WOW.

The US saw 172,000 job cuts in February, with YTD government layoffs SURGING +41,300% due to @DOGE.

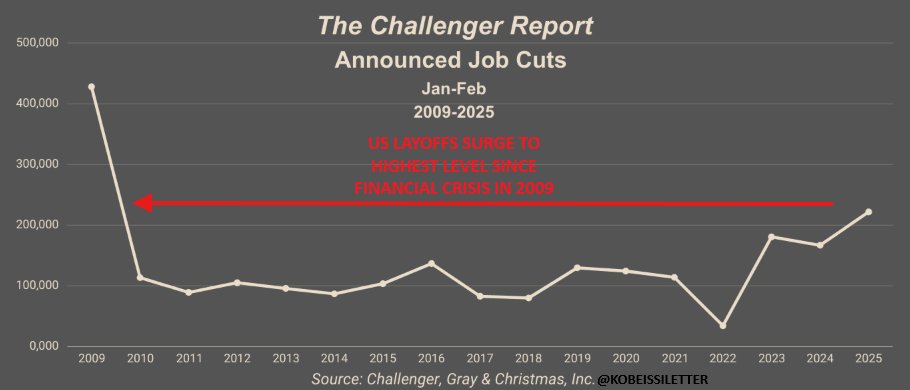

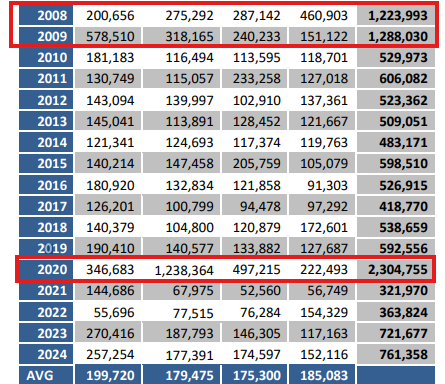

We have now seen a MASSIVE 221,812 job cuts in 2025, the highest YTD total since 2009.

Are we witnessing the largest federal layoff in US history?

(a thread)

The US saw 172,000 job cuts in February, with YTD government layoffs SURGING +41,300% due to @DOGE.

We have now seen a MASSIVE 221,812 job cuts in 2025, the highest YTD total since 2009.

Are we witnessing the largest federal layoff in US history?

(a thread)

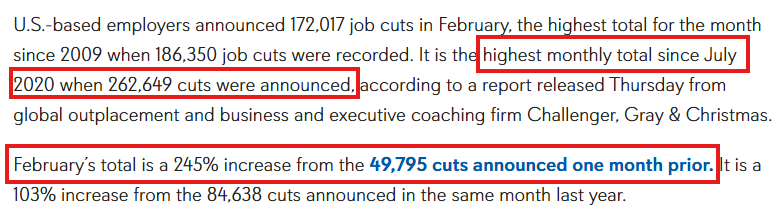

In February, there were a total of 172,017 job cuts in the US which marks a +103% year-over-year jump.

This also marks a +245% month-over-month jump and the highest monthly total since July 2020.

DOGE layoffs and economic uncertainty have resulted in pandemic-like job cuts.

This also marks a +245% month-over-month jump and the highest monthly total since July 2020.

DOGE layoffs and economic uncertainty have resulted in pandemic-like job cuts.

Here's where it gets even more incredible:

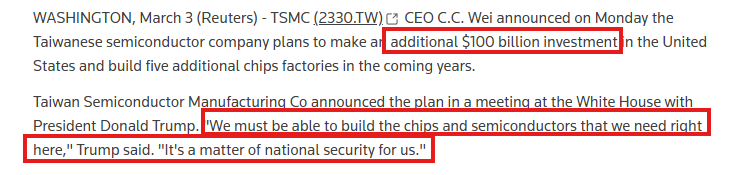

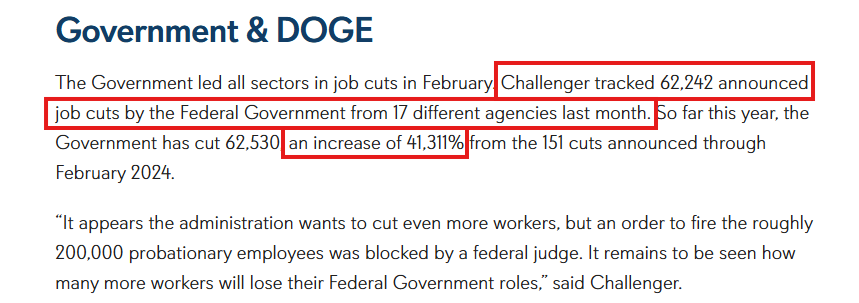

Challenger Gray specifically mentions @DOGE's cuts as a driver behind this trend.

