It's official:

After "Liberation Day," the Russell 2000 has closed in BEAR market territory for the first time since 2022.

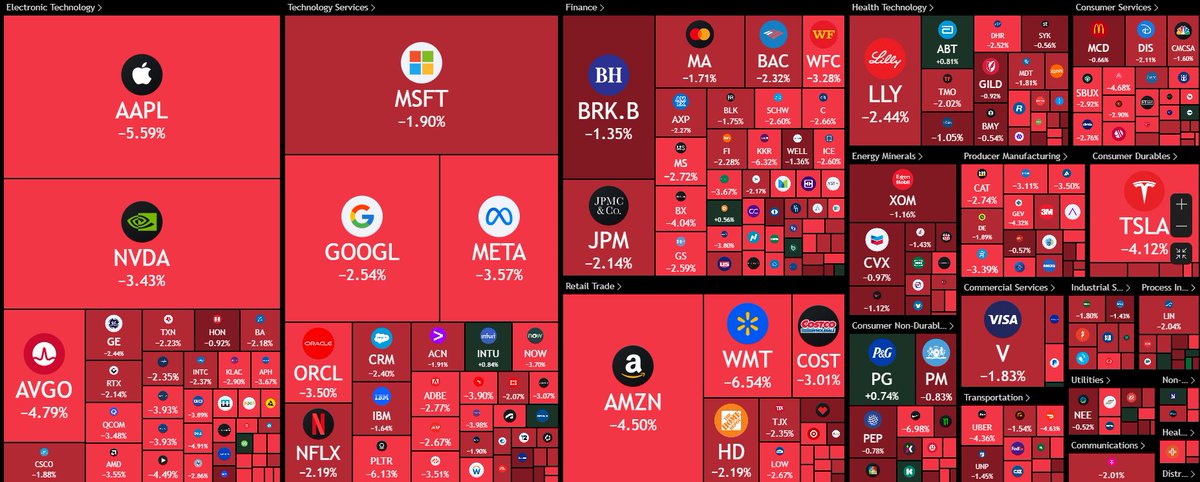

Over the last 24 hours, S&P 500 stocks have erased -$120 billion PER HOUR for a total of -$2.9 trillion.

What's next? Let us explain.

(a thread)

After "Liberation Day," the Russell 2000 has closed in BEAR market territory for the first time since 2022.

Over the last 24 hours, S&P 500 stocks have erased -$120 billion PER HOUR for a total of -$2.9 trillion.

What's next? Let us explain.

(a thread)

The last 24 hours:

On April 2nd, we saw stocks rally into the market's close as investors anticipated lighter tariff announcements.

After the 10% baseline tariff was announced, stocks rallied.

However, stocks collapsed minutes later as more reciprocal tariffs were read off.

On April 2nd, we saw stocks rally into the market's close as investors anticipated lighter tariff announcements.

After the 10% baseline tariff was announced, stocks rallied.

However, stocks collapsed minutes later as more reciprocal tariffs were read off.

Beginning at 11:00 AM ET today, the S&P 500 started to rebound, rising from 5415 toward 5500.

However, the rally was sold after a key headline emerged.

President Trump comments on the stock market's reaction and says "it's going very well" and the "market is going to boom."

However, the rally was sold after a key headline emerged.

President Trump comments on the stock market's reaction and says "it's going very well" and the "market is going to boom."

Since March 6th, President Trump has been saying that he is "not watching the stock market."

On March 10th, he told Fox News the "market is not down much" and "you can't really watch it."

Today, President Trump reiterated that same message

Markets have made a key realization.

On March 10th, he told Fox News the "market is not down much" and "you can't really watch it."

Today, President Trump reiterated that same message

Markets have made a key realization.

