The future of investment research is here. Fundamental research platform for global equities. High quality financial data, available instantly.

3 subscribers

How to get URL link on X (Twitter) App

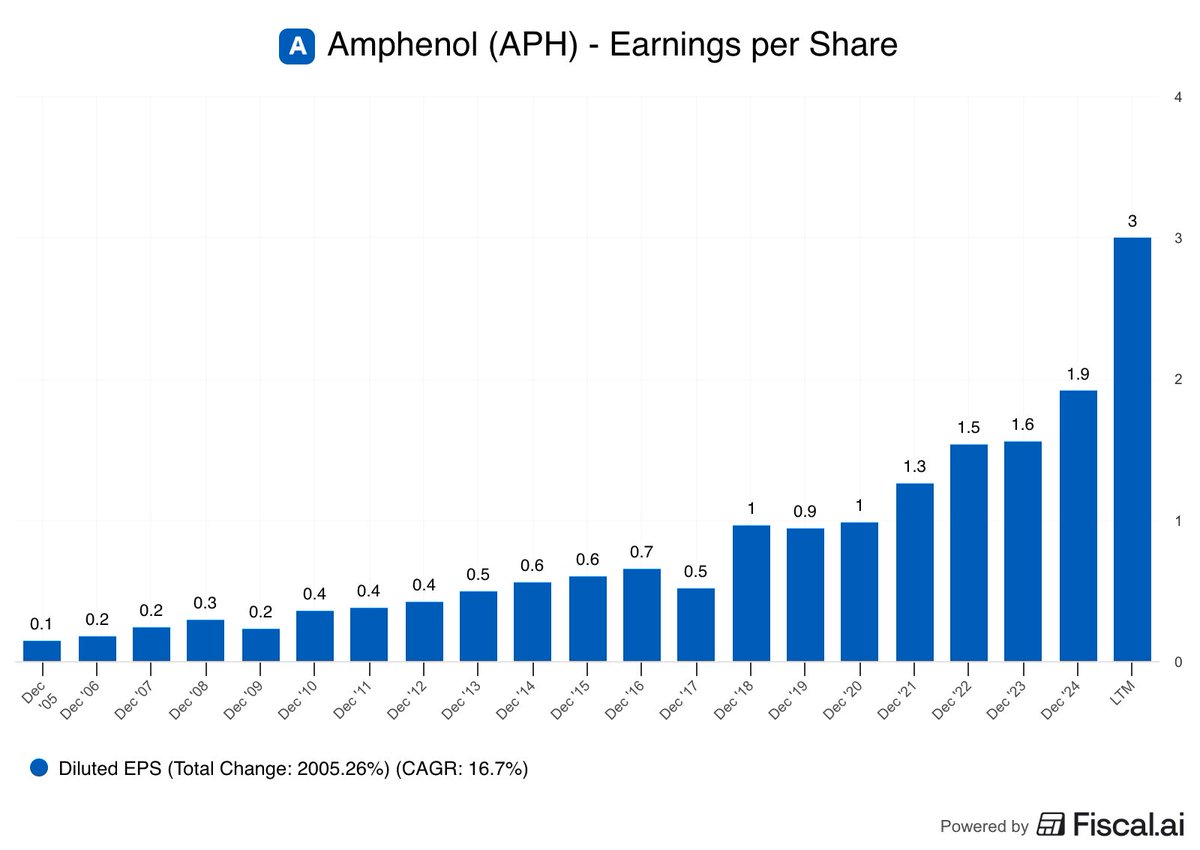

