Let's go to the last part of the Miran's paper, which is currencies (Chapter 4 & 5).

Remember that his articulation of all the ills of the US trade imbalance is about the USD as a reserve currency & also the security support the US has to do (two burdens) that has grown, dwarfing the US economy RELATIVE size.

So let's talk about it. But before we even talk about, we have to go through a bit of economics history, if that is okay with you. We'll keep it pretty brief.

Remember that his articulation of all the ills of the US trade imbalance is about the USD as a reserve currency & also the security support the US has to do (two burdens) that has grown, dwarfing the US economy RELATIVE size.

So let's talk about it. But before we even talk about, we have to go through a bit of economics history, if that is okay with you. We'll keep it pretty brief.

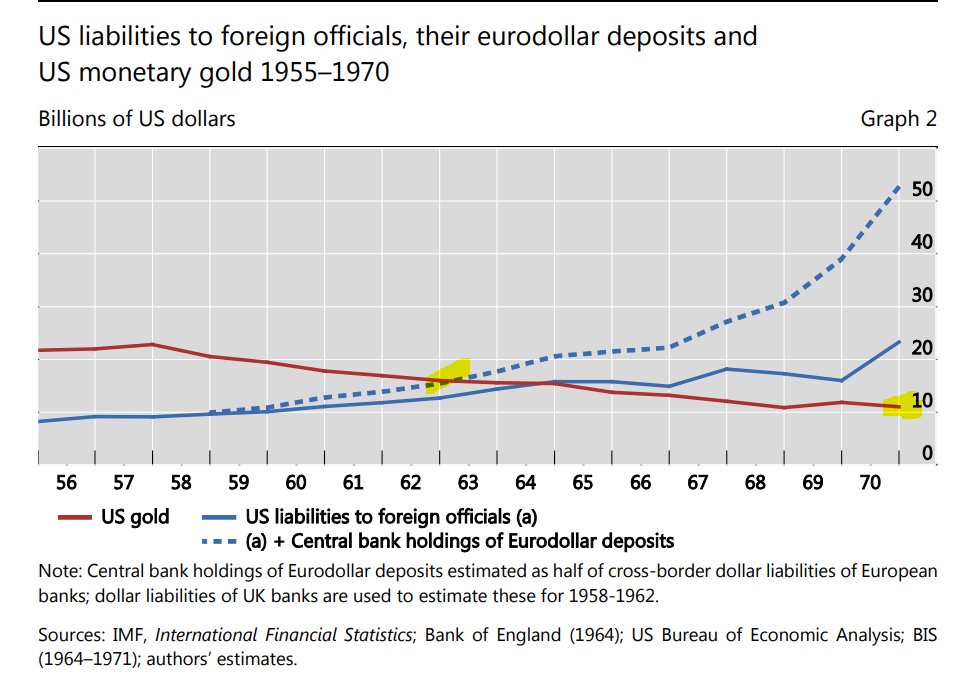

Triffin was a famous guy. He famously testified before Congress in 1959 & predicted the collapse of the Bretton Wood system, which happened in 1971 when the US broke away from the gold-dollar link.

What did he say? Well, simply, that as a gold-dollar reserve currency, the US would have to expand its liabilities as fast as required for global trade. But since it's backed by gold, which grows SLOWER than global trade, then we got a problem as lower rates would cause a run on the gold stock or dollar liabilities > gold stock.

And if the US didn't accumulate fast liabilities, well, global liquidity would shrink as US rates would go to high and cause global deflation.

If you want to learn more about it, see the paper below. The author btw isn't a fan of Triffin so says he got a bunch of stuff wrong and whatever he got right, it was probably not by design but accident.

Either way, he predicted that & got very famous obvs. What else did he predict?

bis.org/publ/work684.p…

What did he say? Well, simply, that as a gold-dollar reserve currency, the US would have to expand its liabilities as fast as required for global trade. But since it's backed by gold, which grows SLOWER than global trade, then we got a problem as lower rates would cause a run on the gold stock or dollar liabilities > gold stock.

And if the US didn't accumulate fast liabilities, well, global liquidity would shrink as US rates would go to high and cause global deflation.

If you want to learn more about it, see the paper below. The author btw isn't a fan of Triffin so says he got a bunch of stuff wrong and whatever he got right, it was probably not by design but accident.

Either way, he predicted that & got very famous obvs. What else did he predict?

bis.org/publ/work684.p…

Btw, the key reason the BIS author said Triffin was wrong/flukey is that dude didn't account for Euro dollar or USD outside the US (note at the time it was mostly Europe that held that hence the name & also the EUR was not even conceived although Charles de Gaulle was already pissed off about the dollar privilege & coined "exorbitant privilege phrase) so his timing of the "crash" was off. Either way, he was right for something and maybe it would have been different but either way, 1971, Nixon called the dollar-gold thing off.