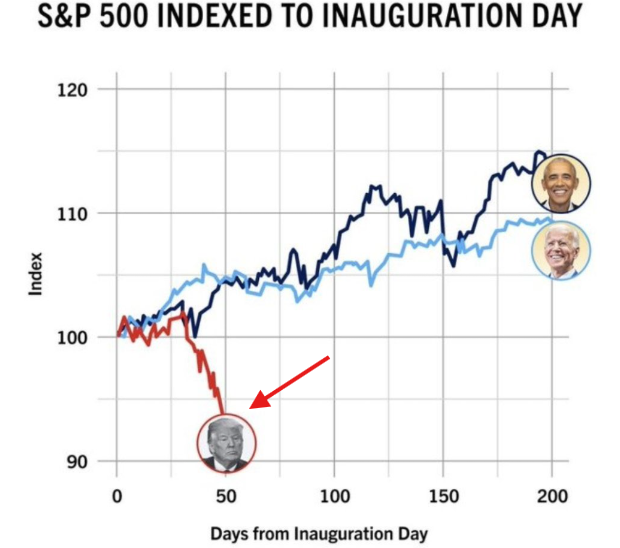

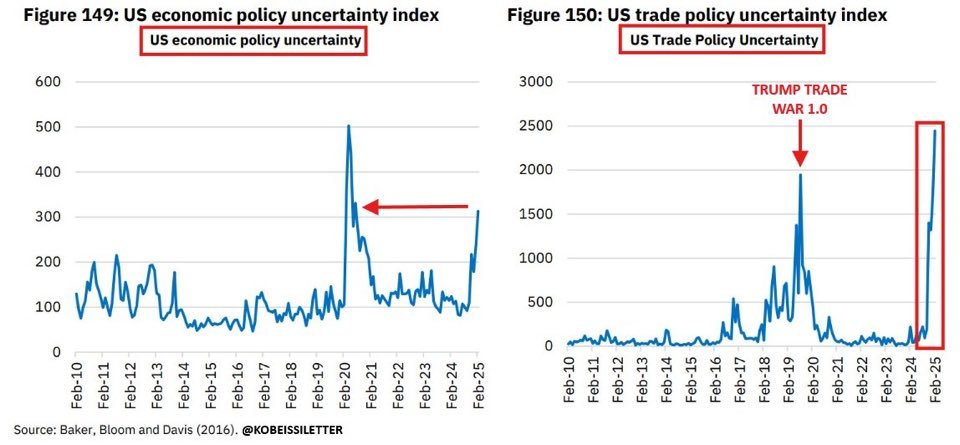

Trump is doing exactly what he has been saying he will do since March 6th.

He is prioritizing what he believes will be "long-term gain" for "short-term pain."

Today's selloff is the first time markets have begun to price-in this mindset.

It's no longer viewed as "posturing."

He is prioritizing what he believes will be "long-term gain" for "short-term pain."

Today's selloff is the first time markets have begun to price-in this mindset.

It's no longer viewed as "posturing."

