case for the billions that AST must raise for its satellites, bulls say that it will find millions of users. Deutsche Bank's Bryan Kraft is the biggest optimist, justifying his Street-high $53 target price for the stock with a projection for nearly $5 billion in yearly revenue by 2030.

He predicts that 12 million people will subscribe for supplemental satellite cell service at $10 a month, with another 300 million paying $5 a day for occasional day passes. Some 125 million others in the developing nations will pay $1 a month to use AST satellites as their primary broadband connection, Kraft believes.

AST hasn't yet said exactly how much it intends to charge for its supplemental service, although executives have spoken of monthly subscription fees in the $10 to $15 range, with revenue split equally between the company and its carrier partners.

"We think there is a ton of demand," says Wisniewski.

But those forecasts for AST's subscribers and pricing might not be easy to achieve, given the extent of terrestrial coverage and the competition from Starlink and others.

Dead zones exist, but nearly 97% of U.S. households now have access to terrestrial 5G broadband service, according to the FCC's year-end 2024 report on the communications marketplace. Household access to 5G in the United Kingdom is only about 80%, but close to 100% in most of Europe's affluent countries. The prior-generation broadband service called 4G LTE has even wider coverage.

The question for satellite phone subscriptions is: How much time do those households spend beyond cell tower reach? Studying that question globally, the wireless researchers at Opensignal found that subscribers in the U.S. and the U.K. spend 1% of their time in places with no tower signal.

As for price levels, the FCC report shows that mobile broadband prices in Germany match those in the U.S. but are cheaper in France and Italy, and far cheaper in the U.K. and Spain. A $10 add-on subscription might be hard to sell abroad.

However large the total market proves for satellite phone service, AST's pricing power will also face competition.

Apple's free iPhone satellite service, available since 2022, can send only terse SOS messages and the phone's location to friends and emergency responders. But Apple thinks enough of the feature to have supplied $1.7 billion in financing to Globalstar. That gives Apple 20% ownership of Globalstar's direct-to-cell service, and covers most of the cost of upgrading satellites and ground stations to allow expanded services in the next couple of years.

Musk's SpaceX is ready to roll. T-Mobile says Starlink service will be included free in its best wireless plans, once beta tests end in July. Lower-tier plans can add satellite coverage for $15 a month, or $10 for those who take part in the beta trial. Even Verizon and AT&T customers will be able to have the service for $20 a month.

T-Mobile Starlink will be text-messaging at first, said T-Mobile CEO Mike Sievert in the company's Super Bowl announcement. Picture messages, data, and voice calls will follow.

Starlink's coverage will be hard for other satellite networks to match. It has launched more than 350 satellites equipped for direct-to-cellphone service, and plans to double that number by mid-2025. SpaceX rockets can carry 60 of the birds per launch, and the FCC has given permission for up to 7,500 of the new-generation satellites. Ultimately, Starlink sees its constellation growing to 40,000.

After several years of delay, Amazon is also entering the internet space race, with FCC approval to launch over 3,200 satellites for its Project Kuiper. It has committed over $10 billion. Amazon has told regulators it is exploring options for direct-to-cell services.

"[AST executives] have to say they're going to offer something orders of magnitude better than those services if they're going to try and charge for it. Because if [another service] is free, they're screwed," says Tim Farrar, a telecom industry analyst and consultant in satellite communications.

AST's Wisniewski is confident that the company's broadband service will prove more valuable than the lower-grade service of rivals. Amazon said it wasn't yet ready to talk about its Kuiper plans. SpaceX didn't respond to requests for comment.

AST is progressing. In January, its British partner, Vodafone, demonstrated what it claimed was a "world's first" video satellite call though AST satellites to a standard smartphone on a Welsh hilltop with no terrestrial coverage. In late January, the FCC authorized AT&T and Verizon to start testing AST's service on a few thousand phones each.

Providing voice service and some video to a demonstration phone is one thing. Serving up 5G-quality broadband concurrently to thousands of moving phones is a technical challenge.

"A modern cellphone is essentially an underpowered, poorly located satellite antenna for a cell tower in space," said Sara Spangelo, the co-leader of SpaceX's direct-to-cell program, at a conference a few years back. To better reach cellphones, SpaceX has asked the FCC to let Starlink satellites transmit at higher power and with narrower safeguards protecting neighboring frequencies from interference.