Anyway, Triffin and went on to modify things because now we are no longer a USD-gold FX but just well, USD fiat currency.

So he now has a current account version of Triffin (btw, there's also a fiscal Triffin too). Let's talk about his current account idea.

He basically says this, well, as reserve FX or KING DOLLAR, the USD liquidity or USD liabilities will need to grow at the rate of global growth, which would lead to persistent current account DEFICIT.

Well, voila, the US did run since 1980s current account deficits (see graph from Miran's note).

Why? Well, it strengthens the USD and makes imports cheaper than exports + other countries' mercantilitic policy that makes them devalue their FX relative to their trade position.

BIS provides a bunch of counter arguments of why Triffin was off so read that but I won't summarize because, well, the point is to read the Miran paper and not why Triffin might be right for the wrong reasons.

Btw, the whole Triffin thing is about eventually, that things would become unsustainable.

But of course, BIS paper disagrees and say, well, FX would readjust and rates would adjust.

Anyway, Triffin and went on to modify things because now we are no longer a USD-gold FX but just well, USD fiat currency.

So he now has a current account version of Triffin (btw, there's also a fiscal Triffin too). Let's talk about his current account idea.

He basically says this, well, as reserve FX or KING DOLLAR, the USD liquidity or USD liabilities will need to grow at the rate of global growth, which would lead to persistent current account DEFICIT.

Well, voila, the US did run since 1980s current account deficits (see graph from Miran's note).

Why? Well, it strengthens the USD and makes imports cheaper than exports + other countries' mercantilitic policy that makes them devalue their FX relative to their trade position.

BIS provides a bunch of counter arguments of why Triffin was off so read that but I won't summarize because, well, the point is to read the Miran paper and not why Triffin might be right for the wrong reasons.

Btw, the whole Triffin thing is about eventually, that things would become unsustainable.

But of course, BIS paper disagrees and say, well, FX would readjust and rates would adjust.

Okay, the fiscal part of Triffin. Note that Triffin didn't come up w/ this but more like fans/students of his. The idea is that reserves are mostly US govies debt and so there is a huge demand for this stuff that needs to be growing, and hence the dilemma, well, well, TOO MUCH DEBT. So we gotta make sure it's sustainable.

So here they debunk that by saying that supply of US govies debt > official global reserves.

Okay, let's talk about Miran now. Btw, I don't agree w/ this chart because FOREIGN PRIVATE BUYERS own a lot of UST too so official reserves is not a complete picture.

So here they debunk that by saying that supply of US govies debt > official global reserves.

Okay, let's talk about Miran now. Btw, I don't agree w/ this chart because FOREIGN PRIVATE BUYERS own a lot of UST too so official reserves is not a complete picture.

As the dollar is too strong (everyone wants this piece of hotness, which is less hot these days but u know what I mean), it causes a structural problem for the US, as in trade imbalances (Triffin here), and so on the FX side, they want a FAIR VALUED DOLLAR as other FX relative to USD is UNDERVALUED.

How are we gonna get there without, well, making dollar assets less attractive for investors???

If foreign investors expect USD to depreciate, investors flee say risk-free asset, which is UST bills/notes/bonds, then that would lead to the rise of longer end UST yields & with high fiscal deficits & debt & risks of inflation.

And w/ US housing are tied to the belly & long end of the curve (US mortgage rates are long-term), then this would be CATASTROPHIC.

Now if you add elevated inflation and depreciation of USD, then inflation would rise.

Why is this bad? Well, le Fed may not cut but may have to hike rates.

hudsonbaycapital.com/documents/FG/h…

How are we gonna get there without, well, making dollar assets less attractive for investors???

If foreign investors expect USD to depreciate, investors flee say risk-free asset, which is UST bills/notes/bonds, then that would lead to the rise of longer end UST yields & with high fiscal deficits & debt & risks of inflation.

And w/ US housing are tied to the belly & long end of the curve (US mortgage rates are long-term), then this would be CATASTROPHIC.

Now if you add elevated inflation and depreciation of USD, then inflation would rise.

Why is this bad? Well, le Fed may not cut but may have to hike rates.

hudsonbaycapital.com/documents/FG/h…

He is pretty much more sanguine about impact of softer USD or MORE FAIRLY VALUED USD on equities because, well, American listed firms revenue are global so a weaker USD = earnings from abroad gets elevated so net net would probably be not so bad.

Overall, what is key is that while Trump does tariffs, which is inflationary whether FX is adjusted or not, and so he has to deploy DEFLATIONARY tools like LOWER ENERGY PRICES and DERAGULATION before currencies can be even considered.

