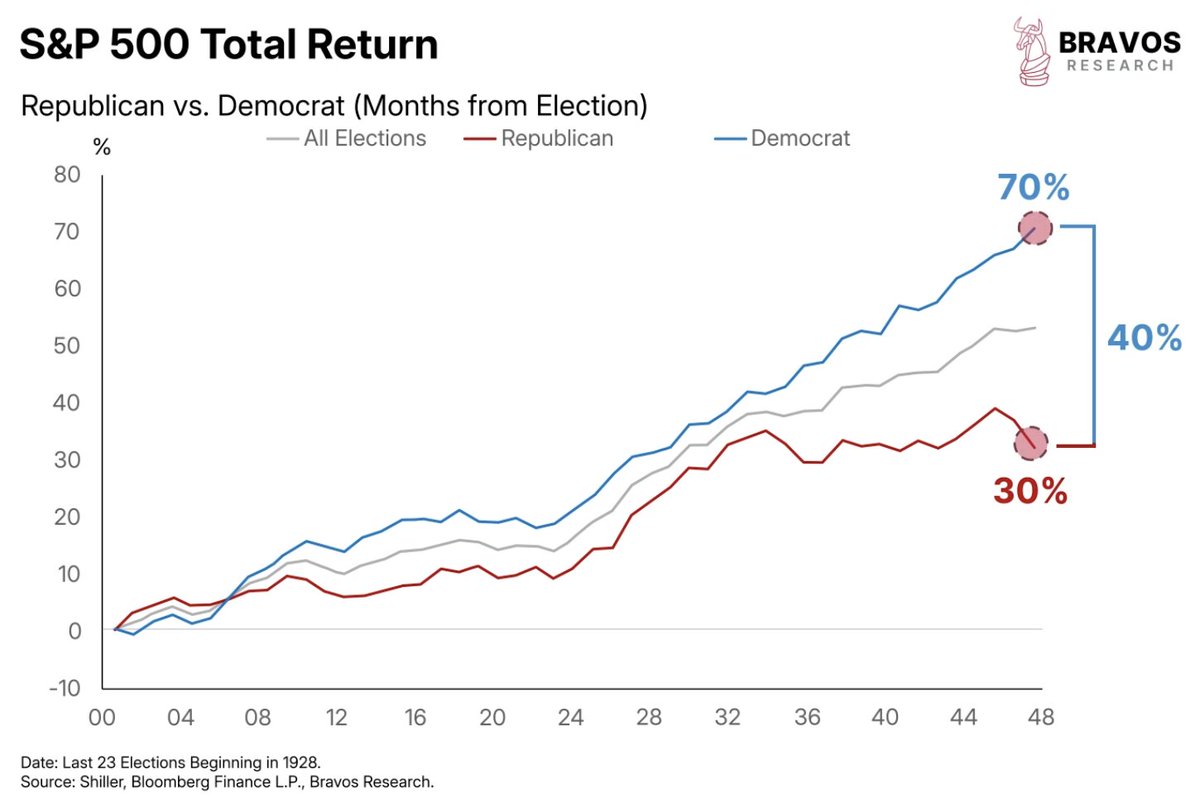

2/ A chart comparing post-election S&P 500 performance shows an eye-opening stat:

S&P 500 sees around 40% higher returns under Democrat-led administrations than under Republican ones

S&P 500 sees around 40% higher returns under Democrat-led administrations than under Republican ones

3/ It’s ironic that markets and economic growth have historically performed better under Democrats

