FinChat just launched Custom Metrics 📊

Here are 10 insane charts you can now build with it:

1. Alphabet - Google Cloud Operating Margin

$GOOGL

Here are 10 insane charts you can now build with it:

1. Alphabet - Google Cloud Operating Margin

$GOOGL

2.) ASML - Average Price per EUV System

ASML's lithography systems are notorious expensive. In fact, in 2023, the average EUV system cost just under $200 million.

$ASML

ASML's lithography systems are notorious expensive. In fact, in 2023, the average EUV system cost just under $200 million.

$ASML

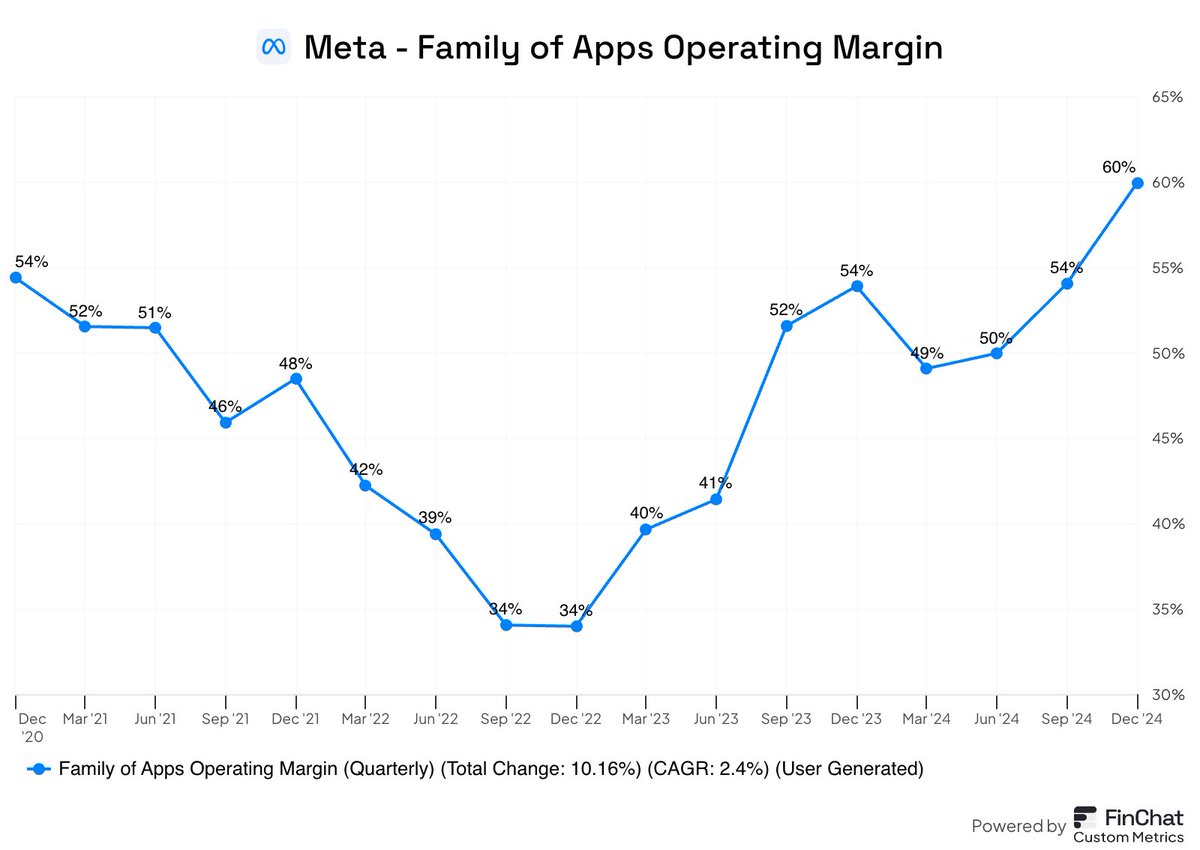

3. Meta - Family of Apps Operating Margin

Meta's Family of Apps business (Facebook, Instagram, WhatsApp, etc.) reached record profitability last quarter with 60% operating margins.

$META

Meta's Family of Apps business (Facebook, Instagram, WhatsApp, etc.) reached record profitability last quarter with 60% operating margins.