As in, logic goes, TARIFFS + SUPPLY-SIDE support must go first before you even consider currencies measures as there are PLENTY OF RISKS.

Overall, what is key is that while Trump does tariffs, which is inflationary whether FX is adjusted or not, and so he has to deploy DEFLATIONARY tools like LOWER ENERGY PRICES and DERAGULATION before currencies can be even considered.

As in, logic goes, TARIFFS + SUPPLY-SIDE support must go first before you even consider currencies measures as there are PLENTY OF RISKS.

Okay, so how are they gonna make the dollar FAIR again? Well, more history here.

Remember the Plaza Accord in 1985? Haha, of course! I was a baby so I remember that meeting between US, France, Germany, Japan and the UK all met to nicely WEAKEN THE USD or make it FAIR VALUE AGAIN! Also there is the Louvre Accord of 1987, remember that one too.

Anyway, while the price of the USD is determined by the Fed alone, as in they determine the supply of it, the DEMAND OF USD is determined globally. So we need to get tons of people on board.

Hence multilateral approach. But why would China or Europe or Japan want to make the DOLLAR FAIR VALUE, as in strengthen their FX versus the USD?

China got deflation and WE MUST EXPORT THAT!!! Expensive reminbi is not the way to get out of deflation.

Europe got inflation but WORSENING EXPORT COMPETITIVENESS VIS A VIS CHINA so not gonna do it.

Japan, ha, more possible. They are gonna raise rates anyway (he didn't write about this, just me adding to his narrative).

So he thinks that Europe and China won't cooperate on this plan because why would them? They want to export, export export!!!

Remember the Plaza Accord in 1985? Haha, of course! I was a baby so I remember that meeting between US, France, Germany, Japan and the UK all met to nicely WEAKEN THE USD or make it FAIR VALUE AGAIN! Also there is the Louvre Accord of 1987, remember that one too.

Anyway, while the price of the USD is determined by the Fed alone, as in they determine the supply of it, the DEMAND OF USD is determined globally. So we need to get tons of people on board.

Hence multilateral approach. But why would China or Europe or Japan want to make the DOLLAR FAIR VALUE, as in strengthen their FX versus the USD?

China got deflation and WE MUST EXPORT THAT!!! Expensive reminbi is not the way to get out of deflation.

Europe got inflation but WORSENING EXPORT COMPETITIVENESS VIS A VIS CHINA so not gonna do it.

Japan, ha, more possible. They are gonna raise rates anyway (he didn't write about this, just me adding to his narrative).

So he thinks that Europe and China won't cooperate on this plan because why would them? They want to export, export export!!!

He thinks that Japan, the UK and maybe Mexico and Canada maybe much amore amenable (Japan has been a great ally to the US). But the issue here is that they are not big and so we need the EU and China onboard.

They are not gonna do it willingly. So how?

Well, voila TARIFFS!!!!, WELL FOR CHINA ANYWAY. For Europe, well, we are gonna use SECURITY AS LEVERAGE.

For China, they will just raise tariffs till it hurts & then lower it if they are willing to adjust their FX.

He even mentions that accords are named where they are negotiated so this would be called a "Mar-a-Lago Accord."

Anyway, he says it's super super hard to do this and the world today is not 1980s.

The US has tons of debt vs 1980s and US size of GDP also smaller. So this accord idea is not gonna work...

They are not gonna do it willingly. So how?

Well, voila TARIFFS!!!!, WELL FOR CHINA ANYWAY. For Europe, well, we are gonna use SECURITY AS LEVERAGE.

For China, they will just raise tariffs till it hurts & then lower it if they are willing to adjust their FX.

He even mentions that accords are named where they are negotiated so this would be called a "Mar-a-Lago Accord."

Anyway, he says it's super super hard to do this and the world today is not 1980s.

The US has tons of debt vs 1980s and US size of GDP also smaller. So this accord idea is not gonna work...

Anyway, must consider other approach then. This one is pretty intense. Basically, need to marry SECURITY & TRADE & FINANCING (as in buying of USTs but not just any, super super long ones).

1) Security zones are a public good & country inside must buy Treasurys

2) Security zones are a capital good & funded by century bonds & not short-term bills

3) Security zones that are well, got tariffs, because you haven't swapped your bills for bonds.

What's the point of all of this? Is for the USD to get to fair value & let other FX appreciate vs the USD to help tradeable and manufacturing sectors.

1) Security zones are a public good & country inside must buy Treasurys

2) Security zones are a capital good & funded by century bonds & not short-term bills

3) Security zones that are well, got tariffs, because you haven't swapped your bills for bonds.

What's the point of all of this? Is for the USD to get to fair value & let other FX appreciate vs the USD to help tradeable and manufacturing sectors.

Anyway, he goes, well, hard to get people to agree to do this btw because why would you do that? haha.

