Range Trading & Value (Part 2) - 🧵

Auction Market Theory + Flow

Part 2 covers practical frameworks including examples & discussion for trading in a range.

Rotational regimes are great for trading if you are patient and know what you're looking for.

Here's how that can look:

Auction Market Theory + Flow

Part 2 covers practical frameworks including examples & discussion for trading in a range.

Rotational regimes are great for trading if you are patient and know what you're looking for.

Here's how that can look:

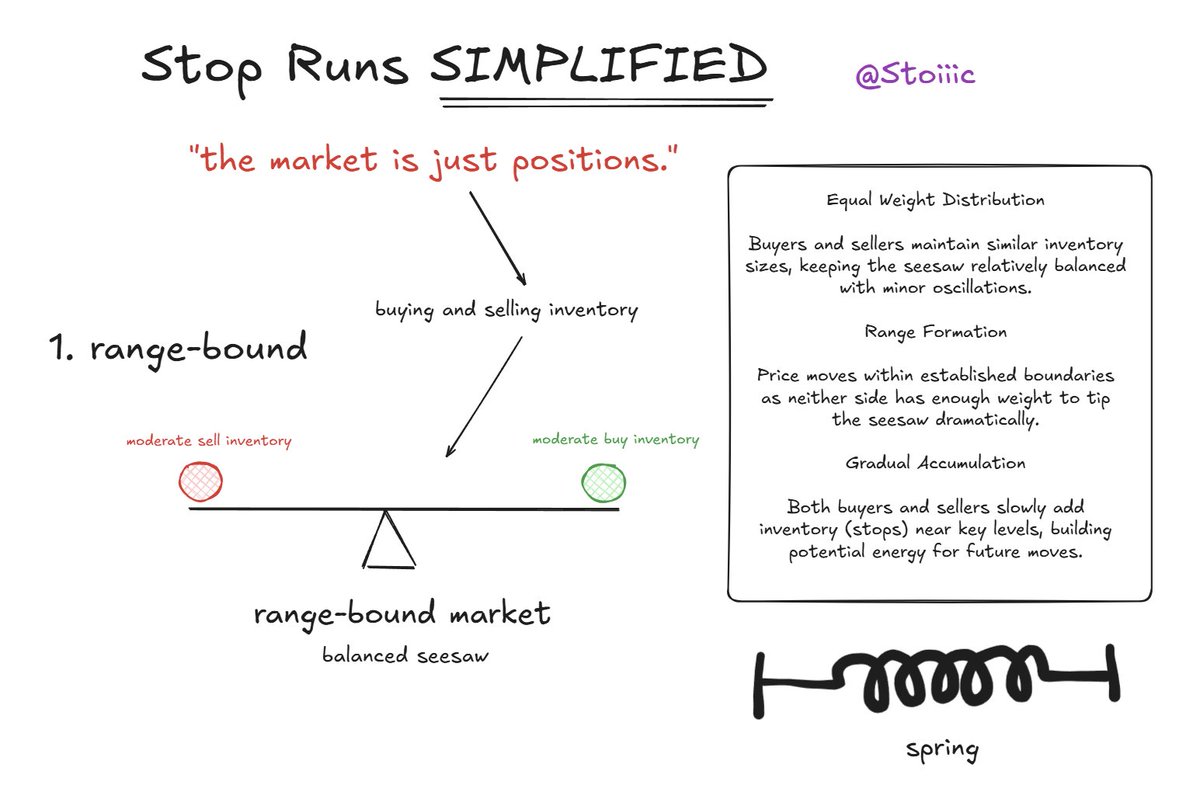

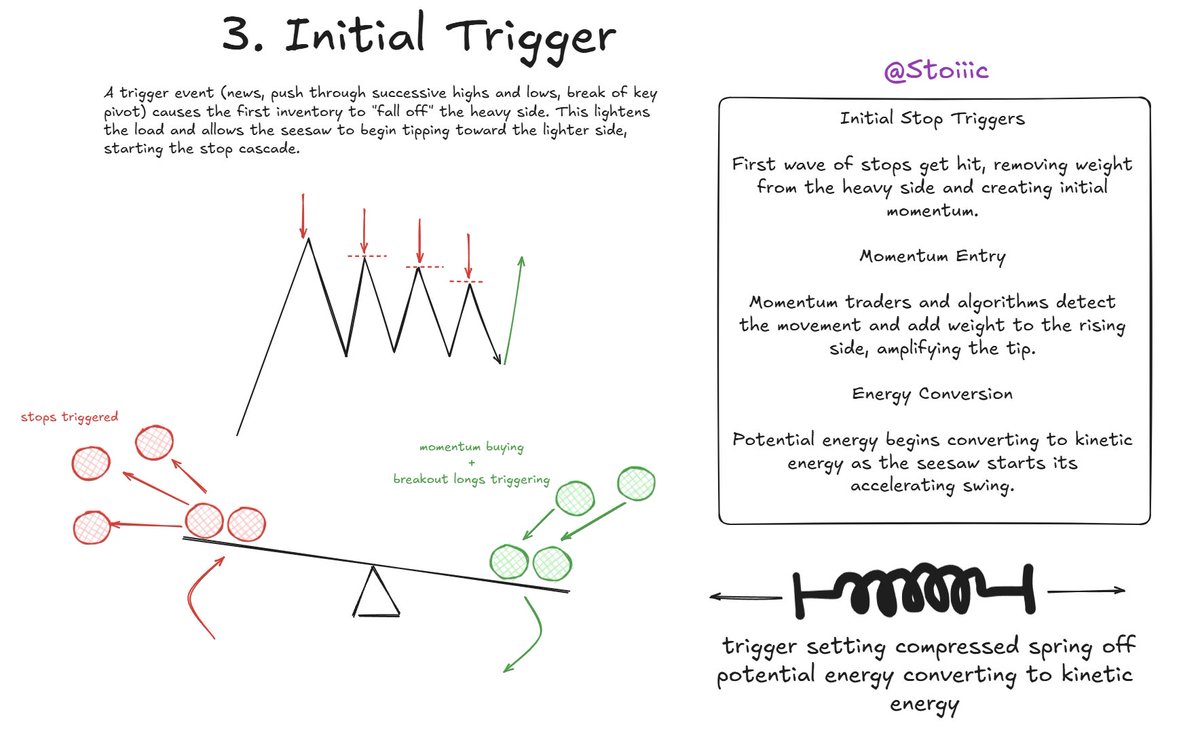

In a range-bound environment the question I'm looking to answer when price navigates towards extremes of value established in a ranging environment:

is the advertised discount or premium still considered a discount or premium by participants once price moves towards & away from extremes of value?

can deploy a two-pronged approach to attempt to answer this question:

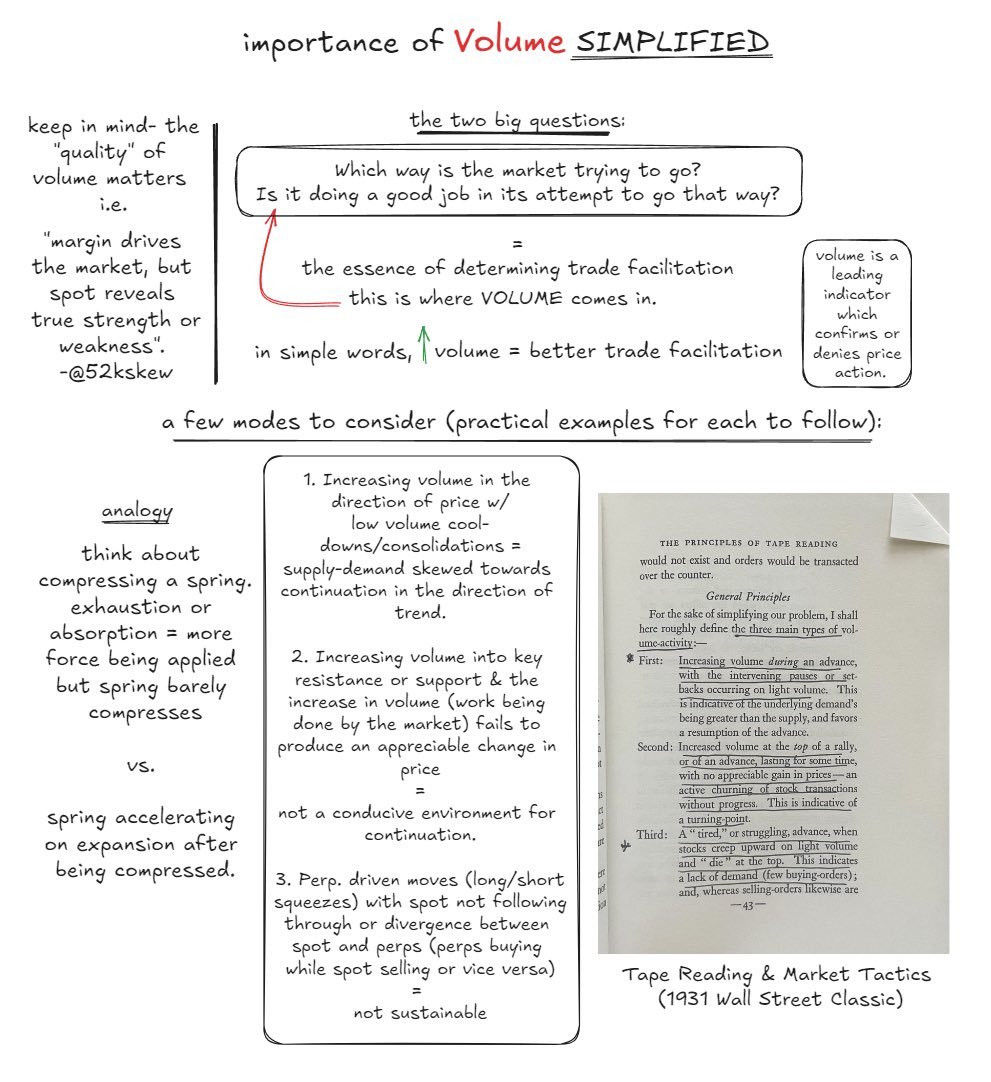

1. passive flow

2. aggressive flow

is the advertised discount or premium still considered a discount or premium by participants once price moves towards & away from extremes of value?

can deploy a two-pronged approach to attempt to answer this question:

1. passive flow

2. aggressive flow

1. Passive Flow

What does passive flow mean?

Why consider looking at aggregate spot behavior?

A recent $BTC example

What does passive flow mean?

Why consider looking at aggregate spot behavior?

