Okay, let's talk about Trump end game. To do that, let's read Stephen Miran's "A User's Guide to Restructuring the Global Trading System" together.

Note that there's a disclaimer that this is not a policy advocacy but catalog of tools available for them to "reshape the global trading system."

hudsonbaycapital.com/documents/FG/h…

Note that there's a disclaimer that this is not a policy advocacy but catalog of tools available for them to "reshape the global trading system."

hudsonbaycapital.com/documents/FG/h…

Trump has been talking about global trade & how he thinks the US trade deficit is unfair since the 1980s (see his Oprah interviews) so this is beef he carries and he has the power to do it.

Trump 1.0 was a test case and Trump 2.0 is going to go full steroid on what he views as the current world order not working for the US. It may work for u, but not for him & his team is going to change it. Here's how Miran is laying it out.

Trump 1.0 was a test case and Trump 2.0 is going to go full steroid on what he views as the current world order not working for the US. It may work for u, but not for him & his team is going to change it. Here's how Miran is laying it out.

First, the root of all US problems & its imbalances lies in the overvalued dollar. Yes, others lament its "exorbitant privilege" (a French FM said it) but here Trump team & also corroborated by many economists, including @michaelxpettis that while it is good for US FINANCIAL SECTORS, terrible for MAINSTREET. So basically Wall Street gains at the expense of the VACUUMING out of US industrial base.

Here he lays the connection between the role/burden of the dollar as a reserve currency, impact on US manufacturing competitiveness and ultimate the US ability to fulfill its security commitment w/ an industrial base that is vacuumed (e.g., no steel, no gun, no tungsten, no bullet so to speak).

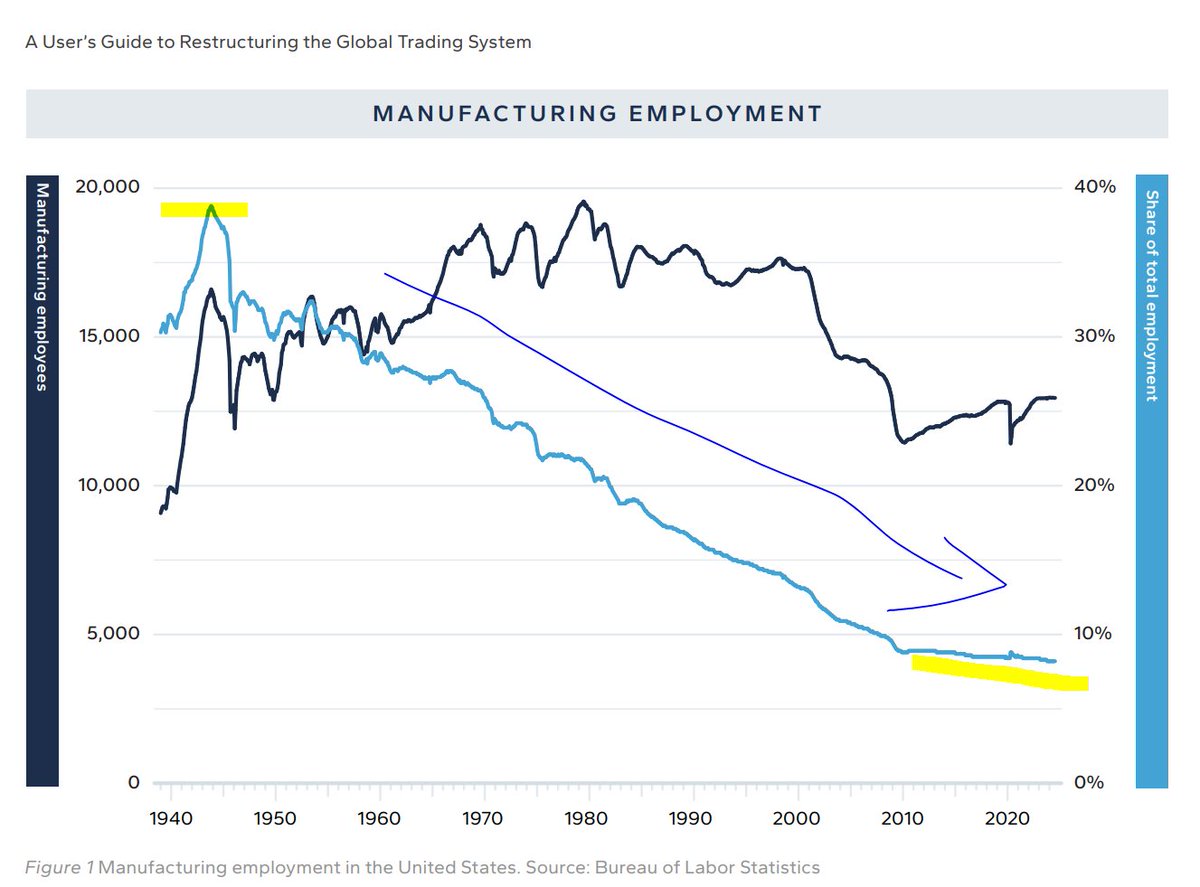

Chart below shows the decline of manufacturing as a share of employment from peak of 40% in 1980s to now less than 10%. That's the beef.

Okay, let's talk about the logical leap between the dollar/trade/security.

Chart below shows the decline of manufacturing as a share of employment from peak of 40% in 1980s to now less than 10%. That's the beef.

Okay, let's talk about the logical leap between the dollar/trade/security.

When countries run TRADE SURPLUSES, and they don't let their domestic currency appreciate, they must recycle such surpluses into something. Well, as the USD or shall I say US treasuries, are the largest asset available, they buy that.

By doing so, they INFLATE the value of the USD & thus makes it EXPENSIVE so it creates a situation where it's CHEAPER TO IMPORT goods than to PRODUCE it. And moreover, the hurts exporters.

So US trade deficit widening is a mirror of countries hoarding their trade surpluses & then recycling it into USTs or USD denominated assets like corporate bonds/etc.

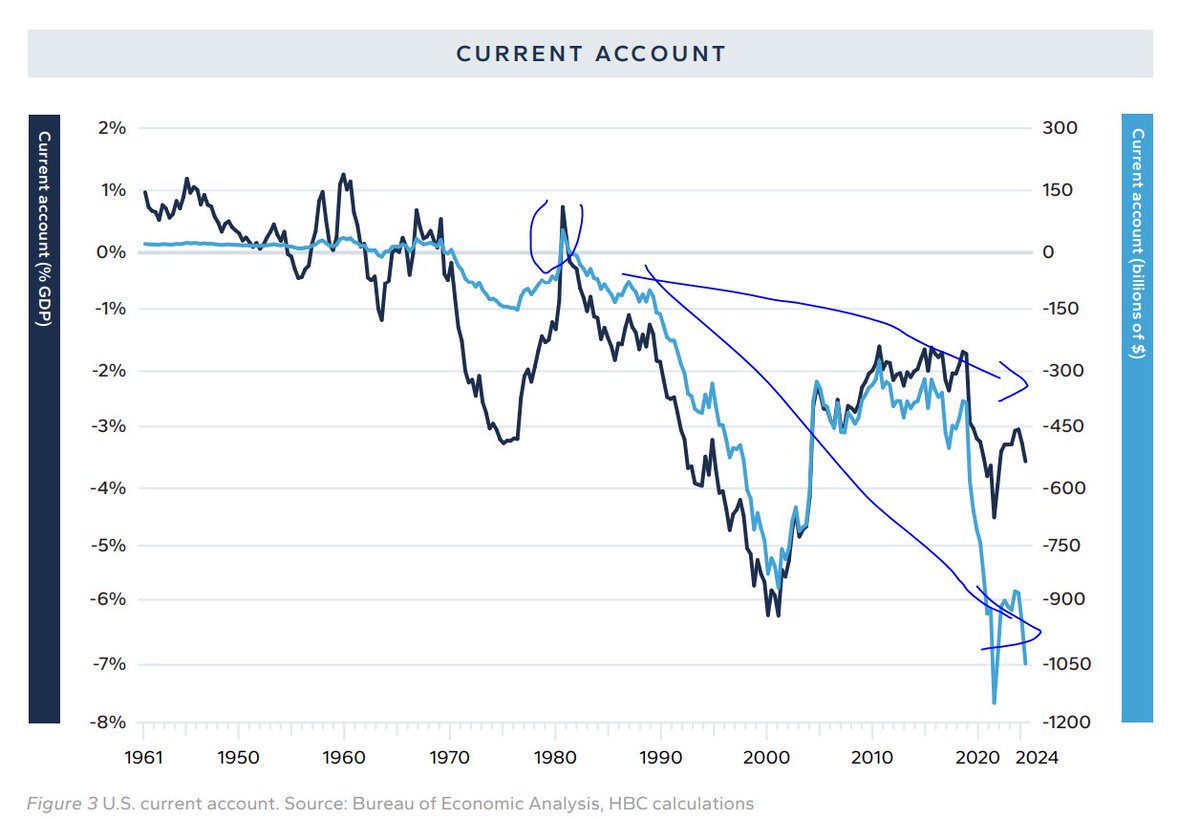

The mirror image of US decline of manufacturing = the deteriorating of US current account (which is an income statement) or net exports + income

Meaning, he thinks the real culprit of this is the EXPENSIVE USD and the way countries unfairly CHEAPEN their FX VERSUS the US so it creates imbalances.

This creates the enlarging of the financial system relative to production forces or mainstreet (ordinary people that lose their dignity/livelihood/community so to speak on the vacuuming out of industrial base - think Detroit).

By doing so, they INFLATE the value of the USD & thus makes it EXPENSIVE so it creates a situation where it's CHEAPER TO IMPORT goods than to PRODUCE it. And moreover, the hurts exporters.

So US trade deficit widening is a mirror of countries hoarding their trade surpluses & then recycling it into USTs or USD denominated assets like corporate bonds/etc.

The mirror image of US decline of manufacturing = the deteriorating of US current account (which is an income statement) or net exports + income

Meaning, he thinks the real culprit of this is the EXPENSIVE USD and the way countries unfairly CHEAPEN their FX VERSUS the US so it creates imbalances.

This creates the enlarging of the financial system relative to production forces or mainstreet (ordinary people that lose their dignity/livelihood/community so to speak on the vacuuming out of industrial base - think Detroit).

As he sights Triffin, he says this situation is UNSUSTAINABLE. As the US runs a twin deficit - current account deficit + fiscal deficit & ultimately that leads to credit risk & lose the reserve status.

Miran thinks that the USD might is reaching an unsustainable level relative to its MIGHT AS AN ECONOMY.

For example in the 1960s, US was 40% of global GDP and today it's 26%.

So this the dollar is a big problem for mainstreet USA & moreover he thinks the global trade system is unfair.

US effective tariff is very low compared to say China of 10% and EU of 5%. He sights Bangladesh 155% but later say has no interest in wanting to get low-cost textile back to the US.

Miran thinks that the USD might is reaching an unsustainable level relative to its MIGHT AS AN ECONOMY.

For example in the 1960s, US was 40% of global GDP and today it's 26%.

So this the dollar is a big problem for mainstreet USA & moreover he thinks the global trade system is unfair.

US effective tariff is very low compared to say China of 10% and EU of 5%. He sights Bangladesh 155% but later say has no interest in wanting to get low-cost textile back to the US.

He admits that the US does have advantages of the USD being reserve status, which is "financial extraterritoriality" as in agility to enforce laws & sanctions etc.

But there is a trade-off and he believes that this is not good trade-off.

That is to be FINANCIALIZED (benefit Wallstreet vs Mainstreet) at the same time putting yourself at A SECURITY RISK.

