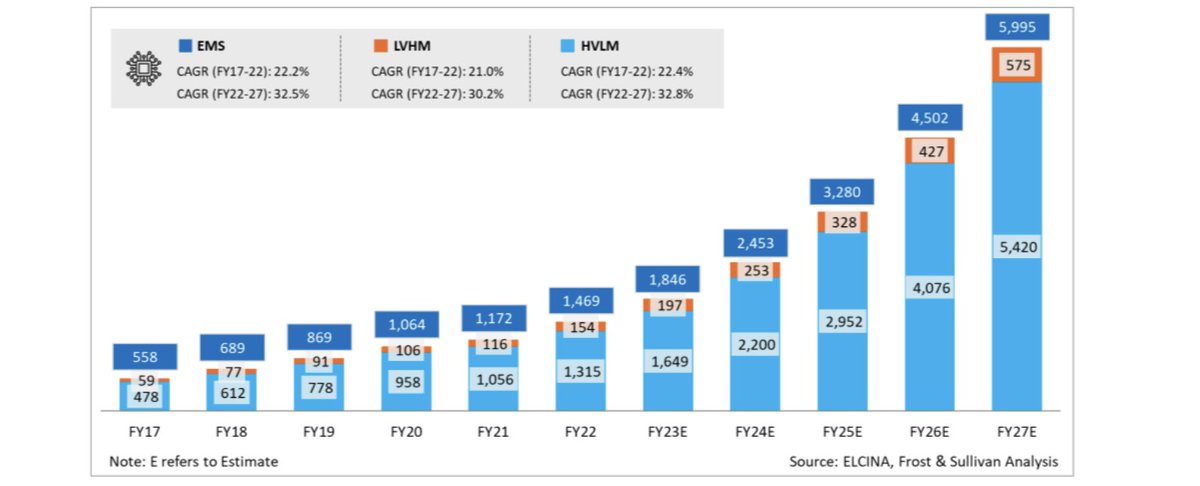

Report on #CDMO business opp. for #Neuland #Bluejet #Aartipharm #AmiOrganics

Growth triggers, Capex, Mgt. outlook etc.

Impressive insights 🧵

Grok 🙌 great starting point for deep dives

"Its a CRIME to not learn how to use these tools"

≠ Buy/Sell 📞 Edu purpose only

1/6

Growth triggers, Capex, Mgt. outlook etc.

Impressive insights 🧵

Grok 🙌 great starting point for deep dives

"Its a CRIME to not learn how to use these tools"

≠ Buy/Sell 📞 Edu purpose only

1/6

2/6

Play w/ prompts, throw in concall transcripts & ppts..voila !

Use of specific prompts like "add silent catalyst" "insights" could add great value to understand businesses.

Play w/ prompts, throw in concall transcripts & ppts..voila !

Use of specific prompts like "add silent catalyst" "insights" could add great value to understand businesses.

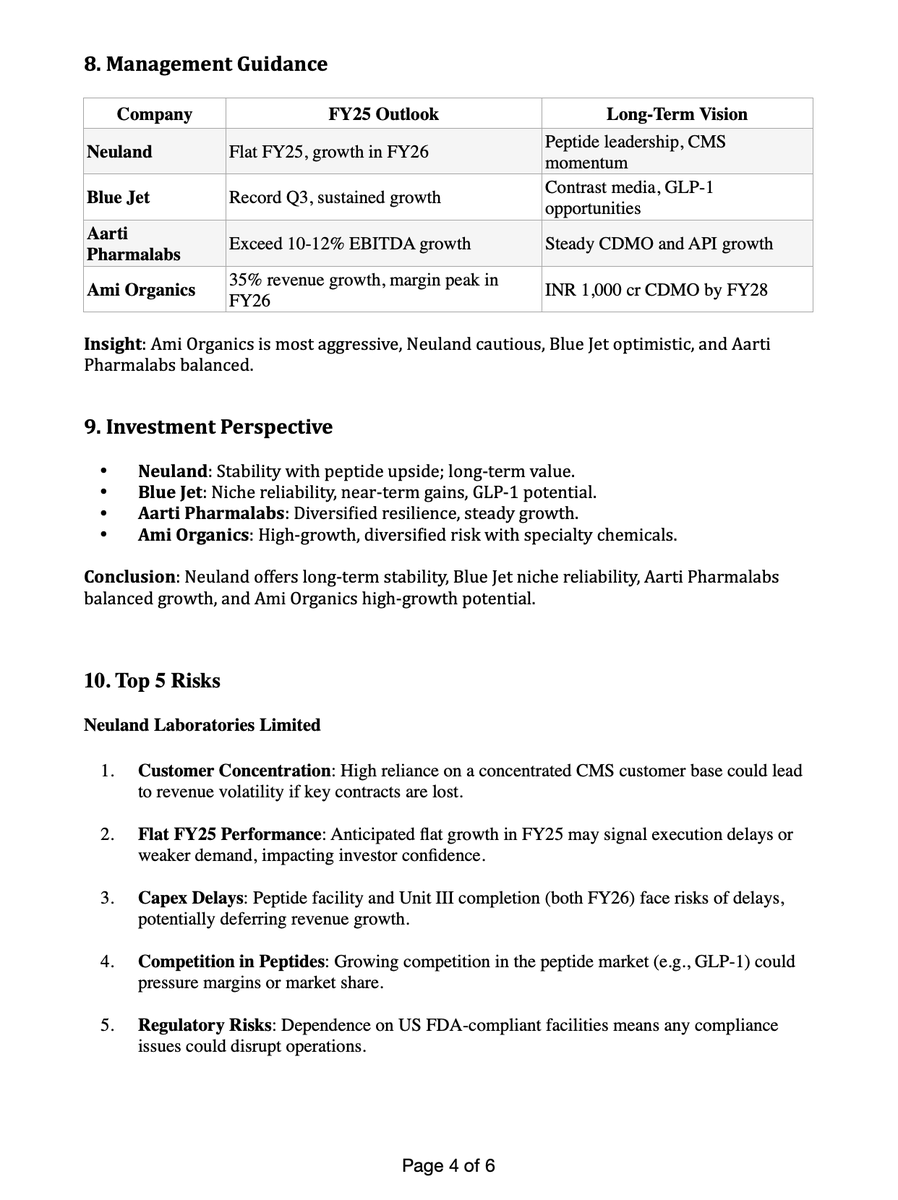

4/6

Management Guidance, outlook & Top 5 risks

Great tool to perform initial analyse from docs and create meaningful insights.

It still has its flaws though as it may capture a participant's comment in concall as mgt., pull incorrect data from sources.

Management Guidance, outlook & Top 5 risks

Great tool to perform initial analyse from docs and create meaningful insights.

It still has its flaws though as it may capture a participant's comment in concall as mgt., pull incorrect data from sources.

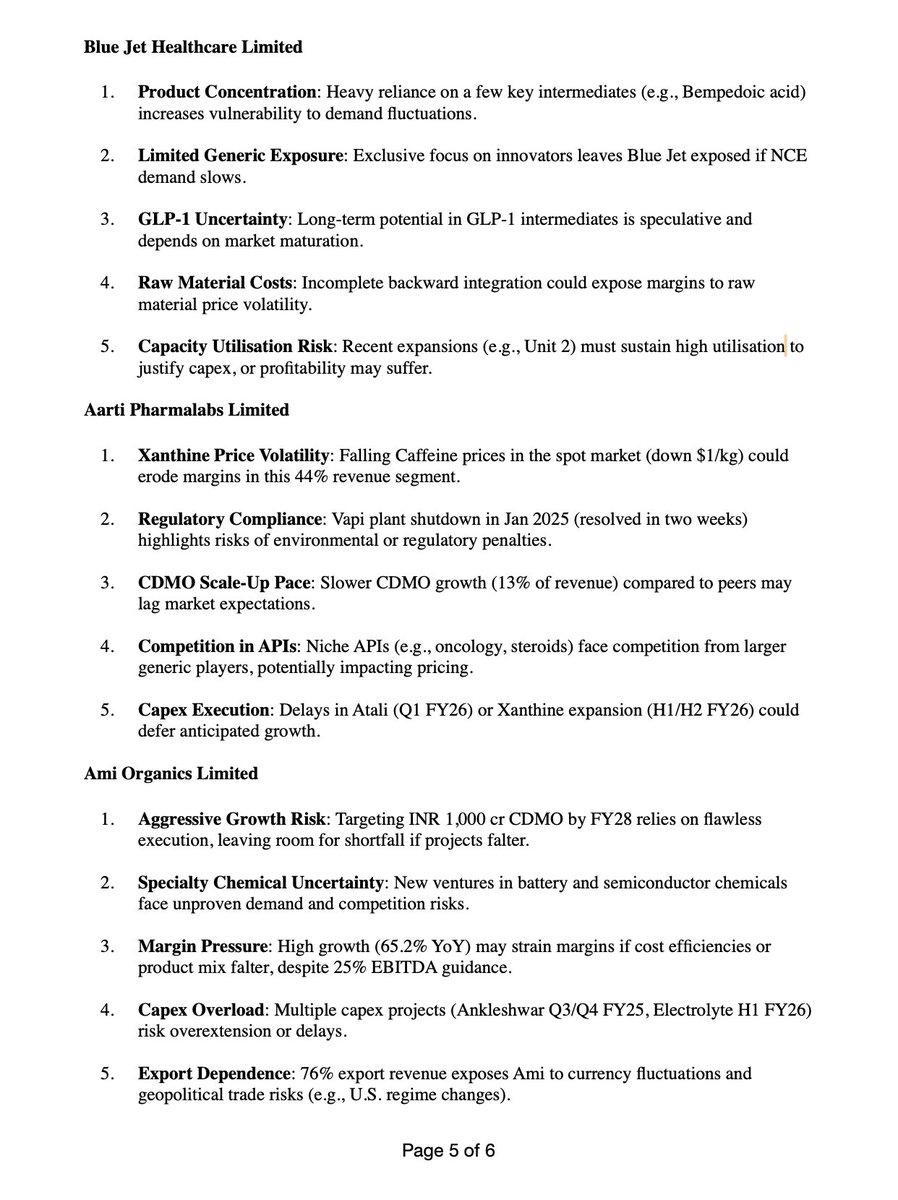

5/6

Top 5 risks cont.

**This report is not exhaustive analysis**

This is just to illustrate how a tool can be used. Need to be creative w/ prompts.

Top 5 risks cont.

**This report is not exhaustive analysis**

This is just to illustrate how a tool can be used. Need to be creative w/ prompts.

6/6

You can ask/add more info to the analysis and keep expanding the report as needed e.g. customers, technical aspects, margins, operating leverage, industry outlook, Bull/Base/Bear scenario etc. but need to have some handle on the business to tweak the valuations.

You can ask/add more info to the analysis and keep expanding the report as needed e.g. customers, technical aspects, margins, operating leverage, industry outlook, Bull/Base/Bear scenario etc. but need to have some handle on the business to tweak the valuations.

• • •

Missing some Tweet in this thread? You can try to

force a refresh