Bitcoin | Director of Bitcoin Strategy & Research @ORANJEBTC 🍊 ₿ 🇧🇷

4 subscribers

How to get URL link on X (Twitter) App

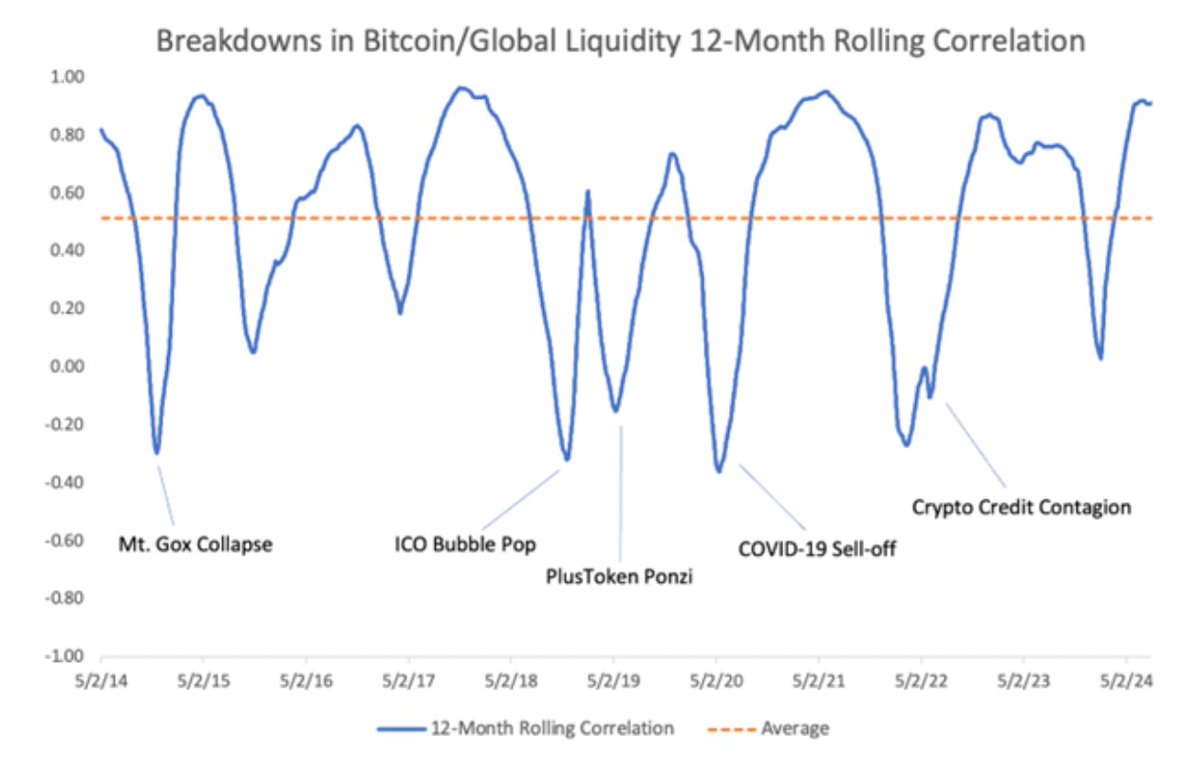

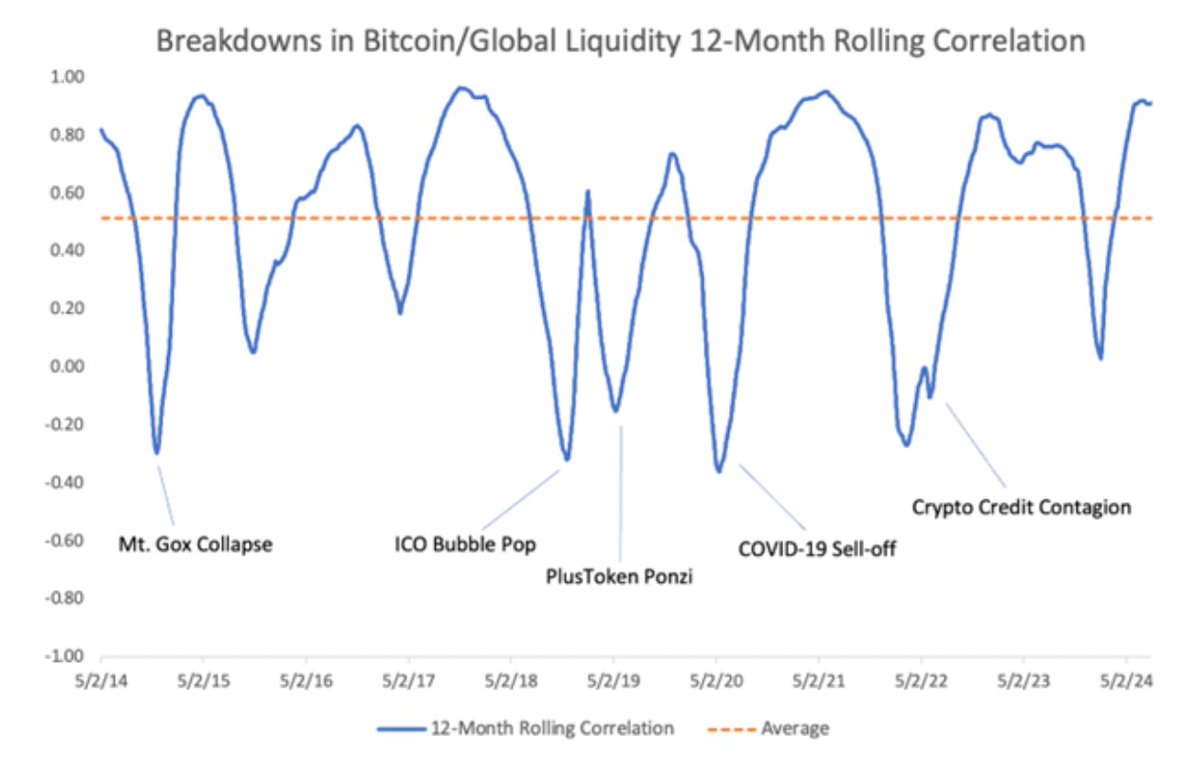

https://twitter.com/AltcoinDaily/status/1989144752982311003The truth is, the relationship between global M2 and Bitcoin has broken on numerous occasions.

"We also showed that Bitcoin's second promise to be a financial asset, the value of which would inevitably continue to rise, was equally wrong."

"We also showed that Bitcoin's second promise to be a financial asset, the value of which would inevitably continue to rise, was equally wrong."

First up - BlackRock (~$9 trillion AUM)

First up - BlackRock (~$9 trillion AUM)

The IMF wants you to believe this is blueprint represents a new system and that this system was proposed in September. But this couldn't be further from the truth.

The IMF wants you to believe this is blueprint represents a new system and that this system was proposed in September. But this couldn't be further from the truth.

Improving financial inclusion is cited as one of the main reasons why central banks worldwide are motivated to launch a retail CBDC.

Improving financial inclusion is cited as one of the main reasons why central banks worldwide are motivated to launch a retail CBDC.

1.) The Great Crypto Contagion has wiped out bad actors, highly leveraged players, and fraudulent operations. This has a healing, cleansing effect on the industry and was necessary. Plus, people have been spooked and more of them are now taking self-custody of their BTC. Bullish.

