Nothing I say/tweet/emoji is investment advice, and is solely for entertainment only. Always DYODD, I am not your fiduciary!

17 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/puppyeh1/status/2010312370460180738There are really only two outcomes re $HUM.AX: the Convenors (me+CSAM) win and complete board renewal; or the Convenors lose and Abercrombie remains Chair.

https://twitter.com/puppyeh1/status/20080133023503732821) Current BoD has been a disaster for shareholders. Abercrombie (Chair) acceded in Aug 2015; since then (before our EGM was called) the stock was -80% in 10.5yrs vs the ASX +50%.

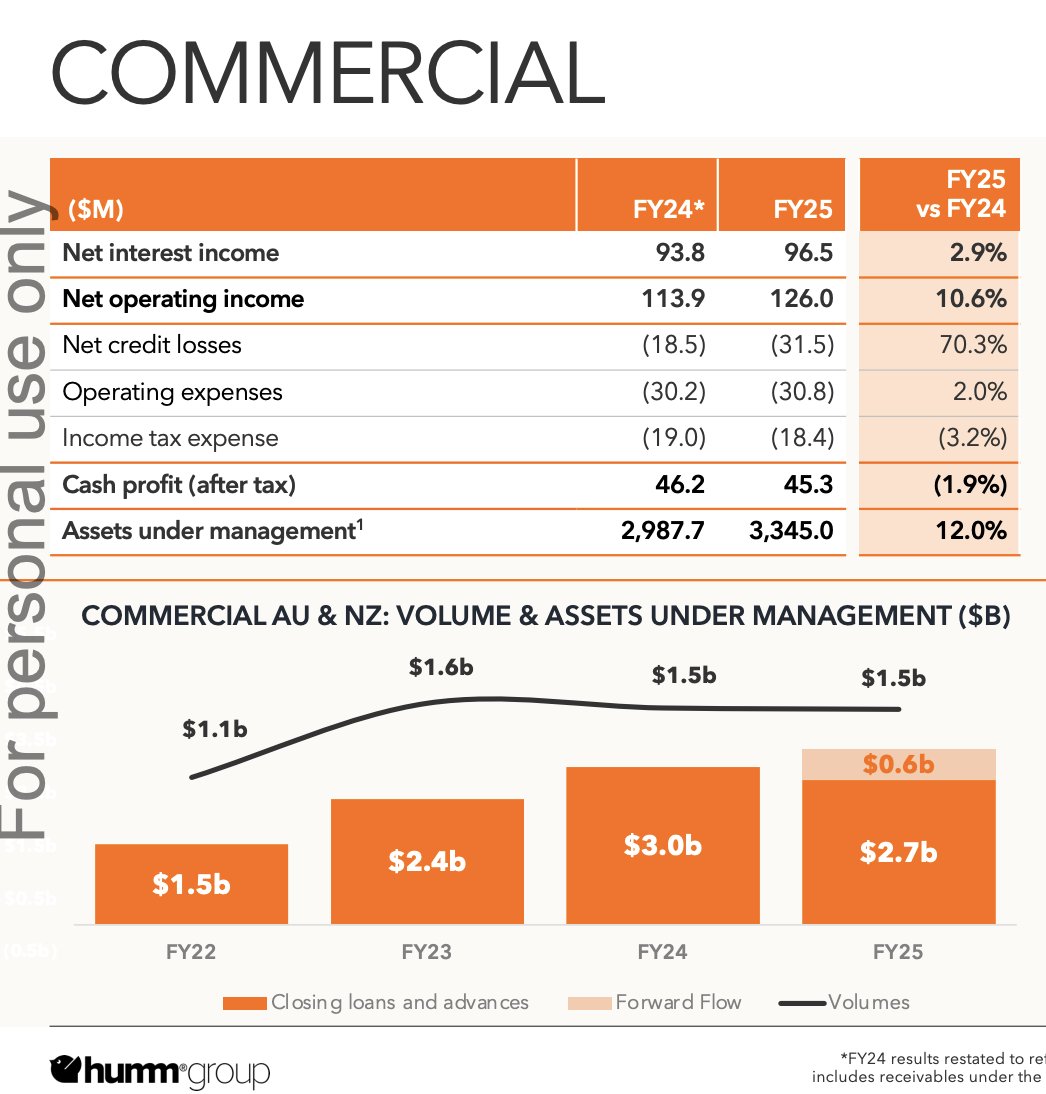

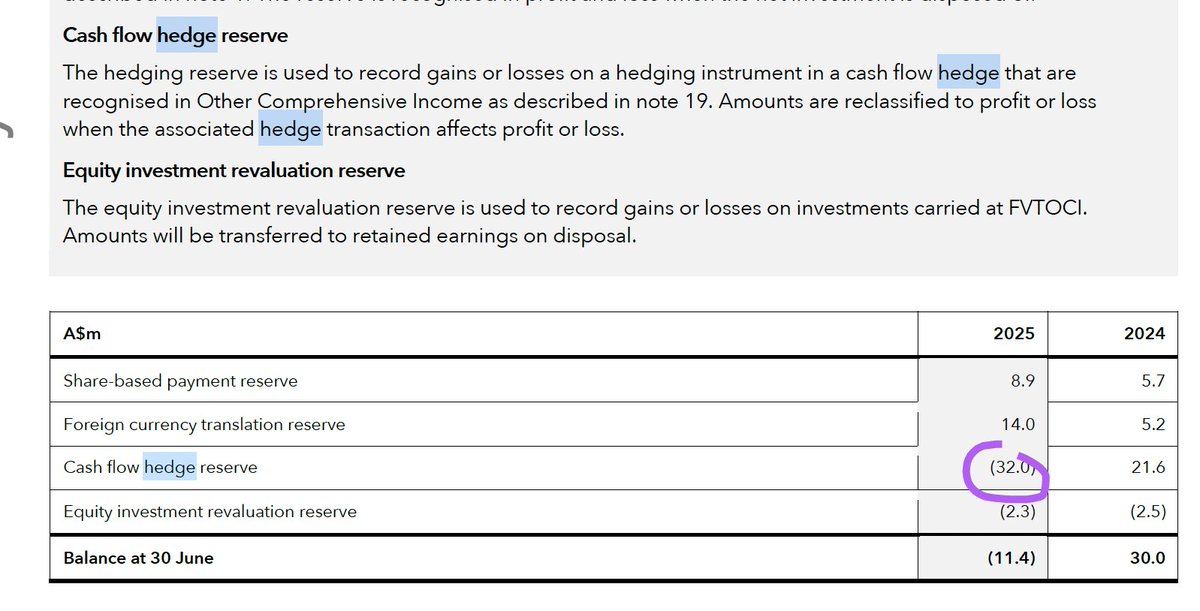

https://twitter.com/puppyeh1/status/19609547324760436091) Running hedge m2m losses through OCI. I saw zero comment on this post $HUM.AX annual numbers. Humm hedges interest rates to protect their NIM and the accounts make it clear that hedges in the accounts are 'effective' - which means simply every $ of hedge losses is offset...

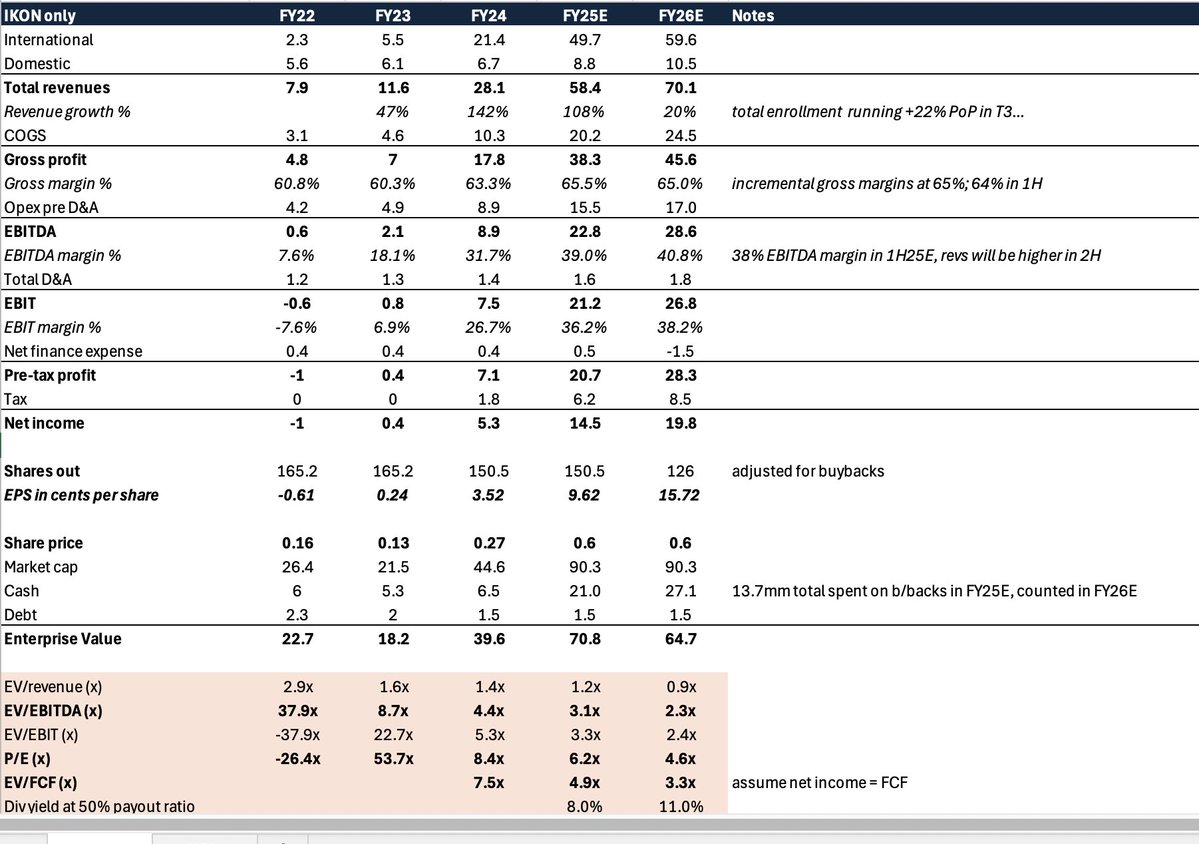

At 16.5c per share (the supposedly 'fair' buyback px) the implied mkt cap was $25mm 🤣🤣

