A couple of thoughts on Avation $AVAP.LN #AVAP post 1H numbers. Big picture, stock trades ~0.8x P/tangible book (which I think is ~$145m, or 170p ref current), and obvi v large discount to NAV (which incorporates intangibles, the purchase rights), 0.46x P/NAV.

👇👇

👇👇

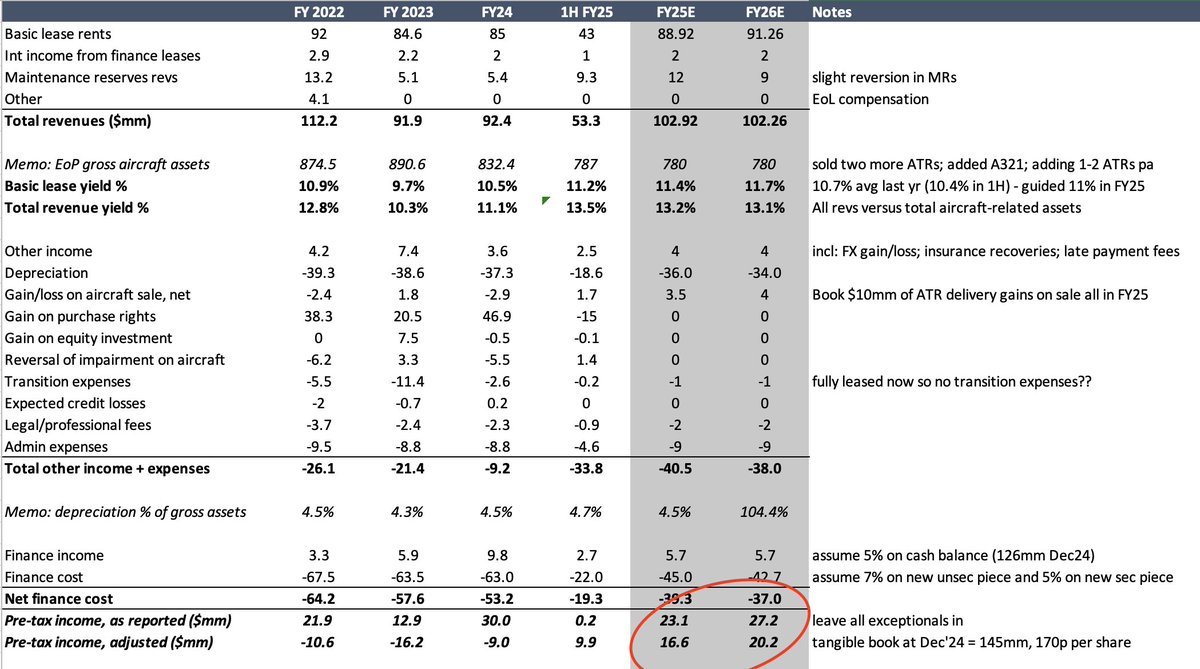

1) Gross lease yields and net spread. Yields back above 11% (reported 11.2% basic, 13.5% including maintenance revs), highest in last 4yrs. This is function mostly of releasing the entire fleet (no idle assets), against depreciating assets. Actually not many leases have rolled...

...to market leases, yet, given maturity profile of their leases. Irrespective of maintenance rev accounting, this number should progressively improve, I estimate 11.5% at basic level, maybe 11.7% in FY26.

This ties in w/ net spread (ie lease yield less depreciation less cost of debt).

This ties in w/ net spread (ie lease yield less depreciation less cost of debt).

Net spread, less depreciation, is best metric for sustainable profits at a lessor. On this basis AVAP turned the corner in 1H as despite rising debt cost net spread was positive for first time in 3-4yrs (at 0.9% annualized vs -1.6% last fiscal).

If you give benefit of maintenance revs, net spread is now 1.6%...

If you give benefit of maintenance revs, net spread is now 1.6%...

Keep in mind this is purest lessor accounting - it gives no benefit (or detriment) to aircraft gains/losses; purchase right sales; etc etc. Just gross yields on the assets less depreciation less interest, as a % of the asset base.

If you run-rate the PnL for: 1) further modest improvement in lease yields; 2) lower debt burden and say 125bps refi benefit on the bonds; and $3-4mm of excess gains thru selling purchase rights each year, you get $23-27mm in PBT this year and next. Or strip out everything 'below the line' and you still get $16-20mm PBT:

Finance theory suggests you should pay (tangible) book value if return on equity > cost of equity. #AVAP has favorable Singaporean tax incentives such that taxes shouldnt take more than 15% out of this PBT; meaning net should be $20-23mm (yes I know I am well ahead of street).

$20mm NI ref $145mm of tangible equity is about a 14% RoE. I don't think CoE for this entity is 10%, but 14-15% should about cover it - meaning this should trade at a minimum north of tangible book.

That ignores the upside optionality around the huge purchase rights balance - 120p per share - and any potential monetization, even partial.

That ignores the upside optionality around the huge purchase rights balance - 120p per share - and any potential monetization, even partial.

This also ignores synergy upside from SG&A - $9mm/pa for a 33 plane fleet - which is (imo) most all upside to any acquirer.

I assume if stock doesn't rerate this year you just see further asset sales and buybacks (PAL shares definitely, widebodies probably?).

Yes I have a yuuge position so take it w/ a grain of salt. But still really like this one, especially as aircraft shortage doesn't seem likely to end for another few years, maybe 5+ years.

I assume if stock doesn't rerate this year you just see further asset sales and buybacks (PAL shares definitely, widebodies probably?).

Yes I have a yuuge position so take it w/ a grain of salt. But still really like this one, especially as aircraft shortage doesn't seem likely to end for another few years, maybe 5+ years.

• • •

Missing some Tweet in this thread? You can try to

force a refresh