I dug through the 13F filings and, by my count, there were 1,573 institutions with long exposure to Bitcoin in Q4 2024.

These include banks, hedge funds, RIAs, family offices, endowments, pensions, sovereign wealth funds, & other asset managers.

Below are some major findings 🧵

These include banks, hedge funds, RIAs, family offices, endowments, pensions, sovereign wealth funds, & other asset managers.

Below are some major findings 🧵

Before we get into it, I want to clarify what a 13F filing actually is.

Every quarter, large investment firms (>$100 million AUM) must submit this form to the SEC, disclosing their holdings of U.S. stocks and equity-related assets such as ETFs, REITs, options, and convertible bonds.

What's important to understand is a 13F filing ONLY contains a firm's long positions in U.S. equity-related assets.

So it excludes assets like: bonds, real estate, commodities, precious metals, private investments (hedge funds, venture capital, etc.), futures, spot Bitcoin, cash, foreign equities/currencies, and short positions.

As a result, a 13F provides an incomplete picture of a firm's total portfolio.

We don't know a firm's positions in other assets classes relative to its allocation to U.S. equity-related assets, nor do we know if a long position is just serving as a hedge against a short position elsewhere.

Every quarter, large investment firms (>$100 million AUM) must submit this form to the SEC, disclosing their holdings of U.S. stocks and equity-related assets such as ETFs, REITs, options, and convertible bonds.

What's important to understand is a 13F filing ONLY contains a firm's long positions in U.S. equity-related assets.

So it excludes assets like: bonds, real estate, commodities, precious metals, private investments (hedge funds, venture capital, etc.), futures, spot Bitcoin, cash, foreign equities/currencies, and short positions.

As a result, a 13F provides an incomplete picture of a firm's total portfolio.

We don't know a firm's positions in other assets classes relative to its allocation to U.S. equity-related assets, nor do we know if a long position is just serving as a hedge against a short position elsewhere.

I bring this up because I'll be discussing Bitcoin position sizes in these filings—but keep in mind, these reflect only the firms' U.S. equity allocation.

In reality, their actual Bitcoin position sizes are likely smaller, assuming they also invest across other asset classes.

In reality, their actual Bitcoin position sizes are likely smaller, assuming they also invest across other asset classes.

A good example: the Abu Dhabi sovereign wealth fund recently disclosed $IBIT holdings—one of the most exciting filings yet.

Bitcoin was the second-largest position in the filing, with ~$437M worth of exposure.

But here's the thing...the 13F only reported $20B in AUM, while the fund’s actual total AUM is $302B.

In other words, the 13F filing accounts for just ~6.6% of the fund’s total holdings.

This makes sense since the fund invests across a broad range of asset classes around the world, well beyond just U.S. equities.

So, in reality, Bitcoin represents 0.1% of the fund’s total portfolio, not 2.1%—but even at this size, it's still a major positive development.

Bitcoin was the second-largest position in the filing, with ~$437M worth of exposure.

But here's the thing...the 13F only reported $20B in AUM, while the fund’s actual total AUM is $302B.

In other words, the 13F filing accounts for just ~6.6% of the fund’s total holdings.

This makes sense since the fund invests across a broad range of asset classes around the world, well beyond just U.S. equities.

So, in reality, Bitcoin represents 0.1% of the fund’s total portfolio, not 2.1%—but even at this size, it's still a major positive development.

