Historically, $BTC has been hard to get yields on.

Restaking and Vaults, however, have unlocked BTCfi for us this cycle so now we can expect ~5% APR or more if we're clever.

And, imo, this is just the beginning.

Let's dive in👇

Restaking and Vaults, however, have unlocked BTCfi for us this cycle so now we can expect ~5% APR or more if we're clever.

And, imo, this is just the beginning.

Let's dive in👇

@SolvProtocol runs BTC-Neutral strategies for you.

The thesis is simple (and it's what we did last cycle to get yield on BTC), collateralize BTC, borrow something yieldy, and then get yield on that while you're long BTC.

Solv has a bunch of products, but most notably:

Solv.BTC.jup with 12% APR (though KYC required)

Solv.BTC.BNB with 5-10% APR plus various airdrops:

► Astherus Points

► Solv S2 Points

► Lista Tokens

► Kernal Points

The thesis is simple (and it's what we did last cycle to get yield on BTC), collateralize BTC, borrow something yieldy, and then get yield on that while you're long BTC.

Solv has a bunch of products, but most notably:

Solv.BTC.jup with 12% APR (though KYC required)

Solv.BTC.BNB with 5-10% APR plus various airdrops:

► Astherus Points

► Solv S2 Points

► Lista Tokens

► Kernal Points

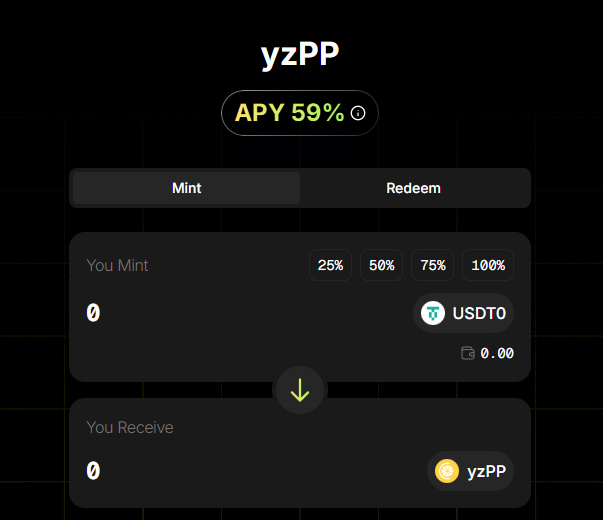

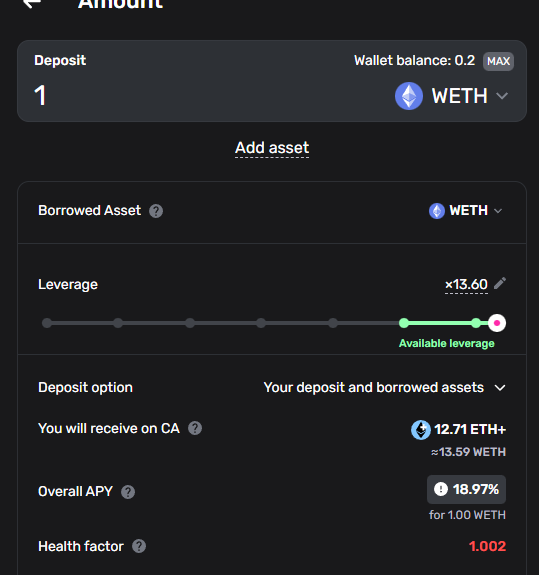

NOW, obviously I'm a composability maximalist.

So if you want to take these solv assets, @eulerfinance and @build_on_bob have you covered.

Big incentives campaign from Optimism right now allows you to get >100% APR on leveraged SolvBTC.

NOW, do be mindful that 8% of the collateral yield is in rEUL, which has a vesting mechanism.

If you discount that portion, you're still looking at 55.74% APR with no vesting.

(and Solv S2, maybe?)

