Let’s walk through the new Brookings paper on the basis trade and especially their proposal that, in stress, the Fed should take over basis trade positions.

I'll link to related work (including ours) in a QT.

I'll link to related work (including ours) in a QT.

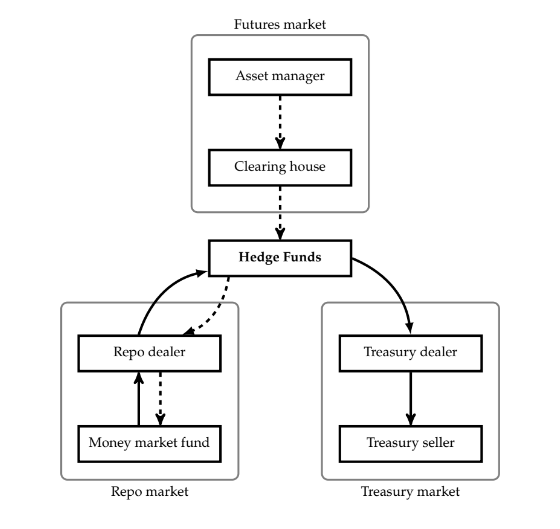

The first portion of this paper is a model of the basis trade.

I've pointed out to the authors that this is essentially the same as the model below from our 2021 paper, which they were apparently unaware of and have agreed to cite in future versions.

I've pointed out to the authors that this is essentially the same as the model below from our 2021 paper, which they were apparently unaware of and have agreed to cite in future versions.

https://x.com/jstatistic/status/1873785252638056599

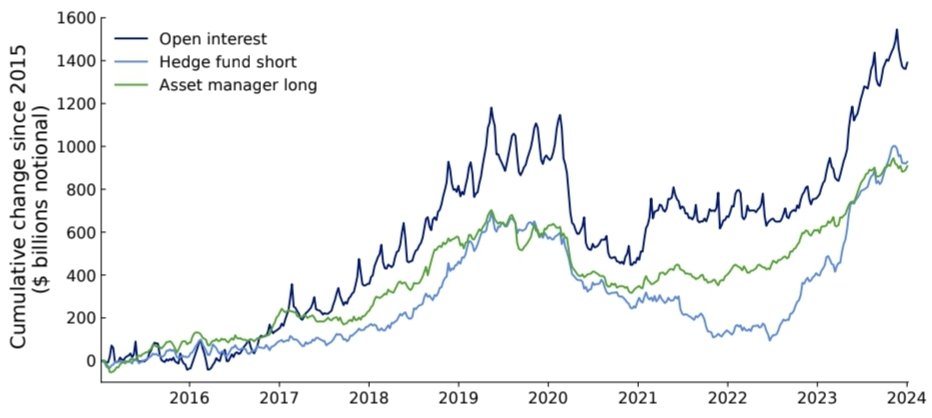

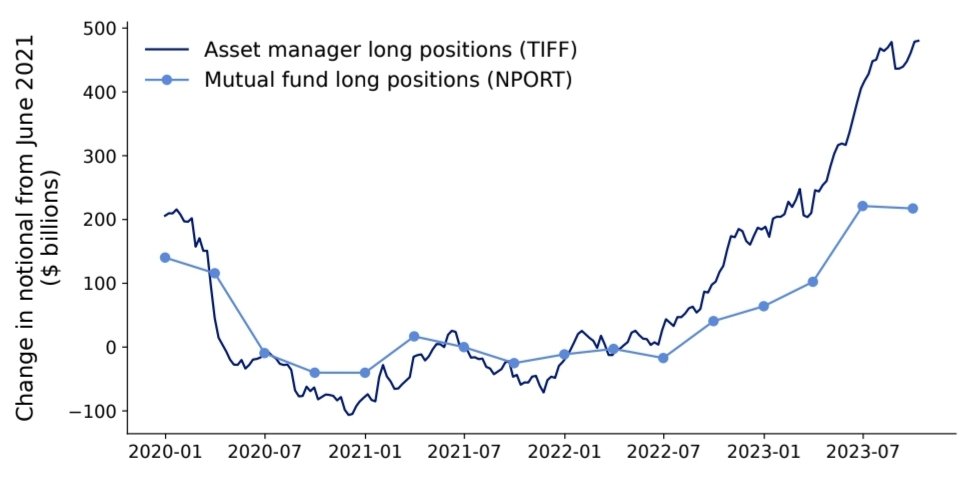

The authors also do some work to establish that the basis trade is indeed large.

