In 2015, foreign VCs poured billions into India creating 100+ unicorns worth $340B.

7 years later, most lost 80% of their value overnight.

Here's how Silicon Valley created the biggest startup bubble since the dot-com crash—and left Indian founders holding the bag 🧵

7 years later, most lost 80% of their value overnight.

Here's how Silicon Valley created the biggest startup bubble since the dot-com crash—and left Indian founders holding the bag 🧵

Around 2014-2015, global investors spotted an opportunity in India:

- 1.3 billion population

- Smartphone revolution taking off

- Internet users growing exponentially

- Digital-friendly government policies

What followed fundamentally transformed India's startup landscape - but not in the way many expected.

- 1.3 billion population

- Smartphone revolution taking off

- Internet users growing exponentially

- Digital-friendly government policies

What followed fundamentally transformed India's startup landscape - but not in the way many expected.

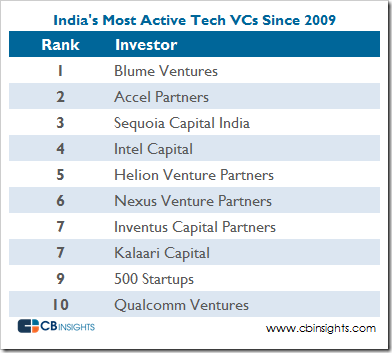

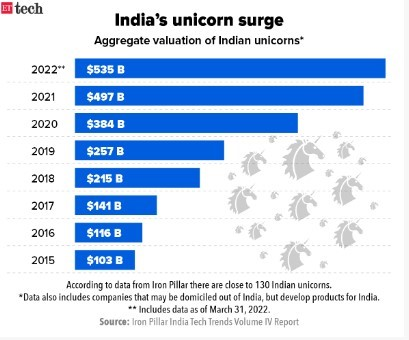

Between 2015-2021, foreign investment in Indian startups exploded from $3.5 billion to $42 billion annually.

This was the fastest capital influx into any emerging startup ecosystem in history.

Major firms like SoftBank, Tiger Global, and Sequoia rushed in to find "the next China."

This was the fastest capital influx into any emerging startup ecosystem in history.

Major firms like SoftBank, Tiger Global, and Sequoia rushed in to find "the next China."

But behind these staggering numbers lay a dangerous game.

Before this foreign capital wave, Indian startups were valued conservatively.

Average time to unicorn status? 8 years.

Valuation to revenue multiples? 5-8x.

Funding rounds? Modest and milestone-based.

Before this foreign capital wave, Indian startups were valued conservatively.

Average time to unicorn status? 8 years.

Valuation to revenue multiples? 5-8x.

Funding rounds? Modest and milestone-based.

Foreign VCs didn't just change this - they obliterated it overnight.

The strategy was seductively simple:

1. Apply Silicon Valley valuation metrics to Indian startups

2. Focus on GMV instead of revenue

3. Value companies on TAM (Total Addressable Market) potential

4. Create FOMO among other investors

5. Report paper gains to LPs back home

The strategy was seductively simple:

1. Apply Silicon Valley valuation metrics to Indian startups

2. Focus on GMV instead of revenue

3. Value companies on TAM (Total Addressable Market) potential

4. Create FOMO among other investors

5. Report paper gains to LPs back home

While local investors questioned these valuations, it was hard to resist the tidal wave.

The numbers tell the story:

Between 2018-2021, the average Indian unicorn was valued at 25-30x GMV compared to global standards of 3-5x.

Median time to unicorn status dropped from 8 years to just 4.2 years.

The pressure to deploy capital was intense.

The numbers tell the story:

Between 2018-2021, the average Indian unicorn was valued at 25-30x GMV compared to global standards of 3-5x.

Median time to unicorn status dropped from 8 years to just 4.2 years.

The pressure to deploy capital was intense.

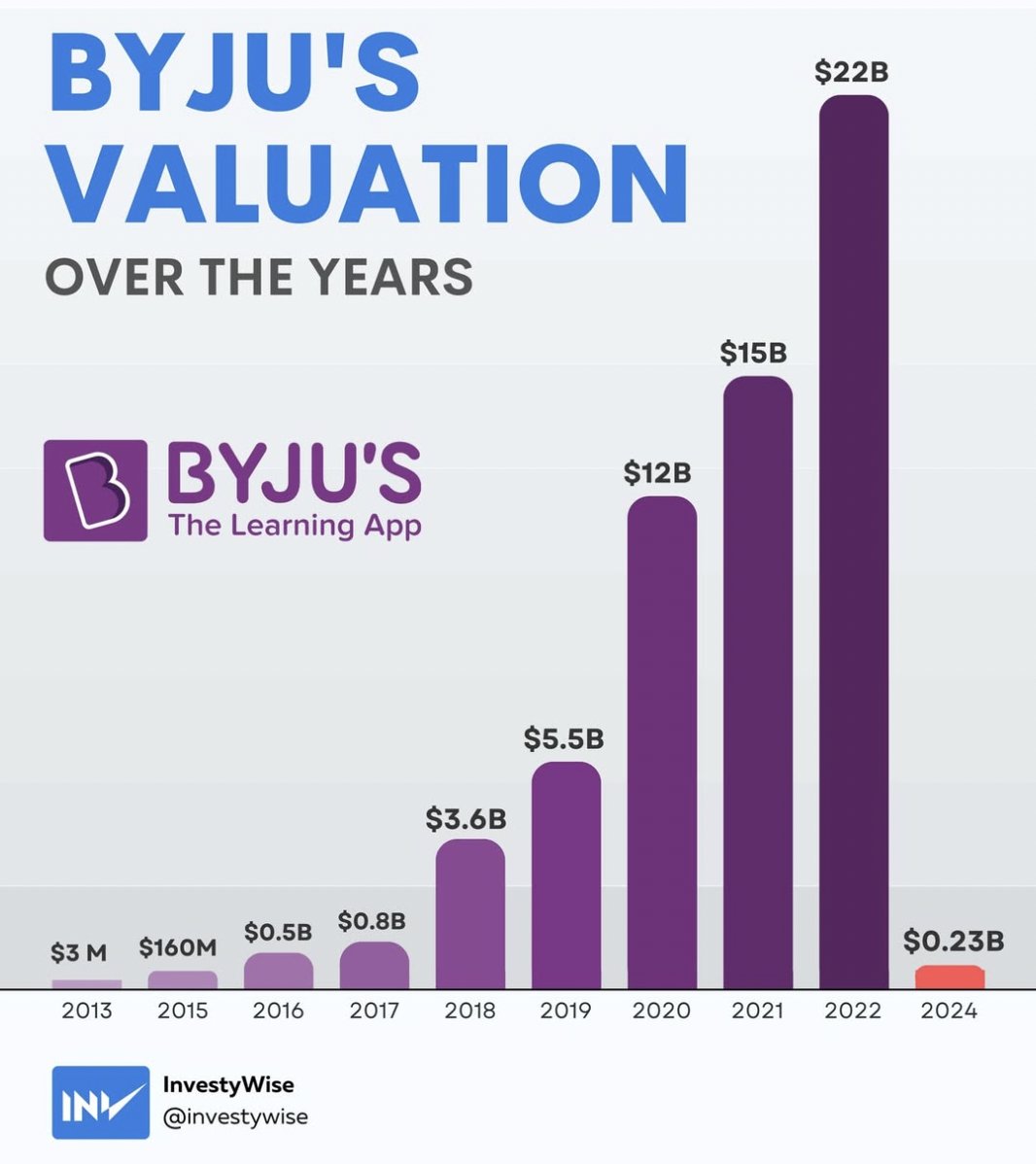

Case study: Byju's

2016: Valued at $400 million

2022: Valued at $22 billion (55x growth in 6 years)

This edtech giant reached a valuation of 27x annual revenue - when global edtech averaged 8-10x.

Today? Investors have marked down holdings by 80%+.

2016: Valued at $400 million

2022: Valued at $22 billion (55x growth in 6 years)

This edtech giant reached a valuation of 27x annual revenue - when global edtech averaged 8-10x.

Today? Investors have marked down holdings by 80%+.

