You've made your choice, time for me to deliver

🚨BEST BTC YIELDS/OPPORTUNITIES ISSUE #2🚨

As always, bookmark this so you don't lose it

🚨BEST BTC YIELDS/OPPORTUNITIES ISSUE #2🚨

As always, bookmark this so you don't lose it

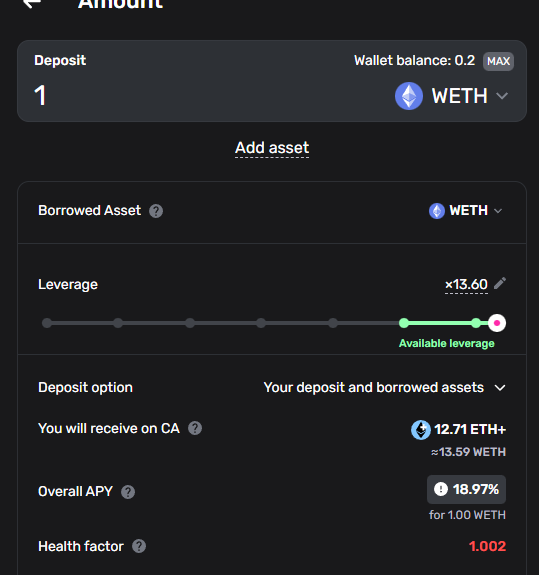

1) @build_on_bob🤝@eulerfinance

TL;DR

⇒ 34-67% APR Organic (+Points)

⇒ >100% APR w/ Incentives

BOB is a BTC-centric EVM superchain. More importantly, they're running an incentives campaign.

You can find most of the incentives on @merkl_xyz.

Anywho, RIGHT NOW you can loop BTC derivates for over 100% APR.

BUT THERE ARE A FEW IMPORTANT POINTS TO MAKE:

1) Slippage matters. I do NOT recommend auto-leveraging through illiquid markets. You can get rekt.

2) Some of the incentives are in rEUL which has a vesting mechanism.

3) Unwinding can also wreck you if you do it automatically, I recommend manually doing it.

FINALLY, the LBTC markets, with over $12,000,000 BTC to borrow are 34% APR and 67% APR respectively.

PLUS POINTS. These are the best @Lombard_Finance opportunities out there, hands down.

TL;DR

⇒ 34-67% APR Organic (+Points)

⇒ >100% APR w/ Incentives

BOB is a BTC-centric EVM superchain. More importantly, they're running an incentives campaign.

You can find most of the incentives on @merkl_xyz.

Anywho, RIGHT NOW you can loop BTC derivates for over 100% APR.

BUT THERE ARE A FEW IMPORTANT POINTS TO MAKE:

1) Slippage matters. I do NOT recommend auto-leveraging through illiquid markets. You can get rekt.

2) Some of the incentives are in rEUL which has a vesting mechanism.

3) Unwinding can also wreck you if you do it automatically, I recommend manually doing it.

FINALLY, the LBTC markets, with over $12,000,000 BTC to borrow are 34% APR and 67% APR respectively.

PLUS POINTS. These are the best @Lombard_Finance opportunities out there, hands down.

2) @SolvProtocol solv.BTC.BNB

Solv has a new BTC derivative that allows you to participate in Binance Launchpad opportunities or staking yield with you BTC.

On top of that, you get points:

► @lista_dao

► @AstherusHub

► @kernel_dao

► @SolvProtocol (s2)

This allows for a 5-10% native yield on a BTC derivative, and a speculative play on the underlying protocol points.

I hope it also gets some composability!

Solv has a new BTC derivative that allows you to participate in Binance Launchpad opportunities or staking yield with you BTC.

On top of that, you get points:

► @lista_dao

► @AstherusHub

► @kernel_dao

► @SolvProtocol (s2)

This allows for a 5-10% native yield on a BTC derivative, and a speculative play on the underlying protocol points.

I hope it also gets some composability!

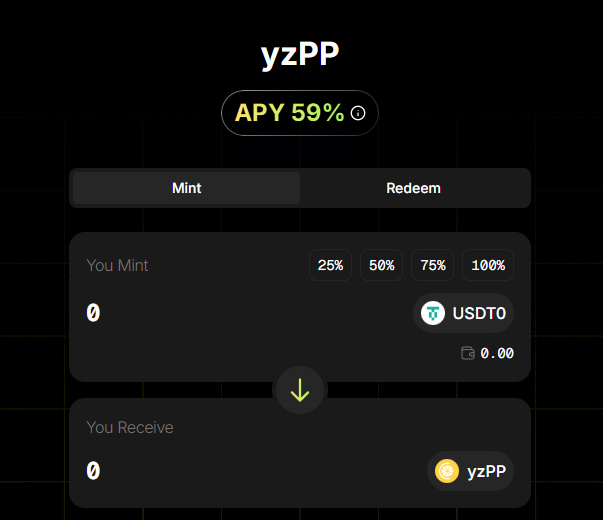

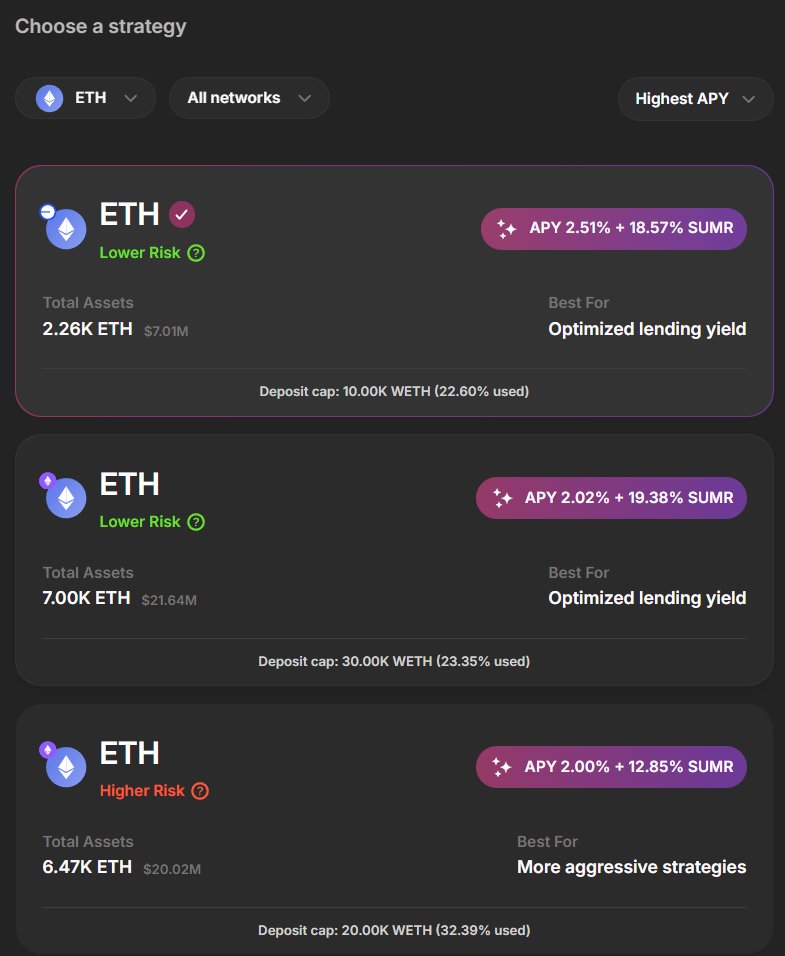

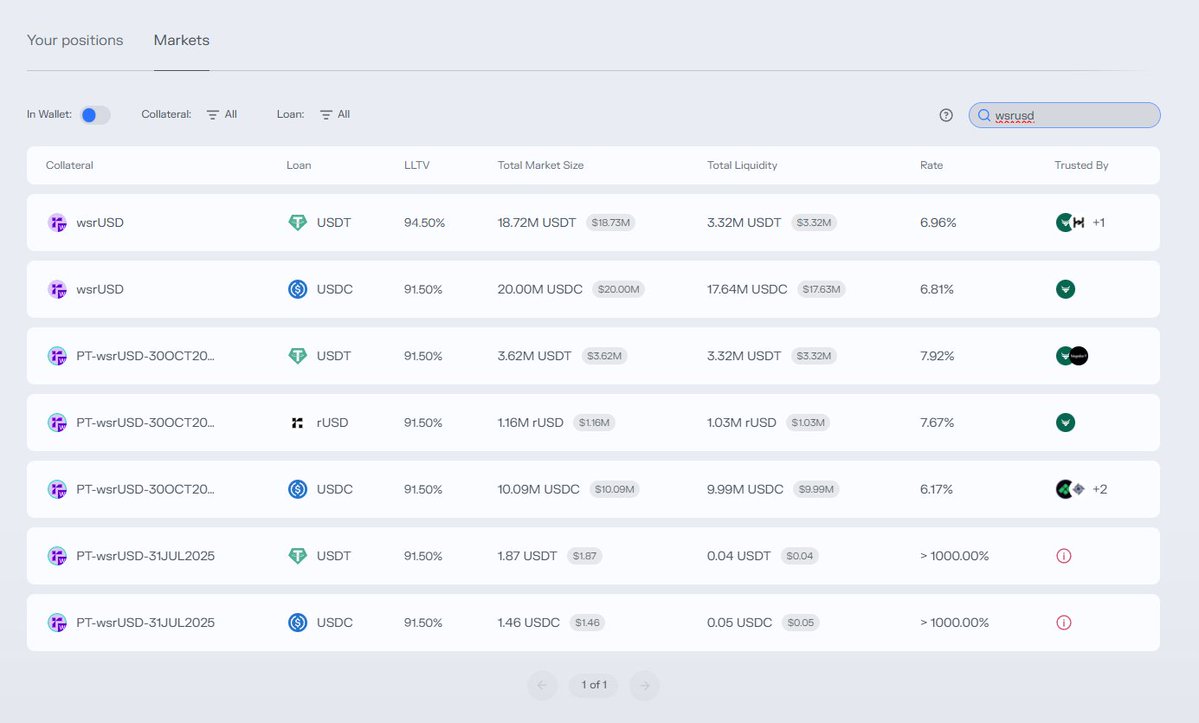

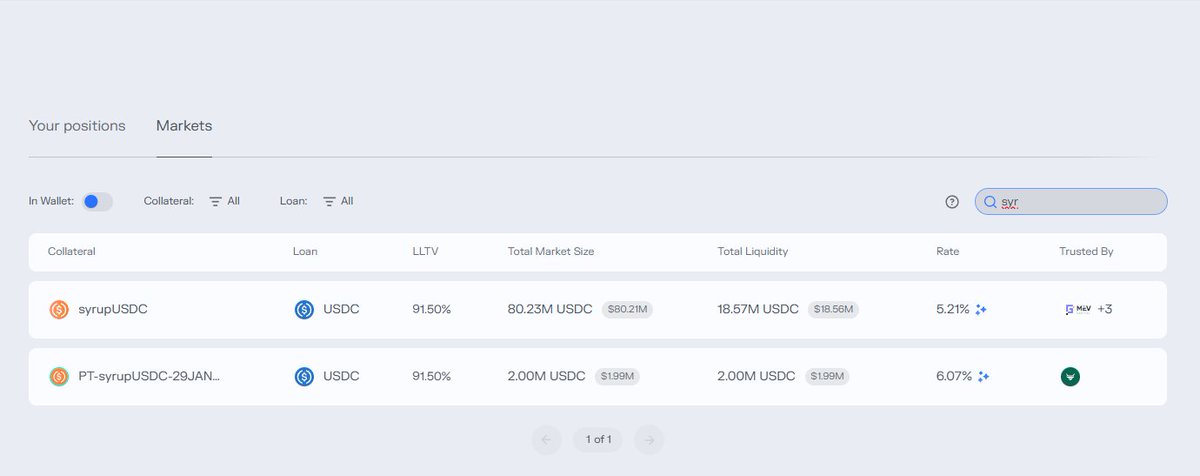

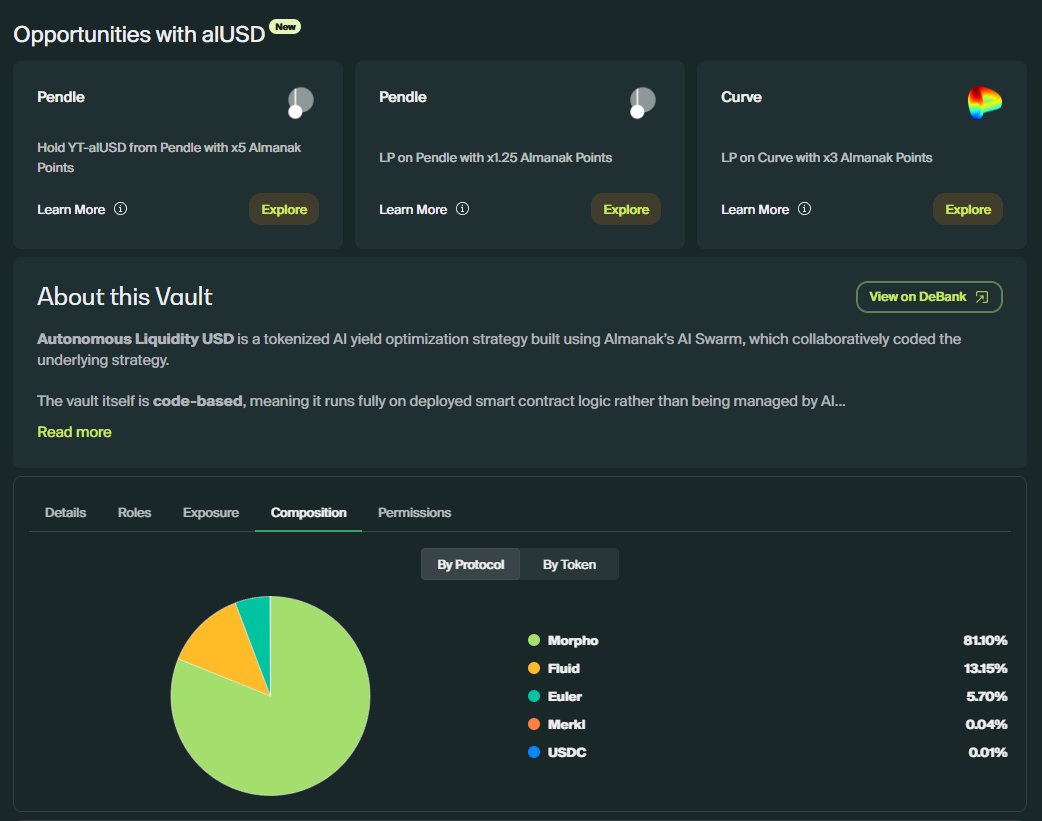

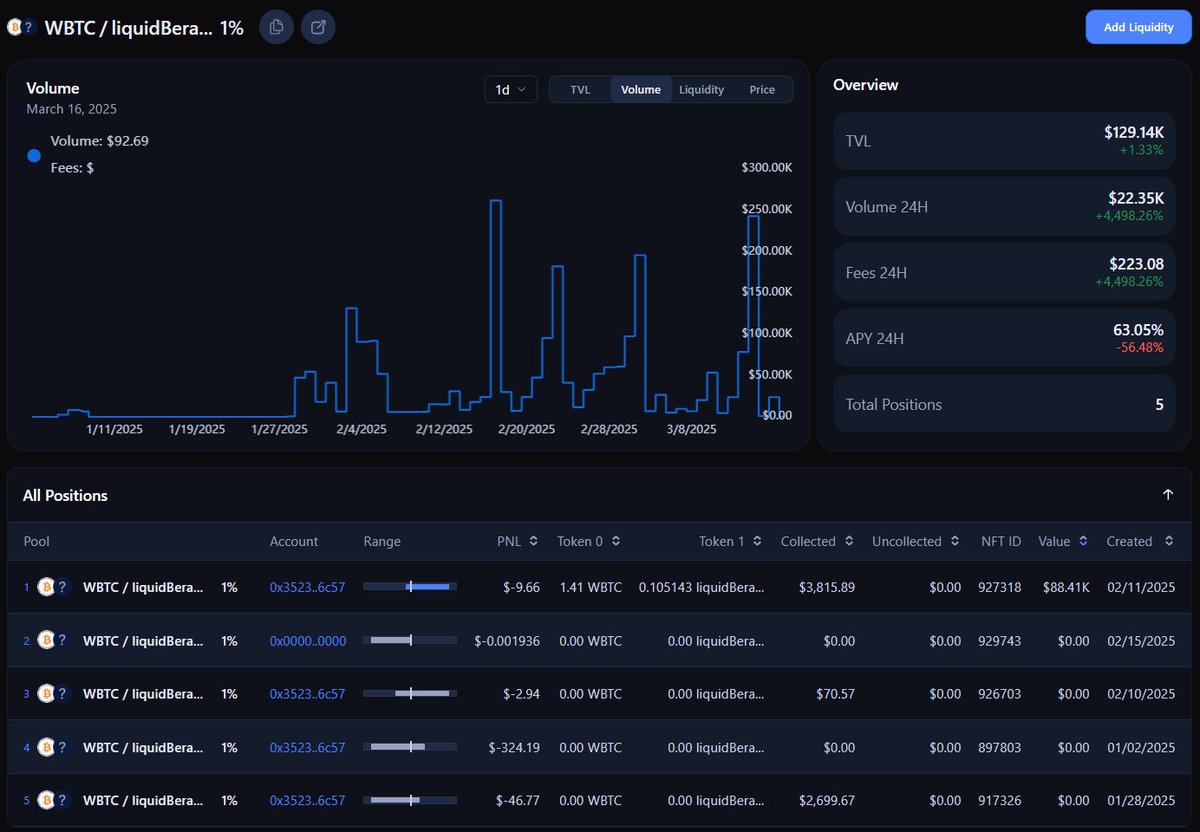

3) @MorphoLabs🤝@Contango_xyz🤝@pendle_fi

With a whopping 8.5 BTC principle to deploy into this, pendle PTs strike again.

Expiry: May 29th

Max Yield: 23.1%

Leverage: 9.27x

Oracle: Pendle AMM

This is on @base and an incredibly attractive yield for the Base airdrop speculator who's also a BTC maximalist.

With a whopping 8.5 BTC principle to deploy into this, pendle PTs strike again.

Expiry: May 29th

Max Yield: 23.1%

Leverage: 9.27x

Oracle: Pendle AMM

This is on @base and an incredibly attractive yield for the Base airdrop speculator who's also a BTC maximalist.

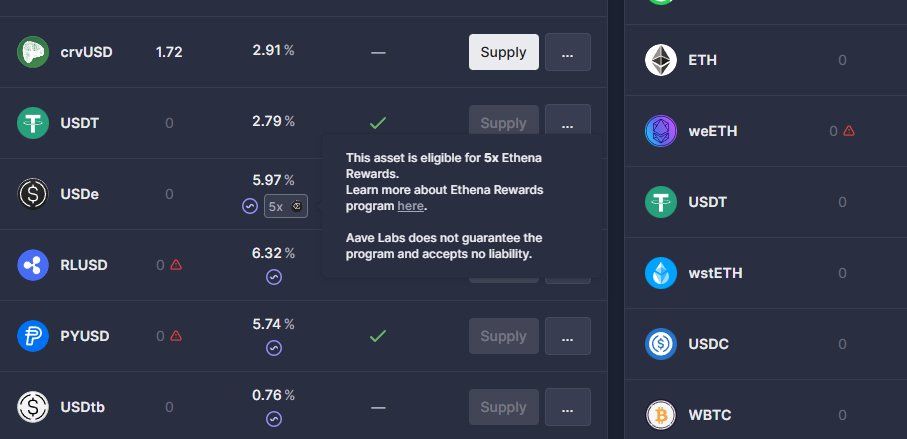

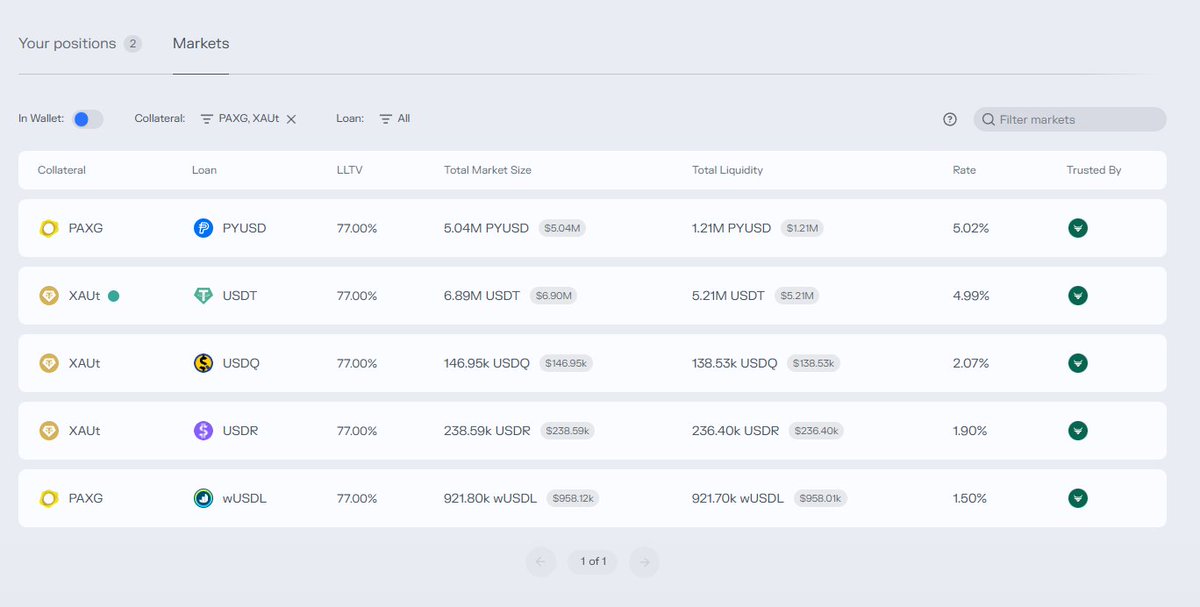

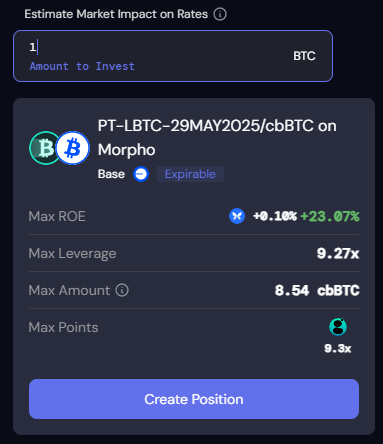

4) cbBTC on @KaminoFinance

Currently, Kamino has an 300K/mo incentives package specifically to borrow USDC against cbBTC.

That means the net cost to borrow stables against cbBTC is roughly 2%.

WHICH MEANS, if you can get a yield higher than 2%, you can get a positive yield on your cbBTC collateral.

EXAMPLE:

1) Collateralize $100,000 cbBTC

2) Borrow $50,000 USDC

3) Bridge to Base

4) Loop sUSDS / USDS on @growcompound for 27%

RESULT:

➢ 12.5% net LTV

➢ $51K BTC liquidation level

➢ Potential Base Airdrop participation

Currently, Kamino has an 300K/mo incentives package specifically to borrow USDC against cbBTC.

That means the net cost to borrow stables against cbBTC is roughly 2%.

WHICH MEANS, if you can get a yield higher than 2%, you can get a positive yield on your cbBTC collateral.

EXAMPLE:

1) Collateralize $100,000 cbBTC

2) Borrow $50,000 USDC

3) Bridge to Base

4) Loop sUSDS / USDS on @growcompound for 27%

RESULT:

➢ 12.5% net LTV

➢ $51K BTC liquidation level

➢ Potential Base Airdrop participation

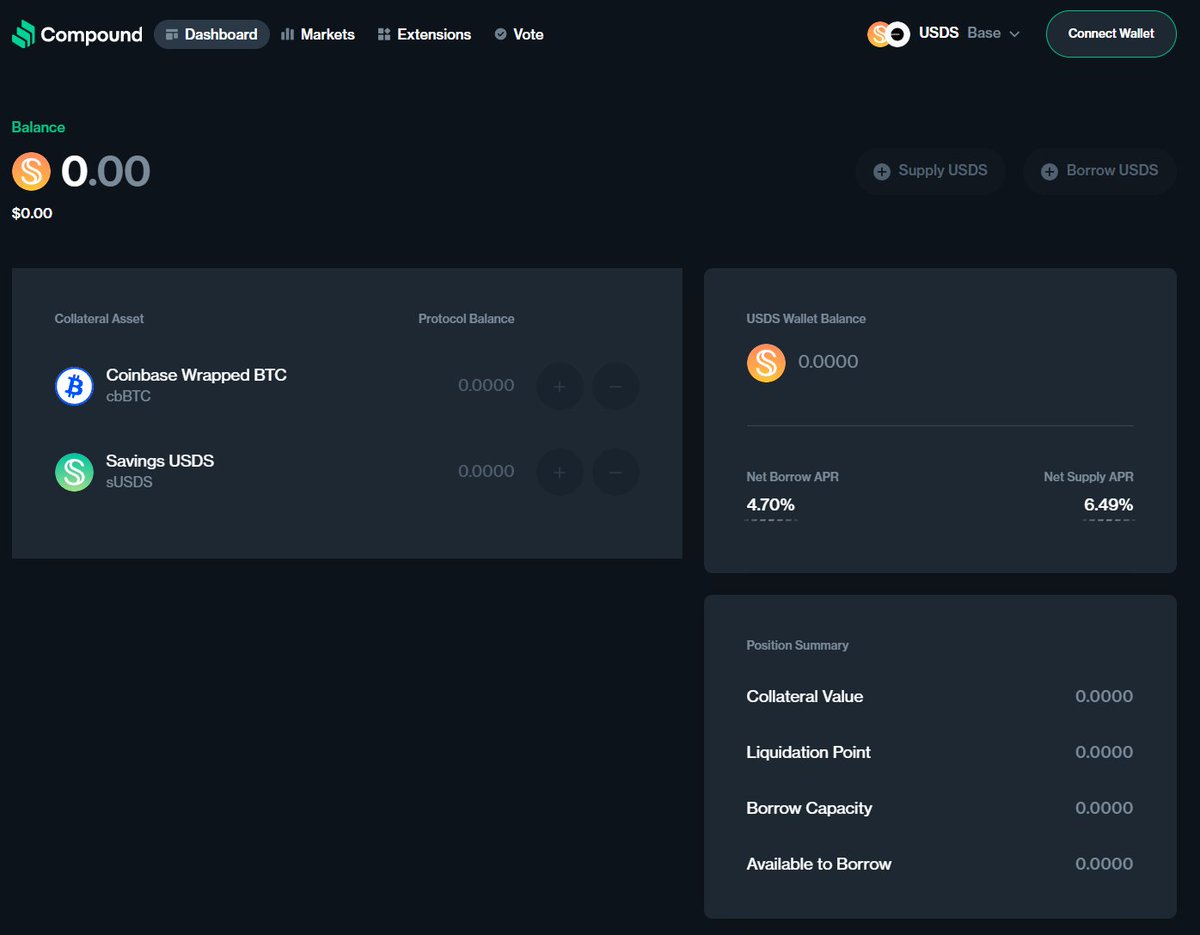

5) Liquidity Plays

This one is sneaky. It's the liquidBeraBTC BOYCO vault receipt token.

It's depegged by 1% because you can't redeem it until Boyco ends.

Here, you can see 70K 7-Day volume through 130-Day Liquidity.

That annualizes to 30% APR.

The caveat, of course, is that you'd have to either put buy-side liquidity in WBTC and wait for more sell pressure to enter, or buy some liquidBeraBTC from this 1% fee tier to enter, which may eat the later gains.

This is NOT for the greenhorn yield farmer.

This one is sneaky. It's the liquidBeraBTC BOYCO vault receipt token.

It's depegged by 1% because you can't redeem it until Boyco ends.

Here, you can see 70K 7-Day volume through 130-Day Liquidity.

That annualizes to 30% APR.

The caveat, of course, is that you'd have to either put buy-side liquidity in WBTC and wait for more sell pressure to enter, or buy some liquidBeraBTC from this 1% fee tier to enter, which may eat the later gains.

This is NOT for the greenhorn yield farmer.

Those are my top 5

BTC is notoriously difficult to find yields on. Nevertheless, I hope you found this useful.

If there are any obvious BTC yields that I missed, PLEASE LET ME KNOW in the comments below.

Ambassadorships Mentioned:

► Solv

► Compound

► Euler

► Kamino

► Contango

► Pendle

BTC is notoriously difficult to find yields on. Nevertheless, I hope you found this useful.

If there are any obvious BTC yields that I missed, PLEASE LET ME KNOW in the comments below.

Ambassadorships Mentioned:

► Solv

► Compound

► Euler

► Kamino

► Contango

► Pendle

• • •

Missing some Tweet in this thread? You can try to

force a refresh