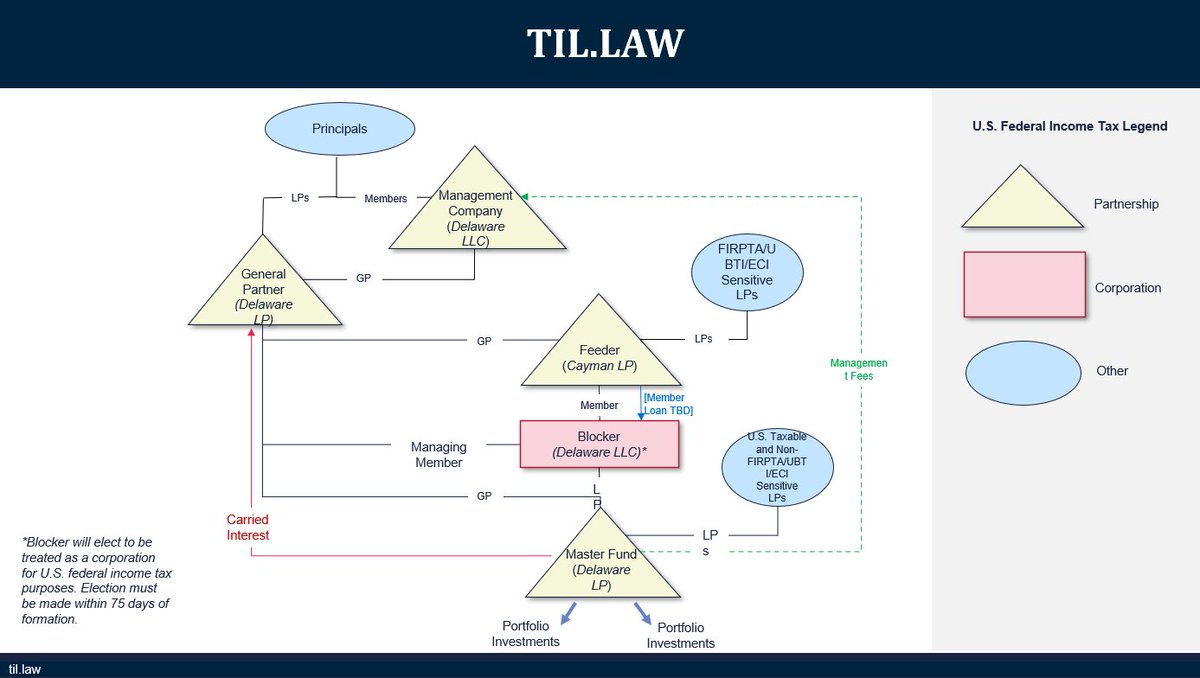

What you need to do if you want to accept money from:

💰 Tax-exempt investors

🌍 Non-US investors

A big post discussing UBTI, ECI, blockers, and more.

⚠️ This is especially true for real estate and private equity (but is sometimes relevant for venture capital...we've seen it before).

Please share if you find this content helpful 🙏

💰 Tax-exempt investors

🌍 Non-US investors

A big post discussing UBTI, ECI, blockers, and more.

⚠️ This is especially true for real estate and private equity (but is sometimes relevant for venture capital...we've seen it before).

Please share if you find this content helpful 🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh