China and "Competitiveness": The Insect Method

The purpose of exports should be more imports; exports are real costs, imports are real benefits. When economic behaviors do not reflect this, an insidious strategy is taking shape.

If global trade were driven by comparative advantage, what free-trade types will tell you is the case, persistent major trade imbalances would not exist, because your exporting success necessarily sows the seeds of your future exporting disadvantage.

There would be a natural equilibrating force that manifests between currency strength and exports that results in something approximating mid-to-long-term trade parity between nations. This is not occurring.

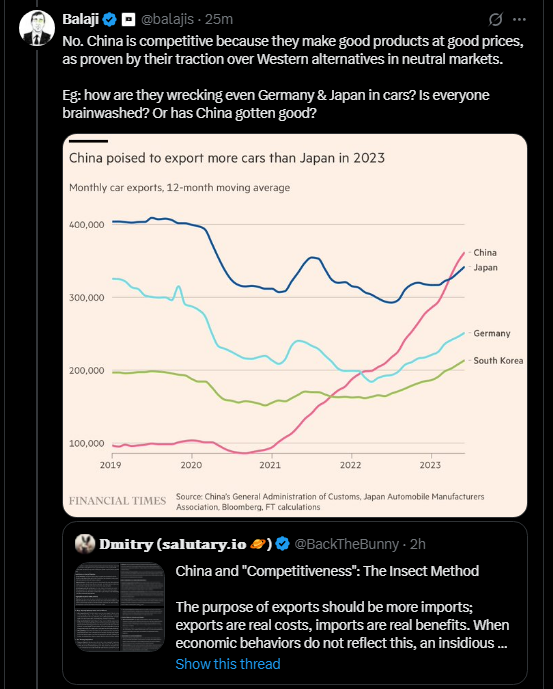

There is one materially flawed point in QT that Balaji and others completely overlook: what the word "competitive" means, how it's achieved, and on what terms.

How did China become so darn "competitive"?

It’s often the case that chronic surpluses are accomplished via varying tactics of domestic wage suppression. A tactic that subverts the natural equilibrating forces of balanced trade.

Germany and China are particular culprits, who coincidentally just so happen to have the two biggest trade surpluses.

China is not “more competitive” due to some Ricardian “free trade” advantage. It has taken the perverse approach of depriving its middle class of its share of GDP, which is a fancy way to say structurally diminishing wages.

The popular human-readable narrative is that China's trade success comes from superior efficiency and work ethic. They're extra busy bees over there!

The reality is something different: through its industrial policies (which manifest as de facto trade policies) it's systematically underpaid workers.

When you pay workers less than their productivity warrants, you're not being "more competitive", you're just shifting money from workers' pockets to exporters' profits. This isn't free trade; it's wage suppression dressed up as economic efficiency.

If your labor input is cheaper because you subvert the wages of labor, it’s not all that surprising where your “advantage” comes from.

This is the Strategy of the Bug. The Method of the Insect.

China didn't magically grow more competitive than the US because its workers one day decided to “save more” or “work harder". People love these story-telling narratives rather than looking at the raw mechanics of what's going on.

China's exporting "competitiveness" is in large part achieved because its workers have intentionally received a smaller share of their productivity gains.

This isn’t "efficiency" but rather a transfer of wealth from workers to businesses.

In China, it's the Hukou system that exploits labor rights and wages. Think of it like the US H1B program, but on steroids. It creates a servant-like, low-wage underclass that China uses to its exporting advantage.

The system classifies Chinese citizens into two categories:

Agricultural (rural) hukou

Non-agricultural (urban) hukou

This classification determines not just where you live, but access to jobs, education, healthcare, housing, and other social benefits.

To compete with this... *shudders*

"Competitiveness"... who wants this?

This is not the only way China facilitates its mercantilist surpluses. It also manipulates its currency, keeping it artificially depressed.

This is of substantial benefit to manufacturing (exporters) at the expense of households (all households are effectively importers, because they only buy goods and do not produce them). A weaker currency aids exporters and is a hinderance to importers.

Important: What matters is whether workers' compensation reflects their productivity. It's the productivity share of GDP where this dislocation has its impact. That's where the Hukou system takes its toll.

To illustrate: on a GDP/worker basis, Chinese workers are around 20% as productive as US ones. If they earned ~20% of the wage that'd be fine and not a competitive advantage.

But they don't, they earn around 10-15% of the US worker. This is a major difference for manufacturing labor inputs.

China has a substantial productivity-income gap relative to the US, and it allows their sustained surpluses to perniciously persist.

The average Chinese worker produces about a fifth of his American counterpart, but consumes an even smaller fraction of that output.

"COMPETITIVENESS"

A global race to the bottom ensues on account of a cancerous globalism wage assault, and the middle class bears the brunt of it. As the only way to compete in this shitty worldwide competition is to continually undermine wages.

To "compete" with this on its own terms is to overtly vitiate labor and hold your middle class in disregard, seeing them as little GDP variables and nothing more. Americans have no desire to "compete" with this, nor should they. Nor should anyone.

I hope this elucidates why certain types love the US H1B program so much, as well as the obsession politicians have with allowing in infinity immigrants.

They present it as “inclusion” “refugees” “diversity” and all walks of warm-and-fuzzy platitudes. This is a lie. It’s a wage-suppression technique.

What else keeps wages down? Labor supply. What increases supply? More warm bodies. Your wages can’t rise if we’re importing a bunch of guys that will work for half the price.

No more.

Don’t worry “free traders”, what you have here is not free trade anyways. You have mercantilist subversions that you have allowed to happen at your expense, because you prefer simple soundbites like “tariffs are tax” rather than root-level, distal-cause analysis.