$META

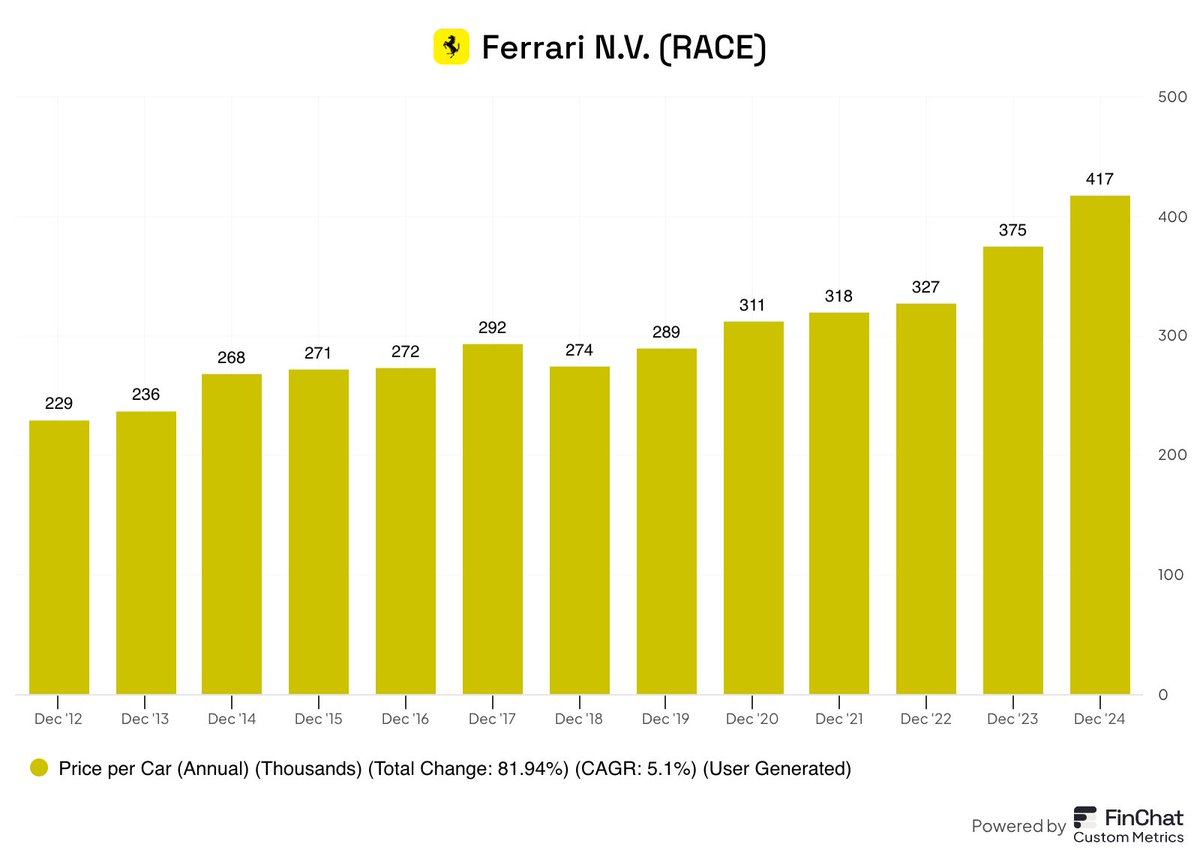

4. Ferrari - Average Price per Car

In 2024, the average price of a Ferrari was north of $400k. Talk about pricing power.

$RACE

In 2024, the average price of a Ferrari was north of $400k. Talk about pricing power.