At 16.5c per share (the supposedly 'fair' buyback px) the implied mkt cap was $25mm 🤣🤣

https://twitter.com/puppyeh1/status/1932979263302689241

Given (I believe) TFG owns (at mids) 4.5mm shs of Ripple Labs, I think they are marking their Ripple shs at about $53/share (a big discount to private market transactions, given liquidity, etc).

Given (I believe) TFG owns (at mids) 4.5mm shs of Ripple Labs, I think they are marking their Ripple shs at about $53/share (a big discount to private market transactions, given liquidity, etc).

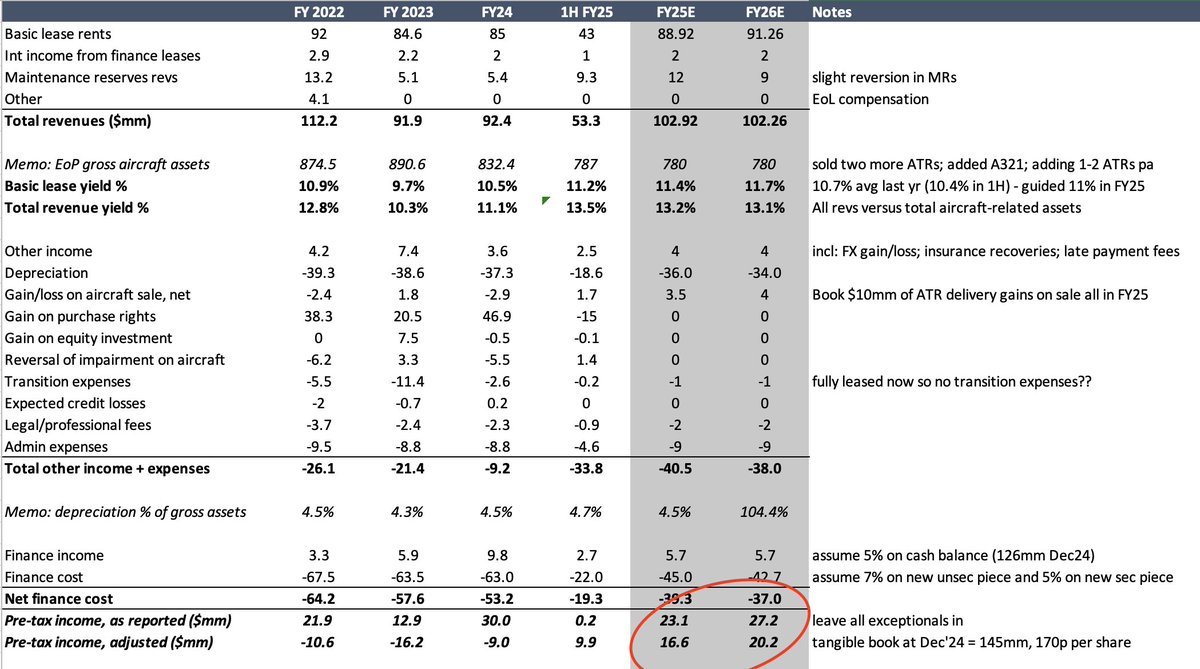

Still think another 10-15% upside nt in $AER but easy $$ has been made.

Still think another 10-15% upside nt in $AER but easy $$ has been made.

https://twitter.com/TRAVmoneyofmine/status/1849332859515081174Greentech is basically a holdco w/ that consolidates its 82% owned sub, YT Parksong, that owns 50% in Renison. Parksong itself JV-accounts Renison (ie just 50% of Renison assets, liabilities, earnings, etc) meaning Greentech accounts show this 50% number (not their 41% true interest)

https://twitter.com/puppyeh1/status/1818618036271943882$CDRO is two B2C igaming businesses in 2 countries (essentially) - Spain and Mexico. both are v diff markets (maturity; growth rates; etc) but quite attractive in their own way.

https://twitter.com/puppyeh1/status/1826124073124114874Recall the three criteria (absolute stonking cheapness; most all value in non-operating liquid assets; open register).

https://twitter.com/puppyeh1/status/1825518135069507774(which often happens w/ controlled or subsidiaries etc) is a pretty bad risk/reward outcome. The fact that many net-nets tend to be bad businesses (chronically poor return and/or no growth), only compounds this worry.

https://twitter.com/puppyeh1/status/17788035337160419232) Leonoil, another SL-affiliated entity (maybe the state oil co?) bought 5% in the market, maybe at 13c avg: