What is happening with crypto?

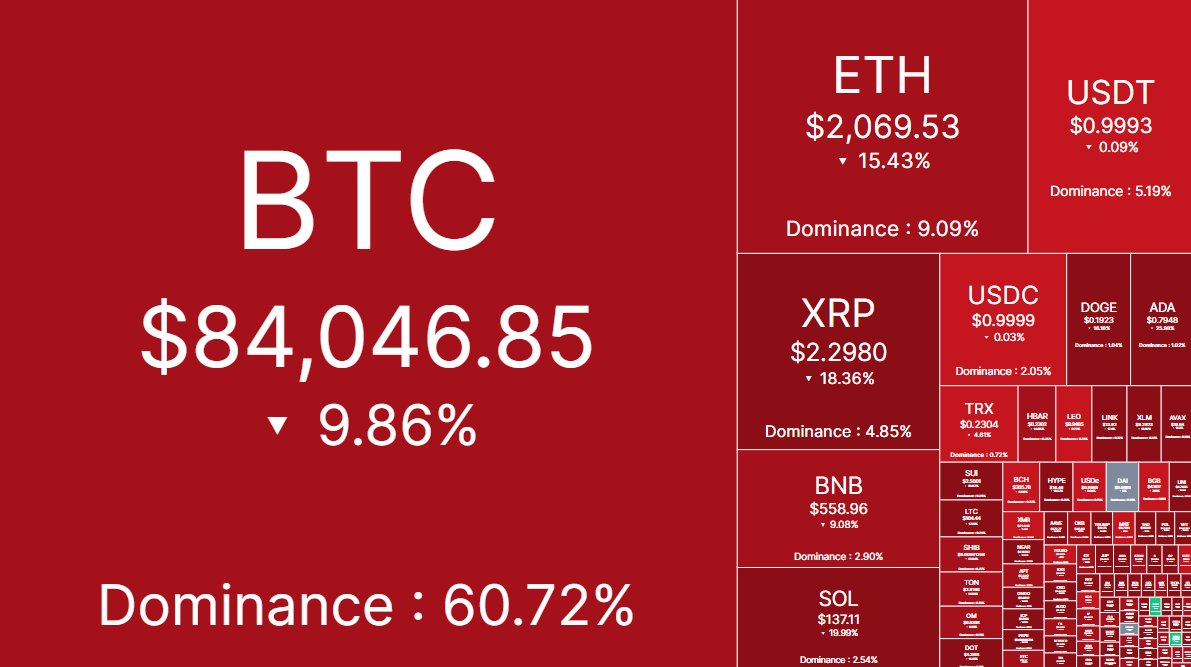

Crypto markets are now worth -$100 billion LESS than they were prior to the US Crypto Reserve announcement.

Over the last 24 hours, crypto has erased -$500 BILLION of market cap in a massive reversal.

Here's what you need to know.

(a thread)

Crypto markets are now worth -$100 billion LESS than they were prior to the US Crypto Reserve announcement.

Over the last 24 hours, crypto has erased -$500 BILLION of market cap in a massive reversal.

Here's what you need to know.

(a thread)

Here's a timeline of the last ~36 hours:

At 10:24 AM ET on Sunday, Trump announced the US Crypto Reserve.

By 8:30 PM ET, Crypto markets had gone from ~$2.7T to ~$3.1T in value, recouping most of their recent losses.

Now, 24 hours later, crypto markets are down to $2.6T.

At 10:24 AM ET on Sunday, Trump announced the US Crypto Reserve.

By 8:30 PM ET, Crypto markets had gone from ~$2.7T to ~$3.1T in value, recouping most of their recent losses.

Now, 24 hours later, crypto markets are down to $2.6T.

Take a look at Ethereum.

Prior to the announcement of the Reserve, $ETH bottomed out at $2,173 on March 2nd.

It then rose as high as $2,550 before falling to $2,002 just now.

This means that #ETH is now ~8% BELOW its pro-reserve announcement bottom in a MASSIVE reversal.

Prior to the announcement of the Reserve, $ETH bottomed out at $2,173 on March 2nd.

It then rose as high as $2,550 before falling to $2,002 just now.

This means that #ETH is now ~8% BELOW its pro-reserve announcement bottom in a MASSIVE reversal.

This came with a huge swing in sentiment in what appears to have been a colossal retail trap.