In common with other stocks that came to the market via SPAC deals, AST has a strong retail investor following. Some institutional fans recognize there is a degree of risk. AST is the single biggest holding in the Hennessy Focus fund, a high-conviction concentrated portfolio run by California-based Hennessy Funds. It recently removed a warning about the potential for a "complete capital loss" on the investment, but still classifies it as a "special situation."

Others remain skeptical. Some 27% of AST's free-trading shares have been sold short by those betting the stock will drop.

So far, AST SpaceMobile's celestial broadband quest has defied skeptics. Some of the world's biggest carriers have bought in, and five functioning satellites now fly overhead. For its numbers to work -- not to mention its stock -- it will have to find millions of callers willing to pay a premium above what rivals like SpaceX charge.

Write to Adam Clark at adam.clark@barrons.com and Bill Alpert at william.alpert@barrons.com

This content was created by Barron's, which is operated by Dow Jones & Co. Barron's is published independently from Dow Jones Newswires and The Wall Street Journal.

🙉T Rowe Ignored The Experts

The change in the holders list is happening. This will help prevent large draw downs going forward and to the upside, bring real buying power

The change in the holders list is happening. This will help prevent large draw downs going forward and to the upside, bring real buying power

🪨Scotia Bank Is a Rock

Credit to this analyst for doing his own work over the last few years, despite the volatility and contrary opinion. I hope his bosses see true independent thinking and reward it.

Credit to this analyst for doing his own work over the last few years, despite the volatility and contrary opinion. I hope his bosses see true independent thinking and reward it.

https://x.com/spaceinvestor_d/status/1889304549103428023?s=61

🪖Shorts Run For Cover

The net short interest decreased…we know that convert holders would have adjusted their delta hedges. So the true outright short position did in fact decrease a bit.

We are on the path to being a normal company. Shorts are starting to realize the flaw in their short thesis.

460,000,000 / 1,000 =460,000 bonds with $1,000 face

460,000 * 37.037 =17,037,020 underlying shares of converts

17,000,000 * .6 =10,200,000 total shares of arbs

10,200,000 * .6 =6,120,000 shares to short on 60 delta

10,200,000 * .9 =9,180,000 shares to short on 90 delta

So +3MM shares on recent move

So short interest decreased by 3MM, but hedgers would have increased by 3MM shares. That means true short interest decreased by around 6MM shares.

x.com/spacanpanman/s…

The net short interest decreased…we know that convert holders would have adjusted their delta hedges. So the true outright short position did in fact decrease a bit.

We are on the path to being a normal company. Shorts are starting to realize the flaw in their short thesis.

460,000,000 / 1,000 =460,000 bonds with $1,000 face

460,000 * 37.037 =17,037,020 underlying shares of converts

17,000,000 * .6 =10,200,000 total shares of arbs

10,200,000 * .6 =6,120,000 shares to short on 60 delta

10,200,000 * .9 =9,180,000 shares to short on 90 delta

So +3MM shares on recent move

So short interest decreased by 3MM, but hedgers would have increased by 3MM shares. That means true short interest decreased by around 6MM shares.

x.com/spacanpanman/s…

📅What Events Are Coming?

We have a Verizon DA coming, and we will get a FirstNet announcement at some point.

We have a Verizon DA coming, and we will get a FirstNet announcement at some point.

https://x.com/cytoplasmicana/status/1890472833819541597?s=61

⚔️Tail Upside - Starwars

To a man with a large phased array, the world looks like an RF application.

I still maintain that $ASTS will get large government deals for complex radar systems.

x.com/catse___apex__…

x.com/sempercitiussd…

x.com/spacenews_inc/…

To a man with a large phased array, the world looks like an RF application.

I still maintain that $ASTS will get large government deals for complex radar systems.

x.com/catse___apex__…

x.com/sempercitiussd…

x.com/spacenews_inc/…

✅Nice To Have 3rd Party Validation

Technology validated. Market opportunity validated (saving them from KDDI roaming). Timing validated. Only a matter of time until the US normies on Wall Street figure this out and I’ll say it again, my belief is that $ASTS becomes THE STOCK people talk about. All people. Not just #Spacemob people.

x.com/spacanpanman/s…

x.com/spacanpanman/s…

Technology validated. Market opportunity validated (saving them from KDDI roaming). Timing validated. Only a matter of time until the US normies on Wall Street figure this out and I’ll say it again, my belief is that $ASTS becomes THE STOCK people talk about. All people. Not just #Spacemob people.

x.com/spacanpanman/s…

x.com/spacanpanman/s…

🧙♂️What Do The Chart Guys Say

They maybe it will go up, or down. But for sure one of the two.