So if you want to take these solv assets, @eulerfinance and @build_on_bob have you covered.

Big incentives campaign from Optimism right now allows you to get >100% APR on leveraged SolvBTC.

NOW, do be mindful that 8% of the collateral yield is in rEUL, which has a vesting mechanism.

If you discount that portion, you're still looking at 55.74% APR with no vesting.

(and Solv S2, maybe?)

And you guys know I can't go three tweets without mentioning the DeFi Darling, @pendle_fi

The @berachain predeposit vaults are still giving fixed rate 10%.

"YES Stephen, sure, BUT YOU CAN'T MINT THEM ANYMORE"

Oh sweet summer child. These are composable vault tokens, some of which you can buy on Uniswap (even a bit under peg).

SO you could buy liquidBeraBTC, e.g., at 99% NAV, and then get 10% fixed on the underlying BTC for the remainder of BOYCO.

The @berachain predeposit vaults are still giving fixed rate 10%.

"YES Stephen, sure, BUT YOU CAN'T MINT THEM ANYMORE"

Oh sweet summer child. These are composable vault tokens, some of which you can buy on Uniswap (even a bit under peg).

SO you could buy liquidBeraBTC, e.g., at 99% NAV, and then get 10% fixed on the underlying BTC for the remainder of BOYCO.