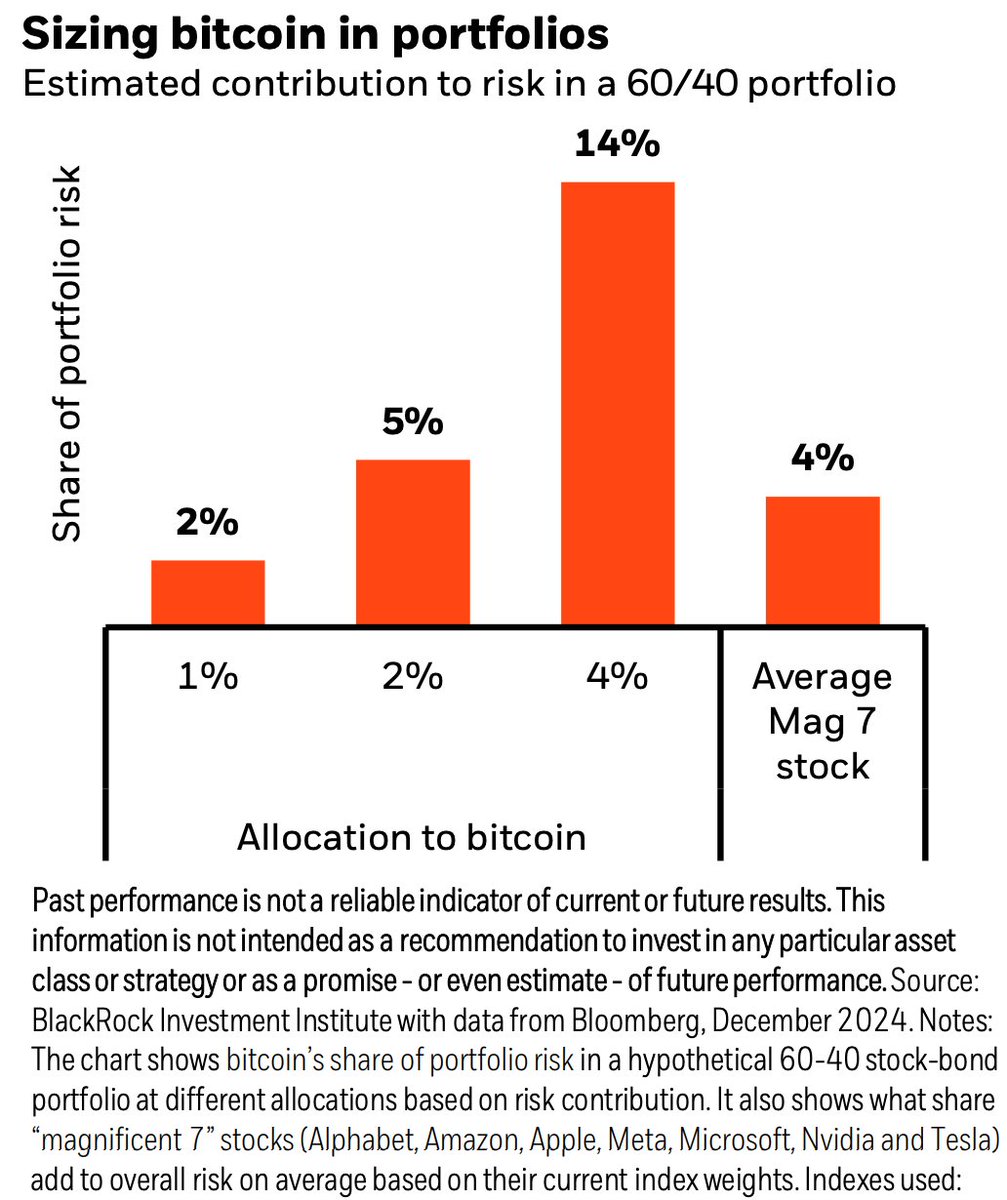

With this in mind, the median Bitcoin position across all institutions in these 13F filings was only 0.13%.

That's tiny...and bullish. It suggests Bitcoin is still in the very early innings of institutional adoption.

Reminder: BlackRock recently recommended a 1-2% allocation.

That's tiny...and bullish. It suggests Bitcoin is still in the very early innings of institutional adoption.

Reminder: BlackRock recently recommended a 1-2% allocation.

But there were a handful of these investment firms that had larger Bitcoin allocations than their peers—and they also just happen to be run by some of the best money managers with proven track records.

Here are some of the most interesting filings that caught my eye...

Here are some of the most interesting filings that caught my eye...

