It's very clear what's happening:

President Trump now believes "short term pain" is his ONLY option to lower inflation and refinance $9+ trillion of US debt.

We have seen over -$5 TRILLION erased from US stocks with the goal of LOWERING rates.

Will it work?

(a thread)

President Trump now believes "short term pain" is his ONLY option to lower inflation and refinance $9+ trillion of US debt.

We have seen over -$5 TRILLION erased from US stocks with the goal of LOWERING rates.

Will it work?

(a thread)

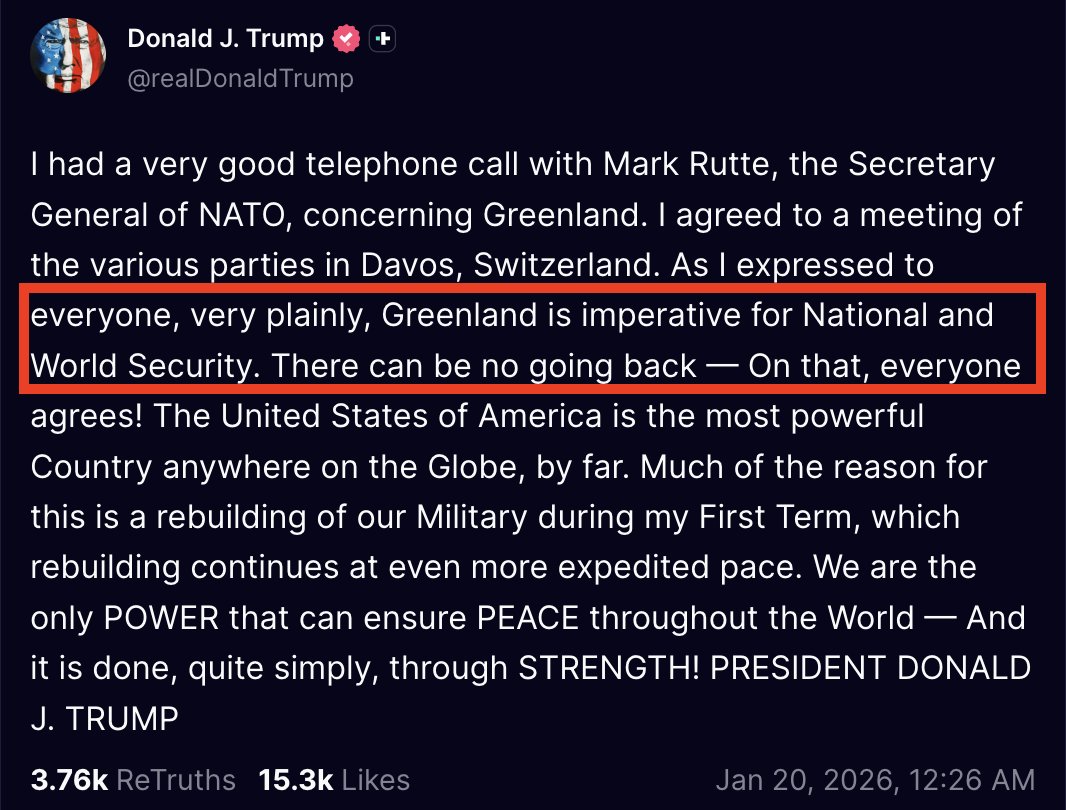

Based on our research, President Trump made this conclusion BEFORE inauguration.

However, he began formally articulating it on March 6th.

Below is the headline that destroyed investor confidence in 2025.

President Trump is no longer the "stock market's President" (for now).

However, he began formally articulating it on March 6th.

Below is the headline that destroyed investor confidence in 2025.

President Trump is no longer the "stock market's President" (for now).

On March 9th, President Trump further confirmed this shift in mentality.

He acknowledged we are in a "period of transition" and it will "take a little time."

This was the next piece of evidence that President Trump is truly not concerned about a crash in asset prices.

He acknowledged we are in a "period of transition" and it will "take a little time."

This was the next piece of evidence that President Trump is truly not concerned about a crash in asset prices.

And, President Trump's Cabinet is also onboard with this plan.

Commerce Secretary Lutnick on March 6th: "Stock market not driving outcomes for this admin."

Treasury Secretary Bessent TODAY: "Not concerned about a little volatility."

The sentiment is unanimous.

Commerce Secretary Lutnick on March 6th: "Stock market not driving outcomes for this admin."

Treasury Secretary Bessent TODAY: "Not concerned about a little volatility."

The sentiment is unanimous.

Furthermore, it's also clear that @DOGE and Elon Musk are on board here.

Even after Tesla, $TSLA, saw its 7th largest drop in history on March 10th, Elon made the below post:

"It will be fine long-term" regarding $TSLA stock.

So, why did this seemingly sudden shift happen?