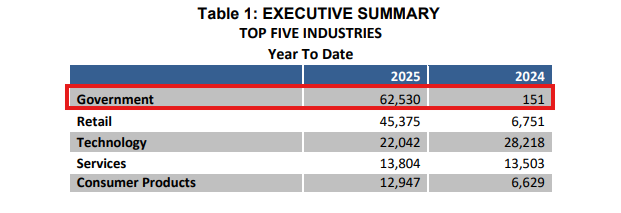

Total DOGE cuts job cuts are up to 62,530 in 2025, which is a 41,311% increase compared to 2024.

We thought this was a typo at first.

It's not.

Challenger Gray specifically mentions @DOGE's cuts as a driver behind this trend.

Total DOGE cuts job cuts are up to 62,530 in 2025, which is a 41,311% increase compared to 2024.

We thought this was a typo at first.

It's not.

Still not convinced?

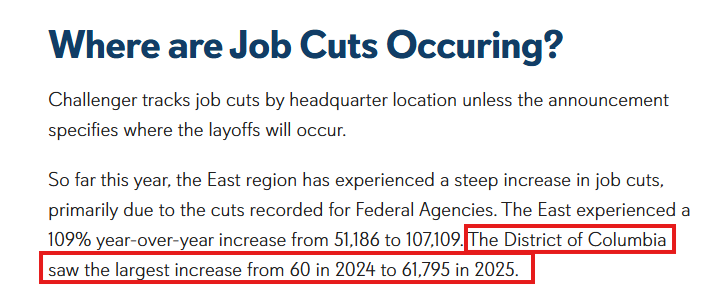

Take a look at WHERE the job cuts are occurring, according to Challenger Gray.

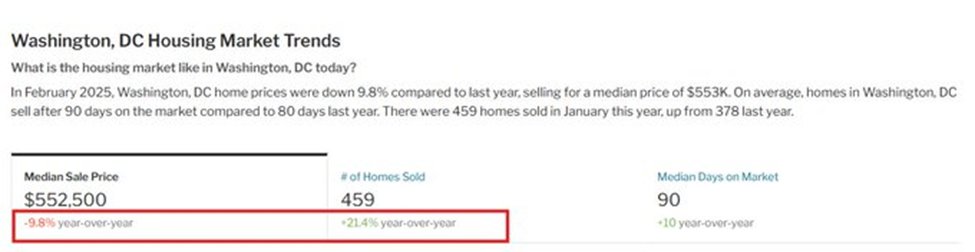

Washington DC saw the largest increase in the COUNTRY, surging from 60 cuts in 2024 to 61,795 in 2025.

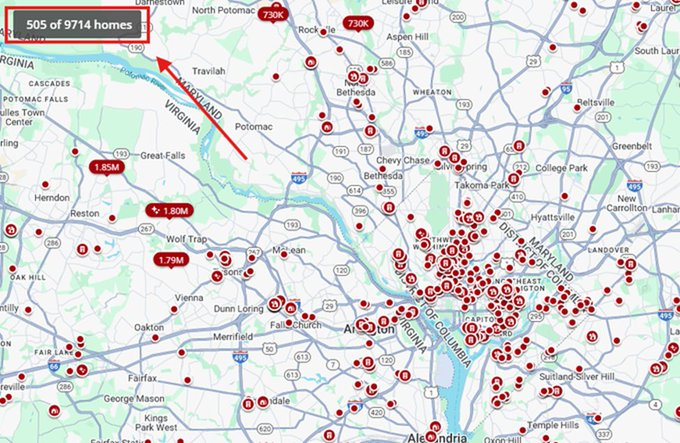

This has effectively sent the Washington DC housing market spiraling.

Take a look at WHERE the job cuts are occurring, according to Challenger Gray.

Washington DC saw the largest increase in the COUNTRY, surging from 60 cuts in 2024 to 61,795 in 2025.

This has effectively sent the Washington DC housing market spiraling.

The median home in Washington DC is now worth $552,500.

Homes have not been this cheap in Washington DC since January 2020, when the median home was $550,000.