1.) The Great Crypto Contagion has wiped out bad actors, highly leveraged players, and fraudulent operations. This has a healing, cleansing effect on the industry and was necessary. Plus, people have been spooked and more of them are now taking self-custody of their BTC. Bullish.

...and worsening the Asian Financial Crisis of 1997-1998.

...and worsening the Asian Financial Crisis of 1997-1998.

The first Bitcoin mention on the WEF's website is from 2017.

The first Bitcoin mention on the WEF's website is from 2017.

In a dynamic economy, businesses are born, grow, and die. Jobs are created and lost. And resources are reallocated to better capital operators in the process.

In a dynamic economy, businesses are born, grow, and die. Jobs are created and lost. And resources are reallocated to better capital operators in the process.

I was motivated to write this after Coinbase recommended "Top 10 Picks" to their customers that didn't include Bitcoin despite Bitcoin outperforming 99.9% of shitcoins long term.

I was motivated to write this after Coinbase recommended "Top 10 Picks" to their customers that didn't include Bitcoin despite Bitcoin outperforming 99.9% of shitcoins long term.

1)imf.org/en/Publication…

1)imf.org/en/Publication…

1.) bis.org/publ/arpdf/ar2…

1.) bis.org/publ/arpdf/ar2…

PoW sets BTC apart from every other asset.

PoW sets BTC apart from every other asset.

Everyone feels like they’re late to the game when they find out about Bitcoin.

Everyone feels like they’re late to the game when they find out about Bitcoin.