Here's the latest variant picture with a global scope, to mid- March.

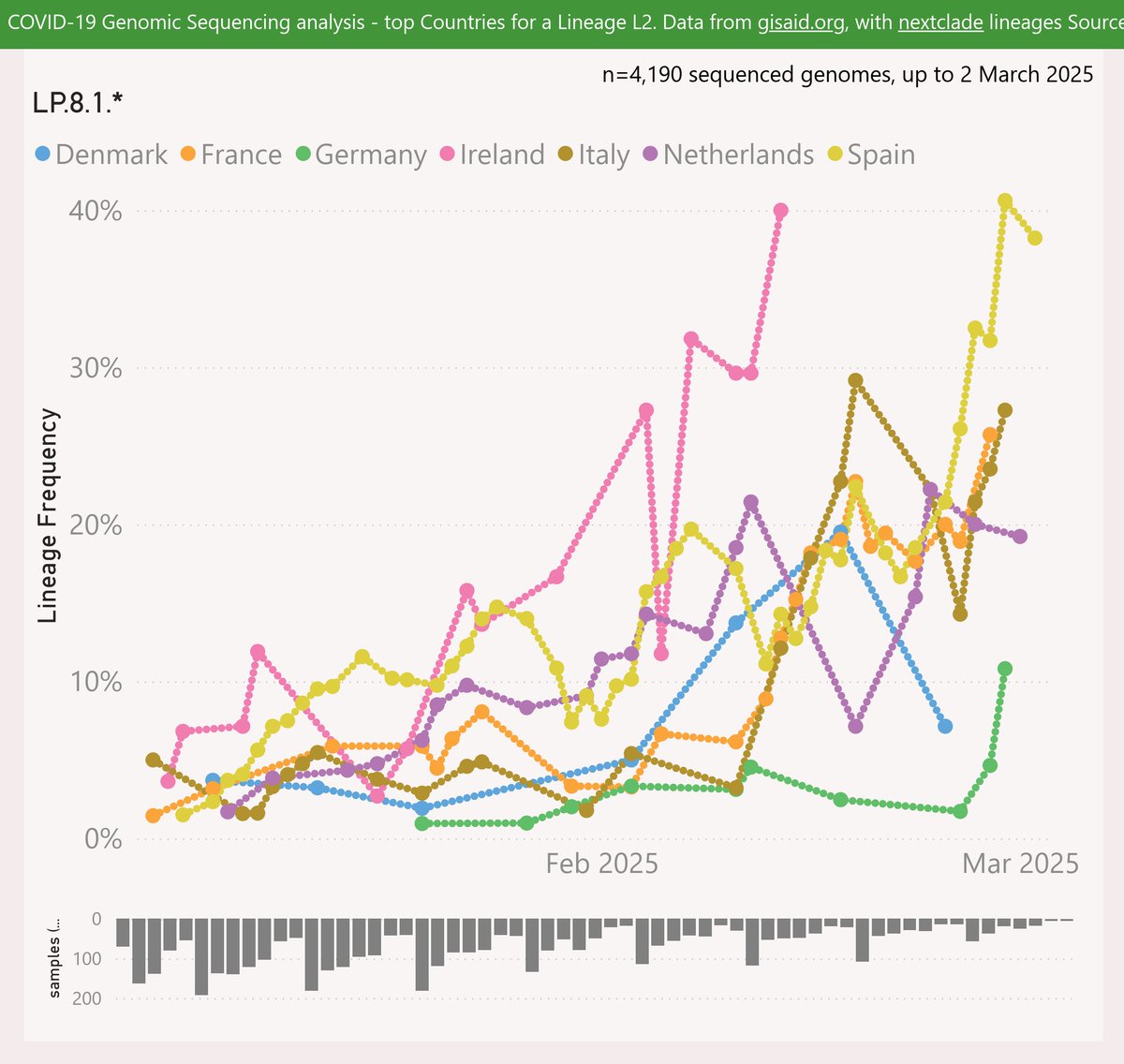

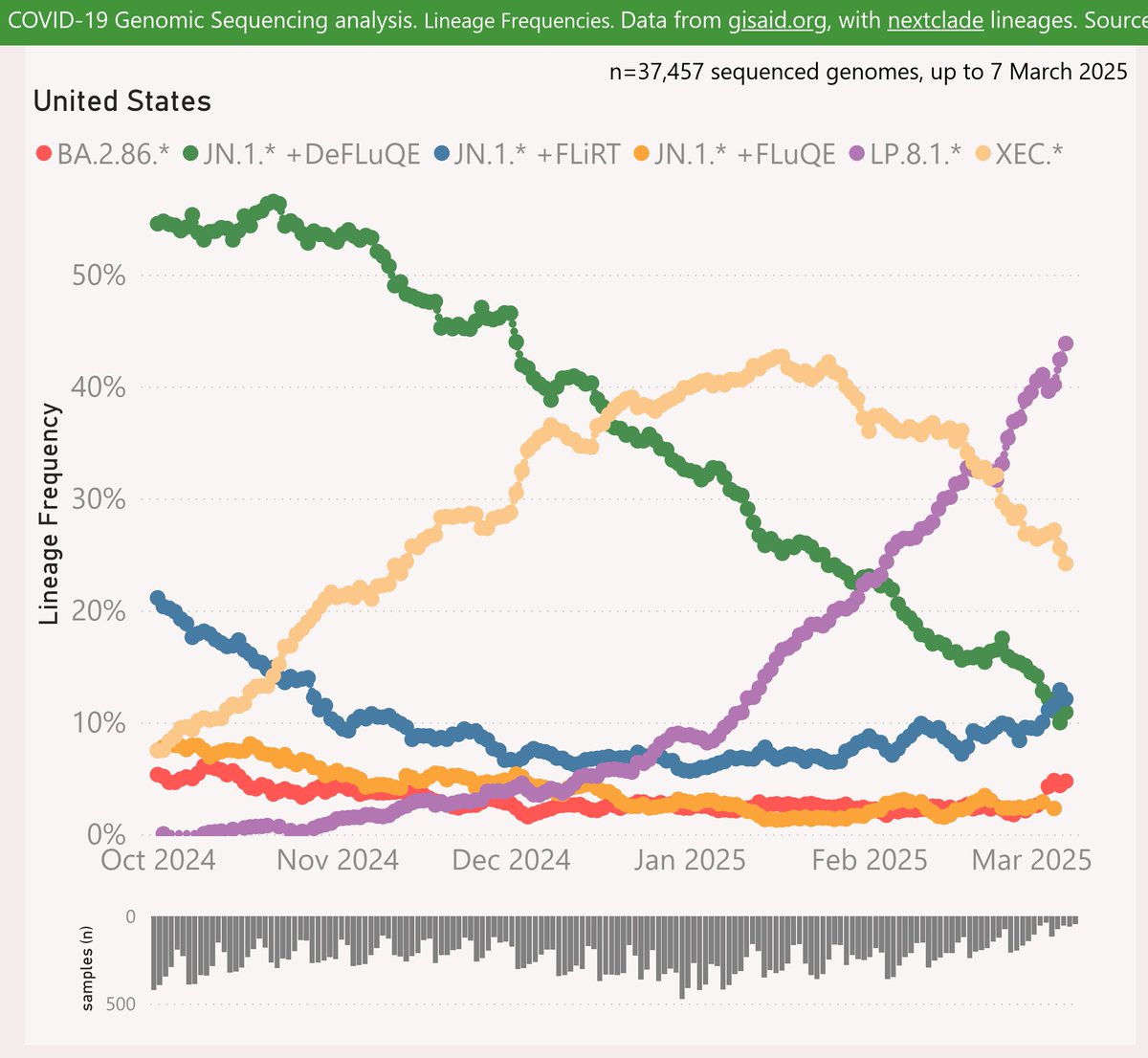

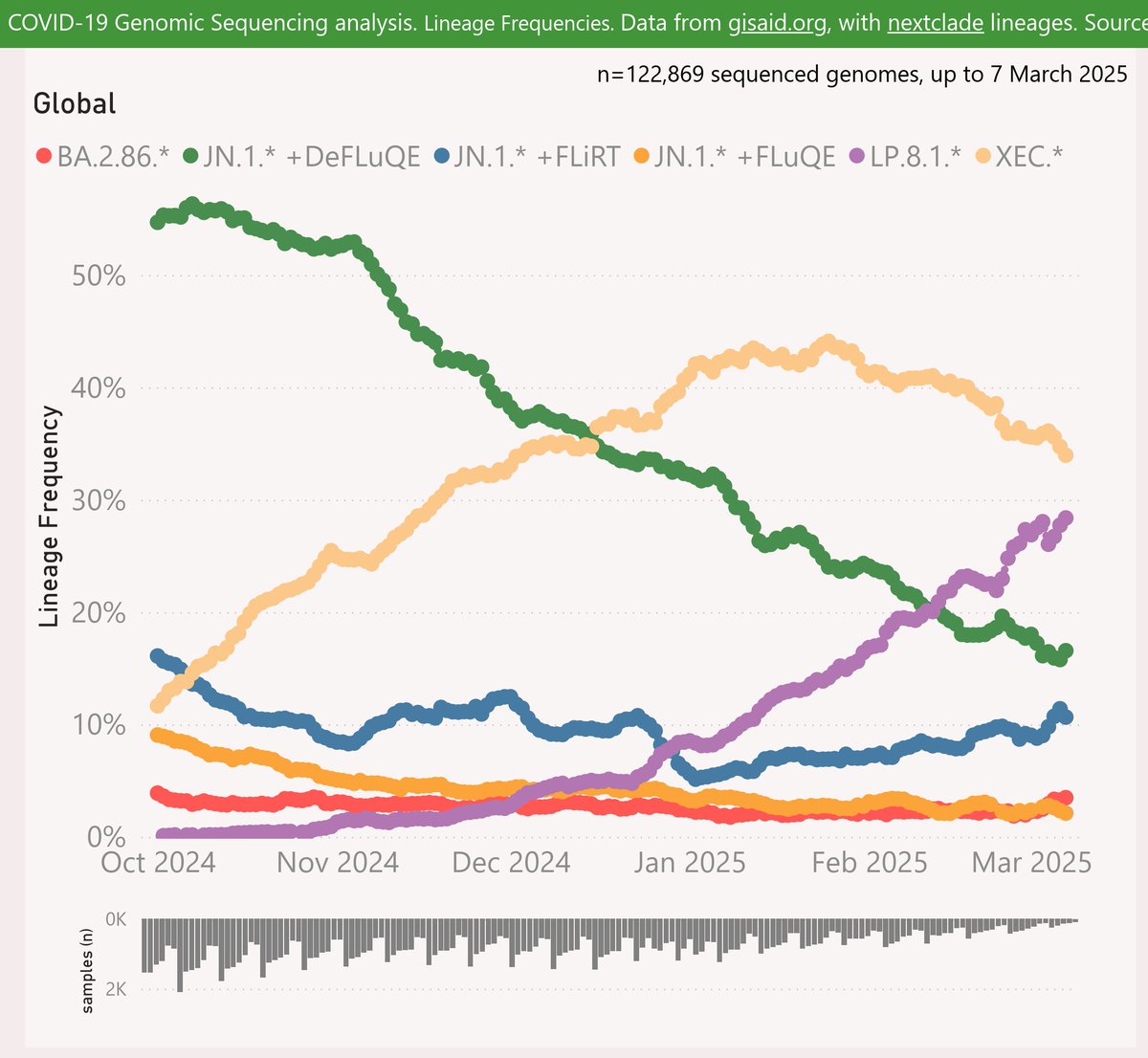

The LP.8.1.* variant grew to around 38%, taking over dominance from the declining XEC.* variant.

#COVID19 #Global #XEC #LP_8_1

🧵

The LP.8.1.* variant grew to around 38%, taking over dominance from the declining XEC.* variant.

#COVID19 #Global #XEC #LP_8_1

🧵

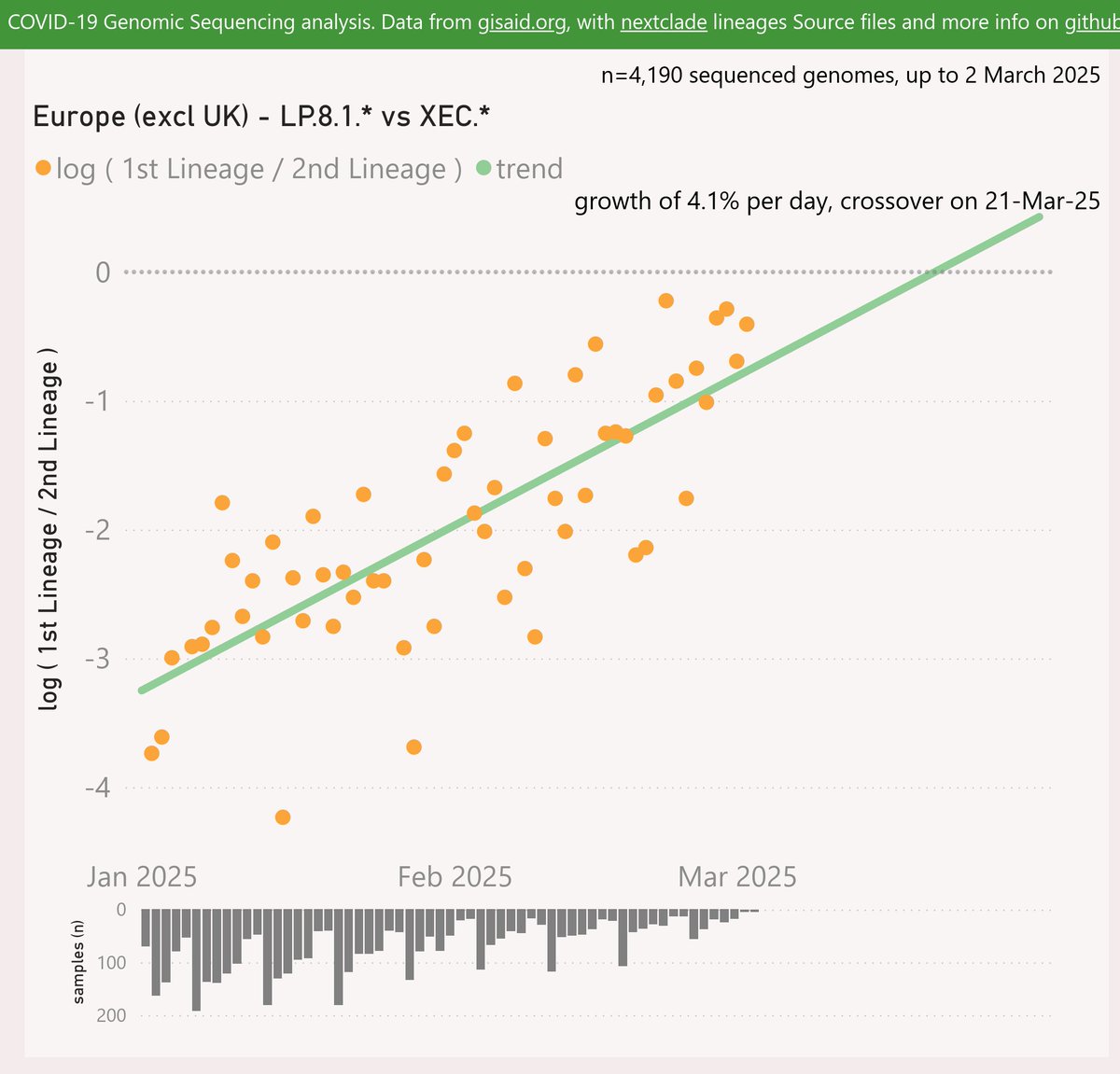

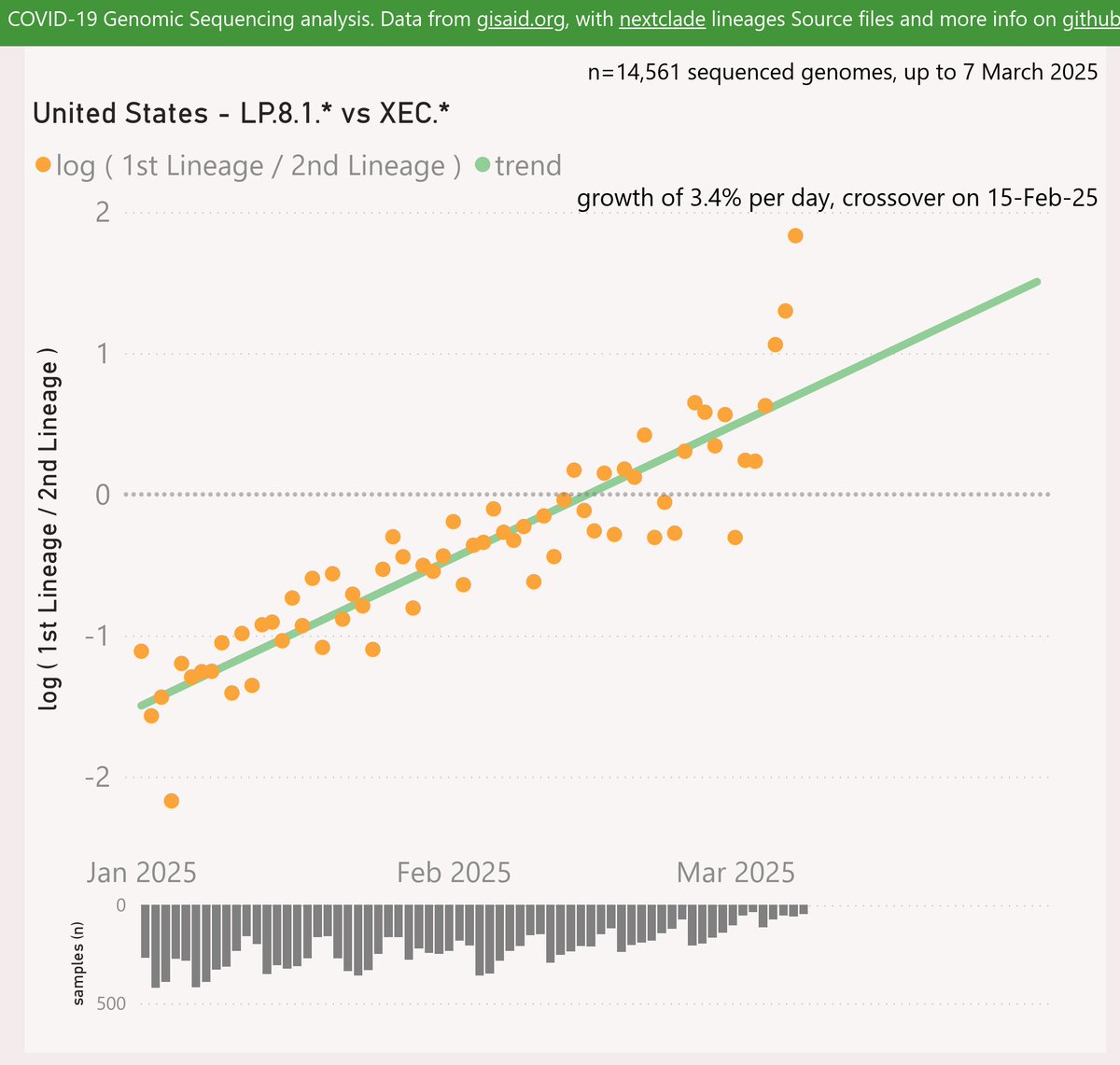

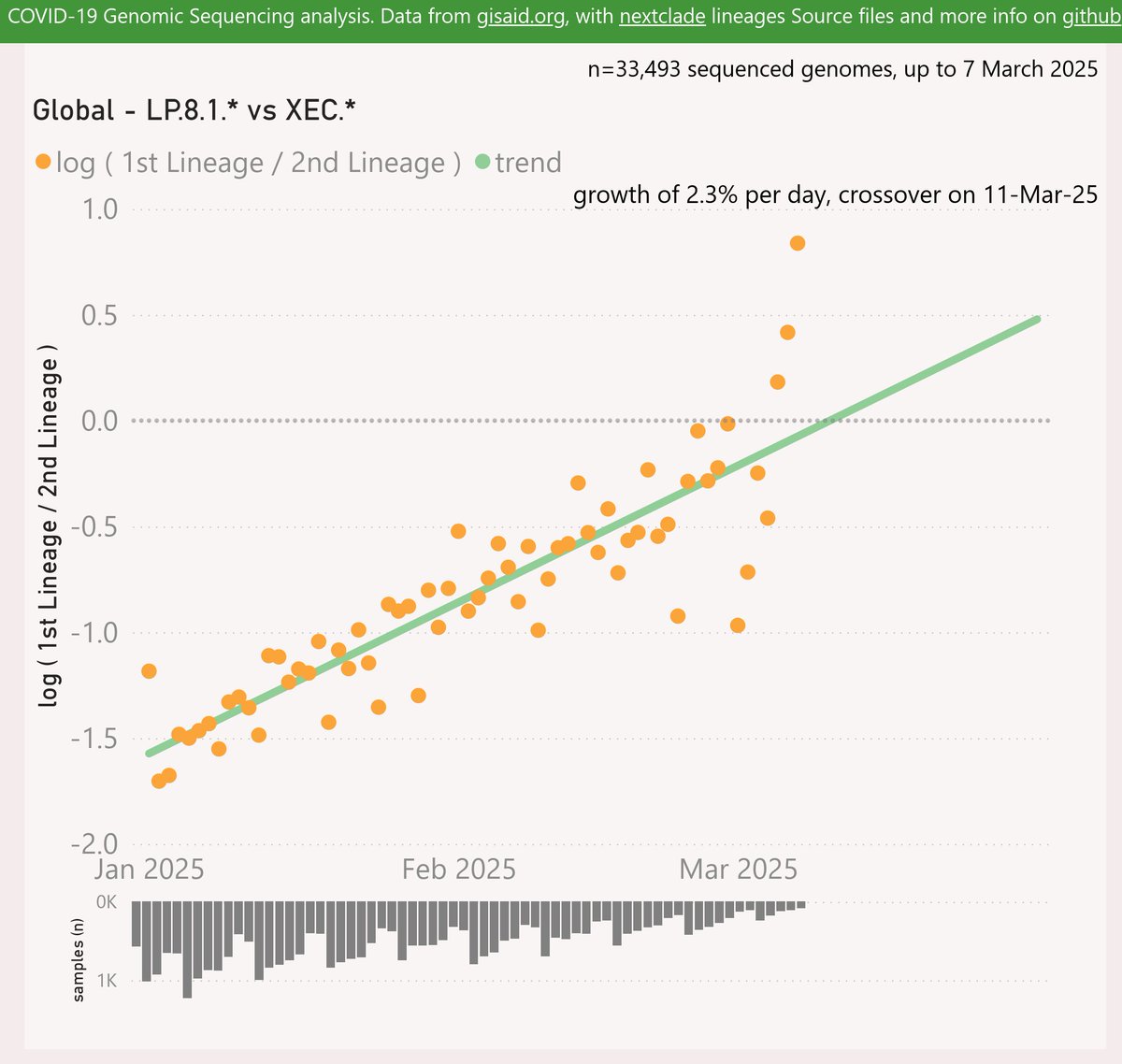

The LP.8.1.* variant shows an accelerating growth advantage of 2.5% per day (18% per week) over the dominant XEC.* variant, with a crossover in early March.

🧵

🧵

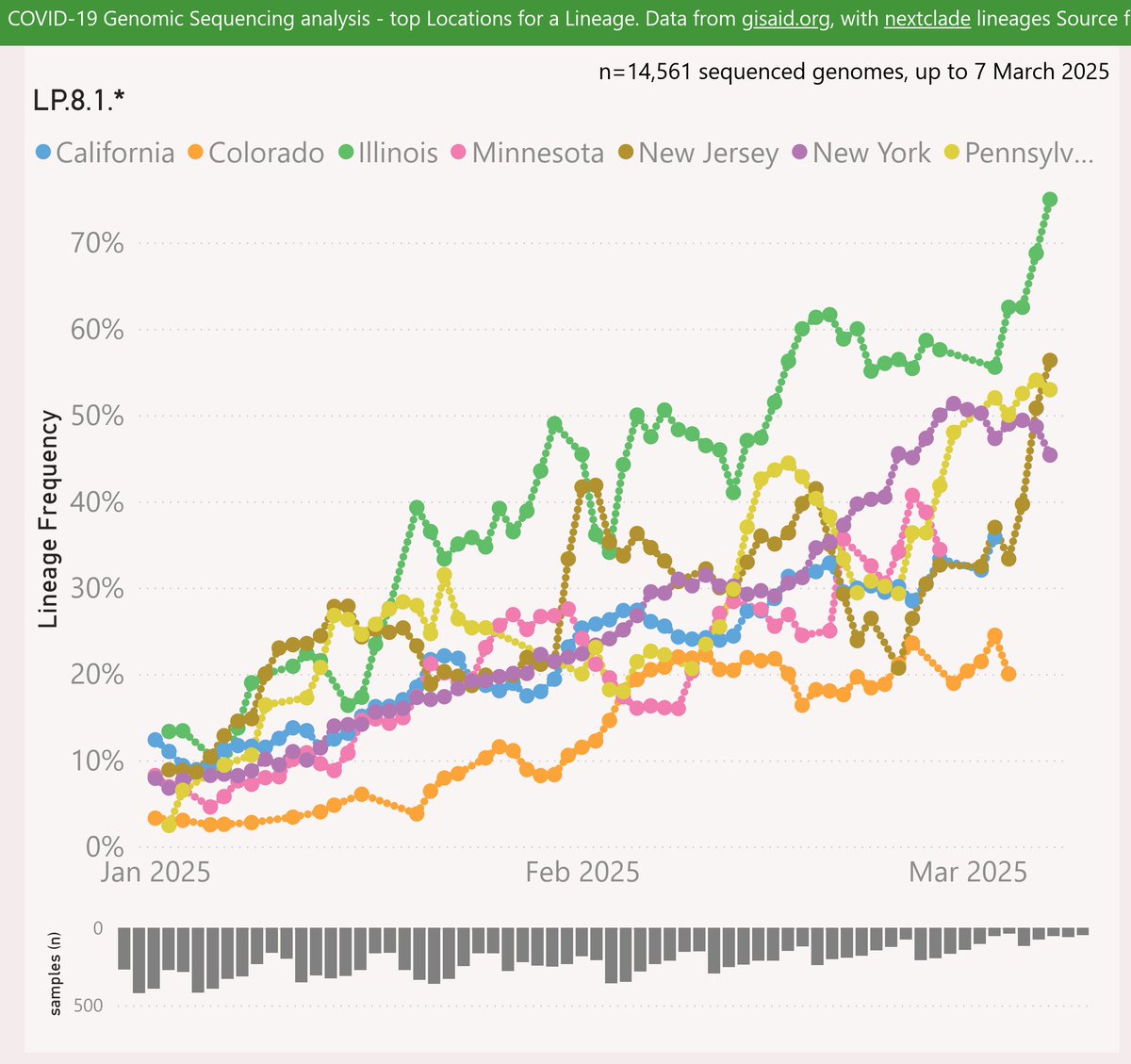

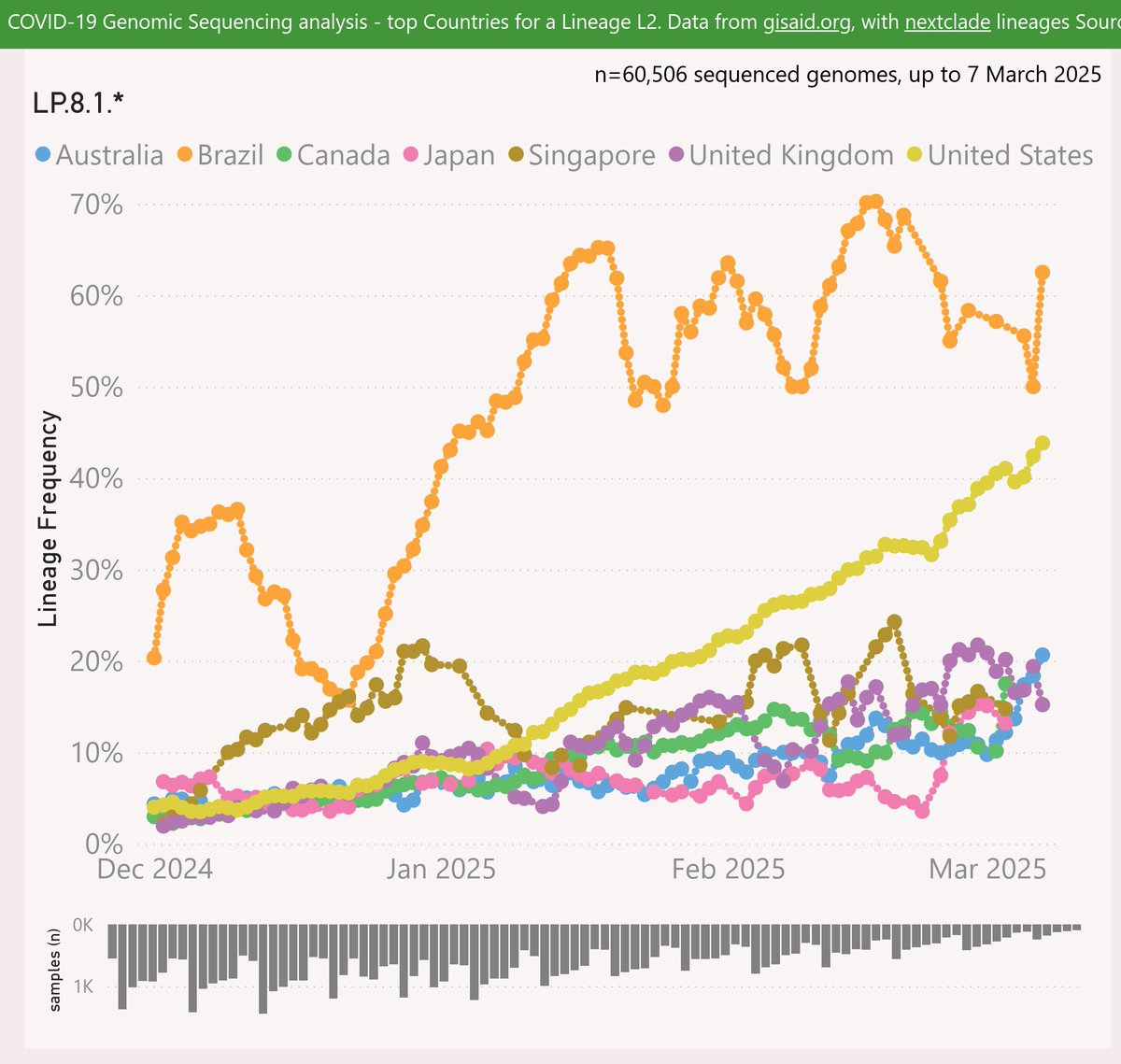

Among the LP.8.1.* sub-lineages, the first child lineage LP.8.1.1 has been the most successful, with accelerating growth in recent samples.

🧵

🧵

• • •

Missing some Tweet in this thread? You can try to

force a refresh