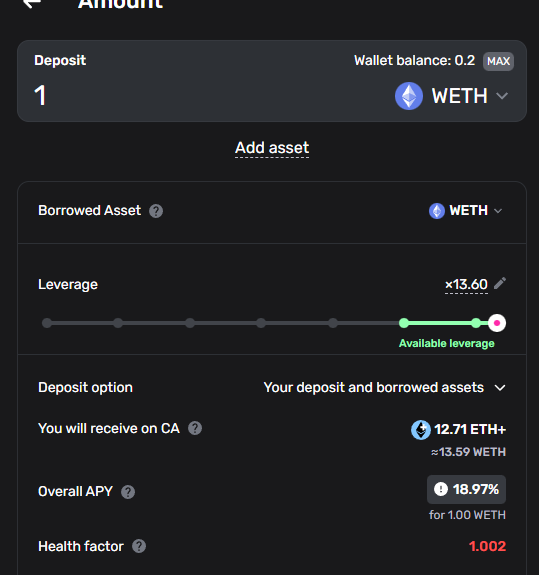

1) @Dolomite_io HAS E-MODE

This is a bigger deal than you can probably imagine, given that they also have $400M of sticky BOYCO liquidity.

There are a few opportunities here worth noting.

A. @reservoir_xyz srUSD/HONEY

7% Collateral Yield

2.55% Borrow Cost

10x Leverage = 47% + Points on Notional

B. @ethena_labs sUSDe/USDC

6.22% Collateral Yield

2.55% Borrow Cost

10x Leverage = 40% + Sats on Notional

Reservoir uses NAV oracles AFAIK

I'm personally farming this.

This is a bigger deal than you can probably imagine, given that they also have $400M of sticky BOYCO liquidity.

There are a few opportunities here worth noting.

A. @reservoir_xyz srUSD/HONEY

7% Collateral Yield

2.55% Borrow Cost

10x Leverage = 47% + Points on Notional

B. @ethena_labs sUSDe/USDC

6.22% Collateral Yield

2.55% Borrow Cost

10x Leverage = 40% + Sats on Notional

Reservoir uses NAV oracles AFAIK

I'm personally farming this.