Despite Republicans being viewed as more pro-business

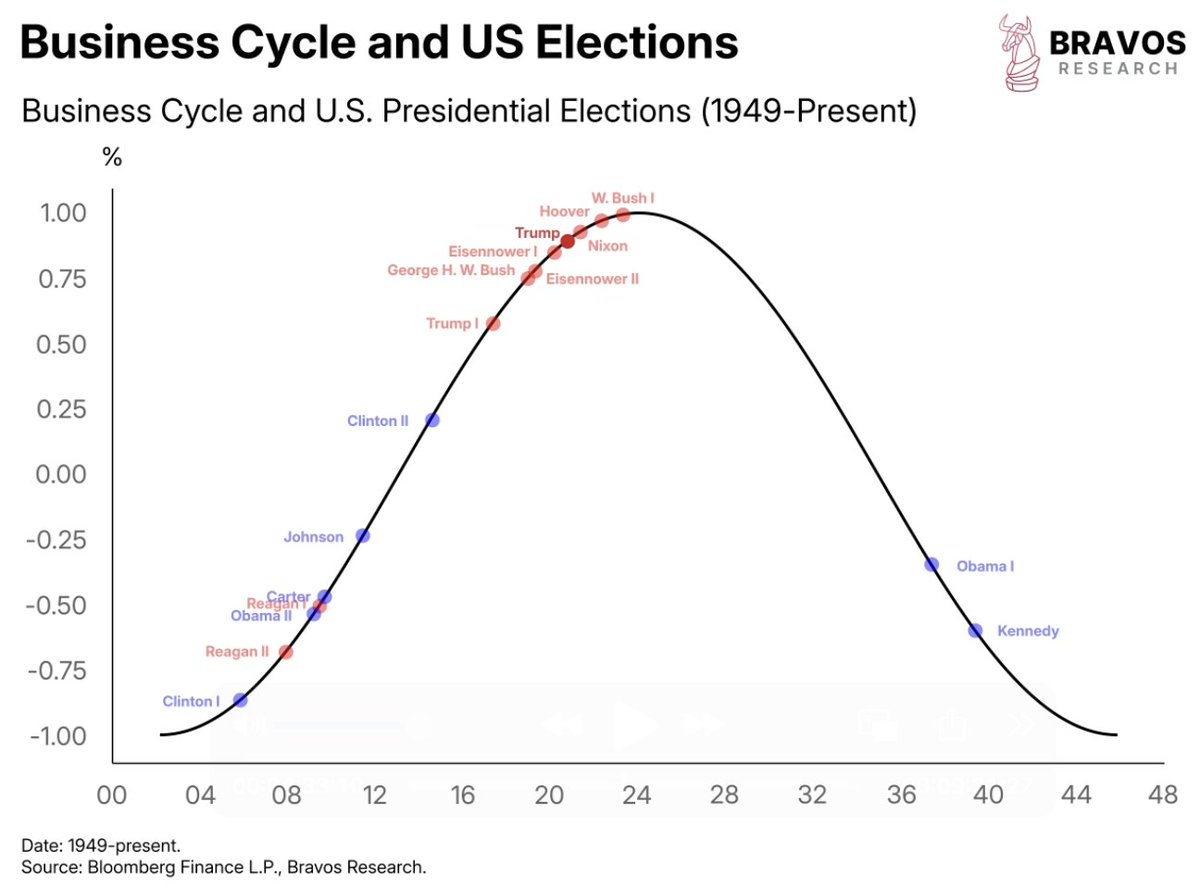

But, timing and luck likely play a bigger role in these outcomes than party policies alone

Despite Republicans being viewed as more pro-business

But, timing and luck likely play a bigger role in these outcomes than party policies alone

4/ The economy naturally moves through cycles of expansion and contraction, largely influenced by the Fed’s monetary policies rather than the president’s actions

Loose monetary policies stimulate growth

While restrictive measures help cool overheating economies

Loose monetary policies stimulate growth

While restrictive measures help cool overheating economies

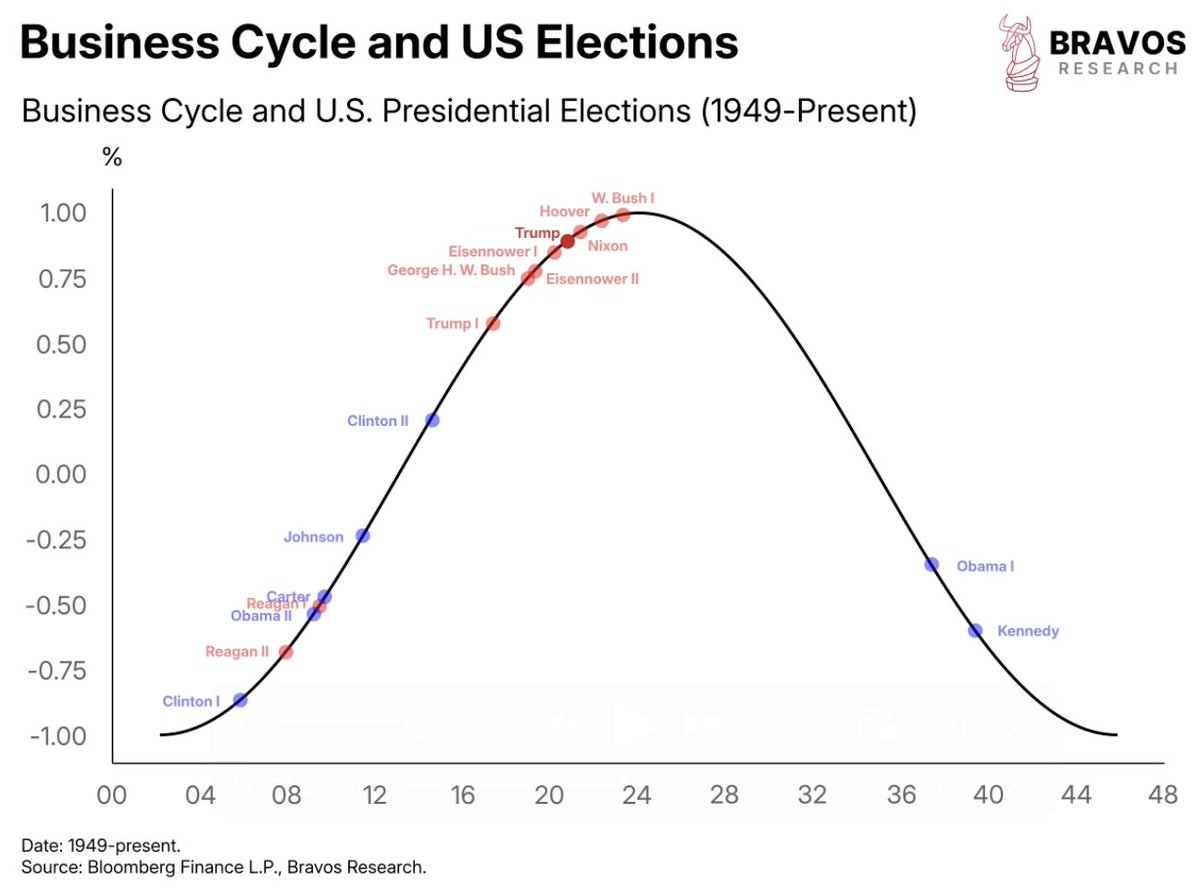

5/ Looking at past elections since 1949, many Republican presidents—Hoover, Nixon, Bush—were elected near the peaks of business cycles

