Sky Gold 🪙 🧵– Business, Financials & Growth Strategy

🥇Business Overview

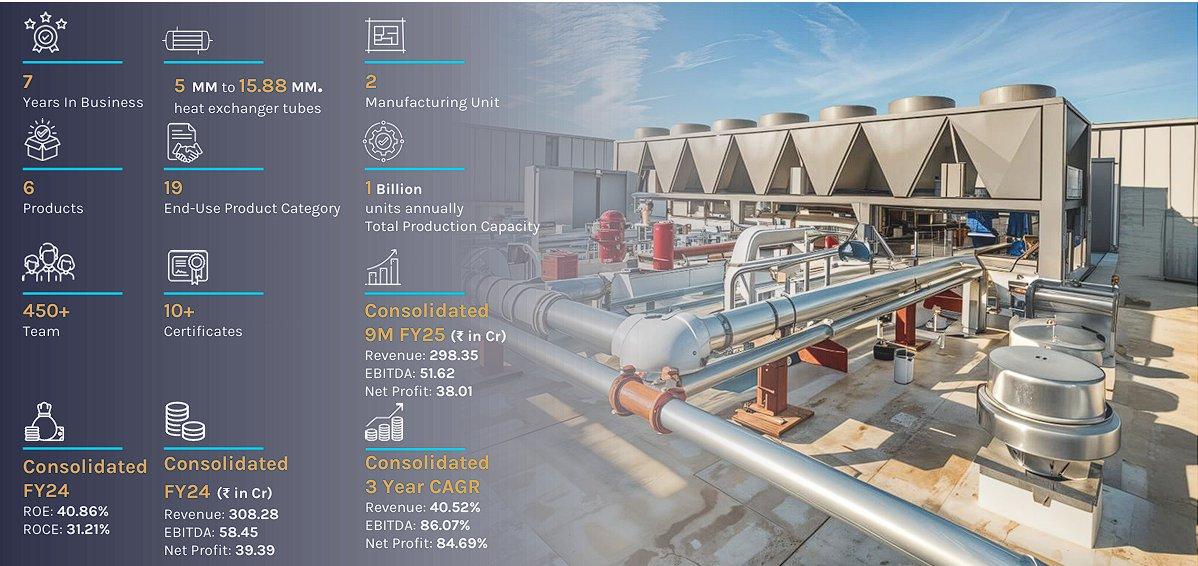

🔸 Core Focus: Designing, manufacturing, and marketing lightweight 18K & 22K gold jewelry

🔸 B2B Model: Supplies Malabar Gold, Joyalukkas, Kalyan Jewellers & other major brands

🔸 Market Presence: 2,000+ showrooms in India, 500+ globally

🔸 Manufacturing Facility: 81,000 sq. ft. Navi Mumbai plant with 9-tonne annual processing capacity