$RACE

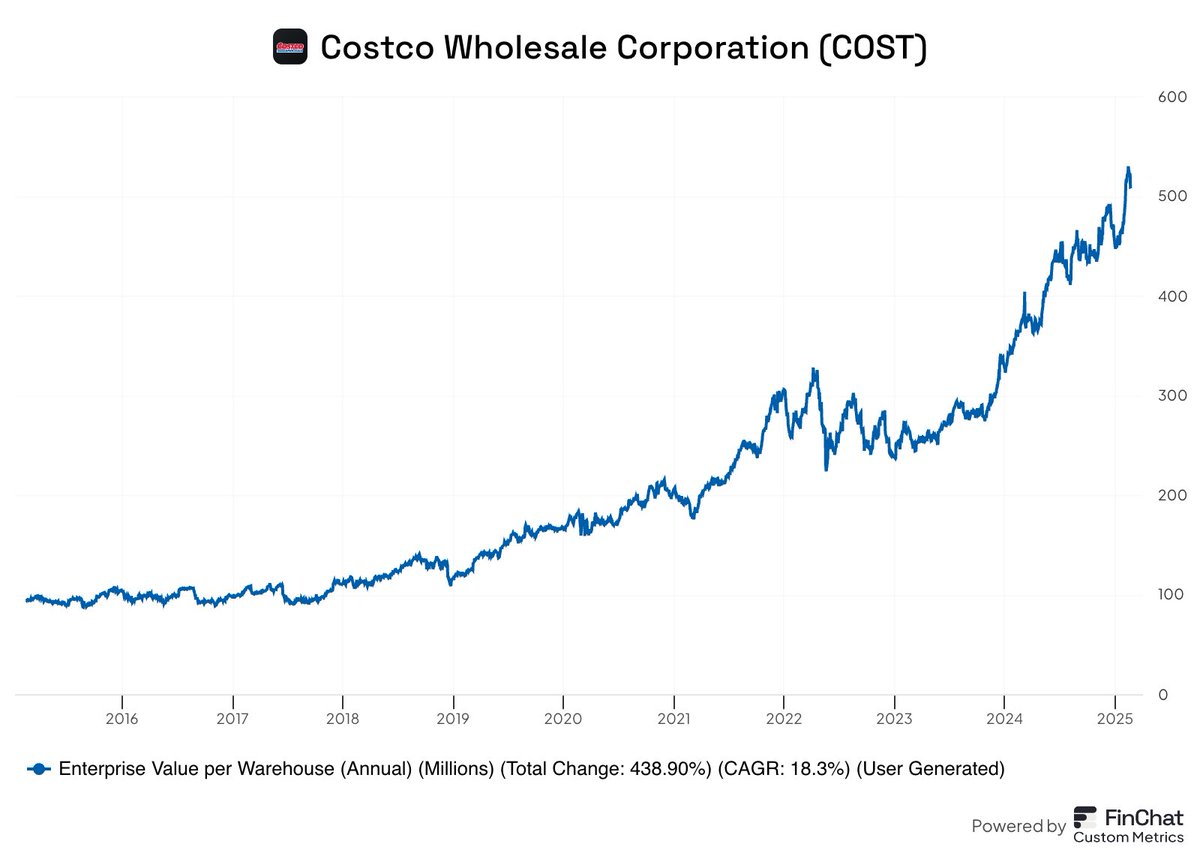

5. Costco - Enterprise Value per Warehouse

The average Costco warehouse is currently valued at $509 million!

$COST

The average Costco warehouse is currently valued at $509 million!