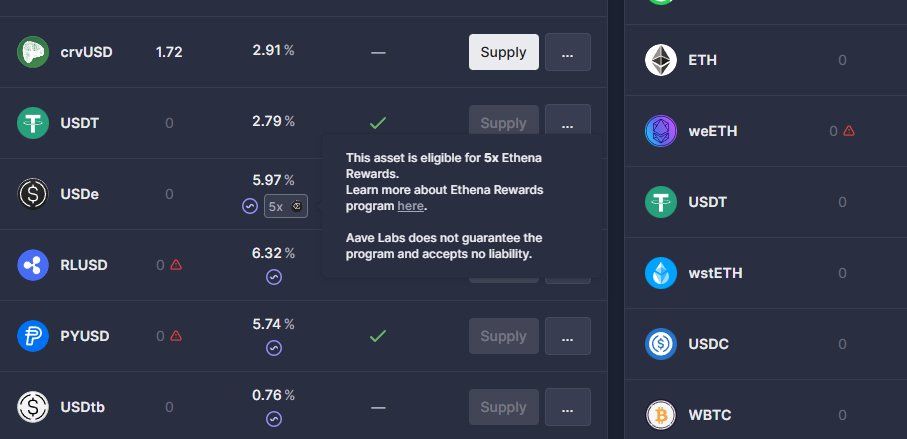

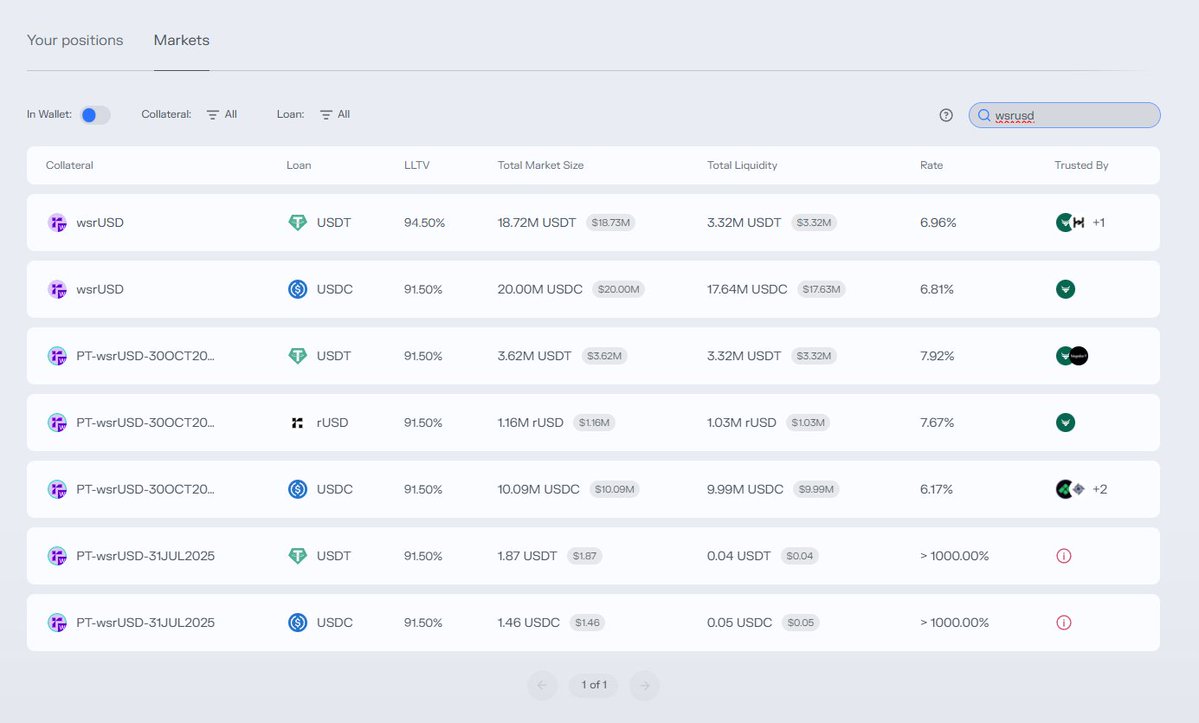

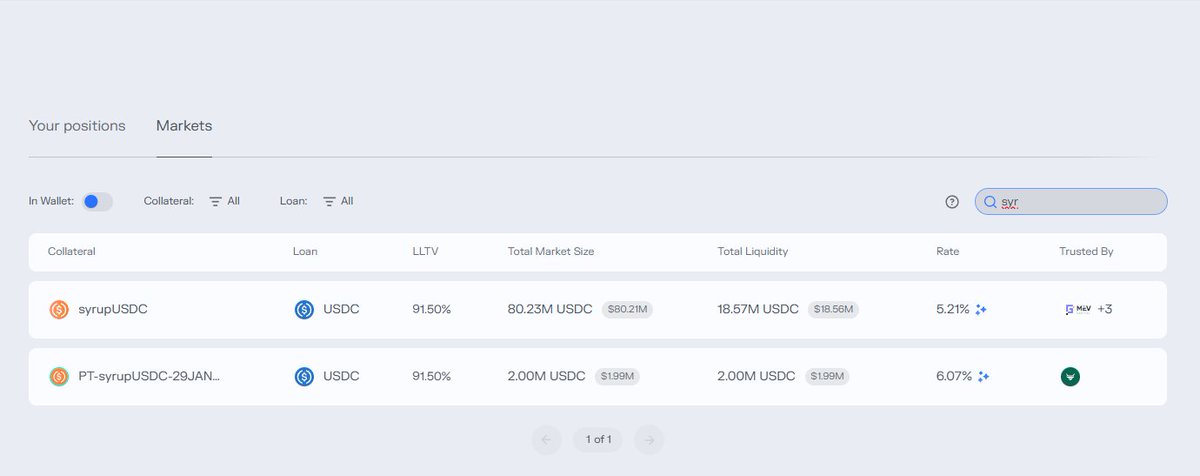

If you are more of a mainnet guy, Euler also has a bunch of PT and LBTC markets.

The PTs expire in March, so I wouldn't rush in unless you're okay with the position only lasting 21 days.

That said, leveraging $LBTC from @Lombard_Finance could make sense, since the IY on Pendle for Lombard points is around 5-6%.

The PTs expire in March, so I wouldn't rush in unless you're okay with the position only lasting 21 days.