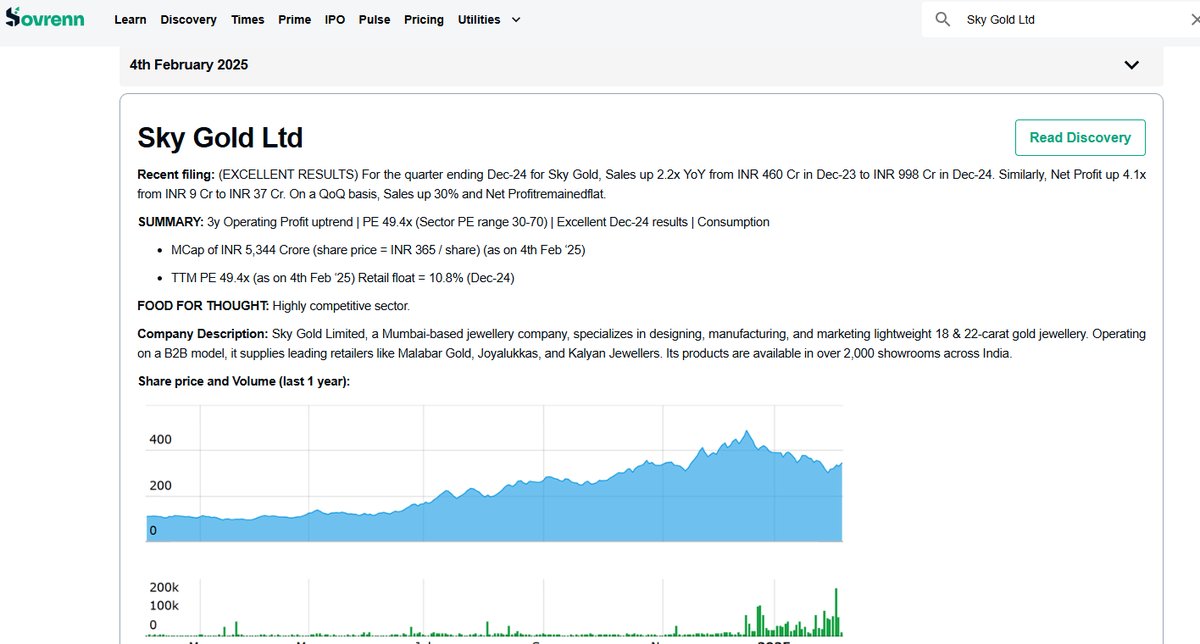

📊Data Credit: Sovrenn

#SkyGold 1/10

🥇Business Overview

🔸 Core Focus: Designing, manufacturing, and marketing lightweight 18K & 22K gold jewelry

🔸 B2B Model: Supplies Malabar Gold, Joyalukkas, Kalyan Jewellers & other major brands

🔸 Market Presence: 2,000+ showrooms in India, 500+ globally

🔸 Manufacturing Facility: 81,000 sq. ft. Navi Mumbai plant with 9-tonne annual processing capacity

📊Data Credit: Sovrenn

#SkyGold 1/10

2/10

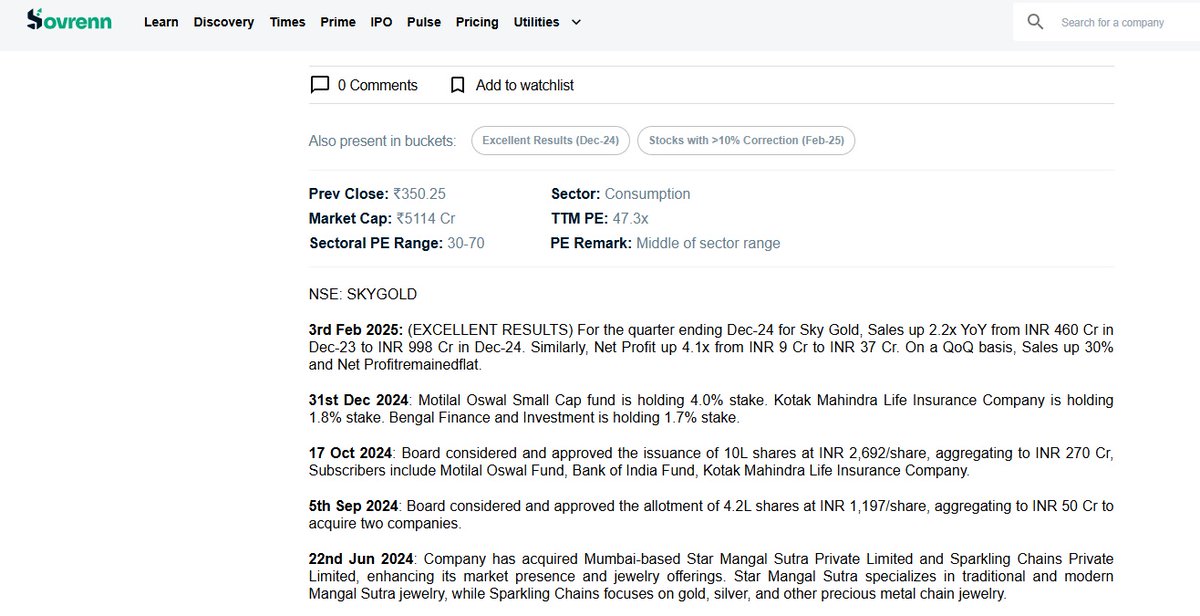

💰 Financial Performance

📌 Q3FY25 Results

🔹 Revenue: ₹998 Cr (+116.7% YoY)