Meaning their terms were more likely to face downturns

In contrast, Democrats often took office during recessions or early recoveries, benefiting from natural economic growth

Meaning their terms were more likely to face downturns

In contrast, Democrats often took office during recessions or early recoveries, benefiting from natural economic growth

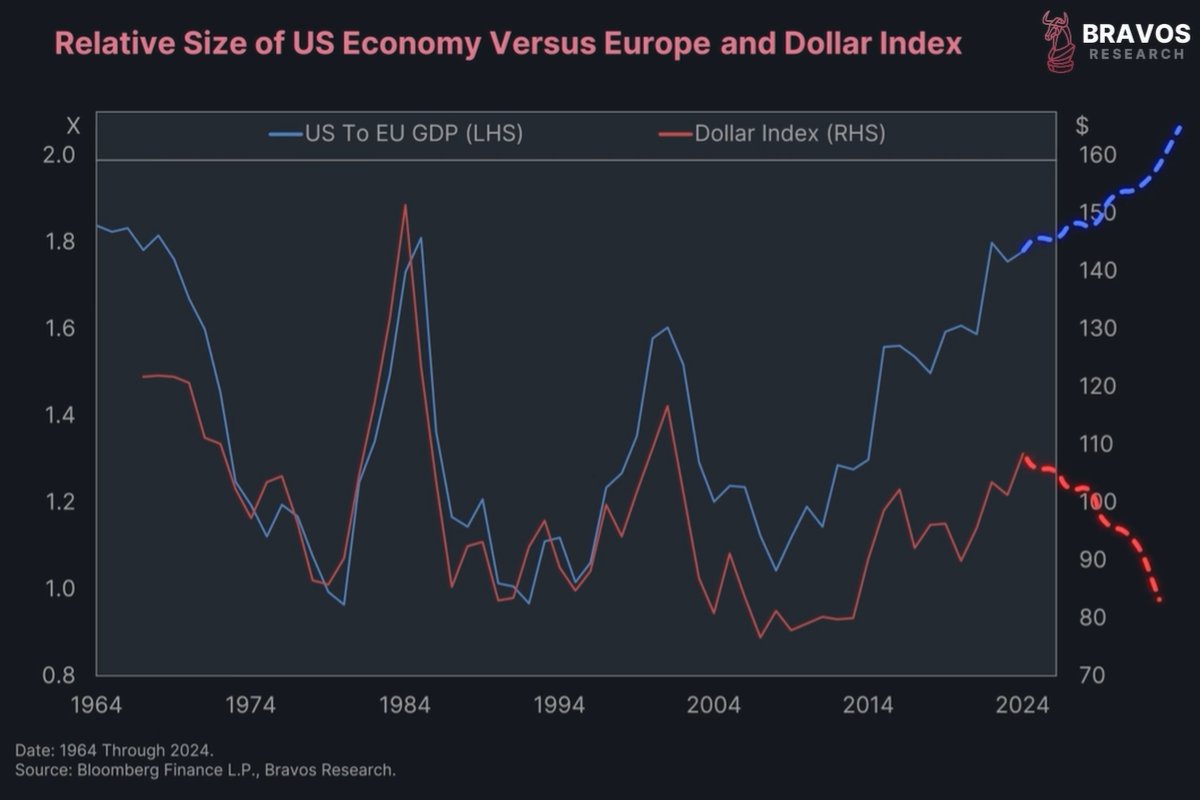

6/ Trump’s return seems to follow this historical trend

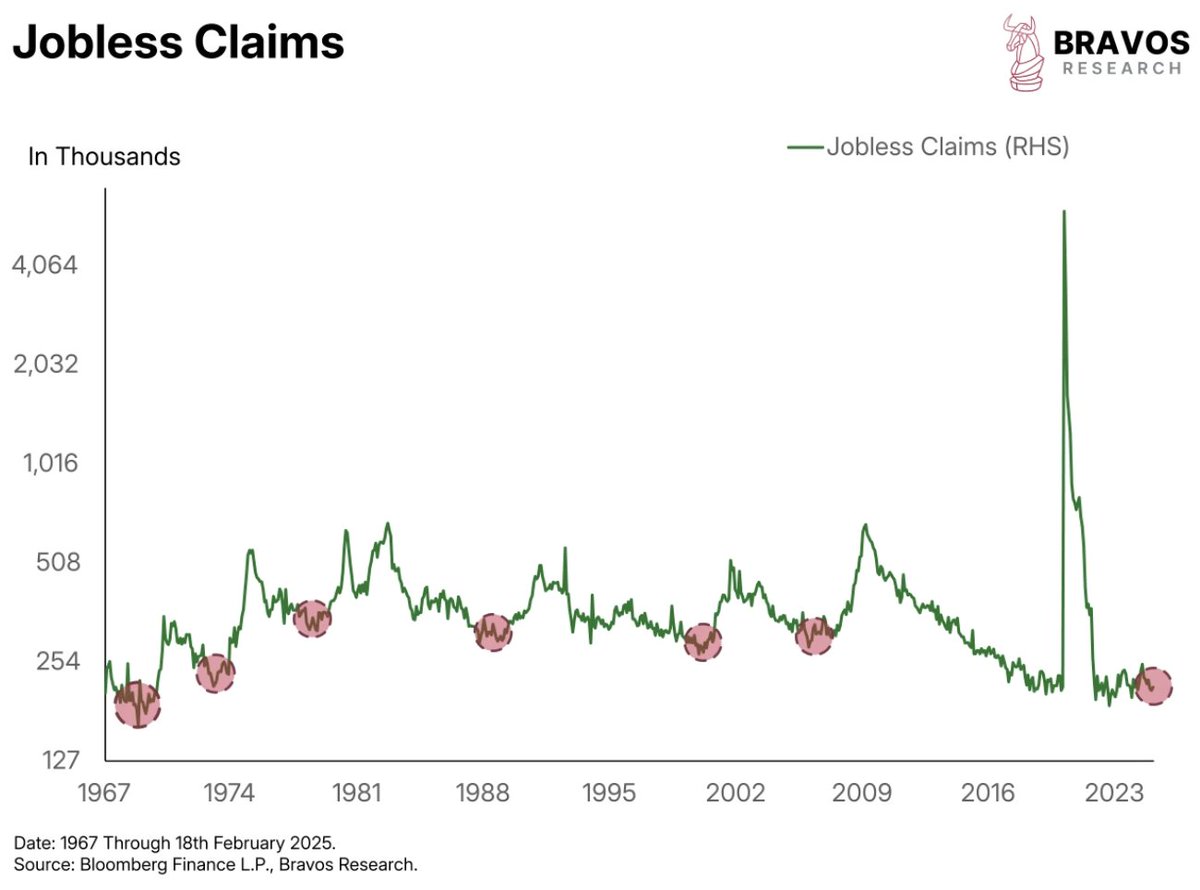

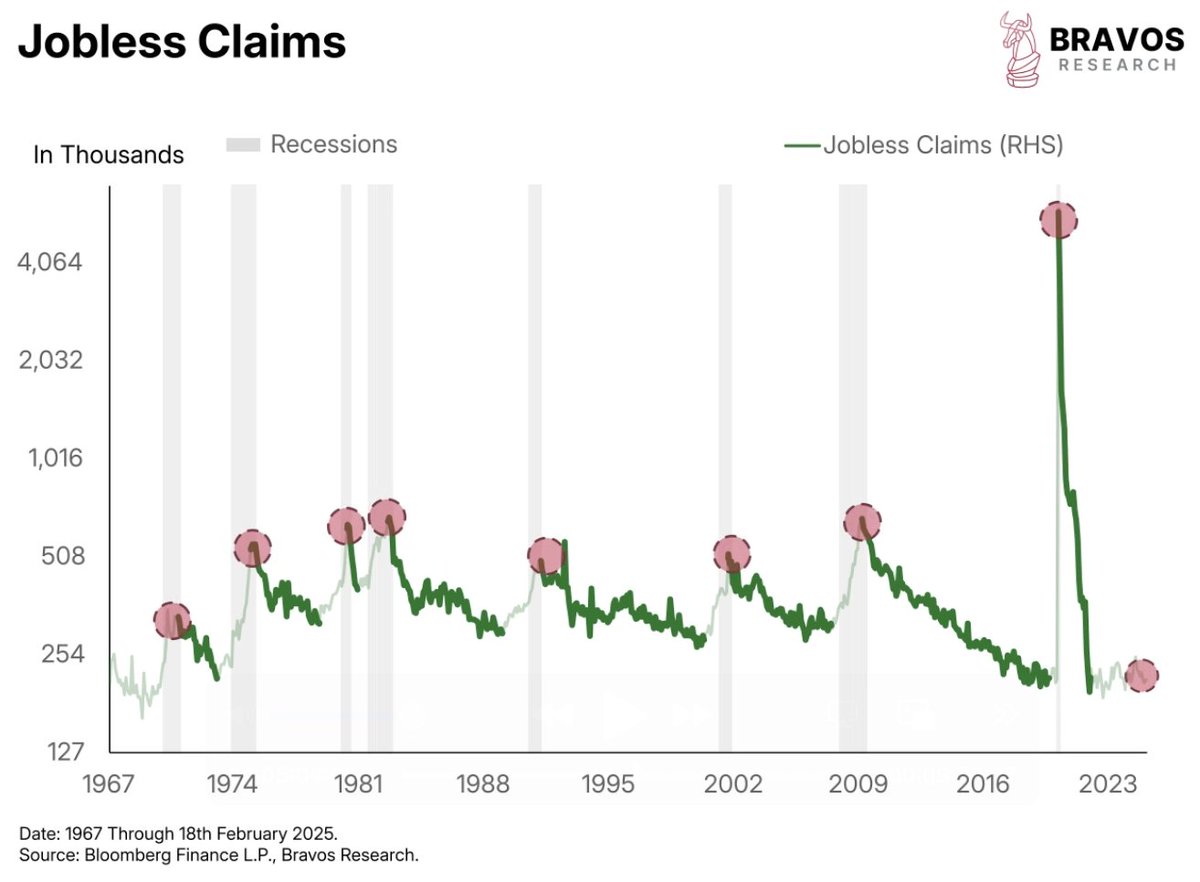

Low initial jobless claims suggest we’re nearing the end of the current business cycle

Which is a period that often precedes a recession within a few years

Low initial jobless claims suggest we’re nearing the end of the current business cycle

Which is a period that often precedes a recession within a few years

7/ At the beginning of a business cycle, jobless claims are typically high, leaving room for improvement

Right now, jobless claims are near historic lows, which could signal that the cycle is nearing its peak

Right now, jobless claims are near historic lows, which could signal that the cycle is nearing its peak

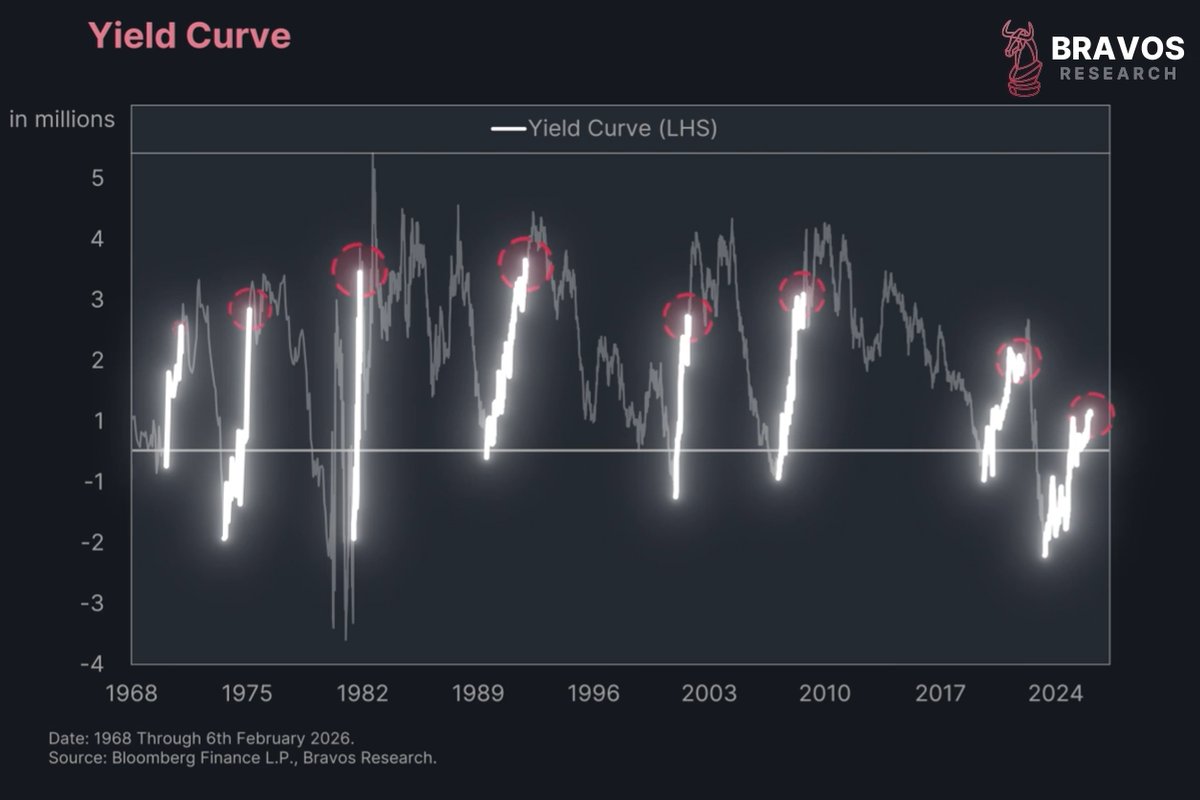

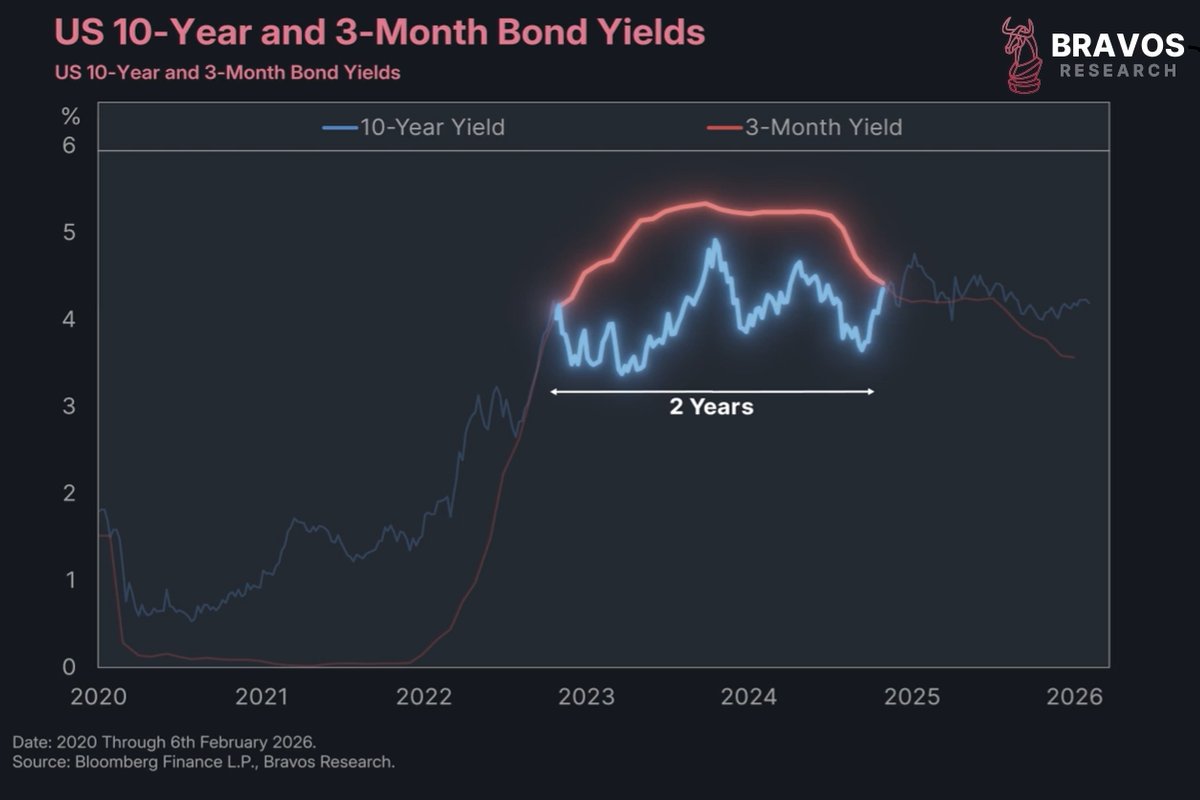

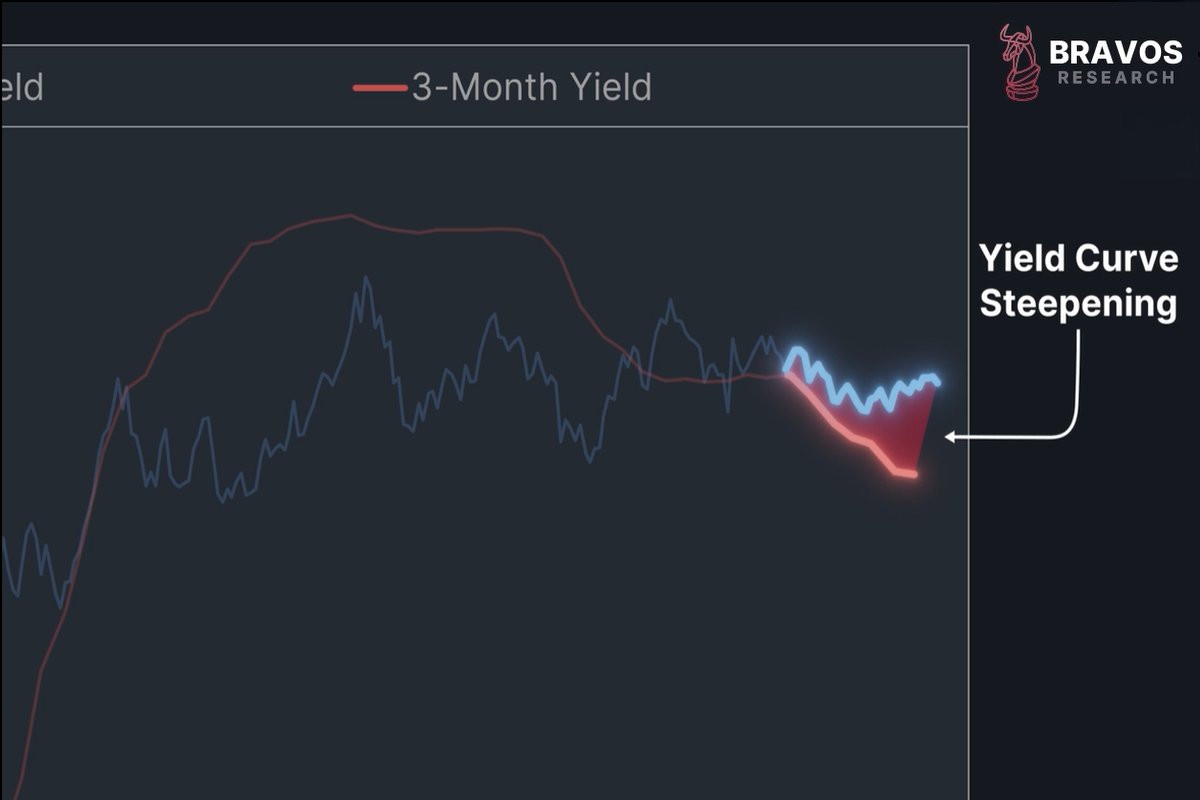

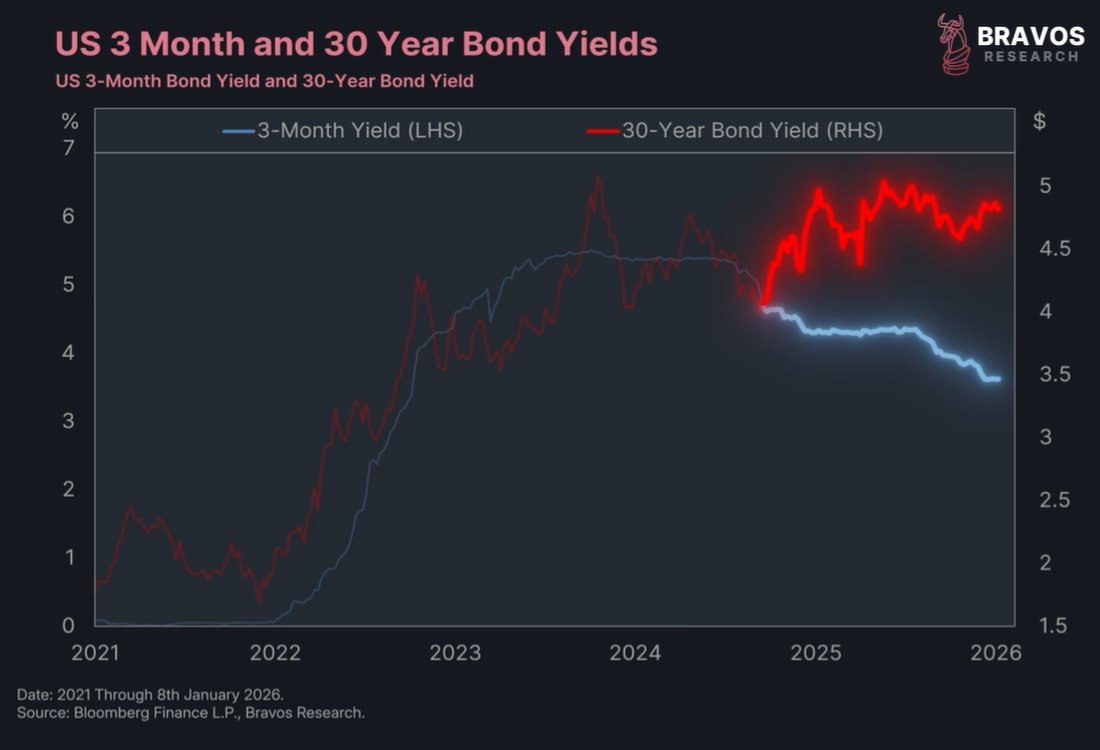

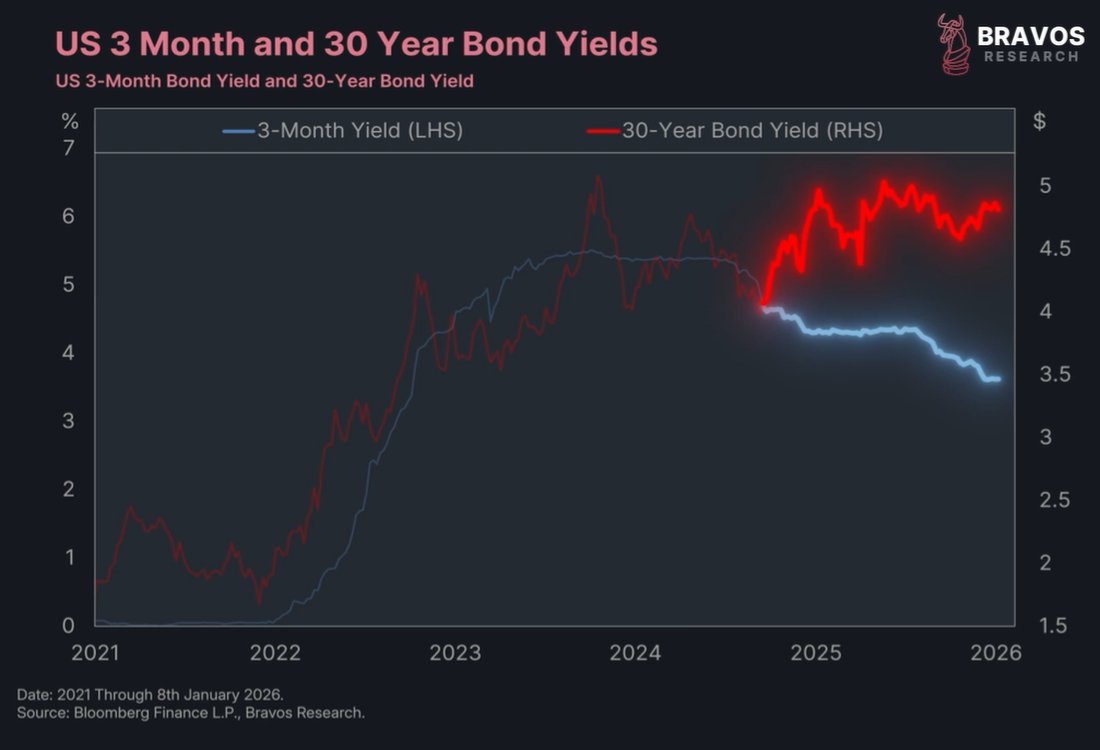

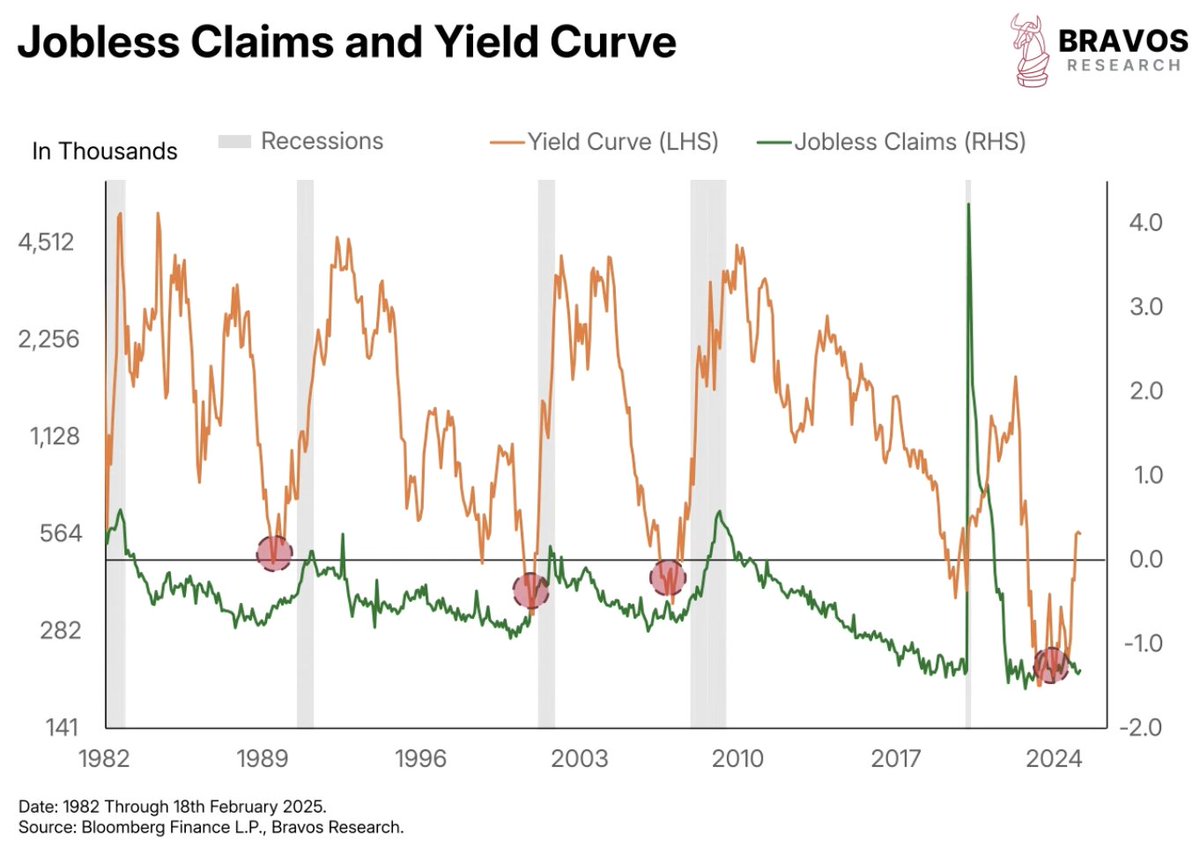

8/ The yield curve is another classic recession warning

While we’ve extended our recession forecast to 2026, that still puts a potential downturn during Trump’s term

Again, not necessarily because of his policies, but where we are in the business cycle

While we’ve extended our recession forecast to 2026, that still puts a potential downturn during Trump’s term

Again, not necessarily because of his policies, but where we are in the business cycle

9/ At Bravos Research, we stay apolitical and focus solely on objective, data-driven analysis

Trading success relies on probabilities, consistent strategies, and managing risk - not political opinions

Get real-time Trade Alerts with a 30% DISCOUNT at:

bit.ly/BravosResearch

Trading success relies on probabilities, consistent strategies, and managing risk - not political opinions

Get real-time Trade Alerts with a 30% DISCOUNT at:

bit.ly/BravosResearch

10/ Thanks for reading!

If you enjoyed this thread, please ❤️ and 🔁 the first tweet below

And follow @bravosresearch for more market insights, finance and investment strategies

If you enjoyed this thread, please ❤️ and 🔁 the first tweet below

And follow @bravosresearch for more market insights, finance and investment strategies

https://x.com/bravosresearch/status/1894394341860544742

• • •

Missing some Tweet in this thread? You can try to

force a refresh