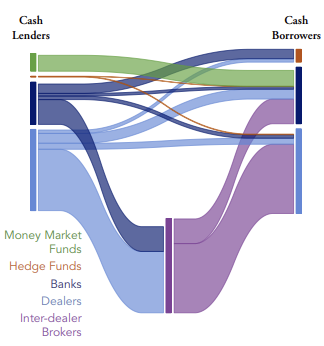

We also already did this in our 2021 paper, and used data from regulatory reports by hedge funds and repo transaction data, which provides a much cleaner picture than the futures data they use.

We also already did this in our 2021 paper, and used data from regulatory reports by hedge funds and repo transaction data, which provides a much cleaner picture than the futures data they use.

The third part, which has gotten more attention (e.g. below), proposes that if basis trades come under stress, as in 2020, the Fed should not just buy Treasuries, but also short futures at the CME.

IMO, this is a solution in search of a problem.

IMO, this is a solution in search of a problem.

https://x.com/bennpeifert/status/1905267260958363987

The rationale? That the central bank could intervene in the basis trade without taking on duration risk.

But I’d argue the Fed already has tools that do exactly that—and used them effectively in March 2020.

But I’d argue the Fed already has tools that do exactly that—and used them effectively in March 2020.

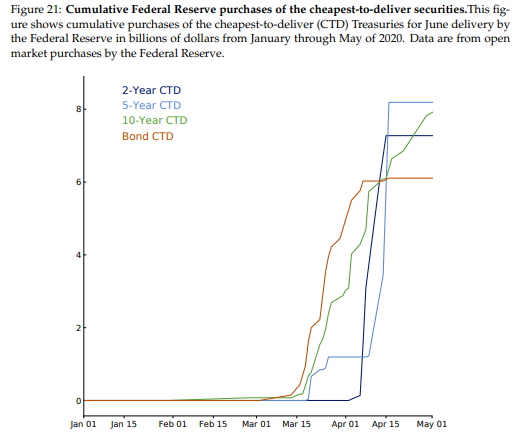

Brookins paper emphasizes purchases of deliverable Treasuries as the key point for intervention.

But as we show in our 2021 paper, in March 2020 the Fed took the unusual step of purchasing deliverables, but CTD sales to the Fed only ramped up after the stress had largely passed.

But as we show in our 2021 paper, in March 2020 the Fed took the unusual step of purchasing deliverables, but CTD sales to the Fed only ramped up after the stress had largely passed.

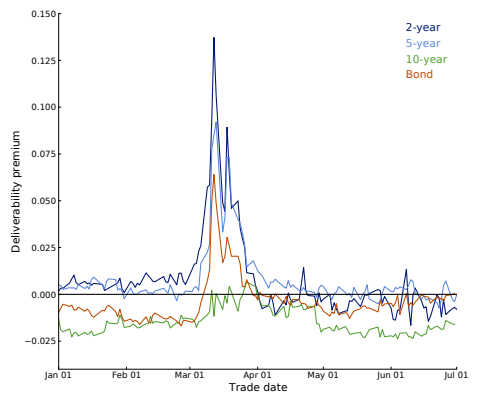

Why the delay? Because CTDs are already liquid through the option to deliver them into the futures contract! They command a significant liquidity premium, so you don't want to sell.

You don’t need to buy the CTDs. You just need to ensure basis traders can carry them to delivery!

You don’t need to buy the CTDs. You just need to ensure basis traders can carry them to delivery!

