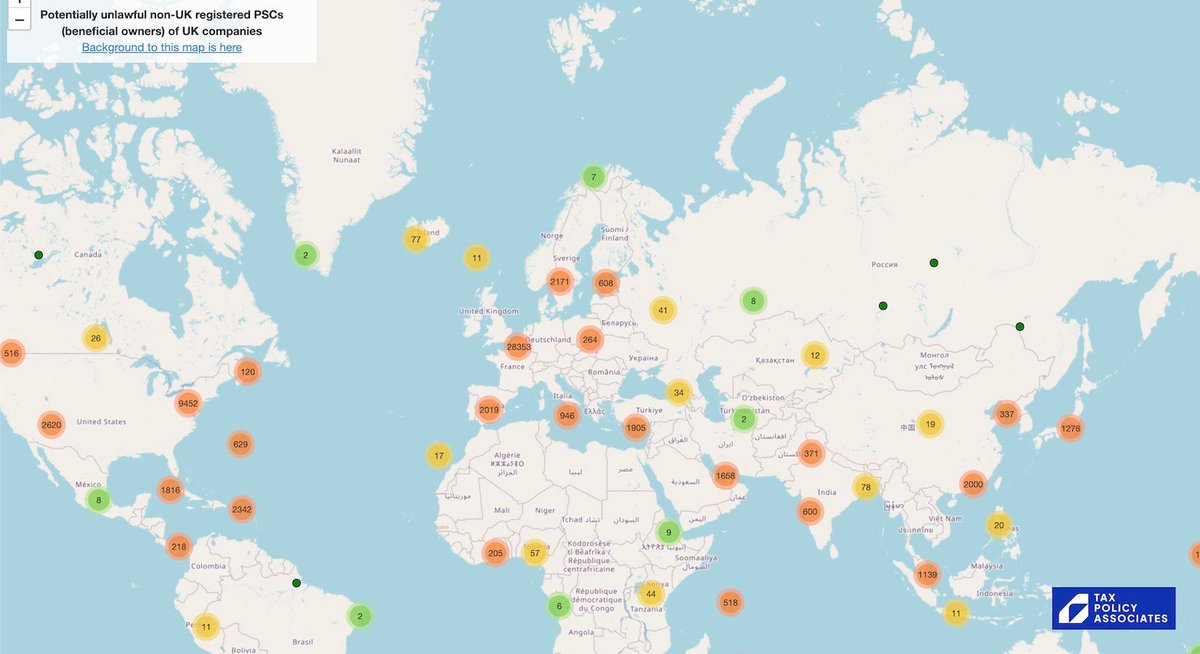

65,000 UK companies are unlawfully hiding their beneficial owner. We've just published an interactive map showing them all.

Thread:

Thread:

If you want to jump straight to the interactive map, it's here, together with a short article on the background: taxpolicy.org.uk/2025/03/19/650…

Historically, Companies House showed who the shareholders of a company were, but stopped there. So if, for example, a company was owned by a tax haven holding company, you wouldn't be able to ever find out who the ultimate shareholder was.

This all changed in 2016 - rules were put in place requiring companies to identify their "persons with significant control" - meaning the actual humans who were able to tell the company what to do. gov.uk/guidance/peopl…

Normally this would be the ultimate shareholder - but sometimes there would be someone who wasn't a shareholder, but who nevertheless could ensure that the company always adopted the activities they desired. They too would be a "person with significant control".

So, let's say a secretive oligarch establishes a UK company with some local directors. The shares in the company are held by a Panamanian company, and that in turn is held by the oligarch's personal chef.

Pre-2016, any Companies House search stopped dead in Panama. But today, the company should register the oligarch (not the Panamanian company, and not the chef) as the "person with significant control".

And that's the whole point of the rules - to enhance corporate transparency and help stop the abuse of companies for nefarious purposes.

But the rules are widely ignored.