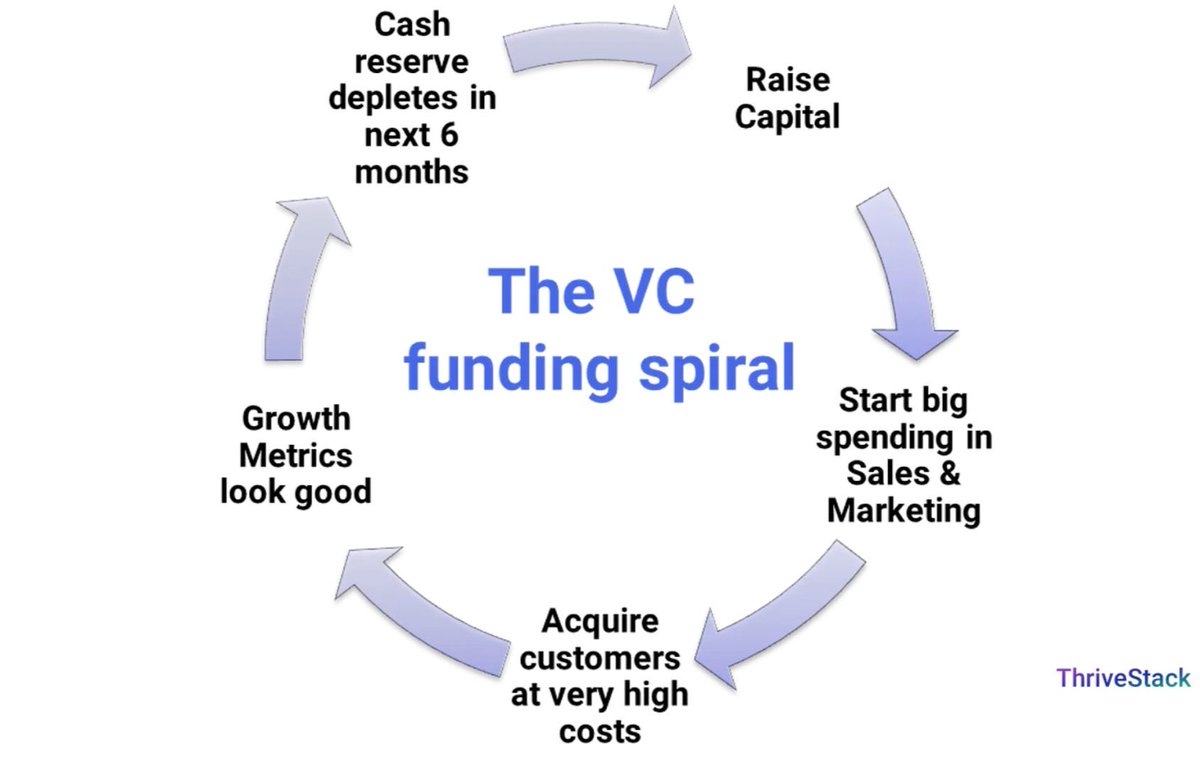

The masterstroke? Foreign VCs created a self-reinforcing cycle:

1. Invest at inflated valuation

2. Push for hyper-growth at all costs

3. Lead next round at higher valuation

4. Sell partial stake in secondary to book paper profits

5. Report incredible IRR to limited partners

All without businesses reaching profitability.

1. Invest at inflated valuation

2. Push for hyper-growth at all costs

3. Lead next round at higher valuation

4. Sell partial stake in secondary to book paper profits

5. Report incredible IRR to limited partners

All without businesses reaching profitability.

By 2021, India had 100+ unicorns with a combined valuation exceeding $340 billion.

The ecosystem celebrated.

Founders became celebrities.

Politicians touted India's startup success.

Then reality hit....

The ecosystem celebrated.

Founders became celebrities.

Politicians touted India's startup success.

Then reality hit....