This marks yet another pandemic-like similarity in Washington DC due to DOGE cuts.

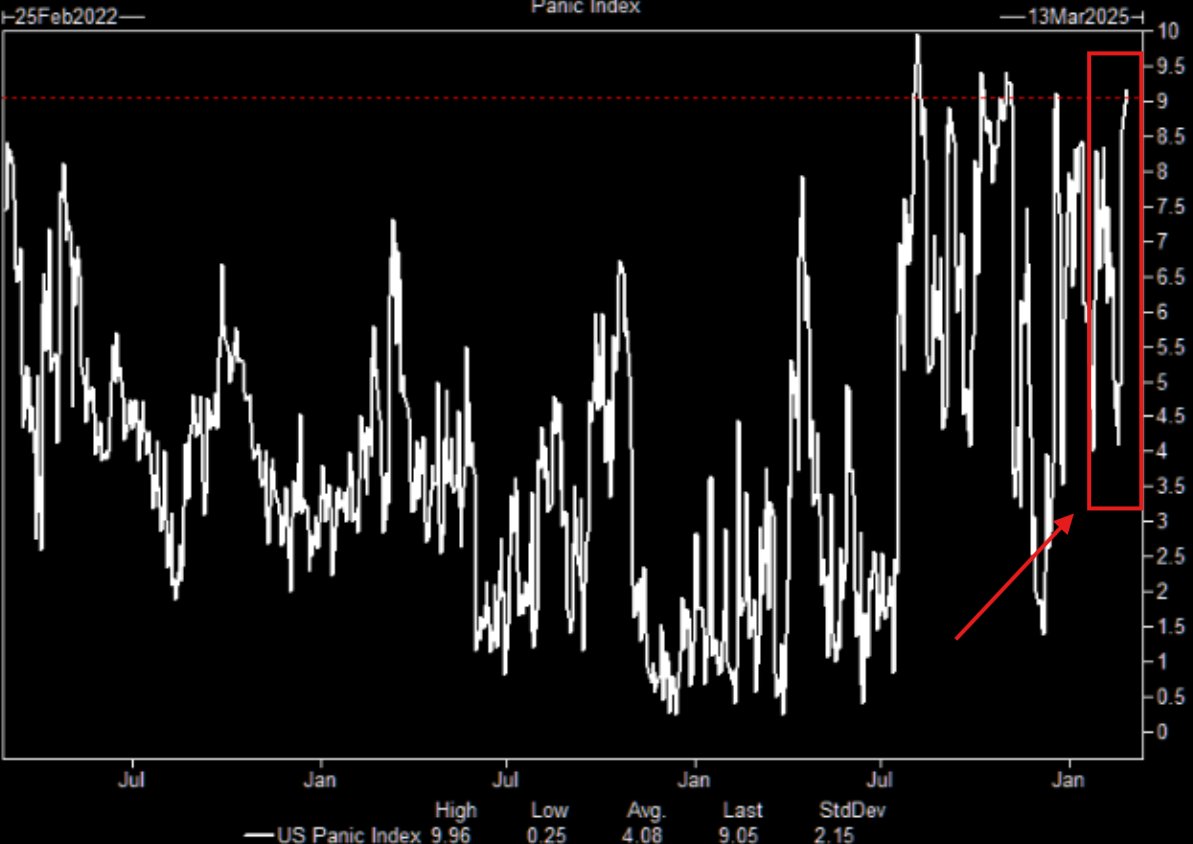

So, how bad has it become?

Homes have not been this cheap in Washington DC since January 2020, when the median home was $550,000.

This marks yet another pandemic-like similarity in Washington DC due to DOGE cuts.

So, how bad has it become?

There are now nearly 10,000 homes for sale in the Washington, DC metro area.

Around 50% of these homes have been listed for sale since January 1st.

Since November 2024, nearly 5,000 homes have been listed for sale, well above average.

Not even 2008 saw data like this.

Around 50% of these homes have been listed for sale since January 1st.

Since November 2024, nearly 5,000 homes have been listed for sale, well above average.

Not even 2008 saw data like this.