Industrial policies are de facto trade policies. China can say it has "free trade", but that's a lie. Because it manipulates both its currency and domestic labor, which is every bit a functional trade policy as tariffs are, just with optics that deceive people.

The best time to address this was when it first started, the second-best time is now.

Reject the Insect Method.

Blog in profile.

The purpose of exports should be more imports; exports are real costs, imports are real benefits. When economic behaviors do not reflect this, an insidious strategy is taking shape.

If global trade were driven by comparative advantage, what free-trade types will tell you is the case, persistent major trade imbalances would not exist, because your exporting success necessarily sows the seeds of your future exporting disadvantage.

There would be a natural equilibrating force that manifests between currency strength and exports that results in something approximating mid-to-long-term trade parity between nations. This is not occurring.

There is one materially flawed point in QT that Balaji and others completely overlook: what the word "competitive" means, how it's achieved, and on what terms.

How did China become so darn "competitive"?

It’s often the case that chronic surpluses are accomplished via varying tactics of domestic wage suppression. A tactic that subverts the natural equilibrating forces of balanced trade.

Germany and China are particular culprits, who coincidentally just so happen to have the two biggest trade surpluses.

China is not “more competitive” due to some Ricardian “free trade” advantage. It has taken the perverse approach of depriving its middle class of its share of GDP, which is a fancy way to say structurally diminishing wages.

The popular human-readable narrative is that China's trade success comes from superior efficiency and work ethic. They're extra busy bees over there!

The reality is something different: through its industrial policies (which manifest as de facto trade policies) it's systematically underpaid workers.

When you pay workers less than their productivity warrants, you're not being "more competitive", you're just shifting money from workers' pockets to exporters' profits. This isn't free trade; it's wage suppression dressed up as economic efficiency.

If your labor input is cheaper because you subvert the wages of labor, it’s not all that surprising where your “advantage” comes from.

This is the Strategy of the Bug. The Method of the Insect.

China didn't magically grow more competitive than the US because its workers one day decided to “save more” or “work harder". People love these story-telling narratives rather than looking at the raw mechanics of what's going on.

China's exporting "competitiveness" is in large part achieved because its workers have intentionally received a smaller share of their productivity gains.

This isn’t "efficiency" but rather a transfer of wealth from workers to businesses.

In China, it's the Hukou system that exploits labor rights and wages. Think of it like the US H1B program, but on steroids. It creates a servant-like, low-wage underclass that China uses to its exporting advantage.

The system classifies Chinese citizens into two categories:

Agricultural (rural) hukou

Non-agricultural (urban) hukou

This classification determines not just where you live, but access to jobs, education, healthcare, housing, and other social benefits.

To compete with this... *shudders*

"Competitiveness"... who wants this?

This is not the only way China facilitates its mercantilist surpluses. It also manipulates its currency, keeping it artificially depressed.

This is of substantial benefit to manufacturing (exporters) at the expense of households (all households are effectively importers, because they only buy goods and do not produce them). A weaker currency aids exporters and is a hinderance to importers.

Important: What matters is whether workers' compensation reflects their productivity. It's the productivity share of GDP where this dislocation has its impact. That's where the Hukou system takes its toll.

To illustrate: on a GDP/worker basis, Chinese workers are around 20% as productive as US ones. If they earned ~20% of the wage that'd be fine and not a competitive advantage.

But they don't, they earn around 10-15% of the US worker. This is a major difference for manufacturing labor inputs.

China has a substantial productivity-income gap relative to the US, and it allows their sustained surpluses to perniciously persist.

The average Chinese worker produces about a fifth of his American counterpart, but consumes an even smaller fraction of that output.

"COMPETITIVENESS"

A global race to the bottom ensues on account of a cancerous globalism wage assault, and the middle class bears the brunt of it. As the only way to compete in this shitty worldwide competition is to continually undermine wages.

To "compete" with this on its own terms is to overtly vitiate labor and hold your middle class in disregard, seeing them as little GDP variables and nothing more. Americans have no desire to "compete" with this, nor should they. Nor should anyone.

I hope this elucidates why certain types love the US H1B program so much, as well as the obsession politicians have with allowing in infinity immigrants.

They present it as “inclusion” “refugees” “diversity” and all walks of warm-and-fuzzy platitudes. This is a lie. It’s a wage-suppression technique.

What else keeps wages down? Labor supply. What increases supply? More warm bodies. Your wages can’t rise if we’re importing a bunch of guys that will work for half the price.

No more.

Don’t worry “free traders”, what you have here is not free trade anyways. You have mercantilist subversions that you have allowed to happen at your expense, because you prefer simple soundbites like “tariffs are tax” rather than root-level, distal-cause analysis.

Industrial policies are de facto trade policies. China can say it has "free trade", but that's a lie. Because it manipulates both its currency and domestic labor, which is every bit a functional trade policy as tariffs are, just with optics that deceive people.

The best time to address this was when it first started, the second-best time is now.

Reject the Insect Method.

Blog in profile.

No more destruction and disregard for the middle. No more Harvard Business Review as your gospel.

https://x.com/BackTheBunny/status/1838189260626927779

more manipulations. this is not being "competitive", it's a distortion.

https://x.com/BackTheBunny/status/1896691002058125486

he didn't even read my post! he just "hard work and gumption" posted at me 😔

my reply to this in QT below.

my reply to this in QT below.

https://x.com/BackTheBunny/status/1899432907669909982

• • •

Missing some Tweet in this thread? You can try to

force a refresh