2. Amphenol $APH

2. Amphenol $APH

Competition Risk /1

Competition Risk /1

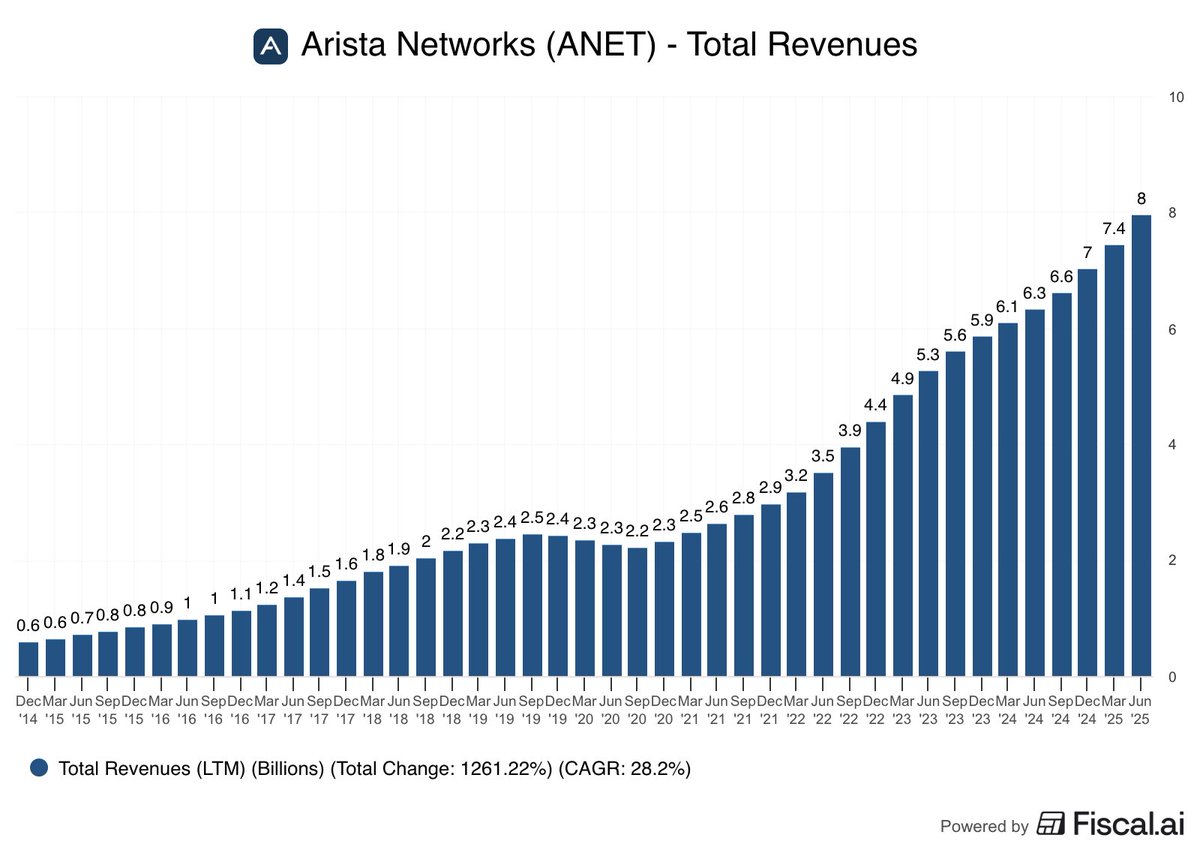

2. Arista Networks $ANET

2. Arista Networks $ANET

2. Li Lu - Himalaya Capital

2. Li Lu - Himalaya Capital

