Investment funds + securities lawyer. Managing Member at https://t.co/lvzUKYCRTT. Ex @lathamwatkins / @DLA_Piper. Newsletter on funds and SPVs: https://t.co/IJHSIc5hEN

3 subscribers

How to get URL link on X (Twitter) App

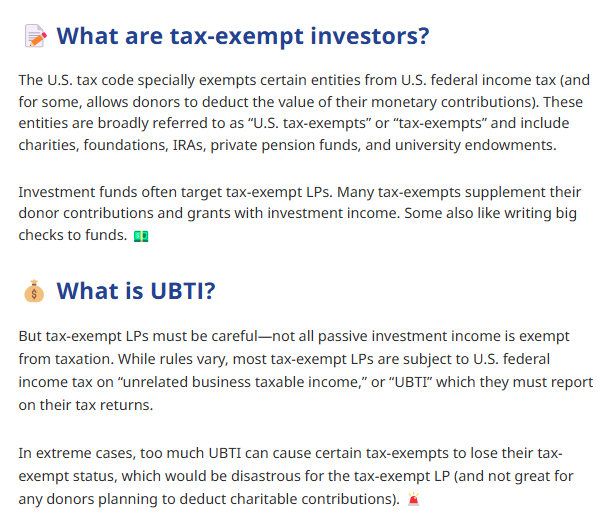

Tax-exempt investors and UBTI

Tax-exempt investors and UBTI

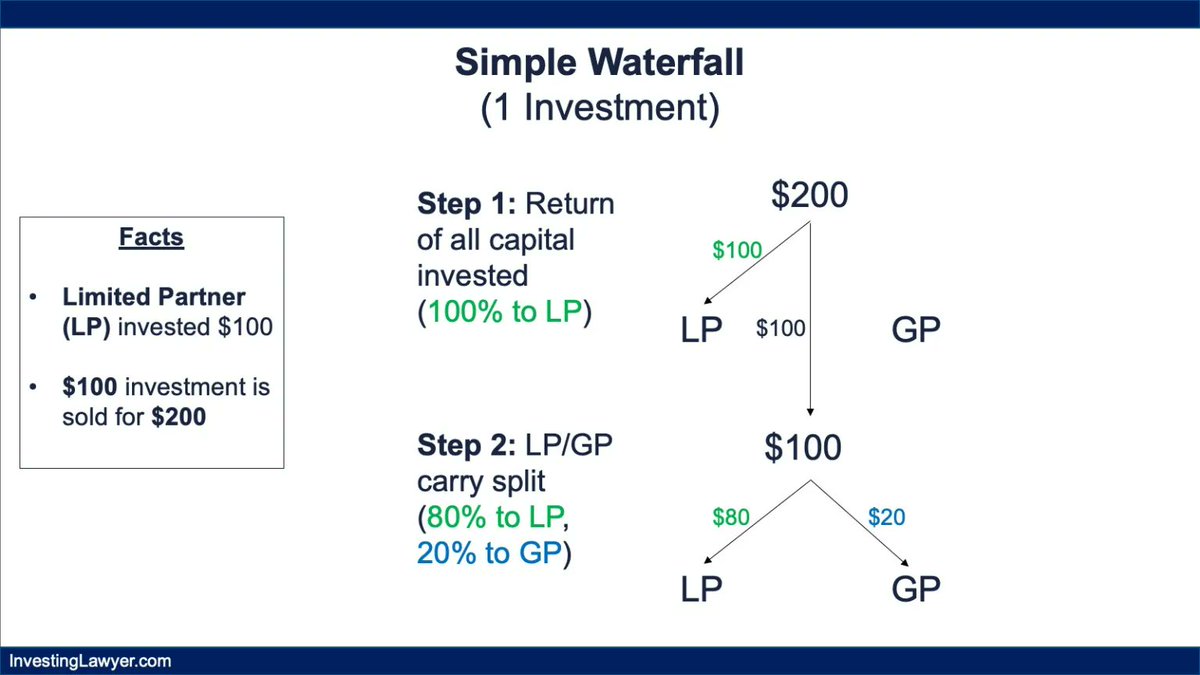

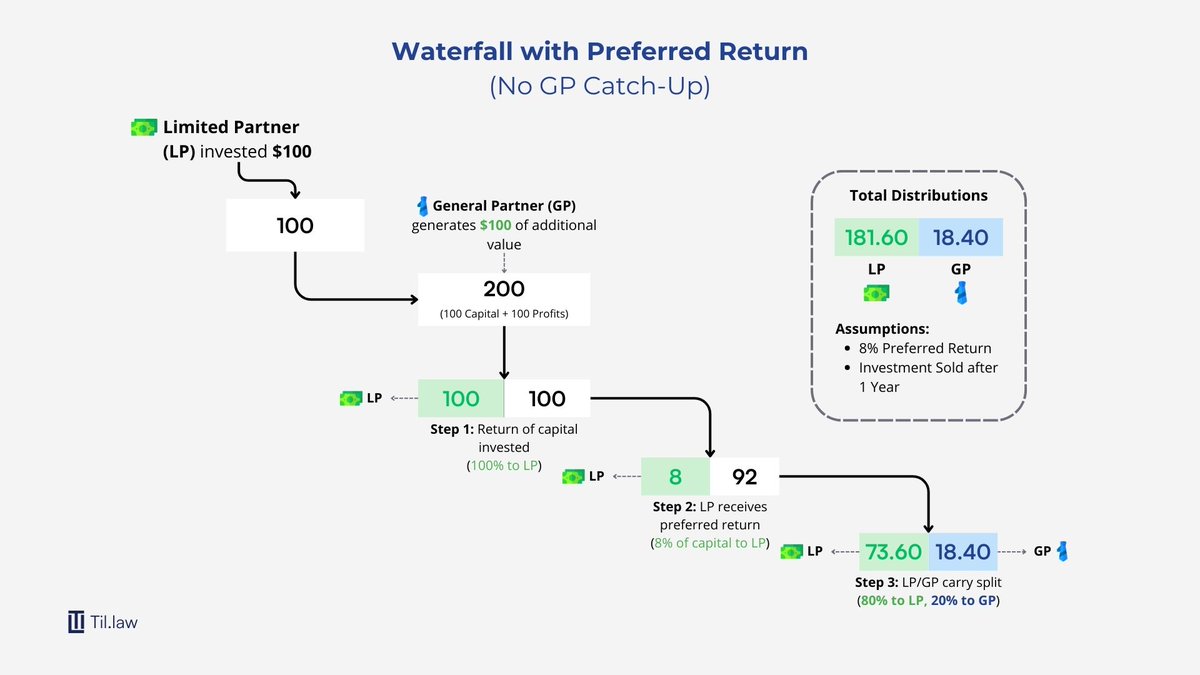

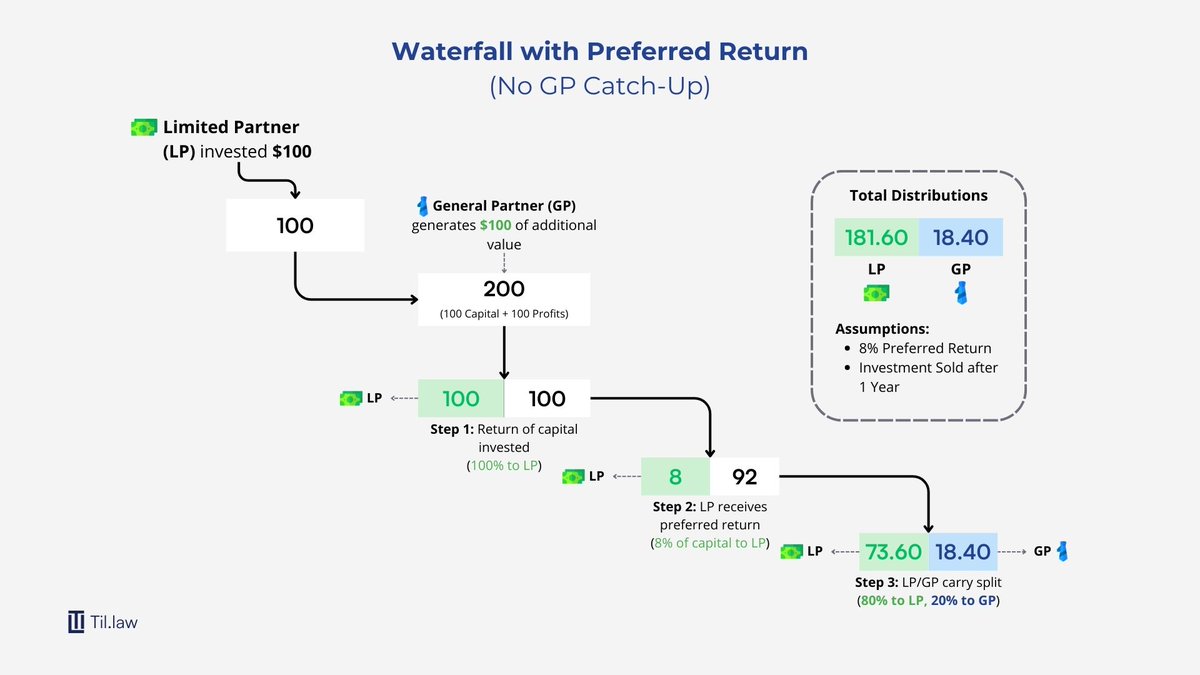

Carried interest is the share of an investment fund's profits earned by the investment manager (the GP). GPs typically take 20-30% of the fund's profits (sometimes after investors receive a priority return).

Carried interest is the share of an investment fund's profits earned by the investment manager (the GP). GPs typically take 20-30% of the fund's profits (sometimes after investors receive a priority return).