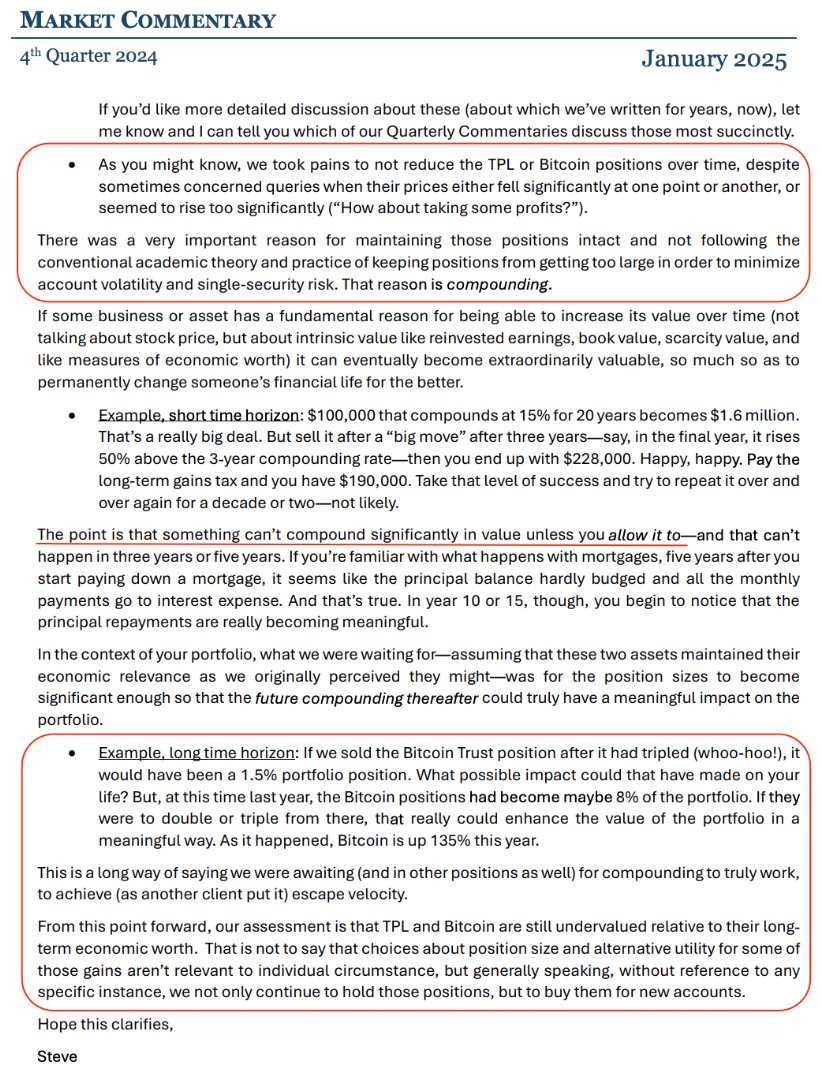

1.) Horizon Kinetics

Horizon Kinetics's second-largest position is BTC (16.16%), with ~$1.3B worth of exposure.

Murray Stahl, one of the most brilliant minds in investing, runs this firm.

In their Q4 commentary, they explained why they haven't rebalanced their BTC position.👇

Horizon Kinetics's second-largest position is BTC (16.16%), with ~$1.3B worth of exposure.

Murray Stahl, one of the most brilliant minds in investing, runs this firm.

In their Q4 commentary, they explained why they haven't rebalanced their BTC position.👇

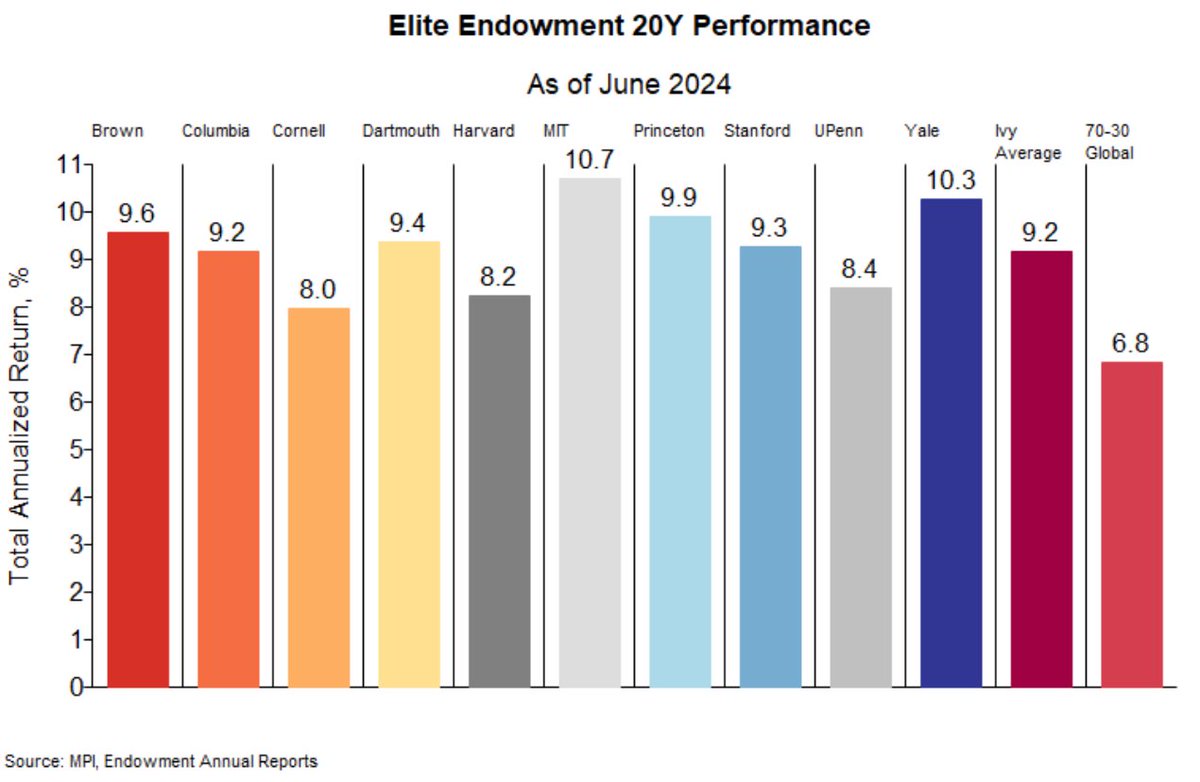

2.) Bracebridge Capital

Its largest position is BTC (23.6%), with ~$334m worth of exposure.

Led by Nancy Zimmerman, it manages money for foundations, pension funds, HNWIs, and oversees portions of two of the best-performing endowments of the last 20 years—Yale and Princeton.

Its largest position is BTC (23.6%), with ~$334m worth of exposure.

Led by Nancy Zimmerman, it manages money for foundations, pension funds, HNWIs, and oversees portions of two of the best-performing endowments of the last 20 years—Yale and Princeton.

3.) Tudor Investment Corp

Tudor's largest position is BTC (1.625%), with ~$436m worth of exposure.

This filing made some headlines and for good reason.

Paul Tudor Jones is one of the greatest investors of his generation. Last month, he talked about why he owns Bitcoin today.👇

Tudor's largest position is BTC (1.625%), with ~$436m worth of exposure.