First, before we talk about the system they envision & the steps they take to do it, let's talk about security liability of this current arrangement.

But there is a trade-off and he believes that this is not good trade-off.

That is to be FINANCIALIZED (benefit Wallstreet vs Mainstreet) at the same time putting yourself at A SECURITY RISK.

First, before we talk about the system they envision & the steps they take to do it, let's talk about security liability of this current arrangement.

As the US shrinks in economic size relative to the world (26% now vs 40% in 1960), the global security order America underwrites is no longer viable.

This is not a privilege but now a burden. Moreover, as the US IMPORTS so much for not just its consumption but also DEFENSE as it is cheaper to do so due to the USD being too strong, the ability to produce equipment is much more limited now as US industrial base is HOLLOWED OUT.

Meaning, the current global system DOES NOT WORK. Needs to be reshaped. In what form? How to do it?

This is not a guide, he writes but rather a consideration of NARROW options & CONSEQUENCES.

This is not a privilege but now a burden. Moreover, as the US IMPORTS so much for not just its consumption but also DEFENSE as it is cheaper to do so due to the USD being too strong, the ability to produce equipment is much more limited now as US industrial base is HOLLOWED OUT.

Meaning, the current global system DOES NOT WORK. Needs to be reshaped. In what form? How to do it?

This is not a guide, he writes but rather a consideration of NARROW options & CONSEQUENCES.

He says, and they know the two paths to do it: UNILATERALLY or MULTILATERALLY.

Multilateral is better as allies/partners are onboard but CURTAILS the gains as, well, you gotta get everyone onboard & it's like moving a very unweildy ship.

Unilateral, by definition is much more flexible & FAST but you face greater VOLATILITY.

So you can see that the Trump team has chosen a fast & volatile approach as it wants to CHANGE first & get others onboard later. We'll talk about that.

Btw, he knows this is high-stake gamble and a very narrow path to success. And the key is HIGH VOL as you are disrupting a, well, GLOBAL SYSTEM.

Multilateral is better as allies/partners are onboard but CURTAILS the gains as, well, you gotta get everyone onboard & it's like moving a very unweildy ship.

Unilateral, by definition is much more flexible & FAST but you face greater VOLATILITY.

So you can see that the Trump team has chosen a fast & volatile approach as it wants to CHANGE first & get others onboard later. We'll talk about that.

Btw, he knows this is high-stake gamble and a very narrow path to success. And the key is HIGH VOL as you are disrupting a, well, GLOBAL SYSTEM.

So how is he/they gonna do it?

Well, 1) TARIFFS is part of that for sure as a way to increase leverage (we'll elaborate soon), but there's also 2) COMPETITIVENESS BOOST TO USA (fiscal devaluations, tax cuts, deregulation, rate cuts) & as well a 3) CURRENCY APPROACH.

Let's talk about tariffs.

Well, 1) TARIFFS is part of that for sure as a way to increase leverage (we'll elaborate soon), but there's also 2) COMPETITIVENESS BOOST TO USA (fiscal devaluations, tax cuts, deregulation, rate cuts) & as well a 3) CURRENCY APPROACH.

Let's talk about tariffs.

Before we talk about what they are going to do on tariffs, we must read their logic on tariff.

