The guy who has been effectively the lead dev for a while will be moving on from @THORChain

As I mentioned yesterday, I will also see myself out if we don't rapidly adopt a solution to stop NK flows, so this will likely be one of my last posts on the TC subject

The TC community has strong beliefs based on what they learn from a messaging that is disconnected from the reality of the people who have been executing on the frontlines. For the longtime now the people communicating and the people maintaining the network have had different views.

As an example, the company running the dev team is american, the devs are mostly americans, they are also the biggest infrastructure provider. Other large infrastructure providers are north americans.

Wallet integrations that provide the majority of the non toxic volume are also corporations and they ALL already censor transactions on their front ends, as I said in my post it is my understanding that a lot of them will be moving on if Thorchain keeps this going

You can say as many times as you want that a blue car is read, but it won't make Thorchain truly decentralized, censorship resistant and permissionless... it's a handful of actors running all the infra and a handful of corporate actors providing all the user flows. My team has spent a lot of time helping newcomers setup validators and learn how to run infrastructure, it isn't easy, it's a lot more complex than anything else we have touched in the blockchain space.

The ethos about being decentralized are just ideas, the same as liquidity blackhole, going live 3x without an audit, various economic incentives that moved risk under the hood like lending, savers, ILP, synths etc.

Sometimes ideas seem nice on paper but don't pan out in reality.

Or maybe they will, and a group will keep maintaining the network in it's current state.

Some of the design choices like running full infrastructure for every chain made it very complicated to onboard new validators and as a result there isn't that many actors running things

It's my opinion that it's not decentralized enough to survive a regulatory attack, it's not a blockchain like eth or btc who have a huge larger validator / node base

BTW as usual I will get shot as the messenger but I have talked about this for years, advocated for lite nodes that check endpoints (recently integrated with base), to move onto a consensus mechanism that allows more validators etc

For those that hate me for speaking out against the cult, don't worry there is a good possibility this is one of the last time I ever speak publicly about Thorchain.

When the huge majority of your flows are stolen funds from north korea for the biggest money heist in human history, it will becomes a national security issue, this isn't a game anymore

The threshold you want to be credibly decentralized you need a network of 1000+ unique validators

There is a reason why @Chainflip fixed this issue on the network level so quickly and all front end are applying censorship

I have brought this to my validator group for questioning almost immediately after those flows started and reached out to team members

As I mentioned yesterday, I will also see myself out if we don't rapidly adopt a solution to stop NK flows, so this will likely be one of my last posts on the TC subject

The TC community has strong beliefs based on what they learn from a messaging that is disconnected from the reality of the people who have been executing on the frontlines. For the longtime now the people communicating and the people maintaining the network have had different views.

As an example, the company running the dev team is american, the devs are mostly americans, they are also the biggest infrastructure provider. Other large infrastructure providers are north americans.

Wallet integrations that provide the majority of the non toxic volume are also corporations and they ALL already censor transactions on their front ends, as I said in my post it is my understanding that a lot of them will be moving on if Thorchain keeps this going

You can say as many times as you want that a blue car is read, but it won't make Thorchain truly decentralized, censorship resistant and permissionless... it's a handful of actors running all the infra and a handful of corporate actors providing all the user flows. My team has spent a lot of time helping newcomers setup validators and learn how to run infrastructure, it isn't easy, it's a lot more complex than anything else we have touched in the blockchain space.

The ethos about being decentralized are just ideas, the same as liquidity blackhole, going live 3x without an audit, various economic incentives that moved risk under the hood like lending, savers, ILP, synths etc.

Sometimes ideas seem nice on paper but don't pan out in reality.

Or maybe they will, and a group will keep maintaining the network in it's current state.

Some of the design choices like running full infrastructure for every chain made it very complicated to onboard new validators and as a result there isn't that many actors running things

It's my opinion that it's not decentralized enough to survive a regulatory attack, it's not a blockchain like eth or btc who have a huge larger validator / node base

BTW as usual I will get shot as the messenger but I have talked about this for years, advocated for lite nodes that check endpoints (recently integrated with base), to move onto a consensus mechanism that allows more validators etc

For those that hate me for speaking out against the cult, don't worry there is a good possibility this is one of the last time I ever speak publicly about Thorchain.

When the huge majority of your flows are stolen funds from north korea for the biggest money heist in human history, it will becomes a national security issue, this isn't a game anymore

The threshold you want to be credibly decentralized you need a network of 1000+ unique validators

There is a reason why @Chainflip fixed this issue on the network level so quickly and all front end are applying censorship

I have brought this to my validator group for questioning almost immediately after those flows started and reached out to team members