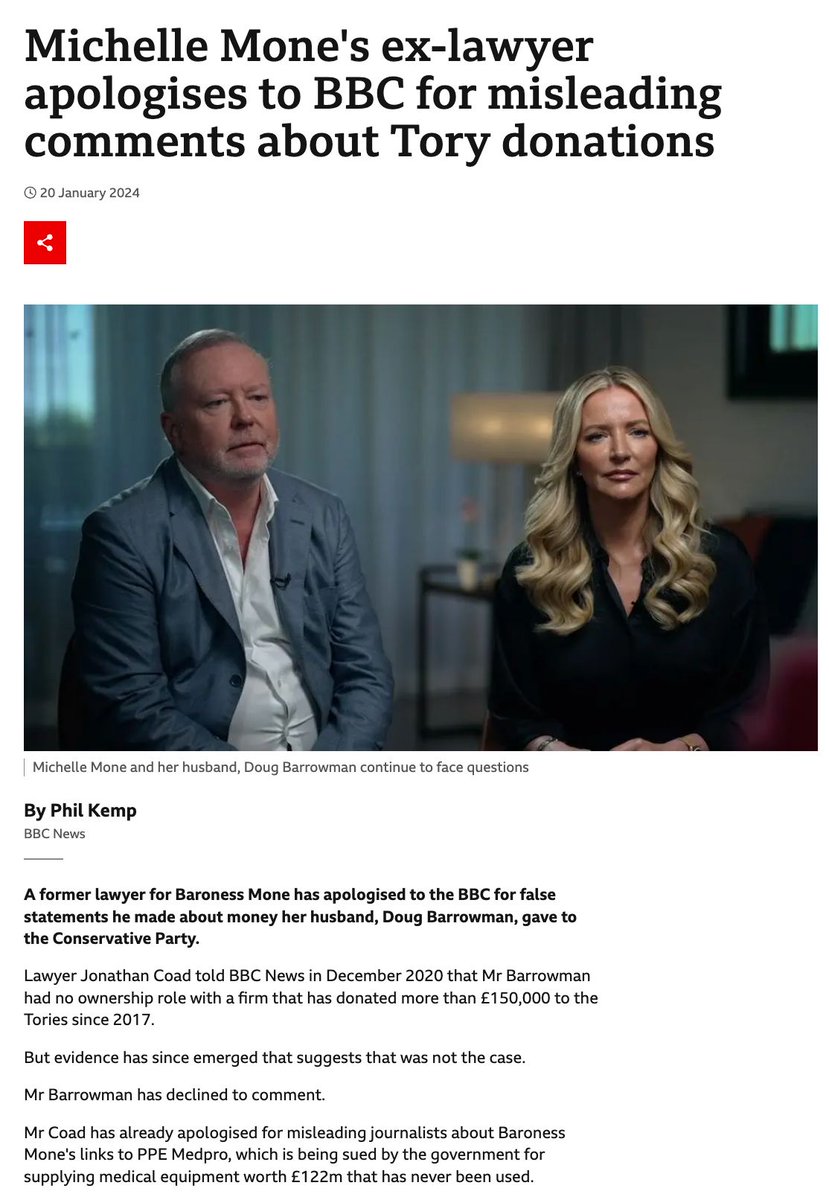

Some people, like Douglas Barrowman, arrange for their companies to report a false PSC - often an employee (i.e. analogous to the personal chef in the oligarch example). taxpolicy.org.uk/2022/12/09/ppe/

Others simply fail to file a PSC at all.

But a common approach - sometimes an error, sometimes intentional, is to file a foreign company as the PSC. So, in the oligarch example, the Panama company would be listed as the PSC. That's unlawful.

So we analysed Companies House data to plot each suspicious corporate PSC onto a map.