🔹 PAT: ₹37 Cr (+309.1% YoY)

📌 FY24 Full-Year Performance

🔹 Revenue: ₹1,745 Cr (vs ₹1,154 Cr in FY23, +51.2%)

🔹 PAT: ₹40 Cr (vs ₹19 Cr in FY23, +110.5%)

📌 Key Valuation Metrics

🔹 Market Cap: ₹5,134 Cr

🔹 Promoter Holding: 58.2%

#SkyGold

💰 Financial Performance

📌 Q3FY25 Results

🔹 Revenue: ₹998 Cr (+116.7% YoY)

🔹 PAT: ₹37 Cr (+309.1% YoY)

📌 FY24 Full-Year Performance

🔹 Revenue: ₹1,745 Cr (vs ₹1,154 Cr in FY23, +51.2%)

🔹 PAT: ₹40 Cr (vs ₹19 Cr in FY23, +110.5%)

📌 Key Valuation Metrics

🔹 Market Cap: ₹5,134 Cr

🔹 Promoter Holding: 58.2%

#SkyGold

3/10

🏗 Expansion & Growth Strategy

📌 Capacity Expansion Targets

🔹 Q3FY25: 447 kg/month (+66% YoY)

🔹 FY26 Target: 650-700 kg/month

🔹 FY27 Target: 1,050+ kg/month

🔹 New Manufacturing Facility to scale 4,000 kg/month by FY27

📌 Product Diversification

🔹 Expanding into 18K Gold, Natural Diamonds, & Lab-Grown Diamonds (LGDs)

🔹 Lab-Grown Diamonds contribute 5% of revenue

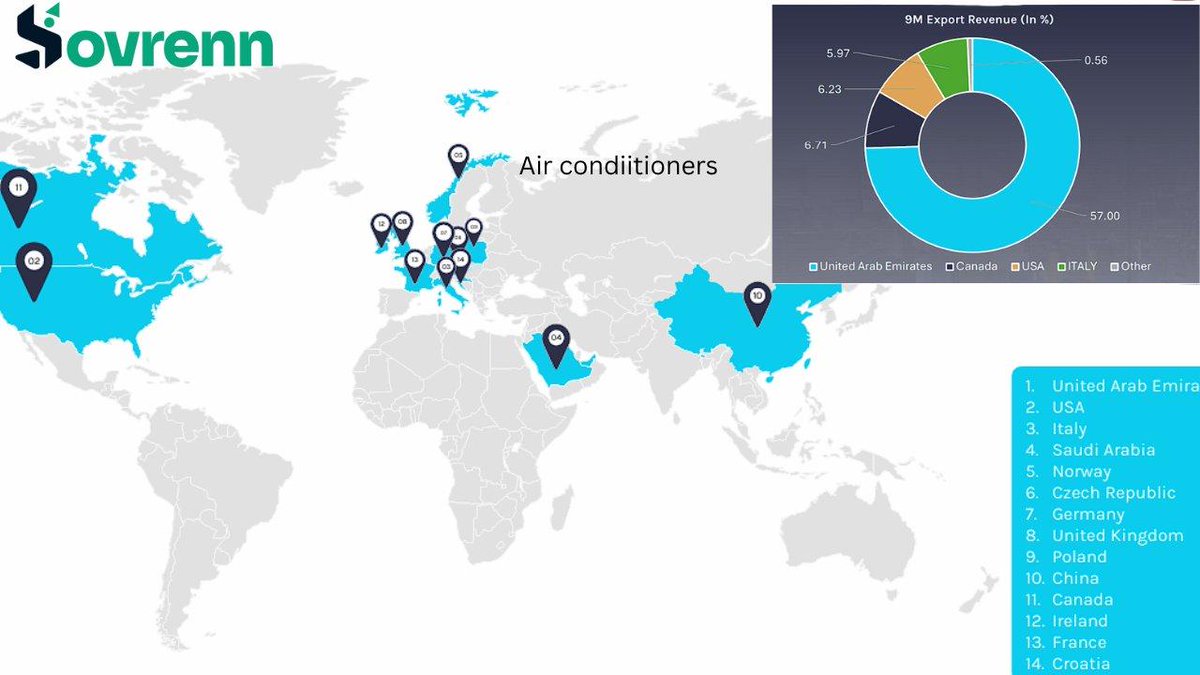

📌 Global Expansion

🔹 Strengthening exports in UAE, Singapore, Malaysia, & the Middle East

#SkyGold

🏗 Expansion & Growth Strategy

📌 Capacity Expansion Targets

🔹 Q3FY25: 447 kg/month (+66% YoY)