Even after Tesla, $TSLA, saw its 7th largest drop in history on March 10th, Elon made the below post:

"It will be fine long-term" regarding $TSLA stock.

So, why did this seemingly sudden shift happen?

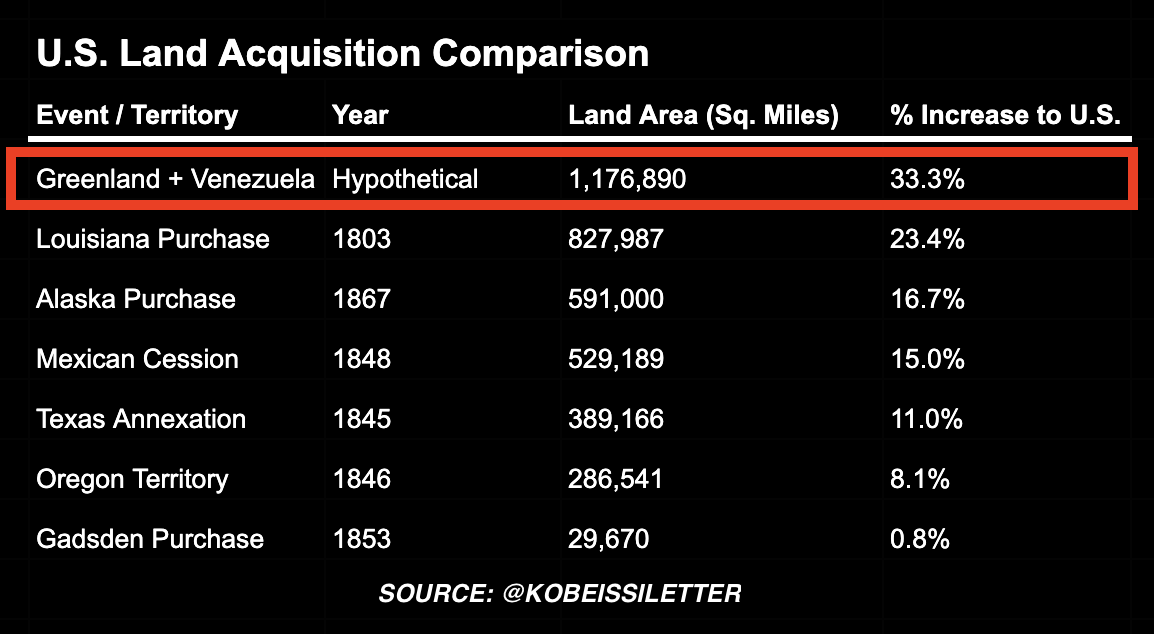

First, as we have previously noted, the US is facing a massive refinancing task.

In 2025, $9.2 TRILLION of US debt will either mature or need to be refinanced.

The quickest way to LOWER rates ahead of this colossal refinancing would be a recession.

Rates have been stubborn.

In 2025, $9.2 TRILLION of US debt will either mature or need to be refinanced.

The quickest way to LOWER rates ahead of this colossal refinancing would be a recession.

Rates have been stubborn.

For the last 2-3 years, the Fed believed they could obtain a "soft landing."

This was a scenario where inflation falls to 2% and unemployment remains relatively contained.

As inflation began to rebound into Trump's inauguration, he decided a new strategy was needed.

This was a scenario where inflation falls to 2% and unemployment remains relatively contained.

As inflation began to rebound into Trump's inauguration, he decided a new strategy was needed.

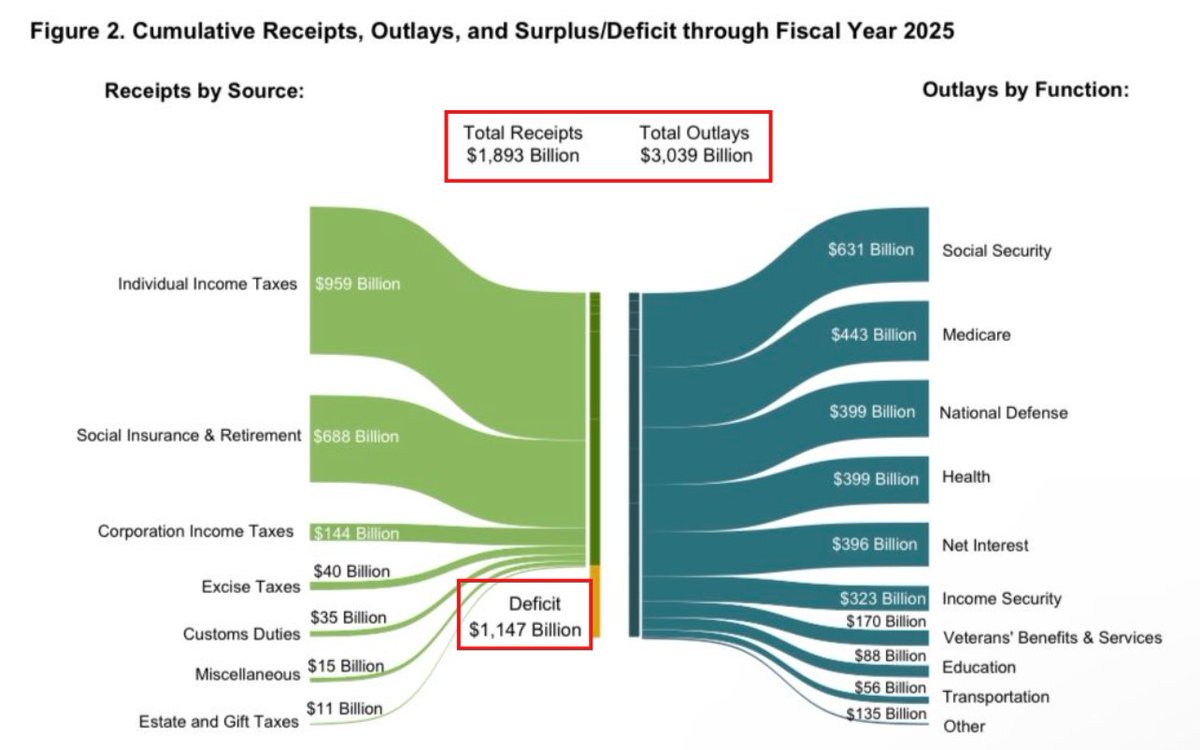

Yesterday, data showed the US Government's YTD deficit in FY2025 hit a record $1.15 trillion in February, a new year-to-date record.

The deficit is now $318 billion above 2024 levels for the same time period, or ~38% higher.

This worsened the crisis for @DOGE and Trump.

The deficit is now $318 billion above 2024 levels for the same time period, or ~38% higher.

This worsened the crisis for @DOGE and Trump.

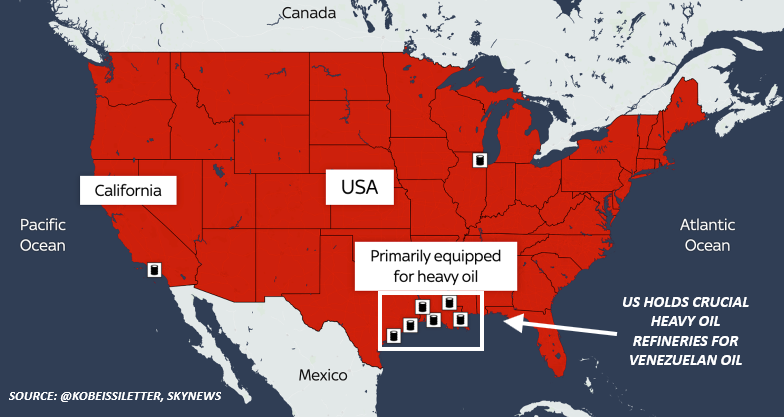

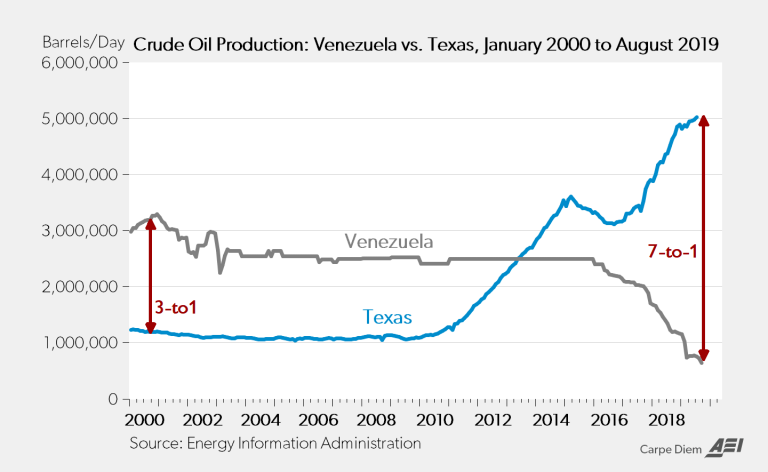

Furthermore, a clearly defined part of President Trump's strategy has been to LOWER oil prices.

Oil prices are down 20%+ since Trump took office.

This morning, Citigroup said oil prices falling to $53 would lower inflation to 2%.

What would lower oil prices? A recession.

Oil prices are down 20%+ since Trump took office.

This morning, Citigroup said oil prices falling to $53 would lower inflation to 2%.

What would lower oil prices? A recession.