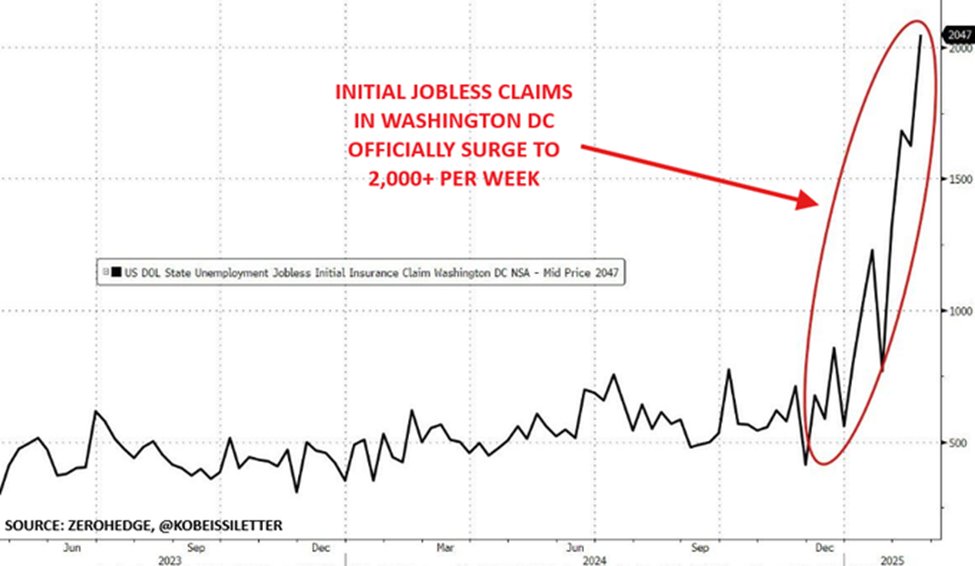

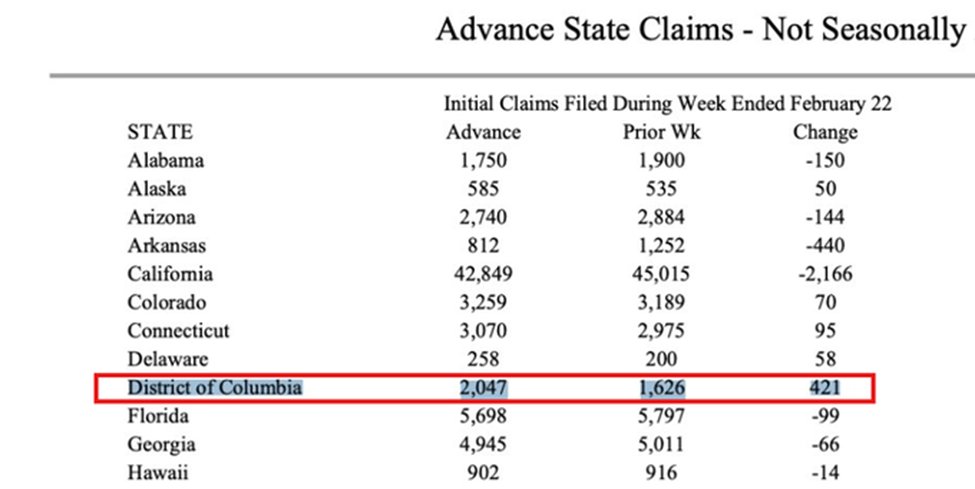

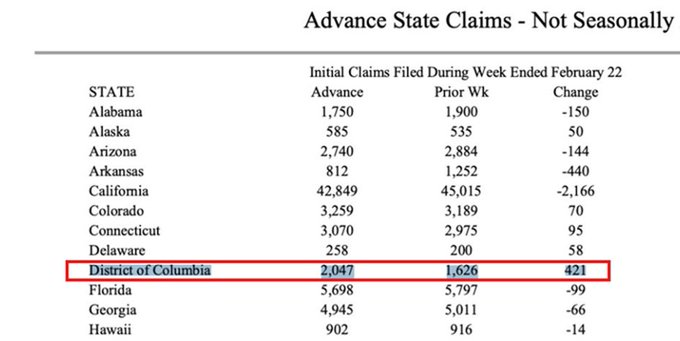

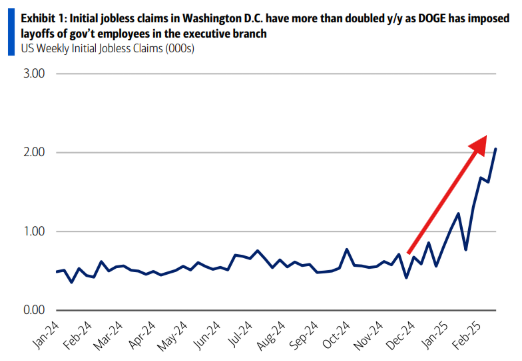

And, the layoffs continue to accelerate week-over-week in Washington DC.