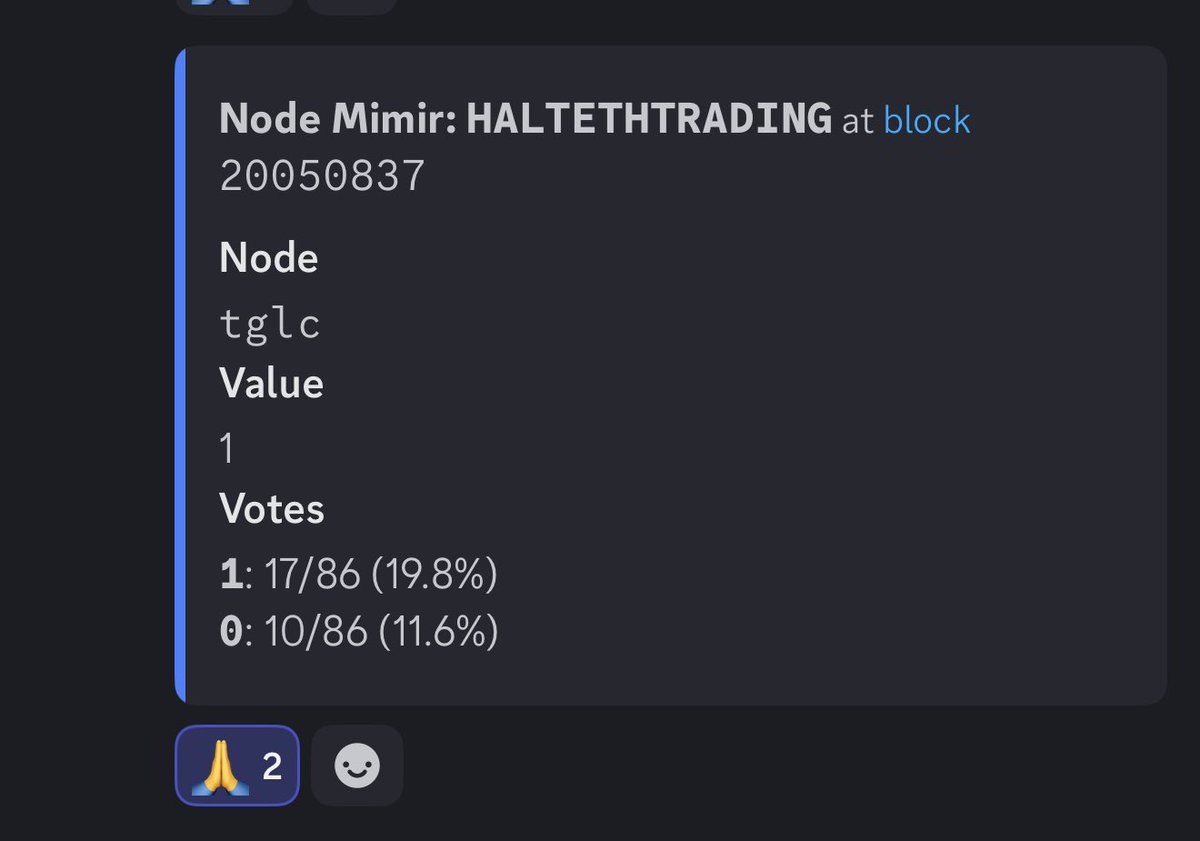

@THORChain Update : $eth halted again, @ol3gpetrov is working on something to block wallet addresses at the Bifrost level, there should be a governance vote tomorrow.

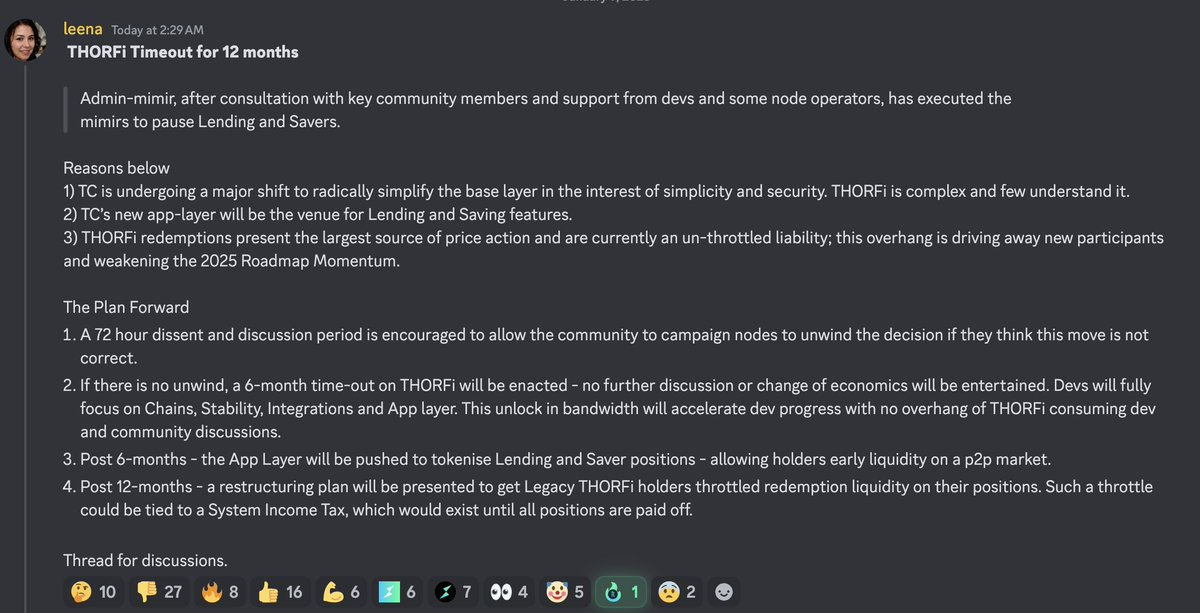

This comes from one of the smartest guys in the ecosystem and a guy who's ethics I respect : @mogarchy

He is directly in touch with front ends

Read in between the lines

He is directly in touch with front ends

Read in between the lines

• • •

Missing some Tweet in this thread? You can try to

force a refresh