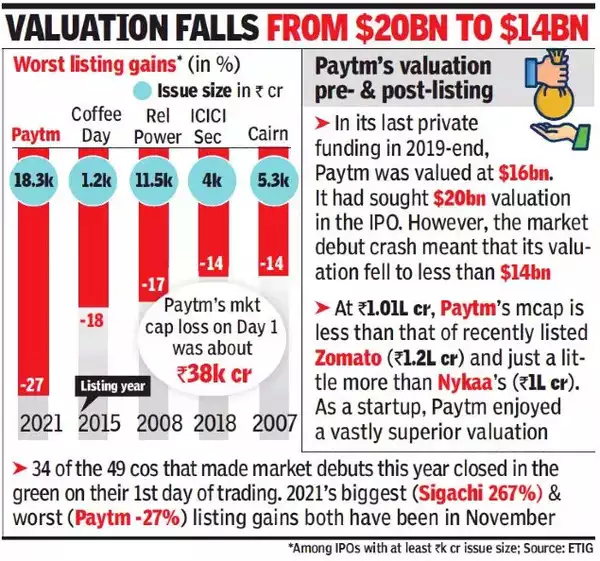

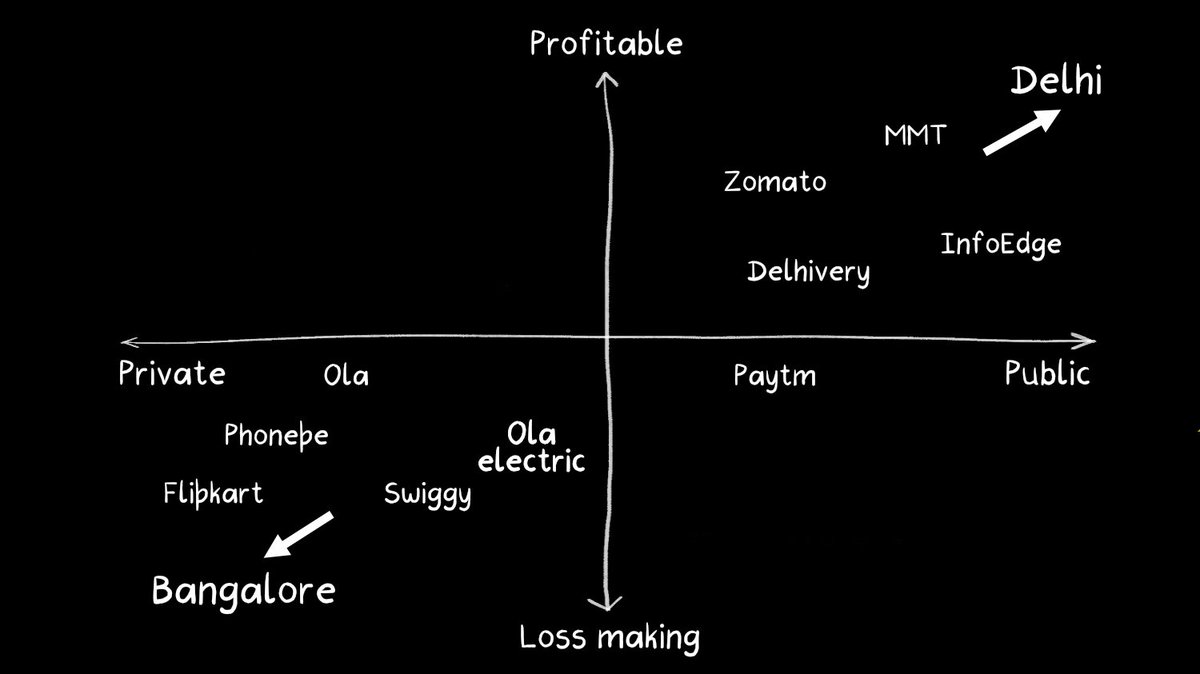

The evidence of trouble was apparent in public markets:

When Paytm IPO'd in 2021 at $16 billion valuation, it immediately crashed 27% on listing day.

By 2024, its market cap had fallen below $4 billion - a 75% drop.

This wasn't an isolated case.

When Paytm IPO'd in 2021 at $16 billion valuation, it immediately crashed 27% on listing day.

By 2024, its market cap had fallen below $4 billion - a 75% drop.

This wasn't an isolated case.

