Economist covering markets that work quietly but fail loudly: repo, Treasuries, safe assets. Alum @MichiganRoss, @SimonSchool, @Reed_College_. Views my own.

How to get URL link on X (Twitter) App

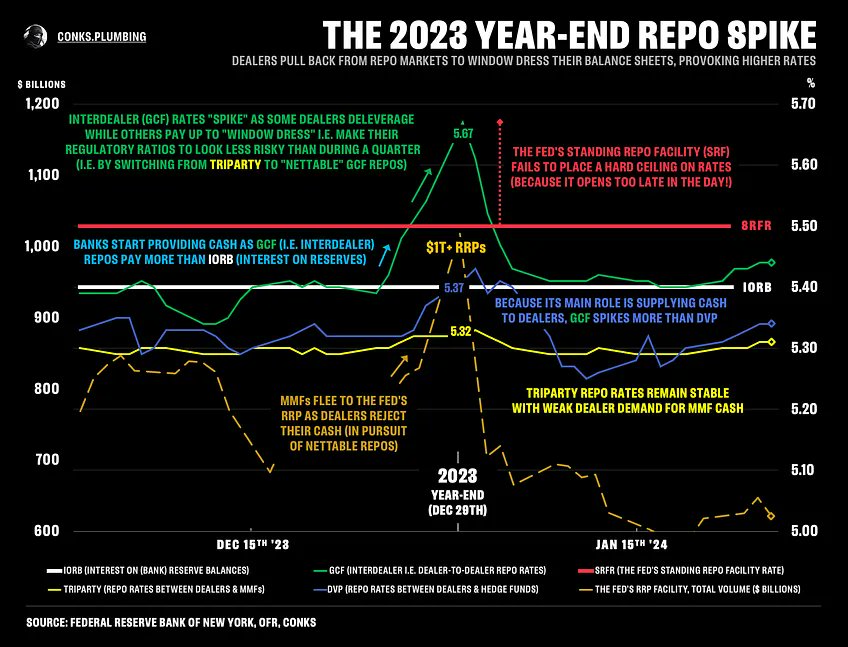

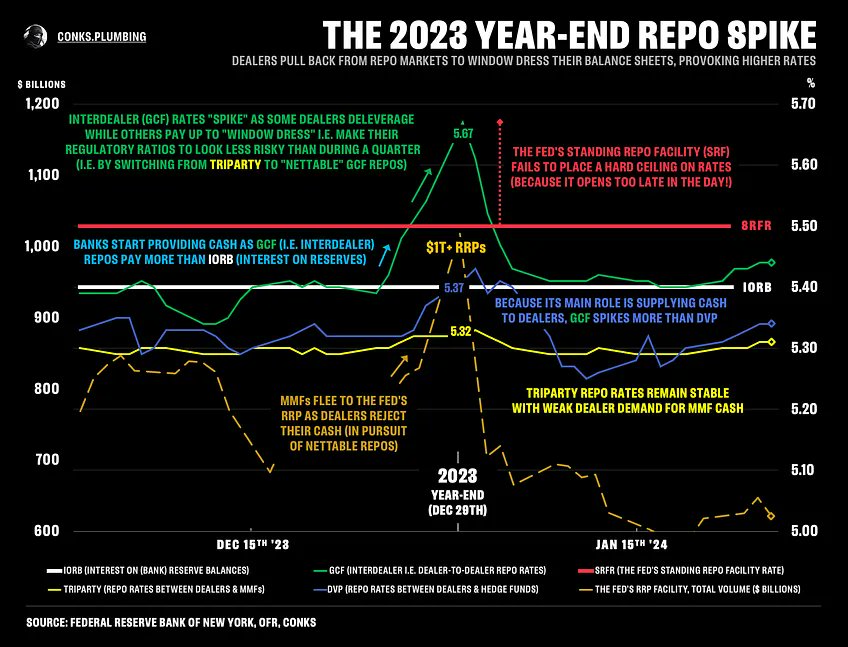

When reserves are ample, dealers can tap their bank affiliates for funding.

When reserves are ample, dealers can tap their bank affiliates for funding.

The first portion of this paper is a model of the basis trade.