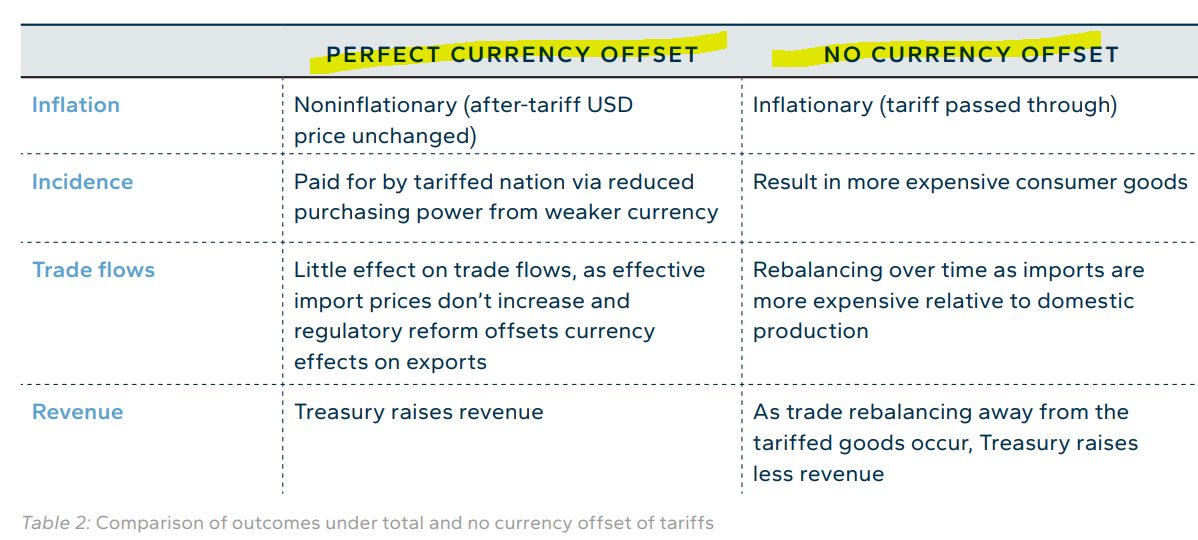

First, they know what tariffs do and have a table below on two scenarios & their impact.

But before that, they cite Gopinath (2015) paper on 6-12% of consumption is derived from imported sources & so it's roughly 10%, citing Briggs (2022).

So 10% w/ 100% passthrough =1% increase in CPI.

But tariffs do not get 100% passthrough as it depends on FX adjustments (China devalued FX during Trump 1.0 so that nullified it) & also whether importers pass-through margin compression.

Assuming offset, it will be less than 1%, say 0 to 0.6% and if there's NO FX OFFSET, consumer pay higher prices that leads to higher price of goods & eventually imports become more expensive to domestic production.

He sights that should China deval FX, it will increase significant volatility as FX move can lead to significant FX vol. JPY vol is an example he sighted where JPY moves unwound yen carry trade that leads to global financial volatility.

So what he is saying here is that tariffs have consequences and can be mitigated but also can lead to wide vol.

He also notes that DIFFERENT than 2018, the USD is much richer valued now so the strengthening of the USD is less likely than before under a tariff scenario to offset impact on US consumers as well as a bunch of other factors like Fed rate cut, worries about US debt, and so very plausible, OFFSET OF FX not happening possible & he thinks also more likely than not but anyway.

First, they know what tariffs do and have a table below on two scenarios & their impact.

But before that, they cite Gopinath (2015) paper on 6-12% of consumption is derived from imported sources & so it's roughly 10%, citing Briggs (2022).

So 10% w/ 100% passthrough =1% increase in CPI.

But tariffs do not get 100% passthrough as it depends on FX adjustments (China devalued FX during Trump 1.0 so that nullified it) & also whether importers pass-through margin compression.

Assuming offset, it will be less than 1%, say 0 to 0.6% and if there's NO FX OFFSET, consumer pay higher prices that leads to higher price of goods & eventually imports become more expensive to domestic production.

He sights that should China deval FX, it will increase significant volatility as FX move can lead to significant FX vol. JPY vol is an example he sighted where JPY moves unwound yen carry trade that leads to global financial volatility.

So what he is saying here is that tariffs have consequences and can be mitigated but also can lead to wide vol.

He also notes that DIFFERENT than 2018, the USD is much richer valued now so the strengthening of the USD is less likely than before under a tariff scenario to offset impact on US consumers as well as a bunch of other factors like Fed rate cut, worries about US debt, and so very plausible, OFFSET OF FX not happening possible & he thinks also more likely than not but anyway.