That said, leveraging $LBTC from @Lombard_Finance could make sense, since the IY on Pendle for Lombard points is around 5-6%.

If you're looking for some lending yields, check out @merkl_xyz's BTC yields on @build_on_bob.

Some of these are the Euler yields we saw (and could leverage) before.

But there are also some LPs you might find interesting.

Some of these are the Euler yields we saw (and could leverage) before.

But there are also some LPs you might find interesting.

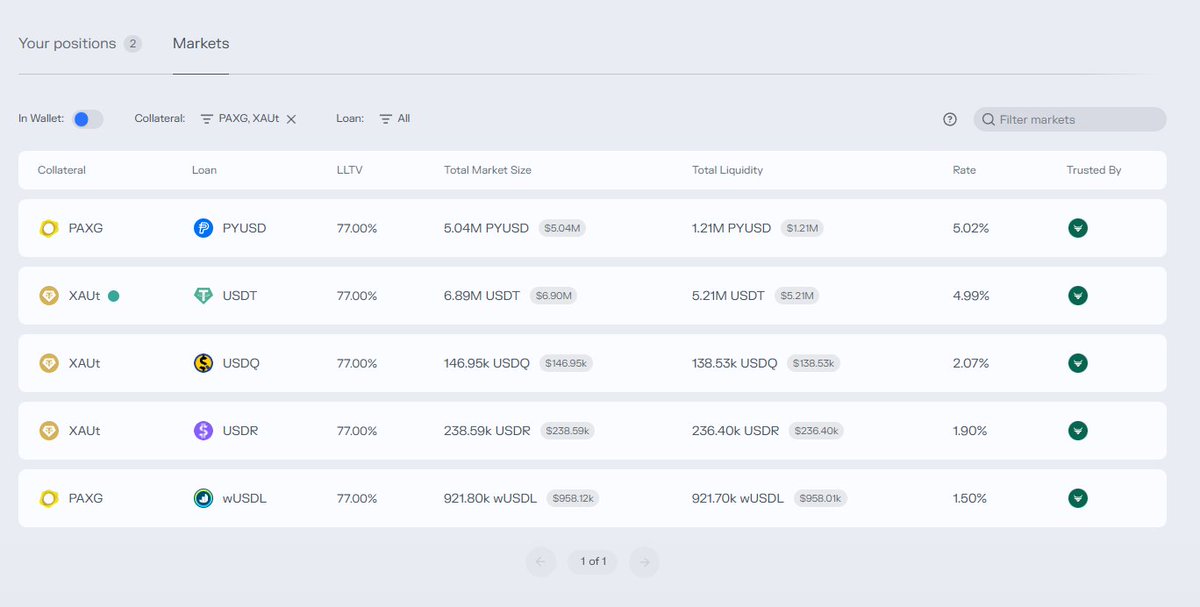

Do not, wary farmer, fade @Contango_xyz

25% leveraged intrinsic yield on PT-LBTC on @MorphoLabs.

Even at 8 BTC principal, you still get over 15% APR.

Please be careful with leverage though and mind your price impact, slippage, and fees.

This market expires in May, so it's a good chance to sit in a multi-month BTC strategy with competitive yield.

25% leveraged intrinsic yield on PT-LBTC on @MorphoLabs.

Even at 8 BTC principal, you still get over 15% APR.

Please be careful with leverage though and mind your price impact, slippage, and fees.

This market expires in May, so it's a good chance to sit in a multi-month BTC strategy with competitive yield.

Honorable Mention: @InfraredFinance

The WBTC/WBERA pool has been at >120% for a good while now, with minimal IL.

Granted, if you want to hedge your Bera exposure, it's very expensive and probably not worth it.

If you like BERA and don't mind the mixed delta though, this is a good one.

Possible on @InfraredFinance, @stride_zone, and @beefyfinance.

The WBTC/WBERA pool has been at >120% for a good while now, with minimal IL.