🔹 FY26 Target: 650-700 kg/month

🔹 FY27 Target: 1,050+ kg/month

🔹 New Manufacturing Facility to scale 4,000 kg/month by FY27

📌 Product Diversification

🔹 Expanding into 18K Gold, Natural Diamonds, & Lab-Grown Diamonds (LGDs)

🔹 Lab-Grown Diamonds contribute 5% of revenue

📌 Global Expansion

🔹 Strengthening exports in UAE, Singapore, Malaysia, & the Middle East

#SkyGold

4/10

🤝 Key Clients & Partnerships

📌 New Clients Acquired

🔹 Aditya Birla Novel Jewels (Indriya Brand) – Secured exclusive contract

🔹 CaratLane & P.N. Gadgil – Growing monthly orders

🔹 Reliance & Tanishq – Partnership discussions ongoing

📌 Existing Clients Scaling Up

🔹 CaratLane: Plans to open 300+ new stores

🔹 Malabar Gold: Expanding at 100+ stores/year

#SkyGold

🤝 Key Clients & Partnerships

📌 New Clients Acquired

🔹 Aditya Birla Novel Jewels (Indriya Brand) – Secured exclusive contract

🔹 CaratLane & P.N. Gadgil – Growing monthly orders

🔹 Reliance & Tanishq – Partnership discussions ongoing

📌 Existing Clients Scaling Up

🔹 CaratLane: Plans to open 300+ new stores

🔹 Malabar Gold: Expanding at 100+ stores/year

#SkyGold

5/10

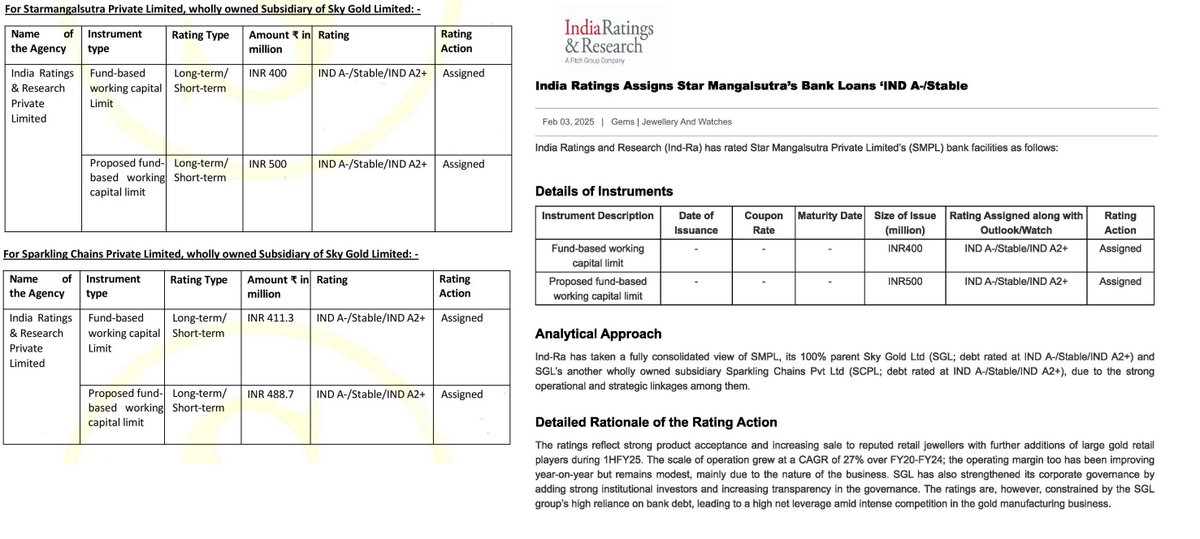

📊 Financial Strength – Credit Rating & Fund Raising

📌 Credit Rating Upgrade

🔹 India Ratings upgraded bank loans to IND A-/Stable

📌 Recent Fundraising (QIP)