$COST

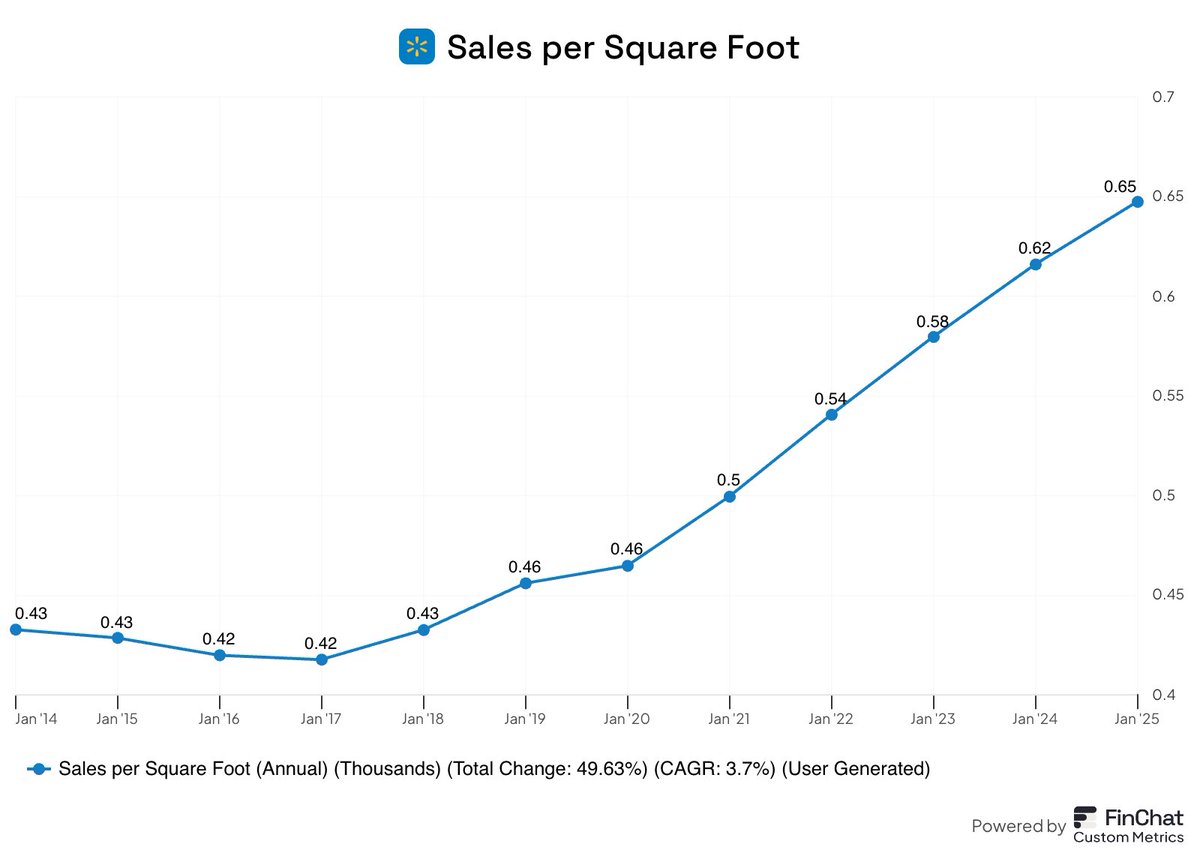

6. Walmart - Sales per Square Foot

Last year Walmart averaged $650 of sales per square foot. That's up ~50% from a decade ago.

$WMT

Last year Walmart averaged $650 of sales per square foot. That's up ~50% from a decade ago.