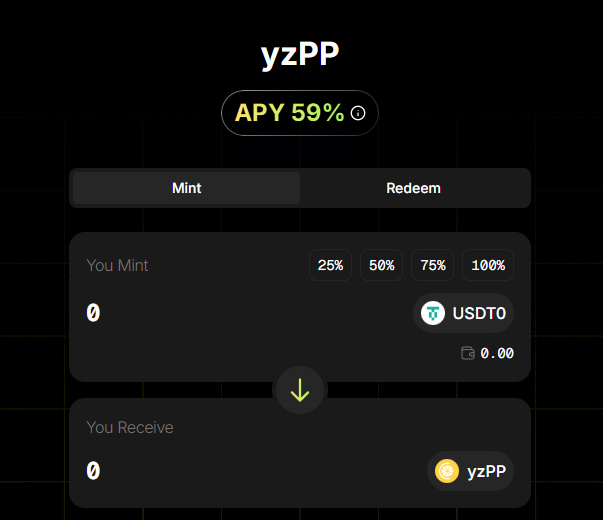

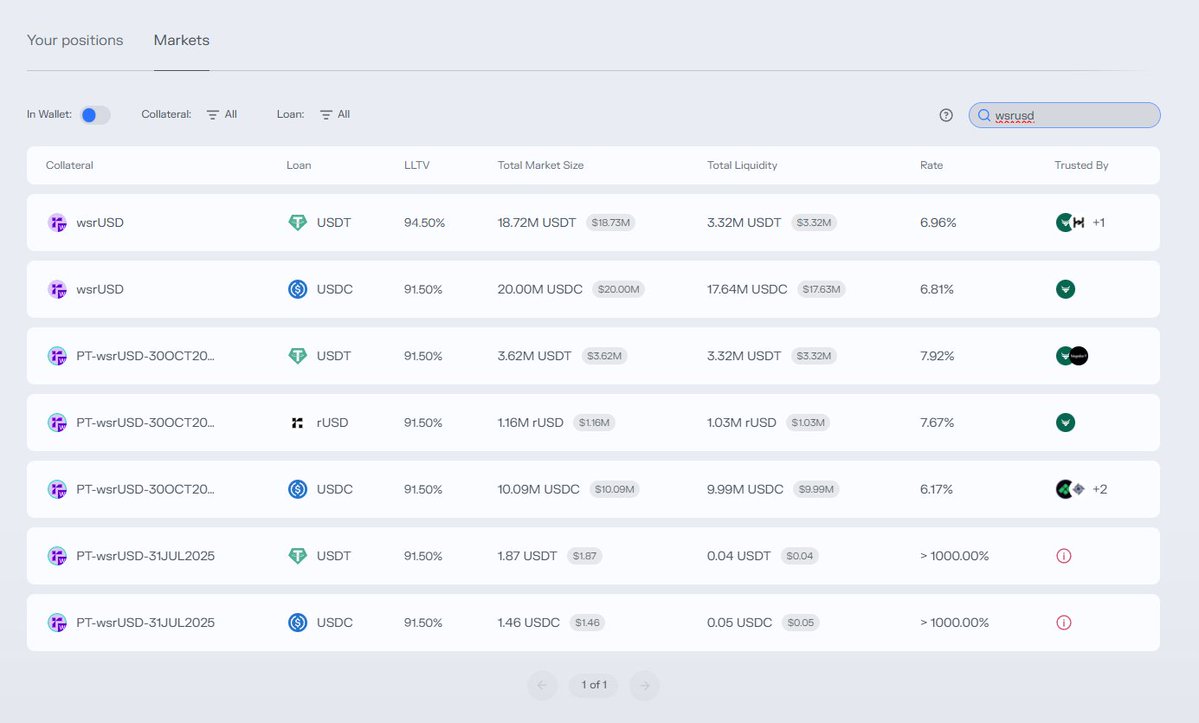

2) @syrupfi on @Contango_xyz

I mentioned this yesterday, but here's my whole thesis.

► SyrupUSDC has a ~7% organic APR

► I can lock for 6mo for max $SYRUP emissions (+5%)

► I don't mind doing this because there's an LP to exit through if need be

► Gauntlet is curating on Morpho, so there should be consistent liquidity

So what do we get?

30% APR plus 5% in $Syrup times leverage.

That's 50% additional APR or 80% total.

You bet your butt I'm in this as well.

I mentioned this yesterday, but here's my whole thesis.

► SyrupUSDC has a ~7% organic APR

► I can lock for 6mo for max $SYRUP emissions (+5%)

► I don't mind doing this because there's an LP to exit through if need be

► Gauntlet is curating on Morpho, so there should be consistent liquidity

So what do we get?

30% APR plus 5% in $Syrup times leverage.

That's 50% additional APR or 80% total.

You bet your butt I'm in this as well.