This filing made some headlines and for good reason.

Paul Tudor Jones is one of the greatest investors of his generation. Last month, he talked about why he owns Bitcoin today.👇

4.) Fortress Investment Group

Its fourth-largest position is BTC (11.2%), with ~$70m worth of exposure.

Note: Mubadala—the Abu Dhabi Sovereign Wealth Fund— acquired 68% of Fortress last year, making it the majority owner.

So really, this is just more BTC exposure for the UAE.

Its fourth-largest position is BTC (11.2%), with ~$70m worth of exposure.

Note: Mubadala—the Abu Dhabi Sovereign Wealth Fund— acquired 68% of Fortress last year, making it the majority owner.

So really, this is just more BTC exposure for the UAE.

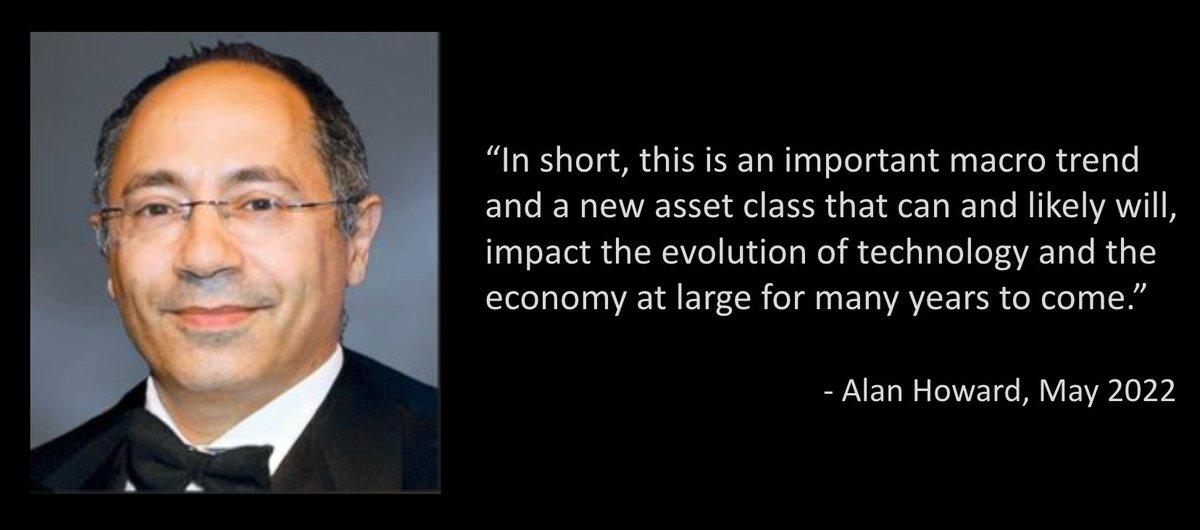

5.) Brevan Howard

Its second-largest position is BTC (8.74%), with ~$1.4B worth of exposure.

The folks at BH have been bulls for years. The massive macro fund knows something about holding.

During the 2022 bear market, with BTC down -50%, billionaire Alan Howard said this.👇

Its second-largest position is BTC (8.74%), with ~$1.4B worth of exposure.

The folks at BH have been bulls for years. The massive macro fund knows something about holding.

During the 2022 bear market, with BTC down -50%, billionaire Alan Howard said this.👇

6.) Discovery Capital Management

Its fifth-largest position is BTC (4.6%), with ~$68m worth of exposure.

Discovery is led by Robert Citrone, who worked with Julian Robertson & George Soros and is a minority owner of the Pittsburgh Steelers. He explained why he focuses on BTC.👇

Its fifth-largest position is BTC (4.6%), with ~$68m worth of exposure.

Discovery is led by Robert Citrone, who worked with Julian Robertson & George Soros and is a minority owner of the Pittsburgh Steelers. He explained why he focuses on BTC.👇

7.) Jericho Capital

Its fifth-largest position is BTC (5.4%), with ~$378m worth of exposure.

Led by Josh Resnick, Jericho has had quite an impressive run—growing from $36m in 2009 to over $7B AUM today.

And wouldn't you know it...look who he worked with early in his career. 👀

Its fifth-largest position is BTC (5.4%), with ~$378m worth of exposure.

Led by Josh Resnick, Jericho has had quite an impressive run—growing from $36m in 2009 to over $7B AUM today.

