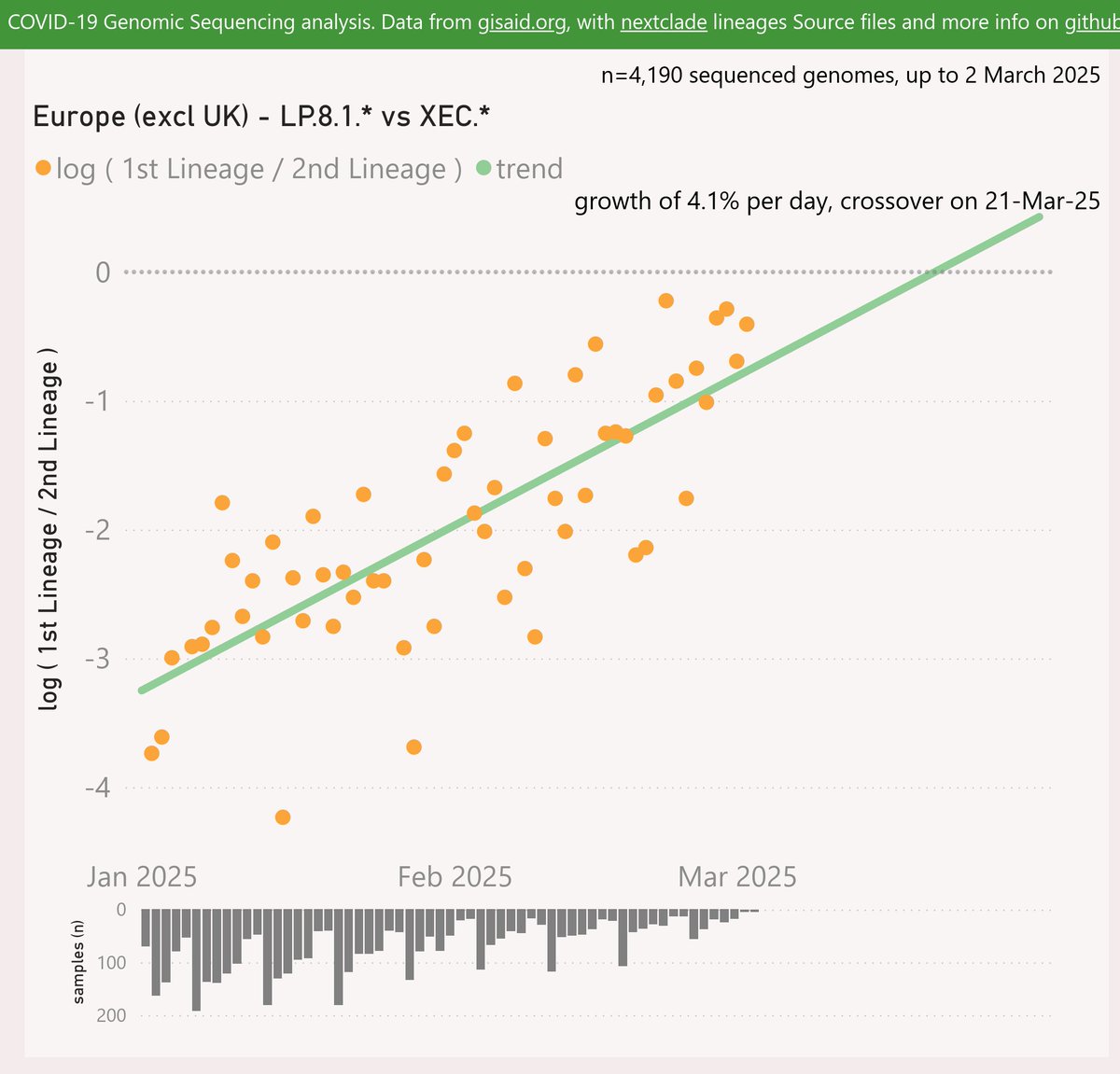

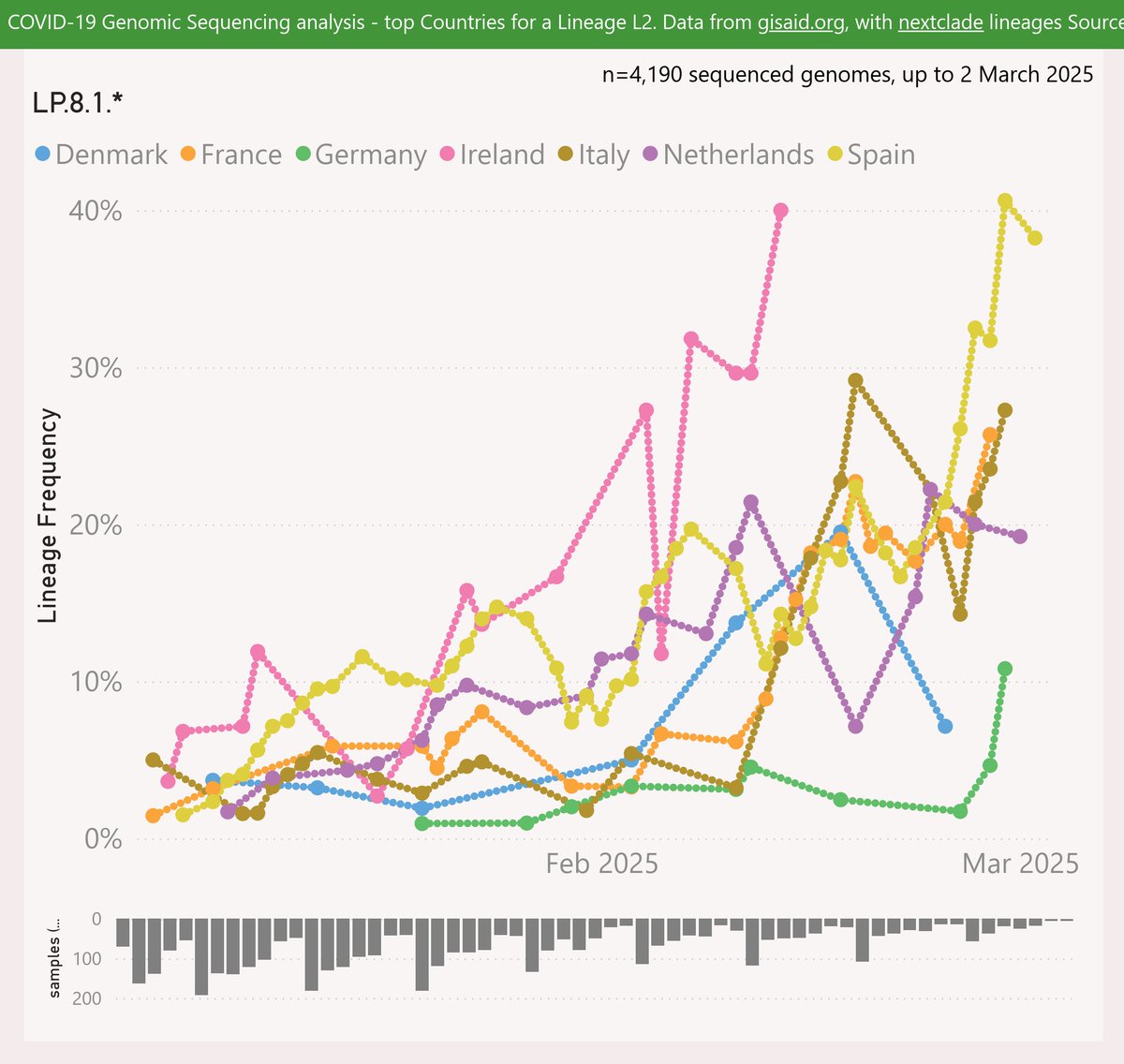

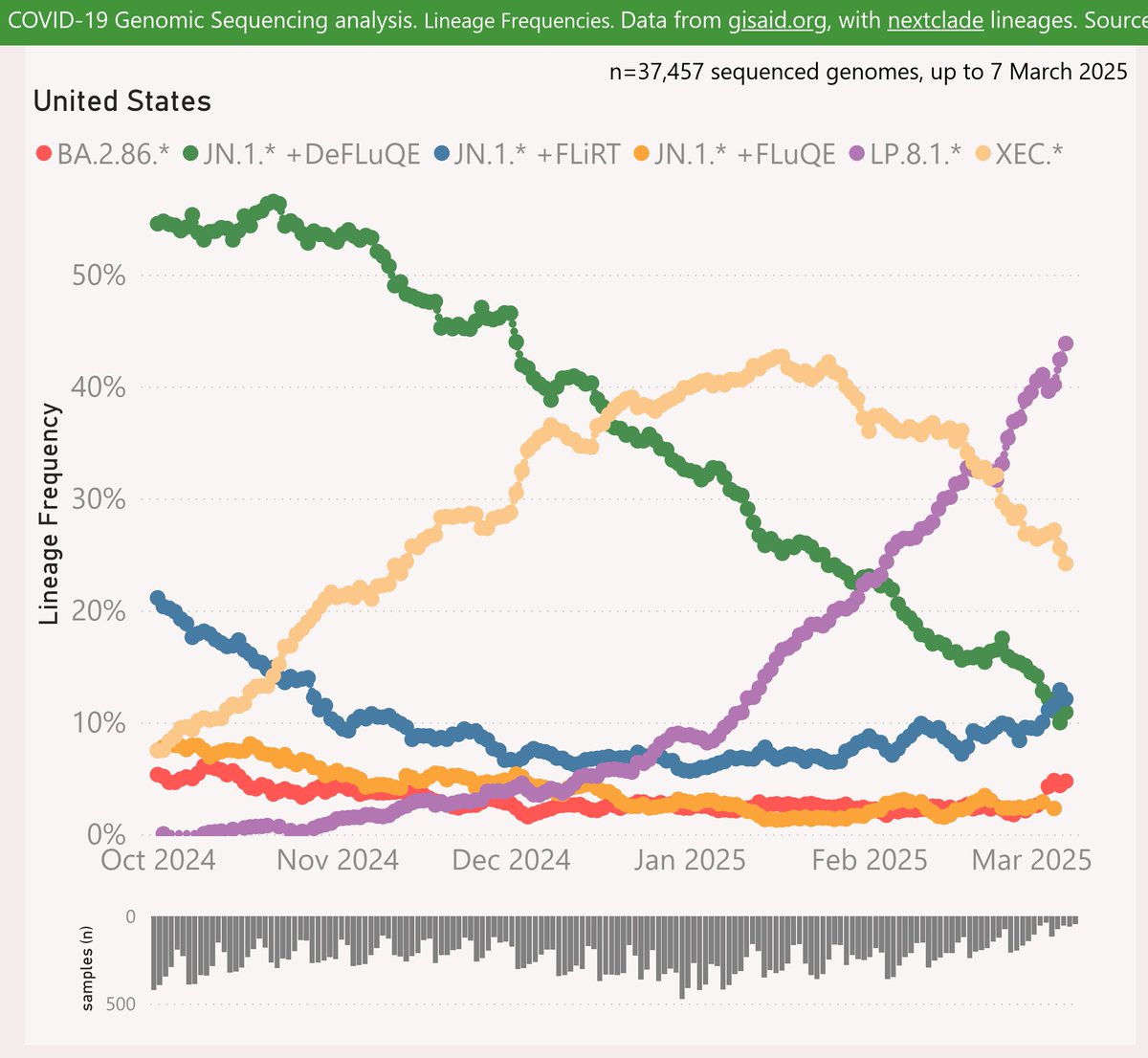

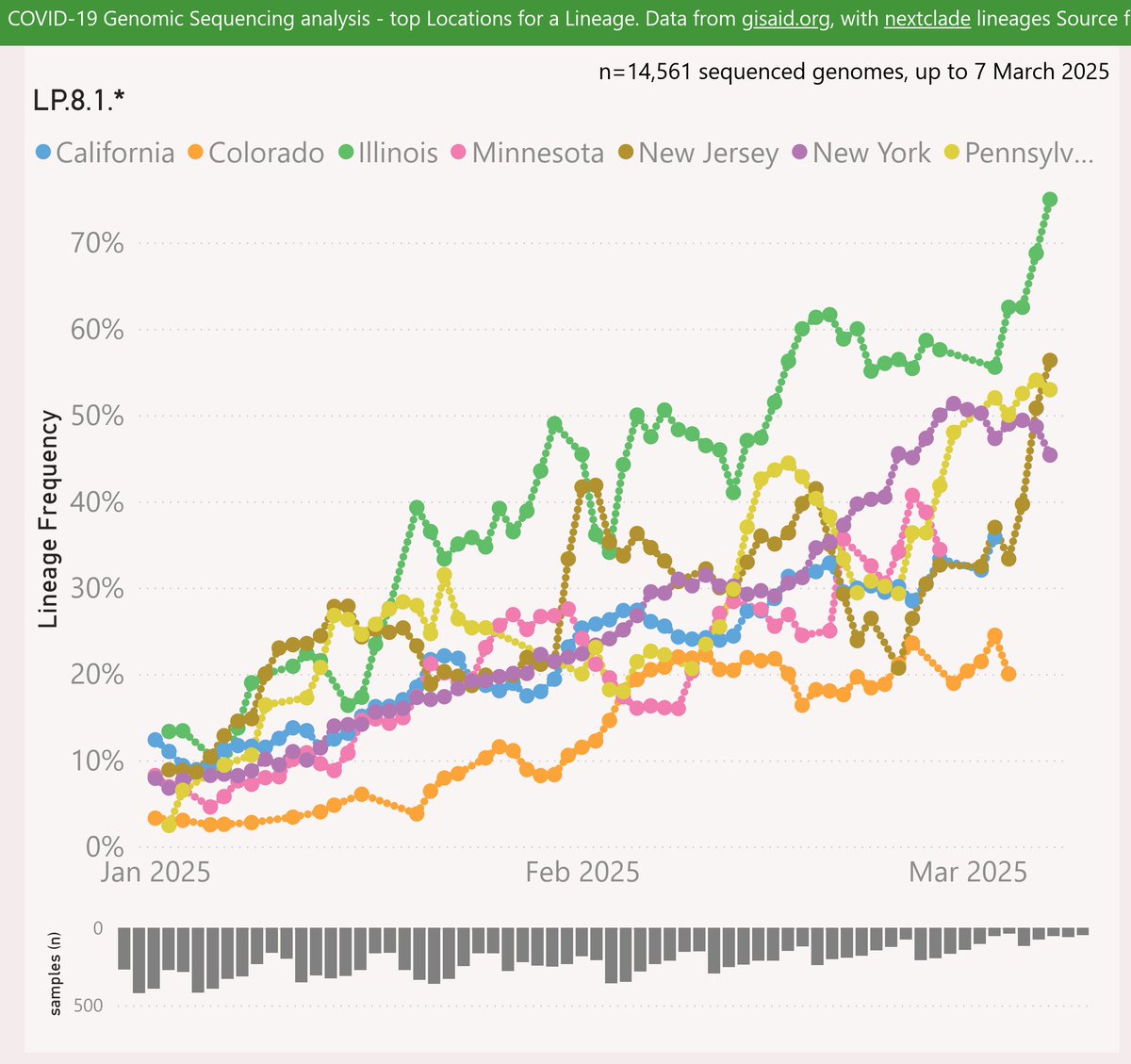

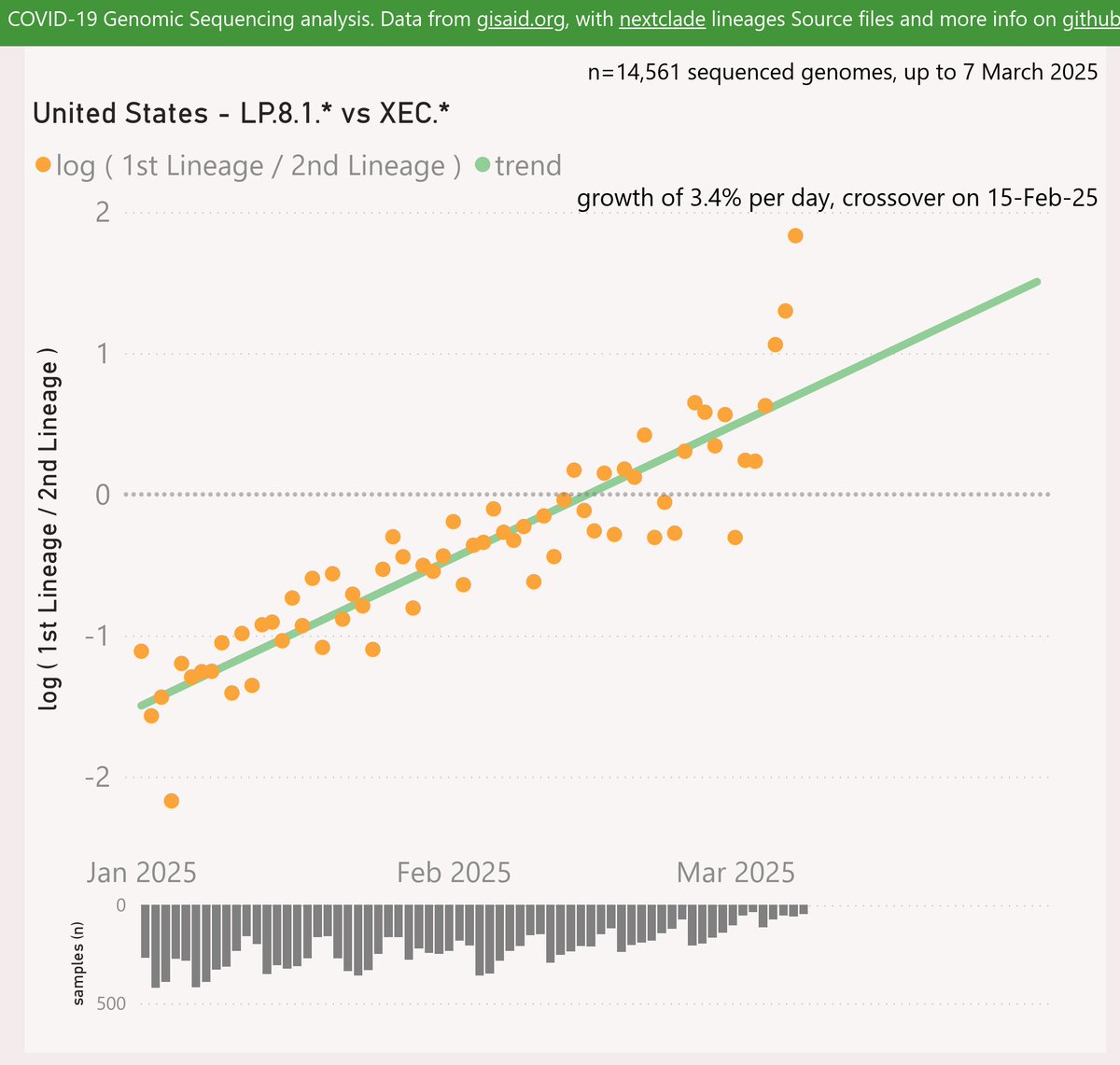

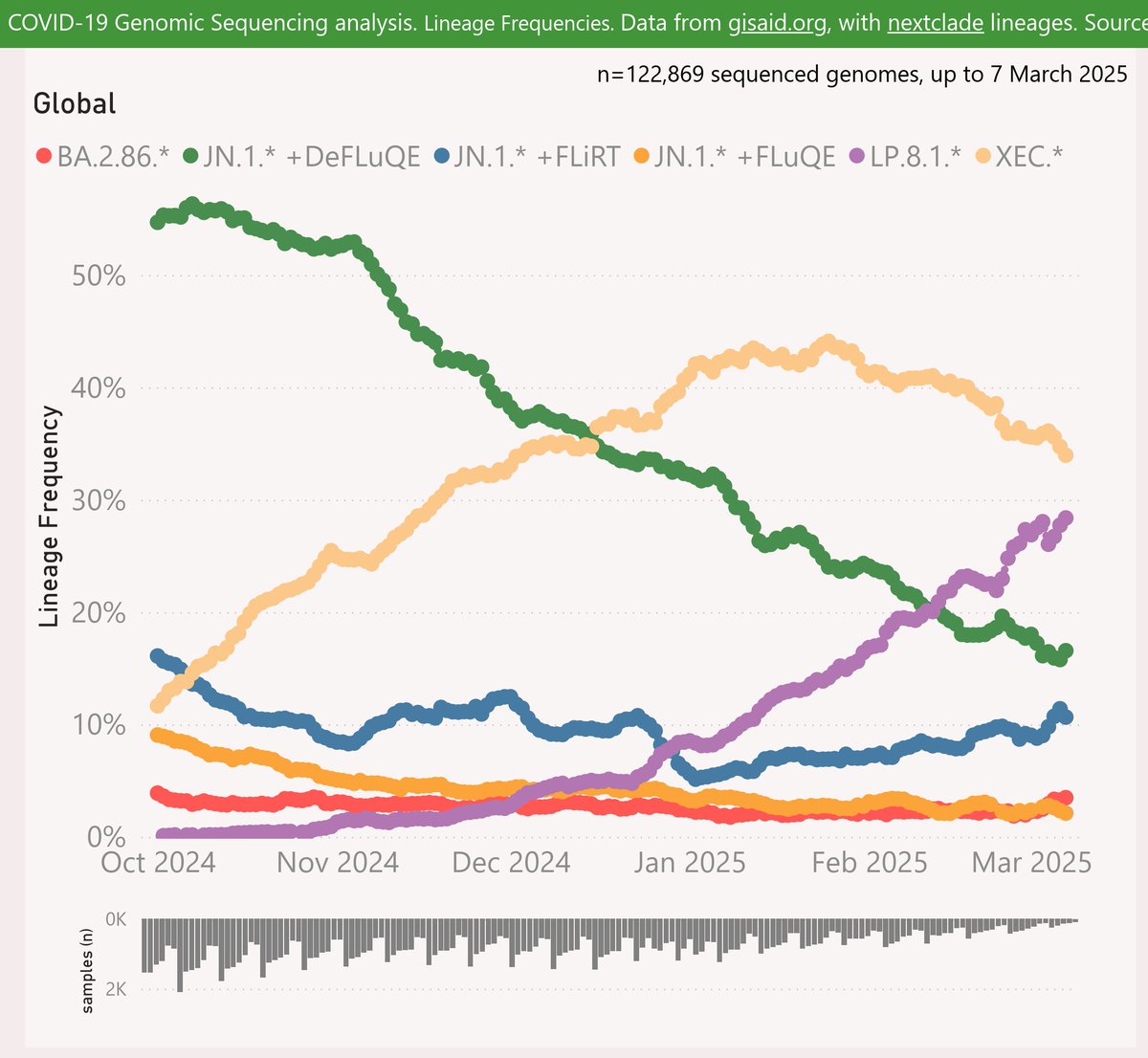

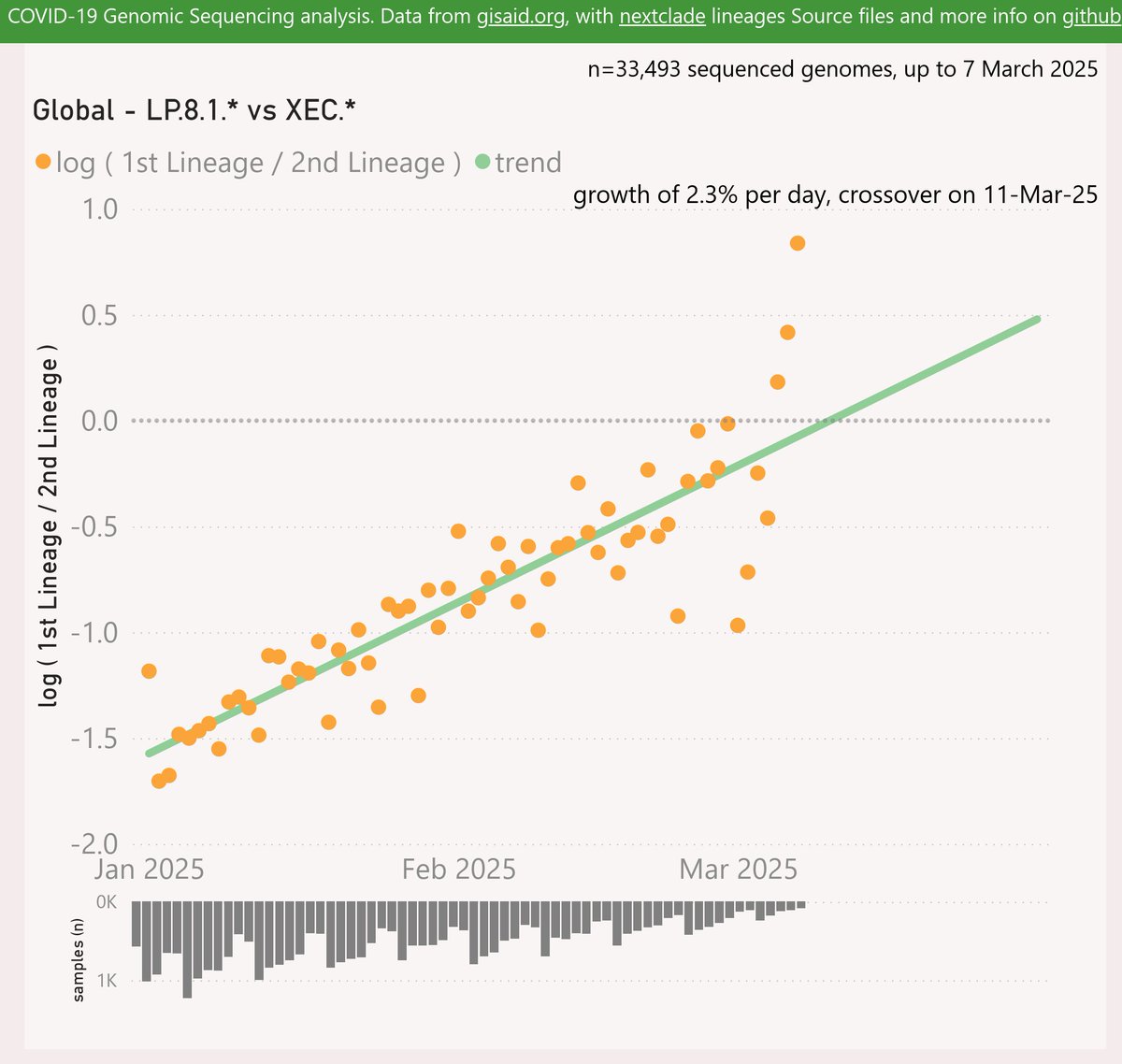

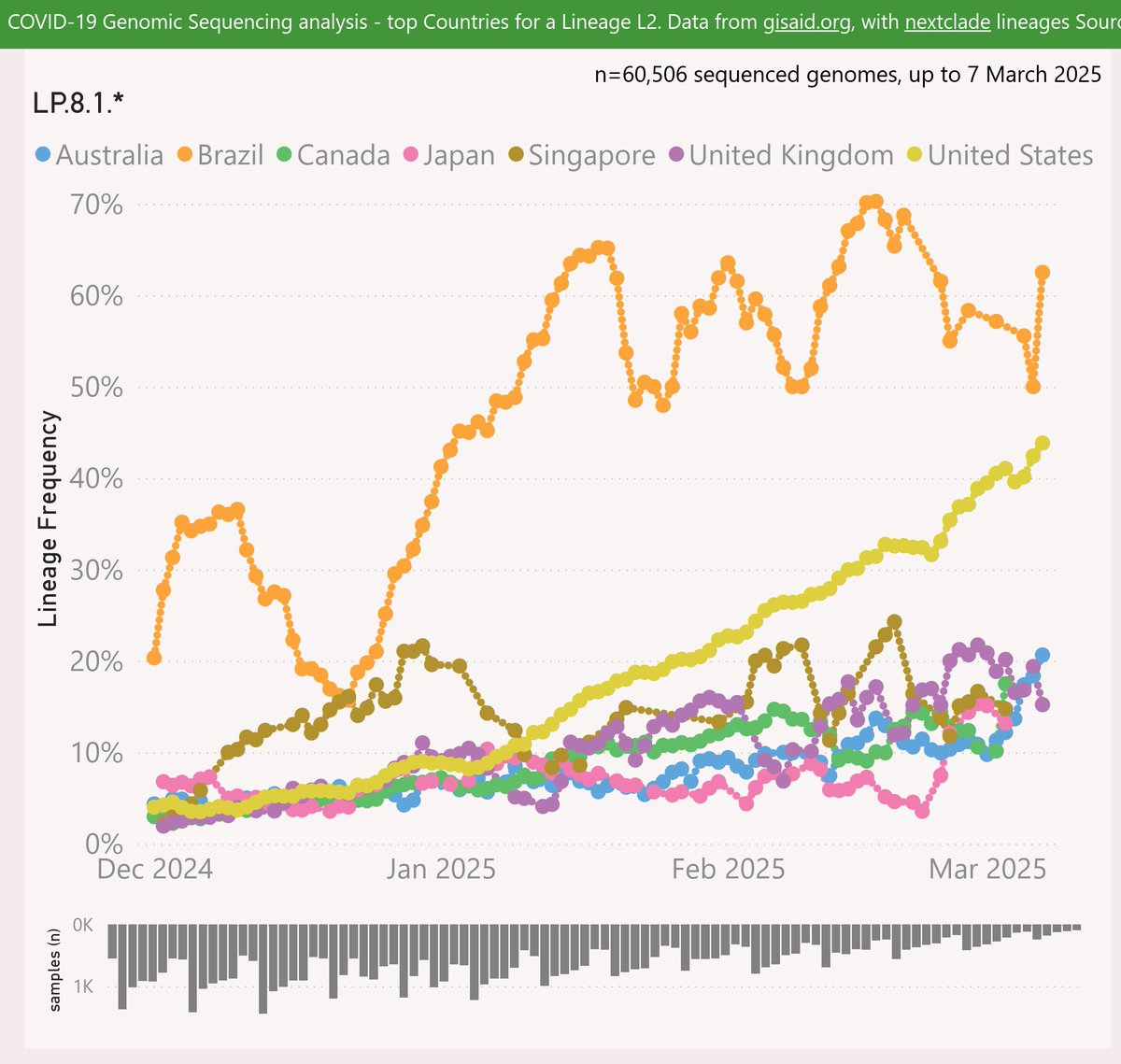

With the LP.8.1.* variant on the way to dominance in most places, it is time to ponder which variant might drive the next wave.

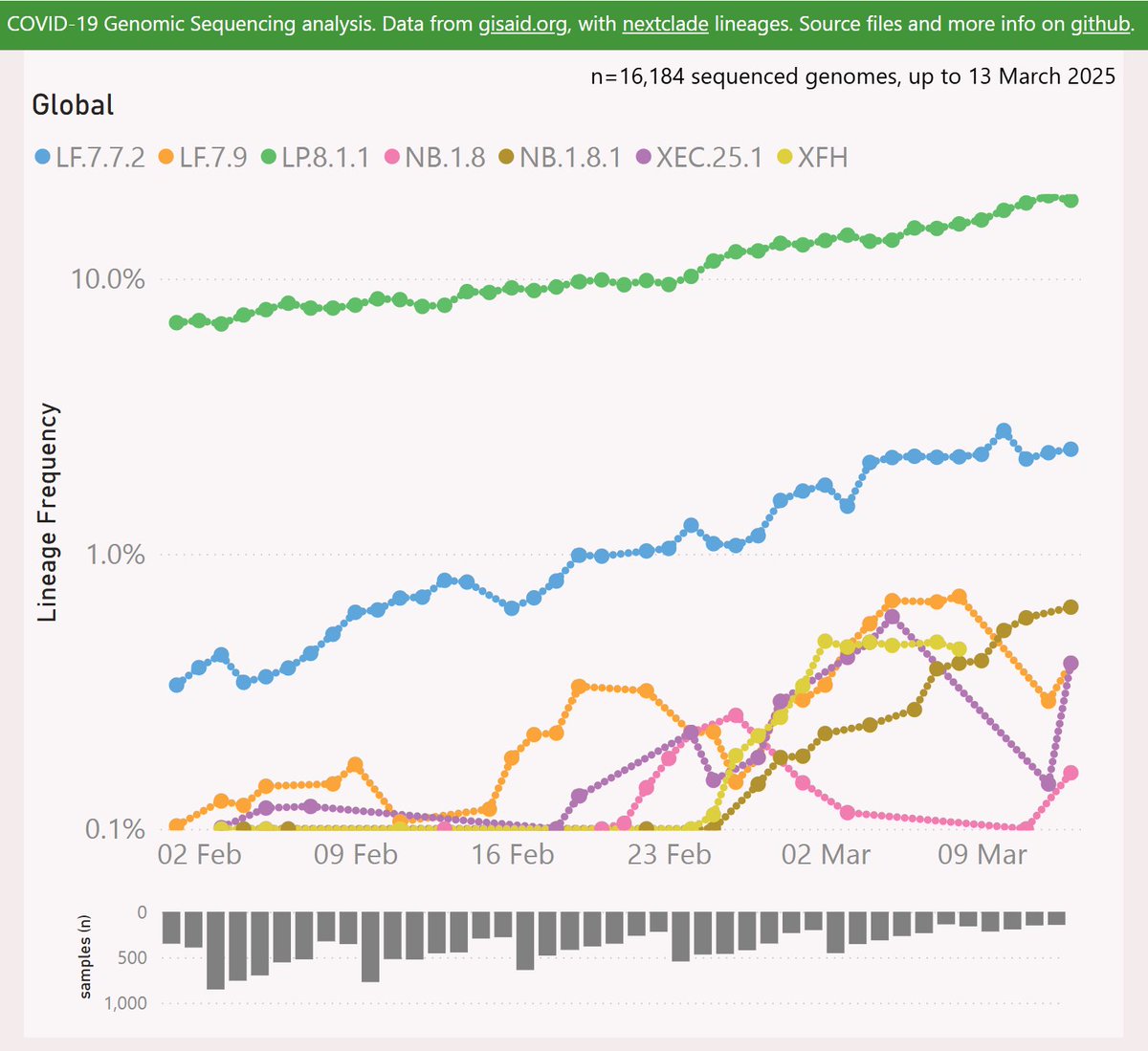

The leading contenders at this point are LF.7.7.2, LF.7.9, NB.1.8.1, XEC.25.1 and XFH.

#COVID19 #LF_7_7_2 #LF_7_9 #NB_1_8_1 #XEC #XFH

🧵

The leading contenders at this point are LF.7.7.2, LF.7.9, NB.1.8.1, XEC.25.1 and XFH.

#COVID19 #LF_7_7_2 #LF_7_9 #NB_1_8_1 #XEC #XFH

🧵

I show them above using a log scale, so you can compare their growth rates vs the most common LP.8.1.* sub-lineage: LP.8.1.1.

🧵

🧵

LF.7.7.2 is descended from FLiRT JN.1.16.1. LF.7 added several Spike mutations: T22N, S31P, K182R, R190S and K444. Then LF.7.7.2 added the Spike H445P mutation.

LF.7.7.2 has been most successful in Canada, rising to 12% frequency. The US has reported growth to 4%.

🧵

LF.7.7.2 has been most successful in Canada, rising to 12% frequency. The US has reported growth to 4%.

🧵

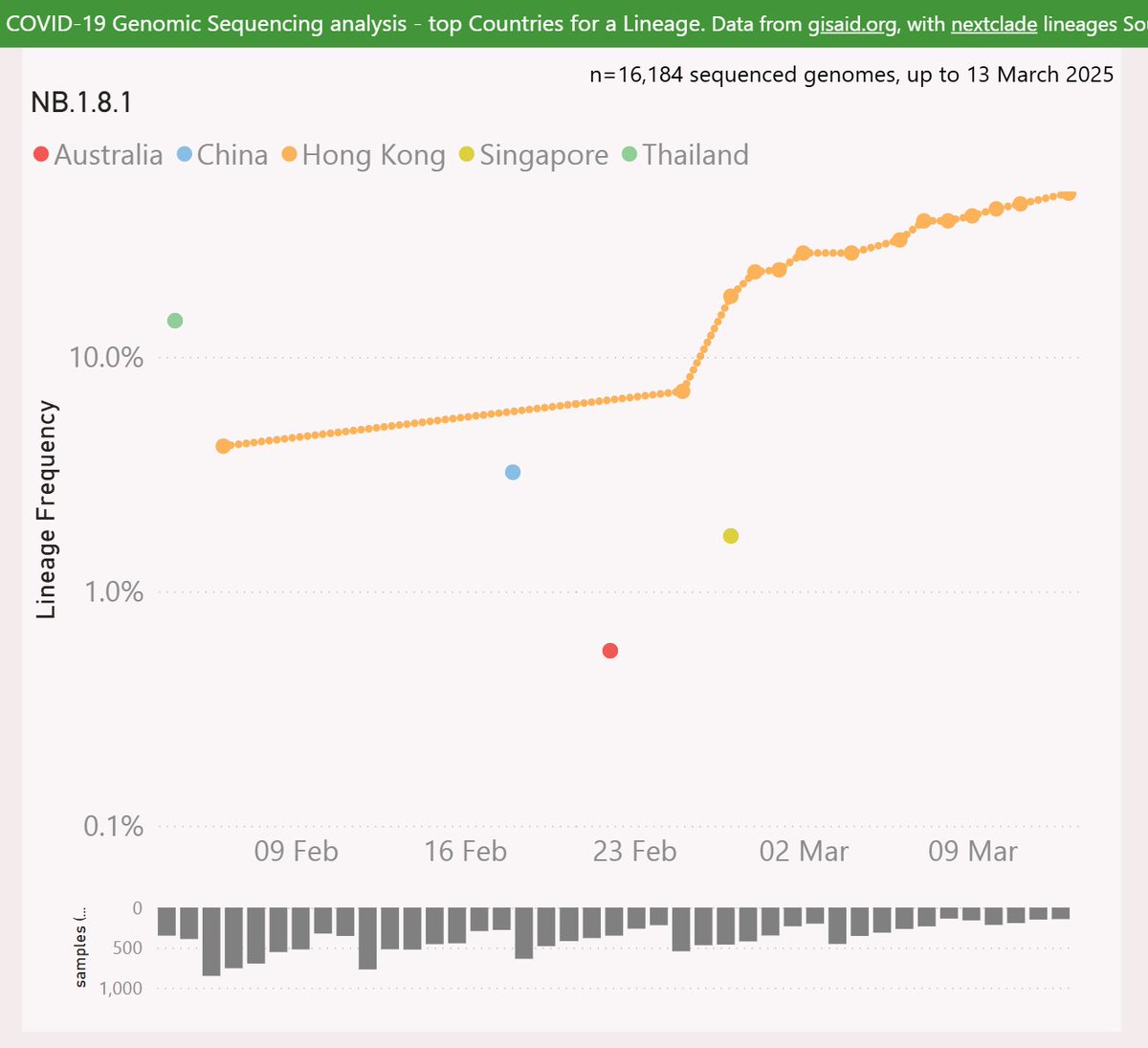

NB.1.8.1 is descended from XDV.1.5.1. XDV was a recombinant of XDE and JN.1. XDE was a recombinant of GW.5.1 and FL.13.4, so this represents the last current variant with any non-JN.1 ancestry.

🧵

🧵

XDV.1 added the F456L mutation, then XDV.1.5 added G184S and K478I. NB.1 then added Spike mutations: T22N and F59S. Then NB.1.8 added the Spike Q493E mutation that characterised KP.3.1 FLuQE – an example of convergent evolution. Finally NB.1.8.1 added the A435S mutation.

🧵

🧵

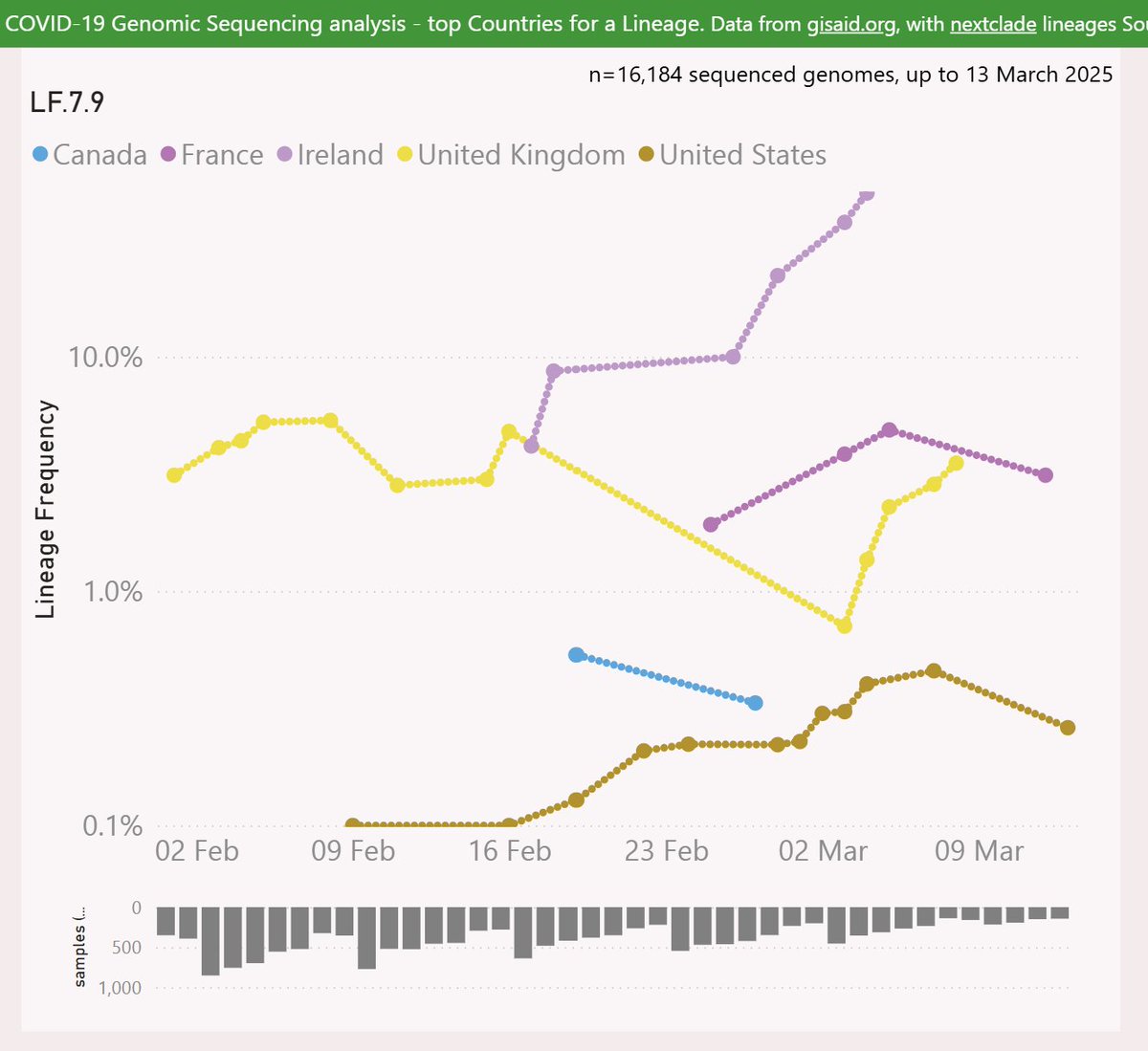

LF.7.9 is descended from FLiRT JN.1.16.1. LF.7 added several Spike mutations: T22N, S31P, K182R, R190S and K444. Then LF.7.9 added the Spike L441R, H445P and A475V mutations.