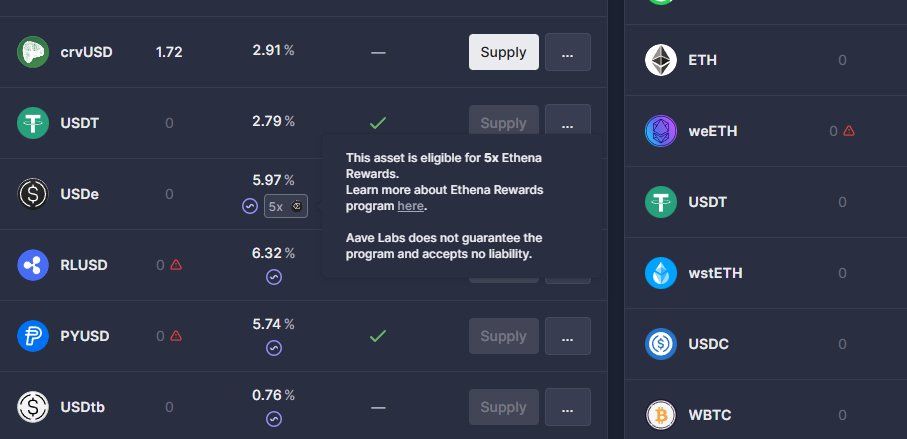

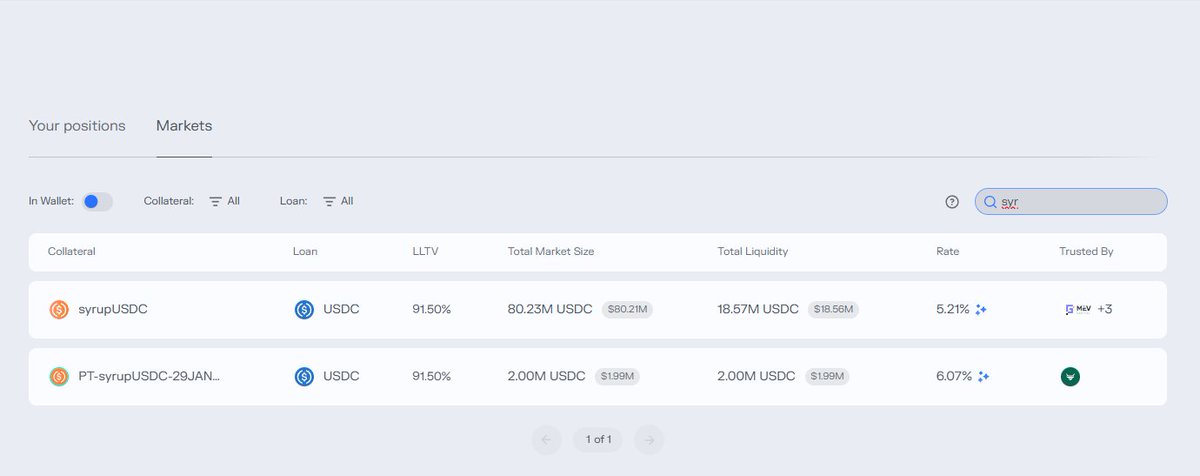

3) Millions to Borrow on @eulerfinance

@berachain has a remarkable number of yields right now.

@beraborrow's $NECT is currently emitting cPOLLEN, which will entitle you 1:1 for fully liquid POLLEN at TGE from @ramen_finance.

I'm not sure how they're valuing the emissions though, so do be careful there.

HOWEVER,

➤ sUSDe/USDC: 64% Organic

➤ sUSDe/HONEY: 63% Organic

➤ HONEY/NECT: 40% (mostly WBERA)

@berachain has a remarkable number of yields right now.

@beraborrow's $NECT is currently emitting cPOLLEN, which will entitle you 1:1 for fully liquid POLLEN at TGE from @ramen_finance.

I'm not sure how they're valuing the emissions though, so do be careful there.

HOWEVER,

➤ sUSDe/USDC: 64% Organic

➤ sUSDe/HONEY: 63% Organic

➤ HONEY/NECT: 40% (mostly WBERA)