And wouldn't you know it...look who he worked with early in his career. 👀

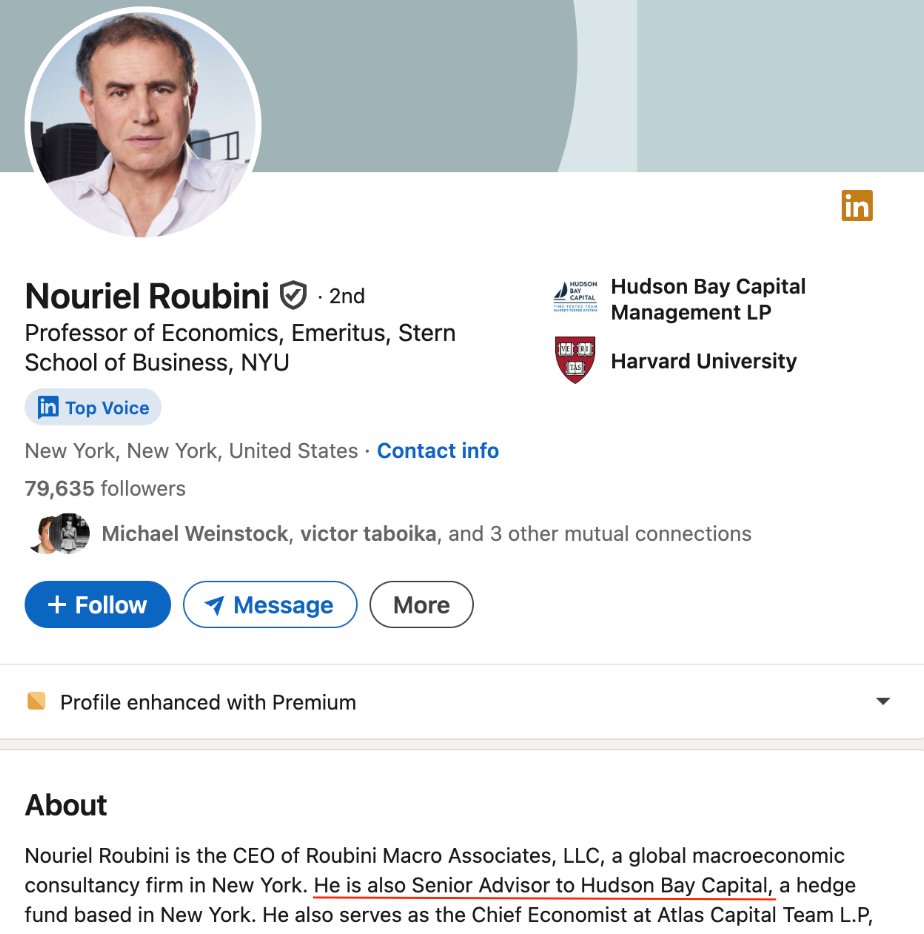

8.) Hudson Bay Capital Management

The firm has a 0.15% position, with ~$44m worth of exposure.

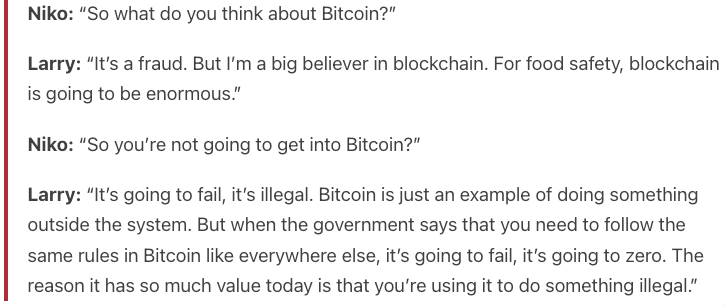

But that’s not the real story here—it's that infamous Bitcoin bear Nouriel Roubini is a Senior Advisor to the firm. lol

It's a good thing they didn’t take his advice on Bitcoin.

The firm has a 0.15% position, with ~$44m worth of exposure.

But that’s not the real story here—it's that infamous Bitcoin bear Nouriel Roubini is a Senior Advisor to the firm. lol

It's a good thing they didn’t take his advice on Bitcoin.

9.) State of Wisconsin Investment Board

The big news here is the state pension fund has more than tripled its Bitcoin position from the last quarter.

Q2: $99m, 2,898,051 shares (0.26%)

Q3: $104m, 2,889,251 shares (0.26%)

Q4: $321m, 6,060,351 shares (0.82%)

Add to your winners.

The big news here is the state pension fund has more than tripled its Bitcoin position from the last quarter.

Q2: $99m, 2,898,051 shares (0.26%)

Q3: $104m, 2,889,251 shares (0.26%)

Q4: $321m, 6,060,351 shares (0.82%)

Add to your winners.

10.) State of Michigan Retirement System

But Wisconsin wasn't alone...the Michigan state pension fund also nearly doubled its Bitcoin position.

Q2: $6.6m, 110,000 shares (0.03%)

Q3: $6.9m, 110,000 shares (0.03%)

Q4 $9.3m, 100,000 shares (0.05%)

It's still small, but growing.

But Wisconsin wasn't alone...the Michigan state pension fund also nearly doubled its Bitcoin position.

Q2: $6.6m, 110,000 shares (0.03%)

Q3: $6.9m, 110,000 shares (0.03%)

Q4 $9.3m, 100,000 shares (0.05%)

It's still small, but growing.

11.) Emory University

Its second-largest position is BTC (32.3%), with $22m worth of exposure.

The endowment's position size did not change from last quarter, meaning that it didn't actively rebalance despite its Bitcoin position currently being up ~50%.

Emory is holding.

Its second-largest position is BTC (32.3%), with $22m worth of exposure.