🔹 ₹270 Cr raised via Qualified Institutional Placement (QIP) at ₹2,692/share

🔹 Investors: Motilal Oswal Fund, Kotak Mahindra Life, Bank of India Fund

#SkyGold

📊 Financial Strength – Credit Rating & Fund Raising

📌 Credit Rating Upgrade

🔹 India Ratings upgraded bank loans to IND A-/Stable

📌 Recent Fundraising (QIP)

🔹 ₹270 Cr raised via Qualified Institutional Placement (QIP) at ₹2,692/share

🔹 Investors: Motilal Oswal Fund, Kotak Mahindra Life, Bank of India Fund

#SkyGold

6/10

🔄 Inorganic Growth & Acquisitions

📌 Recent Acquisitions

🔹 Starmangalsutra & Sparkling Chains – Strengthening niche jewelry categories

📌 Future Acquisition Plans

🔹 Pursuing more inorganic growth opportunities to reinforce market position

#SkyGold

🔄 Inorganic Growth & Acquisitions

📌 Recent Acquisitions

🔹 Starmangalsutra & Sparkling Chains – Strengthening niche jewelry categories

📌 Future Acquisition Plans

🔹 Pursuing more inorganic growth opportunities to reinforce market position

#SkyGold

7/10

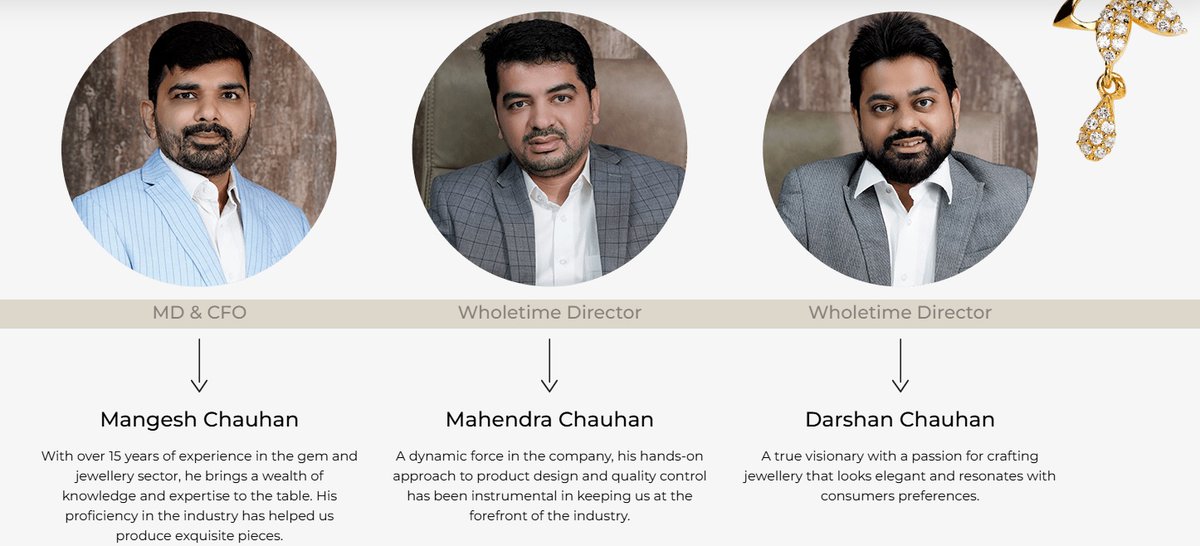

📌 Leadership Update

📌 New Independent Director Appointment

🔹 Mr. Bharat Jhaveri joins as Independent Director

🔹 Expertise in Gemology & Diamond Assortment

🔹 Led key projects for Tanishq & introduced Open Polki jewelry

#SkyGold

📌 Leadership Update

📌 New Independent Director Appointment

🔹 Mr. Bharat Jhaveri joins as Independent Director

🔹 Expertise in Gemology & Diamond Assortment

🔹 Led key projects for Tanishq & introduced Open Polki jewelry

#SkyGold

8/10

🚀 Revenue & Future Guidance

📌 Projected Revenue Targets

🔹 FY25: ₹3,300 Cr

🔹 FY26: ₹5,700 Cr

🔹 FY27: ₹7,200 Cr

📌 Key Risks?