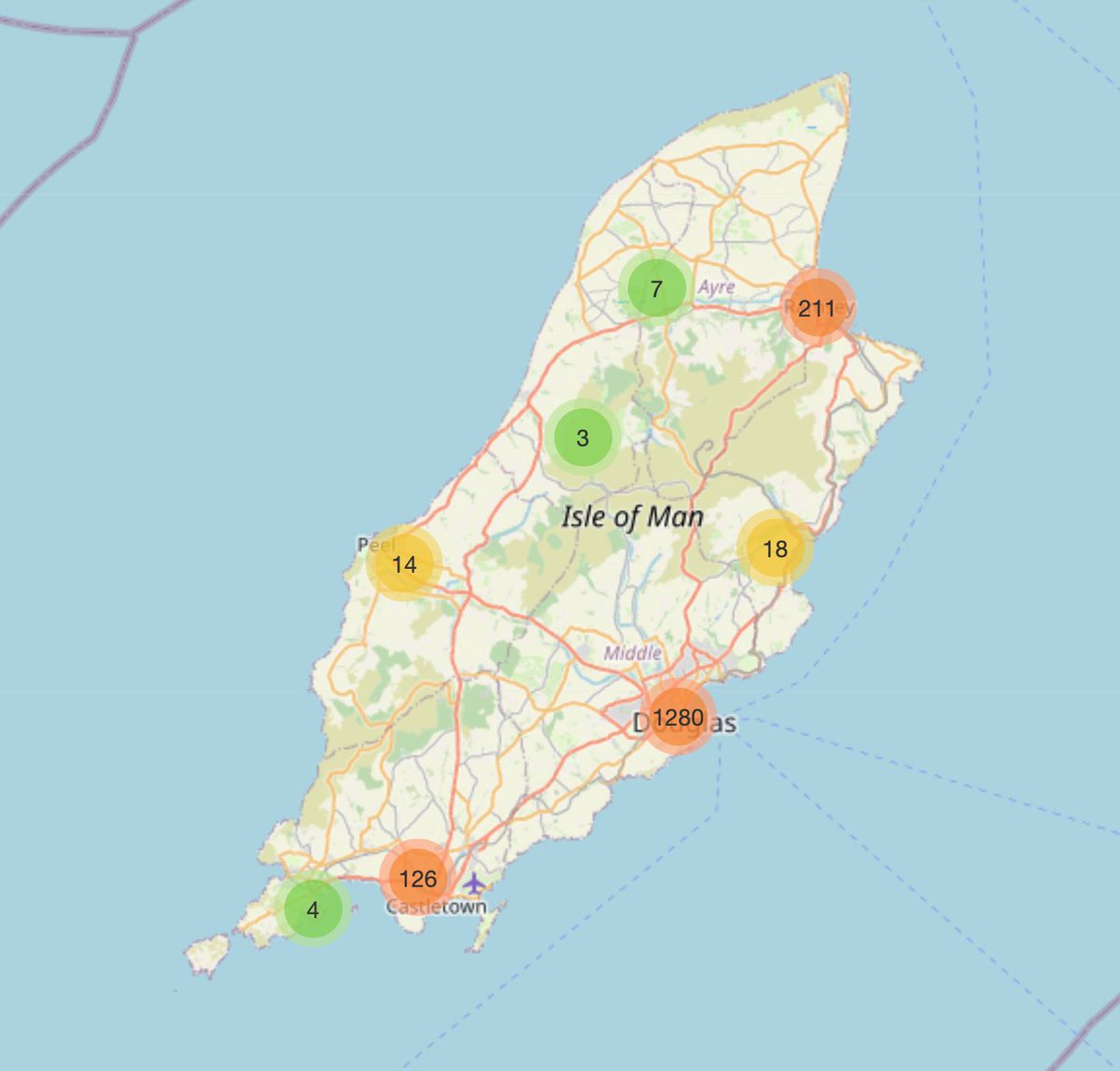

Here, for example, is the Isle of Man. Over a thousand companies hiding their ownership by unlawfully listing an Isle of Man company as their PSC, instead of showing the actual individual owner:

Here, for example, is the Isle of Man. Over a thousand companies hiding their ownership by unlawfully listing an Isle of Man company as their PSC, instead of showing the actual individual owner:

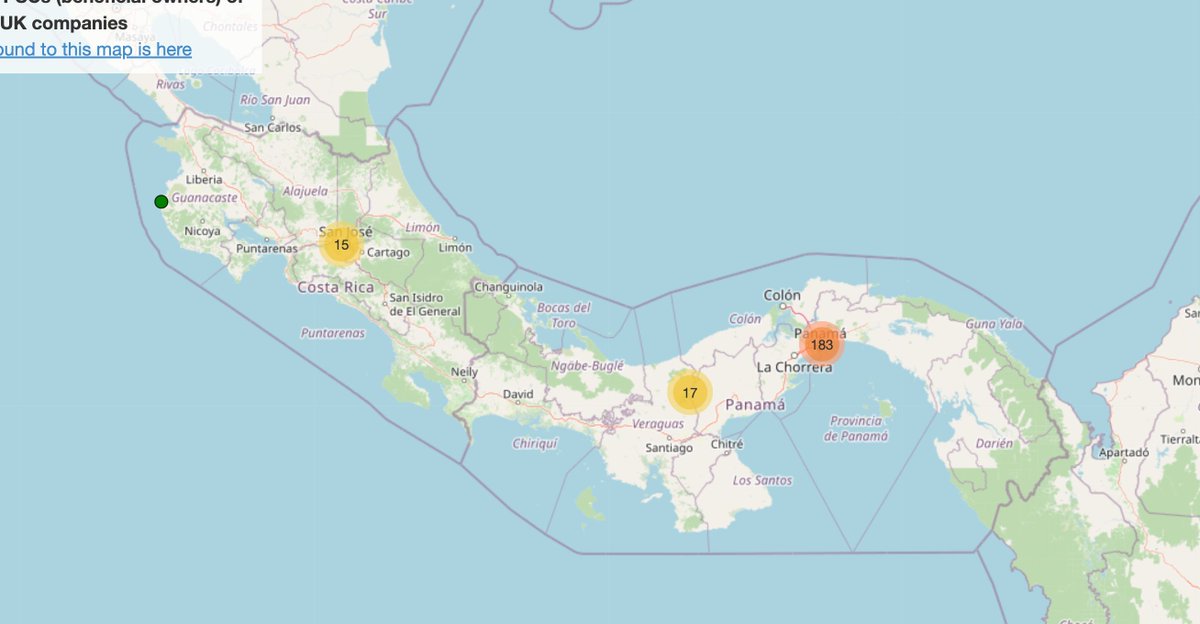

And here's Panama. 200 companies hiding their ownership. When you zoom in you see some dots are red - that's where the UK company has failed to file accounts, or has a suspicious registered office.

Important to note, there are cases where it is legitimate to report a foreign company as a PSC. Listed companies, widely held companies, and a few others.

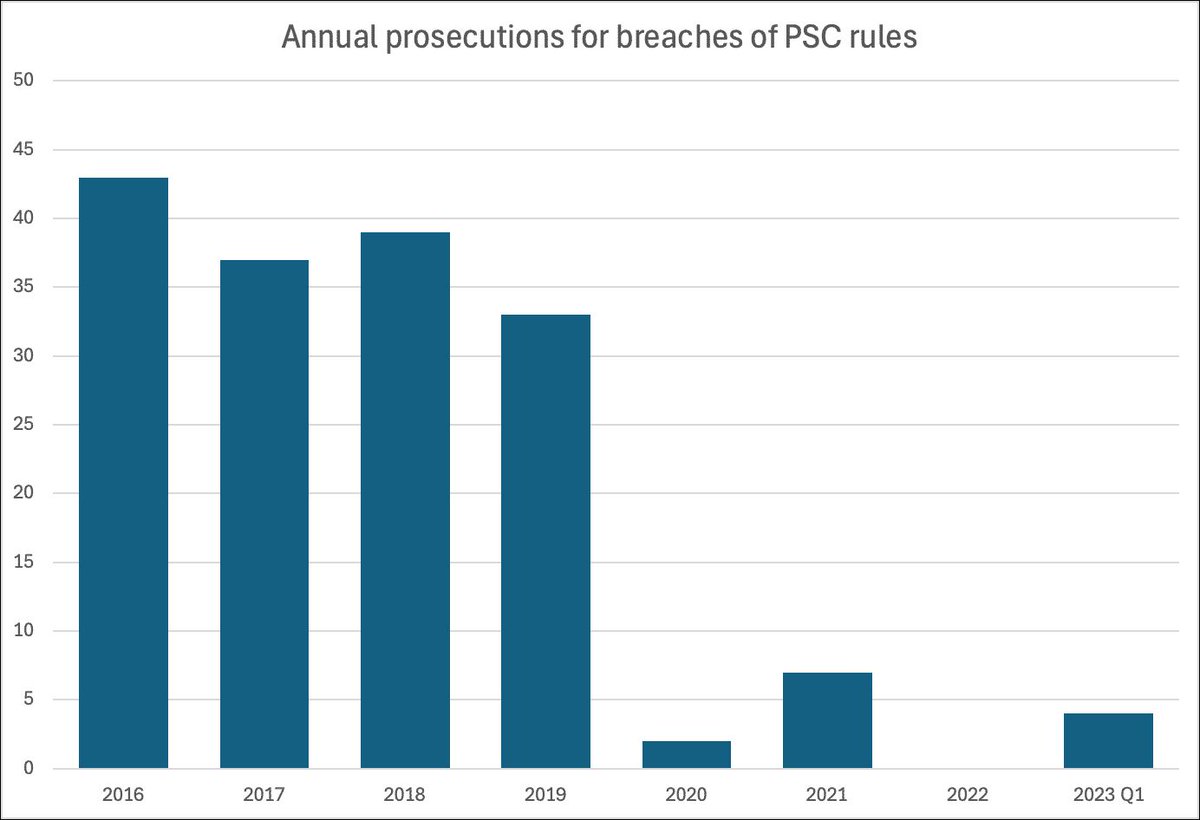

But most of the dots on the map - about 65,000 in total, represent a breach of the law.

But most of the dots on the map - about 65,000 in total, represent a breach of the law.

I'll be talking more about this to the House of Commons Business and Trade Committee later this afternoon.

Full write-up here, with an explanation of the methodology and limitations. taxpolicy.org.uk/2025/03/19/650…

And you can subscribe for free updates from our Panamanian web-server here: taxpolicy.org.uk/subscribe?pana…

• • •

Missing some Tweet in this thread? You can try to

force a refresh