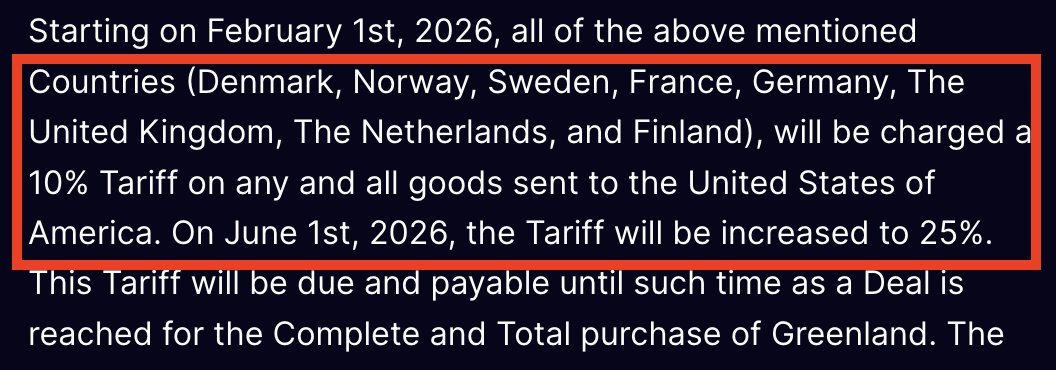

Simultaneously, President Trump wants to reduce the US trade deficit.

This is the whole point behind his global trade war.

Trump's strategy of levying tariffs on almost ALL US trade partners is lowering GDP growth estimates.

This also sounds like a recessionary case.

This is the whole point behind his global trade war.

Trump's strategy of levying tariffs on almost ALL US trade partners is lowering GDP growth estimates.

This also sounds like a recessionary case.

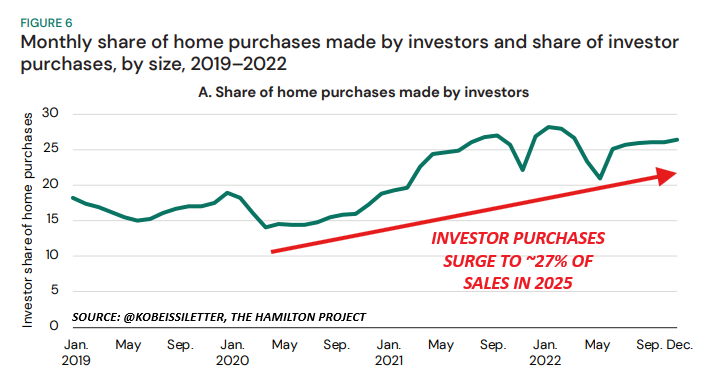

On top of this, @DOGE and Trump are attempting to cut TONS of government jobs.

These are the same jobs that have accounted for much of the recent job "growth" in the US.

Government jobs have risen by 2 million over the last 4.5 years.

Cutting these jobs will spur a recession.

These are the same jobs that have accounted for much of the recent job "growth" in the US.

Government jobs have risen by 2 million over the last 4.5 years.

Cutting these jobs will spur a recession.

Sum this all up, and here's what Trump wants:

1. Lower inflation

2. Lower oil prices (for #1)

3. Lower interest rates

4. Less deficit spending

5. Reduced US trade deficit

6. Less government inefficiency

ALL of these can be obtained by, or are a byproduct of, economic weakness.

1. Lower inflation

2. Lower oil prices (for #1)

3. Lower interest rates

4. Less deficit spending

5. Reduced US trade deficit

6. Less government inefficiency

ALL of these can be obtained by, or are a byproduct of, economic weakness.

To top it off, President Trump's first month of inflation data came in weaker than expected.

Both headline and core CPI/PPI inflation FELL by more than expected in February.

This gives Trump the "green light" to continue doing what he is doing.

At least for the next month.

Both headline and core CPI/PPI inflation FELL by more than expected in February.

This gives Trump the "green light" to continue doing what he is doing.

At least for the next month.

These changes in the macroeconomic backdrop will have market-wide implications.

We are trading it and will continue to capitalize on it.

Want to see how we are trading the market?

Subscribe to our premium analysis and alerts at the link below:

thekobeissiletter.com/subscribe

We are trading it and will continue to capitalize on it.

Want to see how we are trading the market?

Subscribe to our premium analysis and alerts at the link below:

thekobeissiletter.com/subscribe

The question is, will this strategy work?

The 10-year note yield recently fell ~50 basis points from its high.

Is the "short term pain" worth the "long term gain" in President Trump's economic strategy?

Follow us @KobeissiLetter for real time analysis as this develops.

The 10-year note yield recently fell ~50 basis points from its high.

Is the "short term pain" worth the "long term gain" in President Trump's economic strategy?

Follow us @KobeissiLetter for real time analysis as this develops.

• • •

Missing some Tweet in this thread? You can try to

force a refresh