They maybe it will go up, or down. But for sure one of the two.

https://x.com/Reformed_Trader/status/1890514085927645551

🪦All the FUD Dies

As we’ve been saying…

As we’ve been saying…

https://x.com/catse___apex___/status/1889722463715570101?s=61

🤡The Dumbest Guy in the Room 🤣🤣🤣

Tim really needs to clam it. He says the richest man in the world, who literally is entirely focused on ROÍ so much so he’s reorganizing the United States of America based on ROÍ…does not care about ROÍ in a capital intensive business? He thinks Starlink is going to blow itself up by not earning its cost of capital? Why do people invite this clown to conferences anymore?

““Starlink does not care about ROI. Today Starlink are closing in on 2 million US broadband subs in the US, 200-300k of which came from substituting traditional terrestrial broadband. At present the service costs $120/month and usage is 300-400GB. They have enough capacity for 5 million US subscribers by 2028, but he thinks they will have to cut price to get there (and that they will). Worryingly he does not think ROI is a key metric for Starlink, and what matters more is the ability to keep the satellite story going.”

advanced-television.com/2025/02/14/ban…

Tim really needs to clam it. He says the richest man in the world, who literally is entirely focused on ROÍ so much so he’s reorganizing the United States of America based on ROÍ…does not care about ROÍ in a capital intensive business? He thinks Starlink is going to blow itself up by not earning its cost of capital? Why do people invite this clown to conferences anymore?

““Starlink does not care about ROI. Today Starlink are closing in on 2 million US broadband subs in the US, 200-300k of which came from substituting traditional terrestrial broadband. At present the service costs $120/month and usage is 300-400GB. They have enough capacity for 5 million US subscribers by 2028, but he thinks they will have to cut price to get there (and that they will). Worryingly he does not think ROI is a key metric for Starlink, and what matters more is the ability to keep the satellite story going.”

advanced-television.com/2025/02/14/ban…

🐘Warming Up Our Big Ride

SpaceX is our workforce, but the big blue thing is going to keep getting its cadence

Interesting thought experiment - if $ASTS could get the insurance for it, is it worth the risk to put 3 birds on the next New Glenn launch? Upside - probably a discounted ride to space and just get them up faster. Downside - if NG is still shaking down, market might just be idiotic. If something goes wrong, you get your insurance proceeds but lose all the associated SG&A and lost time. Probably makes sense to wait if I were $ASTS, but let’s see what happens.

x.com/spacenews_inc/…

SpaceX is our workforce, but the big blue thing is going to keep getting its cadence

Interesting thought experiment - if $ASTS could get the insurance for it, is it worth the risk to put 3 birds on the next New Glenn launch? Upside - probably a discounted ride to space and just get them up faster. Downside - if NG is still shaking down, market might just be idiotic. If something goes wrong, you get your insurance proceeds but lose all the associated SG&A and lost time. Probably makes sense to wait if I were $ASTS, but let’s see what happens.

x.com/spacenews_inc/…

🖇️Surprisingly, Lynk Gets Money

Riding on the coattails of excitement. Reminds me of Shift, Vroom, etc trying to chase $CVNA. Good luck to people trying to be a weak #3 or #4 in a market.

Riding on the coattails of excitement. Reminds me of Shift, Vroom, etc trying to chase $CVNA. Good luck to people trying to be a weak #3 or #4 in a market.

https://x.com/spacenews_inc/status/1890184975468613801?s=61

💩Not Surprisingly, Starlink Service Is Not Good

What a frustrating consumer experience.

What a frustrating consumer experience.

https://x.com/KthankS24/status/1890764093524484204

🤱Stop Complaining about ASTS IR

The literally won an award for being good at it

The literally won an award for being good at it

https://x.com/AST_SpaceMobile/status/1889374470101459080

Spaces tomorrow. I'll target 6 pm PST / 9 pm EST.

• • •

Missing some Tweet in this thread? You can try to

force a refresh