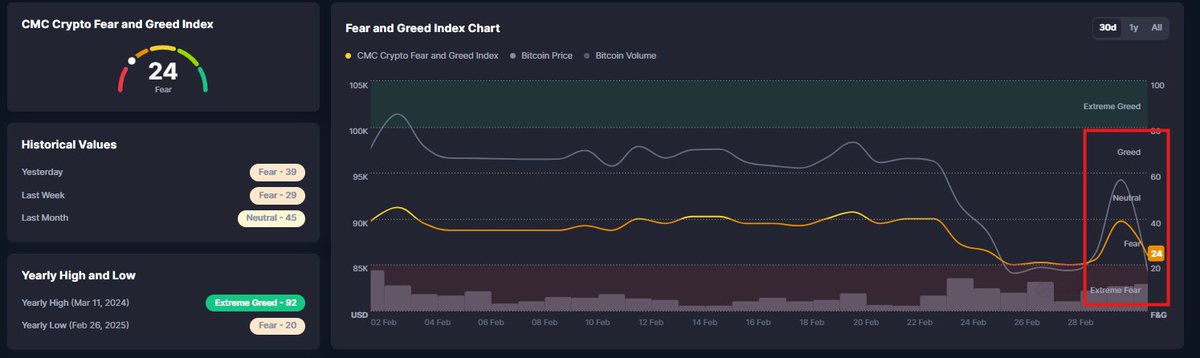

Prior to the announcement of the Reserve, the Crypto Fear & Greed index was at ~20, extreme fear.

It then soared to ~55, nearing greed levels, before falling right back into ~24 now.

Prior to the announcement of the Reserve, the Crypto Fear & Greed index was at ~20, extreme fear.

It then soared to ~55, nearing greed levels, before falling right back into ~24 now.

Here's why it was even more of a retail bull trap:

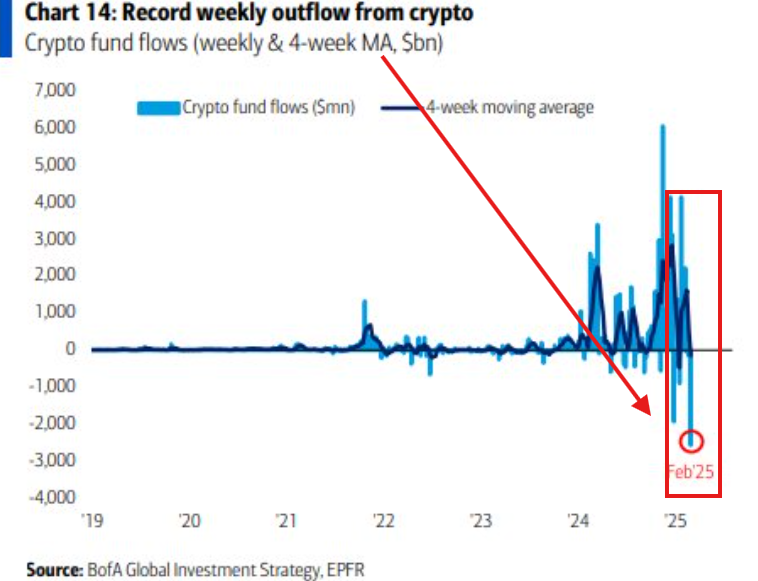

In the last week of February, crypto saw a RECORD weekly outflow, and it wasn't even close.

Crypto funds posted a record $2.6 BILLION outflow for the week.

This is ~$500 million above the previous record set in 2024.

In the last week of February, crypto saw a RECORD weekly outflow, and it wasn't even close.

Crypto funds posted a record $2.6 BILLION outflow for the week.

This is ~$500 million above the previous record set in 2024.

Bitcoin is also bleeding lower.

It now trades 3% BELOW its pre-US reserve announcement levels.

Over the last 12 hours, Bitcoin alone has erased nearly $250 BILLION of market cap.

So, why is capital rotating out of crypto following one of the most bullish announcements ever?

It now trades 3% BELOW its pre-US reserve announcement levels.

Over the last 12 hours, Bitcoin alone has erased nearly $250 BILLION of market cap.

So, why is capital rotating out of crypto following one of the most bullish announcements ever?

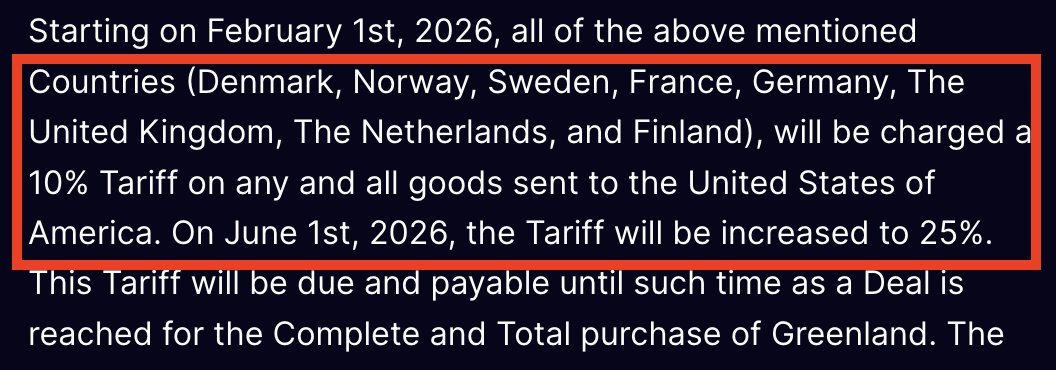

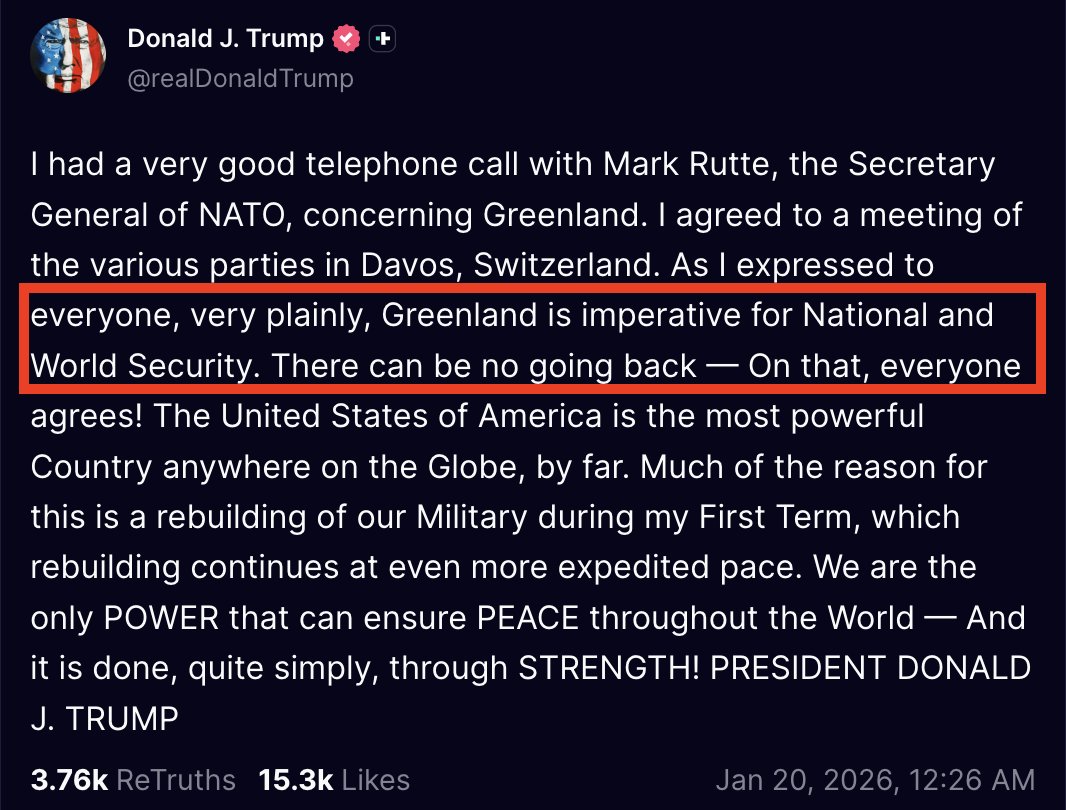

The real driver here is the GLOBAL move towards the risk-off trade.

As trade war tensions rise and economic policy uncertainty broadens, ALL risky assets are falling.

This was seen in stocks, crypto and oil prices which all fell sharply today.

Safe havens are thriving.

As trade war tensions rise and economic policy uncertainty broadens, ALL risky assets are falling.

This was seen in stocks, crypto and oil prices which all fell sharply today.

Safe havens are thriving.

And, the reality is that crypto is now viewed as a risky asset.

Take a look at the sharp divergence between Gold and Bitcoin in their YTD performance.

While gold prices are up +10%, Bitcoin is down -10% since January 1st.

Crypto is no longer viewed as a safe haven play.

Take a look at the sharp divergence between Gold and Bitcoin in their YTD performance.

While gold prices are up +10%, Bitcoin is down -10% since January 1st.

Crypto is no longer viewed as a safe haven play.

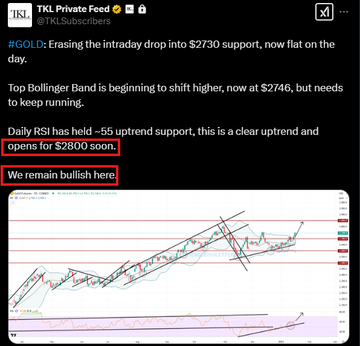

Our premium members were buying gold for months.

We bought the dip into January and called for $2,850+.

On Friday, we called for another higher low at $2850 and gold is nearing $2900+ again now.

Subscribe at the link below to access these alerts:

thekobeissiletter.com/subscribe

We bought the dip into January and called for $2,850+.

On Friday, we called for another higher low at $2850 and gold is nearing $2900+ again now.

Subscribe at the link below to access these alerts:

thekobeissiletter.com/subscribe

This was also seen in technology stocks which were crushed by the risk-off trade today.

In fact, Nvidia, $NVDA, fell BELOW its post-DeepSeek low seen on February 3rd.

This comes even as the company exceeded earnings expectations posting record quarterly revenue of $39.3B.

In fact, Nvidia, $NVDA, fell BELOW its post-DeepSeek low seen on February 3rd.

This comes even as the company exceeded earnings expectations posting record quarterly revenue of $39.3B.

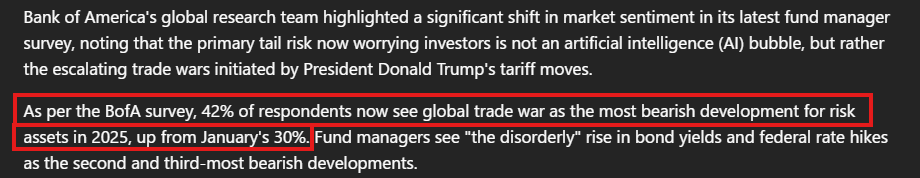

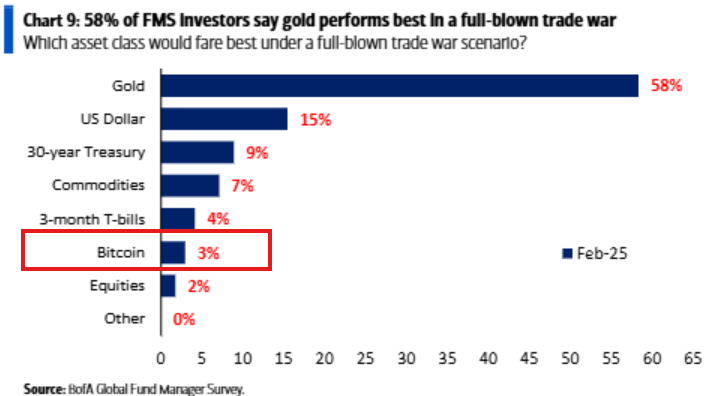

A recent Bank of America survey confirms our view here.

42% of respondents now see global trade war as the most bearish development for risk assets in 2025, up from January's 30%.

This is an even bigger headwind than the recent worries about AI competition from China.

42% of respondents now see global trade war as the most bearish development for risk assets in 2025, up from January's 30%.

This is an even bigger headwind than the recent worries about AI competition from China.

Furthermore, just 3% of respondents said that Bitcoin would preform best in a full-blown trade war.

This is 12 percentage points less than the US Dollar and 55 percentage points less than gold.

The reality is that markets no longer view crypto as a hedge during uncertainty.

This is 12 percentage points less than the US Dollar and 55 percentage points less than gold.

The reality is that markets no longer view crypto as a hedge during uncertainty.

Lastly, Goldman's' volatility panic index surged from its December low of ~1.4 to ~9.1 on Friday and is nearing ~10 today.

As a result, we see even wider swings in crypto ahead.

Volatility is the new normal.

Follow us @KobeissiLetter for real time analysis as this develops.

As a result, we see even wider swings in crypto ahead.

Volatility is the new normal.

Follow us @KobeissiLetter for real time analysis as this develops.

• • •

Missing some Tweet in this thread? You can try to

force a refresh