Why does having a system (strategy) with an edge still not work out🧵

Many people fail even when they have a highly capable system.

Here’s why.

↓Thread 1/5

Many people fail even when they have a highly capable system.

Here’s why.

↓Thread 1/5

2/5

Even if you have a “system with a probabilistic edge,” the reason it doesn’t work is simple.

Probability functions through the “law of large numbers” over a large sample size, and for that to happen, your consistency is essential.

If probability doesn’t work, it means the law of large numbers doesn’t work.

And the reason it doesn’t work is either:

- you lack consistency, or

- the sample size is not large enough for the law of large numbers to apply.

In other words, no matter how strong your system’s edge is, it can only function through your long-term consistency.

Even if you have a “system with a probabilistic edge,” the reason it doesn’t work is simple.

Probability functions through the “law of large numbers” over a large sample size, and for that to happen, your consistency is essential.

If probability doesn’t work, it means the law of large numbers doesn’t work.

And the reason it doesn’t work is either:

- you lack consistency, or

- the sample size is not large enough for the law of large numbers to apply.

In other words, no matter how strong your system’s edge is, it can only function through your long-term consistency.

3/5

However, many people judge the quality of a trade by whether it wins or loses in the short term.

Despite the need for consistency, they stop being consistent when losses continue.

Because they believe losses are “bad,” they abandon consistency (by changing rules or abandoning the system) to avoid further losses, mistakenly thinking they’ve “done the right thing” or “made an improvement.”

The law of large numbers doesn’t apply to a small sample size in front of you, so any “improvement” made in that context is just reacting to randomness and actually breaking consistency.

As long as you perceive losing as “bad,” you cannot harness probability.

That’s because any excellent strategy will inevitably involve losses and losing streaks, and if you see losing as something bad, you’ll always try to avoid it.

In short, you end up abandoning consistency with “misguided good intentions.”

However, many people judge the quality of a trade by whether it wins or loses in the short term.

Despite the need for consistency, they stop being consistent when losses continue.

Because they believe losses are “bad,” they abandon consistency (by changing rules or abandoning the system) to avoid further losses, mistakenly thinking they’ve “done the right thing” or “made an improvement.”

The law of large numbers doesn’t apply to a small sample size in front of you, so any “improvement” made in that context is just reacting to randomness and actually breaking consistency.

As long as you perceive losing as “bad,” you cannot harness probability.

That’s because any excellent strategy will inevitably involve losses and losing streaks, and if you see losing as something bad, you’ll always try to avoid it.

In short, you end up abandoning consistency with “misguided good intentions.”

4/5

Probability works through the law of large numbers →

Your consistency is essential →

Losing streaks will inevitably occur →

You must stay consistent nonetheless →

What makes that possible is trust and understanding in your system →

That trust and understanding come from looking at a larger sample size and a long-term perspective →

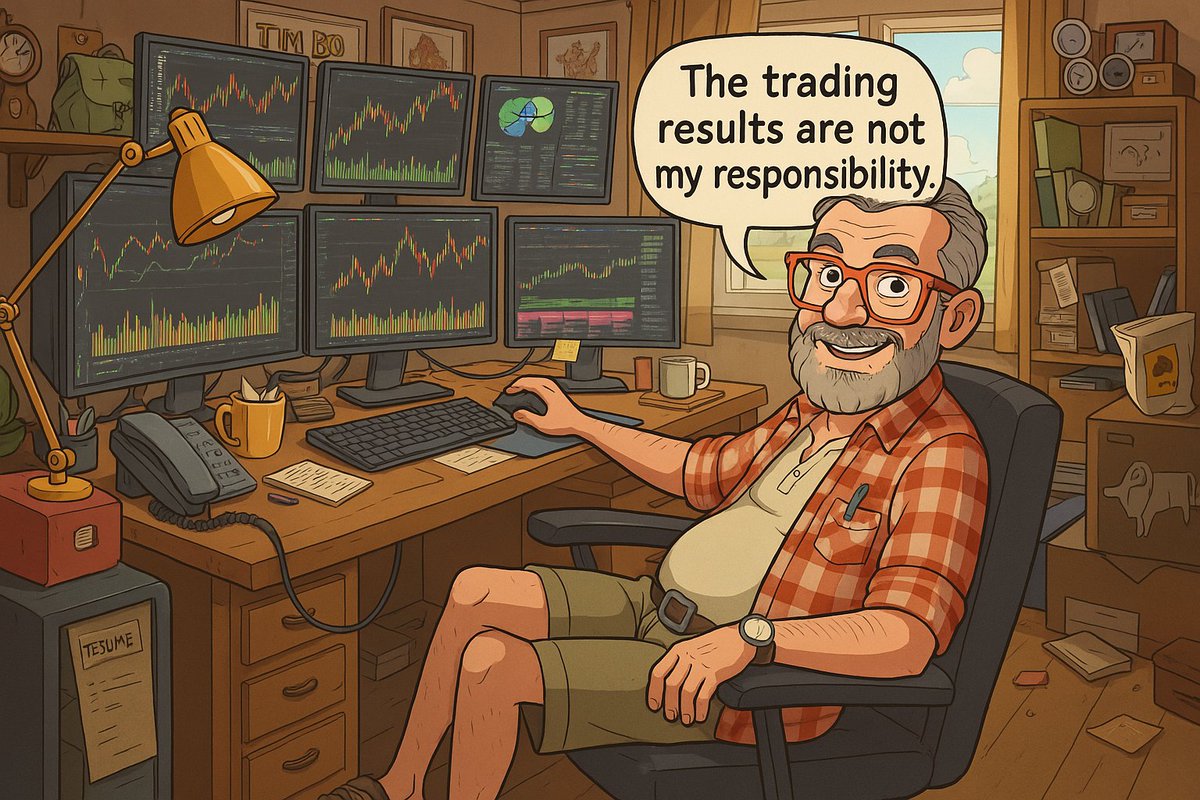

This leads to an understanding of the real work and responsibilities of a trader

Unless you mature as a trader in this way, your own “misguided good intentions” will keep trying to avoid losses.

And in doing so, you’ll lose consistency and fail to extract the edge from even the most capable system.

The enemy that disrupts consistency is yourself.

And as long as that self is convinced that breaking consistency in response to short-term losses is a “correct improvement,” it becomes all the more troublesome.

Probability works through the law of large numbers →

Your consistency is essential →

Losing streaks will inevitably occur →

You must stay consistent nonetheless →

What makes that possible is trust and understanding in your system →

That trust and understanding come from looking at a larger sample size and a long-term perspective →

This leads to an understanding of the real work and responsibilities of a trader

Unless you mature as a trader in this way, your own “misguided good intentions” will keep trying to avoid losses.

And in doing so, you’ll lose consistency and fail to extract the edge from even the most capable system.

The enemy that disrupts consistency is yourself.

And as long as that self is convinced that breaking consistency in response to short-term losses is a “correct improvement,” it becomes all the more troublesome.

5/5

To utilize probability means accepting the losing streaks that are bound to occur.

How well you can accept those losing streaks depends on whether you’re looking at a large enough sample size and maintaining a long-term perspective.

Think bigger.

Thanks for reading!

If you enjoyed this thread, check out my books on trading.

【THE PATH TO SUCCESS IN TRADING】

E-book:payhip.com/b/H1ZBo

Paperback:a.co/d/fXmRhIa

【Trading Psychology】

E-book:payhip.com/b/SNnJC

Paperback:a.co/d/d0QJMxK

Hope these insights help your trading journey 😊

To utilize probability means accepting the losing streaks that are bound to occur.

How well you can accept those losing streaks depends on whether you’re looking at a large enough sample size and maintaining a long-term perspective.

Think bigger.

Thanks for reading!

If you enjoyed this thread, check out my books on trading.

【THE PATH TO SUCCESS IN TRADING】

E-book:payhip.com/b/H1ZBo

Paperback:a.co/d/fXmRhIa

【Trading Psychology】

E-book:payhip.com/b/SNnJC

Paperback:a.co/d/d0QJMxK

Hope these insights help your trading journey 😊

• • •

Missing some Tweet in this thread? You can try to

force a refresh