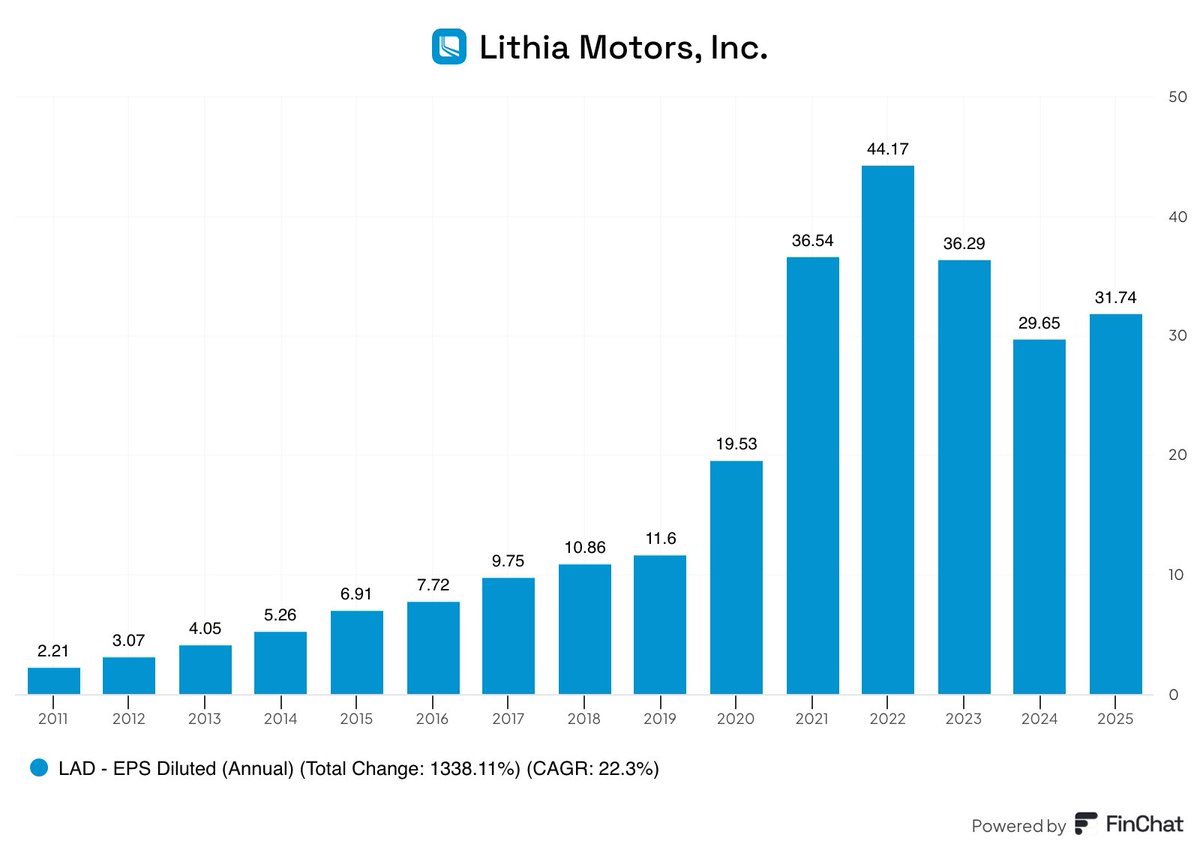

1.) Lithia Motors $LAD

1.) Lithia Motors $LAD

2.) Apple $APPL

2.) Apple $APPL

1.) YouTube $GOOGL

1.) YouTube $GOOGL

1.) Costco $COST - EV/Warehouse

1.) Costco $COST - EV/Warehouse