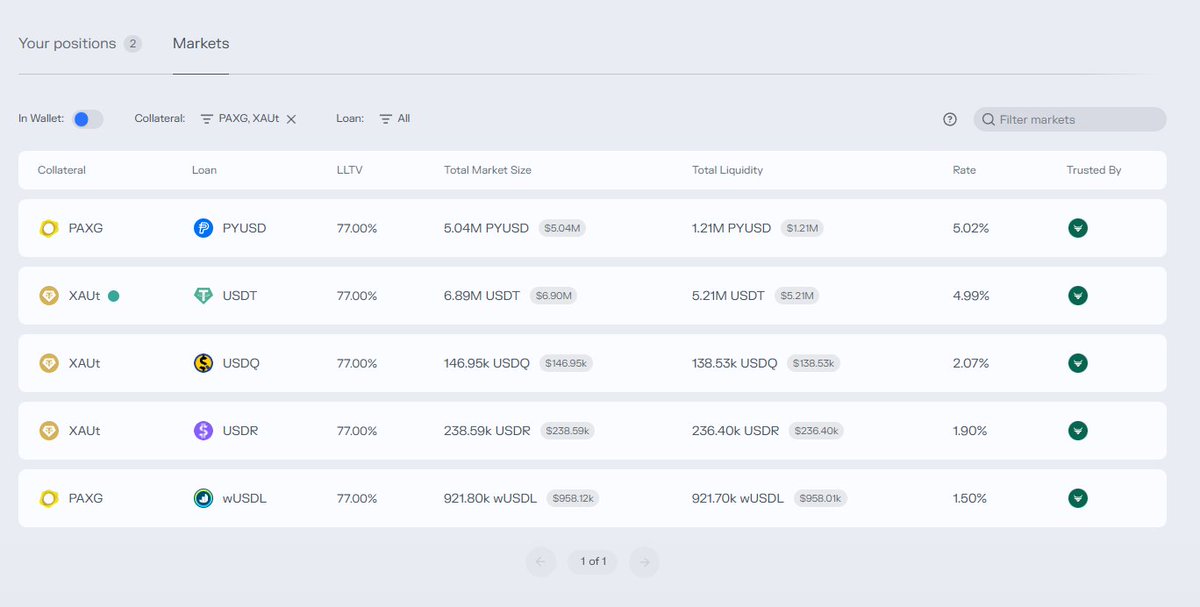

4) @SwapXfi has some new pools...

As a reminder, SwapX incentives ARE FULLY LIQUID WITH NO VESTING SHENANIGANS.

I appreciate this immensely. They've also tokenized gems, which I also appreciate immensely.

bUSDC.e-20 is @SiloFinance's receipt token for a lend side USDC deposit.

There's 6MILLION in liquidity there at 33% APR.

I wonder if @beefyfinance has this yet?

As a reminder, SwapX incentives ARE FULLY LIQUID WITH NO VESTING SHENANIGANS.

I appreciate this immensely. They've also tokenized gems, which I also appreciate immensely.

bUSDC.e-20 is @SiloFinance's receipt token for a lend side USDC deposit.

There's 6MILLION in liquidity there at 33% APR.

I wonder if @beefyfinance has this yet?

5) Oh snap, @beefyfinance does have that.

And more.

I've been banging my shield a bit about Beefy aggregating some of the best stablecoin LPs lately.

Still true.

As a reminder, the best thing is that you don't deal with any gov tokens or emissions. You just get the yield compounded for you and then can withdraw it however / whenever you want.

⇒ 45% on USDC/HONEY

⇒ 35% on bUSDC.e-20/wstkscUSD

(say that five times fast)

Oh, and points

And more.

I've been banging my shield a bit about Beefy aggregating some of the best stablecoin LPs lately.

Still true.

As a reminder, the best thing is that you don't deal with any gov tokens or emissions. You just get the yield compounded for you and then can withdraw it however / whenever you want.

⇒ 45% on USDC/HONEY

⇒ 35% on bUSDC.e-20/wstkscUSD

(say that five times fast)

Oh, and points

6) These scare me, but I'll show them to you.

@Paladin_vote has bribe markets for veUSD.

veUSD is vote-escrowed scUSD.

veUSD can get you bribes from people who want the yield of the underlying veda vaults that scUSD is backed by.

Right now, there's 240K space for the last remaining market.

If it fills, the APR will be 47% at current bribe value.

BUT, "ve" does imply locked. And although THEORETICALLY veUSDs can be sold on @paint_swap, I haven't seen any yet.

@Paladin_vote has bribe markets for veUSD.

veUSD is vote-escrowed scUSD.

veUSD can get you bribes from people who want the yield of the underlying veda vaults that scUSD is backed by.

Right now, there's 240K space for the last remaining market.

If it fills, the APR will be 47% at current bribe value.