$WMT

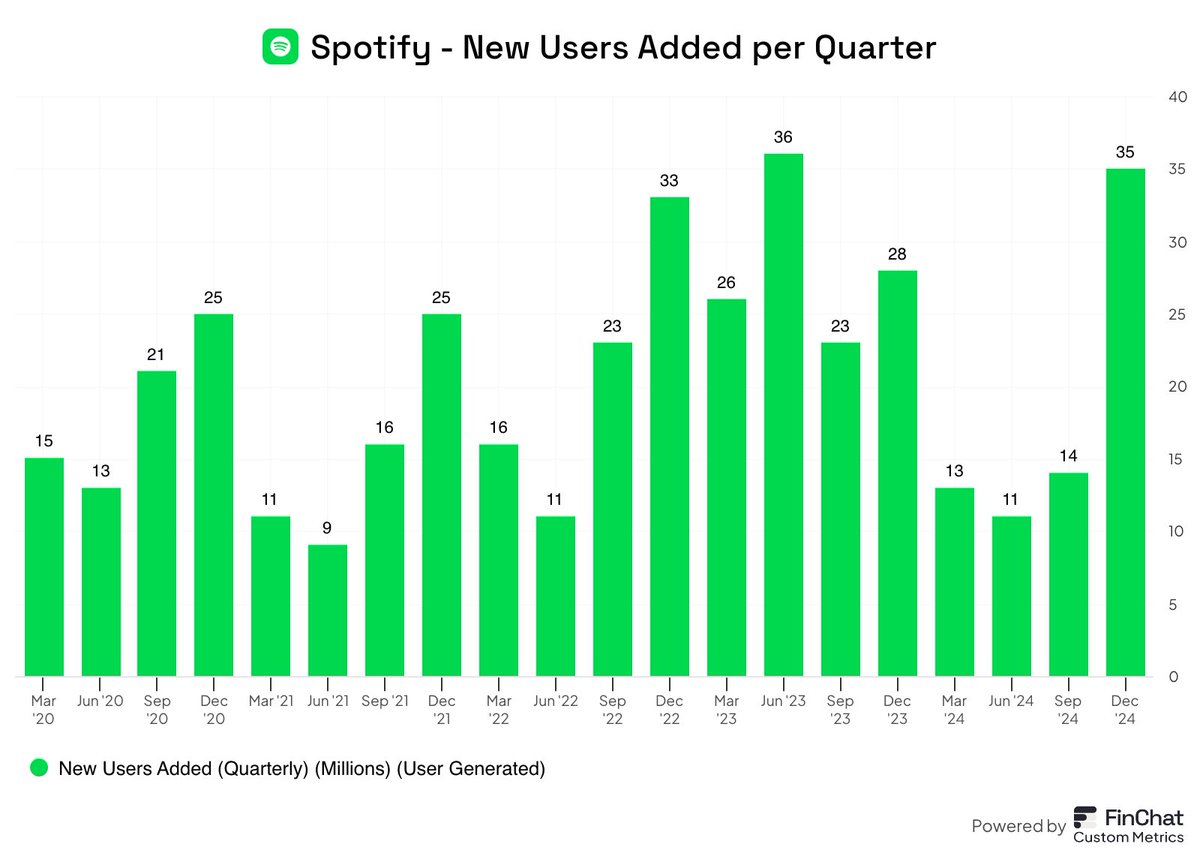

7. Spotify - New Users Added per Quarter

Last quarter Spotify added 35 million new MAUs. The 2nd highest quarter in the company's history.

$SPOT

Last quarter Spotify added 35 million new MAUs. The 2nd highest quarter in the company's history.