New unemployment claims across the US rose by 22,000 in the last week of February, to 242,000.

But, take a look at Washington, DC.

Unemployment claims SURGED +26% week-over-week on DOGE layoffs.

New unemployment claims across the US rose by 22,000 in the last week of February, to 242,000.

But, take a look at Washington, DC.

Unemployment claims SURGED +26% week-over-week on DOGE layoffs.

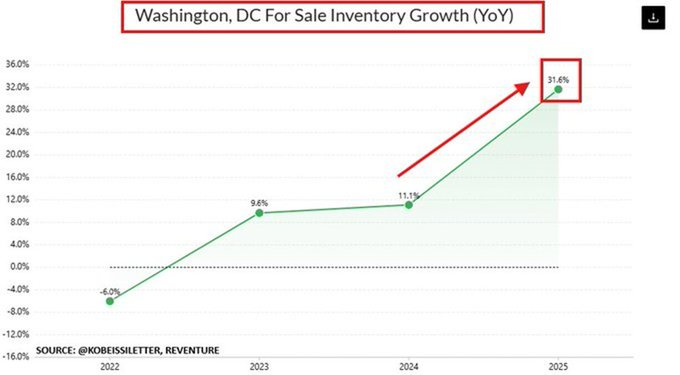

Washington DC for sale home inventory growth hit +31.6% year-over-year in February 2025.

To put this into perspective, for sale home inventory growth in Washington DC was 23.8% in May 2008.

We are seeing for sale inventory growth that is ~8 percentage points ABOVE 2008 levels.

To put this into perspective, for sale home inventory growth in Washington DC was 23.8% in May 2008.

We are seeing for sale inventory growth that is ~8 percentage points ABOVE 2008 levels.

It also makes you wonder, why were government job cuts so low in 2024?

Here are the top 5 industries with YTD jobs cuts.

As seen below, even the 2nd smallest category in the list, Consumer Products, was ~44 TIMES larger than US Government cuts in 2024.

Truly incredible.

Here are the top 5 industries with YTD jobs cuts.

As seen below, even the 2nd smallest category in the list, Consumer Products, was ~44 TIMES larger than US Government cuts in 2024.

Truly incredible.