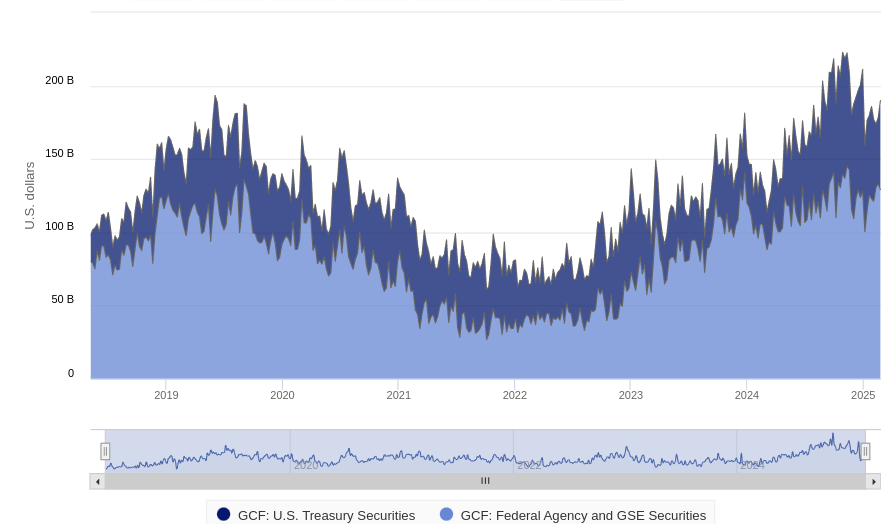

What determines whether a basis trader can carry a Treasury? Repo funding—the cost and availability of financing to basis traders.

The issue isn’t the cash or futures markets. It’s the repo market.

The issue isn’t the cash or futures markets. It’s the repo market.