A recent $BTC example

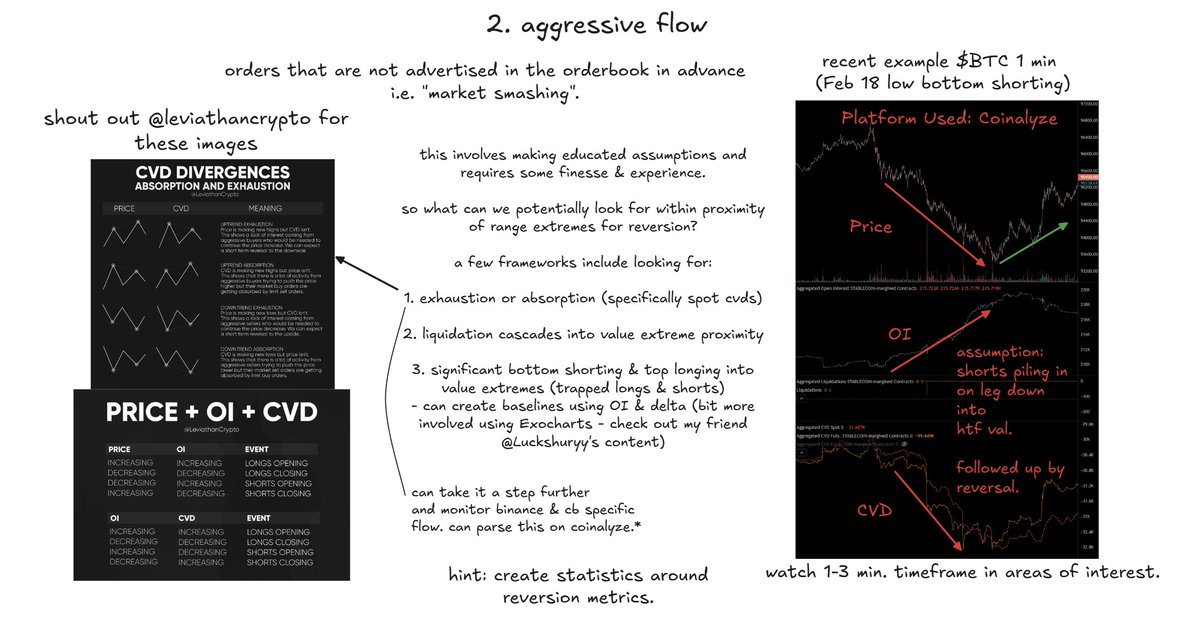

2. Aggressive Flow

A recent $BTC example

Potential Frameworks to consider

Cheat Sheets from @leviathancrypto

@Luckshuryy as a good resource for some of these frameworks as well as use of Exocharts.

A recent $BTC example

Potential Frameworks to consider

Cheat Sheets from @leviathancrypto

@Luckshuryy as a good resource for some of these frameworks as well as use of Exocharts.