Granted, if you want to hedge your Bera exposure, it's very expensive and probably not worth it.

If you like BERA and don't mind the mixed delta though, this is a good one.

Possible on @InfraredFinance, @stride_zone, and @beefyfinance.

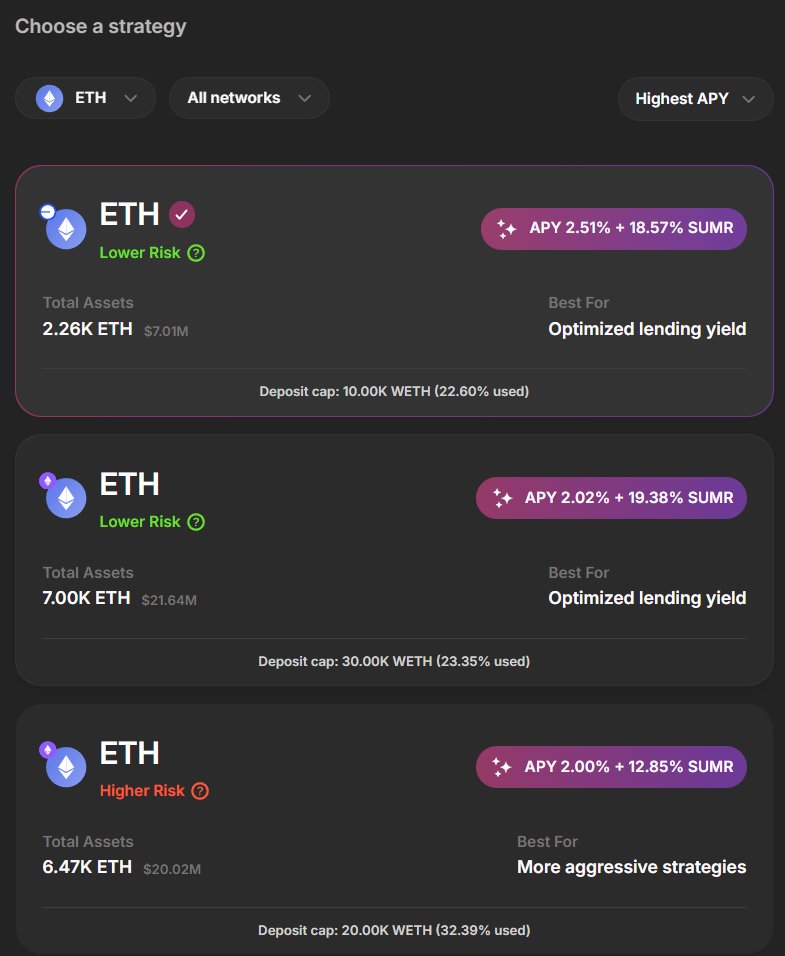

The Sleeper

@0xfluid has boasted potentially the best BTC play out there for those lucky enough to squeeze in when there's availability.

THE MATH:

► 95% LLTV = 20x Leverage

► 2.96% Collateral Yield

► -0.4% Borrow Cost

= 66.8% APR

But, like I said, there's almost never any room to enter 🥲

@0xfluid has boasted potentially the best BTC play out there for those lucky enough to squeeze in when there's availability.

THE MATH:

► 95% LLTV = 20x Leverage

► 2.96% Collateral Yield

► -0.4% Borrow Cost

= 66.8% APR

But, like I said, there's almost never any room to enter 🥲

That's all!

If you guys have any yields to add, please do in the comments below, I've inevitably missed quite a few, but I do what I can.

Relevant Ambassadorships:

- Pendle

- Euler

- Solv

- Contango

If you guys have any yields to add, please do in the comments below, I've inevitably missed quite a few, but I do what I can.

Relevant Ambassadorships:

- Pendle

- Euler

- Solv

- Contango

• • •

Missing some Tweet in this thread? You can try to

force a refresh