$SPOT

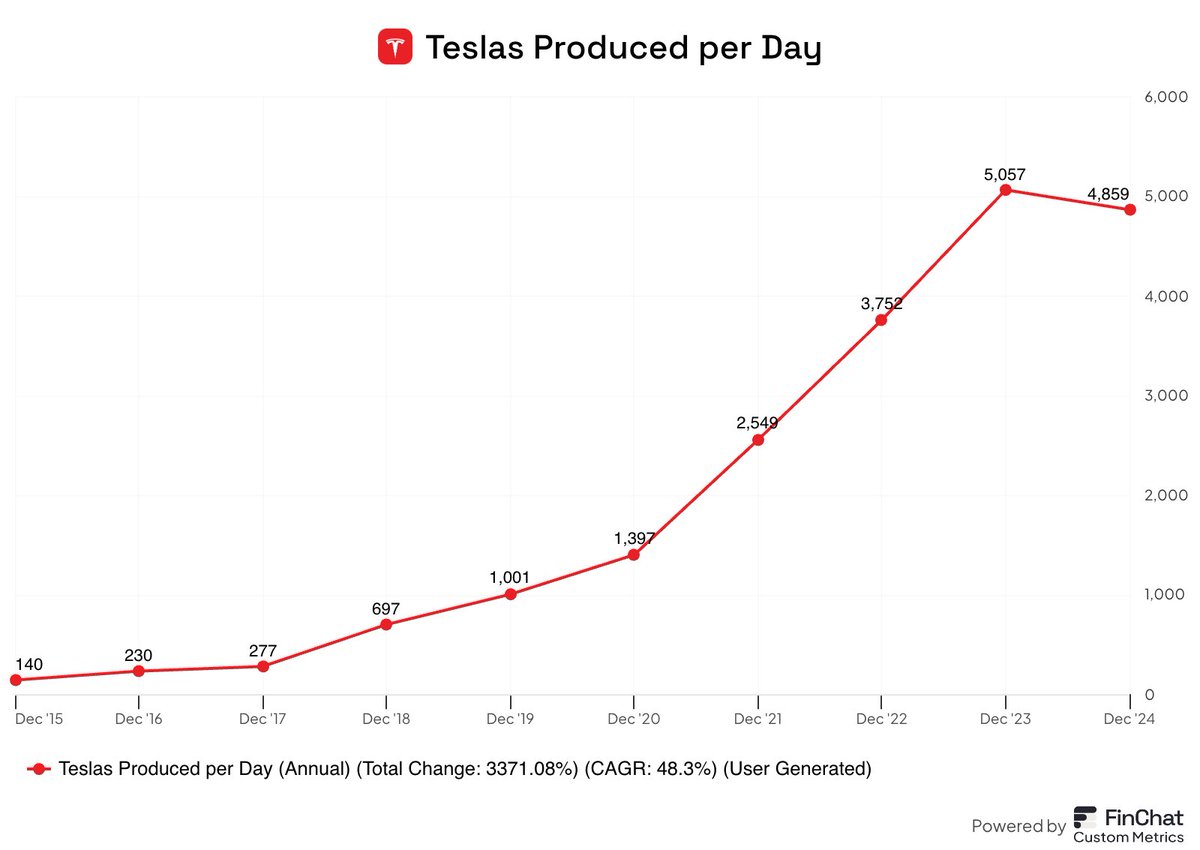

8. Tesla - Cars Produced per Day

This year, Tesla produced an estimated 4,859 cars every single day. In 2015, they were producing just 140 cars per day.

$TSLA

This year, Tesla produced an estimated 4,859 cars every single day. In 2015, they were producing just 140 cars per day.

$TSLA

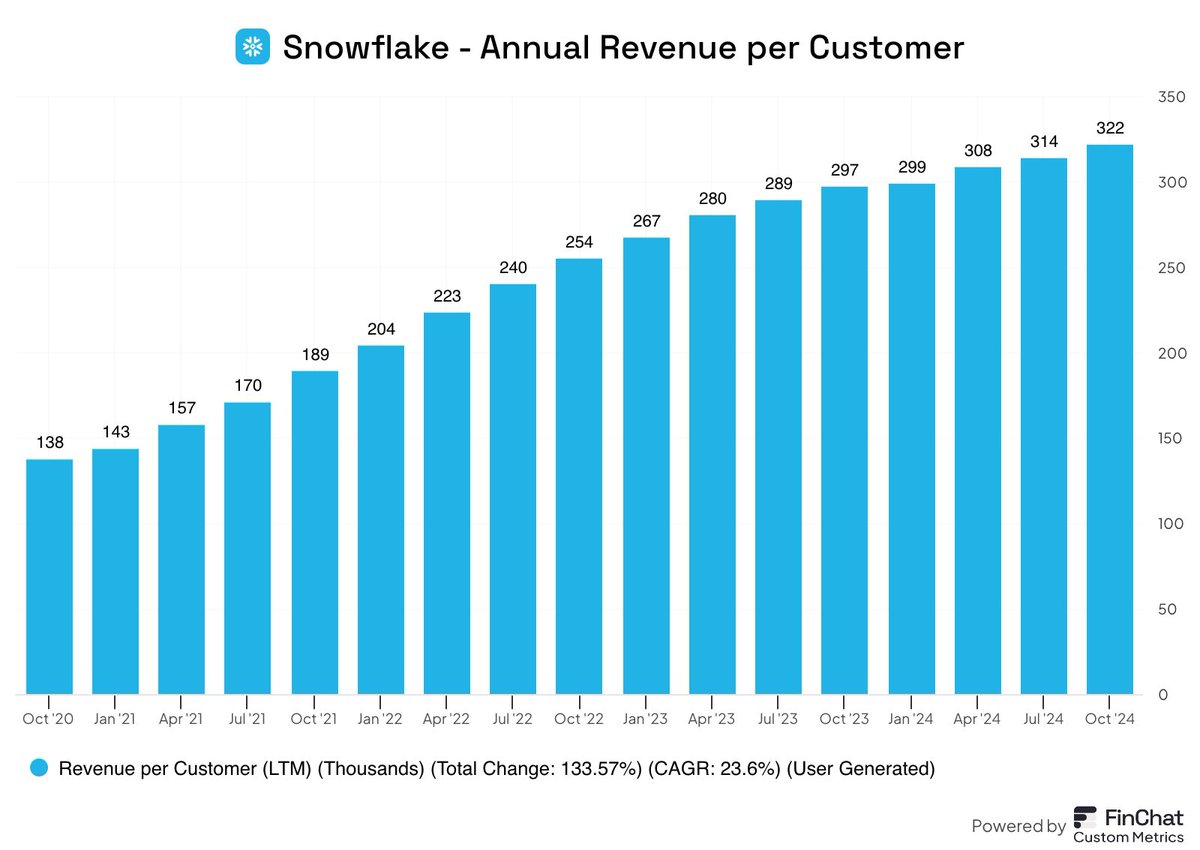

9. Snowflake - Annual Revenue per Customer

Not only is Snowflake growing its customer count, but the average revenue per customer has grown at 23.6% annually over the last 4 years.