The first portion of this paper is a model of the basis trade.https://x.com/jstatistic/status/1873785252638056599

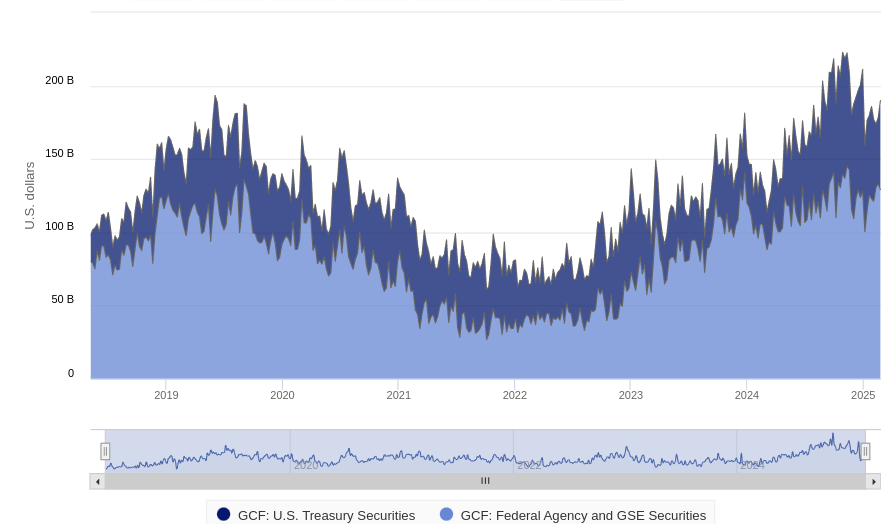

1) GCF is largely term agency repos, rather than UST repo.

1) GCF is largely term agency repos, rather than UST repo.

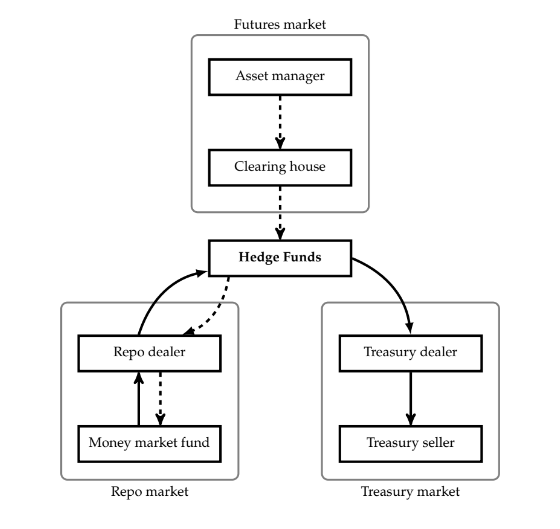

https://twitter.com/StevenKelly49/status/1865148165533425690The basis trade hinges on three players:

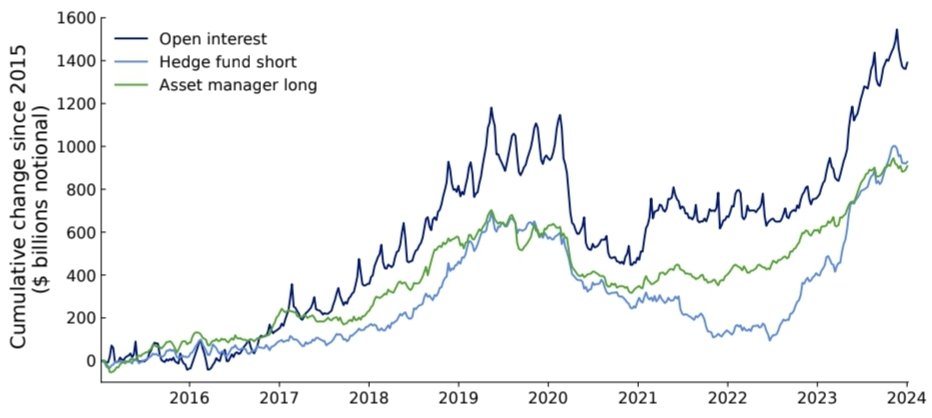

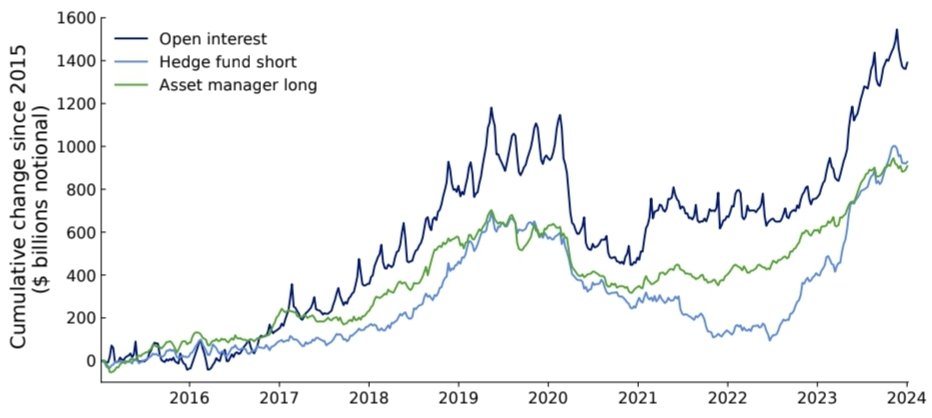

2/🧵 Previous work by myself and others has shown that the opposite side of this trade, the short position, is mostly a very large and highly levered arbitrage trade by hedge fund known as the cash-futures basis trade.

2/🧵 Previous work by myself and others has shown that the opposite side of this trade, the short position, is mostly a very large and highly levered arbitrage trade by hedge fund known as the cash-futures basis trade.

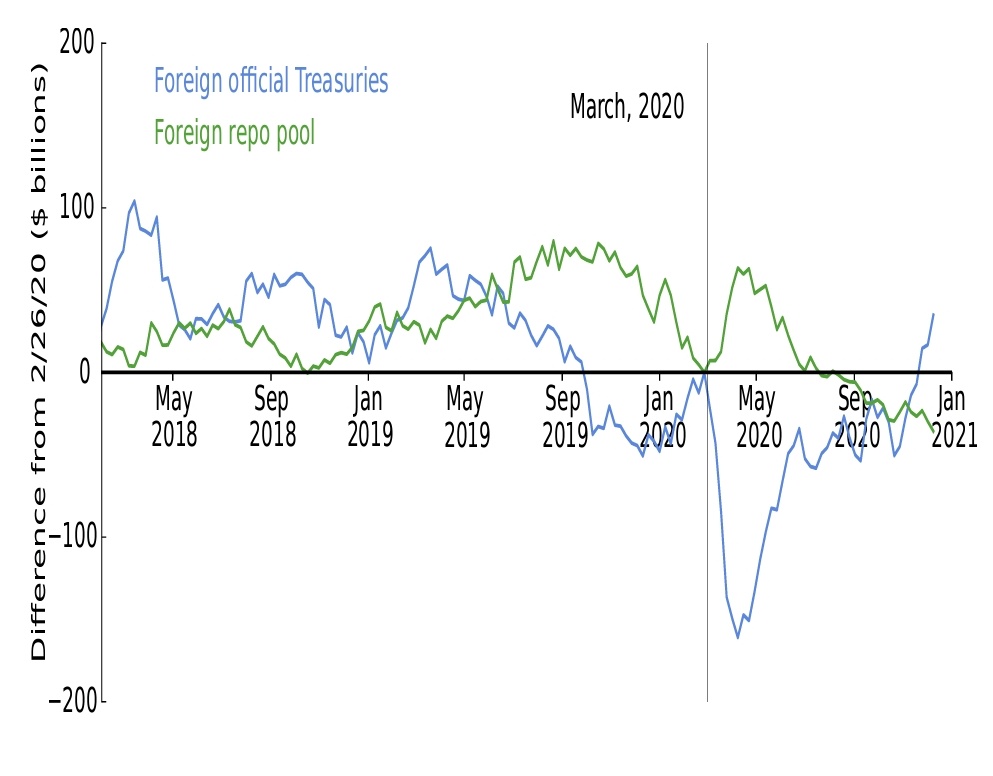

Our motivation comes from events in March 2020, when a global dash for cash occurred among foreign central banks, as they build up dollar FX buffers by selling Treasuries while simultaneously *buying* USD liquidity through vehicles like the Fed's foreign repo pool.

Our motivation comes from events in March 2020, when a global dash for cash occurred among foreign central banks, as they build up dollar FX buffers by selling Treasuries while simultaneously *buying* USD liquidity through vehicles like the Fed's foreign repo pool.