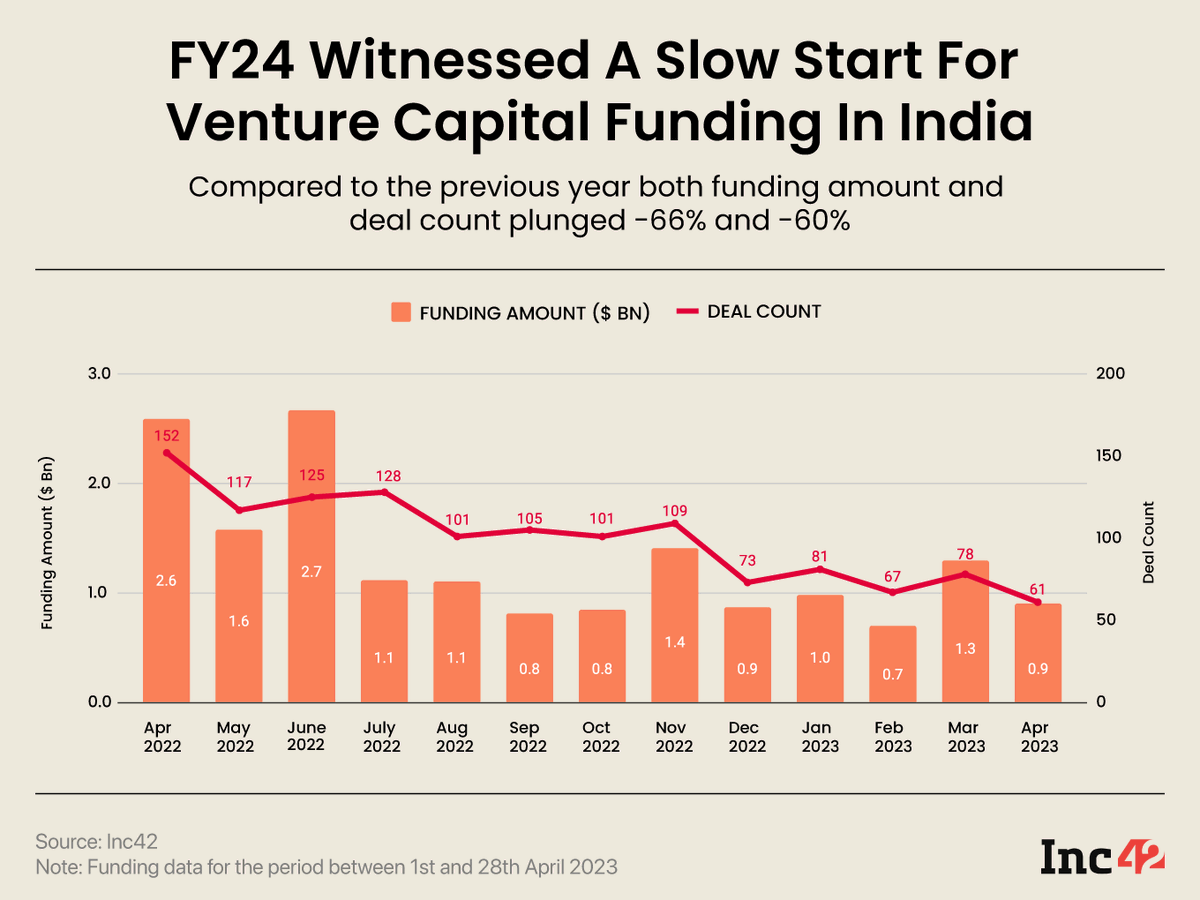

When interest rates rose globally in 2022, the entire house of cards began collapsing:

- Foreign investment in Indian startups dropped 65%

- 18 significant companies had down rounds

- Over 25,000 startup employees were laid off

- Multiple unicorns shut down operations

- Foreign investment in Indian startups dropped 65%

- 18 significant companies had down rounds

- Over 25,000 startup employees were laid off

- Multiple unicorns shut down operations

The hardest hit? Companies with the highest valuations.