So we need to raise leverage. What's that? Tariffs (sticks), security (carrots), and tools to mitigate risks such as swap lines.

So we need to raise leverage. What's that? Tariffs (sticks), security (carrots), and tools to mitigate risks such as swap lines.

Dollar reserves today are in Asia & the Middle East and not in Europe like the 1980s and they are not as friendly as Europeans so not gonna work.

Basically, he's saying that the multilateral approach to dollar adjustment is not gonna work because in the 1980s we did it with friendly allies & now, well, hard to get it right.

On top of that, we got private investors, institutional and retail. They wouldn't want to term out their treasury. And their rush out the door is a big risk.

So for Miran, it's difficult the multilateral approach.

Basically, he's saying that the multilateral approach to dollar adjustment is not gonna work because in the 1980s we did it with friendly allies & now, well, hard to get it right.

On top of that, we got private investors, institutional and retail. They wouldn't want to term out their treasury. And their rush out the door is a big risk.

So for Miran, it's difficult the multilateral approach.

What about the unilateral approach?

Well, he says they can even if the Fed doesn't cut rates. You can charge a fee on reserve assets which disincentive them from accumulating it.

He says that domestic holders of UST already pay income tax so it just levels the playing field w/ foreign investors.

But doing that would INCREASE VOLATILITY. Because u basically want people to sell USTs (it's basically like lowering rates if you make people pay some of it - I personally get less income than foreign investors on my UST bills as I pay a tax), BUT NOT TOO MUCH SELLING.

How to find the balance? Well, you have to make the fees very very small & move very slowly. Gradualism he says!!!

And he says on NEW ISSUES versus existing US debt because, well, that would be unfair! hahaha.

Also the rates DIFFER for these fees.

Allies = < than Adversaries.

Oh we also need voluntary cooperation from the Fed too for helping w/ capping long-term yield but have independence on short-term rates.

Well, he says they can even if the Fed doesn't cut rates. You can charge a fee on reserve assets which disincentive them from accumulating it.

He says that domestic holders of UST already pay income tax so it just levels the playing field w/ foreign investors.

But doing that would INCREASE VOLATILITY. Because u basically want people to sell USTs (it's basically like lowering rates if you make people pay some of it - I personally get less income than foreign investors on my UST bills as I pay a tax), BUT NOT TOO MUCH SELLING.

How to find the balance? Well, you have to make the fees very very small & move very slowly. Gradualism he says!!!

And he says on NEW ISSUES versus existing US debt because, well, that would be unfair! hahaha.

Also the rates DIFFER for these fees.

Allies = < than Adversaries.

Oh we also need voluntary cooperation from the Fed too for helping w/ capping long-term yield but have independence on short-term rates.

Third option is reserve accumulation, as in accumulate foreign FX. But this is hard, the Treasury's Exchange Stabilization Fund is limited in scope/size. ESF can leverage but, well, that adds risks to the US gov.

And the negative carry issue as foreign assets likely yield less than the US right now.

Oh can sell gold to accumulate foreign FX but that is a very politically costly thing to do. But gold has no income so income side is positive but not like a good move.

Build a reserve portfolio at Fed SOMA. But Miran is like, well, not a good use of funds because u buy foreign assets that yield less than ours and so not a productive use of it (hahah that's why people own UST duh!) and the Fed can like buy foreign debt but that exposes the US to credit risks because well, other foreign gov, is well, u know, risky too.

Basically he considers more and more but that seems like not a good idea...

And the negative carry issue as foreign assets likely yield less than the US right now.

Oh can sell gold to accumulate foreign FX but that is a very politically costly thing to do. But gold has no income so income side is positive but not like a good move.

Build a reserve portfolio at Fed SOMA. But Miran is like, well, not a good use of funds because u buy foreign assets that yield less than ours and so not a productive use of it (hahah that's why people own UST duh!) and the Fed can like buy foreign debt but that exposes the US to credit risks because well, other foreign gov, is well, u know, risky too.

Basically he considers more and more but that seems like not a good idea...

So here we get to the end and I must go because I am getting late to my appointment.

Miran says CURRENCY policies are super RISKY and so TARIFFS are to go first.

Only when the coast is clear, then we can consider this.

Miran says CURRENCY policies are super RISKY and so TARIFFS are to go first.

Only when the coast is clear, then we can consider this.

Conclusion, buy GOLD.

Just kidding. I gotta go. Hope you enjoyed it!

No, the US is not gonna buy cryptos & unlikely to sell its gold anytime soon given political risks.

Just kidding. I gotta go. Hope you enjoyed it!

No, the US is not gonna buy cryptos & unlikely to sell its gold anytime soon given political risks.

• • •

Missing some Tweet in this thread? You can try to

force a refresh