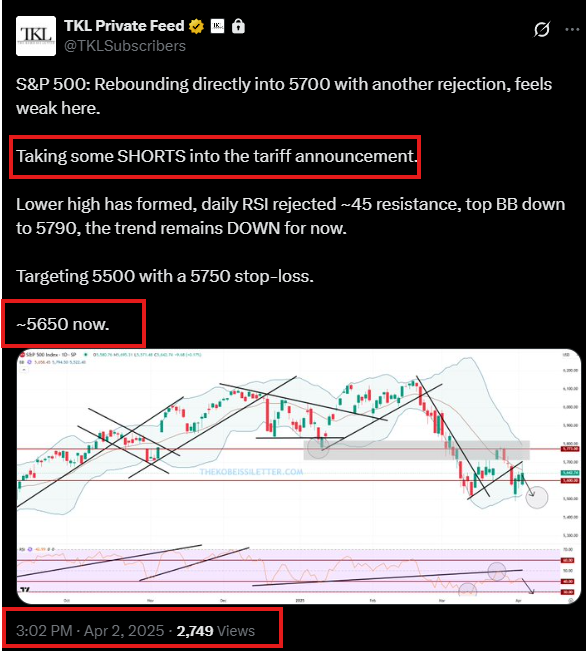

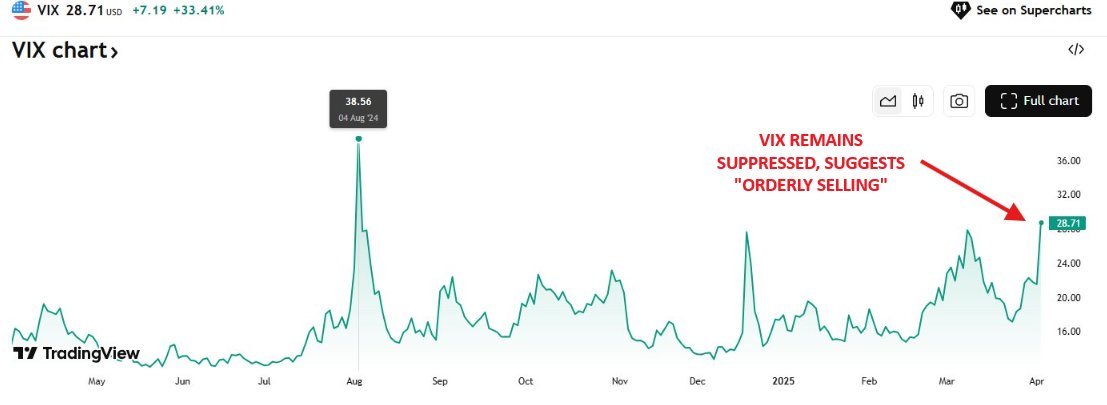

Heading into the announcement yesterday, the Volatility Index, $VIX, dropped sharply.

We viewed this as a complete misread by the market.

In fact, we have been SELLING all rallies on the notion that Trump was no longer "posturing."

Even today's $VIX reaction is underwhelming.

We viewed this as a complete misread by the market.

In fact, we have been SELLING all rallies on the notion that Trump was no longer "posturing."

Even today's $VIX reaction is underwhelming.

That's when we posted the below alert premium subscribers prior to the close yesterday.

We took shorts at 5650 and outlined EXACTLY that, the market misread Trump.

These puts are now up +600% and we have secured profits.

Subscribe at the link below:

thekobeissiletter.com/subscribe

We took shorts at 5650 and outlined EXACTLY that, the market misread Trump.

These puts are now up +600% and we have secured profits.

Subscribe at the link below:

thekobeissiletter.com/subscribe

What's even more incredible is the S&P 500 is down just -7.3% YTD.

However, sentiment is as if we are down 30%+.

Why is this the case?

Because the Magnificent 7 index, which capital is highly concentrated in, is down -25% from its high.

The Mag7 is in a bear market.

However, sentiment is as if we are down 30%+.

Why is this the case?

Because the Magnificent 7 index, which capital is highly concentrated in, is down -25% from its high.

The Mag7 is in a bear market.

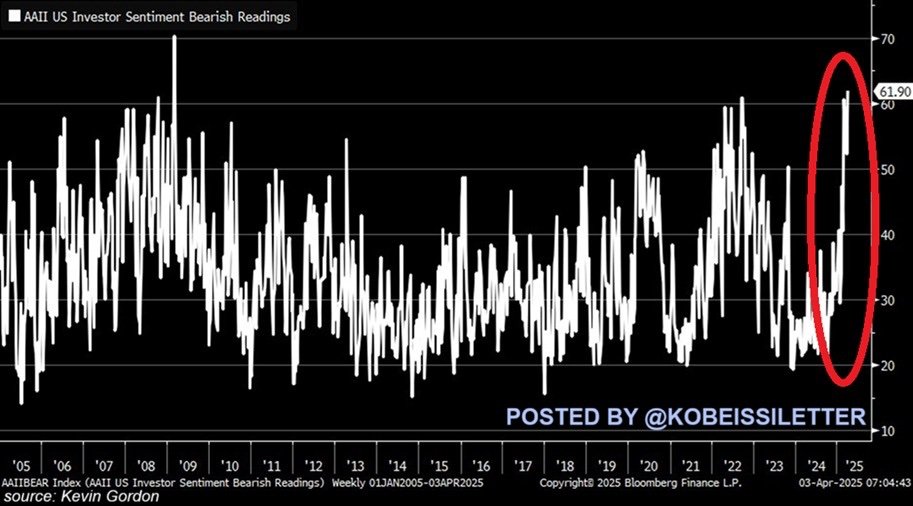

The share of investors expressing bearish sentiment in the AAII survey hit 61.9%, the most since March 2009.