❌ High competition in the jewelry industry

❌ Low-margin business model

#SkyGold

🚀 Revenue & Future Guidance

📌 Projected Revenue Targets

🔹 FY25: ₹3,300 Cr

🔹 FY26: ₹5,700 Cr

🔹 FY27: ₹7,200 Cr

📌 Key Risks?

❌ High competition in the jewelry industry

❌ Low-margin business model

#SkyGold

9/10

💡 Why Sky Gold is Poised for Growth?

✅ Strong revenue & PAT growth 📈

✅ Expanding production & scaling exports 🌍

✅ New partnerships & acquisitions 🤝

✅ Entering high-margin segments (LGDs & Diamonds) 💎

✅ Credit rating upgrade & strong financial backing 💰

Sky Gold Limited is set for exponential growth in the coming years! 💎📈

📢 Disclosure: This is NOT a Buy/Sell/Hold recommendation. Shared for educational purpose only. Please do your own due diligence.

#SkyGold

💡 Why Sky Gold is Poised for Growth?

✅ Strong revenue & PAT growth 📈

✅ Expanding production & scaling exports 🌍

✅ New partnerships & acquisitions 🤝

✅ Entering high-margin segments (LGDs & Diamonds) 💎

✅ Credit rating upgrade & strong financial backing 💰

Sky Gold Limited is set for exponential growth in the coming years! 💎📈

📢 Disclosure: This is NOT a Buy/Sell/Hold recommendation. Shared for educational purpose only. Please do your own due diligence.

#SkyGold

10/10

🥇Here are some excellent X accounts sharing valuable stock market investing content.

🎯Think this thread could help other investors?💭Kindly Share the first post!

@microcp2mltibgr

@AimInvestments

@ArindamPramnk

@KhapreVishal

@AnirbanManna10

@preet2419

@TheAlpha10X

@logical_traderr

@vandit_jain1994

@vardhiitbhu

@tsatwork

@tayyyyciturn

@prateek_madaan1

@namanrathi003

@AshishMeher7

@Portfolio_Bull

@vishan_khadke

@anupammahor

@AdityaMittal795

@selvaprathee

@Praveen12Pranis

@GuruShareMarket

@Stock_marketIND

@swing_blaster

@trader_amay

@Vaishnav1904

@InvestWithAkhil

@vsvicky_

@1mukulahuja

@FinAspiration

@Fintech00

@choudhary0898

@DeepCUpreti

@sriranganek

@elesbaanp

@FinTaxCoach

@thiru_gowda

@StockGeeks11

@PulkitA30298377

@SasmitaM92

@ManishK46113331

@ManojSh52935210

@iamsutanudas

@investor_sr33

@disguisedtrader

@EquityInsightss

@vineetjain1101

@jineshhshah

@MayankSaraf123

@DhawalDoshi5

🥇Here are some excellent X accounts sharing valuable stock market investing content.

🎯Think this thread could help other investors?💭Kindly Share the first post!

@microcp2mltibgr

@AimInvestments

@ArindamPramnk

@KhapreVishal

@AnirbanManna10

@preet2419

@TheAlpha10X

@logical_traderr

@vandit_jain1994

@vardhiitbhu

@tsatwork

@tayyyyciturn

@prateek_madaan1

@namanrathi003

@AshishMeher7

@Portfolio_Bull

@vishan_khadke

@anupammahor

@AdityaMittal795

@selvaprathee

@Praveen12Pranis

@GuruShareMarket

@Stock_marketIND

@swing_blaster

@trader_amay

@Vaishnav1904

@InvestWithAkhil

@vsvicky_

@1mukulahuja

@FinAspiration

@Fintech00

@choudhary0898

@DeepCUpreti

@sriranganek

@elesbaanp

@FinTaxCoach

@thiru_gowda

@StockGeeks11

@PulkitA30298377

@SasmitaM92

@ManishK46113331

@ManojSh52935210

@iamsutanudas

@investor_sr33

@disguisedtrader

@EquityInsightss

@vineetjain1101

@jineshhshah

@MayankSaraf123

@DhawalDoshi5

• • •

Missing some Tweet in this thread? You can try to

force a refresh