The endowment's position size did not change from last quarter, meaning that it didn't actively rebalance despite its Bitcoin position currently being up ~50%.

Emory is holding.

12.) Pine Ridge Advisors

Its 2nd-largest position is BTC (18.4%), with $209m worth of exposure.

Idk much about the firm, but I'm mentioning cuz it has a highly concentrated allocation for a family office of this size.

This is their entire website, so you know they're legit.😂

Its 2nd-largest position is BTC (18.4%), with $209m worth of exposure.

Idk much about the firm, but I'm mentioning cuz it has a highly concentrated allocation for a family office of this size.

This is their entire website, so you know they're legit.😂

13.) Capula Management

Its second-largest position is BTC (5.4%), with ~$936m worth of exposure.

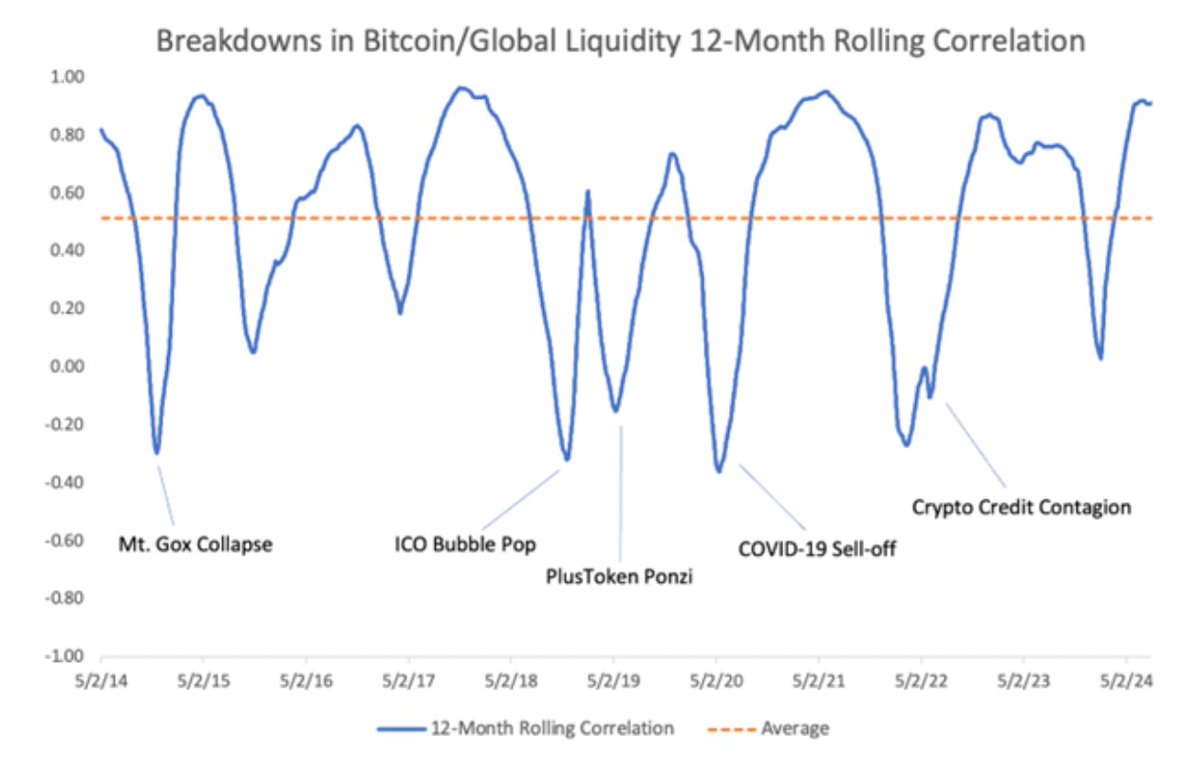

The fourth-largest hedge fund in Europe is led by Yan Huo, former head of fixed-income trading at JPM. Their focus? Innovative, uncorrelated strategies.

No wonder they're long BTC.

Its second-largest position is BTC (5.4%), with ~$936m worth of exposure.

The fourth-largest hedge fund in Europe is led by Yan Huo, former head of fixed-income trading at JPM. Their focus? Innovative, uncorrelated strategies.

No wonder they're long BTC.

14.) Cresset Asset Management

Bitcoin is a top 30 position for one of the largest, top-ranked independent RIAs in the U.S.

Cresset has increased its position size every quarter.

Q2: $33.7m (0.14%)

Q3: $53.9m (0.21%

Q4: $107.5m (0.51%)

Worth monitoring to gauge FA activity.

Bitcoin is a top 30 position for one of the largest, top-ranked independent RIAs in the U.S.

Cresset has increased its position size every quarter.

Q2: $33.7m (0.14%)

Q3: $53.9m (0.21%

Q4: $107.5m (0.51%)

Worth monitoring to gauge FA activity.

You might have noticed that I haven't mentioned some major firms with large Bitcoin ETF holdings:

- Millennium ($2.6B, 1.28%)

- Jane Street ($2.4B, 0.52%)

- Susquehanna ($1B, 0.16%)

- DE Shaw ($869m, 0.64%)

- Citadel ($446m, 0.08%)

- Point72 ($155m, 0.34%)

That's because these are mainly quant funds and market-making firms. Their algos don’t care if the ticker is IBIT, META, GE, SPY, or TLT—they're just hunting for arbitrage opportunities and inefficiencies.