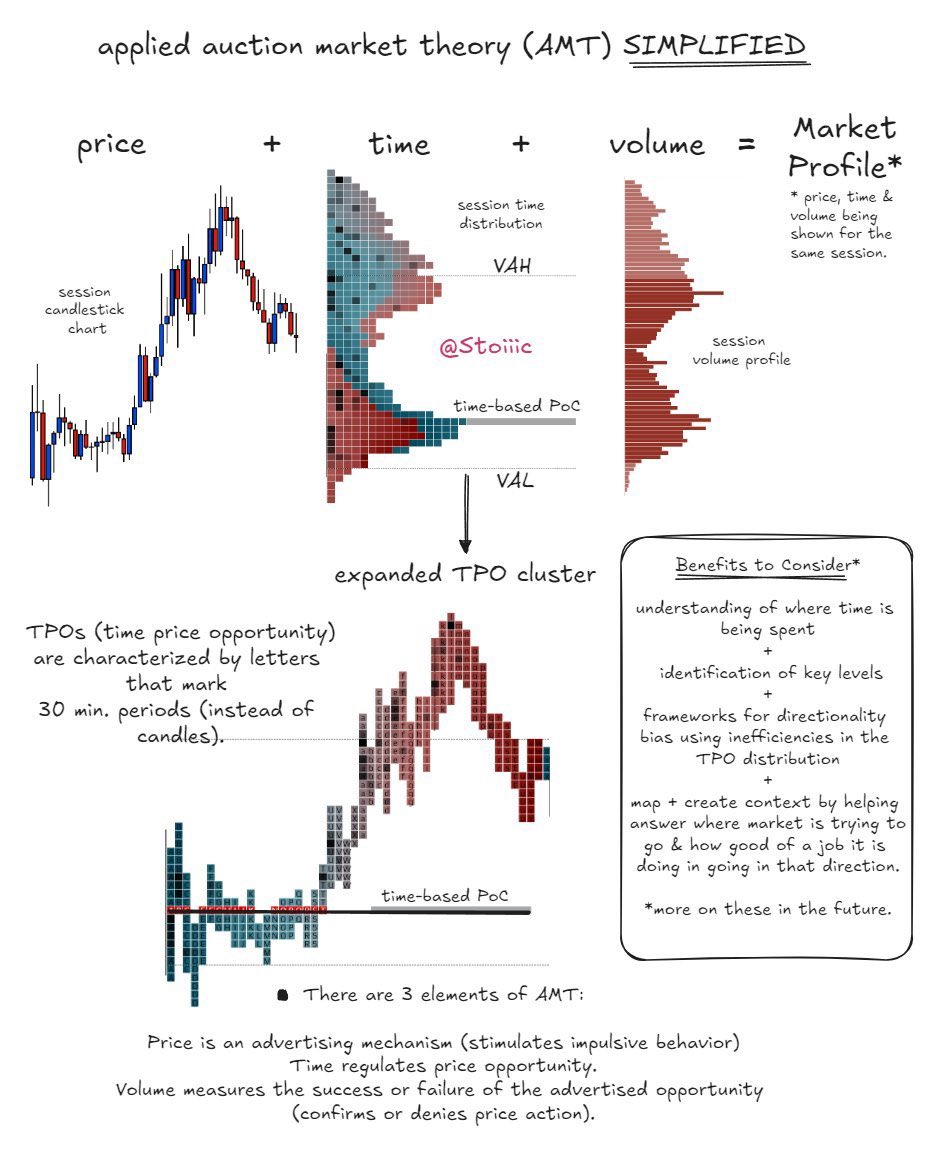

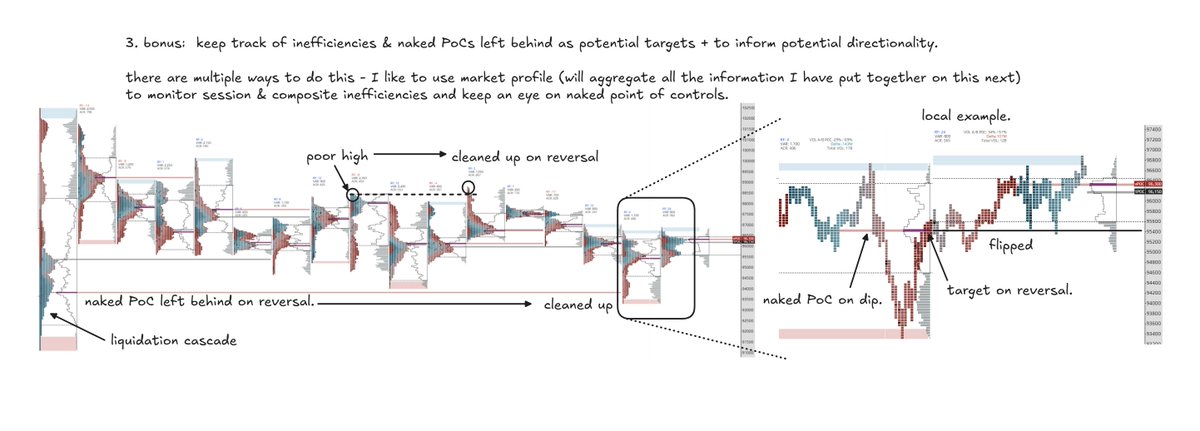

3. Bonus - Market Profile

Use of MP anomalies & naked point of control.

will aggregate all MP information in a thread next (what it is, how it can be useful, explanations on anomalies, what they mean & how they can be used + naked point of controls)

Use of MP anomalies & naked point of control.

will aggregate all MP information in a thread next (what it is, how it can be useful, explanations on anomalies, what they mean & how they can be used + naked point of controls)

Hope this was insightful. Tried to provide some nuanced frameworks that can be used to create your own ideas.

Takes a significant amount of time to put these visuals together so if you want more of these, engage with the first tweet in the thread.

Takes a significant amount of time to put these visuals together so if you want more of these, engage with the first tweet in the thread.

• • •

Missing some Tweet in this thread? You can try to

force a refresh