Proud Nationalist 🇮🇳 | India First | Investing | Financial Freedom | All Views are Personal | No Buy/Sell Recommendation | DYODD.

How to get URL link on X (Twitter) App

2/13

2/13

2/10

2/10

2/8

2/8

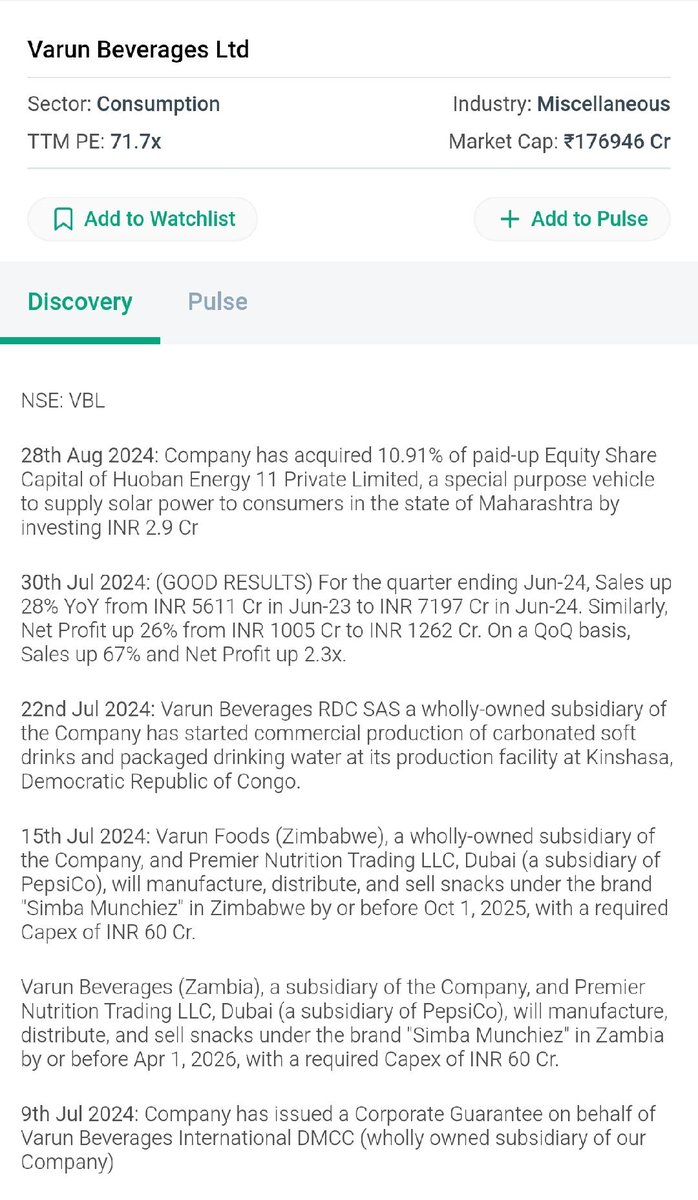

2 | ❄️Key Developments

2 | ❄️Key Developments

2/12

2/12

2/9

2/9

2/10

2/10

2/9

2/9

2/9

2/9

2/9

2/9

2/7

2/7

2/7

2/7

2/7

2/7

2/7

2/7

2/7

2/7

2/5

2/5

2/8

2/8

https://twitter.com/indiantechguide/status/1825555823638073817

2/10

2/10

2/7

2/7

https://twitter.com/Anvith_/status/1818310856939339856

2/7

2/7