BUT, "ve" does imply locked. And although THEORETICALLY veUSDs can be sold on @paint_swap, I haven't seen any yet.

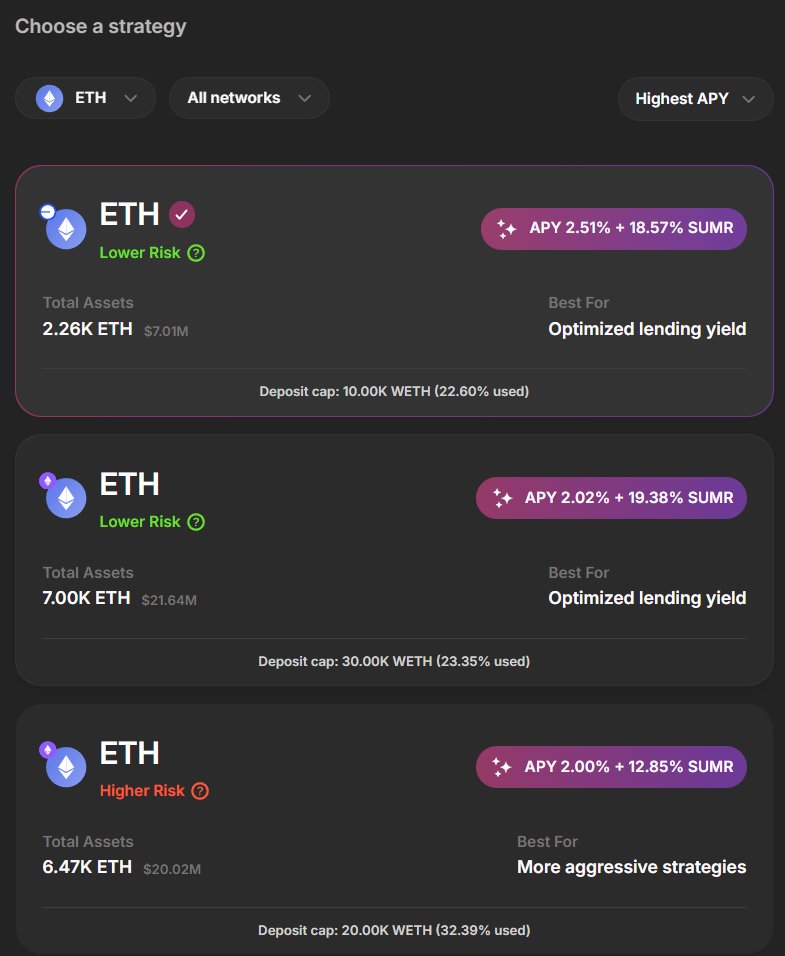

7) @ethena_labs is having a good week.

I just did some math.

Latest Reward: 181,632 USDe

TVL: 2.4B USDe

That's 8.6% APY this week.

That makes almost every sUSDe loop on @Contango_xyz look great.

You love to see it.

I just did some math.

Latest Reward: 181,632 USDe

TVL: 2.4B USDe

That's 8.6% APY this week.

That makes almost every sUSDe loop on @Contango_xyz look great.

You love to see it.

8) @0xfluid's also got some spicy sUSDe yields

It's all in the title, but I particularly like borrowing smart collateral when there's space.

But I would settle for 39% APR while shorting GHO.

It's all in the title, but I particularly like borrowing smart collateral when there's space.

But I would settle for 39% APR while shorting GHO.

Of course there are many more stablecoin yields, but these are the new ones I've found interesting.

To compensate for diluting my bags, please leave a like or give a share 🙏

Ambassadorships Mentioned:

■ Dolomite

■ Reservoir

■ Contango

■ Sonic

■ SwapX

Thanks for reading!

To compensate for diluting my bags, please leave a like or give a share 🙏

Ambassadorships Mentioned:

■ Dolomite

■ Reservoir

■ Contango

■ Sonic

■ SwapX

Thanks for reading!

• • •

Missing some Tweet in this thread? You can try to

force a refresh