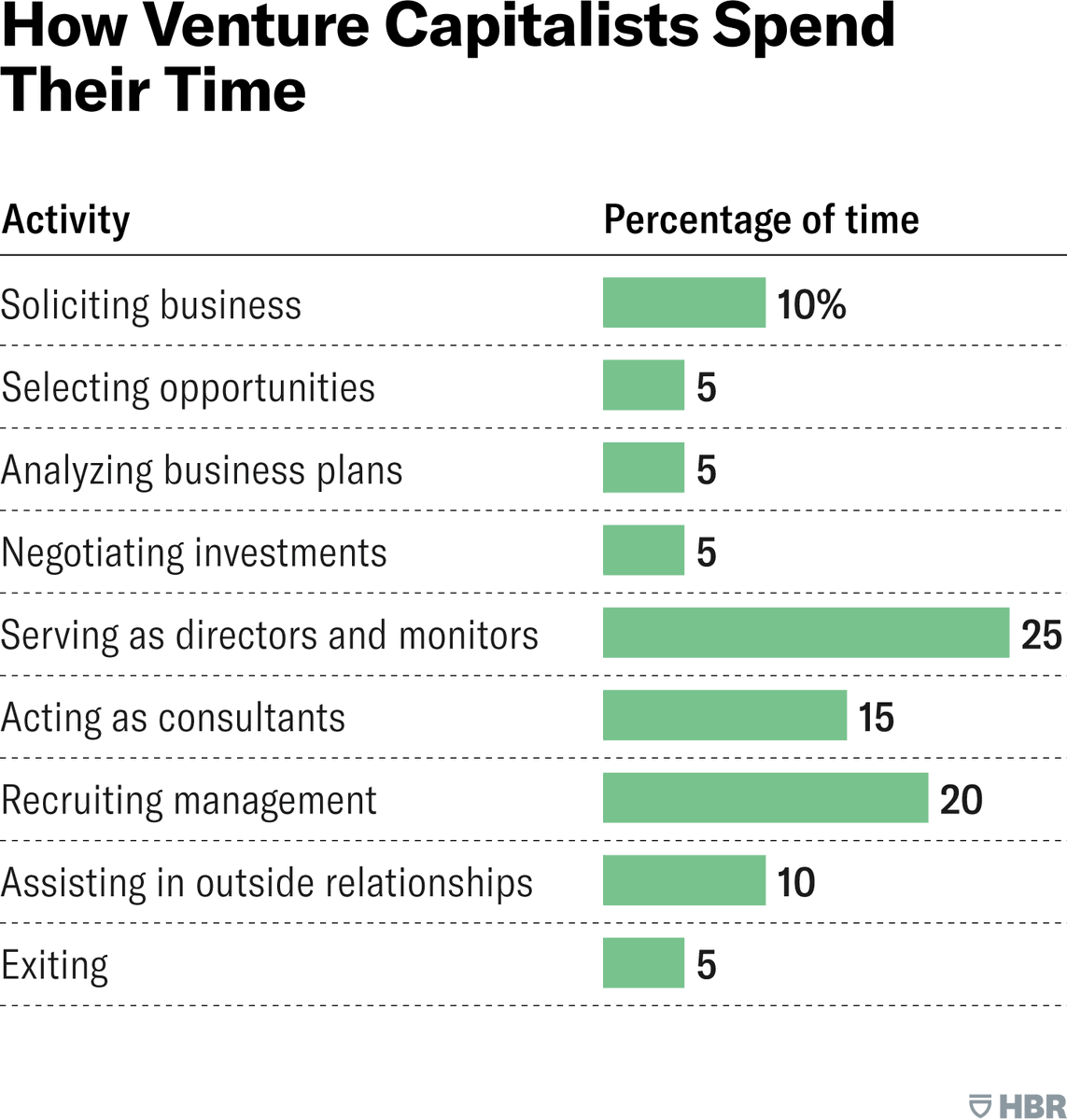

But foreign VCs had already secured their wins:

Data shows 38% of major foreign VC firms partially exited investments via secondary sales at peak valuations, with average returns of 3.7x in just 2.5 years.

They had already reported these gains to their LPs.

But foreign VCs had already secured their wins:

Data shows 38% of major foreign VC firms partially exited investments via secondary sales at peak valuations, with average returns of 3.7x in just 2.5 years.

They had already reported these gains to their LPs.

The bubble revealed something profound:

In startup ecosystems, valuation distortion doesn't just hurt investors - it warps founder incentives.

Companies optimized for:

- Vanity metrics over unit economics

- Blitzscaling over sustainable growth

- Fundraising skills over business fundamentals

In startup ecosystems, valuation distortion doesn't just hurt investors - it warps founder incentives.

Companies optimized for:

- Vanity metrics over unit economics

- Blitzscaling over sustainable growth

- Fundraising skills over business fundamentals

Looking back, the bubble wasn't just about inflated numbers.

It exposed the fundamental mismatch between:

- Silicon Valley's winner-take-all approach

- India's price-sensitive, fragmented market realities

- Short-term capital deployment pressure

- Long-term business building need

It exposed the fundamental mismatch between:

- Silicon Valley's winner-take-all approach

- India's price-sensitive, fragmented market realities

- Short-term capital deployment pressure

- Long-term business building need

The lesson?

Sometimes, the fastest way to build a sustainable startup ecosystem isn't through paper unicorns and inflated valuations.

Tt's through creating real businesses that solve real problems at prices the market can sustain.

In the end, India's startups learned that valuation isn't validation.

Sometimes, the fastest way to build a sustainable startup ecosystem isn't through paper unicorns and inflated valuations.

Tt's through creating real businesses that solve real problems at prices the market can sustain.

In the end, India's startups learned that valuation isn't validation.

Thanks for reading! A bit about me:

I’m Shawn, a Generative AI Consultant passionate about building AI-driven solutions. I write about AI, startups, and the future of work.

I’m Shawn, a Generative AI Consultant passionate about building AI-driven solutions. I write about AI, startups, and the future of work.

If you found these insights valuable: Sign up for my free newsletter!

the-unbound-ai.beehiiv.com/subscribe

the-unbound-ai.beehiiv.com/subscribe

I hope you've found this thread helpful.

Follow me @shawnchauhan1 for more.

Like/Repost the quote below if you can:

Follow me @shawnchauhan1 for more.

Like/Repost the quote below if you can:

https://twitter.com/813034080044392448/status/1898383517211635797

• • •

Missing some Tweet in this thread? You can try to

force a refresh