creating @BuildForWeight, visit https://t.co/MEBrQEXeXc

| complex-realm respecter | biofoundationalism | neoromantic?

| blog linked below, subscribe

2 subscribers

How to get URL link on X (Twitter) App

https://x.com/BackTheBunny/status/1887110408315793585

No more destruction and disregard for the middle. No more Harvard Business Review as your gospel.

No more destruction and disregard for the middle. No more Harvard Business Review as your gospel.https://x.com/BackTheBunny/status/1838189260626927779

https://x.com/BackTheBunny/status/1684496961091796992

Masculine Adoration

Masculine Adoration

related:

related:https://x.com/BackTheBunny/status/1809891095758651753

many, many, such cases (basically all such cases):

many, many, such cases (basically all such cases):https://x.com/BackTheBunny/status/1778605541834838365

manipulative, mendacious middling bureaucrats who play pavlovian games. there's no institution less deserving of your fear and respect than the fed.

manipulative, mendacious middling bureaucrats who play pavlovian games. there's no institution less deserving of your fear and respect than the fed.

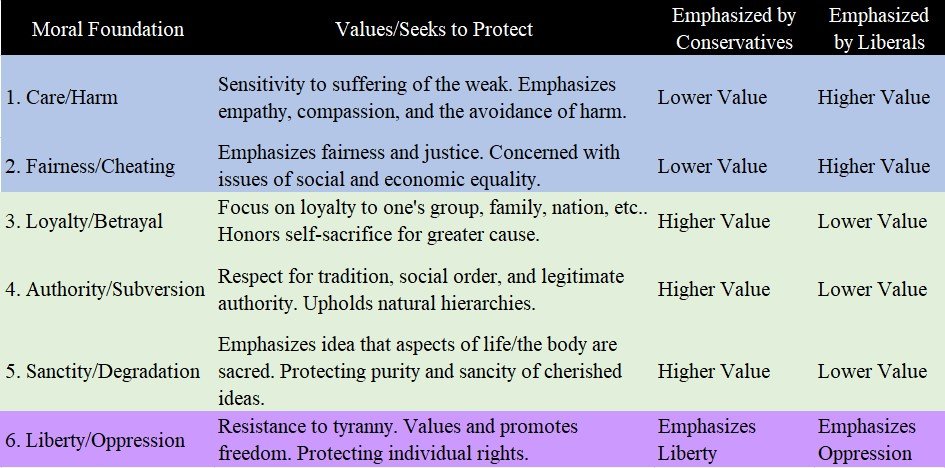

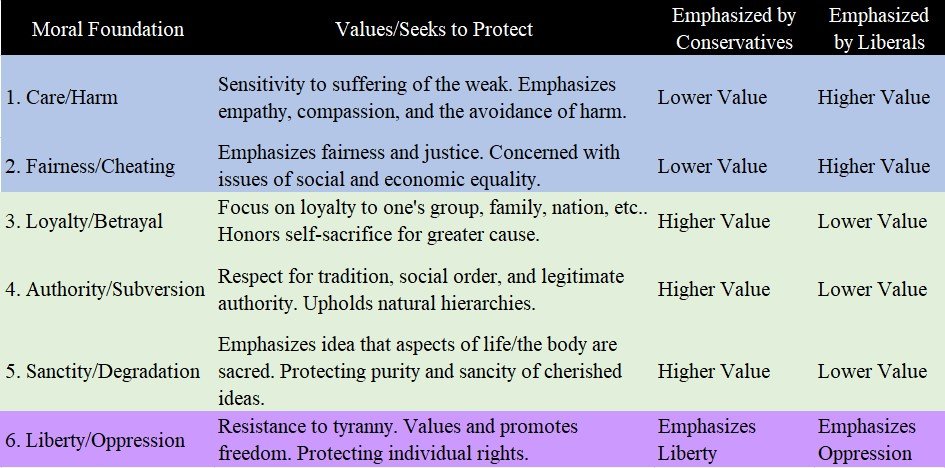

@curtis_yarvin @realchrisrufo Poverty and wealth sit on a spectrum. Moral foundations derive their utility and social emphasis based on where a nation sits on this spectrum.

@curtis_yarvin @realchrisrufo Poverty and wealth sit on a spectrum. Moral foundations derive their utility and social emphasis based on where a nation sits on this spectrum.https://twitter.com/BackTheBunny/status/1735175459288264798

Addendum: dividends put cash in your pocket, and technically hinder stock price while doing so.

Addendum: dividends put cash in your pocket, and technically hinder stock price while doing so.

Looks like about half the Nasdaq doesn't pay a dividend.

Looks like about half the Nasdaq doesn't pay a dividend.

This is going to focus on rate conceptualization and why yield curve inversion is a recession indicator. There isn't much else to cover on Fed monetary operations and their lack of control over rates.

This is going to focus on rate conceptualization and why yield curve inversion is a recession indicator. There isn't much else to cover on Fed monetary operations and their lack of control over rates.

Part 2 of 6: Biofoundationalism

Part 2 of 6: Biofoundationalism

https://twitter.com/BackTheBunny/status/1709899882813911450

PoV from WW2 allowed the US to establish influence and soft violence. Like dollar diplomacy and sanctions, effected via “international” institutions like the World Bank and IMF, and banking pipelines beholden to SWIFT.

PoV from WW2 allowed the US to establish influence and soft violence. Like dollar diplomacy and sanctions, effected via “international” institutions like the World Bank and IMF, and banking pipelines beholden to SWIFT.

Generations of War, Crypto, And Business Part 4 (5th in series):

Generations of War, Crypto, And Business Part 4 (5th in series):

This series focuses on war as a leading indicator for adversarial domains and extrapolates application for DeFi.

This series focuses on war as a leading indicator for adversarial domains and extrapolates application for DeFi.

What’s a prime broker (PB):

What’s a prime broker (PB):

This idea came from one of the most influential essays I’ve ever read: Superhistory, Not Superintelligence, by Venkatesh Rao @vgr

This idea came from one of the most influential essays I’ve ever read: Superhistory, Not Superintelligence, by Venkatesh Rao @vgrhttps://twitter.com/BackTheBunny/status/1664050317644955648

Thus far, this series has focused on the Fed’s asset-swapping programs, namely QE.

Thus far, this series has focused on the Fed’s asset-swapping programs, namely QE.https://twitter.com/BackTheBunny/status/1636766538446540800

https://twitter.com/BackTheBunny/status/1590580285942685696

I went from thinking I was essentially retired to realizing how painfully naive I was.

I went from thinking I was essentially retired to realizing how painfully naive I was.

Complementary products (CPs) are ones that feed off each other. Many products have complements.

Complementary products (CPs) are ones that feed off each other. Many products have complements.

If you run your business for the long-term, you attract long-term thinkers. If you run it for quarter-over-quarter (QoQ) metrics and hyped forward guidance… you attract short-term speculators.

If you run your business for the long-term, you attract long-term thinkers. If you run it for quarter-over-quarter (QoQ) metrics and hyped forward guidance… you attract short-term speculators.