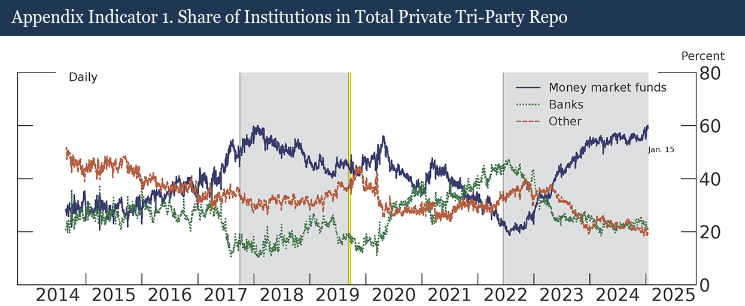

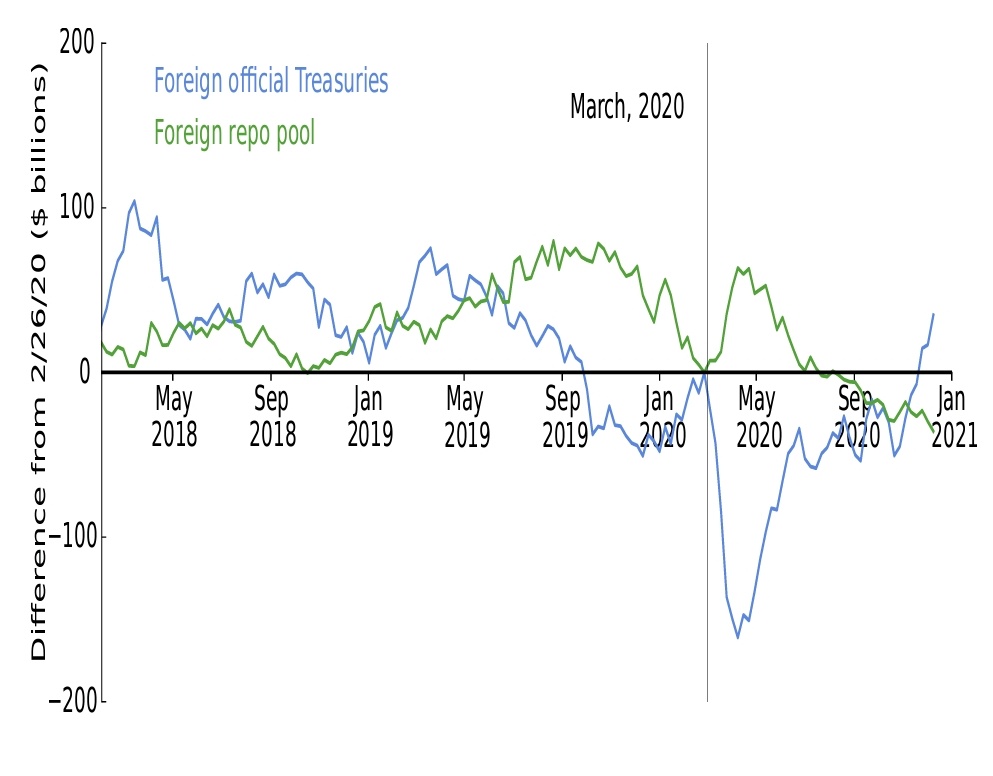

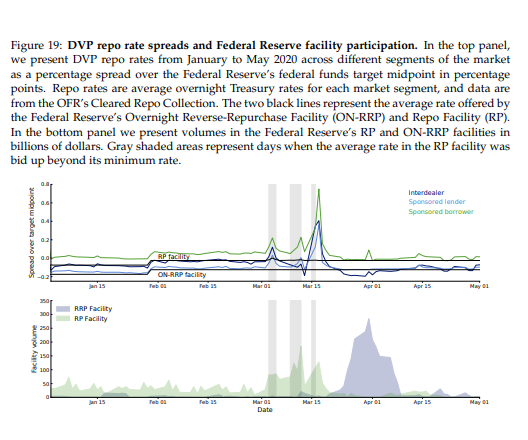

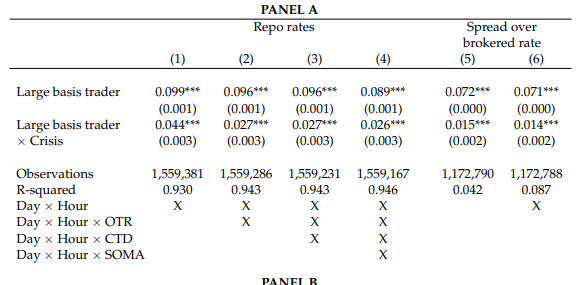

And that’s what we documented in our 2021 paper: repo became expensive as basis trades came under stress in March 2020.

(The Brookings paper gets it wrong and thinks the causality goes the other way, from the basis to repo, we did a lot of work to show this isn't the case)

(The Brookings paper gets it wrong and thinks the causality goes the other way, from the basis to repo, we did a lot of work to show this isn't the case)

We show that spikes in repo rates coincided with stress around the Fed's then existing tool to address this, the repo facility.

Repo rates for basis traders increased the most when dealers were concerned about its capacity.

These were pinch points.

Repo rates for basis traders increased the most when dealers were concerned about its capacity.

These were pinch points.

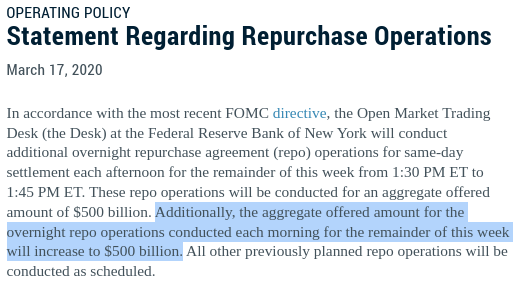

Crucially, traders don’t just need repo today—they need confidence repo will still be there tomorrow.

Peak stress came March 17, when the Fed announced it would expand the facility and keep it open for the rest of the week.

Now we have the SRF to provide this daily.

Peak stress came March 17, when the Fed announced it would expand the facility and keep it open for the rest of the week.

Now we have the SRF to provide this daily.

This repo facility is just classic central banking. Providing liquidity when markets need it—especially in government bond markets—is what central banks have always done, with these very instruments.

Repo lending also DOESN'T require taking on duration risk. It’s overnight!

Repo lending also DOESN'T require taking on duration risk. It’s overnight!

Finally, unlike exposures to the CME required to take on futures positions, lending through the SRF is fully collateralized by Treasuries!

There are even existing mechanisms to change haircuts or penalty rates! It's ready-made for the purpose.

There are even existing mechanisms to change haircuts or penalty rates! It's ready-made for the purpose.

• • •

Missing some Tweet in this thread? You can try to

force a refresh