Okay, now we get to the tariff implementation after he has laid out the risks, which VOLATILITY as uncertainty how other countries respond, and HIGHER PRICES to consumers.

He says here that tariff implementation is very important because SHOCKS CAUSES FINANCIAL MARKET VOLATILITY.

So there has to be a way to MINIMIZE or neutralize shocks to the system. They understand full well that what they are doing is SHOCKING the system and would lead to financial volatility, if not mitigated.

He says here that tariff implementation is very important because SHOCKS CAUSES FINANCIAL MARKET VOLATILITY.

So there has to be a way to MINIMIZE or neutralize shocks to the system. They understand full well that what they are doing is SHOCKING the system and would lead to financial volatility, if not mitigated.

He advocates for GRADUAL IMPLEMENTATION. He says that during Trump 1.0, the tariffs on China was gradual.

He says Trump needs to do this gradually over time to mitigate the fallout, which is uncertainty and volatility.

He says that there is no reason to do a deal w/ China as it is clear that they don't honor their deal so there's less cause to negotiate.

So if there's no cause to negotiate, gradual tariff implementation is key on China.

He says 2% per month on China (Trump has done 10% per month so far - 10% in Feb and 10% in March) until it reaches 60%.

He says Trump needs to do this gradually over time to mitigate the fallout, which is uncertainty and volatility.

He says that there is no reason to do a deal w/ China as it is clear that they don't honor their deal so there's less cause to negotiate.

So if there's no cause to negotiate, gradual tariff implementation is key on China.

He says 2% per month on China (Trump has done 10% per month so far - 10% in Feb and 10% in March) until it reaches 60%.

He says that there needs to be a clear path to tariff to ELIMINATE UNCERTAINTY & move gradually.