2.) ASML - Average Price per EUV System

2.) ASML - Average Price per EUV System

6.) DAVE $DAVE

6.) DAVE $DAVE

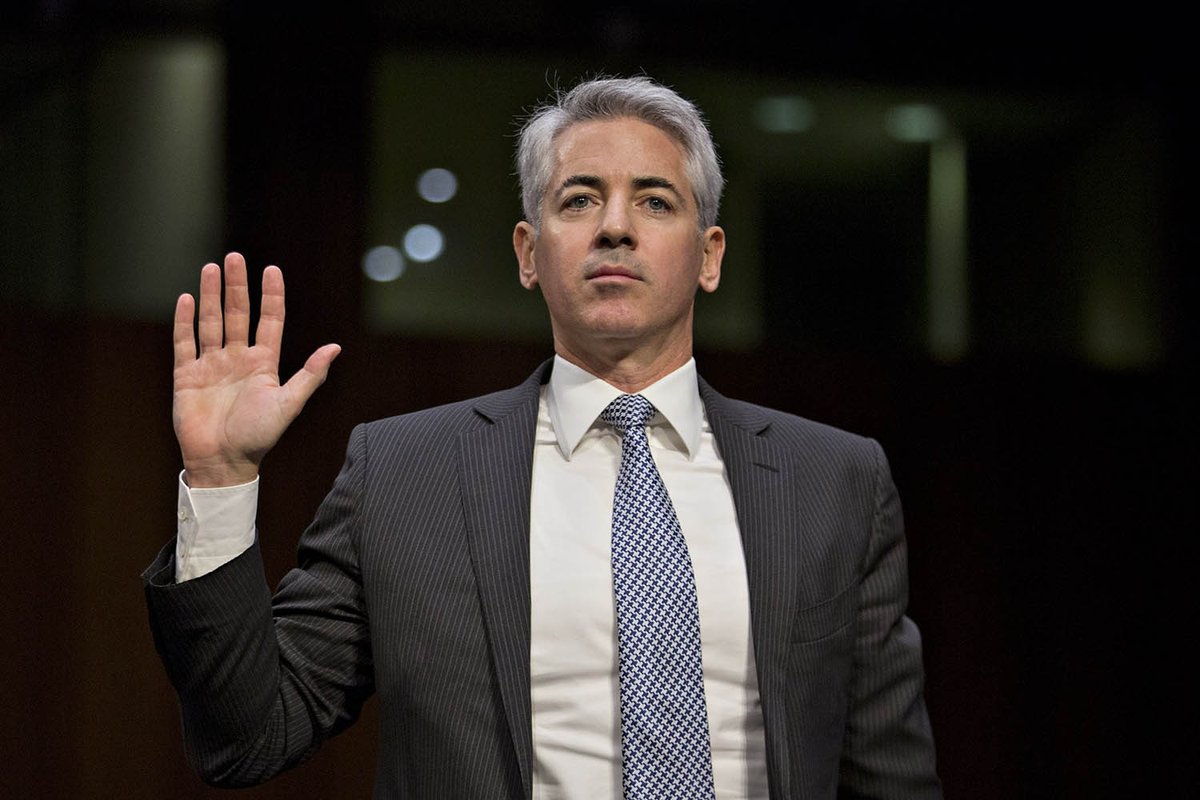

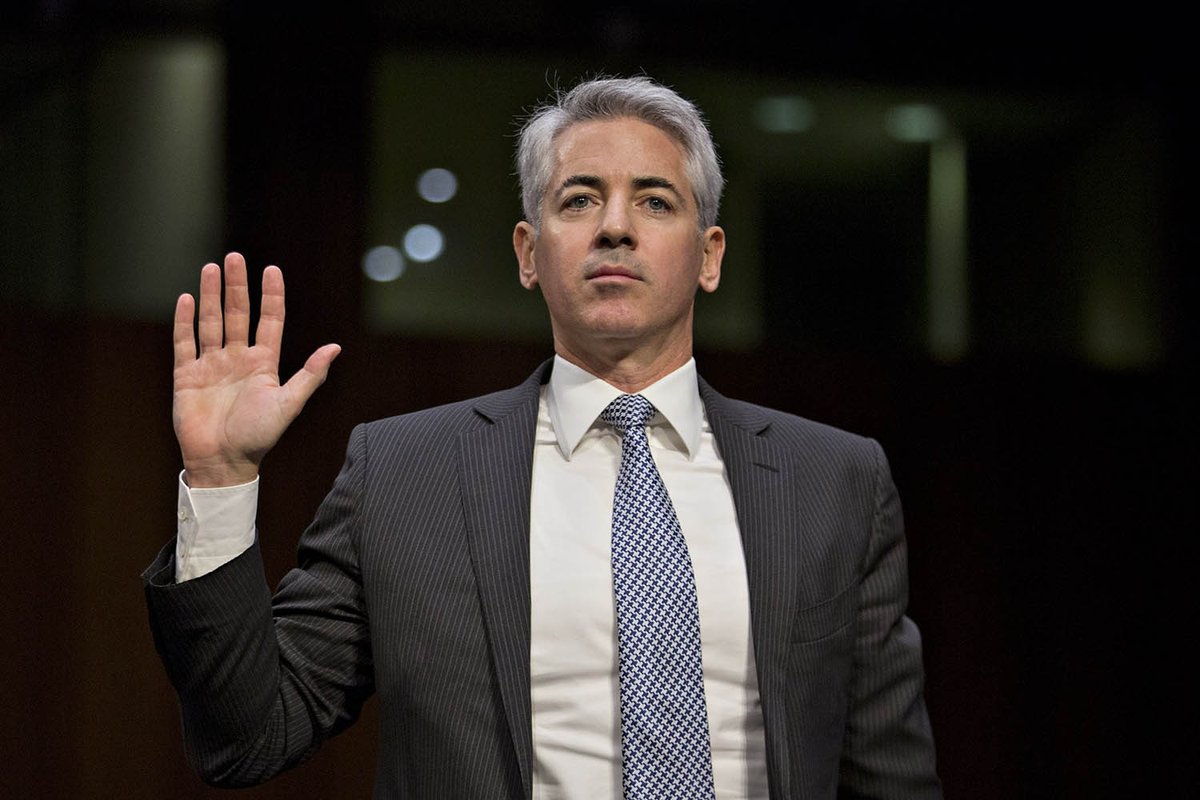

1.) MBIA $MBI

1.) MBIA $MBI