$SNOW

Not only is Snowflake growing its customer count, but the average revenue per customer has grown at 23.6% annually over the last 4 years.

$SNOW

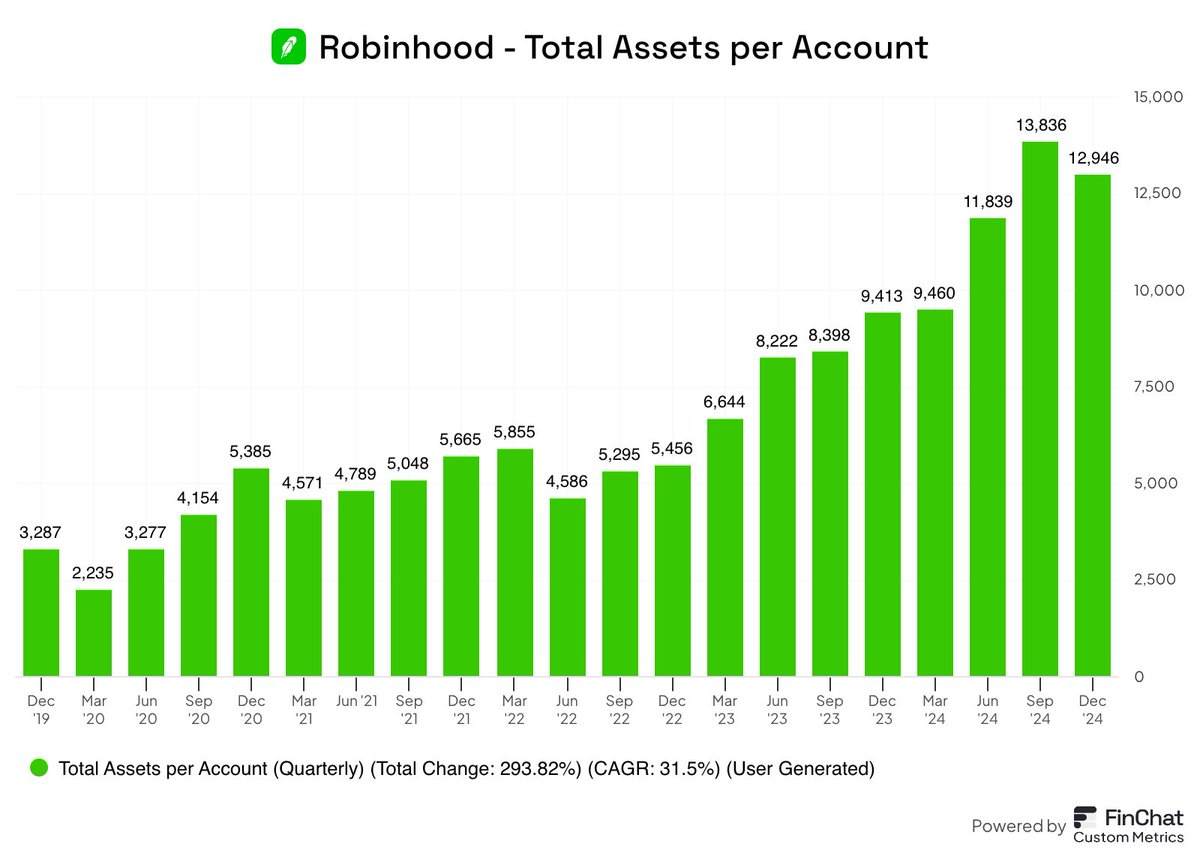

10. Robinhood - Total Assets per Account

Although Robinhood's total users are still down from 2021 highs, the brokerage platform seems to be attracting higher quality users. Average Assets per MAU is ~4x higher than 5 years ago.

$HOOD

Although Robinhood's total users are still down from 2021 highs, the brokerage platform seems to be attracting higher quality users. Average Assets per MAU is ~4x higher than 5 years ago.

$HOOD

• • •

Missing some Tweet in this thread? You can try to

force a refresh