🧵

🧵

LF.7.9 has been most successful in Ireland, rising to 50% frequency. The UK and France have reported growth to 5%.

🧵

🧵

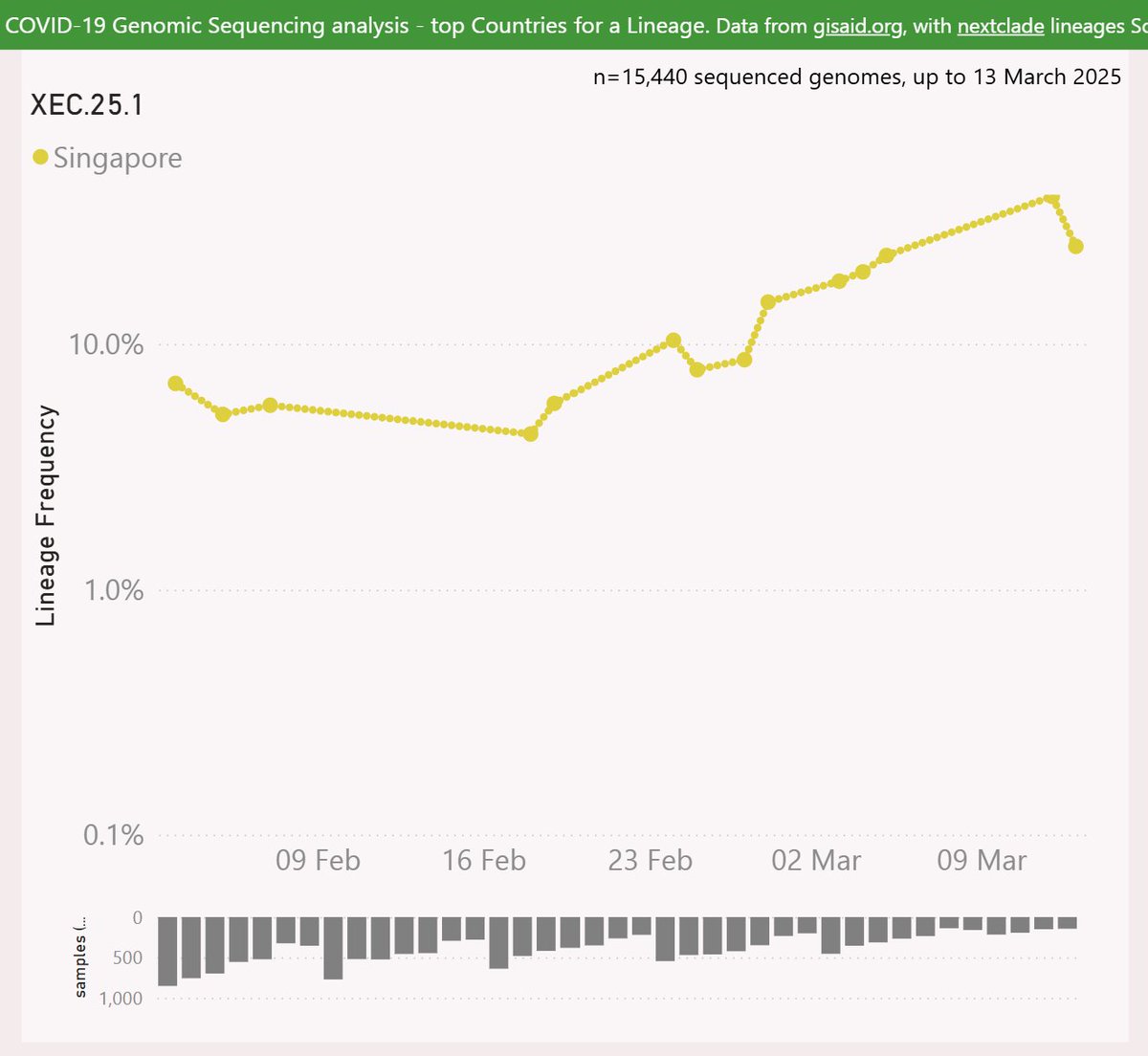

XEC.25.1 adds the A435S mutation.

XEC.25.1 has only been reported from Singapore, rising to 40% frequency. Prior to this sub-lineage, the XEC.* variant had not been dominant in Singapore.

🧵

XEC.25.1 has only been reported from Singapore, rising to 40% frequency. Prior to this sub-lineage, the XEC.* variant had not been dominant in Singapore.

🧵

XFH is a recombinant of LF.7.1 and XEF. XEF was a recombinant of LB.1.4 and KP.3.

XFH has been most successful in Singapore, rising to 7% frequency. The UK has reported growth to 6%.

🧵

XFH has been most successful in Singapore, rising to 7% frequency. The UK has reported growth to 6%.

🧵

So in summary, the most obvious contender to challenge LP.8.1.1 at this point looks like LF.7.7.2, considering it’s healthy growth rate and sustained success in North America. But all of the contenders seem limited to particular countries or regions so far.

🧵

🧵

The usual caveats apply - recent sample sizes are smaller which might skew these results, and “global” sequencing data is dominated by wealthy countries, with many under-sampled regions.

Honourable mention to NB.1.8 (low growth so far).

🧵

Honourable mention to NB.1.8 (low growth so far).

🧵

Huge thanks to Federico Gueli for his tips on new lineages to watch out for, eg

🧵skyview.social/?url=https%3A%…

🧵skyview.social/?url=https%3A%…

Interactive genomic sequencing dataviz, code, acknowledgements and more info here:

🧵 endsgithub.com/Mike-Honey/cov…

🧵 endsgithub.com/Mike-Honey/cov…

• • •

Missing some Tweet in this thread? You can try to

force a refresh