So these aren't long-term holders, and I suspect many hold net-neutral Bitcoin positions, which makes their exposure less interesting to me.

Having said that, I do appreciate them trading in this market. They make it more efficient by tightening spreads, deepening order books, and increasing liquidity.

- Millennium ($2.6B, 1.28%)

- Jane Street ($2.4B, 0.52%)

- Susquehanna ($1B, 0.16%)

- DE Shaw ($869m, 0.64%)

- Citadel ($446m, 0.08%)

- Point72 ($155m, 0.34%)

That's because these are mainly quant funds and market-making firms. Their algos don’t care if the ticker is IBIT, META, GE, SPY, or TLT—they're just hunting for arbitrage opportunities and inefficiencies.

So these aren't long-term holders, and I suspect many hold net-neutral Bitcoin positions, which makes their exposure less interesting to me.

Having said that, I do appreciate them trading in this market. They make it more efficient by tightening spreads, deepening order books, and increasing liquidity.

Same thing with some of these big banks with Bitcoin ETF holdings:

- JPMorgan ($964K, 0.0001%)

- Goldman Sachs ($2.3B, 0.37%)

- Wells Fargo ($375K, 0.0001%)

- Bank of America ($24M, 0.002%)

- Morgan Stanley ($259M, 0.02%)

JPM and others are Authorized Participants (APs) for many of the Bitcoin ETFs and act as market makers. It's completely normal for APs to hold some ETF shares on their balance sheets as they are responsible for creating and redeeming ETF shares.

Market makers also need to maintain an inventory of ETF shares to facilitate trading. By holding ETF shares, they can better keep the market liquid and efficient, and maintain accurate pricing of the ETFs.

Outside of these approved "crypto-asset activities," banks are currently prohibited by the Fed from owning Bitcoin as principal on their balance sheets. See here: federalreserve.gov/newsevents/pre…

However, with the recent rescission of SAB-121, the regulatory landscape is shifting.

Morgan Stanley stands out—it became the first major bank to allow financial advisors to pitch Bitcoin ETFs to clients last August.

Goldman Sachs has also been active, providing Bitcoin exposure to wealthy clients through its asset management arm for years. But if its trading desk has exposure, my guess is it's likely running market-neutral arbitrage strategies like the basis trade—meaning it’s not net long Bitcoin.

As banking regulations evolve, it’ll be interesting to see how these big banks adjust their positions and expand their Bitcoin involvement over the next several quarters.

Something to watch closely.

- JPMorgan ($964K, 0.0001%)

- Goldman Sachs ($2.3B, 0.37%)

- Wells Fargo ($375K, 0.0001%)

- Bank of America ($24M, 0.002%)

- Morgan Stanley ($259M, 0.02%)

JPM and others are Authorized Participants (APs) for many of the Bitcoin ETFs and act as market makers. It's completely normal for APs to hold some ETF shares on their balance sheets as they are responsible for creating and redeeming ETF shares.

Market makers also need to maintain an inventory of ETF shares to facilitate trading. By holding ETF shares, they can better keep the market liquid and efficient, and maintain accurate pricing of the ETFs.

Outside of these approved "crypto-asset activities," banks are currently prohibited by the Fed from owning Bitcoin as principal on their balance sheets. See here: federalreserve.gov/newsevents/pre…

However, with the recent rescission of SAB-121, the regulatory landscape is shifting.

Morgan Stanley stands out—it became the first major bank to allow financial advisors to pitch Bitcoin ETFs to clients last August.

Goldman Sachs has also been active, providing Bitcoin exposure to wealthy clients through its asset management arm for years. But if its trading desk has exposure, my guess is it's likely running market-neutral arbitrage strategies like the basis trade—meaning it’s not net long Bitcoin.

As banking regulations evolve, it’ll be interesting to see how these big banks adjust their positions and expand their Bitcoin involvement over the next several quarters.

Something to watch closely.