This is also the 3rd-highest reading since the survey began in 1987.

AAII Bearish Sentiment has been above 55.0% for 6 weeks, the longest stretch since the 1990s.

This is also the 3rd-highest reading since the survey began in 1987.

AAII Bearish Sentiment has been above 55.0% for 6 weeks, the longest stretch since the 1990s.

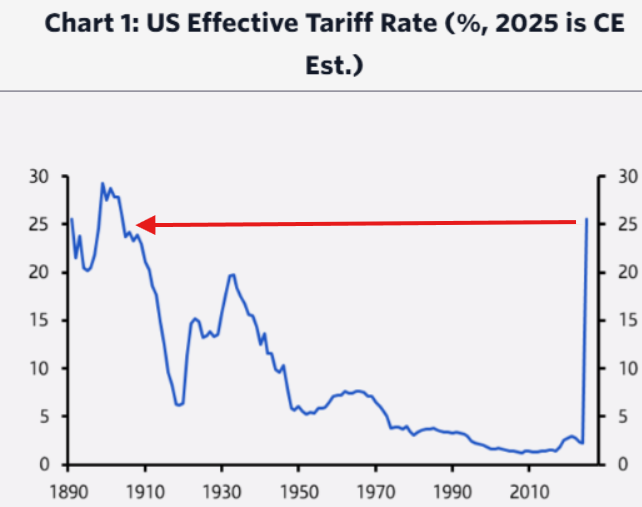

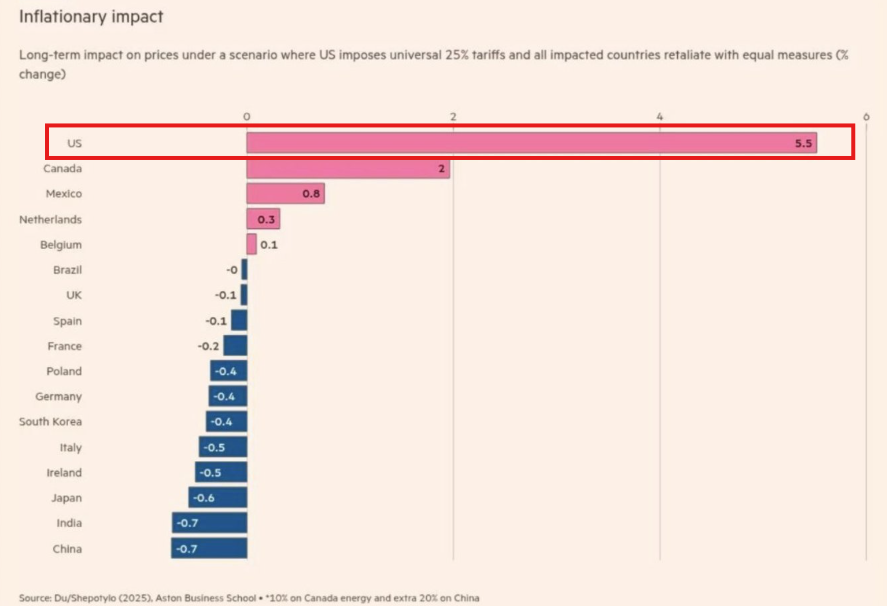

And, the bond market is the most telling part:

Even as inflation forecasts have risen to 5%+ due to tariffs, interest rates are crashing.

Bond markets are pricing in a >50% chance of a recession hitting the US.

Oil prices also collapsed as much as -8% today on the news.

Even as inflation forecasts have risen to 5%+ due to tariffs, interest rates are crashing.

Bond markets are pricing in a >50% chance of a recession hitting the US.

Oil prices also collapsed as much as -8% today on the news.