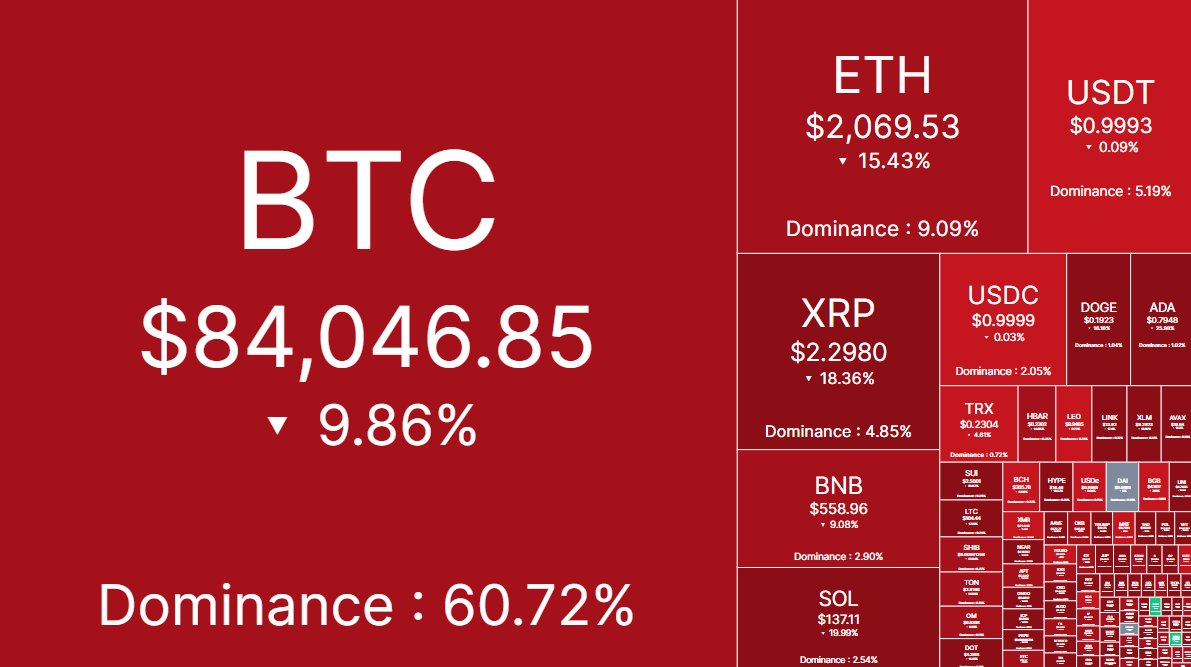

If we saw 172,017 job cuts for the remaining 10 months of 2024, that would mark a 2025 total of 1,941,982.

Not even 2009 OR 2008 saw layoffs at a pace even remotely near this level.

2020 is the only year in Challenger Gray data history to break 2 million job cuts.

Not even 2009 OR 2008 saw layoffs at a pace even remotely near this level.

2020 is the only year in Challenger Gray data history to break 2 million job cuts.

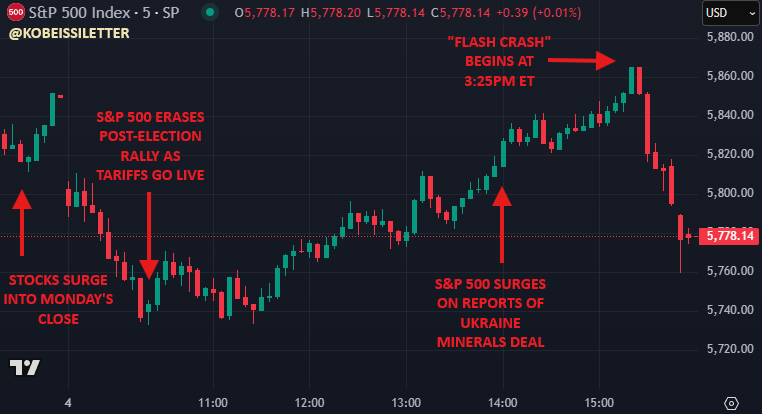

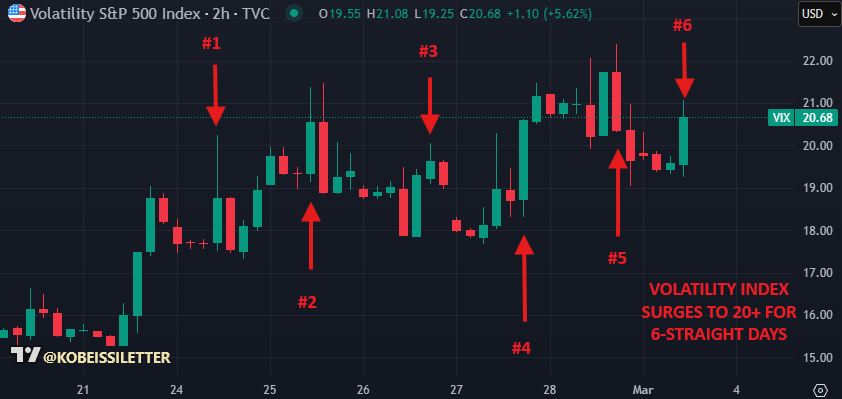

And, interest rates are reflecting the material decline in job growth.

Interest rates are now down -60 BASIS POINTS in 6 weeks as DOGE cuts ramp up.

Even as inflation has rebounded, rates are falling in anticipation of DOGE's economic impact.

Rate cut odds are rising.

Interest rates are now down -60 BASIS POINTS in 6 weeks as DOGE cuts ramp up.

Even as inflation has rebounded, rates are falling in anticipation of DOGE's economic impact.

Rate cut odds are rising.

In the last week of February ALONE, over 2,000 people filed for unemployment in Washington, DC.

In fact, YTD jobless claims in Washington DC are up OVER +200% compared to 2024.

We are tracking DOGE.

Follow us @KobeissiLetter for real time analysis as this develops.

In fact, YTD jobless claims in Washington DC are up OVER +200% compared to 2024.

We are tracking DOGE.

Follow us @KobeissiLetter for real time analysis as this develops.

• • •

Missing some Tweet in this thread? You can try to

force a refresh