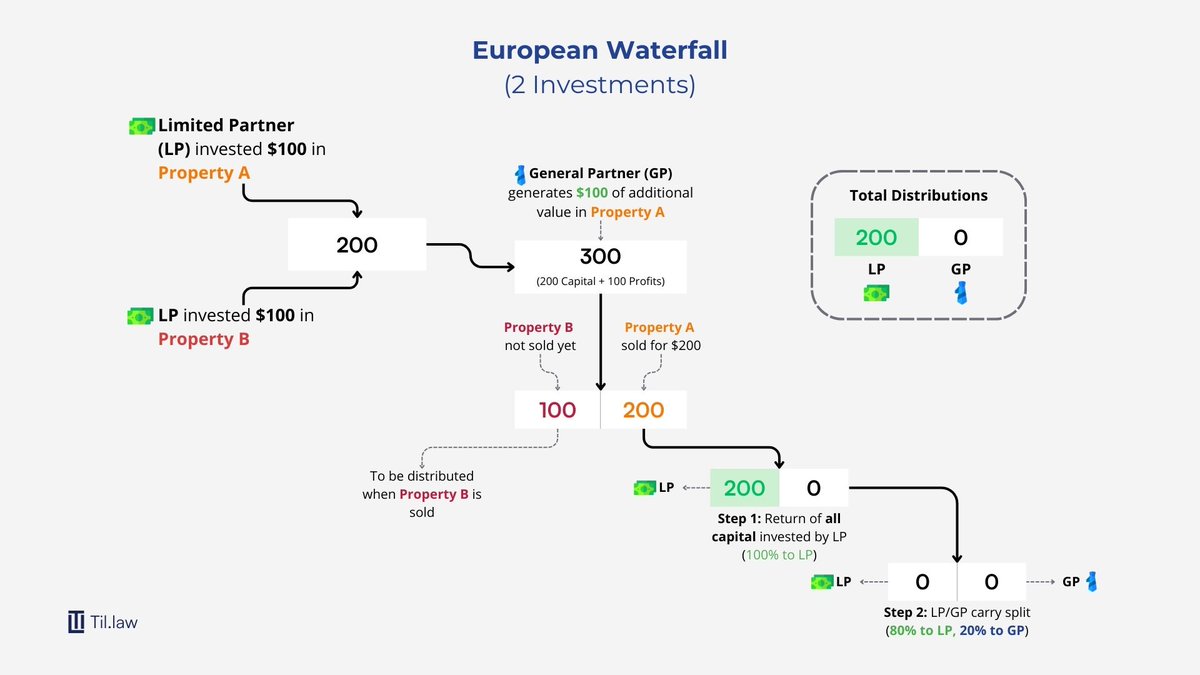

1. European Waterfall

1. European Waterfall

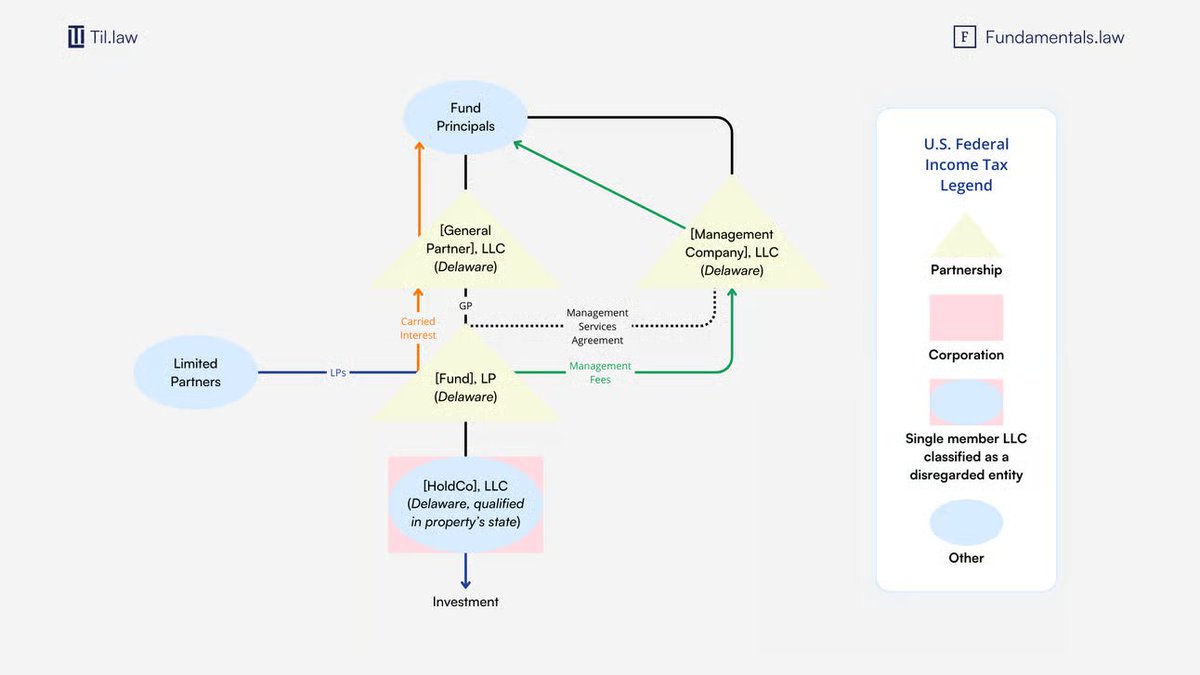

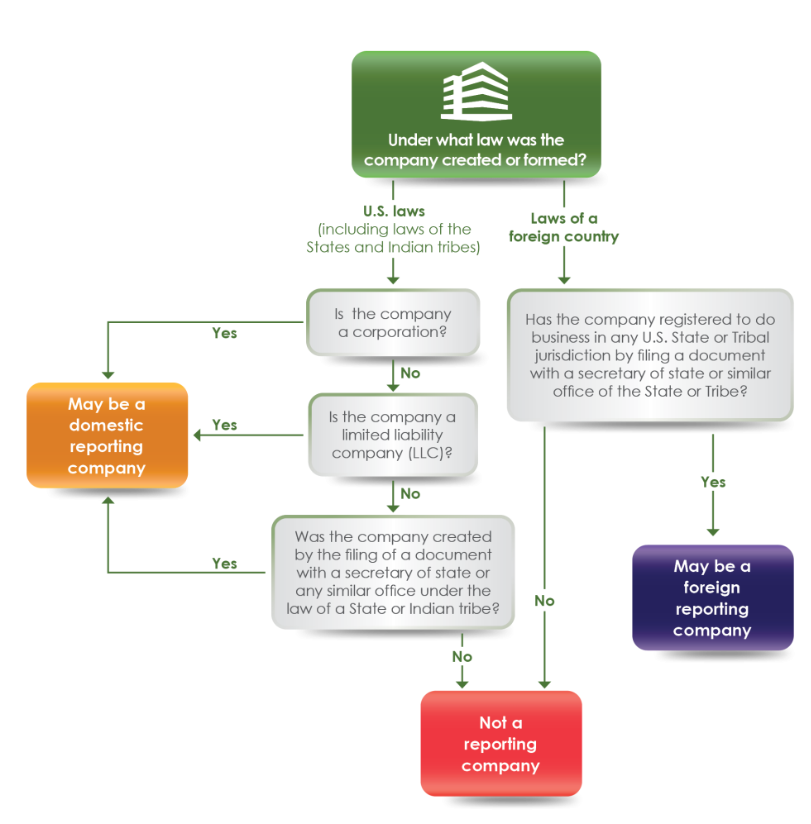

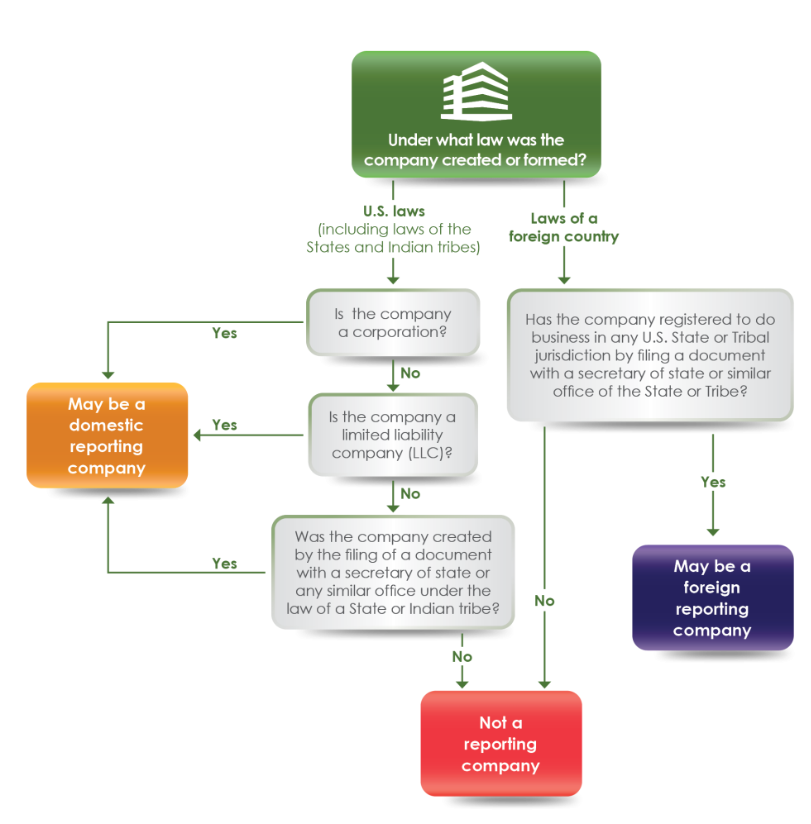