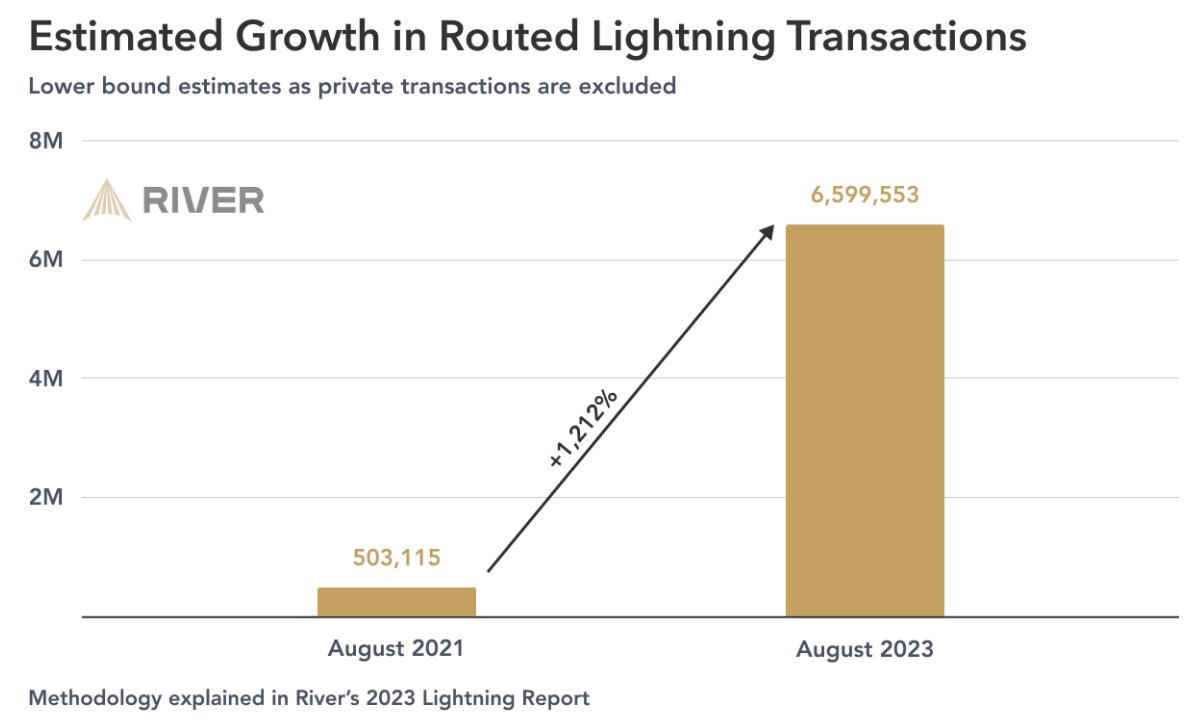

Overall, these 13F filings show how BTC is emerging as an institutional-grade asset.

It's now large and liquid enough to accommodate these investors. As new investment vehicles hit the market, these firms will have more ways to gain exposure to BTC, and adoption will gain steam.

It's now large and liquid enough to accommodate these investors. As new investment vehicles hit the market, these firms will have more ways to gain exposure to BTC, and adoption will gain steam.

I’ve covered some of the pioneers in this thread, but we’re still incredibly early in this trend—meaning significant opportunity lies ahead.

Institutional investors managing trillions of dollars are still just dipping their toes in this market.

From my research: out of 8,190 13F filings last quarter, only ~19% of reporting firms had any kind of long Bitcoin exposure.

As more enter the fray—or those already in increase their allocations—the inflows could drive Bitcoin to new heights and change its investor base forever.

Thanks for reading.

Sources:

Horizon Kinetics: sec.gov/Archives/edgar…

Bracebridge: sec.gov/Archives/edgar…

Tudor Investment Corp:

sec.gov/Archives/edgar…

Fortress Investment Group:

sec.gov/Archives/edgar…

Brevan Howard:

sec.gov/Archives/edgar…

Discovery Capital Management:

sec.gov/Archives/edgar…

Jericho Capital:

sec.gov/Archives/edgar…

Hudson Bay Capital Management:

sec.gov/Archives/edgar…

State of Wisconsin Investment Board:

sec.gov/Archives/edgar…

State of Michigan Retirement System:

sec.gov/Archives/edgar…

Emory University:

sec.gov/Archives/edgar…

Pine Ridge Advisors:

sec.gov/Archives/edgar…

Capula Management:

sec.gov/Archives/edgar…

Cresset Asset Management:

sec.gov/Archives/edgar…

Mubadala Investment:

sec.gov/Archives/edgar…

Institutional investors managing trillions of dollars are still just dipping their toes in this market.

From my research: out of 8,190 13F filings last quarter, only ~19% of reporting firms had any kind of long Bitcoin exposure.

As more enter the fray—or those already in increase their allocations—the inflows could drive Bitcoin to new heights and change its investor base forever.

Thanks for reading.

Sources:

Horizon Kinetics: sec.gov/Archives/edgar…

Bracebridge: sec.gov/Archives/edgar…

Tudor Investment Corp:

sec.gov/Archives/edgar…

Fortress Investment Group:

sec.gov/Archives/edgar…

Brevan Howard:

sec.gov/Archives/edgar…

Discovery Capital Management:

sec.gov/Archives/edgar…

Jericho Capital:

sec.gov/Archives/edgar…

Hudson Bay Capital Management:

sec.gov/Archives/edgar…

State of Wisconsin Investment Board:

sec.gov/Archives/edgar…

State of Michigan Retirement System:

sec.gov/Archives/edgar…

Emory University:

sec.gov/Archives/edgar…

Pine Ridge Advisors:

sec.gov/Archives/edgar…

Capula Management:

sec.gov/Archives/edgar…

Cresset Asset Management:

sec.gov/Archives/edgar…

Mubadala Investment:

sec.gov/Archives/edgar…

• • •

Missing some Tweet in this thread? You can try to

force a refresh