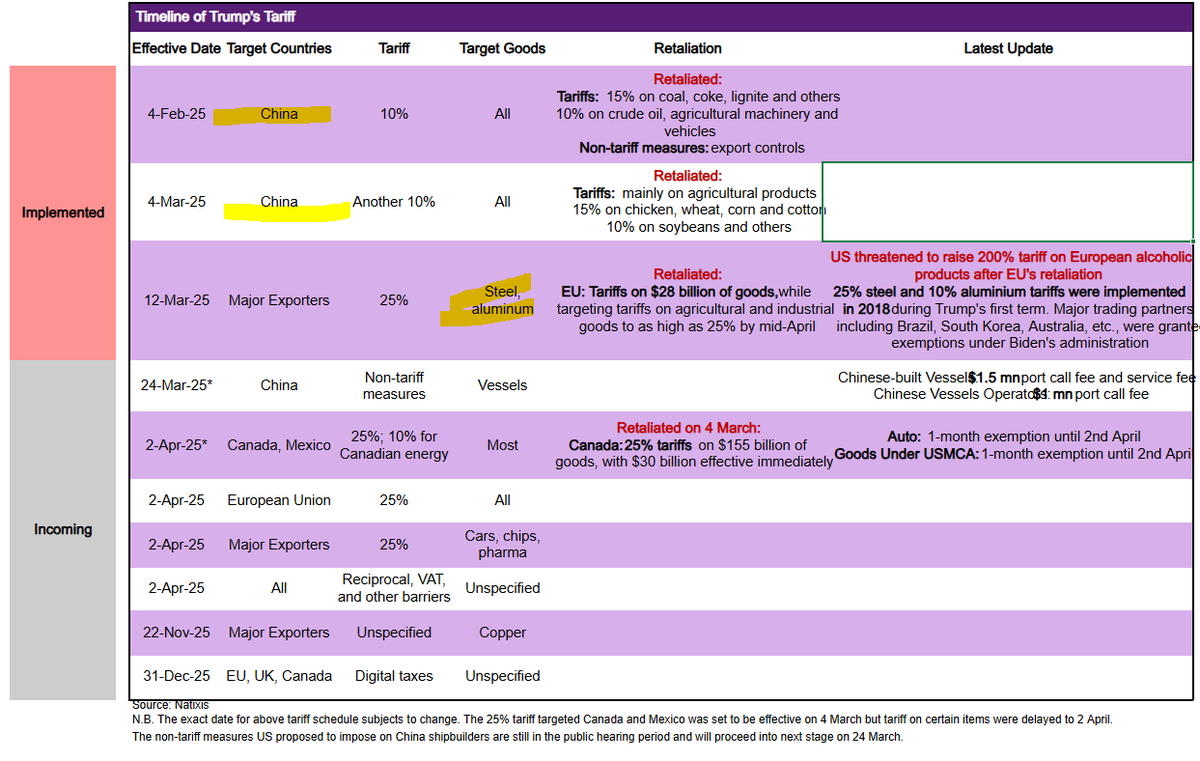

Obvs Trump has done that. But what's clear based on what Trump has implemented so far is that it is very targeted towards China:

+20% on China since 4 Feb 2025

and sectoral on steel & aluminum.

Others are pending. We'll talk about that.

Obvs Trump has done that. But what's clear based on what Trump has implemented so far is that it is very targeted towards China:

+20% on China since 4 Feb 2025

and sectoral on steel & aluminum.

Others are pending. We'll talk about that.

Okay, so now that we have covered their big picture thoughts, let's talk about what they have done since coming to power. Note that this is written by Miran, not Trump, so no telling whether this is a policy playbook or not. But it is an articulation of reasoning that Trump has not done so good to read anyway.

Miran is well-educated & experienced and is a key figure in the Trump administration so worth reading.

So what has Trump done? You know that. So far, basically China implemented + steel & alum & there's a lot looming 2 April.

That's a big date. What's Trump et al going to do? Well, there are hints in this document.

Miran is well-educated & experienced and is a key figure in the Trump administration so worth reading.

So what has Trump done? You know that. So far, basically China implemented + steel & alum & there's a lot looming 2 April.

That's a big date. What's Trump et al going to do? Well, there are hints in this document.

Remember that their goal is not to impose tariffs on EVERYONE but to TARGET CHINA & also OTHERS that they think are unfair & the whole purpose is to INCREASE LEVERAGE to engineer the restructuring of the global trading system.

Seems like they have the following criteria & they will put countries into "BUCKETS" with different tariff rates & then countries will need to take steps to move from a higher bucket to a lower tariff bucket.

They have to "earn" it so to speak. Meaning, they have to be better allies to the US & support the US. If there's evidence that they do not, well...

Seems like they have the following criteria & they will put countries into "BUCKETS" with different tariff rates & then countries will need to take steps to move from a higher bucket to a lower tariff bucket.

They have to "earn" it so to speak. Meaning, they have to be better allies to the US & support the US. If there's evidence that they do not, well...

So this reciprocal tariff thing is not just tariff rates, although it is one criteria, has many others.

And this can explain why Trump is going hard on Canada versus Mexico for example. Basically, he's saying, you are my neighbor, if you want free trade with us & all the benefits, you must act accordingly.

Is that a fair thing to do? Maybe, maybe not. But whatever it is, it gives a clearer sense of what Trump wants.

They want greater support on what they want to do as they know they can't do it alone & they are going to force countries to do it via tariffs.

That is the logic.

And this can explain why Trump is going hard on Canada versus Mexico for example. Basically, he's saying, you are my neighbor, if you want free trade with us & all the benefits, you must act accordingly.

Is that a fair thing to do? Maybe, maybe not. But whatever it is, it gives a clearer sense of what Trump wants.

They want greater support on what they want to do as they know they can't do it alone & they are going to force countries to do it via tariffs.

That is the logic.

Irrespective, it is envisaged that for the Rest of the World, 10% is the maximum, versus 60% for China.

So how are they going to do it? They actually don't have the blue print. It is going to be tried out.

They are going to have a small set of criteria and expand it. They are going to target countries they want support more or countries they have more leverage over first.

They want SECURITY GUARANTEE & TRADE TO GO TOGETHER.