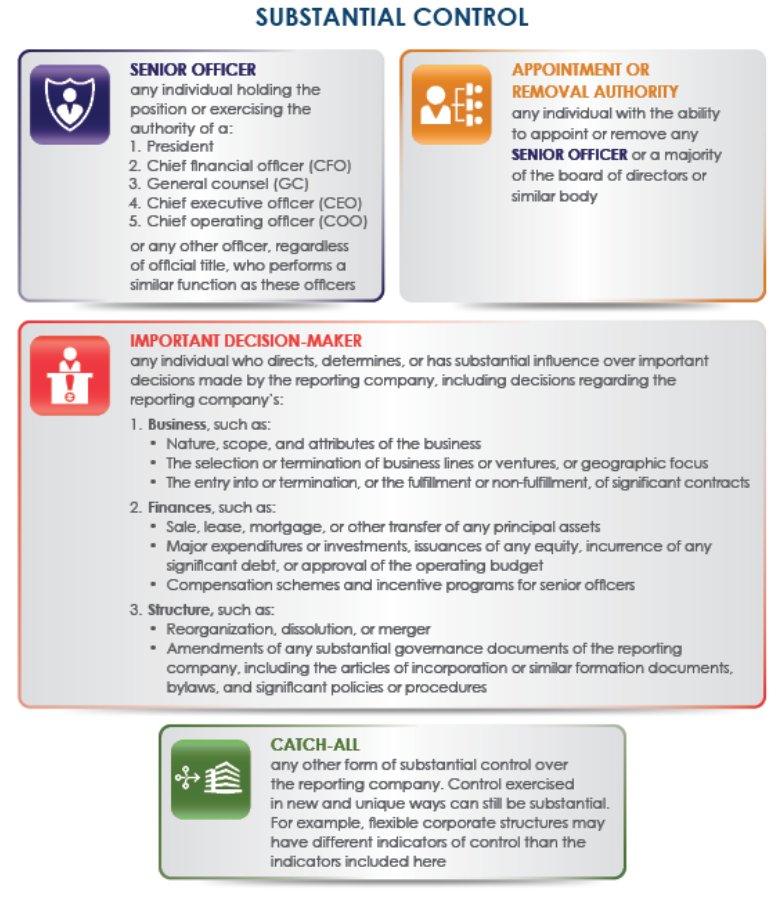

Each entity in the fund structure (Fund, GP, Management Company, etc.) will need to register with FinCEN and disclose the following persons:

Each entity in the fund structure (Fund, GP, Management Company, etc.) will need to register with FinCEN and disclose the following persons:

https://twitter.com/investing_law/status/1652314540221272067?s=20