On March 6th, we posted the below alert for our premium members as we began building a position in $TLT.

We called for the 10-year note yield to drop below 4.00% which just happened.

Bond positions are up SHARPLY.

Subscribe below to access our alerts:

thekobeissiletter.com/subscribe

We called for the 10-year note yield to drop below 4.00% which just happened.

Bond positions are up SHARPLY.

Subscribe below to access our alerts:

thekobeissiletter.com/subscribe

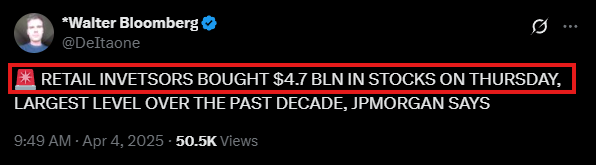

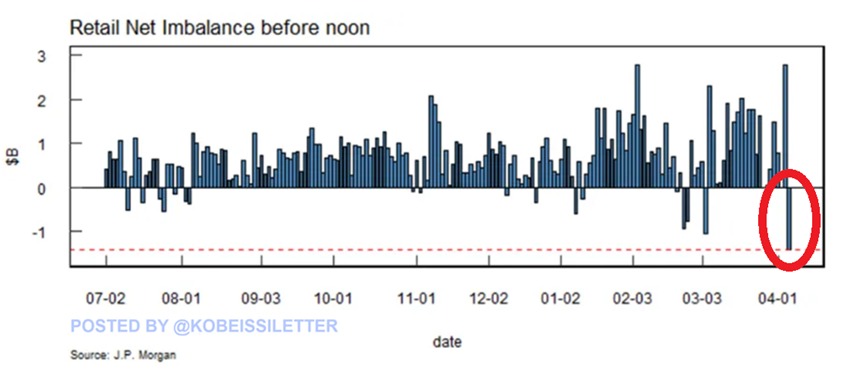

Furthermore, the market's reaction today was bad, but not terrible.

Markets still seem to have some belief that tariffs will NOT be long-lived.

If markets bought Trump's narrative that tariffs will be long-lived, the S&P 500 would be down 10%+ today.

The $VIX would be at 70+.

Markets still seem to have some belief that tariffs will NOT be long-lived.

If markets bought Trump's narrative that tariffs will be long-lived, the S&P 500 would be down 10%+ today.

The $VIX would be at 70+.

On the consumer front, already inflation-exhausted consumers will NOT welcome more price increases.

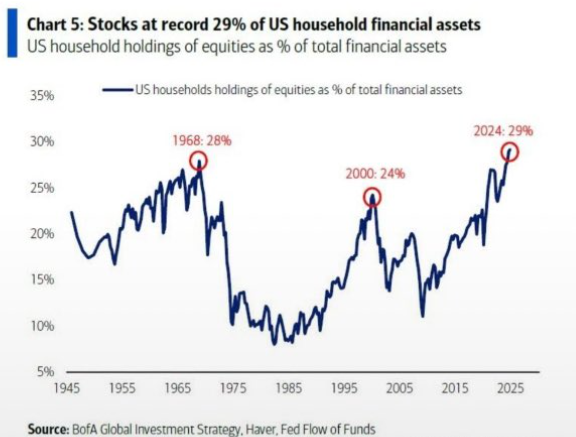

Also, US households held a record 29% of financial assets in stocks at the end of 2024.

These households are now feeling the pain of lower asset prices and prolonged inflation.

Also, US households held a record 29% of financial assets in stocks at the end of 2024.

These households are now feeling the pain of lower asset prices and prolonged inflation.

More uncertainty is the only certainty for investors.

For now, the selloff has been "orderly" without clear signs of capitulation.

The "V-shaped" recovery many are hoping for is becoming less likely.

Follow us @KobeissiLetter for real time analysis as this develops.

For now, the selloff has been "orderly" without clear signs of capitulation.

The "V-shaped" recovery many are hoping for is becoming less likely.

Follow us @KobeissiLetter for real time analysis as this develops.

• • •

Missing some Tweet in this thread? You can try to

force a refresh