So they imagine a system where US allies/like-minded, will act in lock-step for trade & security & to have lower barriers to US markets, they have to help promote US interests/fair trade.

Fundamentally, they want other countries, similar to the US, to erect trade barriers with China to pressure China to change, to turn inward for domestic demand vs outward.

So how are they going to do it? They actually don't have the blue print. It is going to be tried out.

They are going to have a small set of criteria and expand it. They are going to target countries they want support more or countries they have more leverage over first.

They want SECURITY GUARANTEE & TRADE TO GO TOGETHER.

So they imagine a system where US allies/like-minded, will act in lock-step for trade & security & to have lower barriers to US markets, they have to help promote US interests/fair trade.

Fundamentally, they want other countries, similar to the US, to erect trade barriers with China to pressure China to change, to turn inward for domestic demand vs outward.

@michaelxpettis They themselves know this is a very high risk strategy. But the rewards are also high.

So they are going for it.

So they are going for it.

Anyway, he said that tariffs aren't enough. Competitiveness is very important.

Tariffs are just raising costs to foreigners, namely China & others that will go into "buckets" but mostly China, but also need to LOWER COSTS for American producers, consumers etc.

And he understands that tariffs impact as a consumption tax increase that must be mitigated.

How to do that? Well, payroll tax cut. So the combination of either import tariff and an export subsidy or a consumption tax increase & a payroll tax cut are necessary to increase domestic production.

So they advocate for tax cuts (Tax Cuts and Jobs Act). So what you say? Well, I think tariffs are going up.

Their logic is that as long it goes up by not too much, they will ultimately be positive for the US. If too much, well, will be negative.

Tariffs are just raising costs to foreigners, namely China & others that will go into "buckets" but mostly China, but also need to LOWER COSTS for American producers, consumers etc.

And he understands that tariffs impact as a consumption tax increase that must be mitigated.

How to do that? Well, payroll tax cut. So the combination of either import tariff and an export subsidy or a consumption tax increase & a payroll tax cut are necessary to increase domestic production.

So they advocate for tax cuts (Tax Cuts and Jobs Act). So what you say? Well, I think tariffs are going up.

Their logic is that as long it goes up by not too much, they will ultimately be positive for the US. If too much, well, will be negative.

Here they talk about retaliation. They want to prevent it. They expect China to retaliate.

For allies, they marry tariffs with security. You can retaliate but they will use NATO security as a leverage.

And so if Europe retaliates (which it did versus Asian allies like Japan/South Korea etc), they say it's actually fine if they RAISE DEFENSE SPENDING AND CAPABILITY.

They are happy with that outcome as it reduces what they consider s a US burden. So it accomplishes the goal they want anyway.

For allies, they marry tariffs with security. You can retaliate but they will use NATO security as a leverage.

And so if Europe retaliates (which it did versus Asian allies like Japan/South Korea etc), they say it's actually fine if they RAISE DEFENSE SPENDING AND CAPABILITY.

They are happy with that outcome as it reduces what they consider s a US burden. So it accomplishes the goal they want anyway.

Bottom line: TARIFFS ARE COMING!!! They see that as a strategy to offset the reduction in INCOME TAXES and to deal with China & get others onboard on their China strategy.

They do not see Europe retaliating but raising DEFENSE spending as a negative at all but a DESIRED outcome.

I gotta run, we'll do currency next time! Enjoy your lunch. You can get a head start here. Btw, a lot of people are talking about it but I always say, don't read secondary sources when you can go to the primary source.

hudsonbaycapital.com/documents/FG/h…

They do not see Europe retaliating but raising DEFENSE spending as a negative at all but a DESIRED outcome.

I gotta run, we'll do currency next time! Enjoy your lunch. You can get a head start here. Btw, a lot of people are talking about it but I always say, don't read secondary sources when you can go to the primary source.

hudsonbaycapital.com/documents/FG/h…

• • •

Missing some Tweet in this thread? You can try to

force a refresh